In the annals of ruses used to provoke fear in the voting public about government…

Euro policy elites deliberately destroyed jobs and income to achieve erroneous fiscal goals

As Mario Draghi’s tenure at the helm of the ECB draws to a close, he becomes (slightly) more pointed and looser with his public statements. On Friday (October 11, 2019), he gave a speech – Policymaking, responsibility and uncertainty – at the Università Cattolica in Milan on the occasion of receiving the Laurea Honoris Causa (honorary degree). He broadened the scope of his policy ambit by saying that “I will not focus strictly on monetary policy or the business of central banking, but I would like instead to share my thoughts on the nature of policy responsibility.” In the same week, the Eurogroup (the European Finance Ministers) of the European Commission released a press release – Remarks by Mário Centeno following the Eurogroup meeting of 9 October 2019 (October 10, 2019) – which announced that they had agreed to a “a budgetary instrument for the euro area – the so-called BICC”. Don’t get too excited. The BICC will only achieve the status of an “Inter-Governmental Agreement”, meaning it will not be embodied in the Treaties. Also, the Member States will have to contribute funds in advance and must “co-finance” withdrawals. And, as usual, there was no mention of the fund size, which will be miniscule if history tells us anything. But this is all context for Mario Draghi’s Speech.

While the elites in the European Union have a tendency to talk up nothing into something, the real politic about the EU ‘Budget’ has been playing out for some months.

Just a few weeks ago, Germany put its usual ‘spanner in the works’ when it told the European Commission, in the context of the formulation of the next seven-year ‘budget’ for 2021-2027, that it wanted to restrict total spending to just one per cent of total European output.

The European Commission’s Executive Commissoin has previously proposed that spending would be equivalent to 1.11 per cent of Gross National Income.

According to the Reuter’s report (September 16, 2019) – EU budget plans foiled as Germany pushes for less spending – Germany’s desire to restrict the overall fiscal capacity of the European Union was supported by “Sweden, Denmark and the Netherlands”.

Andm, on Friday (October 11, 2019), the Austrian finance minister said that a 1.1 per cent of GDP contribution from the Member States was out of the question.

The Wiener Zeitung article (October 9, 2019) – Österreich und weitere Nettozahler vehement gegen EU-Budgeterhöhung – said that Austria had joined Sweden, the Netherlands and Denmark in demanding a smaller EU budget.

The Austrian finance minister told the paper that with Britain leaving the EU soon, “Eine kleinere EU muss mit einem kleineren Budget auskommen” (“a smaller EU has to manage with a smaller budget”)

He said that (my translation):

It rather requires an expenditure-based consolidation.

So don’t get carried away that the fiscal gates are about to open in the Eurozone anytime soon.

But that is context.

Mario Draghi makes it clear

At one stage in his Speech, Mario Draghi raised the question of “central bank independence” which he said he “described … as ‘independence in interdependence’.

He went on to say that this referred to the fact:

… that the institutional context in which we operate affects the speed at which we can achieve our objective, and the scale of the side effects of our actions. There is a need to say clearly when other policy areas could help us to do our job more quickly and effectively …

Thus central bank independence does not preclude communication with governments when it is clear that mutually aligned policies would deliver a faster return to price stability.

And this allowed him to, once again, talk about:

… the macroeconomic policy mix in the euro area, which is the respective contribution of monetary and fiscal policy in supporting the economy.

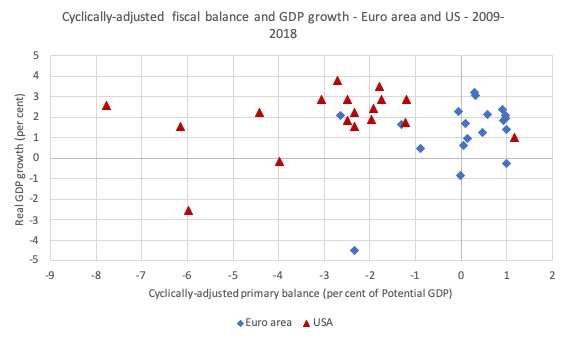

At this point he introduced a rather stunning statistical comparison:

We have seen in other regions where fiscal policy has played a greater role since the crisis that the return to price stability has been faster. In the United States, for example, from 2009 to 2018 the average cyclically adjusted government primary balance … was -3.6%, while it was 0.5% for the euro area.

