Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

The Weekend Quiz – March 11-12, 2017 – answers and discussion

Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of modern monetary theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

If the national accounts of a nation reveal that its external surplus is equivalent to 2 per cent of GDP and the private domestic sector is saving overall 3 per cent of GDP, then we know that national income adjustments would ensure that the fiscal balance was in:

(a) Deficit equal to 1 per cent of GDP.

(b) Surplus equal to 1 per cent of GDP.

(c) Deficit equal to 5 per cent of GDP.

(d) Surplus equal to 5 per cent of GDP.

(e) None of the above.

The answer is Option (a) – Deficit equal to 1 per cent of GDP.

This question requires an understanding of the sectoral balances that can be derived from the National Accounts. But it also requires some understanding of the behavioural relationships within and between these sectors which generate the outcomes that are captured in the National Accounts and summarised by the sectoral balances.

Refreshing the balances (again) – we know that from an accounting sense, if the external sector overall is in deficit, then it is impossible for both the private domestic sector and government sector to run surpluses. One of those two has to also be in deficit to satisfy the accounting rules.

The important point is to understand what behaviour and economic adjustments drive these outcomes.

To refresh your memory the sectoral balances are derived as follows. The basic income-expenditure model in macroeconomics can be viewed in (at least) two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances.

From the sources perspective we write:

GDP = C + I + G + (X – M)

which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

Expression (1) tells us that total income in the economy per period will be exactly equal to total spending from all sources of expenditure.

We also have to acknowledge that financial balances of the sectors are impacted by net government taxes (T) which includes all taxes and transfer and interest payments (the latter are not counted independently in the expenditure Expression (1)).

Further, as noted above the trade account is only one aspect of the financial flows between the domestic economy and the external sector. we have to include net external income flows (FNI).

Adding in the net external income flows (FNI) to Expression (2) for GDP we get the familiar gross national product or gross national income measure (GNP):

(2) GNP = C + I + G + (X – M) + FNI

To render this approach into the sectoral balances form, we subtract total taxes and transfers (T) from both sides of Expression (3) to get:

(3) GNP – T = C + I + G + (X – M) + FNI – T

Now we can collect the terms by arranging them according to the three sectoral balances:

(4) (GNP – C – T) – I = (G – T) + (X – M + FNI)

The the terms in Expression (4) are relatively easy to understand now.

The term (GNP – C – T) represents total income less the amount consumed less the amount paid to government in taxes (taking into account transfers coming the other way). In other words, it represents private domestic saving.

The left-hand side of Equation (4), (GNP – C – T) – I, thus is the overall saving of the private domestic sector, which is distinct from total household saving denoted by the term (GNP – C – T).

In other words, the left-hand side of Equation (4) is the private domestic financial balance and if it is positive then the sector is spending less than its total income and if it is negative the sector is spending more than it total income.

The term (G – T) is the government financial balance and is in deficit if government spending (G) is greater than government tax revenue minus transfers (T), and in surplus if the balance is negative.

Finally, the other right-hand side term (X – M + FNI) is the external financial balance, commonly known as the current account balance (CAD). It is in surplus if positive and deficit if negative.

In English we could say that:

The private financial balance equals the sum of the government financial balance plus the current account balance.

We can re-write Expression (6) in this way to get the sectoral balances equation:

(5) (S – I) = (G – T) + CAD

which is interpreted as meaning that government sector deficits (G – T > 0) and current account surpluses (CAD > 0) generate national income and net financial assets for the private domestic sector.

Conversely, government surpluses (G – T < 0) and current account deficits (CAD < 0) reduce national income and undermine the capacity of the private domestic sector to add financial assets.

Expression (5) can also be written as:

(6) [(S – I) – CAD] = (G – T)

where the term on the left-hand side [(S – I) – CAD] is the non-government sector financial balance and is of equal and opposite sign to the government financial balance.

This is the familiar MMT statement that a government sector deficit (surplus) is equal dollar-for-dollar to the non-government sector surplus (deficit).

The sectoral balances equation says that total private savings (S) minus private investment (I) has to equal the public deficit (spending, G minus taxes, T) plus net exports (exports (X) minus imports (M)) plus net income transfers.

