These notes will serve as part of a briefing document that I will send off…

Reliance on monetary policy is mindless, ideological nonsense

It is Wednesday and so a less intensive blog post. Note how I no longer claim it will be shorter. The less intensive claim refers to how much research I have to put in to write the post. Apart from some beautiful music, the topic for today is yesterday’s RBA decision to cut interest rates to record low levels. The decision won’t save the economy from recession and highlights the sort of desperation that central bankers now face as governments shunt the responsibility of counterstabilisation onto them while claiming that achieving fiscal surpluses is the brief of the treasuries. This self-defeating strategy – failing to use the most effective policy tool in favour of an ineffective tool is the neoliberal way. It is the recipe that New Keynesian macroeconomics offers. It is mindless, ideological nonsense and the problem is that it is not the top-end-of-town that suffers from the negative outcomes that follow. Quite the opposite in fact.

Reliance on monetary policy is doomed

Yesterday (July 2, 2019), the central bank in Australia, the RBA reduced interest rates to 1 per cent, down from 1.25 per cent. This is the lowest they have been in history.

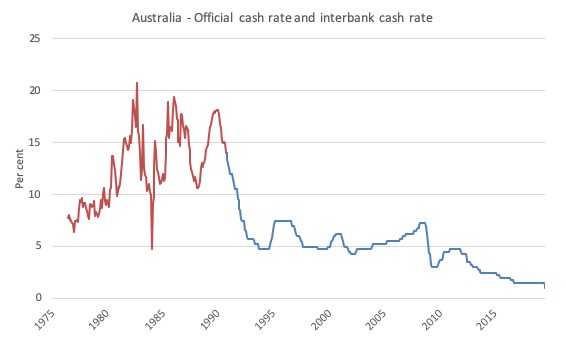

The following graph shows the period since 1975. The blue line is the official cash rate set by the RBA, which is available in time-series for since August 1990. The red line is the closely allied Interbank Overnight Cash Rate, which is the rate the banks loas excess reserves to each other to address payments requirements.

The last two RBA Board meetings have brought interest rate cuts totalling 0.5 percentage points.

In the press release – Statement By Philip Lowe, Governor: Monetary Policy Decision – the RBA said:

1. “This easing of monetary policy will support employment growth and provide greater confidence that inflation will be consistent with the medium-term target.”

2. “the uncertainty generated by the trade and technology disputes is affecting investment and means that the risks to the global economy are tilted to the downside.”

3. “Long-term government bond yields have declined further and are at record lows in a number of countries, including Australia.”

4. “Over the year to the March quarter, the Australian economy grew at a below-trend 1.8 per cent. Consumption growth has been subdued, weighed down by a protracted period of low income growth and declining housing prices.”

They should have also mentioned the record levels of household debt that is putting a brake on spending now as people are trying to reduce the risk associated with their precarious balance sheet positions in the face of a major slowdown in the economy.

5. “There has, however, been little inroad into the spare capacity in the labour market recently, with the unemployment rate having risen slightly to 5.2 per cent.”

6. “overall wages growth remains low.”

7. “Conditions in most housing markets remain soft” – which is a euphemism for significant falls in housing prices.

So essentially they have been forced into this cut by the following:

1. They actually believe that aggregate activity is sensitive to interest rate movements and seem to think any response that is present is linear – that is, it doesn’t matter whether interest rates are at 5 per cent or 1 per cent, the spending responses to a change in the level are similar.

2. The overarching policy framework is neoliberal where the government is pursuing a fiscal surplus – draining demand – and forcing all the counterstabilisation onto the central bank. So failing to use the effective policy tool in favour of an ineffective tool. The neoliberal way.

3. The economy is tanking and heading for recession and the RBA know it, while the Government seems to be in denial about it.

Three of the four big four commercial banks once again demonstrated why they should be nationalised – they declined to pass on the full interest rate cut to their customers. Greed has no bounds for that lot.

