I am late today because I am writing this in London after travelling the last…

No justification for public sector wage freezes during the pandemic

I provide a lot of research support for trade unions in wage determination cases in Australia, where wage agreements are uniquely decided in judicial processes. The cases are onerous and highly contested and as an expert witness I am often grilled for lengthy periods by the employers’ barristers in the evidential phase. One of the things that has been relevant in the last year or so has been the wage caps and freezes that government employers are placing on their workforce as a way of ‘saving money’. Prior to the pandemic they were forcing real wage cuts or zero real wages growth on workers under their wage cap strategies as part of their pursuit of fiscal surpluses. Now they are imposing freezes to reduce the size of their deficits. And, the same is happening in other jurisdictions such as the UK. Not only were the wage caps in the public sector damaging the well-being of public workers, in some cases, the lowest paid (cleaners etc), but they were also providing ‘wage guidance’ to the private sector, at a time when household debt is at record levels and consumption growth wage faltering. At a time when consumers are already wary and saving higher proportions of their disposable income, freezing wages is not a responsible thing to do in a pandemic. The UK government, for example, does not need to ‘save money’. But as part of the recovery from the pandemic, the government will benefit from households having been able to pay down debt while saving more and from the maintenance of their real purchasing power. There are no grounds for freezing wages – public or private.

Wage caps and freezes in Australia

Prior to the outbreak of the pandemic, the Australian economy was facing an uncertain future as a result of the record low wages growth and the refusal of the Federal government to use its fiscal capacity to offset the decline in private spending growth.

Despite increased spending allocated in the most recent fiscal statement, there are no signs that wages growth will increase in the near future, which makes it harder for heavily indebted households to maintain growth in consumption expenditure.

Even the RBA has echoed these concerns, stating that it considers monetary policy alone, is incapable of providing the conditions for sustained economic growth and improvements in well-being.

The RBA Governor, over the last few years, has repeatedly called on the Federal government to introduce fiscal stimulus and other measures to increase public spending and provide for stronger wages growth.

In his – Opening Statement to the House of Representatives Standing Committee on Economics (August 9, 2019) – the Governor said:

… the accumulation of evidence that the economy could be on a better path than the one we looked to be on. The incoming data on wages, prices, GDP and unemployment all suggested that the Australian economy was some distance from running up against capacity constraints …

… if further stimulus to demand growth is required to get us to full employment and closer to the economy’s capacity, monetary policy is not the country’s only option. Monetary policy certainly can help, and it is helping, but there are certain downsides from relying too much on monetary policy …

A few days later, the Governor made some – Remarks at Jackson Hole Symposium (August 25, 2019) – where he reiterated that theme and went a step further:

… monetary policy can’t drive long-term growth, but the other policy levers can.

So a basic proposition of the mainstream New Keynesian macroeconomics that policy reliance on monetary policy is sound is refuted by the central bank governor.

In his August 9, 2019 – Evidence – to the House of Representatives Economics Committee, the RBA governor went further and talked about wage setting developments in Australia.

Specifically, after saying he “would like to see stronger wage growth in the country” he focused in on the way that public sector:

… wage caps in the public sector are cementing low wage norms across the country, because the norm is now two to 2½ per cent, and partly that’s coming from the decisions that are taken by the state governments …

He elaborated further:

In the medium term, I think wages in Australia should be increasing at three point something. The reason I say that is that we are trying to deliver an average rate of inflation of 2½ per cent. I’m hoping labour productivity growth is at least one per cent-and I’m hoping we can do better than that-but 2½ plus one equals 3½. I think that’s a reasonable medium-term aspiration; I think we can do better, but I think we should be able to do that. So I would like to see the system return to wage growth starting with three …

… what is really important is the wage norms in the country … And the public sector wage norm I think is to some degree influencing private sector outcomes as well-because, after all, a third of the workforce work directly or indirectly for the public sector …

And:

The public sector, directly and indirectly, employs roughly one-third of the labour force, and they’re saying wage increases across the public sector may be averaging two per cent. That has as indirect effect on the private sector, because there’s competition for workers and it reinforces the wage-norming economy at two-point something …

… if … wages in the public sector were rising at three per cent, then over time I think we’d see stronger aggregate demand growth in the economy. I don’t think it would have much of a negative effect on employment; in fact, arguably it could be positive.

And:

Most people are accepting wage increases of two to 2½ per cent. And the public sector wage norm I think is to some degree influencing private sector outcomes as well-because, after all, a third of the workforce work directly or indirectly for the public sector. So I think it is an issue but, on the other side of the ledger here, it is important that state governments manage their budgets prudently. I have spoken to a number of state treasurers. They say, ‘We’d like to do more here but we’ve got a tough budget situation.’ So there is a balancing act to be completed here. But I hope that, over time, that balance could shift in a way that would allow wage increases, right across the Australian community, of three point something

In this context, he was talking about Australian state and territory governments which are currency users.