All these relationships (equations) hold as a matter of accounting and not matters of opinion.

So what economic behaviour might lead to the outcome specified in the question?

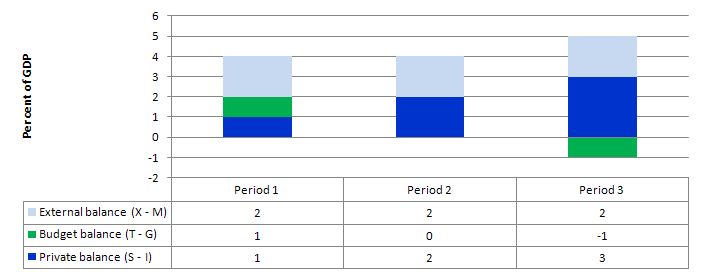

The following graph shows three situations where the external sector is in surplus of 2 per cent of GDP and the private domestic balance is in surplus of varying proportions of GDP (note I have written the fiscal balance as (T – G).

In Period 1, the private domestic balance is in surplus (1 per cent of GDP), which means it is saving overall (spending less than the total private income) and the fiscal position is also in surplus (1 per cent of GDP). The net injection to demand from the external sector (equivalent to 2 per cent of GDP) is sufficient to “fund” the overall private sector saving drain from expenditure without compromising economic growth. The growth in income would also allow the fiscal position to be in surplus (via tax revenue).

In Period 2, the rise in overall private domestic saving drains extra aggregate demand and necessitates a more expansionary position from the government (relative to Period 1), which in this case manifests as a balanced public fiscal outcome.

Period 3, relates to the data presented in the question – an external surplus of 2 per cent of GDP and private domestic saving equal to 3 per cent of GDP. Now the demand injection from the external sector is being more than offset by the demand drain from private domestic saving. The income adjustments that would occur in this economy would then push the fiscal position into deficit of 1 per cent of GDP.

The movements in income associated with the spending and revenue patterns will ensure these balances arise.

The general rule is that the government fiscal deficit (surplus) will always equal the non-government surplus (deficit).

So if there is an external surplus that is less than the overall private domestic sector saving (a surplus) then there will always be a fiscal deficit. The higher the overall private saving is relative to the external surplus, the larger the deficit.

The following blogs may be of further interest to you:

- Barnaby, better to walk before we run

- Stock-flow consistent macro models

- Norway and sectoral balances

- The OECD is at it again!

Question 2:

Even though a government that issues its own fiat currency is not revenue constrained, it is still correct to say that recipients of income support provided by such a national government live off the hard work of those who pay income taxes.

The answer is True.

This question explores the true relevance of the dependency ratio, which will rise as demographic changes age our populations. It also aims to disabuse the reader of the notion that the income support benefits are paid for by taxes that those in employment (and other income generating activities) might pay.

Initially, we have to be very clear as to what “living off the hard work of those who pay taxes” means. In this sense, it is not a focus on the “income” that the non-workers receive but the command over real good and services that that income provides them with. We will come back to the “funds” issue soon.

So the focus has to be on the real side of the economy because that is, ultimately, the only way our material living standards can be expressed. Nominal aggregates mean very little by themselves.

Income support recipients (who do not work – for whatever reason) clearly command real resources that they have not themselves produced. These real goods and services are produced by those who do work (and the presumption is that most workers pay taxes of some sort or another).

The use of the emotive term “living off the hard work” was deliberate and designed, as a foil, to invoke the idea that governments have created welfare states which provide unsustainable benefits to the poor and marginalised at the expense of those who are materially successful – the classic conservative argument against government welfare provision.

But it doesn’t alter the fact that the statement is false because real goods and services have to be consumed by those who are on income support payments and the goods and services are produced by those who are not.

A slight complicating factor is that the income support recipients also pay taxes if there are indirect tax systems in place but that doesn’t alter the story about the provision of real goods and services.

Now the second part of the answer relates to the question of funding. In terms of where the funds come from to provide the income support for those who do not work the answer is simple: no-where.

