Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

The Weekend Quiz – June 25-26, 2016 – answers and discussion

Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of modern monetary theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

The more public debt a sovereign government voluntarily issues to match its fiscal deficits:

(a) the less is the volume of investment funds in the non-government sector that can be used for other investments.

(b) the greater is non-government wealth held in the form of public debt.

(c) the more difficult it is for banks to attract deposits to initiate loans from.

The answer is (b) the greater is non-government wealth held in the form of public debt..

The option “the less is the volume of investment funds in the non-government sector that can be used for other investments”. You may have been tempted to select this option given that the government is withdrawing bank reserves from the system. So a bond issue is a financial asset portfolio swap.

However, banks do not need deposits and reserves before they can lend. Mainstream macroeconomics wrongly asserts that banks only lend if they have prior reserves. The illusion is that a bank is an institution that accepts deposits to build up reserves and then on-lends them at a margin to make money. The conceptualisation suggests that if it doesn’t have adequate reserves then it cannot lend. So the presupposition is that by adding to bank reserves, quantitative easing will help lending.

But this is not how banks operate. Bank lending is not “reserve constrained”. Banks lend to any credit worthy customer they can find and then worry about their reserve positions afterwards. If they are short of reserves (their reserve accounts have to be in positive balance each day and in some countries central banks require certain ratios to be maintained) then they borrow from each other in the interbank market or, ultimately, they will borrow from the central bank through the so-called discount window. They are reluctant to use the latter facility because it carries a penalty (higher interest cost).

The point is that building bank reserves will not increase the bank’s capacity to lend. Loans create deposits which generate reserves. As a result, investors can always borrow if they are credit-worthy.

Further, the option “the more difficult it is for banks to attract deposits to initiate loans from” also reflects the erroneous view of the banking system.

The correct answer is based on the fact that the when the government swaps bonds for reserves (which it has itself created via its spending) it is providing the non-government sector with an interest-bearing, risk free asset (for a sovereign government) in return for a non-interest bearing reserve. Reserves may earn a return but typically have not.

The bonds are thus part of the non-government sector’s stock of wealth and the interest payments comprising a flow of income for the non-government sector. So all those national debt clocks are really just indicators of public debt wealth held by the non-government sector.

I realise some people will say that the stylisation of government funds being provided by MMT doesn’t match the institutional reality where governments is seen to borrow first and spend second. But these institutional arrangements – the democratic repression – only obscure the essence of a fiat currency system and are largely irrelevant.

If they ever created a constraint that the government didn’t wish to accept then you would see institutional change being implemented very quickly. The reality is that it is a wash – net government spending is matched by bond issuance – irrespective of these institutional procedures and the government never “needs” these funds to spend.

The following blogs may be of further interest to you:

- Quantitative easing 101

- Building bank reserves will not expand credit

- Building bank reserves is not inflationary

- Money multiplier and other myths

- Will we really pay higher interest rates?

- A modern monetary theory lullaby

- Hyperdeflation, followed by rampant inflation

Question 2:

When an external deficit and public deficit coincide, there must be a private sector deficit, which means that governments can only really run fiscal deficits safely to support a private sector surplus, when net exports are strong.

The answer is False.

This question relies on your understanding of the sectoral balances that are derived from the national accounts and must hold by defintion. The statement of sectoral balances doesn’t tell us anything about how the economy might get into the situation depicted. Whatever behavioural forces were at play, the sectoral balances all have to sum to zero. Once you understand that, then deduction leads to the correct answer.

To refresh your memory the balances are derived as follows. The basic income-expenditure model in macroeconomics can be viewed in (at least) two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances.

To refresh your memory the balances are derived as follows. The basic income-expenditure model in macroeconomics can be viewed in (at least) two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances.

From the sources perspective we write:

(1) GDP = C + I + G + (X – M)

which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

Expression (1) tells us that total income in the economy per period will be exactly equal to total spending from all sources of expenditure.

We also have to acknowledge that financial balances of the sectors are impacted by net government taxes (T) which includes all tax revenue minus total transfer and interest payments (the latter are not counted independently in the expenditure Expression (1)).

Further, as noted above the trade account is only one aspect of the financial flows between the domestic economy and the external sector. we have to include net external income flows (FNI).

