The Reserve Bank of Australia (RBA) increased the policy rate by 0.25 points on Tuesday…

Comical claims by mainstream economists that the facts have changed

Last week, I wrote this blog post – OECD is apparently now anti austerity – warning, the leopard hasn’t changed its spots (January 12, 2021) – which warned against accepting the idea the growing number of mainstream economists, who were now advocating fiscal dominance, was evidence of a fundamental shift in New Keynesian thinking about macroeconomics. The reality is that they haven’t really shifted much at all and Max Planck’s postulate that paradigms shift one funeral at a time remains true. There are very few cases where the senior members of a dominant paradigm, voluntarily abandon their views when the evidence becomes overwhelmingly against them. They iterate, they declare ad hoc anomalies, they try to voice ideas that a new rival paradigm is articulating which resonate better with the data. This sort of strategy is common across academic disciplines which are under assault from a combination of poor predictive performance (data incongruity) and the arrival of a more convincing alternative paradigm. It is in full swing in macroeconomics now. But don’t believe these characters are suddenly accepting Modern Monetary Theory (MMT) and realising their previous belief system was never a sound way of characterising our fiat monetary systems. If you dig you discover these characters remain charlatans and will do almost anything to maintain their status as the dominant economists.

The Financial Times editorial last week (January 14, 2021) – A fiscal policy for all seasons – held the publication out as a new messenger of fiscal dominance, claiming that “fiscal orthodoxy has changed”.

How do we know that?

Well the editors write:

Organisations such as the IMF and the OECD have told governments that, with low interest rates seemingly here to stay, the costs of excessive borrowing are much lower for advanced economies than previously thought.

Previously thought by them but not any economist who actually understood what the capacities of the fiat monetary system actually are.

Anyway, apparently, “the aim of balancing the budget can, at least temporarily, be dropped.”

Apprently also, this is now an accepted view across the political spectrum.

And the right-wing think tanks also support it.

And apparently, creeps like Robert Rubin support it.

I wrote about him and his errant behaviour in this blog post – Being shamed and disgraced is not enough (December 18, 2009).

The FT editors claim that caution about an emerging consensus needs to be exercised because:

… economists frequently make mistakes and things may change very quickly, in either direction.

They cite the GFC and the flawed advice to cut deficits when, in fact, deficits should have risen substantially.

So why should they change their mind now?

Well, apparently:

The facts have changed and economists have, sensibly, changed their minds.

The reality is that no facts have changed.

The fact that the mainstream economists failed to predict that “Inflation, economic growth and interest rates failed to recover as anticipated after the financial crisis”, which “not only kept borrowing costs down but demonstrated that cutting spending may have had a bigger negative impact than expected” does mean the facts changed.

What has been learned is that the mainstream macroeconomics framework was always deficient and was built on theoretical principles that could never explain what would happen in the real world.

That is what has been revealed.

No fundamental shift in the way the monetary system operates or the capacities and consequences of governments has occurred.

Ever since 1971, the facts have been as espoused in Modern Monetary Theory (MMT).

Further, these mainstream economists, drunk on their own self-importance, are trying to appear as they know what is going on – but obviously trailing reality – have not really changed their minds.

The FT editorial claims that:

There is, however, an ever-present risk that the market will move against governments and the cost of borrowing will rise to such an extent that the choice will be between a painful default or vicious austerity. Keeping a watchful eye on the public finances can prevent societies from ever having to make such a choice.

There have been countless statements like this published in the media and academic papers for decades.

None of the predictions ever come to pass.

They were predicting the Japanese government would fail because the markets would turn against it.

The only thing the markets do is put their hands out continually for on-going corporate welfare in the form of government debt issuance.

And when the debt-issuance doesn’t satisfy their greed (as happened in Australia at the turn of the century) they complain and demand and expansion of debt issuance irrespective of the fiscal position.

I wrote about the Australian farce in this blog post – Direct central bank purchases of government debt (October 2, 2014).

The markets haven’t driven interest rates and bond yields down.

Governments have done that using their superior monetary and fiscal capacity.

They can always keep interest rates low if they choose.

Moreover, they can simply stop issuing debt if they choose.

