It is a public holiday in Australia today celebrating our national day - the day…

MMTed Q&A – Episode 8

Here is Episode 8 in our weekly MMTed Q&A series. In this episode, my special guest was Warren Mosler. We talked about the difference between issuing bonds and overt monetary financing, and issues related to those concepts and practices. And when your done with that you can enjoy some great Latin Jazz from the Monterey Peninsular – from 1959 (a good vintage).

MMTed Q&A – Episode 8

This is Episode 8 in the MMTed Q&A series.

This week, my special guest was Warren Mosler, one of the founders of MMT.

We talked about the difference between issuing bonds and overt monetary financing, and issues related to those concepts and practices.

The video goes for 6.55 minutes.

Note the discussion is mostly via Zoom, which means at time the audio and video quality is less than first-class. But we are learning to live with that constraint.

Call for MMTed Support

We are working towards beginning course delivery in September.

But we still need significant sponsors for this venture to ensure that we can run the educational program with negligible fees and to ensure it is sustainable over time.

If you are able to help on an ongoing basis that would be great. But we will also appreciate of once-off and small donations as your circumstances permit.

You can contribute in one of two ways:

1. Via PayPal – which is our preferred vehicle for receiving donations.

The PayPal donation button is available via the MMTed Home Page or via the – Donation button – on the right-hand menu of this page (below the calendar).

2. Direct to MMTed’s Bank Account.

Please write to me to request account details.

Please help if you can.

Today … Cal Tjader and Mongo Santamaria and others

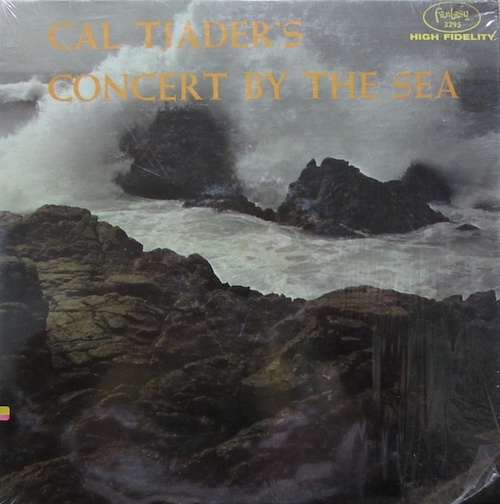

Last week, I offered a track from US vibes player Cal Tjader. As I flicked through the albums, I found another Cal Tjader release from 1959, his so-called – Concert by the Sea – which documented a concert he gave with 5 other players at Carmel-by-the-Sea on April 20, 1959.

It is one of the best albums I have ever owned although I have not listened to it for a while. Better fix that I thought.

But as it was a laid-back feel last week, I took a track from his 1969 album – Cal Tjader Sounds Out Burt Bacharach – on Skye Records. That suited my mood last week.

This week, we go back to 1959 and as musicians were gathering for the second Monterey Jazz Festival, Cal Tjader and some of the great players offered a preview concert, which was recorded and released by Fantasy Records.

The album title channelled the first – Concert by the Sea – release from 1955 by Errol Garner (another of my favourites although the audio is poor), which was a prelude to what became known as the Monterey Jazz Festival.

The 1955 concert was rather impromptu as I understand and was not meant to be recorded. The audio was an early bootleg affair with a reel-to-reel tape recorder planted backstage by a Jazz afficionado. The mix is shocking but the feel is there.

By 1959, things had become a bit more organised and the sound from Cal Tjader’s concert is excellent.

Featured on the album are some of the best players of the era:

- Vibes – Cal Tjader (died 1982)

- Percussion – Mongo Santamaria (died 2003)

- Drums – Willie Bobo (died 1983)

- Alto Saxophone, Flute – Paul Horn (died 2014)

- Bass – Al McKibbon

- Piano – Lonnie Hewitt

The standout player in my view is – Mongo Santamaria – who was born in Cuba and headed up some of the great Latin bands as a conga drummer.

His music drove the boogoloo dance era in the 1960s.

I played in a band in the 1970s where the percussion player was obsessed with Mongo Santamaria. I listened to a lot of his playing around then as he was moving into Latin jazz.

This is track two from the 1959 Volume 1 – Afro Blue – written by Mongo Santamaria. It was the first recorded performance of this instrumental, which was later recorded by John Coltrane in 1963 (the better known but rhythmically-altered version).

I prefer Mongo’s version which features that traditional African 3:2 drumming pattern and the distinctive, repeating bass pattern (six beats per bar).

That is enough for today!

(c) Copyright 2020 William Mitchell. All Rights Reserved.

I always love listening to Warren.

I understand the importance of cutting the length of the video, but when every pause is removed, my brain isn’t fast enough to process the information.

Really enjoyed this episode!