While taxation raises revenue for national governments it doesn’t “fund” its spending. Currency-issuing governments can spend without revenue should they wish to.

Abba Lerner’s 1951 book The Economics of Employment was really a rewritten version of the 1941 article The Economic Steering Wheel where he elaborated his version of Keynesian thinking. He conceptualised macroeconomic policy as being about “steering” the fluctuations in the economy. Fiscal policy was the steering wheel and should be applied for functional purposes. Laissez-faire (free market) was akin to letting the car zigzag all over the road and if you wanted the economy to develop in a stable way you had to control its movement.

This led to the concept of functional finance and the differentiation from what he called sound finance (that proposed by the free market lobby). Sound finance was all about fiscal rules – the type you read about every day in the mainstream financial press. Sound finance is about balancing the fiscal position over the course of the business cycle and only increasing the money supply in line with the real rate of output growth; etc – noting the approach erroneously assumes the central bank can control the money supply.

Lerner thought that these rules were based more in conservative morality than being well founded ways to achieve the goals of economic behaviour – full employment and price stability.

He said that once you understood the monetary system you would always employ functional finance – that is, fiscal and monetary policy decisions should be functional – advance public purpose and eschew the moralising concepts that public deficits were profligate and dangerous.

Lerner thought that the government should always use its capacity to achieve full employment and price stability. In Modern Monetary Theory (MMT) we express this responsibility as “advancing public purpose”. In his 1943 book (page 354) we read:

The central idea is that government fiscal policy, its spending and taxing, its borrowing and repayment of loans, its issue of new money and its withdrawal of money, shall all be undertaken with an eye only to the results of these actions on the economy and not to any established traditional doctrine about what is sound and what is unsound. This principle of judging only by effects has been applied in many other fields of human activity, where it is known as the method of science opposed to scholasticism. The principle of judging fiscal measures by the way they work or function in the economy we may call Functional Finance …

Government should adjust its rates of expenditure and taxation such that total spending in the economy is neither more nor less than that which is sufficient to purchase the full employment level of output at current prices. If this means there is a deficit, greater borrowing, “printing money,” etc., then these things in themselves are neither good nor bad, they are simply the means to the desired ends of full employment and price stability …

Mainstream advocacy of fiscal rules that are divorced from a functional context clearly do not make much sense even though their use dominates public policy these days. It may be that a fiscal surplus is necessary at some point in time – for example, if net exports are very strong and fiscal policy has to contract spending to take the inflationary pressures out of the economy. This will be a rare situation but in those cases I would as a proponent of MMT advocate fiscal surpluses.

Lerner outlined three fundamental rules of functional finance in his 1941 (and later 1951) works.

- The government shall maintain a reasonable level of demand at all times. If there is too little spending and, thus, excessive unemployment, the government shall reduce taxes or increase its own spending. If there is too much spending, the government shall prevent inflation by reducing its own expenditures or by increasing taxes.

- By borrowing money when it wishes to raise the rate of interest, and by lending money or repaying debt when it wishes to lower the rate of interest, the government shall maintain that rate of interest that induces the optimum amount of investment.

- If either of the first two rules conflicts with the principles of ‘sound finance’, balancing the fiscal position, or limiting the national debt, so much the worse for these principles. The government press shall print any money that may be needed to carry out rules 1 and 2.

So in an operational sense, taxation serves to reduce the spending capacity of the non-government sector to ensure that there is non-inflationary space for government to deliver public services. It doesn’t fund anything.

You might like to read these blogs for further information:

- I just found out – state kleptocracy is the problem

- Functional finance and modern monetary theory

- Deficit spending 101 – Part 1

- Deficit spending 101 – Part 2

- Deficit spending 101 – Part 3

Question 3:

There is no difference in terms of the government’s impact on aggregate demand, between the government matching its deficit spending with bond issues to the non-government sector and the situation where the government instructed the central bank to buy its bonds to match the deficit.

The answer is True.

There are two dimensions to this question: (a) the impacts in the real economy; and (b) the monetary operations involved.

