I grew up in a society where collective will was at the forefront and it…

Latest data – largest quarterly output decline in recorded US history – but Europe is worse

The US Bureau of Economic Analysis (BEA) released the – Gross Domestic Product, Second Quarter 2020 (Advance Estimate) – data last week (July 30, 2020). It shows that the US economy has declined by 9.49 per cent between the March- and June-quarters. On an annual basis the decline was 9.54 per cent. This is the largest quarterly contraction in recorded history. Consumption expenditure declined by 10.1 per cent in real terms and business investment by 17.4 per cent. The collapse in consumer expenditure was mostly concentrated in services (-22.6%), which reflected lockdowns and the unwillingness of consumers to continue normal practices. Personal saving as a percentage of disposable personal income jumped dramatically from 9.5 per cent in the March-quarter to 25.7 percent in the second quarter. That is a testament to the endemic uncertainty that the pandemic has created. The contribution of net exports actually rose, not because exports rose (their individual contribution was -9.38 points), but because of the slump in imports – a smaller leakage from the expenditure system (adding 10.1 points t growth!). Overall, there is no trend – just a massive mess. How the second wave of the virus impacts is anybody’s guess but lots more deaths and more disruption is certain.

The global context and overview

The latest Eurostat data shows the European Union contracted by 11.9 per cent in the second quarter 2020, while the euro area was down 12.1 per cent. Italy’s output shrank by 12.4 per cent and is now the same size as it was in 1993. The Spanish economy contracted by 18.5 per cent, France by 13.8 per cent, Portugal by 14.1 per cent and Germany, the largest European economy contracted by 10.1 per cent. Unemployment rates are rising as output shrinks.

Similarly, the US economy contracted by 9.5 per cent in the June quarter, the largest quarterly contraction in recorded history. Consumption expenditure declined by 10.1 per cent in real terms and business investment by 17.4 per cent.

The collapse in consumer expenditure was mostly concentrated in services (-22.6 per cent), which reflected lockdowns and the unwillingness of consumers to continue normal practices.

Durable goods consumption actually rose (0.7 per cent), reflecting purchases of vehicles and white goods brought forward on the back of cash payments associated with government stimulus.

The consumer outlook is bleak. The Conference Board Consumer Confidence Index rose in June, but as the infection rate has accelerated, the July figure declined from 98.3 to 92.6.

This was accompanied by a massive decline in the Expectations Index, which signals short-term consumer estimates of income and labour market prospects – down to 91.5 from 106.1.

The future is not looking optimistic.

Several major US companies are laying off thousands (for example, Boeing, AT&T, Hilton, HSBC, Linked-In, etc and many companies have disappeared forever.

Conversely, Amazon, Apple and Facebook have boomed with shifts to home office setups and on-line shopping. These shifts will not be temporary. Firms will start rationalising expensive office space and the decline in bricks-and-mortar retailing will accelerate. Both trends have serious implications for the viability of commercial real estate, which was already in trouble before the pandemic.

The human tragedy is exemplified by the 54 odd million people that have filed for unemployment insurance since early March. While the weekly claims started to decline as the lockdowns eased, they have risen again with 1.4 million filing in the last week of July. The insured unemployment rate has also risen (11.6 per cent).

The socio-economic crisis is global and will worsen as nations around the world endure the emerging second wave of the virus. Renewed lockdowns are certain as hospital systems face being overwhelmed and death rates remain high.

The politicians started with the V-shaped (hibernation) presumption, while they ‘flattened the curve’. The reality is different. This will be a long-drawn out crisis and many companies will fail to ‘get to the other side’, leaving a residual of high unemployment.

Capitalism is now on state life support. The ‘market’ will not provide the cure.

The age of irrational worry about fiscal deficits and public debt ratios will have to give way to a new era of large, continuous deficits supported by the monetary capacity of the Federal Reserve.

The problem for most nations is that governments ‘penny pinched’ on the fiscal support that accompanied the lockdowns. This not only exacerbated the economic losses, but, created the vicious cycle where political pressure led to premature easing of the lockdowns, which then fuelled the infection rate, and magnified the economic losses.

The only reasonable conclusion, as evidenced by the substantial increase in official unemployment and the rise in the BLS U6 broader measure of labour underutilisation is that the fiscal support has been grossly inadequate and poorly targeted.

The benefits of the US government’s fiscal package flowed disproportionately to corporations and left millions of workers exposed to income loss and financial disaster.

The main action has come from the Federal Reserve’s decisions to purchase government bonds in large quantities and to provide other liquidity support.

The following graphs provide some comparative analysis, given that Eurostat released some June-quarter national accounts data last week.