You’re got to love Warren’s way of cutting through neoliberal crap with the knife of commonsense MMT thinking. I’d like to talk to him about a thought I’ve had for quite a while, concerning two practical and seemingly attractive political policies that seem implicit in the MMT perspective. Why doesn’t a candidate, conversant with MMT, run on something like the following platform? First, cut ALL federal taxes to the bare minimum necessary to validate the official currency. Second, stop issuing federal bonds as unnecessary and unjust welfare for the rich. If we don’t need the money of the rich to improve things for the average citizen and the environment and also to take care of the poor, then why not translate that truth into a clear political position with such potentially broad appeal? I understand that the rich should be substantially taxed for reasons other than the federal government needing their money–reduction of their political influence, more equal wealth distribution, etc.–but that seems to be a secondary battle best fought once the kind of politician I’m envisioning gets into office on the suggested two-principle platform. Why include the bond issue with the tax issue? To counter the anticipated oppositional argument that reduced taxes will necessitate increased borrowing, thus opening the door to talk in a BIT more depth about MMT. In other words, why not make MMT not only intellectually compelling to thoughtful people (the academic battle) but also immediately beneficial to the pocketbook of all taxpaying voters (the political battle)?

Poor hearing and other distortions

Today’s MMT lesson defeated me from the off – but I have no criticism of your efforts Bill, it is my ears that failed the test.

Saddened by this setback I turned to your blog entitled “Overt Monetary Financing would flush out the ideological disdain for fiscal policy, Thursday, July 28, 2016.” I hope this was a correct choice.

Chiefly I picked out the following as particularly relevant:

“Mainstream economists would say that by draining the reserves, the central bank has reduced the ability of banks to lend which then, via the money multiplier, expands the money supply and causes inflation.

However, the reality is that:

Building bank reserves does not increase the ability of the banks to lend.

The money multiplier process so loved by the mainstream does not describe the way in which banks make loans.

Inflation is caused by aggregate demand growing faster than real output capacity. The reserve position of the banks is not functionally related with that process.

The banks are able to create as much credit as they can find credit-worthy customers to hold irrespective of the operations that accompany government net spending.”

The reluctance of mainstream economists to embrace MMT’s approach to overt financing I’m inclined to suppose stems in part from a fear that “creating” spending power will lead inevitably to unsustainable disorder – for example, where governments increase spending beyond reasonable levels to support an economy that reacts perversely to various policy attempts to achieve stability.

In those circumstances there would surely be a clamour for “budget discipline”, with all its employment consequences and the need to re-position various economic sectors so that new employment opportunities arose from the debris – and what then about prospective GDP levels.

Your exposition of MMT is renowned for being precise and founded on robust credentials; indeed, you often describe it as a lens through which its theory can be clearly identified. I therefore hesitate to point out that some mis-interpretation may nevertheless arise because of how we visualise this precise lens – it is possible for instance that, as individuals, we see the lens through a distorting prism, one that resides our minds.

This prism comprises and is influenced by genetic origin, shaped by philosophy and experience, embraced in a large way by ideology too.

This would be insignificant were it not for the effect ideology provides to driven people, able to inspire populations and nations: a pivotal influence on their attitudes. Historically, there does not appear to be any ideology and system of resource allocation that overcomes an inherent power-driven lust to exploit those precious elements inequitably.

MMT may emphatically prove the correctness of its theory but there is still an unproven practical application that must confront an apparent human disinclination to embrace a permanent or substantial concept of humanitarianism.

“Why doesn’t a candidate, conversant with MMT, run on something like the following platform?”

Ah, Newton – I’m sure you of all people know the answer to that one!

What inevitably happens to someone who dares rock the boat? This isn’t just an argument over economics or monetary policy – it’s about an ideology that some characterise, naively, as neoliberalism, but behind the veneer, Zionism is the ascendant force. There is a different order to all of this – unfortunately. Even if the economic argument is won – and why shouldn’t it be – there is another reckoning beyond.

I thoroughly recommend Rutgar Bregman’s “Humankind”. It provides another guiding light – not dissimilar to Bill’s – but on a different level.

Take care, my friend.

I get your point, Mark, and this is a theoretical exercise, but still…has any candidate or party dared to run on the principle of GREATLY REDUCED FEDERAL TAXATION ACROSS THE BOARD, ONLY MINIMAL OR NOMINAL TAXES–a platform which MMT theory would seem to allow? I know many American voters, from both sides of the aisle, who would LEAP to embrace a politician or political party bold enough to push that tax-busting agenda AND BACK IT UP with solid economic facts. If pocketbook issues trump all others at the voting booth, then is not MMT’s take on taxes pure political dynamite, yet to be ignited by the right or left?

This is the first time I listen to music put on by Bill. It is very pleasant to the mood and mind. I will listen to it again.

We (my wife is the mainstream here) normally listen to, for examples, classical music, old Jazz, ethnic music (many Indian traditional and dance music), French chansons, musicals and American songs and all music that produce pleasant and soothing moods.