Adding in the net external income flows (FNI) to Expression (2) for GDP we get the familiar gross national product or gross national income measure (GNP):

(2) GNP = C + I + G + (X – M) + FNI

To render this approach into the sectoral balances form, we subtract total net taxes (T) from both sides of Expression (3) to get:

(3) GNP – T = C + I + G + (X – M) + FNI – T

Now we can collect the terms by arranging them according to the three sectoral balances:

(4) (GNP – C – T) – I = (G – T) + (X – M + FNI)

The the terms in Expression (4) are relatively easy to understand now.

The term (GNP – C – T) represents total income less the amount consumed less the amount paid to government in taxes (taking into account transfers coming the other way). In other words, it represents private domestic saving.

The left-hand side of Equation (4), (GNP – C – T) – I, thus is the overall saving of the private domestic sector, which is distinct from total household saving denoted by the term (GNP – C – T).

In other words, the left-hand side of Equation (4) is the private domestic financial balance and if it is positive then the sector is spending less than its total income and if it is negative the sector is spending more than it total income.

The term (G – T) is the government financial balance and is in deficit if government spending (G) is greater than government tax revenue minus transfers (T), and in surplus if the balance is negative.

Finally, the other right-hand side term (X – M + FNI) is the external financial balance, commonly known as the current account balance (CAD). It is in surplus if positive and deficit if negative.

In English we could say that:

The private financial balance equals the sum of the government financial balance plus the current account balance.

We can re-write Expression (6) in this way to get the sectoral balances equation:

(5) (S – I) = (G – T) + CAD

which is interpreted as meaning that government sector deficits (G – T > 0) and current account surpluses (CAD > 0) generate national income and net financial assets for the private domestic sector.

Conversely, government surpluses (G – T < 0) and current account deficits (CAD < 0) reduce national income and undermine the capacity of the private domestic sector to add financial assets.

Expression (5) can also be written as:

(6) [(S – I) – CAD] = (G – T)

where the term on the left-hand side [(S – I) – CAD] is the non-government sector financial balance and is of equal and opposite sign to the government financial balance.

This is the familiar MMT statement that a government sector deficit (surplus) is equal dollar-for-dollar to the non-government sector surplus (deficit).

The sectoral balances equation says that total private savings (S) minus private investment (I) has to equal the public deficit (spending, G minus taxes, T) plus net exports (exports (X) minus imports (M)) plus net income transfers.

All these relationships (equations) hold as a matter of accounting and not matters of opinion.

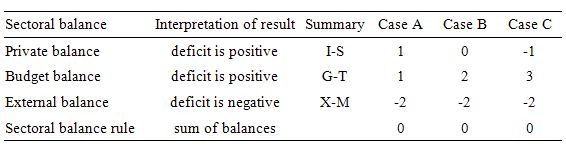

To help us answer the specific question posed, we can identify three states all involving public and external deficits:

- Case A: Budget Deficit (G – T) < Current Account balance (X - M) deficit.

- Case B: Budget Deficit (G – T) = Current Account balance (X – M) deficit.

- Case C: Budget Deficit (G – T) > Current Account balance (X – M) deficit.

The following Table shows these three cases expressing the balances as percentages of GDP. You can see that it is only in Case A when the external deficit exceeds the public deficit that the private domestic sector is in deficit.

So the answer is false because the coexistence of a fiscal deficit (adding to aggregate demand) and an external deficit (draining aggregate demand) does have to lead to the private domestic sector being in deficit.

With the external balance set at a 2 per cent of GDP, as the fiscal balance moves into larger deficit, the private domestic balance approaches balance (Case B). Then once the fiscal deficit is large enough (3 per cent of GDP) to offset the demand-draining external deficit (2 per cent of GDP) the private domestic sector can save overall (Case C).

The fiscal deficits are underpinning spending and allowing income growth to be sufficient to generate savings greater than investment in the private domestic sector but have to be able to offset the demand-draining impacts of the external deficits to provide sufficient income growth for the private domestic sector to save.

The following blogs may be of further interest to you:

- Stock-flow consistent macro models

- Norway and sectoral balances

- The OECD is at it again!

