According to the International Coffee Organization (ICO), the price of coffee has risen for 17 consecutive months and the sector is being hit with sequential shocks, the latest being the Ukrainian conflict, which is having impacts on both the demand and supply sides. I was talking with a friend over the weekend just gone and…

Labour force trends in Timor-Leste continue to point to a need for a Job Guarantee

Last week (October 7, 2019), the ILO released its latest report on Timor-Leste – Timor-Leste labour force surveys 2010-2013-2016: Main trends based on harmonized data. I have been waiting for this publication as it provides the most coherent labour market data for TL. I am working on a detailed Job Guarantee proposal and I needed the ILO data. In this vein, I have also been reviewing the most recent fiscal statement from the Timor-Leste Government to see what direction of policy is taking, which will further help me understand the opportunities. TL is one of the poorest nations. It has a very fast growing and young population. Around 70 per cent of the workforce is ‘self-employed’ in the agricultural sector despite that sector enjoying only modest growth (9 per cent between 2000 and 2017) which has seen it slip in importance from 24.5 per cent of total GDP in 2000 to just 9.2 per cent in 2017 (latest data). The growth in employment in TL has been largely confined to Dili and is mostly in self-employment with limited job security and capacity for wages growth. There are two factors constraining the growth of quality employment: (a) the lack of investment in education and skills development; and (b) the lack of diversity in the structure of the economy, with the oil and gas sector accounting for 43 per cent of total output (2017) but generating very few employment opportunities. Governance issues (rule of law, contractual enforcement, political uncertainty) also contribute to a lack of capital formation, which, in turn, constrains employment growth. What is needed are policies to diversify the economy both in industrial structure and in spatial terms (promote growth outside of Dili), strong investment in education and health, and job opportunities that are suitable to the unmet needs in regional areas and the skill levels of the citizens who live there. Once I investigate the data more deeply I will publish a Job Guarantee proposal. But here are some necessary thoughts that condition my approach.

I last wrote about Timor-Leste in this three part series:

1. Timor-Leste – challenges for the new government – Part 1 (May 15, 2018).

2. Timor-Leste – challenges for the new government – Part 2 (May 16, 2018).

3. Timor-Leste – challenges for the new government – Part 3 (May 24, 2018).

The category – Timor-Leste – also catalogues my earlier blog posts on TL.

Currency sovereignty

I have broached the issue of currency sovereignty before and will not return to that here.

Suffice to say that I remain of the view that in the interests of Timor-Leste’s long-term development, the new government should abandon the US dollar as soon as possible.

The bevy of consultants, IMF delegations etc that hover around the TL consulting ‘honey pot’ all argue that Timor-Leste cannot cope with its own currency.

Why?

1. A TL currency would depreciate quickly and hyperinflation would follow soon after.

2. TL is small, open economy dependent on imports and oil revenue, with few exports which face volatile prices on international markets. It has an undeveloped financial sector and a dearth of private activity.

So such a depreciation would not change the real exchange rate and hence improve competitiveness.

Always these arguments are presented in terms of the failed ‘export-led’ IMF-type models and avoid facing the issue that having its own currency would enhance the government’s capacity to bring all idle resources into productive use, including labour resources.

The IMF obsession with export competitiveness has delivered poor results for nations that have tried to export their way to prosperity with a fiscal straitjacket being imposed.

Even within the trade-narrative, using the US dollar as its currency significantly disadvantages Timor-Leste in terms of international competitiveness.

Timor-Leste has to take US interest rates as given and nominal movements in the US dollar drive its real exchange rate, which is the accepted indicator of international competitiveness.

If the US dollar appreciates against the currencies of TL’s major trading partners – for example, Indonesia, Malaysia, Australia and Chine, then TL loses international competitiveness.

Domestic inflation pressures also exacerbate this shift.

Further, the interest rate environment is clearly determined by what the US Federal Reserve Bank deems to be suitable for advancing its agenda, which certainly does not include any consideration of the impact of different interest rate choices on Timor-Leste.

While the real exchange rate movements (up by around 45 per cent in 2014 relative to 2010 dropping to 30 per cent by 2017 on the back of a more stable US dollar and low domestic inflation) do not affect the oil sector exports (they are contracted in US dollars), other exports such as tourism are disadvantaged.

I discuss this problem more in the blog post listed as (2) above.

