The other day I was asked whether I was happy that the US President was…

Greece – the next bailout is just around the corner

When the latest Greek bailout deal between the Greek government and the European Commission/IMF) was concluded on June 16, 2017, I concluded that it was designed to fail. Please read my blog – Latest Greek bailout – a recipe designed to fail. Despite all the statements from the European Commission and the IMF to the contrary, the terms of the deal with the Greek government confirms that these institutions had abandoned any pretense to being interested in serious economic policy. For the European Commission, the desired irrevocable status of the euro, as a political statement, is all it seems interested in when it comes to Greece. They just don’t want to admit that Greece cannot reasonably function in this monetary union. This deal only stalled reality for yet another day and the only goal it serves is to keep Greece using a currency it cannot afford to use. And now the reality is emerging that the Greek economy will need a further bailout to survive for another period. The latest analysis from the German research group – Centrum für europäische Politik – shows that Greece remains close to insolvent and cannot survive within the Eurozone on its own. One has to ask what has all the austerity been for if the patient is still on life support some 10 years later. We know the answer.

The characters within and outside of the European Commission that are bent on maintaining the Eurozone status quo no matter what have regularly told us that the Greek crisis is over.

Remember in 2013, the Financial Times ran the story (January 30, 2013) – Greece seen as over worst of crisis – where they quoted a Greek central banker as saying that Greece “had turned the corner” and that “confidence in Greece had been boosted by eurozone politicians’ push for greater European integration”.

Denial as the integration message is reinforced!

And then what about on July 21, 2015, when the newly instated President of the German research centre ZEW (Centre for Economic Research) to CNBC that “the worst is over for Greece” (see Is the worst over for Greece?).

And so it goes.

Last year (July 24, 2017), the Greek Prime Minister gave an interview to the UK Guardian – Alexis Tsipras: ‘The worst is clearly behind us’ – where he:

… promised to defy his critics by taking the country out of its longest-running crisis in modern times.

Tsipras said:

We can now say with certainty that the economy is on the up … Slowly, slowly, what nobody believed could happen, will happen. We will extract the country from the crisis … and in the end that will be judged.

Yes?

On January 15, 2018, the Greek government introduced a new bill to the Parliament (a so-called ‘multi-bill’ of some 1,531 pages) which was required as part of the latest bailout plan from the Troika.

The Bill contains some interesting components with have been described by the Defend Democracy Press as only serving to “deepen the despotism of capital” (Source):

Tsipras claimed that the Bill introduced no new fiscal cuts, which on the surface was true.

But previous legislation has embedded automatic fiscal cuts which are aimed at generating a primary fiscal surplus of 3.5 per cent of GDP by 2022 and a permanent 2 per cent surplus by 2060, irrespective of what is going on in the non-government sector.

The new Bill introduced:

1. “Electronic auctions” – which are aimed to reduce the public exposure of the forced sales of homes by banks of households who are in mortgage default.

2. “Prohibition of strikes” – new rules to make it hard for unions to call strikes.

3. “Integration of 14 Public Services and Utilities (DEKOs) on the Privatization Mega-fund” – to accelerate the forced sale (privatisation). 40,000 workers are employed in these public institutions at present

4. “Benefit cuts” – further restrictions on who receives state income support – “only the extremely poor” will now qualify for state subsidies.

5. “Energy stock market” – the financialisation of energy to encourage more privatisation and higher energy costs to consumers.

6. “New Casino licenses” – with tax concessions and state subsidies for construction and further exposes Greek to money laundering and so-called “black money”.

And more.

And meanwhile we learned that while a Xmas bonus to workers is still legally required to be paid in Greece, “some employers … [have] … fired employees who refused to return the Christmas bonus” after the bosses demanded that they be returned.

The local ERT TV reported that some businesses (Source):

… had also assigned a kind of “bully” who would accompany the workers to the ATMs in order to get back the employer’s share of the bonus.

Modern day Greece.