The states have certainly tried to argue that his qualification about “a tough budget situation” allows them not to lift wages above the current (artificial) norms because their fiscal position would not allow it.

Prior to the pandemic, their reasoning was flawed because it was obvious that the wage caps were stifling household spending in their economies both from public and private workers, which then undermined their fiscal positions via the detrimental activity effects on tax revenue (of various types).

The wage caps that States have put in place bias growth in wages throughout the economy downwards, which then has the effect that economic growth has to rely on either increased government deficits, private business investment or household credit growth.

The major component of total expenditure is household consumption and private business investment is linked to that (via accelerator processes), such that, if household consumption expenditure drags, business investment is likely to be slow as well because the existing capital stock can more than cope with the production demands.

It was obvious that with household debt at record levels, growth was no longer going to come from credit-fuelled consumption expenditure.

That means the flat wages growth, exacerbated by the low wage caps, stifle overall growth, which, in turn, damages state revenue receipts.

The state governments believe that they have to maintain these low wage caps because they are presented with a challenging fiscal environment and wish to contain costs.

But the reality is that this challenging environment is, in part, a product of the very policies (wage caps) and net recurrent surpluses that the government has put in place.

They are creating a ‘vicious circle’ that not only suppresses economic growth but also biases their fiscal outcomes against their stated aims.

But as we entered the pandemic, any excuse that their fiscal positions would not allow them to provide wage increases to their workforces were further exposed by the actions of the RBA itself.

For example, on August 14, 2020, the RBA Governor once again appeared before the House of Representatives Standing Committee on Economics and the – Transcript – reveals he said the state governments had much wider fiscal space than had been commonly considered to be the case:

Committee Member Question: Do you think the states should be doing more? When you’ve got the Commonwealth currently spending about $314 billion and the states only contributing about $44.8 billion so far in spending to assist, would an increase or a shift in responsibility to the states help aid the economic recovery?

RBA Governor: I think we need both the federal government and the state governments carrying their fair share … The measures to date from the state governments add up to close to two per cent of GDP. So, in aggregate, those measures are smaller; they’ve largely focused on supporting businesses through this difficult period and extra spending on health, and in some states there’s been extra spending on infrastructure and on housing and skills development.

Going forward, the challenge we face is to create jobs, and the state governments do control many of the levers here. They control many of the infrastructure programs. They do much of the health and education spending. They’re responsible for much of the maintenance of much of Australia’s infrastructure. So I would hope, over time, we would see more efforts to increase public investment in Australia to create jobs, and the state governments have a really critical role to play there.

To date, I think many of the state governments have been concerned about having extra measures because they want to preserve the low levels of debt and their credit ratings. I understand why they do that, but I think preserving the credit ratings is not particularly important; what’s important is that we use the public balance sheet in a time of crisis to create jobs for people. From my perspective, creating jobs for people is much more important than preserving the credit ratings. I have no concerns at all about the state governments being able to borrow more money at low interest rates. The Reserve Bank is making sure that’s the case. The priority for us is to create jobs, and the state governments have an important role there, and I think, over time, they can do more. But the federal government may be able to do more as well. We may need all shoulders to the wheel

And after further interrogation he said:

I think that’s where the debate needs to be: how much government spending should there be? Resolve that answer, and I’m not worried at all about the financing. The Australian and state governments will be able to finance themselves at extraordinarily low interest rates for a long period of time. So the financing constraint is not the issue

We also know that the RBA has changed tack by tweaking its ‘long-dated outright transactions’ program, which involved quarterly purchases of government debt (for open market operations).

Since March 2020, they are buying government debt in secondary markets “to achieve a target for the yield on 3-year Australian Government bonds of around 0.25 per cent, as well as to address market dislocations”.

By the end of September, the RBA had purchased federal debt worth $52,250 billion, and state/territories debt worth $11,098 billion.

Despite RBA denials, it is now funding significant proportions of the government deficit.

So even the conservative RBA governor is demanding the states to abandon their wage cap limits expand their deficits and take advantage of the ultra low borrowing rates and ignore the warnings about lost credit ratings).

The relaxation of the wage cap will stimulate economic activity in the states, which will, in turn, sustain state revenue growth.

And that has never been more important than now, after a once-in-a-century pandemic has devastated the economy and will continue to restrict activity as a result of external border closures.

Further, the impact of the withdrawal of the JobKeeper program in March 2021 by the Federal government will also add to the necessity for state-level stimulus measures to be maintained.

Fast track to a currency issuer – the British government

The British government’s handling of the pandemic is truly amazing. Amazingly bad.

