In the annals of ruses used to provoke fear in the voting public about government…

The effectiveness and primacy of fiscal policy – Part 2

This is the second part of a three-part series discussing the political issues that give me confidence in the primacy of fiscal policy over monetary policy. The series is designed to help readers see that the recent criticisms of Modern Monetary Theory (MMT) as being politically naive and unworkable in a real politic sense have all been addressed in the past. In Part 1, I gave examples of how ‘agile’ or ‘nimble’ fiscal policy can be when an elected government has it in their mind to use their spending and taxation capacities to change the direction of the non-government economic cycle. It is simply untrue that fiscal policy is inflexible and cannot make effective, well-designed policy interventions. In this second part, I will address aspects of how such interventions might be organised. Specifically, some people have advocated that MMT might replace the so-called ‘independent’ central bank, with an ‘independent’ fiscal authority, which they seem to think would take the ‘politics’ out of fiscal policy decision-making and focus it on advancing the well-being of the people. The intentions might be sound but the idea is the anathema of what progressives, interested in maintaining democratic accountability would propose. I consider such an independent fiscal authority would constitute the continuation of the neoliberal practice of depoliticisation and further increase the democratic deficit that is common in our nations these days. Politicians are elected to take responsibility and make decisions on our behalf. They should be always be held accountable for those decisions and not be allowed to defer responsibility to an external source (like an ‘independent’ central bank or an external fiscal authority).

A distinction and setting the scene

Note, the distinction I gave at the outset of this series.

When I write about Modern Monetary Theory (MMT), I try to be careful to distinguish between what we might consider the core MMT principles (theory, description, accounting) and the imposition of my own values (political and otherwise) that is informed by those core principles.

That separation is important and should (but doesn’t) stop others misrepresenting the core principles by appealing to proposals that might flow from the value imposition.

An example of this separation (and confusion), a topic which I receive many E-mails from people which seek clarification, is the concept of setting up an independent fiscal authority.

The proposal to establish such an authority is not a core MMT principle.

It might reflect an opinion that has been expressed by someone writing about MMT but that is as far as it goes.

The issue of outsourcing fiscal policy decision-making to a group of technocrats akin to the way in which monetary policy is deemed to be made has many motivations and raises many questions.

First, there is a claim that reliance on the polity to deliver timely outcomes that are in the best interests of the nation is fraught.

Many issues arise here including:

Can we trust the politicians who, it is claimed, are more interested in short-term power grabs than long-term societal well-being?

Wouldn’t an external body of experts, whose positions are, by construction, not sensitive to the political vagaries of the day, deliver more effective decisions in relation to targets set them?

These propositions assume that the external body of experts are non-partisan. This is the oft-repeated and naive proposition that a fiscal board that is constituted by appointing economists with PhD degrees would be free of ‘ideology’ and thus ‘independent’.

In terms of trust issues – that is what elections are for. Every so often (3 years in Australia) the voters can cast judgement on the performance of the politicians.

Governments regularly change as a consequence of this sort of behaviour and policy regimes can shift quite markedly if there is sufficient heterogeneity across the political classes.

The neoliberal period has been marked by a lack of such heterogeneity but that is not immutable and there is tremendous scope for aspiring, progressive politicians to create meaningful differentiation in their approaches.

The new Green New Deal narrative in the US Democratic Party is a case in point and is causing massive disruption to the regular, shared two-party neoliberalism that has choked American politics for some decades now.

The idea that major economic policy decision-making should be the responsibility of technocrats flies in the face of the fact that they do not stand for election.

They might give advice to elected politicians but have no democratic responsibility. And that is sufficient reason to eschew the ‘independent’ fiscal authority route to implementing a progressive agenda.

Closed-door decision-making is a recipe for Groupthink.

The neoliberal hollowing out of the state

Thomas Fazi and I have written before that the transition to a new economic order (that is, neoliberalism) – was achieved primarily through a gradual depoliticisation of economic policy: that is, through the hollowing out of national sovereignty and removal of macroeconomic policy from democratic (parliamentary) control, thereby effectively insulating the neoliberal transition from popular contestation.

We covered this in detail in our book – Reclaiming the State: A Progressive Vision of Sovereignty for a Post-Neoliberal World (Pluto Books, 2017)

The various policies adopted by Western governments from the 1970s onwards to promote depoliticisation include:

1. Reducing the power of parliaments vis-à-vis that of governments and making the former increasingly less representative (for instance, by moving from proportional parliamentary systems to majoritarian ones).

2. Making central banks formally independent of governments, with the explicit aim of subjugating the latter to ‘market-based discipline’. We note that this ‘formality’ does not create independence in a functional sense. Central banks and Treasury have to work hand-in-glove on a daily basis to ensure the monetary system functions, central bank boards are appointed by governments, and central bankers regularly deliver pronouncements on fiscal policy and thus enter the politicial process.

3. Adopting rules-bound policies – on public spending, debt as a proportion of GDP, competition, etc. – thereby limiting what politicians can do at the behest of their electorates; removing controls over capital flows, thus reducing the ability of governments to exercise control over economic policy.

4. Signing trade and investment treaties, which severely limit the capacity of governments to regulate in the public interest. Allowing corporations the power to subjugate the decisions of parliaments if they impede private profit is the exemplar of the anti-democratic shifts under neoliberalism.

5. Surrendering national prerogatives to supranational institutions and para-state and super-state bureaucracies. Allowing the IMF to impose conditions on democratically-elected governments undermines democracy.

In this sense, the erosion of national sovereignty that we have witnessed in recent decades, rather than the consequence of external factors over which states allegedly have little control, should be considered, to a large degree, the result of a deliberate and voluntary reduction of sovereignty by nation-states themselves.

The reason why governments chose willingly to ‘tie their hands’ is all too clear: as the European case epitomises.

The creation of self-imposed ‘external constraints’ allowed national politicians to reduce the politics costs of the neoliberal transition – which clearly involved unpopular policies – by ‘scapegoating’ institutionalised rules and ‘independent’ or international institutions, which in turn were presented as an inevitable outcome of the new, harsh realities of globalisation.