The Greek economic reality – updated

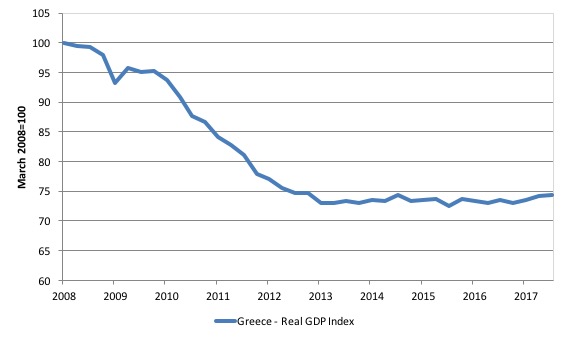

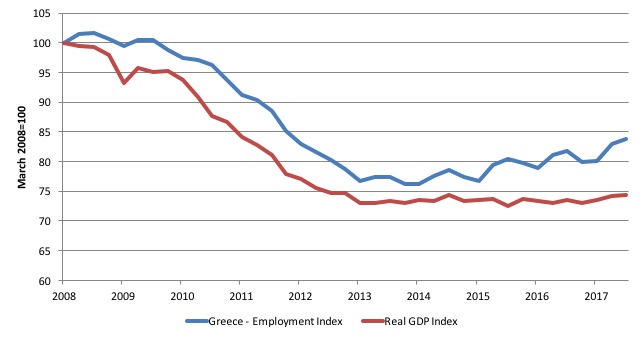

The first graph shows the real GDP Index (quarterly seasonally adjusted data from Hellenic Statistical Authority) from the peak in the March-quarter 2008 to the September-quarter 2017 (latest available).

This is what the European Commission is calling a recovery.

Real GDP has shrunk by 25.6 per cent since the crisis began and has been stuck around that mark since 2012.

The other notable feature is that the Troika engineered the Depression in 2009 and 2010 through to 2012, then have put Greece in a holding pattern – despite all the talk of growth-friendly austerity.

There has been very little gain since 2013. In fact, the real GDP index was at 72.9 points at its worst in the December-quarter 2013 and is only at 74.4 points in the September-quarter 2017.

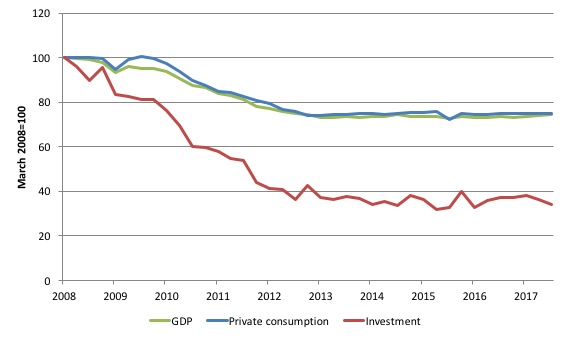

The next graph shows the evolution of real GDP, private consumption and gross fixed capital formation (investment) from the peak in the March-quarter 2008 to the September-quarter 2017 – 9.5 years of travail for the Greek nation.

Private consumption spending is now by 25 per cent lower than it was when Greece entered the crisis.

Moreover, investment spending (capital formation) has fallen by a staggering 76 per cent and has continued to fall over 2017.

The decimation of Greece’s productive capacity is thus on-going.

The other thing to note is that despite all the on-going ‘internal devaluation’ cutting wages, pensions and labour costs in general, allegedly to increase the international competitiveness of the nation, the export index which in the March-quarter equalled 100 (by construction) is sitting at 97 points in the March-quarter 2017.

No progress!

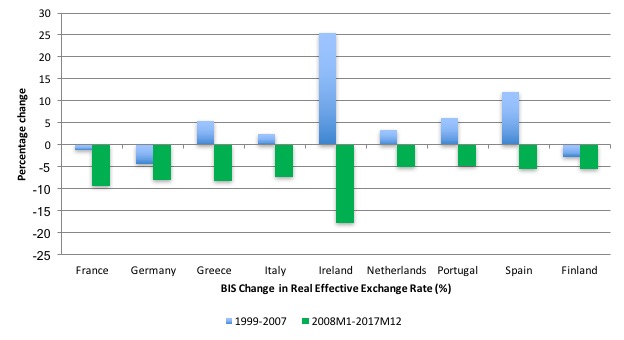

Does internal devaluation – the polite term for the ravages of austerity – boost external competitiveness?

