I have been a consistent critic of the way in which the British Labour Party,…

Bank of England backtracks on its doomsday Brexit scenarios

Earlier this month (March 5, 2019), the Governor of the Bank of England fronted the House of Lords Select Committee on Economic Affairs for his annual grilling. The details of his evidence, covered in the transcript produced – Uncorrected oral evidence: Annual session with the Governor of the Bank of England – should have generated headlines in all the major British press outlets but the UK Guardian, noticeably, avoided reporting the details. The Guardian has jumped on every negative projection since before the 2016 Referendum and published volumes of Op Ed pieces from various correspondents amplifying the negativity. But it largely failed to report the Mark Carney’s backtracking. Turns out that the Bank of England thinks Brexit will be considerably less damaging than its headlined Project Fear estimates published last November, And that is without factoring in any fiscal response from government. It seems that the Bank now believes that a no-deal (disorderly) Brexit won’t be all that damaging at all and an orderly Brexit would be associated with an over-full employment boom over the next three years. Quite a different story to that offered in November 2018. The latest revelations will give Remainers some headaches – their collapse scenarios are evaporating.

I have long held the view that the real problem confronting the British economy has been the neoliberal policy positions taken by the current government which has reduced the incentive of British firms to invest in new productive infrastructure and equipment.

While the Remainers have been hysterical in their focus on the damage that the Brexit decision has ’caused’ (their assertion), and, seize on all the ridiculously overblown estimates coming from the likes of HM Treasury, the Bank of England and other private groups, such as the NIESR, to prosecute their case, the real game has been the decline in business investment and the reliance on increasing household debt as the austerity straitjacket has been tightened.

Note, that, unlike many of the Remainers who just want to overturn the Leave decision in any way they can, I distinguish between the decision to leave (the Referendum result) and the incompetent process that the Tories have pursued in implementing that decision.

I continue to fully support the Leave decision but find the process so ridiculously mismanaged that it is little wonder that the long-standing pessimism of investors (firms), driven by the painful austerity, has been exacerbated.

In other words, I do not believe the decision to leave, itself, would not have undermined confidence in any significant way had the British government displayed even the most basic of negotiating skills against the EU, which was intent on making it as hard as possible to leave.

Before I consider the Governor’s remarks, I recap what the real problem in Britain is – and it is not Brexit!

The British Investment ratio

The next graph shows the UK investment ratio (total capital formation as a percent of GDP) from the March-quarter 1997 to the December-quarter 2018.

The dotted red line is the average ratio over that period.

The drop associated with the GFC is quite stunning. It went from 18 per cent of GDP in the December-quarter 2007 to 14.8 per cent by the December-quarter 2009.

This huge cyclical swing tells us how deep the GFC recession was in the UK. Real GDP growth was negative for 5 successive quarters starting in the June-quarter 2008.

The British economy shrunk by 6.3 percentage points between the March-quarter 2008 to the September-quarter 2009.

But the current sluggishness does not bode well for future growth, given that potential GDP growth will be slowing as a result of the weak investment performance.

Investment expenditure contributes to aggregate demand (spending) now and builds productive capacity (supply) for the future.

The investment ratio, however, is around the same level as it was when the Brexit referendum was held in June 2016. It has fallen from 16.9 per cent to 16.7 per cent since the Referendum and is now at the average level for the period shown in the graph.

So while the GFC and subsequent austerity certainly has damaged the investment ratio, it is hard to implicate the Brexit decision and subsequent process in the performance of the investment ratio to date.

The British Productivity Slump

How has the investment slump impacted on productivity growth?

While not part of the current National Accounts release from the ONS, their January 9, 2019 update of the productivity data is related to the investment slowdown. Note that this data only goes to the third-quarter 2018. The next update will be on April 5, 2019.

I analysed the productivity slump in Britain in this blog post – British productivity slump – all down to George Osborne’s austerity obsession (October 18, 2017).

I have updated that analysis today using the latest ONS data available – HERE.

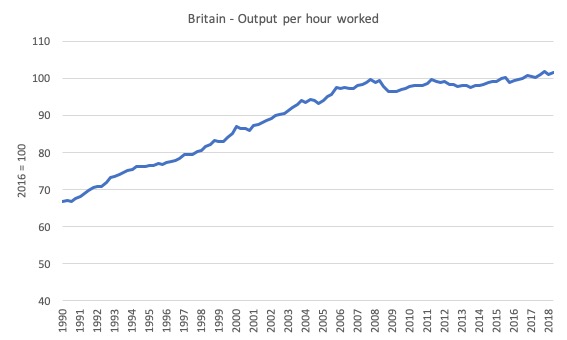

The following graph shows UK Whole economy output per hour worked from the first-quarter 1990 to the September-quarter 2018. The same sort of pattern emerges if we use the output per person employed measure.

