The other day I was asked whether I was happy that the US President was…

Fiscal policy is a potent instrument for productivity growth

Sometimes we have to take a longer look at things to see the present in perspective. Greece has been a living experiment for the neo-liberal Groupthink machine that is the Troika. We rarely experiment on humans on any sort of large-scale if there is the likelihood of adverse result. That would breach any notion of human ethics. It is a pity that we relax those standards when dealing with other animals, but that is another story again, which I will leave silent here. The Nazis certainly conducted large-scale experiments on humans and we vilified them for it. The Troika is conducting different types of experiments on the citizens of Greece, which defy reason, and which also have had devastating effects. But still the mantra continues from the babbling mouths of the political leadership in Europe and its technocratic squawk squad (SS) embedded in the European Commission bureaucracy, the ECB, the IMF and various so-called ‘think tanks’ that continually pump out pro-Euro propaganda disguised as research – more structural reform, more fiscal austerity. Apparently, this scorched earth approach is the only alternative and will deliver higher productivity, increased international competitiveness and underpin a return to prosperity. Greece is on the front line of this approach. I never believed it would work because it defies economic reason. Economic reason that is not blighted by the neo-liberal Groupthink. It hasn’t worked. And now, the IMF, or at least segments within the IMF, are admitting that and producing research that supports the opposite case – the Modern Monetary Theory (MMT) case – that expansive “fiscal policy is a potent instrument for productivity growth through innovation”. Correct!

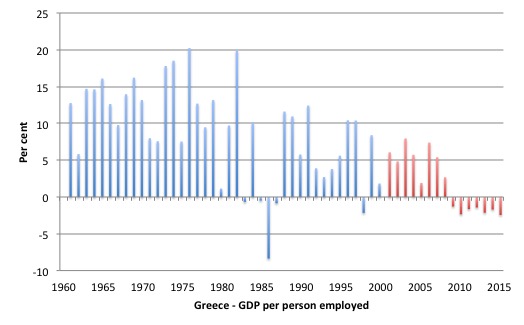

Here is a graph produced using data from the European Commission’s – AMECO Database – which shows the growth in Gross Domestic Product per person employed for Greece from 1960 to 2015. The red bars denote the period since the nation joined the Eurozone.

It is incontrovertible that labour productivity has fallen dramatically since Greece joined the Eurozone and has been negative since 2009 when the austerity and the so-called ‘structural reforms’ began in earnest.

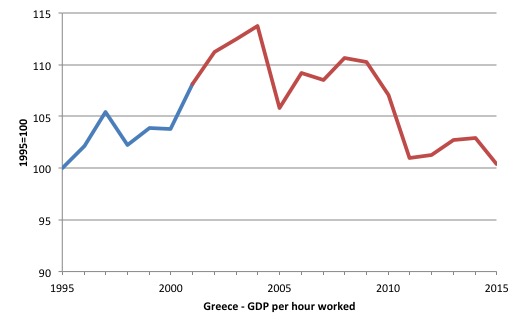

The next graph shows GDP per hour worked for Greece from 1995 (when the first convergence processes were put in place) to 2015. The index is set to 100 at 1995. The facts speak for themselves. There has not been a productivity boom following the introduction of the so-called ‘structural reforms’ and fiscal austerity. Quite the opposite. Productivity per hour worked is now back to the level it was in 1995.

Last week (March 31, 2016), the IMF published a pre-release of their next – Fiscal Monitor April 2016 – which comprised the complete – Chapter 2: Fiscal Policies for Innovation and Growth.

After years of inflicting massive hardship on Greece in the form of harsh fiscal cutbacks and huge attacks on the working pay and conditions, income support and pensions and other aspects of Greek society that help to make it inclusive and supportive of the disadvantaged, the IMF now has the temerity to write:

Against a backdrop of mediocre medium-term growth prospects, identifying policies that could lift productivity growth by promoting innovation is critical. Fiscal policy can play an important role in stimulating innovation through its effects on research and development (R&D), entrepreneurship, and technology transfer.

It makes one think that this institution is living in a parallel universe.

They now claim that “New analysis … identifies areas in which fiscal policy should do more”. It is a pity they didn’t understand this a decade or so ago.

But even more so, it is a pity they didn’t understand this 40 years ago as they embarked on their so-called ‘structural adjustment programs’ (SAPs), which they inflicted at great cost on the poorest nations in this world.

The IMF now claims that:

1. Advanced economies can boost their long-term GDP by 5 per cent and “can achieve this dividend through well-designed policies that include fiscal R&D incentives and complimentary public investments in basic research.”

2. “fiscal R&D incentives … particularly during recessions … play an important role in supporting R&D investment”.