The reality is that with central banks purchasing most of the debt being issued in many countries, governments are effectively doing just that.

And what would happen if the central bank just pressed the zero button on the computer and eliminated all the government debt it holds?

The net public spending that was matched by the debt-issuance is already in the system and so the inflation risk associated with the spending is already known (and low).

Wiping out the debt would not alter any of that.

And nothing else would happen that would cause any catastrophes.

So there is never a situation where the markets “move against governments” if the government doesn’t want them to.

The FT editorial also tries to run the independent monetary policy line and claims that “inflation-targeting central banks should only ‘print’ money to hit their inflation targets and not finance government spending”, which means they still choose to perpetuate the myth that central banks can increase the inflation rate by adding reserves to the banking sector.

That is, they have not abandoned the (failed) Quantity Theory of Money and money multiplier, which are central planks of mainstream macro, despite he lack of empirical support.

So no paradigm shift here, just a pack of opportunists trying to save face.

Let’s go back to September 11, 2020, when ECB Board Member, Isabel Schnabel gave a spech in Berlin – The shadow of fiscal dominance: Misconceptions, perceptions and perspectives.

This is another example of economists trying to protect their position while practically behaving in total contradiction to it.

It was another exercise in Eurozone groupthink. You know the story – Eurozone is spectacularly successful and the ECB has been meeting its objectives because it is independent and all the rest of it.

She claims the fiscal rules established were sensible because “fiscal dominance could induce a central bank to deviate from its monetary policy objectives, endangering price stability.”

She rehearses the deficits are inflationary argument.

She acknowledges that the GFC drove up the debts of Member State governments and the failure to recover coupled with various other challenges (climate, health) have made matters worse.

But the massive bond purchases of ECB has nothing to do with funding government deficits even though she acknowledges they have kept yields low and “in the absence of our sovereign bond purchase … real GDP growth would have been around 1.4 percentage points lower.”

And without that growth, the public debt ratios would have been higher.

But all of that is just a secondary impact of the ECB buying up the debt to push inflation higher.

Yawn.

They keep maintaining this fiction even though she acknowledges that “financial markets and survey data do not suggest that people expect inflation to accelerate.”

Why not?

If the mainstream theories were sound, then inflationary expectations should be through the roof by now, given the scale of the bond purchases.

This lot seems incapable of joining the dots – their theories predict one thing, reality does another, they acknowledge the reality but fail to think it has anything to do with their theories.

Groupthink in action.

At the end of her speech she talked about fiscal and monetary policy interactions.

The reliance on monetary policy, a characteristic of the New Keynesian era, has driven policy to extremes and central banks now are operating with zero or negative interest rates, massive balance sheet expansions from bond purchases, and other extreme parameters.

So suddenly:

… fiscal policy has become more important as a macroeconomic stabilisation tool.

The reality it was always important.

The reason that monetary policy has been pushed to ever extreme limits is because growth kept faltering and people demanded policy action.

The monetary policy was unable to sustain growth.

So now, the political pressures are such that politicians have had to abandon their ideological reluctance to use fiscal policy.

The world they have created has caught up with them.

Three or more decades of reliance on monetary policy has failed to deliver on its promise.

But according to the ECB groupthink:

Calling on fiscal policy to play a more active role in macroeconomic stabilisation is not to be confused with modern monetary theory, which denies the government’s intertemporal budget constraint. Once the economy has recovered and is back on a sustainable growth path, fiscal policy should take a backseat again and regain policy space.

I laughed when I read that.

We will staunch the damage with the only effective macroeconomic policy tool available but once the bleeding stops, we will get our ineffective policy tool back out of the drawer and kill the economy again.

That is what all this sudden pragmatism is about.

They haven’t changed at all.

You also might wonder what this ‘intertemporal budget constraint’ reference is about.

Well I could just say GIGO.

But here is a little exposition which should allow you to realise how the far-fetched the world these economists fantasise about.

In microeconomics, students in advanced courses wade through abstract, multi-period models, usually simplified to two periods because they cannot get the mathematics to solve if there is anything more complicated, which show that a household, again abstracted to be a single unit of the whole economy, because any heterogeneity is also insolvable, solves a complex ‘intertemporal budget constraint’.