The BIS ‘real effective exchange rate indices’ (REER), which are internationally accepted measures of international competitiveness that adjust nominal exchange rates with other data on domestic inflation and production costs can help us determine the answer.

If the real effective exchange rate rises (falls) for a nation, then it signals a loss (gain) in its international competitiveness.

The following graph shows movements in real effective exchange rates for two distinct periods.

The first, the period of growth from January 1996 to December 2007, then the period from January 2008 to December 2017 (the latest data). The graph allows a comparison of selected Eurozone nations.

Given Germany’s trade dominance both within and beyond the Eurozone, we would be looking for Greece’s REER to have fallen more than Germany’s to change the former nation’s relative international position within the Eurozone.

The data shows that following the introduction of the euro, international competitiveness for all the nations shown declined except in the cases of France, Germany and Finland. Further Germany made relative gains on the rest.

Following the crisis, the general tendency has been for real effective exchange rates to decline. However, the real effective exchange rate for Greece was only 8.2 per cent lower in December 2017 than in January 2008 despite the massive austerity program it has endured.

By comparison, the real effective exchange rate for Germany fell by 8.1 per cent over the same period. Of these Eurozone nations, only France and Ireland improved its position relative to Germany over this period.

So we conclude that the massive internal devaluations that Greece, Italy, Portugal, Spain and Finland endured in this period did not restore competitiveness relative to Germany.

Conclusion: what was it all for?

No answer required. It was part of the destruction of resistance in Greece in preparation for ‘colonisation’.

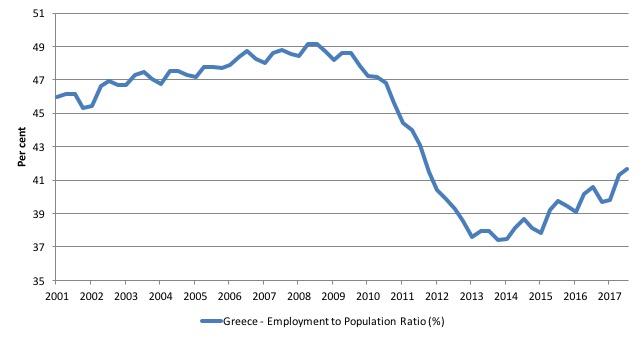

Consider the labour market.

The following graph, which shows the employment-to-working age population ratio (over 15 years). In the September-quarter 2008 (the peak employment quarter before the crisis), the ratio was 49.2 per cent. In the September-quarter 2017, the ratio is 41.7 per cent.

Had the ratio remained at 49.2 per cent, total employment would be 686 thousand larger than it currently is.

That is one measure of the scale of damage that has been inflicted on the labour market.

You should also note that the EPOP ratio is somewhat misleading in this case. Why?

Because it is comprised of a numerator (Employment) and a denominator (Working Age Population). Normally, the denominator will be growing steadily at some positive rate.

But the scale of the crisis has been so great that Greece’s working age population has declined over the period from the September-quarter 2008 to the September-quarter 2017 by some 263 thousand (or 2.8 per cent).

Consider the absolute fall in total employment. It has fallen by 815.9 thousand (17.6 per cent) since the September-quarter 2008 peak.

The recent gains in the EPOP ratio have been biased upwards bu a continued fall over the last year in the working age population even though employment gains have been made.

The next graph shows the decline in employment (indexed to 100 at the March-quarter 2008) and real GDP up to the September-quarter 2017.

I added real GDP to the graph because it allows us to infer that productivity growth has also slumped over this period, which is no surprise, given the dramatic loss in investment spending.