The use of the US dollar was also meant to be attractive for Foreign Direct Investment (FDI) but the evidence is that FDI has declined over the last decade (with some positive blips in recent quarters).

Dollarisation has also undermined the development of a local import-competing sector. At present, Timor-Leste can import goods and services more cheaply than they can be produced locally because it uses the US dollar.

If the US dollar was abandoned and the local currency depreciated somewhat – then that cost disadvantage would be eliminated, thus spawning incentives to develop import-competing products. FDI would be attracted to those opportunities.

A viable import-competing sector is a bulwark against imported inflationary pressures. It also provides for skill development and a ‘market’ for non-government consumption spending.

One of the problems of the agricultural sector is the lack of market access. The development of import-competing processing capacities and increased market access would complement government investment in rural infrastructure designed to improve output and access to the growing markets.

I also have written about the problem with the finite oil resources which contribute to the Petroleum Fund.

The Government is using the considerable resources available from the Petroleum Fund to rebuild the roads, water supply systems, the power supply, houses and school buildings which were targetted as a malicious last act of an illegal colonisation by the Indonesians.

Much more public infrastructure development, especially in rural areas is required.

Diversification

In the blog posts cited above, I have documented the extreme lack of diversity in the TL economy – with its dependence on the oil and gas industry.

It was entirely reasonable for the TL government to draw on the petroleum resources to fund their social and infrastructure programs given that it had been blindsided into using the US dollar as its currency.

The problem for resource-rich poor nations is clear – how to diversify economic activity to provide a richer distribution of jobs for its growing population.

The corollary is how to diversify opportunities for those groups that are marginalised – rural communities, women, those with disabilities, and other minorities.

The following graph shows the evolution of real GDP in TL – separated into Oil and Non-oil production from 2000 to 2017. The decline of the oil contribution is a reflection of falling oil prices and claims that the oil reserves are running out.

The predictions of the demise of the oil sector are probably a little premature given that Australia and TL recently (August) reached a resolution of their maritime borders, which has allowed the TL to issue new licences to explore the so-called “Greater Sunrise offshore gas and condensate fields, and for Carnarvon’s Buffalo offshore oil field” (Source)

And this is the big unknown.

The TL government has spent millions (a significant draw down from its Petroleum Fund) on the so-called Tasi Mane project in the south-west coast of the nation.

The international press regularly reports that there is a new airport that is largely unused, a four-lane ‘superhighway’ that no-one drives down, all part of a plan to build an onshore processing facility to value add on its oil production.

Although, I am reliably told that this infrastructure is being used and is setting TL up for a more prosperous future.

In that sense, the gamble is that the new arrangements with Australia (the “Treaty”) will transfer the majority of the royalties “from the still undeveloped Greater Sunrise field” to TL (Source).

The estimates of the returns are huge and disputed.

The critics claim that the bet is too risky and is “the least efficient way of creating jobs in Timor.”

Further, it is claimed that “Timor simply lacks the skilled workforce to build or operate an LNG plant or oil refinery.”

One of the clear outcomes from the billions that will be spent of the oil infrastructure project is that a small number of people will benefit greatly and the rest will probably not enjoy any significant material advantage.

The question of diversification is continually raised in this context.

One of the accepted principles of economic development is that public investment in education and training (all levels) and health care are essential drivers of increased material prosperity.

There are many reasons for the links between increased prosperity and investment in education and health care that I will not go into here.

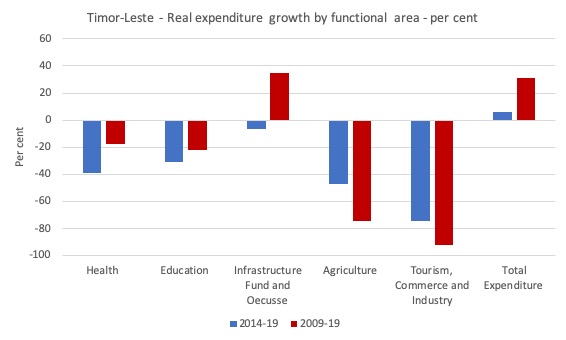

But with such an investment in the oil infrastructure project, the TL government has been significantly reducing its real spending in other functional areas that will be essential for diversifying economic activity and broadening prosperity.

The following graph shows the real public spending by functional area (2019 US dollars) in TL.

It is simply not viable to develop a diversified economy if the Government is cutting back on spending in these essential functional areas.

Quite apart from the quantum of public social spending, another aspect concerns the incidence – who benefits?