Which if one didn’t know anything else would lead to the prediction, based on an uncontroversial conception of fiscal responsibility, that the Eurozone must have been in better shape than the US throughout this period to allow for such a restrictive fiscal position to persist on average.

Which, of course, was nothing like the truth, and that exemplifies the dysfunction of the monetary union.

Some definitions and concepts

To make sure you know what I am talking about here let’s first of all clear up the definitional issues.

1. The overall fiscal balance

This is the difference between total expenditure including interest payments on outstanding debt and total revenue.

It is in deficit if expenditure is greater than revenue and vice versa.

However, as I explain below, the overall fiscal balance may not be a very accurate guide to the discretionary fiscal stance of the government at any point in time (see point 3).

2. Primary fiscal balance

Is the overall balance net of interest payments.

3. Cyclically-adjusted fiscal balance

The overall balance is the sum of the discretionary policy choices taken by government and the state of the economic cycle.

We cannot conclude that changes in the overall fiscal balance reflect discretionary policy changes. The reason for this uncertainty relates to the operation of the automatic stabilisers.

Some expenditure and revenue components that make up the overall fiscal balance (for example, tax revenue and welfare payments) are sensitive to the state of the economic cycle.

Once the policy parameters are set, the actual flows of revenue and outlays associated with these sensitive components vary automatically with economic activity.

For example, in a downturn, employment drops and tax receipts fall away. As unemployment rises, overall welfare payments rise.

These sensitive components are called automatic stabilisers because they change without any policy shifts and serve to attenuate the overall spending variations associated with the economic cycle.

Thus, without any discretionary policy changes, the fiscal balance will vary over the course of the economic cycle – a surplus declines, perhaps into deficit, or a deficit increases when the economy is weak and vice versa.

In other words, for example, just because the fiscal balance goes into deficit doesn’t mean that we can conclude that the government has an stimulative policy position.

It is possible that the policy position is contractionary yet the deficit is rising because economic activity is in a collapsed state.

To decompose (separate) these two influences, economists ‘cyclically-adjust’ the overall balance by assuming a full capacity benchmark and then working out what the expenditure and revenue would be at that level of activity based on the discretionary policy parameters in place.

The difference between that calculation and the overall fiscal balance, is the structural (or cyclically-adjusted fiscal balance) and it is thought to reflect the direction of the discretionary policy choices.

As I explain in these blog posts (and see links to early posts within them) – The NAIRU/Output gap scam (February 26, 2019) and The NAIRU/Output gap scam reprise (February 27, 2019) – the selection (calibration) of the full employment (zero output gap) benchmark is controversial.

In general, the mainstream methods for decomposing the fiscal balance into the discretionary (structural) and cyclical components is fraught and leads to an upwards bias in the structural components (because they set the NAIRU too high and so full employment is associated with unnecessarily high unemployment rates).

So when the economy is at high unemployment, the estimates of the structural fiscal balance is typically biased to be in larger deficit – and hence indicating a more expansionary fiscal position – than is actually the case.

4. The cyclically-adjusted primary fiscal balance just nets out interest payments as before.

The meaning of Mario Draghi’s comparison

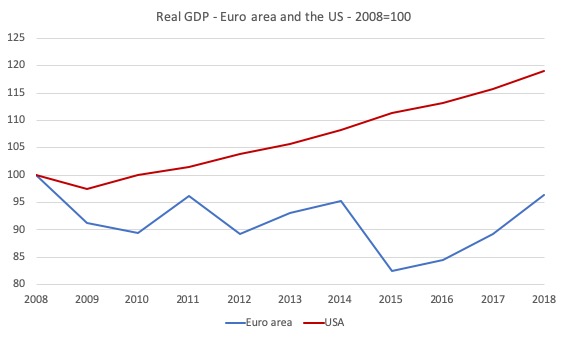

Consider the following three graphs, which compare the Euro area and the US from 2008-2018 in index number form for real GDP, the unemployment rate and employment growth.