Future uncertainty is assumed away.

Households thus ‘know’ the future.

There are all sorts of other assumptions which would make you wonder whether the economists are actually in the business of writing fairy tales or SF, but essentially they get students to solve, using trivial calculus, the consumer problem, which is to choose current and future consumption which maximises satisfaction subject to ensuring that the present discounted value of consumption expenditures must equal the present discounted value of income.

This is the ‘intertemporal budget constraint’ the household faces.

As part of this exercise, there are so-called ‘transversality conditions’ to be met, which relate to the optimality conditions that have to be met at each decision-making point along the optimal path of the dynamic solution (the so-called Euler equations).

Stay with me and just feel lucky you have never had to study this nonsense if you haven’t.

So these ‘transversality conditions’ operate to ensure that when faced with different choices at different points in time, the consumer will always remain on the optimal path because they can instantly work out and differentiate the non-optimal paths from the single optimal path.

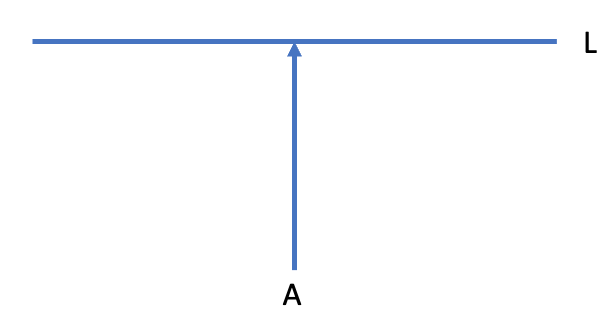

The idea of an optimal path can be understood with this little geometric problem that I constructed.

If L is an infinitely long straight line and A is some point, the problem is to find the shortest path from A to L. Obviously it is to follow a route that is perpindicular to L. Any deviation from that line will not be ‘optimal’.

One could define a range of straight lines from A to L. But only one is the shortest distance.

So at each point in a person’s life, the mainstream economy theory is based on the notion that the person can always solve their consumption decisions to ensure they never deviate from a ‘straight line’ – which means they must know the future prices, relative prices, their future incomes and all the rest of it.

GIGO.

Now in the 1960s, the economics profession ported this nonsense over the analysis of government spending decisions.

So the government was alleged to have an ‘intertemporal budget constraint’ which had to be satisfied.

What does that mean?

The government ‘intertemporal budget constraint’ concept essentially means that the net wealth position of the currency-issuing government is constrained to be zero.

Which means that the current outstanding debt plus all future discounted fiscal positions (which would add or subtract from debt) must sum to zero.

What does that mean?

It means that if a government currently has outstanding debt, then it has to run primary fiscal surpluses (the excess of tax revenue of spending, excluding interest payments) in the future to pay the debt back and ‘end up’ at a zero position.

So the discounted (present value) of taxes must equal the value of the current outstanding debt plus the discounted value of any future government spending.

This concept is then weaponised because it is used to oppose fiscal deficits because if the government is running deficits then the outstanding debt rises which means the government is violating its ‘intertemporal budget constraint’.

First, the government is assumed to be a household, which at the elemental level is a false analogy.

The household uses the currency that the government issues.

Empirical evidence suggests that households don’t even behave like this.

None of us have the information available or the computational capacity to satisfy all the transversality conditions over our lifetimes. We do not know the future and that ignorance or uncertainty constrains our behaviour all the time.

I could write an essay on all the other real world facts that negate this theoretical approach.

Second, think about the purpose of fiscal policy.

It is not to achieve some zero state at some mythical time in the future without regard to context.

Fiscal policy must aim to sustain full employment and ensure inequality declines and the citizens have access to first-class infrastructure.

Even a nation that runs a balanced external position, will need to run continuous fiscal deficits to ensure the private domestic sector can save overall and avoid ever-increasing accumulation of private debt.

There is no evidence base to support the claim that pursuing a fiscal strategy motivated by a regard to a ‘intertemporal budget constraint’ can deliver anything remotely like what we expect fiscal polilcy to achieve.

In fact, the evidence base clearly suggests that when governments act as if they are bound by such a constraint, they inflict damaging austerity on their societies.