It is clear that at any point in time, there are finite real resources available for production. New resources can be discovered, produced and the old stock spread better via education and productivity growth. The aim of production is to use these real resources to produce goods and services that people want either via private or public provision.

So by definition any sectoral claim (via spending) on the real resources reduces the availability for other users. There is always an opportunity cost involved in real terms when one component of spending increases relative to another.

However, the notion of opportunity cost relies on the assumption that all available resources are fully utilised.

Unless you subscribe to the extreme end of mainstream economics which espouses concepts such as 100 per cent crowding out via financial markets and/or Ricardian equivalence consumption effects, you will conclude that rising net public spending as percentage of GDP will add to aggregate demand and as long as the economy can produce more real goods and services in response, this increase in public demand will be met with increased public access to real goods and services.

If the economy is already at full capacity, then a rising public share of GDP must squeeze real usage by the non-government sector which might also drive inflation as the economy tries to siphon of the incompatible nominal demands on final real output.

However, the question is focusing on the concept of financial crowding out which is a centrepiece of mainstream macroeconomics textbooks. This concept has nothing to do with “real crowding out” of the type noted in the opening paragraphs.

The financial crowding out assertion is a central plank in the mainstream economics attack on government fiscal intervention. At the heart of this conception is the theory of loanable funds, which is a aggregate construction of the way financial markets are meant to work in mainstream macroeconomic thinking.

The original conception was designed to explain how aggregate demand could never fall short of aggregate supply because interest rate adjustments would always bring investment and saving into equality.

At the heart of this erroneous hypothesis is a flawed viewed of financial markets. The so-called loanable funds market is constructed by the mainstream economists as serving to mediate saving and investment via interest rate variations.

This is pre-Keynesian thinking and was a central part of the so-called classical model where perfectly flexible prices delivered self-adjusting, market-clearing aggregate markets at all times. If consumption fell, then saving would rise and this would not lead to an oversupply of goods because investment (capital goods production) would rise in proportion with saving. So while the composition of output might change (workers would be shifted between the consumption goods sector to the capital goods sector), a full employment equilibrium was always maintained as long as price flexibility was not impeded. The interest rate became the vehicle to mediate saving and investment to ensure that there was never any gluts.

So saving (supply of funds) is conceived of as a positive function of the real interest rate because rising rates increase the opportunity cost of current consumption and thus encourage saving. Investment (demand for funds) declines with the interest rate because the costs of funds to invest in (houses, factories, equipment etc) rises.

Changes in the interest rate thus create continuous equilibrium such that aggregate demand always equals aggregate supply and the composition of final demand (between consumption and investment) changes as interest rates adjust.

According to this theory, if there is a rising fiscal deficit then there is increased demand is placed on the scarce savings (via the alleged need to borrow by the government) and this pushes interest rates to “clear” the loanable funds market. This chokes off investment spending.

So allegedly, when the government borrows to “finance” its fiscal deficit, it crowds out private borrowers who are trying to finance investment.

The mainstream economists conceive of this as the government reducing national saving (by running a fiscal deficit) and pushing up interest rates which damage private investment.

This trilogy of blogs will help you understand this if you are new to my blog – Deficit spending 101 – Part 1 – Deficit spending 101 – Part 2 – Deficit spending 101 – Part 3.

The basic flaws in the mainstream story are that governments just borrow back the net financial assets that they create when they spend. Its a wash! It is true that the private sector might wish to spread these financial assets across different portfolios. But then the implication is that the private spending component of total demand will rise and there will be a reduced need for net public spending.

Further, they assume that savings are finite and the government spending is financially constrained which means it has to seek “funding” in order to progress their fiscal plans. But government spending by stimulating income also stimulates saving.

Additionally, credit-worthy private borrowers can usually access credit from the banking system. Banks lend independent of their reserve position so government debt issuance does not impede this liquidity creation.

In terms of the monetary operations involved we note that national governments have cash operating accounts with their central bank. The specific arrangements vary by country but the principle remains the same. When the government spends it debits these accounts and credits various bank accounts within the commercial banking system. Deposits thus show up in a number of commercial banks as a reflection of the spending. It may issue a cheque and post it to someone in the private sector whereupon that person will deposit the cheque at their bank. It is the same effect as if it had have all been done electronically.