Over the decade, real GDP in the US has grown by 18.98 per cent whereas the Euro area had contracted overall (-3.6 per cent).

As soon as the fiscal stimulus started to support growth in 2009 and 2010, the US economy began its recovery (albeit slowly). The Euro area growth has been deliberately constrained by the fiscal rules and the obsession with applying them.

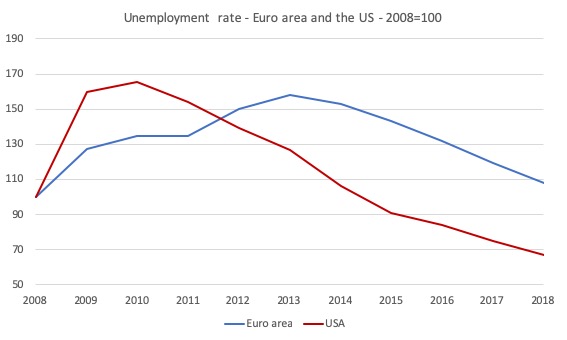

The analogue of the output growth performance is revealed by the behaviour of the unemployment rate.

By 2018, the US unemployment rate was 67 per cent of its value in 2008 (3.8 per cent compared to 5.8 per cent) – it peaked earlier and then followed the steady output growth path downwards.

By comparison, the Euro area unemployment rate in 2018 was still above its 2008 value (8.2 per cent compared to 7.6 per cent).

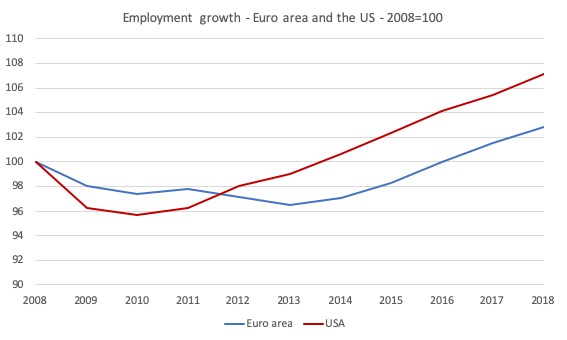

The employment growth history is also inferior in the Euro area but the disparities are less pronounced. Total employment is only 2.8 per cent higher in 2018 in the Euro area relative to 2008 and 7.2 per cent higher for the US.

And what Mario Draghi was making clear that this relative performance – where the Euro area has delivered significantly inferior outcomes on economic outcomes that really matter to the well-being of the people – is the deliberate result of policy choices made by the respective policy makers in the Euro area and the US.

The US chose to support growth with fiscal policy, the Euro area policy makers chose to use fiscal policy to worsen growth at a time that non-government spending and saving choices were already undermining economic growth.

The US chose to support its citizens. The Euro area used its citizens as fodder in a mindless exercise in keeping rules.

But as regular readers know that last statement is not exactly true is it? The mindless exercise was mostly window dressing and applied to fiscal policy while the elites turned a blind eye on the ECB breaching the Treaty with its massive government bond buying program, that masqueraded as liquidity management in the banking system.

The point is that the bond-buying was in the context of rather extreme conditionality being imposed on the Member States with respect to their fiscal flexibility.

So, in fact, the ECB’s bond-buying exercise should have been much larger so that the fiscal deficits could have been supported at much higher levels than the European Commission (in league with the ECB and the IMF) allowed.