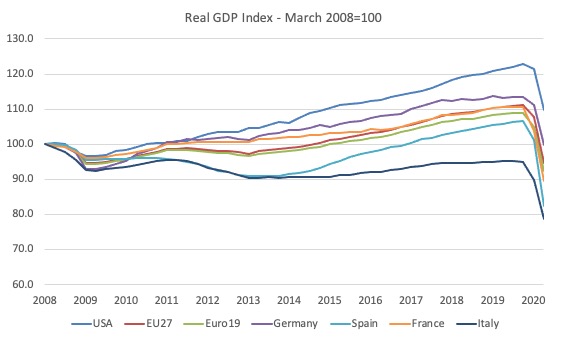

The first shows the GDP indexes for selected European nations (and the EU and Eurozone) and the US from the March-quarter 2008. This graph lets us see the different recovery profiles after the GFC and the dives as a result of the pandemic.

The US recovered more strongly than any of the European nation, the best of them being Germany, which, because of its size drives the overall EU and Eurozone result.

Italy, by way of contrast, never really recovered and is now 21.2 per cent smaller in economic size than it was before the GFC. That is unsustainable.

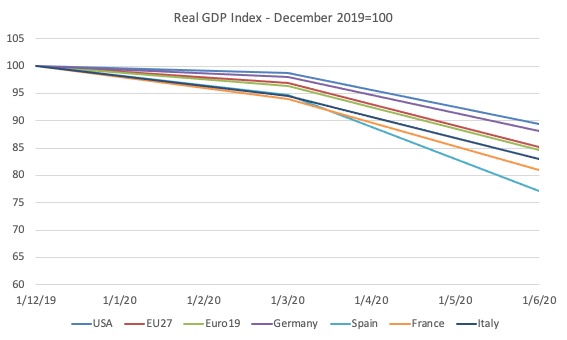

The next graph shifts the benchmark for the index to December 2019 (=100) to better show how the extent of the pandemic slumps in the respective economies.

Three big European nations – Spain, France and Italy – have contracted by 22.8 per cent, 18.9 per cent and 17 per cent, respectively – since the end of last year.

The US has contracted so far over the same period by 10.6 per cent.

The aggregate level

The US Bureau of Economic Analysis said that:

Real gross domestic product (GDP) decreased at an annual rate of 32.9 percent in the second quarter of 2020, according to the “advance” estimate released by the Bureau of Economic Analysis. In the first quarter of 2020, real GDP decreased 5.0 percent.

Note that the BEA is using the annualised quarterly figure here (multiplying the June-quarter growth by 4) rather than the actual annual (year-on-year) growth rate which is the percentage shift from the June-quarter 2019 to the June-quarter 2020.

That contraction was 9.54 per cent, after the annual figure for the March-quarter was a lowly 0.32 per cent.

The quarter-on-quarter growth outcome for the June-quarter was 9.49 per cent after a 1.26 per cent contraction in the March-quarter.

The BEA figure is somewhat misleading in this type of crisis. It is good for headlines but the economy is likely to rebound more quickly than usual once the lockdowns ease, although note my caution above.

The following sequence of graphs captures the story.

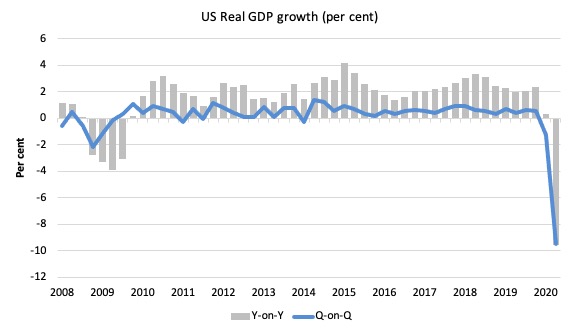

The first graph shows the annual real GDP growth rate (year-to-year) from the peak of the last cycle (December-quarter 2007) to the June-quarter 2020 (grey bars) and the quarterly growth rate (blue line). Note the date line starts at March-quarter 2008.

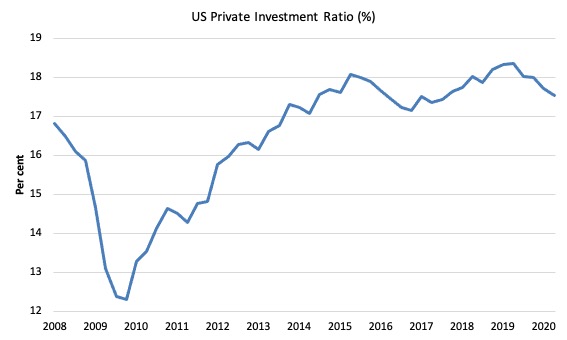

The next graph shows the evolution of the Private Investment to GDP ratio from the December-quarter 2007 (real GDP peak prior to GFC downturn) to the June-quarter 2020. Note the date line starts at March-quarter 2008.