All federal spending happens like this. You will note that:

- Governments do not spend by “printing money”. They spend by creating deposits in the private banking system. Clearly, some currency is in circulation which is “printed” but that is a separate process from the daily spending and taxing flows.

- There has been no mention of where they get the credits and debits come from! The short answer is that the spending comes from no-where but we will have to wait for another blog soon to fully understand that. Suffice to say that the Federal government, as the monopoly issuer of its own currency is not revenue-constrained. This means it does not have to “finance” its spending unlike a household, which uses the fiat currency.

- Any coincident issuing of government debt (bonds) has nothing to do with “financing” the government spending.

All the commercial banks maintain reserve accounts with the central bank within their system. These accounts permit reserves to be managed and allows the clearing system to operate smoothly. The rules that operate on these accounts in different countries vary (that is, some nations have minimum reserves others do not etc). For financial stability, these reserve accounts always have to have positive balances at the end of each day, although during the day a particular bank might be in surplus or deficit, depending on the pattern of the cash inflows and outflows. There is no reason to assume that these flows will exactly offset themselves for any particular bank at any particular time.

The central bank conducts “operations” to manage the liquidity in the banking system such that short-term interest rates match the official target – which defines the current monetary policy stance. The central bank may: (a) Intervene into the interbank (overnight) money market to manage the daily supply of and demand for reserve funds; (b) buy certain financial assets at discounted rates from commercial banks; and (c) impose penal lending rates on banks who require urgent funds, In practice, most of the liquidity management is achieved through (a). That being said, central bank operations function to offset operating factors in the system by altering the composition of reserves, cash, and securities, and do not alter net financial assets of the non-government sectors.

Fiscal policy impacts on bank reserves – government spending (G) adds to reserves and taxes (T) drains them. So on any particular day, if G > T (a fiscal deficit) then reserves are rising overall. Any particular bank might be short of reserves but overall the sum of the bank reserves are in excess. It is in the commercial banks interests to try to eliminate any unneeded reserves each night given they usually earn a non-competitive return. Surplus banks will try to loan their excess reserves on the Interbank market. Some deficit banks will clearly be interested in these loans to shore up their position and avoid going to the discount window that the central bank offeres and which is more expensive.

The upshot, however, is that the competition between the surplus banks to shed their excess reserves drives the short-term interest rate down. These transactions net to zero (a equal liability and asset are created each time) and so non-government banking system cannot by itself (conducting horizontal transactions between commercial banks – that is, borrowing and lending on the interbank market) eliminate a system-wide excess of reserves that the fiscal deficit created.

What is needed is a vertical transaction – that is, an interaction between the government and non-government sector. So bond sales can drain reserves by offering the banks an attractive interest-bearing security (government debt) which it can purchase to eliminate its excess reserves.

However, the vertical transaction just offers portfolio choice for the non-government sector rather than changing the holding of financial assets.

This is based on the erroneous belief that the banks need deposits and reserves before they can lend. Mainstream macroeconomics wrongly asserts that banks only lend if they have prior reserves. The illusion is that a bank is an institution that accepts deposits to build up reserves and then on-lends them at a margin to make money. The conceptualisation suggests that if it doesn’t have adequate reserves then it cannot lend. So the presupposition is that by adding to bank reserves, quantitative easing will help lending.

But this is a completely incorrect depiction of how banks operate. Bank lending is not “reserve constrained”. Banks lend to any credit worthy customer they can find and then worry about their reserve positions afterwards. If they are short of reserves (their reserve accounts have to be in positive balance each day and in some countries central banks require certain ratios to be maintained) then they borrow from each other in the interbank market or, ultimately, they will borrow from the central bank through the so-called discount window. They are reluctant to use the latter facility because it carries a penalty (higher interest cost).

The point is that building bank reserves will not increase the bank’s capacity to lend. Loans create deposits which generate reserves.

You might think that the interest payments on the debt which boost non-government sector income would add to aggregate demand somewhat. That is true. Which is why the question specified the ‘government’s impact’ rather than the overall impact.