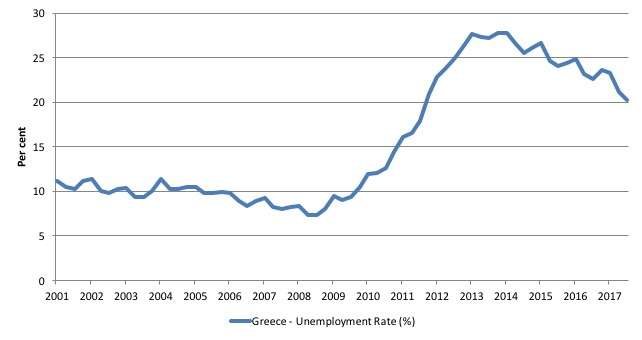

From another perspective, the next graph shows the actual unemployment rate since the March-quarter 2001 to the September-quarter 2017.

While the European Commission talks about progress under the bailout plans, the reality is that the unemployment rate remains above 20 per cent and has been that way for 6 years. An appalling waste of human capacity.

The available statistical indicators all point to the same conclusion – after engineering a Depression, the managers of Greece (the colonial masters) have put it into a holding pattern of stagnation allowing some growth to percolate through on the back of generalised global growth.

They cannot claim that prosperity is just around the corner with current policy structures in place.

The other point to note by way of comparison with the various graphs is that it is impossible to run the structural rigidity line when trying to explain the evolution of the Greek economy.

The correspondence between the collapse in output and employment – linked via the derived demand for the latter as a consequence of the former – and the correspondence between the demand-side of the labour market (employment) and the unemployment rate quells any suggestion that the collapse was driven by supply-side shifts in preferences by workers or rigidities emerging from employment protection, minimum wages or any of the other suspects that are wheeled out by the likes of the IMF, OECD and the European Commission when trying to deflect blame.

This is a massive demand-side induced Depression that Greece has been dealing with – deliberately inflicted and persisted with by the Troika.

The next Greek bailout

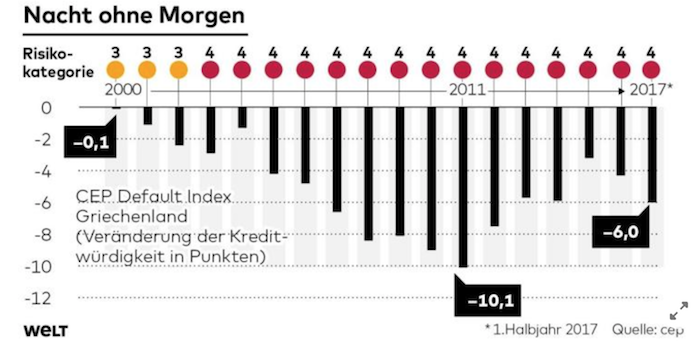

The German research group – Centrum für europäische Politik – publishes their annual cepDefault-Index, which appraises the creditworthiness of Eurozone Member States.

Conducting such an exercise for currency-issuing nations would be pointless because they carry zero default risk (unless the politicians go crazy and voluntarily refuse to pay up on their liabilities).

But for the 19 Member States of the Eurozone, all of whom use a foreign currency (the euro), the concept of credit and default risk is very real.

There was an interesting article in the conservative German daily newspaper Die Welt (January 20, 2018) – Brüssels Pläne für Griechenland sind eine große Illusion – which for those who do not read German means “Brussel’s plans for Greece are a big deception”.

The CEP research is discussed and leads to the conclusion that Greece will not be able to survive without further bailout funds.

It notes that despite the rhetoric from the Greek government (Tsipras claiming that “Greece was only ‘a breath away’ from freeing itself from the Troika”) which precipitated the riots in Athens last week, the Greek economy is still on death row.

The article considers Tsipras has “Augen seiner Landsleute vom Rebellen der Euro-Zone zum Handlanger der Geldgeber mutierte” (“in the eyes of the people he has mutated from being a Eurozone rebel to being a pawn of the financiers”).

Stern stuff.

The most recent CEP report (not public yet) viewed by Die Welt concludes that:

The three bailouts since 2010 have changed nothing. Greece will not be able to get along without a fourth rescue package.

The most recent cepDefault index appraises the creditworthiness of the overall economy – both government and non-government sectors.

The latest result for Greece showed that:

For the first half of 2017, the barometer shows a decline of minus six percent – a significant deterioration compared to the previous year and at the same time the lowest level since 2012.