The decline in the investment ratio as a result of the crisis was substantial and endured for 2 years. As a result the potential productive capacity of the US contracted somewhat. There are various estimates available but the overall message is that potential GDP fell considerably as a result of the lack of productive investment in the period following the crisis.

In more recent times, the investment ratio has stalled and is now at 17.5 per cent of GDP, down from 18.4 per cent in the June-quarter 2019, which was the highest levels since the current BEA data series began in the June-quarter 1947.

In this blog post – Common elements linking US and UK economic slowdowns (May 1, 2017) – I discussed estimates of potential GDP in the US and the shortcomings of traditional methods used by institutions such as the Congressional Budget Office.

So if you are interested please go back and review that discussion.

The latest CBO estimates, made available through – St Louis Federal Reserve Bank, show why we should be skeptical.

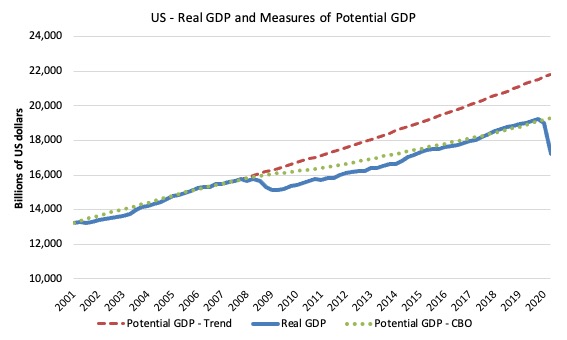

To get some idea of what has happened to potential real GDP growth in the US, the next graph shows the actual real GDP for the US (in $US billions) and two estimates of the potential GDP. There are many ways of estimating potential GDP given it is unobservable.

While I could have adopted a much more sophisticated technique to produce the red dotted series (potential GDP) in the graph, I decided to do some simple extrapolation instead to provide a base case.

The question is when to start the projection and at what rate. I chose to extrapolate from the most recent real GDP peak (December-quarter 2007). This is a fairly standard sort of exercise.

The projected rate of growth was the average quarterly growth rate between 2001Q4 and 2007Q4, which was a period (as you can see in the graph) where real GDP grew steadily (at 0.65 per cent per quarter) with no major shocks.

If the global financial crisis had not have occurred it would be reasonable to assume that the economy would have grown along the red dotted line (or thereabouts) for some period.

The gap between actual and potential GDP (red dotted version) in the June-quarter 2020 is around $US4,625.4 billion or around 21.2 per cent.

The green dotted line is the estimate of potential output provided by the US Congressional Budget Office and suggests that the US economy was estimated to be operating at 0.8 per cent over its potential in the December-quarter 2019.

It is hard to believe the estimate given the suppressed inflationary environment leading into the pandemic.

The CBO is now estimating a 10.8 per cent output gap – so the reality is somewhere between the two estimates – probably closer to the read line than the green line.

Contributions to growth

The accompanying BEA Press Release said that:

The decrease in real GDP reflected decreases in personal consumption expenditures (PCE), exports, private inventory investment, nonresidential fixed investment, residential fixed investment, and state and local government spending that were partly offset by an increase in federal government spending. Imports, which are a subtraction in the calculation of GDP, decreased …

The decrease in PCE reflected decreases in services (led by health care) and goods (led by clothing and footwear). The decrease in exports primarily reflected a decrease in goods (led by capital goods). The decrease in private inventory investment primarily reflected a decrease in retail (led by motor vehicle dealers). The decrease in nonresidential fixed investment primarily reflected a decrease in equipment (led by transportation equipment), while the decrease in residential investment primarily reflected a decrease in new single-family housing.

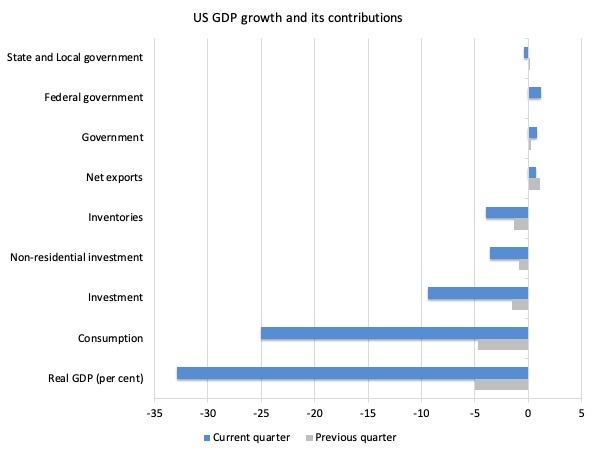

The next graph compares the June-quarter 2020 (blue bars) contributions to real GDP growth at the level of the broad spending aggregates with the March-quarter 2020 (gray bars).

The major driver of the GDP collapse has been the decline in personal consumption spending with private capital formation the second largest driver.

It is clear that the contribution of the government sector has been weak compared to the contraction in the private sector.