Thus, the hollowing out of substantive democracy and curtailment of democratic controlling rights that has accompanied the neoliberal transition in recent decades should not be viewed as a separate development, possibly resulting from the pressures of economic and political internationalisation, but as an essential element of the neoliberal project.

The important point is that all these shifts have come with the participation and cooperation of the leaders of the nation states.

All these shifts have come via changes to legislation and regulation at the behest of the governments involved.

Short of military invasion, neoliberal interests have to work through the legislative processes. They have to co-opt government to advance their interests at the expense of broader public interest.

The nation state has been hollowed out – but that situation (status) can only be maintained while the polity is cooperative and compliant.

A progressive new polity could unwind those shifts any time it chose, which is why the elites work so hard to keep those political positions subdued.

As I often note in presentations, if the nation state was powerless, why do corporate interests spend billions every year lobbying the politicians to advance their interests?

Answer: obvious!

The logic advanced to justify the outsourcing of fiscal policy

This brings us to the proposal to outsource fiscal policy.

The logic of such a proposal appears to be that:

First, the neoliberal period has been marked by a shift in macroeconomic policy emphasis away from fiscal policy to an almost total reliance on monetary policy to stabilise the economic cycle via so-called ‘independent’ central bans.

Decisions about macroeconomic policy are thus outsourced to unelected and unaccountable officials.

Second, this shift was part of the depoliticisation noted above.

Third, it was justified in various ways including statements that fiscal policy suffers from time lags that leave it open to becoming pro-cyclical.

For example, in a downturn in non-government spending, the correct fiscal response is to expand net public spending to support growth while the non-government sector reorganises itself.

However, if there are decision, design, and/or implementation lags in that policy intervention, the net spending impulse might finally enter the economy at a time the non-government spending cycle has already turned, which means the fiscal intervention will be pro- rather than counter-cyclical.

One of the features of MMT, to reduce this possibility is to bolster the automatic stabilisers, which come into play immediately there are shifts in the non-government spending cycle.

That is one of the important roles that the Job Guarantee plays in our macro approach. It expands both public employment and public spending in a downturn in non-government economic activity and vice versa in an upturn.

The Job Guarantee becomes the minimum government spending that is required to sustain what we call ‘loose’ full employment.

Note, that the operation of the Job Guarantee doesn’t always mean that fiscal deficits will increase. One could imagine a situation where aggregate demand was lower as the Job Guarantee was introduced.

This is the point that Randy Wray and I made in our 2005 article – In Defense of the Employer of Last Resort: A Response to Malcolm Sawyer – which was published in the Journal of Economic Issues (Vol 39(1), pp.235-244).

The Job Guarantee provides ‘loose’ full employment in two ways:

1. It buys labour, for which it there is no market bid (that is why they are unemployed) at a fixed price – that is, it buys ‘off the bottom’.

2. It offers a single living wage to all workers who see a job irrespective of their skills.

While critics make much of the fact that labour is heterogeneous and so the Job Guarantee would just force skilled workers into jobs below their capacity, the reality is that such workers typically prefer what we call ‘wait’ unemployment which is subsidised by their redundancy payments, a luxury that most low-pay workers do not enjoy.

Further, mass unemployment is predominantly endured by such low-pay workers anyway.

As an aside, I get tired of reading that the Job Guarantee is not a core part of MMT – so the argument goes, because MMT allegedly just describes what is and the Job Guarantee is not what is so it cannot be core.

The twisted logic fails immediately, once one assumes that MMT is more than just descriptive.

When I introduced the notion of MMT being a superior lens to allow people to achieve a better understanding of the way the monetary system work, the operative word is ‘understanding’.

That goes beyond description. Understanding requires an appreciation of causal process, which, in turn, requires theorising.

For more discussion about this please see the blog post – Understanding what the T in MMT involves (September 20, 2018).

The point here is that one of the novel features of our work (MMT) is to address the debate within macroeconomics concerning whether there is a trade-off between inflation and unemployment using a buffer stock of employment concept.

The debate has been traditionally bogged down – with New Keynesians, Monetarists, Post Keynesians etc – arguing about the concept of a trade-off within an unemployment buffer stock paradigm.

The Job Guarantee cuts through that debate and helps to establish MMT as a new approach by showing that if there is an employment buffer stock operating, the economy can maintain both full employment and price stability.

The government does not have to sacrifice one to get the other.

But in the context of today’s post, the emphasis is on the automatic stabilisation properties of the Job Guarantee.

I also note some characters trying to denigrate the concept of the Job Guarantee by denying that it is, in fact, a buffer stock mechanism. Their flimsy logic is that a buffer stock requires the held stock to be withheld from active use.

It is a ridiculous ploy.

The buffer stock characteristics of the Job Guarantee are clear – it is a fluctuating stock of workers that is created by a fixed price purchase and varies directly with the overall level of activity.

It rises, when non-government activity is low and falls when non-government activity is high.

That is the same cyclical mechanism as operates in a wool price stabilisation scheme, which is where I originally derived the idea of the employment buffer stock from in the late 1970s.

The wool stock held by the government rises when the market is weak (and endangers the agreed price) and falls when the market is strong.

It doesn’t matter that the wool is held back from use by the government in the wool stores and the Job Guarantee workers are deployed on socially useful production.

In fact, that difference is a strength of the Job Guarantee buffer stock.

Agricultural buffer stocks require costly maintenance (refrigeration, etc) and can deteriorate to the point of being unsalable again, whereas, workers who maintain their employment retain many of their general skills that would otherwise deteriorate if they were forced into an unemployed buffer stock (as is the practice now).

The fourth part of the outsourcing logic seems to argue that politicians cannot be trusted and will deliberately use their fiscal policy powers to advance their own electoral chances at the expense of long-term economic stability.

This is a common theme in the neoliberal literature and one of the major sources of attack on MMT which prioritises fiscal policy.

The argument claims that central bankers are independent of the political cycle and make decisions that reflect data realities rather than the to and fro of the electoral cycle.

Given that MMT prioritises fiscal policy over monetary policy, the argument goes that a similar arrangement for determining the fiscal settings (spending and taxation choices) would be optimal as it would separate these choices from the electoral cycle.

Politicians would not be able to choose fiscal settings that enhance their electoral prospects but undermine longer-term stability and well-being.