The cyclical swings throughout this extended period are evident and the size of the GFC downturn is obvious.

The point is that British labour productivity growth slumped during the GFC, and, then stalled as a result of the austerity that was imposed in the aftermath of the recession.

A shallower slump followed and pre-dates, by some years, the Brexit referendum.

Further, in recent quarters, British productivity has actually been rising steadily and has consistently done so since the June 2016 Referendum, albeit at a modest rate, although it fell slightly (0.4 points) in the September-quarter 2019.

In other words, the poor British productivity performance has little to do with the Brexit referendum outcome or what has followed.

Structural explanations of this slump are also unlikely to have traction. The massive cyclical contraction pushed British productivity growth of its past trend. Structural factors work more slowly and we would not witness such a fall if they were implicated.

Why would that cause productivity growth to slump then fail to recover?

A major driver of productivity is investment – both public and private.

While business investment is cost sensitive (so may respond to interest rate changes), mainstream economists usually ignore the fact that expectations of earnings are also important as are asymmetries across the cycle.

Cyclical asymmetries mean (in this context) that investment spending drops quickly when economic activity declines and typically takes a longer period to recover. So fast drop and slow recovery.

The cyclical asymmetries in investment spending arise because investment in new capital stock usually requires firms to make large irreversible capital outlays.

I also discussed that phenomenon in detail in the blog post – British productivity slump – all down to George Osborne’s austerity obsession (October 18, 2017) – which gives additional references to earlier academic work I have published on this topic.

The point is that when the economy experiences a sharp contraction, there is a necessity for strong fiscal support to rebuild confidence among firms that it will be worthwhile investing in new capacity.

Exactly the opposite happened in the UK with George Osborne pursuing his ideological obsession for fiscal surpluses (and failing).

Imposing pro-cyclical fiscal austerity of the scale that George Osborne initiated when the Tories came took government in May 2010 is the last thing a government should do when non-government spending is in retreat.

Fiscal austerity in these circumstances exacerbates the typical asymmetry associated with investment expenditure and is a major reason why business investment in the UK has been so weak.

We often focus on the short-term negative impacts of fiscal austerity, but in this case, it also has serious long-term impacts on both the rate of business investment and the potential growth rate (which falls as capital formation stalls).

The longer it takes for business investment to recover, the worse will be the long-term impact on potential GDP growth. In turn, this means that the inflation biases are increased because full capacity is reached sooner in a recovery – often before all the idle labour is absorbed.

So, while George Osborne is long gone, the negative impacts of his policy folly will reverberate for a long time to come. His failings will continue on for many years and the flat productivity growth is one manifestation of that failing.

What the Governor said

During his oral evidence to the Lords Select Committee on Economic Affairs, the Bank of England governor was interrograted about the Bank’s view of the Brexit situation.

In the – Transcript – we read that:

1. “the bulk of the speech was about the global outlook” – in other words, the Governor thought the fact that “the global economy has been slowing over the last half of the year” was a more significant focus for attention than being sidetracked by domestic issues (Brexit).

2. He noted that “Less than a third of the globe is growing above trend, investment growth is quite modest and indeed is stagnant in some economies, and trade growth has slowed quite markedly as well.” – which mostly explains, together with the on-going fiscal austerity in Britain, why British growth has been stalling.

3. He mentioned Brexit in the context of “the short-term global outlook”.

4. He noted that “Any trade globalisation creates tensions in terms of inequalities; there are winners and losers and there is a requirement for redistribution or, at a minimum, reinvestment” and that fiscal austerity, of the scale introduced in Britain, exacerbates these losses for some workers and their communities.

5. He agreed that his preference was that the UK becomes “a rule-setter” rather than “being a rule-taker within an international context”.

The discussion then focused on the Bank’s own Brexit assessments.

It was noted that “in November the Bank published its assessment of different withdrawal scenarios for Brexit” which I considered, in part, in this blog post – Britain’s austerity costs are larger than any predicted Brexit losses (March 4, 2019).

On November 28, 2018, the so-called independent Bank of England published its own horror story to go with the HM Treasury’s report released in the same month – EU withdrawal scenarios and monetary and financial stability.

The Report presented various “scenarios” relating to Brexit – a “disruptive” scenario and a “disorderly” scenario (distinguished by the extent to which trade agreements were sustained) – with the real GDP loss of 5 per cent and inflation rising to over 4 per cent in the first case; and real GDP contracting by 8 per cent and inflation rising to 7.5 per cent in the second case.

The period over which these losses would be sustained over a period of “up to five years”.

In formulating these ‘scenarios’, the Bank assumed that:

1. “no discretionary changes in spending or tax policy are assumed” – in other words, the Government passively watches the economy plunge into recession.