In 2014, 41.8 per cent of the population of TL lived below the National Poverty Line (Source) but the spatial distribution is very biased towards rural areas – there is evidence that in some places poverty rates are 25 per cent (Dili) yet rise to 80 per cent in some remote areas.

This puts the oil-export growth strategy into context.

It has reduced poverty rates overall but barely touched the rural areas.

The Asian Development Bank report – The Social Protection Indicator for the Pacific Assessing Progress (published July 2019) – provides evidence that Social Protection expenditure (aged and other pensions, welfare cash transfers, active labour market programs) in the Pacific region nations:

… tends to favor the nonpoor over the poor.

We learn that:

1. “Social insurance spending on the nonpoor in 2015 (2.4% of GDP per capita) was nearly five times as high as that on the poor (0.5% of GDP per capita). Nearly all countries spent more on the nonpoor.”

2. “The gap in social assistance spending was less pronounced than that in social insurance, but the nonpoor still received more than the poor”.

3. “In ALMPs, the difference in spending was very small, at 0.2 percentage points in favor of the nonpoor.”

Specifically, for TL:

… despite these poverty-targeted programs, the nonpoor still received more than the poor in the Cook Islands and Timor-Leste …

Timor-Leste has an ALMPs that targets cash for work for rural youth. It spent 0.2% of GDP per capita on the poor and 0.5% of GDP per capita on the nonpoor.

Which suggests that the schemes in place need to be more effectively targetted and the level of spending on human development needs to rise in TL.

If one wants to reduce the poverty rate, then welfare assistance has to disproportionately benefit the poor rather than the non-poor.

In general, the ADB found that “Social insurance programs … remain very narrowly based on those in formal employment. Social assistance programs reach only a fifth of intended beneficiaries.”

They recommend broadening the schemes “to reach those in the informal economy” and to “expand coverage of social assistance programs to better reach vulnerable groups, such as children, older persons, and persons with disabilities”.

Spending on training and skill development (ALMPs) is woeful.

The ADB recommend that:

Further investment in ALMPs is clearly needed to help address the needs of the unemployed and underemployed through skills development. It can also help support the poorest segments by involving them in food- and cash-for-work programs and providing them with immediate relief.

Further, for those in employment, there has been a distinct lack of Government motivation to keep lifting the minimum wage.

On May Day 2019. there was the largest gathering of workers in Dili “in decades”, according to the Union Aid Abroad-APHEDA report (May 3, 2019) – Workers in Timor Leste come together for Dili’s biggest May Day ever.

The rally demanded that the minimum wage be increased to around $US200 per month.

But any increase in the minimum wage in the formal sector, while desirable, will have to be extended by appropriate institutional arrangements into the informal sector, where most of the poverty exists.

Which brings me to the Job Guarantee.

Labour Force trends in Timor-Leste

The ILO data is based on three labour force surveys conducted in 2010, 2013 and 2016. The data conforms to ILO Labour Force standards which all national statistical agencies deploy in their labour force data collection and dissemination.

The main results are:

1. The working age population expanded from 627 thousand in 2010 to 724.5 thousand in 2016 – an increase of 97.5 thousand (15.6 per cent). This amounts to an annual average rise of 16.3 thousand.

2. If that growth continues (and I will come up with some fairly accurate predictions another day), then the working age population will grow to 790 thousand by 2020.

3. The participation rate is also increasing – having risen from 24 per cent in 2010 to 46.9 per cent in 2016. As the formal economy expands so will the participation rate, given the young age profile of the nation.

One might expect this to rise to around 60 per cent by 2020 (a very modest assumption).

4. Between 2010 and 2016, the labour force rose by 188 thousand or 31 thousand per year.

5. However, employment only increased by 164 thousand (or 27.5 thousand a year) which accounts for the rise in unemployment by 23.6 thousand.

6. So while the size of the labour market is rising, unemployment is rising disproportionately and is was 10.4 per cent (2016) rather than 7.8 per cent in 2010.

7. The ILO provides broader measures of labour underutilisation to reflect underemployment and unemployment. It was last calculated in the 2013 LFS to be 14.7 per cent up from 9.9 per cent in 2010.

The ILO caution us not to interpret the rise in employment as “massive expansion of job creation”.