The usual examples that are provided to justify this preference are typically flimsy and often rely on flawed mainstream reasoning.

So we often hear that politicians facing an election will go on a spending spree to garner votes which will generate inflation or some debt crisis sometime in the future, after they have been re-elected.

Where are the real-world examples of this sort of behaviour?

And how damaging is this behaviour in the long-term if we can punish it regularly at elections?

When these sort of criticisms are raised they never include the lobbying behaviour of the corporations and the financial sector to distort government policy in their favour.

That is a much greater problem than some power hungry politician announcing a pork barrel on the eve of an election.

It is the on-going capture of politicians that needs to be addressed and safeguards put in place so that there is transparency in the dealings between the public and the polity.

The objections to an independent fiscal authority

So what the objections to an ‘independent’ fiscal authority making decisions that the government would have to wear?

First, the notion that we now have ‘independent’ monetary authorities is a ruse promoted by neoliberals to justify their attacks on fiscal policy.

I have covered that issue in these blog posts (among others):

1. Censorship, the central bank independence ruse and Groupthink (February 19, 2018).

2. ECB continues to play a political role making a mockery of its ‘independence’ (June 12, 2018).

3. The sham of ECB independence (October 24, 2017).

4. The sham of central bank independence (December 23, 2014).

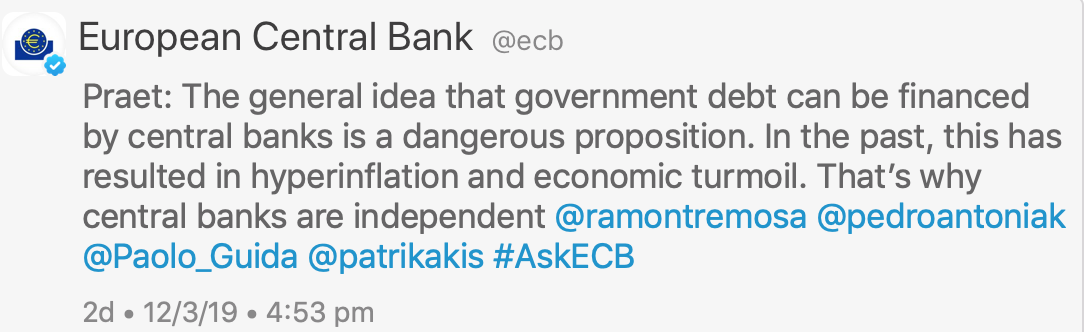

I also thought this little intervention was apposite.

On March 12, 2019, Peter Praet, an Executive Board member of the ECB conducted a Twitter Q&A.

At one stage he tweeted this statement, thereby buying into the MMT is dangerous narrative that has brought the mainstream out in droves in recent weeks.

Perhaps he might explain why the ECB continually misses its own inflation target (that is, cannot get inflation high enough to even satisfy its own definition of price stability) while pumping billions of euros into the non-government sector.

Perhaps he might explain why the ECB needed to pump billions of euros into the non-government sector via its various QE programs if the stated intention was to enhance liquidity management.

Such an operation would have required the tiniest proportion of the amount actually pumped in.

I considered that question in my book – Eurozone Dystopia: Groupthink and Denial on a Grand Scale (published May 2015).

Perhaps Praet might also explain why the ECB has effectively become the fiscal capacity in the Eurozone via its QE programs, which have, effectively, violated the Treaties by funding government deficits.

And, perhaps he might explain why, if the ECB was ‘politically’ independent, it continually makes statements about the fiscal policy positions taken by Member State governments; was a key player in the Troika and imposed harsh austerity conditions on those Member States in return for propping up their solvency via the QE purchases; and directly participated in the Troika threats to inflict financial instability (exactly the opposite of its legal charter) against the Greek government in June 2015, which forced the latter to surrender and defy the peoples’ voted wish to end austerity?

And, of course, if funding government deficits (whether directly or via the secondary market) “is a dangerous proposition” because it results “in hyperinflation”, why isn’t the Eurozone hyperinflating, given that the ECB has been doing exactly that in large proportions for many EMU governments for nearly a decade now?

And, of course, why isn’t Japan enduring hyperinflation?

So Praet wants us to believe in what he says not what he does. Another hypocrite.

The point is that those who use the false claim, that there are ‘independent’ central banks to justify outsourcing fiscal policy decision-making, always fall back, in one way or another, into the neoliberal narrative.

Such a proposition is problematic at the most elemental level.

There is always politics involved in macroeconomic policy-making and progressives must demand that these decisions are not taken by outsourced, unelected bodies that allow politicians to then depoliticise them.

To be continued.

Conclusion

The third and final part of this series will appear tomorrow.

I am pursuing these ideas further in my research activities and will have more to say in the future.

Many of these issues will appear in the next book that Thomas Fazi and I publish – hopefully later this year (if not early in 2020).

That is enough for today!

(c) Copyright 2019 William Mitchell. All Rights Reserved.

That is enough for today!

After reading and gradually starting to make sense of MMT (I hope), a question I have along lines discussed by Bill above concerns how to redesign the current financial architecture in the US government.

The House of Reps decides how to spend. The Treasury spends as directed and as constrained by facts of the ground. And the Fed Reserve monitors inflation and unemployment and messes with interest rates accordingly. Or something like that.

So what better arrangements are possible by the lights of MMT, say, if MMT were *understood* by all involved? Get rid of the Fed as an independent authority, probably. But more than that, what should Congress and the Treasury be doing that they are not doing, or what should they not do that they are currently doing? There is probably not just one way to do this.

If this has been discussed somewhere already, someone please point me in that direction.

So, Bill, I understand what you wrote here above, to be that the Job Guarantee program is not just descriptive but is a “core” part of MMT. Fine, I can certainly agree with that. But, then MMTers should not be sloppy and try to claim, as several have, that MMT is just descriptive.

. . . As I have said, one of the key most important elements of MMT that makes it so powerfully convincing is that it *never* makes false statements or makes false assumptions.

. . . Therefore, if we accept that it should never make a false statement, then it should say things like —

.