2. The central bank hikes interest rates “mechanically” and in some scenarios the interest rate rises to 5.5 per cent.

It was, of course, a ridiculous exercise but fuelled the Remain hysteria.

If one thought about it for a second: the scenarios posited that external trade would collapse, credit availability would tighten, macroeconomic uncertainty would increase and choke off household consumption spending and business investment, and, as a result GDP growth would nose-dive and inflation would rise.

And while that was happening, they were assuming that the Treasury would sit idle while the Bank of England would hike interest rates to 5.5 per cent.

It was not believable.

In reply to the question about the November ‘scenarios’, the Governor noted:

1. “these are scenarios, not forecasts”.

2. “we did the scenarios, apart from the fact that we were asked to divulge them. The reason we do the scenarios is to test the system … so we can be assured that financial institutions will be in a position to withstand a shock like that, however unlikely.”

I found that interesting – the Treasury required the Bank to “divulge” the scenarios and knew them to be highly political. This demonstrates the obvious point I make often that the central banks are not independent institutions.

Claiming independence is just an act of depoliticisation. The Treasury knew that their own estimates would be given a credibility boost if the Bank was forced to disclose similar estimates.

It was a jointly coordinated stunt to put further pressure on the Brexit process.

3. The Governor then disclosed that:

Since we released those scenarios in November, there have been some constructive developments in preparedness … procedures-have been put in place, plus an initial approach in the UK, which would reduce security and other checks at the border, in effect creating the prospect of roll-off behaviour at the border for a period of time …

There has been progress on the financial side: material progress in the derivative markets. Alongside the ECB and ultimately the Commission, with the Treasury’s help, there has been important progress on cleared derivatives, which has reduced some of the financial risk …

And the implication of these developments?

… would pull back somewhere between 2% and 3.5% of those losses depending on the scenario … My point is that there has been progress in preparedness, which reduces … the level of economic shock. Again, it is a matter of judgment. There is false precision in all these numbers.

In other words, even on the Bank’s own terms a disorderly, no-deal Brexit would be only result in 50 per cent of the GDP losses predicted in November 2018.

A Lord Kerr noted that “the labels ‘disruptive’ and ‘disorderly'” should be dropped because they “may be a bit emotive” and then asked Carney “which of the scenarios now seems more plausible”.

The Governor replied:

… it depends on the extent to which we are in control of events … whether … clear steps are taken to mitigate and manage it.

So if the assumptions noted above relating to government inaction did not hold, and the Government, instead, used its fiscal capacity to support aggregate spending, it is entirely possible (and likely) that real GDP growth would remain positive even with a no deal Brexit.

The Bank can no longer rule that out.

He was also asked about the inflation estimates in the November Brexit scenarios.

Lord Sharkey noted that “in the Bank’s February inflation report suggested an interest rate rise of 0.25% over the next three years compared to the 0.75% rise that was expected in November 2018”.

The Governor responded by saying that the global slowdown has altered the expected trajectory of inflation for Britain and created “a degree of slack … in this economy” which “would be consistent with a reduced degree of interest-rate tightening”.

But then he said that:

In our forecast, inflation is above target throughout the horizon and remains above target at year 3. By the end of the forecast, which of course is presumed on some form of Brexit deal and a smooth transition to that, the economy is growing at 2%, above our estimate of trend; the economy is in excess demand, so it is more than in full employment and factories are running hot, if I can put it that way, and inflation is above target. In other words, the path of interest rates is not firm enough or quite high enough to be consistent with us fulfilling our mandate, which sends a broad signal about the stance of policy.

So while he admitted that it would be “foolish” for the bank “to raise interest rates … when the economy was weak and inflation was under control” the likely outcome is that once Britain transitions to “some form of Brexit deal” the economy will be growing strongly and all the rest of it.

So the Remain argument that Brexit per se is a disaster for the British economy is not shared by the Bank of England. In fact, Carney claims the economy will be “running hot” under an orderly exit.

Conclusion

The UK Guardian did not give this evidence much scope at all whereas The Times and Bloomberg featured the hearing.

That should pose questions for bias in the editorial policy of the UK Guardian. They are quick to headline doomsday scenarios such as when the Bank first published its November ‘scenarios’ but reluctant to give space to pro-Brexit or nuanced-Brexit analysis.

The fact that in the Bank’s assessment, a worst-case Brexit scenario would lead to 3.5 per cent GDP loss over three years, without any government response, suggests that with a strong government intervention, the losses would be small if at all.

And, with an orderly Brexit, the Bank estimates boom-time conditions.

Where is the Remain argument then?

Tweet away.

Of course, I don’t see any of these impacts. The real problem is not Brexit (one way or another) but the austerity bias choking the economy.