Rather:

A significant part of the increase is due to the change in operations of subsistence foodstuff production from production mainly for own-consumption not considered as employment to production wholly or mainly for the market considered as employment … Another part of the increase reflects the movement of subsistence foodstuff producers to informal employment as own-account workers or contributing family workers in informal sector enterprises. The increase in employment reflecting job creation in the formal sector has therefore been much lower than what the numbers suggest.

Consider what the growth in formal employment will have to be to return and stabilise the unemployment to its 2010 level of 7.8 per cent.

This would require that unemployment remains at its 2016 level as the labour force grows.

The following graph shows the trajectory of employment from 2010 to 2016 (solid blue line), the projected increase based on the average annual change between 2010 and 2016 (dotted blue line), and, the employment trajectory that will be required to achieve that goal (grey line).

The projected shortfall will be 20 thousand odd jobs by 2020.

But bear in mind the caveat that the ILO presented above in relation to shifts between the subsistence farming sector.

That caveat is likely to require a much larger increase in actual job creation to stabilise the unemployment rate at the 2010 level, which is still too high.

The point is that the gap between the projected lines gets bigger as time passes.

The spatial considerations are also relevant.

The ILO write:

The expansion of labour market activity in the rural areas from 2013 to 2016 can be explained partly by the contraction of subsistence foodstuff production …

This refers to the massive rise in participation in the rural areas from 19.6 per cent in 2010 to 62 per cent in 2016. Compare that to the decline in the urban areas from 35 per cent (2010) to 32.1 per cent (2016).

Then there is the NEET problem – Youth who are not in employment, not in education or training.

In total there were 71.6 thousand youth in this category, which constituted 29.2 per cent of the total youth population. There is no future if this group is not eliminated.

And I could dig deeper into skill and occupation structures.

The challenges are clear.

A faster growth in employment is required in the formal sector, which will such more and more of the informal population into paid work. That employment will have to be highly targetted and accessible to the youth who are increasingly being excluded.

In that context, an essential starting point should be to introduce a Job Guarantee.

It is clear that skill levels vary and in Timor-Leste there is a paucity of skilled labour. Does this mean that large-scale public works programs such as road building etc are unsuitable?

Not at all. It just means that the public works programs have to be designed in ways that are inclusive to the least-skilled workers and are highly labour intensive.

My work in South Africa (in relation to the Expanded Public Works Program which employed more than a million workers in the first five years of operation) taught me that large-scale public works initiatives can be very successful in alleviating poverty and improving intergenerational opportunities for families (adults get work, children perform better at school).

That model would provide a useful framework for the TL Government.

Piecemeal and small-scale employment programs based on some limited international development aid might create a few jobs here and there.

But what Timor-Leste needs are tens of thousands of jobs to be created in the first instance and the decentralised institutional structure developed to support this development.

There is thus two issues. The micro one of building the capacity to run a large-scale employment guarantee. There are good models available to guide such a process.

Second, the only way that nation such as Timor-Leste will move into the middle-income cohort of nations and be able to successfully create enough jobs for their rapidly growing populations is for them to abandon these nonsensical neoliberal concepts of ‘fiscal space’ and appreciate that the space for government spending is defined by the real resources the government can bring into productive use without creating accelerating inflation.

Conclusion

I will return to these issues when I have built a formal JG model for TL.

That is enough for today!

(c) Copyright 2019 William Mitchell. All Rights Reserved.

Great.

Can’t overstate the value of children seeing parents going to work.

Social inclusion and proper personal development is so predicated on being employed and being able to contribute. its good that same policy can be pursued in TL. I hope the TL state succeeds so people live comfortably and pursue whatever goals in live more easily.

Mainstream economics is like a one-trick-pony isn’t it? Every single time, they just push out the inflation excuse to put the state into a straitjacket.

I am reminded of Fritz Schumacher’s “development” suggestions for “undeveloped”countries, which he put forward in “Small Is Beautiful” and many of his other writings. As Bill is fleshing out in greater detail, Schumacher’s advice was that such countries not attempt to ape the development models of global capitalism but rather pursue more localized and gradual human-scale development with the goals of maximizing self-sufficiency, minimizing environmental damage, and enhancing the quality of life of its citizens. MMT, with its national job guarantee funded by a nation’s own currency, provides structure to Schumacher’s thinking, which in turn was inspired by Gandhi. Were Bill’s and Fritz’s and Gandhi’s recommendations to be followed by Timor-Leste, I would not be surprised if tourism someday became a major source of its revenue, as people from all over the world–people trapped in the relentlessly competitive and demoralizing economic treadmill–came to visit a place where life was substantially freer from the neoliberal curse.