We conclude that the fiscal stimulus has been totally inadequate relative to the scale of the crisis.

Further state and local government spending contracted.

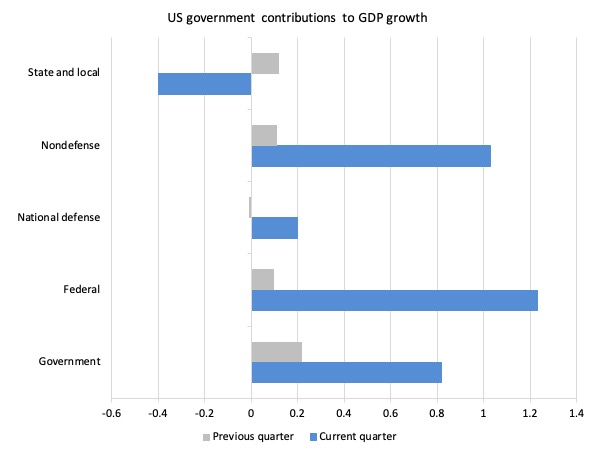

The next graph decomposes the government sector and shows that all levels of government contributed significantly to growth in the current-quarter but decreased their contributions relative to the previous-quarter.

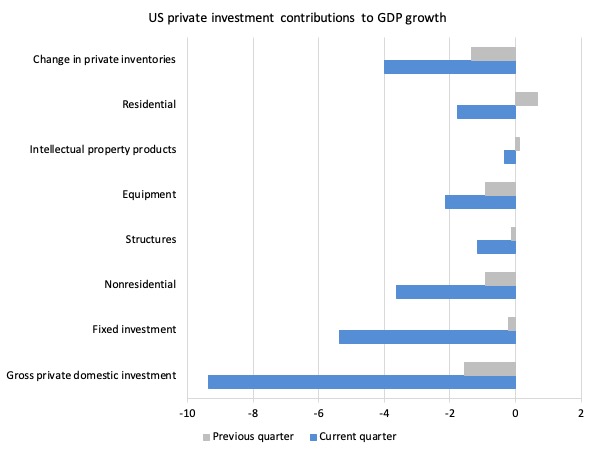

The next graph breaks down the contributions to real GDP growth of the various components of investment.

The decline in most categories of investment is a worrying sign.

Household consumption and debt

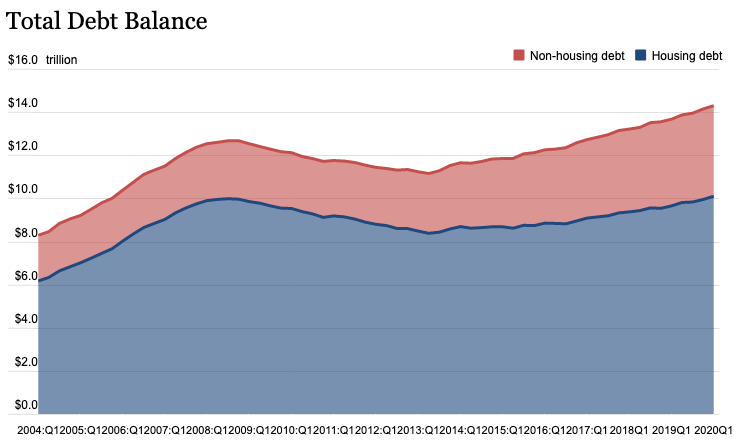

The Federal Reserve Bank of New York publication – Household Debt and Credit Report – was last updated for the March-quarter 2019 (published May 2020) – (PDF Download).

It shows:

… total household debt increased by $155 billion, or 1.1 percent, to reach $14.3 trillion in the first quarter of 2020. Mortgage balances rose by $156 billion, while nonhousing debt balances remained relatively flat. Credit card balances declined by a larger-than-expected degree, based on seasonal patterns, but it is too soon to confidently assess any connection between this decline and the coronavirus outbreak.

The rise in non-housing debt (for example, credit card balances) is particularly worrying. It is a sign that household income growth is not sufficient to finance basic needs.

The Data shows that:

About 189,000 consumers had a bankruptcy notation added to their credit reports in 2020Q1, a small decrease from the 192,000 seen in 2019Q1.

The following graph is taken from the FRBNY publication. Clearly the gap between mortgage and non-mortgage debt is rising as total household indebtedness rises.

Part of any stimulus/recovery program should be targetted on increasing real wages growth and household disposable income growth to allow these debt levels to be reduced.

Conclusion

The pandemic has created the largest quarterly contraction in recorded US history.

The US economy has declined by 9.49 per cent between the March- and June-quarters.

On an annual basis the decline was 9.54 per cent.

Consumption expenditure declined by 10.1 per cent in real terms and business investment by 17.4 per cent.

The collapse in consumer expenditure was mostly concentrated in services (-22.6%), which reflected lockdowns and the unwillingness of consumers to continue normal practices.