That has to be relaxed for Britain to return to more robust growth.

That is enough for today!

(c) Copyright 2019 William Mitchell. All Rights Reserved.

I am getting the distinct impression that their has never been any intention on the part of British policy makers of all stripes to actually deliver on the outcome of the 2016 referendum. They are after all, members of the political and social elite who go swanning around Brussels and Brexit is a threat to their very way of life.

As near as I can discern, they are attempting to construct a false dichotomy and present it to the public as TINA! by framing Brexit as a choice between remain and a leave deal so appalling that is essentially remain by another name, except worse – and that these two outcomes are the only two choices possible. Once they feel they have embedded this falsehood in the minds of enough of the electorate, they will call for a second referendum as a way of overturning the results of the original referendum that they never intended to deliver on in the first place.

It reminds me somewhat of the republic referendum here in Australia, where the political elite – who had no intent whatsoever of removing a foreign monarch as our head of state – offered a similar false dichotomy: either keep the status quo (which had allowed the British monarch’s representative in Australia in the 1970’s to sack the Australian Labor government and install the conservatives) or accept the version of a republic being offered by the political elite – a version so bad that it would have been a republic in name only. The same strategy looks to be being played in the UK right now.

Thanks Bill. The EU really is a piece of work and the UK government, pitiful. Of course referendums are more abhorrent to the EU than UK governments. But if the EU really cared about the total 6.6m people in the island of Ireland, they’d take rather more care of the vote of the 64m people in the landmass sitting between it and continental Europe, notwithstanding those people’s appetite for French wines and German cars. By the way, I don’t think you intend the double negative in this sentence:

‘I do not believe the decision to leave, itself, would not have undermined confidence in any significant way had the British government displayed even the most basic of negotiating skills against the EU, which was intent on making it as hard as possible to leave.’

Prof bill

I am quite surprised by your brexit stance. The uk before the brexit was already in the best position in the Eu. It had and will have currency sovereignty. So what’s the point of advocating brexit? There’s no gain but only losses by going into the wto and then getting bullied by bigger countries into accepting lower standards in particular the USA. So on what basis are you supporting brexit?

Timely, thanks Bill. Of course, the FT, BBC et al continue to refer casually to a “disastrous”, “chaotic”, etc No Deal. After all, its obvious, isn’t it? I am furious at the majority of MPs that last week chopped the British people’s legs away by ruling out No Deal in any circumstances. I hate to use the word, but treasonous is the best one that comes to mind.

Dear Gary (at 2019/03/18 at 3:03 pm)

I have written several blog posts about why I support Brexit. Go to the Britain link on the right-hand side and search.

As a start:

1. Do you want British Labour to be able to recreate state transport monopolies? EU railway directives prevent this, for example.

2. Do you want Britain to be able to avoid investor dispute mechanisms in trade agreements? Impossible under EU membership.

3. Do you want British local governments to be able to regulate local accommodation to avoid rental space being overrun by tourist industry and Airbnb etc? EU services directives will make that impossible.

4. Do you want the British court system to determine the ultimate legality of legislation introduced by the elected government? Impossible under EU membership, which defers to the European Court of Justice.

Just for starters.

I could continue for hours documenting why EU membership undermines a progressive policy stance.

Britain has its own currency but is not fully sovereign in a democratic sense.

I cannot fathom why a progressive Left person would want Britain to be a member of a corporatist, neoliberal cabal like the EU.

best wishes

bill

@Gary – at least 17.4 million voters in the UK begged to differ with the argument that membership of the EU produces greater benefits than losses. It appears that not many of them did so under the prime motive of being stupid, ill-educated bigoted racists. The belief that “decisions made about the UK should be taken IN the UK” was identified as motive number one for voting to leave – I find it very hard to disagree with that sentiment, since it is a necessary condition for national democracy.

In a recent post, I said that I thought Theresa May (originally a Remainer) never had any intention of delivering Brexit, but had deliberately (or unavoidably) made such a mess of it, that when it really came to the crunch, the reality would appear so bad that even her hard-line Brexiters would pull back. I still think that’s a possible explanation, but of course another approach might have been to deliver “Brexit in Name Only” which is how her famous deal could be described with some justification.

As for the Guardian, Larry Elliot has been the lone voice in favour of Brexit, although in fairly muted tones, I would say. I was interested to find recently a video on the Counterfire Youtube channel of Elliot speaking at an event in Nov 2018 entitled “Corbyn, the labour movement and a People’s Brexit” in which he is much more explicitly pro-Brexit from a socialist perspective than I normally notice in his Guardian pieces. He does mention how lonely he feels at the Guardian in that context. I’ve often wondered why he never seems to come out in favour of MMT, since it’s 99% certain that he understands it, and probably agrees with it, or at least has no intellectual objection to it.