- Saturday Quiz – May 22, 2010 – answers and discussion

Question 3:

In a fixed coupon government bond auction, the higher is the demand for the bonds:

(a) the higher will be the yields on the issued bond, suggesting higher fiscal deficits drive short-term interest rates down.

(b) the lower will be the yields on the issued bond, suggesting that higher fiscal deficits drive short-term interest rates down.

(c) the lower will be the yields on the issued bond, which tells us nothing about the effect of fiscal deficits on short-term interest rates.

The answer is (c) the lower the yields will be at that asset maturity but this tells us nothing about the effect of fiscal deficits on short-term interest rates

The option “(b) the lower the yields will be at that asset maturity which suggests that higher fiscal deficits will eventually drive short-term interest rates down” might have attracted your attention given that it correctly associates higher demand for bonds will lower yields. You then may have been led by your understanding of the fundamental principles of Modern Monetary Theory (MMT) that include the fact that government spending provides the net financial assets (bank reserves) and fiscal deficits put downward pressure on interest rates (with no accompanying central bank operations), which is contrary to the myths that appear in macroeconomic textbooks about “crowding out”.

But of-course, the central bank sets the short-term interest rate based on its policy aspirations and conducts the necessary liquidity management operations to ensure the actual short-term market interest rate is consistent with the desired policy rate. That doesn’t mean the central bank has a free rein.

It has to either offer a return on reserves equivalent to the policy rate or sell government bonds if it is to maintain a positive target rate. The “penalty for not borrowing” is that the interest rate will fall to the bottom of the “corridor” prevailing in the country which may be zero if the central bank does not offer a return on reserves.

This situation arises because the central bank essentially lacks control over the quantity of reserves in the system.

So the correct answer is that movements in public bond yields at the primary issue stage, tell us nothing about the intentions of central bank with respect to monetary policy (interest rate setting).

Given that the correct answer includes lower yields the logic developed will tell you why the option “the higher the yields will be at that asset maturity which suggests that higher fiscal deficits will eventually drive short-term interest rates down” was incorrect.

Why are yields inverse to price in a primary issue? The standard bond has three parameters: (a) the face value – say $A1000; (b) the coupon rate – say 5 per cent; and (c) some maturity – say 10 years. Taken together, this public debt instrument will provide the bond holder with $50 dollar per annum in interest income for 10 years whereupon they will get the $1000 face value returned.

Bonds are issued by government into the primary market, which is simply the institutional machinery via which the government sells debt to “raise funds”. In a modern monetary system with flexible exchange rates it is clear the government does not have to finance its spending so the the institutional machinery is voluntary and reflects the prevailing neo-liberal ideology – which emphasises a fear of fiscal excesses rather than any intrinsic need.

Most primary market issuance is via auction. Accordingly, the government would determine the maturity of the bond (how long the bond would exist for), the coupon rate (the interest return on the bond) and the volume (how many bonds) being specified.

The issue would then be put out for tender and the market then would determine the final price of the bonds issued. Imagine a $1000 bond had a coupon of 5 per cent, meaning that you would get $50 dollar per annum until the bond matured at which time you would get $1000 back.

Imagine that the market wanted a yield of 6 per cent to accommodate risk expectations (inflation or something else). So for them the bond is unattractive and under the tender or auction system they would put in a purchase bid lower than the $1000 to ensure they get the 6 per cent return they sought.

Alternatively if the market wanted security and considered the coupon rate on offer was more than competitive then the bonds will be very attractive. Under the auction system they will bid higher than the face value up to the yields that they think are market-based. The yield reflects the last auction bid in the bond issue

The general rule for fixed-income bonds is that when the prices rise, the yield falls and vice versa. Thus, the price of a bond can change in the market place according to interest rate fluctuations.

The following blogs may be of further interest to you:

- Saturday Quiz – April 17, 2010 – answers and discussion

- Time to outlaw the credit rating agencies

- Studying macroeconomics – an exercise in deception

- Time for a reality check on debt – Part 1

- Will we really pay higher interest rates?

That is enough for today!

(c) Copyright 2016 William Mitchell. All Rights Reserved.

If you want to stop crying – get out of the European Onion 🙂

Dear Bill,

If would be great to have an article on what Britain could and should do now that Brexit is a reality.