Personal saving as a percentage of disposable personal income jumped dramatically from 9.5 per cent in the March-quarter to 25.7 percent in the second quarter.

The contribution of net exports actually rose, not because exports rose (their individual contribution was -9.38 points), but because of the slump in imports – a smaller leakage from the expenditure system (adding 10.1 points t growth!).

Overall, there is no trend – just a massive mess. How the second wave of the virus impacts is anybody’s guess but lots more deaths and more disruption is certain.

That is enough for today!

(c) Copyright 2019 William Mitchell. All Rights Reserved.

BTW, the Spanish National Institute of Statistics reported that 1.6 million people couldn’t look for jobs because of the lockdown situation. Hence they were classified as inactive and not unemployed. If they had been counted as unemployed the rate would have 20% of the active population, not the officially reported 15%.

Bill writes

“The latest Eurostat data shows the European Union contracted by 11.9 per cent in the second quarter 2020, while the euro area was down 12.1 per cent. Italy shrank by 12.4 per cent and is now the same size as it was in 1993. ”

But that is misleading. GDP (per quarter) shrinking doesnt mean that the country losing size or the economy. It’s the Flow, the output, which is shrinking. All the production potential build up is still there. So the comparison whith a year in the past seems heavily misleading and shouldnt happen by a proponent of SFC-modelling.

You can just about guarantee they will reintroduce their austerity policies early as resistance is futile against the BORG.

Converge or die.

” It shows that the US economy has declined by 9.49 per cent between the March- and June-quarters. On an annual basis the decline was 9.54 per cent.” This confuses me. Are you referencing Year over Year declines? A quarterly decline of 9.54%, if carried out through the year, translates into an annual decline of 27.5% even if the first quarter was zero. Then later on this: “Real gross domestic product (GDP) decreased at an annual rate of 32.9 percent in the second quarter of 2020, according to the “advance” estimate released by the Bureau of Economic Analysis. In the first quarter of 2020, real GDP decreased 5.0 percent.” I get that x4 gives a more stark headline and all, but I’m still confused about the figures. If first quarter declined by 5% and then the second quarter declined further by 9.49%, then the annual quarter projected out would be X2, or 29.08%. Anyway, I’ll just go with the reality that whatever the declines are, it’s a disaster!

As a construction worker I experience the changing attitudes towards investment every day on the job. A seemingly large amount of investors and their money are still trying to force construction projects through, everyday there are large starts that stutter to stops, yet they keep trying. The general contractor companies would love a “don’t ask, don’t tell” policy about illness among workers withmany people desperate to work, but right now the threat of legal liabilities forces them to follow through and shut jobs down (these are large projects). I know many workers laboring under an imagined future they are trying to make happen and would rather be dead than not working. If Mitch McConnell gets the proposed protection from liability for companies and employers there will be a large jump in construction investment and output, along with a jump in cases (though many will not be reported) and probably deaths. The carrot needs to be removed so the lash of the whip will be felt.

“Capitalism is now on state life support. The ‘market’ will not provide the cure.” It is only a matter of time (and suffering) before the people make the decision to pull the plug on the machinery of capital-controlled government that is infusing fiat money to keep capitalism alive. Instead of perpetuating the capitalist coma, this fiat money must be redirected to support life itself, to restore the health of people and planet. And no, “the market” cannot do this; only the people can. The view through the MMT lens shows that this redirection of fiat money is THE life-and-death issue that dwarfs all others. The coming Covid Depression will provide the context in which this single, vital issue can be politicized in the positive sense of entering public awareness and creating consensus around the elemental agenda of survival. Thus, I submit, more than ever in recent memory, there is reason right now, as the darkness sets in, to hope.

Willy love your explanation how Libertarian based market economies self-equilibrate through cheating!

I admire your optimism, Newton. It will not be easy, as I’m sure you know.

I’ve enjoyed reading through the posts on Bill’s blog. It’s been a long time since I read Frank Livesey’s textbook at high school – but it wasn’t long before I realised just how redundant these teachings were.

I graduated in 1983 – just as Thatcher came to power and deregulated finance. My first house was a five bedroomed detached Victorian villa that cost £70K – way beyond what my parents or grandparents could ever have dreamt of owning. Everything seemed so easy. Money was plentiful.

But every now and again, the bubble burst. Nigel; Lawson and the ERM was my first experience – but there were other shocks, of course.

9/11 and the GFC. Much of the last decade has been a rolling crisis – particularly since Brexit and Trump – and I don’t know about you, but by Christmas last year it was pretty obvious that the powder keg was about to erupt again.

Why?

Take a step back for a moment. What Bill et al. have done is to seek a rational explanation for what governments and central banks do with money in relation to their economic framework. Including the creation of money under the fiat currency principles.