I saw on the news this morning that yesterday, the country racked up a second day of consecutive record number of infections as the numbers started to really spiral upwards at the end of September.

On December 22, 2020, 691 deaths from the virus were recorded taking the total to 68,307 deaths so far and the nation is no where near being clear of the problem.

The official (accepted) data suggests that on “average 17,000 people have died from the flu in England annually between 2014/15 and 2018/19 – with the yearly deaths varying widely from a high of 28,330 in 2014/15” (Source).

Among the stupid policies that the Chancellor has introduced is his ‘wage freeze’.

On November 25, 2020, the British Chancellor made his – Spending Review Speech – which set in motion the current fiscal stance of the government.

He stated that the:

… coronavirus has deepened the disparity between public and private sector wages.

In the six months to September, private sector wages fell by nearly 1% compared to last year. Over the same period, public sector wages rose by nearly 4%.

And unlike workers in the private sector, who have lost jobs, been furloughed, seen wages cut, and hours reduced, the public sector has not.

In such a difficult context for the private sector – especially for those people working in sectors like retail, hospitality, and leisure I cannot justify a significant, across-the-board pay increase for all public sector workers.

Instead, we are targeting our resources at those who need it most.

So there were two elements:

1. A pay equity argument (apparently).

2. The financial constraint on government spending argument.

I will leave it to the reader to determine which one drove the decision to place a temporary freeze on public sector wages.

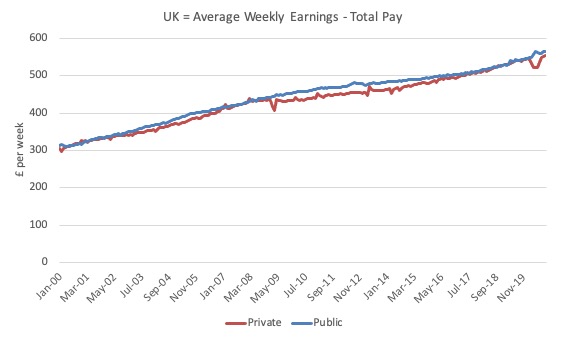

Here is the evolution of Average weekly earnings since January 2000 for the public and private sectors.

I have excluded the financial services from the public service, remembering that during the GFC, the government nationalised the Royal Bank of Scotland and Lloyds Banking Group, which inflated the public sector wages, after that time.

So there was a blip in the private sector between January 2020 and July 2020, after which the relativities have recovered.

It is also hard to actually validate the Chancellors’s claims about wage movements.

The peak private AWE was in January 2020. The trough was June 2020, a fall of 4.3 per cent. Over the same period, public wages rose by 3.4 per cent – which describes the blip in the graph.

By October 2020 (latest data), the private sector AWE was 1.7 points above the January 2020 peak while the public AWE was 3.4 points.

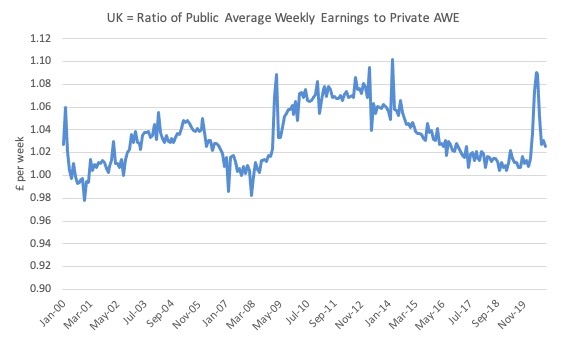

But we get a better idea of the movements in the relativities by looking at the ratio of public average weekly earnings to private AWE over the same period, which I show in the next graph.

So the blip in the early part of the pandemic is compared to the downward trend in the ratio since the austerity period really started to bite the public sector.

I haven’t heard previous Tory chancellors talking about the need for public sector wage rises to restore the relativity with private sector workers as the ratio was falling from about 2011.

There are several reasons why the public sector pay is slightly above the private pay.

1. The public sector workforce is dominated by an older demographic and so compositionally this leads to higher average earnings. Older workers in the private sector also receive higher average wages than younger workers.

2. The neoliberal period of outsourcing and privatisation has meant that many of the lower paid positions that were formerly in the public sector are now in the private sector, biasing the relativity downwards.

In terms of the ratio above, I have not adjusted for experience and age.

But the Institute for Fiscal Studies has and in their report (November 19, 2019) –

Public sector pay and employment: where are we now? – we learn that:

… significant pay restraint after 2010 reduced average public sector earnings in 2014 Q2 to 4.7% below their level at the start of 2008 …

Pay restraint in the public sector has reduced the gap between public and private sector wages to the lowest level since the early 2000s …

Overall, the public pay premium once you adjust for compositional differences (age, education, training) is negligible.