The following blogs may be of further interest to you:

- When a huge pack of lies is barely enough

- Saturday Quiz – April 17, 2010 – answers and discussion

- Quantitative easing 101

- Building bank reserves will not expand credit

- Building bank reserves is not inflationary

- Money multiplier and other myths

- Will we really pay higher interest rates?

- A modern monetary theory lullaby

That is enough for today!

(c) Copyright 2017 William Mitchell. All Rights Reserved.

This is the best blog on the planet.

“This is the best blog on the planet.”

Yes Alan…you be right.

In relation to question 2, the benefit recipients are contributing to income with their spending to contribute to direct as well as indirect taxation although they provide no official physical work or service themselves. So Governments that reduce benefits as here in the UK are affecting the income of those ‘productive’ workers negatively.

I got the question wrong because I didn’t notice Bill’s trick of turning the question to the production of resources themselves and thought it was a simple question of challenging the taxes fund things myth.

Not awake this morning -though I like Bill’s questions which cause one to do a doublethink!

But the most correct answer to question 2 is ‘false’. As Bill’s explanation shows, it is not taxes – and not income taxes in particular, which may be more or less significant in the tax mix – on which income support depends: it is the work done by those who do it (some of whom may qualify for a bit of income support…), with taxes functional only to ensure that total demand doesn’t exceed productive capacity.

Note that everyone who doesn’t work is supported by those who do: and that this directly demolishes any claims of the familiar form ‘we can’t afford public provision of X and must substitute tax subsidies for private buccaneering’.

The only issue I have with this is the illegitimate inference of the results of the quiz.

“If you scored less than 66.6% then you have neo-liberal tendencies which need debriefing.”

Not true. I scored less that 66.6 and I have no neo-liberal tendencies. In fact, quite the opposite. And I’ve been advocating on behalf of MMT for years. I just didn’t really understand the questions.

Dear John T (at 2017/03/13 at 1:20 am)

There is an exception to every rule. Chill out, it is just a bit of fun.

best wishes

bill

Bill Mitchell proposes:

“Using the sectoral balance framework, we can say that a current account surplus (X – M > 0) allows the government to run a budget surplus (G – T 0.”

https://billmitchell.org/blog/?p=2418

So, what he is saying is that all three sectors may – under certain circumstances – show a surplus.

But how is this supposed to comport with Wray’s adamant below conclusion, based on the identity according to which:

(S – I) = (G – T) + (X – M)

“It is apparent that if one sector is going to run a budget surplus, at least one other sector must run a budget deficit.”

(Wray, Modern Money Theory, 1915, p. 14, emphasis in the original.)

I’m at a loss. I just can’t figure out where I am going wrong in thinking that the two statements are incompatible?

Dear lector (at 2017/03/13 at 6:44 am)

The full quote from the blog you mention is:

The other way of expressing the sectoral balance accounting relationship is as you quote (from my colleague Randall Wray):

(S – I) = (G – T) + (X – M)

Now put some numbers in:

1. Private domestic balance (S – I) = 2 per cent of GDP – saving overall.

2. External balance (X – M) = 4 per cent of GDP – surplus

So we have:

+ 2 = (G – T) + 4

Which means that (G – T) must be – 2 ( surplus).

You are getting confused because the balance for government in the way Wray expresses it is written (G – T) which means a surplus is a negative number.

Note also that (X – M) above is really (X – M + FNI) or the current account balance. In the simplified version, (X – M) we are assuming net income transfers to be zero.

The way to understand it is that the current account surplus is an injection of net spending, while the private domestic surplus is a net withdrawal. As long as the government surplus is equal to the difference, then the overall impact on national income is stable.

If the government surplus was greater than the difference between the external injection and the private domestic withdrawal of spending then the economy would reduce overall output and income and head to recession.

best wishes

bill

I’m with Christopher, support recipients live off the labour of “others”, whether these “other”s pay taxes or not is not established. For example, these “other”s may be other support recipients or even multi-national corporations.

When I miss a question it is usually because I have mistaken the burden proof required, whether beyond doubt or on the balance of probabilities.