“MMT is *just* a description of how modern Gov. with their own true fiat currency actually do currently operate, except that it calls for a Job Guarantee program as its one and only core policy proposal.”

Steve-America

Christian Reilly in an interview with Steven Grumbine expands on that-

http://macroncheese.com/the-state-of-mmt-activism-around-the-world-with-christian-reilly?fbclid=IwAR0r514PPOshalfQ3Pav2AY6bSk42Sy_h_0OwHvQS_XjLGZi7sOK8Qf_s74

This is a really good essay.

I’m all for as close to a democracy as we can get while still always protecting the human rights of whoever is in the minority. While recognizing that democratic decision making can take some- no a lot of- time and is inefficient that way. Which is what is great about the ‘automatic stabilizer’ aspect of many government fiscal tax and spending policies-they take action without new legislative action. Which would be a large additional economic side benefit to what I see as the ethical imperative of the Job Guarantee program- which I would support politically regardless of the automatic stabilizer part of it. But it is good to have ALL the arguments- especially when they are so good.

Anyways. There is one thing about the automatic stabilizers that is sort of similar to a ‘fiscal council’ or ‘committee’ or whatever. They are not ‘democratic’ at the time they go into effect. They act upon the changing economic circumstances and have their economic effects without any new input from the elected representatives due to those changes. You could argue that that is built into the laws that were made by those representatives and therefore democratic in nature. You can make an argument that the policy leeway granted to say the Federal Reserve Board of Governors ahead of time could be similar in nature. Keeping in mind that the Fed serves the elected representatives and the people through them. As in it is not ‘independent’.

Suppose the US Congress had previously given Ben Bernanke the option to have the Fed monetize some percentage of Social Security payroll taxes in an economic downturn. So in 2010, when he was asking for Congress to do some expansionary fiscal policy, workers and employers could have got an immediate tax cut without all the crap about how are we going to pay for it. I think he might have done that- and I think it would have been a good thing. And that would have been ‘fiscal’ policy and so long as it had been authorized by Congress, I think it would be just as democratic as all the other worse stuff my government does.

While I can understand why you call a job guarantee an essential part of MMt, and I certainly support that, I think that aspect could turn many people off MMT. While that can be called a knee jerk approach, when I am advocating MMT I do not mention it. Rather I talk about sovereign countries, creation of money, deficits and surpluses, taxation not needed to run a country but how it is different purposes. Softly softly catchee monkey!

Dear Steve_American (at 2019/04/01 at 2:30 pm)

In terms of what constitutes MMT, everyone should only consider what the core development group has said. The social media uptake of our work is appreciated but, as I have pointed out before, sometimes generates misunderstandings.

There are others who want to redefine MMT in their own image. That has nothing to do with our work and their efforts should be ignored.

best wishes

bill

Dear Patricia (at 2019/04/01 at 4:44 pm)

Thanks for your comment and your efforts in promoting a better public discourse.

However, I don’t support an approach that ‘waters down’ central aspects of our work to make it appeal to the public. As you have seen in recent weeks, the major issue that critics raise against MMT is ‘inflation’.

The Job Guarantee is a central part of MMT’s anti-inflation framework and so an understanding of that provides a basis for the public then rejecting the mainstream criticism.

You are promoting MMT with almost both of our hands tied behind our backs. I don’t advise that.

Education is a long-term process. Seeking short-term hits based on ‘watered down’ versions of an idea is not a sustainable educative approach, in my view.

best wishes

bill

Bill,

There is no doubt that you are a member of the core MMT group.

Today above you said that the Job Guarantee program is not descriptive and is part of the core program.

At least that is how I personally understood what you wrote above.

Did I miss read your intent?

Elementary my dear MMT, that we distinguish between theory (the donkey) and practice (the cart) and obviously the job guarantee is in the cart. Most politicians tend to put the cart before the donkey and we certainly need more cart and less donkey in order to sell MMT to people like Jeremy Corbyn. Possibly it is not a bad idea to sell both sides of MMT.

Just as an aside Robert Schiller has a piece in the New York Times yesterday where he says he partially approves of MMT. That’s a step forward compared to Rogoff and Co “denunciation”. They are gradually coming around. Most arguments centre on the apparent ease of excess spending, but that is possible already.

Today on “the Conversation” I wrote a technical explanation of the budget to set the record straight regarding a Surplus and a Deficit. It was deleted after an hour or so. I was ropeable and told them so. However it occurred to me that that the Budget tomorrow will stress the big news of a surplus, according to Peter Hartcher. I now believe that my blog was seen as a menace and they had to delete it. Certainly the decision was political as none of the usual rules were broken. It reminds me of your choice to boycott it. No reply so far.

@Robert Eversfield Manely Francis,

I would prefer to think of MMT as a thoroughbred race horse than as a donkey, but if we can put the equine metaphors to one side for a moment, selling MMT to Corbyn is one thing. Selling it to his rather more neoliberal, mostly rabidly pro-EU parliamentary Labour Party (i.e. the Labour MPs), is quite another.

I believe it is simply impossible to have full control of the narrative about any subject all of the time and MMT is/won’t be an exception. After all, even if every supporter of MMT was to adhere to a strict understanding of core principles and terminology (haiku-like rules Blanchard-style anybody?), the detractors most certainly won’t.

Unfortunately, part of the long political fight for an idea to establish itself is to continually take down the strawmen and fallacies being put up around and against it without validating them. A most tedious and difficult, yet important task. There are just too many livelihoods, too many “very serious people”, with too much invested in the current neoliberal understanding of economics for them to just adimt they were wrong all along and that the evidence was ever availabe, in fact often pushed in front of their noses. Imagine the troika, Syriza and Ms. Merkel having to explain that they had the Greek, Spanish, Portuguese and Italian people suffer for years for absolutely nothing. It’s as if the high priest of Tenochtitlan had to admit to the families of all those sacrificed children, that it turns out Tlaloc never really demanded blood for rain and that it was all a tragic (yet somehow comical, right?) missunderstanding. If the priest got something THAT elementary wrong, what else might he have bungled?! Maybe that “emperor” of ours isn’t chosen by the gods either!

Surely, the better informed supporters of a cause are the better. Nevertheless, I wouldn’t have people take twenty of Bill’s weekend tests and score >66% before allowing them to vote for whomever supports a programm like the GND.