For most people in the world, understanding what that means would be a paradigm shift – for good reason. A light-bulb moment indeed.

As economists – once you’ve gained that enlightenment, there has been an explosion of positive and productive ideas – and that’s most commendable. Bill’s suggestion with the JG is a fine example – but there are other’s too. It’s heartening to see a quality discussion stimulated by a simple focus.

Many of the ideas and proposals I’ve read here are worth consideration – they have an underlying goodness – a clear focus to the importance of the collective; the preserve this place for the benefit of all who come after us. Dreamers and organisers – it’s been a joy to read.

However, I feel you underestimate the challenge ahead.

By your very observations, money supply and creation has been pretty much unlimited for many countries over the past two(?) decades. I suspect if we truly knew how much money has been created by governments and banks, we’d be completely flabbergasted. Is there a figure above a Trillion yet?

As economists, you might think governments would be taxing their citizens to an extraordinary degree just to sift some of the cash back out to prevent inflation – but that has never happened. Instead we have the off-shore banking system to conveniently hide the cash instead. It serves a purpose, I guess – but only if you understand human nature, as I’m sure Warren Mosler would agree.

So, beyond the hermetically sealed national economies – where you practice your progressive fiscal policies, there is a huge elephant in the room sitting atop an enormous drain. It’s called the “Other World”. Here live the true “Masters of the Universe”.

This is the world we have to conquer, if there is to be any hope for humanity, as we know it could be.

It’s as if we’ve discovered the Magic Money Tree in our adolescence and behaved accordingly. Suddenly we’re near retirement and have to change course – urgently, but it isn’t easy.

Bill devotes much writing to Japan. What an interesting journey – particularly the relationship between the Ministry of Finance and the Central Bank of Japan. Whilst they were both consumed by each other – behind the scenes, in the ‘other world’, currency traders, vulture funds, speculators – were waiting to pounce.

Just like every other crisis.

As Central Banker, Masaaki Shirakawa, noted:

“It is not easy to change the institutional framework and promote structural reform, since it necessarily involves the vested interests of all the related economic agents.”

Yutaka Yamaguchi, a deputy governor of the Bank of Japan remarked:

“The Bank of Japan had faced the big dilemma, that monetary easing would produce the mitigation of immediate risks, which in turn, would result in a delaying adopting ultimate solutions.”

The examples of the Japanese and Asian crises illustrate how crises can be engineered to facilitate the redistribution of economic ownership and to implement legal, structural and political change.

But by whom and why?

The solutions offered here are dependant on individual countries using their own powers of money creation with a fiat currency and practising the principles espoused by Bill et al. with specific goals of full employment and a green, sustainable economy.

Most admirable. But our governments are only middle managers – it’s the board and chairman that dictate the ultimate policy and they will likely also have the same objectives as Bill et al. Only their methodology is radically different. And callously brutal.

We’re all desperately trying to solve the impossible, but only because we’re looking in the wrong direction.

Newton, fellow contributors – and Bill. It’s been a pleasure reading your thoughts. I wish you all the very best in the days and months ahead.

Nae Pasaran!

One other thing. Be careful, Bill. What you’re doing here is lifting a tightly closed lid and exposing a squalid, disgusting world – but a dangerous one nonetheless. You’re fellow countryman – Julian Assange is experiencing the most horrid torture for exposing secrecy and corruption. What you are doing is on another scale, altogether.

Remember the Joe South song.

Great ideas. If you’d like a hand to put them in place, please let me know. You’ll need all the help that you can muster.

All the best.

I believe this short essay of mine addresses some central issues of thes times. It definitely draws on MMT as well as on influences from Marx, Veblen and CasP theory (Capital as Power).

DIFFERENT CRISIS – SAME SYSTEM.

“GDP measures only the flow of currency through the production-and-consumption economy.” – Ed Zimmer.

Currency is notional not real. The corollary of Ed Zimmer’s statement is: “GDP measures nothing real.” GDP measures the flow of the notional numéraire. The numéraire (money) measures the social-fictive and market-mediated dimension of “value” in the floating base unit of the numéraire, usually dollars. In reality, the only way to accurately measure anything objectively real is to measure it in a scientific dimension and to use a rigorously defined and fixed base unit. (See the SI (International System of Units) table for the scientifc dimensions and base uniis.)

The above argument does not state that money is unusable. Clearly, it is usable. We have the empirical proof that it is established and produced by state fiat and is used by people for purchases and trades of goods and services, including labor services, in our extant political economy system. This kind of reality of money, its use in exchanges, is a constructed and extensive, processual, complex-system and sociopolitical fact in modern economies.