They produced the following graph for Greece which is titled “Night without Tomorrow”.

Veränderung der Kredit-würdigkeit in Punkten means Change in Creditworthiness in percentage points.

Risiko-kategorie means risk category.

The coloured lights are as in traffic lights – red means “Risk category 4: Consolidated diminishing solvency”.

That is the basket case.

The main problem identified is the “private sector continues to deteriorate” squeezed by the pursuit of fiscal surpluses.

The appraisal indicated that Greece’s:

… capital stock of the country shrank in 2017 more than ever before. In other words, the country … no longer invests in new factories, machinery and factories or patents.

Both government and non-government investment has fallen. The fiscal austerity has created such appalling domestic demand conditions that there is no incentive for private investors to expand productive capacity.

CEP concluded that the only way this situation can be reversed is that conditions for new investment have to improve, which will require an increase in public spending among other things.

Conclusion

It is clear that the European Commission’s dealings with Greece have nothing to do with economic reasoning, despite the articulation of those dealings being expressed in terms of economic aggregates.

All the Commission seems interested in is keeping Greece within the Eurozone. It knows that if Greece was to exit then the dominoes would start to tumble because Greece would immediately begin to grow as a result of its new found currency sovereignty.

Obviously, the Commission wants to prevent that reality so as to keep other Member States (such as Italy) in line.

It is a scenario designed to fail.

The next episode in that failure is about to be revealed.

And the feckless Alexis Tsipras meanwhile continues to do the bidding of those that are destroying his nation.

And the European Left keep telling itself that the reforms are coming … coming … just be patient. But the social democrats are just disappearing into political irrelevance.

MMT University Logo competition

I am launching a competition among budding graphical designers out there to design a logo and branding for the MMT University, which we hope will start offering courses in October 2018.

The prize for the best logo will be personal status only and the knowledge that you are helping a worthwhile (not-for-profit) endeavour.

The conditions are simple.

Submit your design to me via E-mail.

A small group of unnamed panelists will select the preferred logo. We might not select any of those submitted.

It should be predominantly blue in colour scheme. It should include a stand-alone logo and a banner to head the WWW presence.

By submitting it you forgo any commercial rights to the logo and branding. In turn, we will only use the work for the MMT University initiative. It will be a truly open source contribution.

The contest closes at the end of March 2018.

That is enough for today!

What sticks out a mile from the 3rd chart is that Ireland is doing something right which Greece is not doing. What exactly is it?

Hello,

Excellent post, thanks.

I have been doing some work on the Greek macro-fiscal sectoral flows and came up with the following numbers all of % of GDP based on 2016 GDP

Private Sector Credit Creation [P] External Sector [X] Government Sector [G] TOTAL [P]+[X]+[G]

2016 -1.1% -0.6% -0.7% -2.4%

2017 -3.0%* -0.029%* -0.133%* -3.2%*

2018 -3%# 0%# 0%# -3%

*Estimates pending final numbers.

#Forecast based on present flow rates.

This shows the net flow of money out of the economy and so it must shrink.

Hello,

Did not realise the table would lose its formatting after pressing send so here is another go so that it lines up and is easy to read:

Private Sector Credit Creation [P] External Sector [X] Government Sector [G] TOTAL [P]+[X]+[G]

years__P________X_______G_________Total

2016 -1.1%___ -0.6%___ -0.7%___ ___-2.4%

2017 -3.0%*__ -0.029%* -0.133%*__ _-3.2%*

2018 -3%#_____ 0%#____ 0%# ______-3%

*Estimates pending final numbers.

#Forecast based on present flow rates.

It’s been a while since I took German O’Level, but “Nacht ohne Morgen” = “Night withOUT Tomorrow”, surely?

(Or better still, “Night without Morning”?)

@Ralph Musgrave,

Ireland acts as a low-taxing flag of convenience for the headquartering of multinational corporations, which artificially pumps up its GDP.

Left to its own devices, it’s performance would be far less impressive.