Further, it is not a sensible strategy to punish public workers because the non-government spending cycle has cause unemployment in the private sector.

That is just a race-to-the-bottom strategy.

The other problem is that many of the 2.6 million public sector workers are significantly underpaid relative to comparative private sector workers – for example, education workers and police force staff.

The Resolution Foundation released a commentary (December 21, 2020) – Public sector workers affected by the pay freeze next year already face a pay penalty compared to private sector staff in similar roles – to accompany their latest – Earnings Outlook – which analyses the impacts of the pay freeze on different cohorts of public sector workers.

They concluded that:

1. “Public sector workers affected by the pay freeze next year already face a pay penalty compared to private sector workers in similar roles, while those exempt from the freeze enjoy a pay premium”.

2. “A decade of pay restraint since 2010 had brought this pay premium down to zero by 2019, but the pandemic has changed the relationship between public and private sector pay yet again.”

3. “public sector workers affected by the pay freeze coming into effect next year – such as those in local government and education – actually already face a 7.9 per cent pay penalty compared to private sector workers in similar roles.”

4. “In contrast, public sector workers exempt from the freeze – such as NHS workers and those earning less than £24,000 – already enjoy a 6.7 per cent pay premium over their private sector counterparts.”

5. “The Government has justified the coming public sector pay freeze on the basis of the pay premium these workers will experience as a result of the pandemic. But this is a very poor description of the impact of the policy – with the freeze largely falling on those already experiencing pay penalties relative to the private sector.”

Conclusion

As usual, conservative governments and those that have accepted the usual fictions about the need to ‘save money’ turn on workers. The British government’s claims about relativities are spurious.

Their real issue is the expanding fiscal deficit that has been necessary to deal with the pandemic – not that they are dealing with the pandemic very well at all.

But with a massive economic slump on their hands, which will get worse as the Brexit reality unfolds – if the nasty recent border closures from Macron are anything to go by – the last thing a government should be doing is reducing the purchasing power of a significant number of workers.

Today, we compared two quite different situations – state governments in Australia who use the currency with the currency-issuing British government.

While their financial circumstances are different, neither can justify in the current settings suppressing the pay of their public workforces.

It is the last thing they should be doing during a pandemic.

That is enough for today!

(c) Copyright 2020 William Mitchell. All Rights Reserved.

The UK seems to be going to another “Poll Tax” moment, when misery spread across the island like the plague.

It was medieval in nature and fitted the neoliberal mantra to shift income to the rich.

Now, as the UK government seems to be lost in some kind of maze, only a strong push forward can curb the dawning of another dark age.

Thatcherism needs to die once and for all.

So wages would keep pace with productivity gains?

Now there’s an interesting idea!

Off topic, however,

Wishing you all a Merry Christmas and a healthy and trouble free New Year.

Happy surfing Bill.

@ John Armour,

I’m not an economist.

It seems to me that capital ought to get some gain from its investment in productivity increasing investments.

Nations ought have a discussion between the gov., the people, and the corps. on just how to split the increased profits from such investments.

IMHO, the corps. ought to get 3% over the inflation rate and the workers the rest. Here I’m assuming that management will price their product at the max. the market will bare, and not at the level that returns just 3% plus inflation.

@Steve_American. Capital, like land, is passive and inanimate – why should it have a return? But I guess you mean the owners of capital, so the question is why should they have a return? Only labour earns its return as it alone creates wealth, using capital (which they create) and land. The rest is economic rent.

The bit about the RBA monetizing (is that the correct term for when the central bank purchases government debt outright?) the sub-sovereign State debt was very interesting to me because without it I would have assumed as currency users they would be tightly financially constrained. Does the Australian government also support municipalities this way via central bank purchasing of their debt as well?

If so, the call for public wage restraint in those jurisdictions becomes a sort of nonsense, doesn’t it?

I don’t know Carol, I think risking what you already have needs some reward if it works out. Or the risk won’t be taken in the first place.

Jerry, this ‘risk’ thing is over-stated, imo. .

What risk was Gates taking when he was fiddling around with computers in the 70’s?

And as for Bezos, a shop keeper who had the idea he could access the global marketplace, is his reward commensurate with the risk he took? He’s now wealthier than some entire countries….while some entire economies are collapsing.

“And as for Bezos, a shop keeper who had the idea he could access the global marketplace, is his reward commensurate with the risk he took?”

The actual question is why does that matter to you? And the millions of others who failed where Amazon succeeded – because they believed they could be Bezos.

In a world where numbers don’t matter which does it matter is somebody has lots of numbers. There is no shortage of numbers.

What there is is a shortage of jobs paying a living wage. What Bezos and pals need to realise is that the deal for them having numbers is that everybody else has a living wage job. Otherwise the numbers will be removed by those without the jobs.