It’s a long road from heresy to self-evident truth and there are no shortcuts.

@John Doyle

” They are gradually coming around.”

No, my friend, they “knew it all along”, just like Krugman did 😉

But seriously, I find the reason for their relatively sudden motivation to come around in the results of Google trends for searches for “MMT”. I won’t link to the them but suffice it to say they are most encouraging and Zimbawians seem to be the most interested.

I believe it was yesterday that I saw a tweet from a left-winger advocating an independent fiscal authority – meant to respond and forgot about it until reading this. I then googled the phrase and came up with only IMF, OECD etc. I’m now determined to find out what’s going on. Surely McDonnell’s advisers aren’t heading down this road!

Dear Carol Wilcox (2019/04/01 at 8:38 pm)

In effect, this is what the Labour Party’s Fiscal Credibility Rule is about.

1. There are strict rules that the Government has to follow.

2. Fiscal policy can only break out of them when the Monetary Policy Committee of the Bank of England admits that monetary policy can no longer be effective.

3. As I have pointed out previously, even at the depths of the GFC, the MPC still believed its policy was effective.

4. So the Government would have been hamstrung with respect to using fiscal policy or would have had to openly broken its rules and faced political scorn.

That is why I am so opposed to the Rule. It has neoliberalism and depoliticisation written all over it.

Best Wishes

bill

Depoliticization ? What??? There has never been anything apolitical about neoliberal intentions; that is the illusion they have been trying to implant, in order to mask corporatism/fascism, a definite political movement, just as clear and present a threat to democracy today as it was 80 plus years ago. Large corporations and their ubermen, the defacto “government”, deciding what’s best for all, is what it amounts to.

I would suspect that anyone promoting the next step towards that reality, in the form of an “independent” fiscal authority is not so naiive; rather, using MMT and it’s more naiive followers as tools in the march toward that goal.

At 19:05 i started thinking of Greece and later in the sentence included more Souther European Countries. The Syriza cave-in of 2015 had nothing to do with those other countries, of course. My bad.

Thanks, Bill. The Labour Party’s Fiscal Credibility Rule is indeed the equivalent of an independent fiscal authority. I’ll work on that.

At the risk of sounding like a Johnny one-note (and perhaps incurring Bill’s ire), I again urge that the JG be conceptualized not merely in economic terms but, even more importantly, in environmental terms. Some important work has been done in this area by MMT economists, but not yet enough. MMT means little, does it not, if it only describes a more efficient way to operate a human economy in dying world? To my mind, what MMT and its JG reveal is something far grander, far more hopeful and beautiful. What they point to is a viable path to pour human skill and effort (I refuse to use the neoliberal term “human resources”) into restoring the health of a global ecosystem under existential threat from climate change, species extinction, and a host of related maladies which relentlessly undermine the quality of air, land, and water. For me, the crucial question is not merely the level of JG workers necessary, at one time or another, for the peak efficiency of a particular economy (the economic calculus), but also the level of such workers necessary to make a substantial contribution toward reversing our suicide by ecocide (the environmental calculus). And yes, I get the fact that the JG, alone, even at its most robust, would not be sufficient to address this massive issue, that fiat money far beyond wages for the unemployed or underemployed must come into play here. Yet is it too much to ask that when we, economists and non-economists alike, speak about MMT and the JG, we do so with all of the urgency, passion, and conviction we would muster when speaking about matters of life and death? Because, as best I can see it, we are.

John Doyle,

I wouldn’t interpret Shiller in a positive way in light of his NYT article. His support of MMT is so distorted, he says that while he would not go as far as Reinhart and Rogoff, he actually says this:

“I wouldn’t be that harsh. It seems that modern monetary theory is not so much a recipe for disaster as it is a not entirely original series of ideas that are not well defined or well integrated, and whose implications have been exaggerated.

Entire fields of study in economics departments are devoted to grappling with some of these problems. For a serious examination of issues concerning public debt, for example, consider the classic 1979 study “On the Determination of the Public Debt,” by Robert Barro of Harvard.

Professor Barro said, in essence, that the government faced time-varying expenditure needs and, optimally, could attempt to keep tax rates constant by varying borrowing. Then there is the 1936 opus of John Maynard Keynes, “The General Theory of Employment, Interest and Money,” which prescribes countercyclical deficit spending to stabilize the economy.

Are such works new enough to be called “modern”? If so, they might be considered the core foundations for modern monetary theory, though I haven’t seen them cited that way.”

I view this article as deplorable. Barro as a core foundation for MMT? Not likely — cf. Bill’s comments on Barro in previous blog posts. And MMT not well designed or well integrated? And whose exaggerated implications does Shiller have in mind — Mitchell, Wray, Kelton, Mosler, Fullwiler, Forstater, Black? None of these. In point of fact, there isn’t an alternative to the mainstream narrative that is better designed or integrated. Ignore this article. Even the postive mention of Kelton doesn’t save it.

Perhaps one should ask the academic community if the Job Guarantee is a core aspect of MMT. Ask those who are involved in the inflation/unemployment debate, as part of their work.