Dear MrShigemitsu (at 2018/01/23 at 8:06 pm)

Yes, that was my translation too. But my fingers didn’t type it. Fixed now. I think Tomorrow is better in the context by the way.

best wishes

bill

MrShigemitsu,

Thanks for your response. Strikes me the “flag of convenience” theory only works if Ireland made Ireland an EVEN MORE convenient flag of convenient country than it previously was. Possibly that’s what Ireland really did over the last ten years. Is there any evidence on that?

Dear Bill

You showed a graph with EPOP. You said that it referred to the ratio of employment to working-age population. Shouldn’t that be the ratio of employment to the whole population?

Regards. James

Ireland: I suspect its proximity to England also has something to do with its relative success (or lesser failure).

“Nacht ohne Morgen” – I think when it means “tomorrow”, “morgen” is usually written with lower case “m”, although it might be different in headlines/ titles. “Night without morning” seems to have an appropriate, tragic ring to it, although “Endless Night” (“Nacht ohne Ende”) might have been even better.

Surely no one, least of all the Troika, believed that the state of “Bailoutistan” was ever going to be good for Greece (this was even admitted behind closed doors, according to Varoufakis). It was rather a continual and very public economic waterboarding “pour encourager les autres”.

Tsipras has behaved like a useful idiot; a leftist doing the right’s dirty work for it. When he has served his purpose, he and Syriza and their allies will be out on their ears for a long time to come.

@ Mike Ellwood,

Tsipras is not a leftist. One can’t be a leftist if one endorses and implements far right, anti-labor economic policies. Tsipras is a proponent of the gold-standard like euro currency union and had presided over one of the most labor abusive governments in human history.history.

Mike, wouldn’t it be décourager?

Hi Larry,

Well, literally yes, of course. The original quote was meant ironically, and so was my use of it. 🙂

(I had to google it, and apparently it refers to the execution of Admiral Byng on his own ship after allegedly failing to show sufficient courage at the Battle of Menorca. The quote actually comes from Candide, by Voltaire. cf. Wikipedia).

In more recent times, we should have imprisoned a few bankers “pour encourager les autres”.

Dear Bill,

I think “Night without Morning” better conveys the grim condition of there being darkness with no light at the end.

Because there’s no guarantee that tomorrow will be any better than today (or tonight…), using “tomorrow” rather than “morning” does not necessarily provide the comparative improvement of light over dark offered by the latter.

Best wishes, Mr S.

Ugh poor greece.I appreciate article like these…aa the recurring headling of greece’s recovery…had made me almost believe it.

As Mike Ellwood wrote this is economic water boarding of Greece. Add to that the plundering of national assets by the banksters – colonialism as Bill mentioned. The primary reason no doubt is the enforced continuation of the eurozone as without this, the absurd German export machine would contract substantially due to an appreciating currency.

The UK is also now going to be denied a mutually beneficial BREXIT deal by the EU to scare other EU members into remaining and ongoing submission to the banksters Germany centred hegemonic and neoliberal order. Both sides will now lose until a better day returns.

We all know the answer is to end the effective rule of Europe by the banksters led by figurehead Jean Claude Juncker. Ideally the EU should return to being a preferential trade zone of independent democratic nations each returning to free floating national currencies.

For convenience especially for the smaller European nations I can see merit in retaining the euro as a consumer level transactional currency and the national currency being used for governmental and major private sector transactions. Citizens could have bank accounts in both currencies.

The final piece is optimal national fiscal policy, full employment, adequate government services across the board, an ambitious transition to environmental sustainability, democracy by and for the people and an unwinding of most of the neoliberal fraud of the last forty years.

This is going to be a long process and tens of millions will continue to unnecessarily live awful lives worrying about bankruptcy, unemployment, underemployment and poverty, until the current EU apple cart is finally tipped over.

Will Angela Merkel and Emmanuel Macron deliver on such a plan? Hell no, short term greed, expediency and hollow words and policy will always be prioritised over sound long term policy. Even if a major crisis were to occur, the banksters will still be pulling the strings and siezing ever more of Europe’s collective wealth.

Will individual European nations come round to abandoning the neoliberal era at a time when the corporate oligarchy, especially the finance sector, and the oligarchies mass media have never been so dominant? Maybe.