Leaving aside the ontological “value mistake” in microeconomics, the scientific mistake in macroeconomics and national accounts is to assume that numéraire amounts can be used used to aggregate unlike things in the (fictitious) dimension of “value”. Collections of objects and processes may only be validly aggregated in the same dimension. In turn, the base unit for measuring in the aggregation dimension must be scientifically objective, reliable and stable. Money is none of those things. (See Blair Fix – “The Aggregation Problem – Implications for Ecological and Biophysical Economics.)

What does this mistake of aggregating in money (as in GDP calculations) mean in practice? While it is pragmatically possible to use money for trade and exchanges, it is not scientifically valid to aggregate in the money “dimension” to get a true picture of the overall real economy system or to get a true picture of the effect of the real economy system on the surrounding real systems of ecology and biosphere. The only way to get a true picture in those arenas is to measure real things in real dimensions and categories and do so scientifically. This alerts us to the true nature of GDP and other macroeconomic numbers. They are tools of propaganda and control and nothing more. They are among the prime tools of the capitalist system. If any non-objective or concocted “picture” is used to “inform” people then the only true purpose can be indoctrination and control. These GDP numbers and national account numbers are used to justify decisions and to lend authority to edict, not to make decisions.

The political economy system of capitalism makes a priori assumptions and decisions on other criteria and then uses macroeconomic numbers to justify the decisions. That the decisions precede the number calculations is clearly demonstrable by real examples. Conditions of war and of civil crisis demonstrate this fact most clearly. These are conditions where, as in the Wizard of Oz, we see the curtain of “good governance” and “fiscal responsibility” twitched aside to reveal the true sequence in which the levers of power governance and fiscal governance are pulled. The political power lever is pulled first. The fiscal lever is pulled afterwards to ring up the necessary concocted numbers to justify the decision.

There are clear examples of this from recent Australian history. One example occurred when Australia was embroiled, in a somewhat token manner, in the Middle Eastern Wars in an effort to ingratiate itself with its ally and master, the USA. At the time in question, the low level of unemployment payments in Australia was a political issue and indeed it had been a perennial issue. The government’s line was that it had to balance the budget. No extra funds could be found for unemployment benefits or other social issues for that matter. Then, the USA put pressure on Australia. We were not doing enough in the War on the Arabic Peoples, otherwise known as the “War on Terror”. Suddenly, our government found $500 million extra Australian dollars to fly missions and drop bombs in the Middle East using our small but relatively high-tech Air Force.

The next clear example comes from the COVID-19 pandemic and we will all be able to relate to this. Once again, pre-pandemic, the goal was a balanced budget and no government debt. No monies (and thence no real resources) were available to lift the miserable rate of unemployment benefit or improve other social programs. Suddenly, when faced with economic and societal breakdown due to closures necessarily enforced to deal with the dangerous pandemic, the dollars were found (electronically “printed”) to pay “jobseeker” (a much raised unemployment benefit) and “jobkeeper” (a benefit really paid to employers to help keep people on). We can note that business people (big firms and small petite bourgeois owned firms alike) are in favor of subsidy dollars when they flow through them.

The point is that the flows of the real resources, real goods and real services of the nation can be adjusted, by political fiat, in times of crisis existential or political, to any level and in any direction at political will, within the parameters of what is possible in the real and machtpolitik (power politics) spheres alone. Consent of the people is sometimes preferred but not absolutely necessary. Money has nothing to do with the decisions or the feasibility of the decisions. It only has to do with facilitating exchanges necessary to implement the decisions. In this sense, money is logistics consequential on government strategic command and control; simply part of the delivery system of decisions for all that is usually – or suddenly and in a new fashion – declared within the ambit of government fiat.

There is no reason that radical changes to the flows of real resources, real goods and real services of the nation should be limited to war and pandemic crises. Many enduring social ills have festered and become chronic under the rule of neoliberal or late stage capitalism. There is no reason not to make radical changes to solve these chronic ills and then keep these radical changes in place more or less permanently.

Managing the economy and the environment must be made subject to science for production and impact options (using the production and impact sciences) and then made subject to democratic and ethical decision making for the choices from scientifically feasible and ethically defensible options. Thence decisions must be made as to what real resources are available, what the priorities are and where the real resources are to be deployed. This must all be done at the statist, dirigist and command level. In crucial matters (like halting climate change) we do need to institute new command economy elements. A command economy in a democracy is not the same sociopolitically as a command economy in an authoritarian state. If one holds the view that there are the same then one must hold the view that both sides of WW2 were morally indistinguishable, as they both ran command war economies, and that for the post-WW2 era it would have made no practical difference for human rights who won war.

Advances in science, technology, computing power and data gathering capacity now make it possible for a command economy system, using accurate data about real parameters (not notional numéraire data about fictive values unrelated to science or ethics) to plan the essential real aspects of the economy and to meet real human and ecological needs. and to do this for the very purposes of civilizational and existential survival. Again, if one’s thinking recoils from this conclusion, it means essentially one is rejecting the possibility of democratic command of the economy and ceding that command to cartels of oligopolistic corporations under ever-increasing conditions of corporate monopolization of the global economy.