But I suppose he feels, probably justifiably, that going out on a limb on two major fronts would put him too far beyond the pale for the great and good at our only (supposedly) left-wing newspaper. Even though the only good Brexit would be one managed by a left-wing government which is also MMT-aware (and prepared to act on this awareness).

As it is, we’ll have a bad Brexit (if we have one at all, which is still very doubtful to my mind), managed by a right-wing government. This is something we’re going to have to take on the chin and live through, hoping that enough of us can survive to eventually bring about a good government which can eventually make good the further damage that the Tories will inevitably cause, and deliver the right kind of bottom-up prosperity and well-being for all of our citizens.

It looks like I owe Larry Elliot at least a partial apology:

https://www.theguardian.com/business/2019/mar/17/as-recession-looms-could-mmt-be-the-unorthodox-solution-modern-monetary-theory

@Mike Ellwood,

“But I suppose he feels, probably justifiably, that going out on a limb on two major fronts would put him too far beyond the pale for the great and good at our only (supposedly) left-wing newspaper.”

Probably doesn’t want to end up marginalised like some of the other excellent writers, such as John Pilger, Jonathan Cook, or Jeremy Hardy (RIP), whose politics no longer suit the Guardian’s socially liberal but economically neo-liberal pitch. It was never a left-wing newspaper IMO, but if it ever was, it certainly isn’t now.

Dear Bill,

“In other words, I do not believe the decision to leave, itself, would not have undermined confidence in any significant way had the British government displayed even the most basic of negotiating skills against the EU, which was intent on making it as hard as possible to leave.”

“I do believe” instead of ” i do not believe” OR

“Would have undermined” instead of “would not have undermined”

We await the decision of the 27 Members of the EU whether to allow an Article 50 extension. It needs just one refusal and Brexit proceeds on WTO terms on March 29th.

There is a glimmer of hope from the likes of Italy, Hungary and Poland. who have woken to the danger that the Neoliberal and austerity policies of the EU offers to a Sovereign Nation. Brexit would help them in their own situation.

Whatever happens, the Conservative and Labour Parties are finished in the UK. Treasonous May has driven a stake thru’ the heart of Conservatives by her betrayal of the democratic will of the people.

Jeremy Corbyn’s support for a second referendum has finished the credibility of the Labour Party.

Nigel Farage or UKIP will be the benificaries of a disillusioned electorate and great changes will take place in the UK, political system

@ Mike Ellwood

Regarding Larry Elliott, a partial apology if any, only appropriate, for raising awareness of MMT but then misrepresenting it as a policy. It’s a shame as his concise speech on the EU/Brexit on Youtube shows he has the capacity to sort issues out and put them across. Bill, I hope you’re ok with a link https://www.youtube.com/watch?v=UoDtvktb0GM as it would be better if more people looked at this than read his Guardian article. Elliott has been at the Guardian a long time. I guess he feels he has too much personally at stake not to keep warming a seat but he would seem to be an honorary economics editor only.

Willem – see my post above yours.

Well, there is still the possibility that May’s deal will go through on a third (or even fourth) vote.

In the meantime, I’ve come across two Youtube videos which suggest that Leave voters have been well and truly stitched up. I won’t give links, but the titles, for anyone who wishes to search for them, are:

“May’s third Brexit deal vote offers two options: Stay in EU or be ruled by EU”

“Secret Documents Suggest Brexit Will Never Happen | Janice Atkinson”

The second one suggests that there was a secret agreement between May and Merkel at least a year ago in which May would appear to deliver Brexit, to appease Leave voters and her own Brexiteers, but that it would be Brexit in name only. Merkel was going to support this deal within the EU, and supposedly it was confirmed recently between May and Juncker. And then after a general election (which May would have to win), the UK would rejoin the EU.

I must say, this sounds too conspiracy-theory-ish to me, but it does seem to explain some events. The other video suggests that May is (as is obvious) trying to deliver Brexit in Name Only, but that this was more by accident than design, and that her original plan was for something at least a bit more like a real Brexit (it would not have had the “backstop” in, for example). That does tie in more with my gut feeling about May.

And even some leavers are now thinking that maybe it’s better to be in the EU and have some influence on the rules, than be permanently in a state of “Brexit in name only” with no influence on the rules. And that if we did land up in that state, even some leavers might want us to rejoin. So the end result would be the same as in the first scenario.

Mike, I wouldn’t be too quick to apologize to Elliott. His piece isn’t that good. For one thing, his reasoning about Trump is misguided. Trump reasoning isn’t as deep as Elliott suggests. And I wouldn’t characterize Krugman or Summers as progressive. And his final sentence is deeply suspect. What does ‘however financed’ mean?