I have been lurking on various economic blogs, forums and sites for a long time now. I also have been following the development of MMT since the early days. I fully endorse it as both a correct reflection of reality and an excellent foundation for the government policies. I myself am not an economist. My background is in theoretical physics where I had a chance to successfully complete the PhD program (admittedly a long time ago). I am not a practicing academic however. That said and disclaimer aside, I would like to make a few observations regarding the recent trends related to MMT and the people involved in developing and popularizing this paradigm. Until not long ago MMT had been a curious yet relatively obscure perspective on macroeconomy actively developed by a stable group of dedicated professionals with a small following of enthusiasts like myself. During this period the focus was primarily on bringing the view into the main stream and flashing out a great number of details and considerations. Lack of attention from the heterodoxy and the media was perhaps as much a curse as it was also a blessing. On the one hand it was an impediment to spreading the awareness and a restriction on available resources. On the other hand it allowed to focus the discussion on purely scientific arguments and avoid personal attacks in part due to a relative friendliness of the ‘audience’ at the time. Now, as we all know, the environment has changed. The amount of attention has increased considerably. Major media outlets are compelled to publish on this topic. Some politicians consider it to be worth their while to make MMT or derivative claims part of their platforms. Main stream academics, policy makers, pundits, talking heads etc. on all sides engage in publicized discussions and commenting. Overall I consider it to be a positive development reflecting the transition into the next segment of the path that any new ideas must take. Increased exposure inevitably attracts participants with diverse interests and intentions. Personal attacks, defensive and offensive stances motivated by unrelated factors should be expected. I feel I must apologize for a long and not entirely coherent post. Here is my main point. I notice that defensive and sometimes also offensive tone in some of the recent posts on this blog and elsewhere. I also notice an attempt to partition the participants into so called ‘core’ group and everyone else, not unlike the partitioning into ‘us’ and ‘them’ frequently practiced in politics primarily to unite and solidify the population behind a common ideology. I want to say right away that in no way I claim MMT to be an ideology. I do however believe that the emphasis on or even a claim of existence of ‘core’ and ‘fringes’ (I apologize if my phrasing is inaccurate, English is not my first language) is not helpful if acceptance is the goal. It smells of the argument from the position of authority. It also, perhaps indirectly, makes a claim about the quality of the arguments of everyone outside of the ‘core’ group regardless of the content. This is unnecessary and does a great disservice to the movement. It gives an opportunity to the opponents to derail the discussion by pointing this out. Everyone who has been following MMT for sufficiency long already knows how and when it all began and who the first contributors were. No one in good faith can dispute the contributions of the ‘core’ group. Membership in this group, however, doesn’t entitle one to any special privileges in a discussion. All positions and arguments should be considered strictly based on their individual merit. Whether the claim originates inside or outside of the ‘core’ group is irrelevant. Now, I don’t want to interpret the rant above as an attempt to undervalue the effort that Bill or any other ‘core’ members, by whatever criteria, make to further the cause. It is undisputed and highly appreciated. I read this blog every day and overwhelming majority of the material is impartial, factual and very well researched… with rare and certainly avoidable regencies to ‘core’, ‘origins’, ‘them’ etc. As Bill himself at one point argued, framing and perception are important. I believe these references do not help with either.

Dear lavrik (at 2019/04/02 at 6:15 am)

Thank you for your thoughtful comment.

I disagree about the question of ‘standards’. My reference to a ‘core’ group is not to create an elite or a hierarchy. It is merely to define the body of work that is now called MMT in order to provide a benchmark as to what that term refers to.

The increasing criticisms of ‘MMT’ often are based on derivative work (often confined to social media contributions from people who did not contribute to that original body of work).

For example, I sometimes read from those writing under the broad MMT umbrella that the Job Guarantee could be improved by adding a wage structure to ensure those on high wages would not be required to accept the social minimum offered. The point here is that then the proposal is no longer the MMT Job Guarantee but another sort of public service employment program, that eliminates the buffer stock price anchor that is central to the MMT framework.

If the distinction isn’t made between that conception of a employment guarantee and the MMT Job Guarantee then MMT becomes open to criticism on the inflation front, for example.

That is the sense that I use the term ‘core’ to define what we consider to be MMT and what is not MMT.

There is no sense of superiority or a ‘them’ and ‘us’ type story operating here.

We have to have clarity in what we call things (hence the ‘standards’); otherwise, as the critics have been claiming, the concept becomes fuzzy and difficult to tie down.

best wishes

bill

Larry, I wasn’t praising Shiller. It’s just that it was less negative than earlier comments by Rogoff et al. As you say he is still well outside understanding it.

In the above blog post Bill wrote,

“One of the features of MMT, to reduce this possibility is to bolster the automatic stabilisers, which come into play immediately there are shifts in the non-government spending cycle.

That is one of the important roles that the Job Guarantee plays in our macro approach. It expands both public employment and public spending in a downturn in non-government economic activity and vice versa in an upturn.

The Job Guarantee becomes the minimum government spending that is required to sustain what we call ‘loose’ full employment.

Note, that the operation of the Job Guarantee doesn’t always mean that fiscal deficits will increase. One could imagine a situation where aggregate demand was lower as the Job Guarantee was introduced.”

I make the following claims:

1] One of the most important elements of the persuasiveness of MMT is that it makes few if any obviously false statements or makes no false assumptions. To make even one self contradictory pair of statements is therefore counter-productive.

2] I have seen many claims by the core MMTers that MMT is just descriptive of what gov. that have their own true fiat currencies do now or have done in the recent past [during the GFC/2008 for example].

3] In the part I quoted above, Bill says that the Job Guarantee program is required because it covers the claim that MMT will cause massive inflation.

4] However, no nation now or recently has had a program much like the JG program.

5] Therefore, the 2 claims that MMT is just descriptive and that the JG is necessary are contradictory. One or the other is false. Specifically the “just descriptive” one is false.

6] If the core group agrees with me that even one obviously false claim is a very bad thing then it is simple to just make the JG program the ONE AND ONLY exception to the “MMT is just descriptive” claim.

Dear Steve_American (at 2019/04/02 at 2:08 pm)

Your accusation of inconsistency continues the myth that MMT is one-dimensional – description. I keep reiterating that it is a multidimensional lens to help us better understand what the system we live in is about.

That requires lots more than description. We need theories, stock-flow consistency accounting frameworks, etc.

Somehow, you need to get over this one dimensional view.

best wishes

bill

OK Bill,I’ll drop it , after one last try to convince you.

It sounds like my ignorance of the details of deep economic ways of thinking leads me to the wrong conclusion.

I am not alone though. Others have agreed with me here on this site.

So, it is a fairly common misconception among those who are not very knowledgeable about economic flows and stocks.

Because the people you mostly need to convince are politicians and not prof. economists [who you will never convince until they die] perhaps my POV is the one you should be aiming your arguments at.

Anyway, that is my last words on the subject.

The claim as I understand it is that MMT theory demonstrates that it is possible to maintain an economy in a state of full employment with stable prices and the witness control mechanism is the employment buffer. The employment buffer is then a critical result of MMT that clearly distinguishes it from the employment/price models admitted by mainstream theory.