I urge people to abandon any dealings with these banks and move your banking to an institution that does pass on the rate cuts in full and has low management and service charges.

The community banks and building societies fit into that category.

My overall assessment is as follows:

1. The claim by mainstream economists that the lower interest rates will boost spending is flawed.

2. The problem is that peoples’ and firms’ borrowing behaviour is not driven solely by the cost of funds. The mainstream macroeconomic models all believe so-called substitution or relative price effects are large – so they predict that when interest rates fall, total spending will rise because the cost of funds is lower.

But reality intervenes, always. Reality is driven by more than relative prices. Psychology is important.

At a time when the outlook is decidedly uncertain, real wages growth is barely positive if at all, households are carrying massive debt levels and desperately trying to save, unemployment and underemployment is rising – it is highly unlikely that there will be an outpouring of spending.

Households are likely to use the small gains from lower mortgage payments (remembering the banks haven’t played ball with the RBA) to reduce debt exposure or boost saving ahead of going on a spending spree.

3. The mainstream economists have also argued that the lower interest rates will drive the Australian dollar down (because the lower rates reduce the relative attractive of financial investments in Australian currency denominated assets) which will benefit the export sector and reduce spending on imports – a win-win for GDP growth.

But once again, reality intervenes.

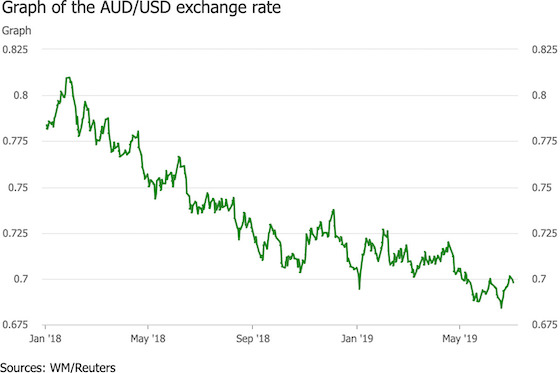

Have a look at the following graph which shows the AUD/USD parity since the beginning of last year. Don’t be fooled by the vertical scale – the series has been very flat, especially over the last 12 months.

On August 15, 2018, the parity was 72.13. Yesterday (July 2, 2019) the parity was 69.79. In the intervening period, rates have been cut from 1.5 per cent to 1 per cent.

Not much movement is evident on the exchange rate front.

Of course, the export sector has already been relatively strong as a result of strong terms of trade (iron ore prices) and mining profits are high.

The problem is that these profits are not translating into wages growth or investment.

The strong income growth for miners, many of who repatriate the gains to overseas owners, is also fuelling strong tax revenue growth for the Federal government but they are not spending as they should because they are trying to claim virtue as a result of a surplus they might temporarily achieve.

Which reminds me of a great Jim Morrison quote – during a concert in LA he said:

I don’t know what’s gonna happen, but I wanna have my kicks before the whole shithouse goes up in flames …

That is sort of what the Federal government is doing at present.

Any surplus they may achieve will soon be gone if recession hits – and then it will run up what I call a ‘bad’ deficit – one associated with falling employment, rising unemployment and underemployment and general malaise.

It is not the way to run an economy.

4. A sole reliance on monetary policy to boost aggregate spending at a time the non-government sector is resolutely trying not to spend (bar exports growth) is the hallmark of the stupidity of neoliberalism.

This was brought out again last week when the General Manager of the Bank of International Settlements gave a speech – Time to Ignite All Engines – at the Annual Meeting of the BIS in Basel on June 30, 2019.

He said all the usual things about headwinds, China, US, trade, subdued inflation, slowing growth etc.

He noted that:

Importantly, after the prolonged period of easy financial conditions, many vulnerabilities have built up and could throw the global economy off course.

One such vulnerability is high household debt in many advanced economies, especially those not directly affected by the Great Financial Crisis. These historically high debt levels limit the scope for households to drive economic activity.