Like many people, I’ve always thought net exports (trade surplus) were good for a country and net imports (trade deficit) were bad. After all, net exports increase demand, production, employment and national income, while net imports do the opposite. Would China, South Korea and Japan have been able to lift their people out of poverty so quickly without massive net exports?

Yet Bill insists that exports are “bad” and imports “good”:

“First, exports are a cost – a nation has to give something real to foreigners that it could use domestically – so there is an opportunity cost involved in exports.

Second, imports are a benefit – they represent foreigners giving a nation something real that they could use themselves but which the local economy will benefit from having. The opportunity cost is all theirs!”

https://billmitchell.org/blog/?p=41797#more-41797

I’ve now found a passage in an old (mainstream) textbook which fully endorses Bill’s (and MMT’s) point of view and clears up the confusion, at least for me:

“Saying that exports raise national income means that they add to the value of output, but they do not add to the value of domestic consumption. In fact, exports are goods produced at home and consumed abroad, while imports are goods produced abroad and consumed at home. The standard of living in a country depends on the goods and services available for consumption, not on what is produced.

If exports were really good and imports really bad, then a fully employed economy that managed to increase its exports without any corresponding increase in its imports ought to be made better off thereby. Such a change, however, would result in a reduction in current standards of living because when more goods are sent abroad and no more are brought in from abroad, the total goods available for domestic consumption must fall.

What happens if a country does achieve a surplus of exports over imports for a considerable period of time? It will be accumulating claims to foreign exchange for which there are three possible uses: 1. To add to foreign exchange reserves, 2. To buy foreign goods, and 3. To make investments abroad. Consider each of these.

(1) Foreign exchange reserves are required for the smooth functioning of a system of fixed exchange rates. Accumulation of reserves over and above those required to cope with fluctuations in private payments serves no purpose. Permanent excess reserves represent claims on foreign output that are never made effective.

(2) American dollars or Indian rupees cannot be eaten, smoked, drunk or worn. But they can be spent to buy American and Indian goods that can be eaten, smoked, drunk or worn. When such goods are imported and consumed, they add to UK living standards. Indeed, the main purpose of foreign trade is to take advantage of international specialization; trade allows more consumption than would be possible if all goods were produced at home. From this point of view, the purpose of exporting is to allow the importation of goods that can be produced more cheaply abroad than at home.

(3) An excess of exports over imports may be used to acquire foreign exchange needed to purchase foreign assets, but such foreign investments add to living standards only when the interest and profits earned on them are used to buy imports that do not have to be matched by currently produced exports – that is, when, in the future, they produce an excess of imports over exports. From this point of view, the purpose of exporting more than one is importing in order to make foreign investments is eventually to be able to import more than one is exporting.

In summary: The living standards of a country depend on the goods and services consumed in that country. The importance of exports is that they permit imports to be made. This two-way international exchange is valuable because more goods can be imported than could be obtained if the same goods were produced at home.”

Page 667-8 of An Introduction to Positive Economics by the Canadian economist Richard G. Lipsey (5th edition, undated but apparently late 1970s), Weidenfeld and Nicolson.

Sorry this is so long, Bill, but I thought it was worth quoting in full. It’s really more for your info than publication on the blog. best, Norman

Dear Norman (at 2019/03/19 at 6:39 am)

Thanks for the comment.

Note that I do not say ‘exports are a bad’ – they are a cost, a term that has a different connotation.

Lipsey was a dominant text when I was a student.

But this passage is sound because it emphasises that we do not produce to produce but in order to consume. A nation that is working hard to produce things that other nations consume is working too hard, unless it is using the funds obtained from the foreign consumption to improve its own consumption possibilities (imports are a benefit).

It makes little sense to be continually exporting well in excess of imports – say, like Germany. It means German workers are overworked and/or underpaid.

It is so obvious that I am confounded why progressive people continue to criticise MMT based on this insight.

Thanks again.

best wishes

bill

Off topic – Bill, Greg Jericho has an interesting article at his Guardian column this morning regarding the Australian labour force statistics. If he’s correct, it may go some way toward explaining the curious divergence in recent times between the reasonable jobs growth and the lack of any of the effects such as wage growth and consumer spending growth that should be resulting from said jobs growth.

@Mike Ellwood – I agree that we should be careful with conjecture regarding conspiracies. But I also think we should ask “who are the losers from a (real) Brexit?”. Probably first and foremost are the political elite, who would not only lose access to their sweet honeypot but would find themselves suddenly more accountable to their own electorates on a broader range of domestic issues then they have been for a very long time.

With such an incentive to not deliver a real Brexit, it doesn’t seem too much of a stretch to me that they would covertly do everything within their power to stop the will of the majority from being carried out.