Newton Finn,

Thanks for bringing up Small is Beautiful, so I know that such writing existed.

” At present, Timor-Leste can import goods and services more cheaply than they can be produced locally because it uses the US dollar.

If the US dollar was abandoned and the local currency depreciated somewhat – then that cost disadvantage would be eliminated, thus spawning incentives to develop import-competing products. ”

Doesn’t this come back to the central problem of countries like TL being extremely materially poor in nearly everything? How do they afford to import the continual supply of materials needed to successfully set up and run import-competing industries when their own currency would likely be worth so little against the currency in which most of those materials are traded on the world market – the US dollar – that they probably couldn’t afford those imports in the first place?

I’ve come to suspect that for most countries – including Australia – the notion of currency sovereignty might be something of an illusion. The Australian government may be able to buy anything – end everything – that is for sale in Australian dollars……but how much of what this country consumes is actually for sale in our own currency? We are heavily import-dependent and the majority of the worlds goods/commodities trade is carried out in US dollars. This country may be a currency sovereign but it requires a lot of foreign currency to keep functioning. This may not be the problem for Australia in the way it is for a poor country but it seems far from an insignificant issue.

Viewed in the context of high levels of global trade interdependence, the Gold Standard was never really replaced with fiat currencies issued by sovereign national governments – it was replaced with a US dollar standard. If you want to import anything you haven’t got, there’s a fair chance you need to acquire a foreign currency in the form of US dollars in order to do it.

@Leftwinghillbillyprospector,

I think you are forgetting the problem small nation had under the god standard.

If T-L keeps importing stuff using dollars and so has a balance of payments deficit, then it is losing its dollars week after week.

Someday it will not have enough dollars for its local economy to function.

I see the same sort of problem for nations in the eurozone, like Greece, German banks were happy to lend euros to Greek residents. The banks did this because they needed to make loans to use the surplus they had from their trade surplus. Now that the Geek people had more euros the spent them to buy more German stuff. Soon Greece had fewer euros

@Leftwinghillbillyprospector said:

“I’ve come to suspect that for most countries – including Australia – the notion of currency sovereignty might be something of an illusion”.

……Just as I believe the notion of ‘absolute national sovereignty’ is incompatible with an international rules-based system…..obviously.

So a change in the concept of ‘sovereignty’ is needed: and in the case of *currency* sovereignty, we need an IMF that takes into account the different resources naturally available to each nation, and ‘weights’ each nation’s currency accordingly, to facilitate sustainable economic development in all nations. [I think this is similar to what Keynes had in mind in 1944, with his ‘clearing union’ concept].

Then indeed sovereign fiat-currency issuing governments will be able to introduce a JG, regardless of external trade balances.

It doesn’t matter for well-being, if citizens in some countries will need to rely on public instead of private transport. for example.

Thanks Bill, an excellent summary of the situation in Timor-Leste with regard to economic activity and growth.

I am glad you highlighted the subtleties of the source of the rapid employment growth. A growth of 164,000 in 6 years is huge, and yet the vast majority is people switching from own-consumption agriculture to producing mainly for sale. This is encouraging progress in agriculture, as it is a “natural next step” for subsistence producers. I don’t know well enough about how ‘real’ this difference is – the survey questions are quite general. e.g. We don’t know what this has translated to in terms of increases in income / consumption of agricultural households, etc.

But regarding your main point, this employment growth is no sign of rapid growth in formal / modern economy activities. That remains a big challenge. Will wait to learn more about what you are proposing.

The leadership of Timor Leste have only themselves to blame for their nations problems. The answers to their problems are all provided here.

Abandon the US dollar and appoint an MMT proficient finance/economic development minister and ministry, harness the fiscal capacity of government, diversify the economy, improve education, improve services and infrastructure and implement a JG.

Say yes, yes, yes to the foreign neoliberal advisors and when they leave place their advice and reports in the rubbish bin.

hi. what happened with this? very a propos in the COVID-19 context.

thanks

Dear Radhika Lal (at 2020/06/15 at 2:55 am)

Discussions are continuing. Remember the government in TL has been ineffectual (cannot pass a fiscal position) and new elections are required.

I have various meetings coming up with influential players in the TL setting and will report back when something concrete emerges from those interactions.

best wishes

bill