Clearly, the era of credit binging by the household sector is over in Australia. It was always unsustainable and it is the only reason the Federal government was able to achieve fiscal surpluses in 10 out of 11 years from 1996. Without the record levels of household debt, the Australian economy would have been in recession by 1997 and the surpluses would have been eliminated by the automatic stabilisers.

But in considering the question – “How should monetary policy respond in the event of a sharper than expected weakening of economic activity?”, the BIS manager said:

… these considerations highlight the fact that monetary policy cannot be the engine of higher sustainable economic growth. More realistically, it is better regarded as a backstop …

a more balanced policy mix is badly needed … we need a better balance between monetary policy, fiscal policy, macroprudential policies, and structural reforms.

That is the point.

We cannot keep constructing fiscal policy targets in terms of a one way street to surpluses. That is not what fiscal policy is meant to achieve.

It is the most powerful economic policy tool available to a currency-issuing government and its purpose is to improve the well-being of the population not to achieve any particular number or balance status.

When we escape that ideological trap – the surplus mania – better days will be ahead.

Call for financial assistance to make the MMT University project a reality

The – Foundation for Monetary Studies Inc. – aka The MMT Foundation serves as a legal vehicle to raise funds and provide financial resources for educational projects as resources permit and the need arises.

The Foundation is a non-profit corporation registered in the State of Delaware as a Section 501(c)(3) company. I am the President of the company.

Its legal structure allows people can make donations without their identity being revealed publicly.

The first project it will support is – MMTed (aka MMT University) – which will provide formal courses to students in all nations to advance their understanding of Modern Monetary Theory.

At present this is the priority and we need some solid financial commitments to make this project possible and sustainable.

Some sponsors have already offered their generous assistance.

We need significantly more funds to get the operations off the ground.

In order for FMS to solicit tax-exempt donations while our application to the IRS is being processed, the Modern Money Network, Ltd. (“MMN”) has agreed to serve as a fiscal sponsor, and to receive funds on FMS’s behalf.

MMN is a non-profit corporation registered in the State of Delaware, and is a federal tax-exempt public charity under Section 501(c)(3) of the Internal Revenue Code.

Donations made to MMN on behalf of FMS are not disclosed to the public.

Furthermore, all donations made to MMN on behalf of FMS will be used exclusively for FMS projects.

Please help if you can.

We cannot make the MMTed project viable without funding support.

Clarification

I saw a Twitter torrent last night (and into this morning) trying to claim that a diagram in our Introductory Macroeconomics textbook (released in 2016 and which is no longer available for sale) was evidence that MMT economists believe in the money multiplier and are “inconsistent”.

That textbook has been replaced with the more comprehensive book published by Macmillan in March 2019 – Macroeconomics.

But let me make it absolutely clear – the diagram floating around the Twitter space has nothing at all to do with the money multiplier.

The person prosecuting this lie needs serious help and should be ignored.

Falling Leaves

Music today is from the British singer – Clare McGuire who has one of the best alto voices you can ever hear although she is not very well known.

She started out posting her own songs on MySpace when she was 17 years old. Her songs proved popular and the capitalists came running.

Unfortunately, the record company she signed with (Polydor) “persuaded to abandon her musical roots of folk and blues” and become a sort of Kylie Minogue type artist. She should have kept the faith.

The song – Falling Leaves – appeared on her 2016 album – Stranger Things Have Happened – and is 3 minutes and 5 seconds of haunting piano and voice.

The song was part of the soundtrack for the recent Netflix program – When They See Us – which traces the story of the so-called Central Park 5.

The five teenage boys (aged between 14-16) of African American and Latino descent were wrongly convicted of the beating and rape of a girl in Central Park (NYC) in April 1989.

Their questioning by the cops was coercive and they were forced into making false confession tapes. There was no hard evidence that connected the boys to the crime.

They were subsequently imprisoned for periods of between 6 and 14 years, and one of them, who was 16 at the time went to adult prison and was brutalised beyond belief.