One would be acquiescing and acceding to corporate dictatorship as the rising corporate monopolies take over more and more of the world economy. The power vacuum left by ceding democratic command and control via neoliberalism and minarchism is being filled by the corporate capitalist governance of the world. It is under that system that the real power decisions are already being made behind the cloak and veil of money. It is under their aegis that the common people and the entire biosphere environment are being destroyed. Money is propagandistically reified as the highest “reality” which logically and imperatively justifies the diktats of corporate capital.

Money is properly a tool of the exchange system and nothing more. It is not a measure of “value”, nor a measure of anything at the macro real levels, nor a decision metric useful for managing real systems. Any decision for the command, control and management of society by capital, as cover and control, is a decision for corporate capitalist dictatorship.

Newton,

“”Capitalism is now on state life support. The ‘market’ will not provide the cure.”

And I suspect the mainstream and their boosters now believe this too, given the pandemic caused economic crisis.

I was surprised that Bill and Noel Pearson were able to publish their JGS manifestos in the Murdoch press in Australia. I am beginning to think that Murdoch and the like now can see monetary policy is useless and that the only way to bail out and save capitalism’s skin is for fiscal policy to take the running. This is the only way I can rationalize the Murdoch press promoting MMT after spending decades promoting the mainstream government spending, deficit and debt mythologies.

Private debt level is higher than GFC.

What a dumpster fire.

Debt is not real. Real systems are real: real economy, real environment, real people. When things are going wrong in the real systems then you really are in trouble. Debt can be cancelled. This can even be done in ways that minimize real harm to the real systems mentioned above.

https://www.theguardian.com/business/2020/aug/03/global-debt-crisis-relief-coronavirus-pandemic

The graph on contribution to US growth of various government levels does not match the analysis. It’s only state and local governments that actually decreased whereas every other sector shows an increased contribution in the current quarter relative to the previous.

Ikonoclast: Nice essay. Many important observations. One that especially struck me: “Advances in science, technology, computing power and data gathering capacity now make it possible for a command economy system, using accurate data about real parameters (not notional numéraire data about fictive values unrelated to science or ethics) to plan the essential real aspects of the economy and to meet real human and ecological needs. and to do this for the very purposes of civilizational and existential survival.” Couldn’t agree more. We’ve reached a point where we can plan, coordinate, and operate a viable, humane, and ecologically-sensitive economy–a way of living together as full human beings–that makes the so-called free market look primitive and pathological. Many see this fact but let the possibility of achieving it go with a sigh, seeing it as a pipe dream up against insurmountable forces. Yet others like Bill and those of us who converse here simply refuse to let that neoliberal bitch called TINA have the last word.

Ikonoclast:

A relief to read. We cannot let the suborned administrators of our nations and cultures determine what is real. For example, population growth is officially not a component of the climate emergency. The USA is will succeed in “conquest of space” despite the problem of “conquering” neutron stars at 10 million tons per teaspoon, and share prices on north american markets is an indicator of value. The only sensible form of discourse we can retreat to and depend upon is a loosely scientific one.

Somebody has to devise a reality filter. The bulb on my BS warning device has been flashing for decades and it and I are fatigued. Thank you, and thanks for this site and its commentators.

@Iconclast

Of course, there are reasons. During the postwar period, most OECD countries and also others had economic policies that kept unemployment low.

But this also resulted in a stronger market position for the working class, they got a larger part of productivity growth than top end of town.

We cannot have it like that? That those who “deserve” get less?

But It was also war/pandemic times, the top end of town was afraid of the commie pandemic. Afterall Soviet had shown a significant endurance and industrial capacity in WWII.

Better to keep the working class “happy” or they might go commie.

So, when the enemy was defeated economic order was back to “normal”.

Of course, we should avoid the financialized GDP gobbledygook and focus on the real economy, what is and can be produced with available real resources. And is it necessary and without negative side effects.

With almost 8 billion on the planet and growing we have to household with real natural resources.

Globally population has grown from 2.5 billion 1950 to almost 8 billion now, +220 %. Europe did grow with +36%, considered a demographic if not disaster but a big problem. What number had been the “right”? 220 %? And 1.8 billion in Europe.

Permanent population growth is impossible.

The global +220 % growth, mainly Asia and Africa will create an enormous aging population problem if they don’t keep up population growth. +36 % are nothing compared to that.

Another thing is food production, in Sweden now a mantra is that we just produce 50 % of what we eat. That does not consider how much food we export and are a purely economic calculation. If one calculates in total tons and calories the possible food supply picture is significantly different. We are not dependent on imported lettuce, kiwis and so on for our nutrition, even if oranges and bananas are nice to have.

The real dependence is on diesel and energy consuming artificial fertilizers.