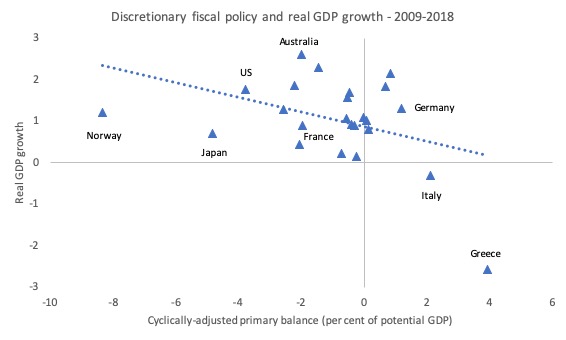

The next graph shows the relationship between the Cyclically-adjusted primary fiscal balance (horizontal axis) and the real GDP growth rate (vertical axis) between 2009-2018.

The average GDP growth rate for the US over this period was 1.76 per cent per annum, whereas the Euro area averaged 0.29 per cent.

Now correlation doesn’t infer causation and, of course, the fiscal balance is endogenous, which means that it is sensitive, as explained above, to the state of the cycle.

That is why we are using the cyclically-adjusted primary balance – it is supposed to net out the effect of the cycle and also nets out the rising interest payments on outstanding debt, which also typically rise in a downturn as more debt is issued to match the rising deficits.

So this measure (even though it is biased as explained above) is a better indicator of the discretionary policy shifts that the policy makers took over this period.

If I did more sophisticated econometric work, I would definitely find that the discretionary fiscal policy choices had their predicted outcome – rising primary deficits (net of interest payments) supported growth and vice versa.

And the next graph shows the relationship for average cyclically-adjusted primary balances and real GDP growth between 2009-18 for for many European and other nations (I left out Ireland because of its ridiculous National Accounts data these days).

The dotted line is a simple linear regression which shows the nations typically enjoy higher average real GDP growth with higher cyclically-adjusted primary deficits.

Remember, again, the caution about causality.

Conclusion

Despite the on-going denials by many mainstream economists that fiscal policy is the least preferred policy intervention, it is clear that Mario Draghi understood the challenge he was facing – being in charge of monetary policy in the context of fiscal policy makers or their overseers who were happy to use fiscal instruments in a totally perverse manner – contrary to all concepts of responsibility.

The data is emphatic.

The Euro area elites deliberately created elevated levels of joblessness and deliberately sacrificed national income production so that they could claim they were achieving their fiscal targets.

The malfeasance is so arrant that I wonder why any reasonable person would continue to support such a damaging farce.

That is enough for today!

(c) Copyright 2019 William Mitchell. All Rights Reserved.

Brilliant !

If anyone watched the Andrew Marr show on Sunday live from Aberdeen then they must realise everything I have been saying for the last few months has been the truth.

No lies, no pretending that I don’t understand the obvious, no burying my head in the sand. I have simply told the truth.

Scotland is marching head first into a European dystopia. A faux independence for eternity. Everyone in Scotland is giving the SNP a free pass.

One thing I’ve noticed is that China often simply writes off investments that don’t pan out. Apparently if you are a sovereign government and you don’t always use debt, but rather use overt monetary finance (OMF) instead, one can eliminate money that way, as opposed to using taxes. The spending occurred, did not have the desired effects, so one writes it off. Debt is not involved. MMT principles favor direct fiscal stimulus, or taxes, to influence economic activity, not debt. To me this is simple common sense. Debt is the preferred way to finance spending in the private, so-called free market, system. OK, that’s the private market’s choice. In fact it’s mandatory because interest on debt generates the income for private banks and savers who own them. Socialists, on the other hand, understand this non productive expense and use public banks to avoid it. Common sense, really.

@ Christopher Herbert

Very clearly expounded. Thanks!

@ Derek Henry

For the edification of any interested bystanders (me for instance) who don’t have access to the Andrew Marr Show, could you kindly elaborate? It would be much appreciated – by yours truly at least.

Gee…

Compared to US, European countries are even worse in terms of growth?

And I thought i had a raw deal in the USA.

I think you can argue the recession never stopped for EU countries.