In 2002, the real offender, who was serving life for a series of rapes at the same time, found Jesus and confessed to the Central Park crime. His DNA matched the samples from the rape.

The five boys were then exonerated and received a total of $US41 million (the highest in New York history).

The 4-part series is a shocking indictment of the US criminal justice system and very sad.

Falling Leaves

Falling, falling leaves

Falling, falling leaves

You left me in the falling leaves

Orange skies under the blood red moon

He left me under falling leaves

What has that man gone and done underneath?

What has that man gone and done underneath?

He left me in the falling leaves

That is enough for today!

(c) Copyright 2019 William Mitchell. All Rights Reserved.

At the time, Trump took out full page newspaper ads calling for the boys’ execution. His evidence? None, other than his racist inclinations. To my knowledge, he has never apologized. What a creep.

No need for the Australian government to do anything at all – Scott believes in miracles.

Bill, I do want you to succeed with the MMT University but wouldn’t it be cheaper to buy a Department in an existing University? While I am certainly willing to donate to a MMT University I don’t think my NZ$100.00 will go very far. From what I have heard for a University to subscribe to the existing academic articles costs millions.

Dear larry (at 2019/07/03 at 3:35 pm)

And he told crowds during the 2016 Presidential nomination primaries that he considered they were guilty despite being completely exonerated.

Disgusting. What was done to those boys – and one of them wasn’t even in the park when the crime was committed – was disgraceful.

best wishes

bill

“At a time when the outlook is decidedly uncertain, real wages growth is barely positive if at all, households are carrying massive debt levels and desperately trying to save, unemployment and underemployment is rising – it is highly unlikely that there will be an outpouring of spending”.

– as the RBA apparently wants us to do. But on the ABC ‘nightlife’ program last night the financial adviser, while acknowledging this, advised us instead to “look after our own interests first” and pay down (mortgage) debt ASAP. Philip will no doubt be not too pleased with that advice – what a fool his orthodox economics makes of him!

And another adviser noted that, while house prices appear to have stabilised in the big cities, these prices still mean a large sector of the population will be locked out of the housing market in those cities.

Meanwhile regional housing is falling, I suppose in part because many regions don’t seem to be engines of employment-creating growth any more.

“(Fiscal policy) is the most powerful economic policy tool available to a currency-issuing government and its purpose is to improve the well-being of the population not to achieve any particular number or balance status.” Another succinct statement from Bill, capturing the essence of MMT when linked to progressive politics. As Bill has made clear, this link does not come from MMT itself but rather from humanist or religious political values. So if we are ever to see that socioeconomic transformation of society that Bill and Tom envision in “Reclaiming the State,” we must fight on two fronts: clarifying the economic lens AND rekindling the human spirit. Only by such a pincer movement can the entrenched neoliberal enemy be defeated. Forgive me for stating the obvious, but there is still a desperate need for cooperation and coordination between those polishing the economic lens and those pushing for a more healthy and humane social order. Small wonder that Bill often supplements his precise and piercing economic analysis with the moving music he makes and loves.

I would’ve loved to see a word or two on the Liberal’s tax cut plan which is generating such a drama in the media at the moment. Of course the tax cuts are horrible from a social equity point of view, but all articles against them that I’ve seen emphasise the angle that the government might run out of money. It just goes to show how pervasive the misunderstanding of the monetary and tax system is these days.

re. Trump, the following item from BBC News website could be relevant:-

“Sri Lanka has recruited two hangmen as it prepares to carry out four executions – the first in 43 years…

“…Over 100 candidates responded to an advert posted in February for executioners with “strong moral character”.

“…State-owned media Daily News said two Americans and two women had also applied”.

With Larry’s and Bill’s posts in mind, I’m wondering if Trump might have been one of the two American applicants. Though he wouldn’t be able to satisfy the criterion of demonstrating “strong moral character” that wouldn’t have put him off: in his own mind he demonstrates that every day – relentlessly.