Reflect back on the FT editorial acknowledgement of the damage caused during and after the GFC by economic advice that led to austerity.

Third, the ‘intertemporal budget constraint’ is predicated on the view that governments are at the behest of the private bond markets and need their funds to spend.

Neither proposition is correct as I have demonstrated on more times than I care to remember.

Conclusion

The only thing that Isobel Schnabel gets right is that Modern Monetary Theory (MMT) economists reject the operational significance or existence of the government ‘intertemporal budget constraint’.

There is no such thing.

That is enough for today!

(c) Copyright 2021 William Mitchell. All Rights Reserved.

On the happy side- You are definitely making progress even if you and MMT are not getting much credit so far. It is still a climb but the truth is out already and I think it gets easier from here. You got this Professor.

Somebody failed to tell all the above ‘facts’ to the Repuds in the US Congress and Senate. Also, to a few Dems in the Senate. I’m currently hearing talk that the $1400 relief/stimulus checks are going to be blocked by Dem. Sen. Joe Manchin in the Senate. He says they are unnecessary and must have the means test limit somewhat reduced, that $75,000 per person or $150K/couple is too high. That too much spending “may be bad for the US economy”.

It reads like it could be a Monty Python script. Oh, that’s right, they’ve already done that one, it’s the Black Knight sketch in Monty Python And The Holy Grail.

‘if the central bank just pressed the zero button on the computer and eliminated all the government debt it holds’. In the UK, many accountancy hours are put into producing (to gather dust) ‘Whole of Government Accounts’ (WGA) supposedly consolidating the accounts of the public sector. I would have thought the accounts of the Treasury and Central Bank would be the first to be and most easily consolidated. That a huge borrowing figure is still touted, can only be for ideological scare tactics.

When an accounting year ends, a business puts together its annual accounts. The surplus or deficit (which of course for a government should be retitled as net input/withdrawal from the economy) is interesting, but what ensures whether the business can continue or is bankrupt is the net assets on the balance sheet. This will never be a problem for a government that doesn’t borrow in a foreign currency and doesn’t hawk out its assets.

The FT editorial… claims that “inflation-targeting central banks should only ‘print’ money to hit their inflation targets and not finance government spending”. I shan’t be taking out a FT subscription just yet.

I wish I was back in grad school. This would have been my thesis topic.

I am amazed at how so called debt has become a bogey man.

Thank you for your well written piece it was a delight to read. Sometimes in life we can be simply wrong, and its high time neo classical economists went along with this notion of getting with the program.

“The world they have created has caught up with them.” This could serve as a tagline for the 21st Century as a whole, could it not? In almost every way, including but far from limited to economics, humanity has painted itself into a corner. The only way out is a leap, an evolutionary leap, and sooner or later we will have to make it.

The most despicable thing is that while people are waiting for them to change their minds, the working class is suffering immeasurably.

“The world they have created has caught up with them.”

Isn’t that right.

People still claim there is democracy and free press when we KNOW these are almost completely corporate controlled.

What do political science and economics classes do? Waste people’s time?

@Tom Y. Democracy has always been an ideal, and with that, a label to be misused. But on this day (Jan 20th) we can at least be a little happy that America’s version, failing miserably short of being of the people, by the people, for the people, has at least removed a really bad leader after only four years.

Excellent article; did you read Goodhart’s letter in response to the FT editorial?

Patrick indeed a really bad leader was removed after only one term but behind the possibly reasonable man that is now president is a system as evil as the previous president.

As you infer a system of the rich by the rich for the rich has indeed relentlessly taken over and almost no legislation in the public interest is passed by Congress unless one of the power centres should want the same thing.

The sub-prime mortgage frauds and Wall Streets apalling excesses, the bailouts after 2008 ($28 trillion of FED loans according to Randy Wray) the absence of prosecutions, the massive job losses, home evictions, bankruptcies and suicides followed by Obama’s absurd fiscally constrained recovery and all of the same vultures still feeding on the carcass called the USA and much of the rest of the world; is just the worst of 40+ years of relentless neoliberalism and near total political capture by various strands of the wealthy.

The evil captain has left and been replaced but the ship is sinking fast.