The Nobel Prize in economics proves to be worse than useless, again.

No mention of a Job Guarantee to eradicate poverty.

[btw, the WTO and IMF need to be on board with MMT, if the 3rd world is also going to eradicate poverty, are they not?].

@ Neil,

Why do you think the WTO needs to grok MMT to help 3rd World nations?

OTOH, The IMF & WB can clearly be seen to need to grok MMT for 3rd World nations to be helped by MMT. They are supposed to make loans in hard currencies so that nations can import stuff like factories that will earn foreign exchange to repay the loan and employ native people. This is their primary function, right? But, if I can ask, where do they get their hard currency? If they also just create it then {like China seems to} they can just write off bad loans because it was magic money anyway. Currently they {WB & IMF} are Neo-liberal through and through. They demand 2 unnecessary things; i.e., austerity and repayment at any cost.

Robert

The SNP want to be at the heart of Europe if they ever get Independence.

I don’t think I need to say anymore on that, as you surely must understand that is not independence at all. They would be trapped by the EU rules.

Problem is because over 60% of people voted to stay in the EU they are cheering Scotland into that fiscal and monetary policy prison.

Nobody in Scotland is challenging the SNP on that position. Nobody is asking them the awkward questions that need to be answered.

The people who do know it would be a faux independence are staying quiet because it is an independence at all cost strategy. They think they are powerful enough to stop Scotland from doing this after Scotland gets independence. Even though the majority who will vote for Independence want to be at the heart of Europe.

I say they are delusional and the SNP will ride rough shot right over the top of them put it to a vote at conference and boom full members of the EU.

The growth comission produced by a bunch of ex bankers in the SNP was a blue print so that the SNP could achieve that goal. My view is secretly the SNP want to adopt the Euro the Irish model.

What reinforces my view is the fact the SNP lost a vote on the currency at conference and decided to ignore the result of that vote. They have a plan the Irish model and nobody is going to stop them.

The SNP are delusional if they think they will win when they sit around a table with the EU. If they think they can pick the best parts of the EU and drop the bad parts as the brexit talks have shown. You are either part of the neoliberal globalist agenda or you are not. There is no goldilocks choices here.

Indy movement just can’t see the danger they are in and what a monster is coming up over that hill.

@ Derek Henry

Thanks for that. Very enlightening.

I would imagine that if as you believe the SNP are aiming at the Irish model there’s going to be a big shock in store for them along the road. No way is Germany going to be onboard with seeing another one of those Trojan horses being wheeled into the Single Market: the original Irish one is already one too many for them (quite rightly).

(“Irish Trojan horse” seems a bit – well, Irish , if you see what I mean. Never mind!).

But as you say by the time they find that out the fateful step will already have been taken.

What a depressing prospect.

Mr. Draghi is aware of MMT: “we should look into this …”

This is great news, I think.

https://www.youtube.com/watch?v=2M1jcnQi8eg

@Steve_American: I included WTO because we need a body who can define IP, such that the US and China, with their own self-interestedness, cannot take such matters into their own hands via a trade war, to the detriment of the world economy as at present.

@Derek, because of Brexit, I, like many others I suppose, have been taking more notice than usual lately of what goes on in the Westminster parliament. We have been “treated”, if that is the right word, to the sight and sound of the SNP’s leader in the Commons, one Ian Blackford, blathering on against Brexit, and how evil we English are for dragging the Scots unwillingly out of the precious EU (never mind that 38% of Scots actually voted to leave), and yet the only reason for his party to exist is to take Scotland out of the union with England, Wales and N.Ireland. So as well as being a windbag and a complete pain to listen to, the man is a hypocrite of the worst order, and, I am afraid to say, does not bring any honour or credit to the name of Scotland.

In fact, one of your countrymen has started a series on Youtube: “Bawbag of the week”, and I am delighted to say that Mr Blackford was first in the series! 🙂

I suppose that it hardly needs pointing out that Mr Bawbag, sorry, Blackford, is a former banker.