The employment buffer provides downward pressure on wages by providing a pool of job ready workers in opposition to those who seek to bid up the price of labour.

The employment buffer provides upward pressure on wages by providing a pool of well paid jobs in opposition to those who seek to bid down the price of labour.

The employment buffer provides upward pressure on declining private demand by offering stimulus spending to those unable to pay for the goods they desire through unemployment.

The employment buffer provides downward pressure on rising private demand by producing free public goods that fulfil private desires and by withdrawing stimulus spending as workers return to the private sector.

Not being fully across the effectiveness proof, it seems to my intuition that the employment buffer should be effective as long as there is in fact an employment buffer.

What is the behaviour in the case of an empty buffer?

On a different subject. Above Bill wrote, “While critics make much of the fact that labour is heterogeneous and so the Job Guarantee would just force skilled workers into jobs below their capacity, the reality is that such workers typically prefer what we call ‘wait’ unemployment which is subsidised by their redundancy payments, a luxury that most low-pay workers do not enjoy.”

Is the phrase ‘redundancy payments’ the same as US style unemployment insurance?

Does MMT want to replace unemployment insurance with the JG? Or, just for the lower paid workers, with the higher paid workers only having to pay the premiums?

” . . . even at the depths of the GFC, the MPC still believed its policy was effective.”

Did they have a ‘policy’?

M. A. King said in his opening remarks: {Thursday 11 September 2008} :

“In the UK we face a difficult but, temporary, period during which inflation will remain high for a while and output growth at best weak. . . . But provided we do not impede the required adjustment we will come through this temporary period and resume a path of normal economic growth with inflation close to target.”

Provided we focus on bringing inflation back to target, our present difficulties will prove to be temporary. Inflation will fall back, and growth will resume.

Bank of England publications/ treasury committee ir tsc080911

The job guarantee seems like such an easy idea when stated in that two word description. As I try to think of the details of implementation, it stops sounding so easy. As I hear it proposed for the USA, it will be implemented at the state and local government levels with money furnished by the federal government. I find it hard to believe that every such authority will be capable of managing that job guarantee. Sure there are plenty of socially useful jobs that need to be done, but will the population of unemployed be universally capable of performing those jobs. What about people who are just incapable for one reason or another of fitting into a traditional job? I hear proposals that the workers can define the jobs. Artists can do art, etc. I find it hard to imagine how this could be managed by the state and local governments. Being hard to imagine, does not prove it can’t be done. I am just saying it won’t be so easy to do as the simple words “job guarantee” seem to imply.

“redundancy payments, a luxury that most low-pay workers do not enjoy”

“redundancy payments” might mean “severance pay”, paid out by the employer on termination?

I just thought I would note that, while the JG is a very important part of MMT (if not core, certainly nearly core), it does not require MMT to validate it as a policy option (one that is being discussed in my government department — in a certain G7 country). Even with senior management waffling on about “taxpayers money,” the job guarantee is a valid and useful policy option. As I recall, Randall Wray and others have pointed out that a JG would likely be mildly deflationary — among other reasons, so often outlined by Bill, because of reduced spending on corrections, health, the justice system, etc. On that basis alone, the JG is a good policy — and it may be possible to move from JG to MMT, as opposed to doing the reverse. Not ideal, I concede. I would love to talk to senior management about buffer stocks and so-on, but such as I must work within a bureaucratic hierarchy.

Bill, your answer to lavrik helps me. I’ve been thinking that the JG would not be necessary for a Corbyn government as there are so many socially useful jobs which could be funded by the state now. It is the minimum/floor wage which separates the JG from these.

I have just had to open up this blog again to reply to this from a member of our campaign to the Labour Party, which I received on Sunday: “Now is a good time to develop your election manifesto on taking the economy out of politics. Go a few steps further than handing interests rates to the Bank of England, actually move the responsibility for the UK economy outside of parliament and into the hands of professional economists , such as HMRC, HM Treasury, Bank of England and the Financial services. By all means Parliament continues to make the laws and police those laws – but the economy goes out of politics and into practical thinking and action for the benefit of all UK citizens.”.

@Carol Wilcox:

Oh my goodness, they’ve certainly been drinking the Kool-Aid, haven’t they? The exact opposite of what Bill says, although it could have come from the likes of Positive Money.

The twisted logic is all yours .A job guarantee is not descriptive.So logically

MMT is not just descriptive it is something you apply but you often deny it is

something you apply.

If you want to be logical MMT can of course include a job guarantee but then do

not ridicule people who say MMT is something you apply.

I am in favour of a jg but highly sceptical of its ant -inflationary claims, such a theory

can only be proved in practice i hope we get a chance to see that .

If you have a model of inflation that is robust and predictive in a scientific sense and can

factor in a jg then maybe we do not need decades of a JG to prove your theory.

Dear Kevin Harding (at 2019/04/04 at 4:25 am)

I have never denied that the Job Guarantee is an application. I also continually write that MMT is more than meagre description. It is a lens for understanding better.

Why would you want to make stuff up?

best wishes

bill

Bill you have continually blogged that people do not understand MMT if they think

it is something you introduce.

By the way i like the notion of a theory being a lens through which to view reality.

Dear Kevin Harding (at 2019/04/06 at 7:12 pm)

Yes, MMT is not a regime.

But in reality, nations use buffer stocks to achieve price stability. The question that MMT addresses is which buffer stock option is the most effective. Then the Job Guarantee becomes obvious.

best wishes

bill

Unlike wool, corn, or money, people and their jobs are not fungible. When you start thinking ” the Job Guarantee becomes obvious”, then you are actually not thinking deeply enough.

Steven Greenberg: When you start thinking ” the Job Guarantee becomes obvious”, then you are actually not thinking deeply enough.

No, to start thinking it isn’t obvious, is to think illogically and outsmart oneself. Overlooking the obviousness of the JG is the outcome of disorganized, not “deep” thinking. People underestimate how much MMT is “basic research”, “first philosophy”, an attempt to discover, explore, understand and apply fundamental principles. It’s not just a new theory tacked on to the same old highly defective basics; but a refurbishing of the basic definitions and propositions.