Thanks to Larry and others for pointing out the problems with Larry Elliot’s piece on MMT in The Guardian today. I guess I got so excited about the fact that he was writing about MMT at all, that I only read it quickly, and not critically enough. Hopefully he will give MMT a fairer shake in future.

@Mike Ellwood

It’s not an entirely objectionable article, in fairness. And frankly, given the complete nonsense from many of the usual suspects who have made outright straw man attacks against MMT recently (and who ought to know better) it’s useful in keeping the topic alive.

Mind you, I haven’t had a chance to read the comments yet, so there may be unhelpfulness buried there …

No worries, Mike. Easy to do.

Fortunately for Britain as it soon makes its own way in the world cast off from mothership EU, a bit like Australia’s situation after you deserted us in the early 1970’s, Britain’s sparsity of natural resources and an absence of much surplus agricultural capacity will be a blessing and not a curse as it has proven to be for Australia.

Commodity exports suck as they generally provide minimal employment; the wealth generated is very narrowly focused even when royalties are paid for access to minerals; most of the ACTUAL profits are sent to overseas investors and financiers; declared profits are minimal as are taxation revenues; the sizable magnitude of these exports appreciates the national currency making exports from other local economic sectors like manufacturing or services less competitive and imports cheaper which again contracts local industries leading to a net loss of jobs. Combine this with the brainless government austerity of the 40+ year neoliberal era and millions suffer, especially the no longer working class, even as the centres of our major cities glisten with the glass clad totem poles of greed and people get by on debt.

Dutch disease should now really be renamed Australian disease as Australia in the neoliberal free trade era outperformed every other advanced nation in the De-Industrialisation Revolution, even Britain. The once substantial Australian car industry was forced out in a well planned pincer movement by the finance and mining kleptocracy, finally closing down in 2017. Only remnants of heavy industry and light industry remain. This was all done so the AU dollar would not appreciate too much during the resources export boom as consumers then provided downward pressure by buying more imported stuff. The kleptocracy had to ensure their AU dollar expenses did not cut too far into their US dollar resource export revenues and that these exports remained competitive with other supplier nations. It’s tough in the jungle and your governments work for the meanest animals.

Similar to natural resource deprived Japan, Britain should be able to once again sustain a viable and sizable advanced manufacturing sector along with some sort of information technology sector, that complements a diverse services sector that delivers social worth and a finance sector that hopefully can be regulated and downsized to meet local and international customer needs and not just the usual scamming, speculation, customer exploitation and crony capitalism that one has now come to expect from this sector throughout the world.

The goods and services produced by an advanced R&D intensive manufacturing/information technology sector and its associated service sectors can provide considerable value adding, can attract high prices and can therefore contribute to a wealthier economy which also provides more headroom for MMT fiscal policy. Prices for outputs are generally more stable and these industries are generally much more labour, creativity, technology and knowledge intensive. These industries can provide large numbers of stable and rewarding jobs for semi skilled to trades workers as well as professionals and high level academic personnel even in an AI world. These industries have good future prospects especially now as the world urgently transitions to environmental sustainability. The more complex and diverse an economy the easier it is to establish viable spin off business opportunities and Germany is an example of this phenomenon.

Britain is actually well placed like Japan, Germany, Korea and China to take a slice of the action if:

(1) A national government arises soon that understands the global warming challenge, macroeconomic policy, full employment policy, how to regulate business, how to repair the democratic process, economic development policy, social policy and trade policy.

(2) In regard to trade policy, Britain really should try to avoid excessively open across the board free trade agreements with relatively low wage and technologically capable nations like China, Thailand, India and similar nations. These nations will flood your markets and your trade exposed industries will die even with a low valued currency and you will only be allowed to sell a peanut or two to them if you push really hard or you have a unique peanut to sell. They are as advanced or more advanced than Britain in most areas, this is not the 19th century! The only strategy that works with international trade is ‘playing to win’ as practiced by these and other economic predators. Britain has to decide beforehand which industry sectors are to be fostered and protected if and when necessary and which sectors are to be placed in the shark pool of international trade. Britain is far from self sufficient and must export to pay for imports and to hopefully sustain an appreciating currency as the economy develops. Man does not live by fiscal policy alone. Germany is also problematic due to its dominance over undervalued Euroland and due to its substantial and advanced export industries. High wage countries like the US, Canada, Australia, the rest of Europe, much of the Middle East along with all the less developed countries are better candidates for freer trade as the trade is more likely to be balanced, but most of Europe is entrapped in Germany’s web. The US is dominated by corporate greed so food health and animal welfare standards are however of concern and have those anti dumping laws in place – stand firm against any threats. Japan is also good at stacking trade in its favour even though their costs of production are similar so an incremental and reciprocal trade approach is warranted as it is for many nations.