“Deeply disorganized thinking” is as good a description as any of the current dark age of macroeconomics that MMT is dispelling. Money and jobs, like a JG job, and individual choice to take a job in order to get fruits of others’ jobs MAKE people and their jobs sufficiently “fungible”. The proof of this pudding – this act of making – is the success of monetary economies in beneficial organization of the division of labor. and the even greater success of monetary economies with full employment, with guaranteed jobs.

People are either employed or they aren’t. Which is “most effective”? Well, the idea that unemployment can have some magical benefit is so insane – that if you want to get things done, to be able to do things, that it isn’t better to – uhhh, DO THINGS – that it isn’t worth discussing. The impossible burden of proof is on the (mad) believers in the magic of unemployment, enforced idleness, contempt of others’ labor.

As is usual in the “deepest” reaches of thought, in philosophy and the sciences – the problem is getting oneself and other people to stop ignoring the trivial things – that ARE obvious, that are and were always in front of their noses – once people make the Herculean effort of organized and careful thinking.

Some Guy,

Your reaction to what I didn’t write is exactly what I was thinking about. The idea that ” the Job Guarantee becomes obvious” without also thinking “how hard is it going to be to implement this idea”, is what was in my mind. All the rebuttals you posed were exactly the reaction I was hoping people would avoid. As I wrote elsewhere on this thread, people and their jobs are not fungible the way buffer stocks of wool are. Think of all the square people you will have to pound into round holes. Think about all the odd shaped holes you will have to invent to get all people to fit. I am not saying that it is impossible. I am saying it is not going to be as easy as having the flash of insight “a jobs guarantee”.

Some states’ objections to Trump’s work requirements for SNAP are that it is too hard to implement. If that is too hard to implement, think of what they will say when the federal government funds the state to run a jobs guarantee program. This JG is going to have to have a lot of thought put into it before it is ready to be implemented.

Bill in reality what buffer stocks does Japans’ government use to secure

price stability?

What size of unemployed buffer stocks does the Turkish government need to

achieve price stability?

The Phillips curve is another mainstream myth.

Steve Greenberg:

SG: “how hard is it going to be to implement this idea .. I am not saying that it is impossible. I am saying it is not going to be as easy as having the flash of insight “a jobs guarantee”.

I agree. That is what you are saying. I am saying you are completely wrong, you have it completely backwards. What you’re calling hard is easy, what you’re calling easy is hard.

In fact, implementing a Job Guarantee is easy. “The Flash of Insight” is the hard part. That’s what history and experience shows. FDR and Harry Hopkins et al did it all in months, starting from nothing, usefully employing millions. I’ve been criticizing MMTers for a long time for providing too many details about the Job Guarantee, not too few. Because people miss the forest (flash of insight) for the trees (details).

Want details? The WPA & other programs did about a million projects. There’s a book at the Internet Archive from when it was ended that summarized tens of thousands of them. How to do a JG?: Answer: Do stuff like that. We in the USA (and many other countries) did it before, quickly and effectively.

We don’t need to “expand the definition of work or job” – we need to shrink the definition of work or job. No low-paying and hazardous or onerous work. Ever. Period. Somewhere else an ignorant skeptic asked me -Well, what if I want to be a ballerina? Well, I provided a list of ballets that the WPA put on.

Suppose you are the world expert in something really obscure: say, ancient safety pins. Well, the WPA funded someone to write a history of ancient safety pins; Hopkins himself defended that project against the mindless zombie horde of critics. Think that is useless? I bet many modern ‘compliant mechanism’ engineers would like a look at that book.

SG: Think of all the square people you will have to pound into round holes. Think about all the odd shaped holes you will have to invent to get all people to fit.

Well, the JG has a ton of money and a ton of people working on it to do such things.

Problem solved. The only “implementation” problems are political. Getting the local administrators to get The Flash of Insight, to not run it as a fiefdom, to abuse JG workers, to use them against other workers, etc. IMHO – US New Deal experience showed that there should be somewhat less decentralization of the JG than the modern MMTers suggest.

But these are mere details, that any big project faces. But all of a sudden, when there is a Job Guarantee, all these things that every business and government does as a matter of course – become Oh-So-Terribly-Difficult! So these imaginary difficulties are a joke – but they show how deep the neoclassical economics programming is in everyone’s mind.

Also:

a: A JG is not about pounding square pegs into round holes. A Job Guarantee takes people as they are. They say what job they like, are good at, have done etc and then the administrators try to find as near a job as they can. It ain’t rocket science. As Bill says, no country that has ever tried to do such things has ever failed. The problem is the Not Trying, the “smothering negativism”, the “can’t do” attitude. Above all, the completely insane belief that people working more makes people poorer, not richer.

b: To compare “work requirements for SNAP” to a Job Guarantee is to misunderstand the Job Guarantee. The Job Guarantee is NOT workfare. It is not taking away something from people (welfare benefits) – and imposing an intentionally onerous requirement on them. That kind of crap is intended to be “difficult to implement” and follow.

SG: This JG is going to have to have a lot of thought put into it before it is ready to be implemented.

The MMTers, the New Dealers etc have put far more thought into it than is necessary.

A JG is long past ready to be successfully implemented tomorrow. Concerning “thought” – One good JG job for unemployed intellectuals would be – read and report on the enormous amount of unread and forgotten literature from the New Deal – to not repeat their (minor) mistakes.

Could go either way, I think. Proper decentralisation could reinvigorate local communities, many of whom have little contact with anyone but carpet baggers coming to show off their latest Government check.

Mr Greenberg’s elite view that there would not be enough “reliable” types willing to find something for all these “ne’erdowells” to do … does tend to get my hackles up.

Most jobs these days are already Bullshit Jobs. It’s not really a Job Guarantee if it simply offers “less important” bullshit jobs. Let people develop their own economic interactions in a fiscally prosperous environment.

Since I made my comment, I have learned a lot more about the JG and the thought, research, and implementation that various MMTers have put into it. As your reply did, it opened my eyes.

Steven Greenberg: Thanks for your gracious comment and compliment! And my apologies if I came on too strong.

BrendanM,

I am sorry my remarks mislead you as to my thinking. Now that I have been educated about how the JG could be implemented and its past history of implementations, there is no point in further discussion of what I was trying to say.