(3) In regard to economic development policy a state interventionist approach that cooperates with the private sector such as that adopted by all of the East Asian tiger nations and many Northern European nations is likely to deliver the best results for Britain. The post-war Japanese Ministry of Economy, Trade and Industry model is a good fit for Britain.

@Leftwinghillbillyprospector

But Hard-Brexit lost by only 4 votes in the UK Parliament a few days ago. This to my mind indicates the MP’s want some form of Brexit.

@Andreas Bimba: I don’t think it’s so much that MPs want Brexit; rather it is because they fear the backlash from their leave-voting constituents if they are seen to oppose it. This is why (according to the pundits, anyway) it seems unlikely that MPs would vote to rescind Article 50, for example. So for the true Remainers in Parliament, their best bet is to try to get a second referendum which they will hope to “win”, and a long delay will help that to be more likely. For the MPs who are more on the fence, then a “Brexit in Name Only” would fit the bill. They would have appeased their Leave voters, but left the EU safely still in charge. “Win Win!” (or “Trebles all round!”, as Private Eye would probably say).

Re: British industry, etc: One example where the UK could rediscover its design, engineering and manufacturing expertise might be in building its own modern electric railway locomotives and rolling stock.

With regard to your paragraph (3), this is the kind of thing that the Wilson Labour governments of the 1960s and 1970s tried to do, and succeeded to some extent. No doubt they made mistakes, and a future Labour government should learn from those.

I linked to this in a comment on the Guardian. I came back later and they had deleted it. I can only presume the Guardian doesn’t like their bubble being burst, or perhaps that should be the bubble they have built for their readers?

Thanks for the summary Mike. Personally I hope its Hard Brexit in the end despite the initial turmoil.

Yes I agree railway infrastructure is a good fit but many more areas suit such as New Energy Vehicles, wind power, wave and tidal power, aerospace, consulting engineering, pharmaceuticals and medical devices, software and entertainment, specialist shipbuilding, defence equipment and systems, improved agriculture that minimises environmental damage and protects animal welfare, forestry, domestic appliances, aquaculture, machinery, trucks and buses, hardware and systems for high energy efficiency dwellings, bio fuels, biotechnology and many more.

Leaving this just to the market especially with open borders will not achieve much. Japan faced a similar problem after WW2 with little remaining industry and the US predominant technologically, with huge capacity and ample capital. The government simply had to stack the game in favour of local businesses and to actively get involved in developing many new areas.

Earlier this week I was unfortunate enough to see Tony Blair interviewed on the ITV ‘news’ program, Good Morning Britain. He was asked about his previous enthusiasm for the UK adopting the Euro. His response was interesting. I’m not quoting verbatim, but the gist of what he said was that, while it might have proved to be a bad choice economically, it would still have been politically preferable. I guess what underlies this is that he, like many others, feels it is desirable to move economic policy choices further from the electorate. He also outlined his reasons for wanting the UK to stay in the EU. Basically, it all came down to being better able to compete with US and China as part of a ‘strong’ bloc. Nothing about using a nation’s capacities to improve the lives of those living there. When he speaks it seems he’s only ever trying to appeal to global leaders, not the general public.

I was doubly unfortunate to see some of the same program again this morning. They interviewed the current Education Secretary, supposedly about outlawing the use of on-line essay services for students, but mostly about leaving the EU. After the interview the hosts reflected on what had been said. They wondered how the Education Secretary could plan for the future as they couldn’t see how the UK can continue to finance education services once (if) it leaves the EU. If it wasn’t for the fact that other family members watch it, I would get rid of the TV.

Yes GH, the progressive establishment is the other side of the same neoliberal coin. I too cringe at the thought of Tony Blair and I’m half a world away. The turd took tips from our head turd at the time – Paul Keating on how to sell the neoliberal vision.

Thanks very much to an Australian (Bill Mitchell) for keeping us ignorant Brits (well ignorant me anyway) up to date with what our own central bank governor is saying.

If UK Labour was MMT literate, following Brexit Corbyn would announce his Labour govt, free from the fiscal dictates of Brussels, will implement a ‘pilot’ Job Guarantee program for Northern Ireland.

A Corbyn govt could offset the return of border controls with a full employment program for the rundown North.

The JG would almost immediately ameliorate widespread austerity and poverty – get people to work rebuilding social infrastructure instead of the poverty stricken idle masses fighting – thus put some money in the pockets of the most needy to spend in the local economy and restore some hope for the depressed upcoming generation.

Within a couple of years they will be thankful that border controls stem the flow of economic refugees from EU imposed neoliberal austerity.

Interesting to read this over 3 years later. John Springford’s recently published study suggests a loss in GDP resulting from Brexit as being in excess of 5% . Perhaps the Bank’s forecast of a 5% cost over a period up to 5 years was not that far out after all?