3. “In emerging market and developing economies, investment in education and infrastructure strengthens their capacity to absorb technologies from abroad.”

All of these claims would represent the antithesis of fiscal austerity and the harsh SAPs that the IMF has pushed for years.

The IMF states the obvious that:

R&D expenditures are widely seen as a key driver of TFP growth. To promote these expenditures, governments can either invest directly in R&D (through public universities, government research institutes, and defense-related research) or design policies that encourage firms to undertake more private R&D.

I guess a whole host of mainstream economists will say yes we have known that all along. This cohort apparently knows everything except they really state anything that is factual.

They advocate fiscal contraction that concentrate the cuts, in part, on tertiary education and public research expenditure. They claim the market will fund R&D much better than public institutions.

But now the IMF is stating the importance of government expenditure in this area, these mainstream economists will forget their previous exhortations for government to cut public expenditure.

The IMF quotes data that shows that US firms “shifted away from doing basic scientific research” between 1980 and 2007.

This is the type of research that we do in universities that advance basic knowledge and which has been under constant attack from the funding bodies in this neoliberal era, even though the IMF report that “Public R&D programs often yield positive and sometimes high rates of return, averaging about 20 percent”.

The IMF also notes that:

Private R&D investments chosen by individual firms might be lower than the socially efficient level because of two important market failures: credit constraints and externalities.

Heterodox economists have long understood the importance of public support from research and authors such as Mariana Mazzucato have recently brought into relief the facts that the major innovations and advances in our time are spawned by strong state involvement – both direct and in terms of funding.

The private ‘market’ does a bad job in this area without strong fiscal support.

So why would we allow governments to cut spending in these areas, especially in times of recession, where growth is needed?

Fiscal countercyclicality is good for R&D

The IMF has been one of the champions of so-called ‘fiscal consolidation’ – which really means cutting net public spending against the cycle – when private spending is also contracting or weak.

As we know, when private spending is contracting or weak, the fiscal position will move further into deficit (typically) as a result of the automatic stabilisers (falling tax revenue and rising welfare spending) without any discretionary change in government fiscal policy parameters.

The rising fiscal deficit has been held out by the likes of the IMF as a precursor to government insolvency, which has to be avoided by so-called ‘fiscal consolidation’. The IMF has led the way in what we call pro cyclical fiscal adjustment.

Please read my blogs – IMF agreements pro-cyclical in low income countries and Exploring pro-cyclical budget positions – for more discussion on this point.

In the April 2016 Fiscal Monitor, they write instead that:

Fiscal stabilization policies can promote R&D investments by helping dampen recessions. Firms may encounter difficulties in obtaining funding for R&D investments because R&D often involves a high level of risk, significant fixed costs, and returns that materialize only in the medium to long term. Firms’ ability to borrow can be especially impaired during recessions, when liquidity risks are more prevalent. By reducing business cycle volatility, a more countercyclical scal policy can pave the way for greater private R&D

But then we knew all this all along, which is one of the advantages of discretionary increases in the fiscal deficit when times are tough to provide sufficient spending to improve confidence and, more specifically, promote R&D.

The IMF produce “new analysis” which shows that “that higher fiscal countercyclicality increases R&D expenditure significantly more in industries that are highly dependent on external finance.”

Let us be clear:

1. Fiscal austerity equals fiscal procyclicality.

2. Fiscal countercyclicality means discretionary increases in government net spending in times of lower activity – that is, higher fiscal deficits. The anathema of what the IMF has been pushing on beleagured nations.

Fiscal policy is essential to correct market failure

The IMF also argue (NOW!) that “domestic social rates of return to private R&D are generally estimated to be two to three times the private return” and “that market forces will lead to an underinvestment in R&D compared with the level that is socially efficient”.

Who would have ever though!

So the market is incapable of delivering sufficient R&D. Solution?

We knew all along …

The IMF say:

This underinvestment can be addressed by corrective fiscal instruments that provide incentives for private R&D. Fiscal incentives such as tax credits and direct subsidies can lower the private cost of R&D so that firms are inclined to invest more, which is socially desirable because other firms will benefit, too.

The upshot is that the IMF conclude:

1. “Good fiscal stabilization policies promote R&D” – so why would we continue to support pro-cyclical fiscal cuts?

2. “Governments should do more to boost R&D” – by increasing deficits!.

3. “Governments can invest more in public R&D, such as basic scientific research, which will advance firms’ own research activities”.

4. “Technology transfer in emerging market and developing economies requires better institutions, education, and infrastructure.” So why would we support policies (advocated in the past by the IMF) that attack basic education, training and health infrastructure in poorer economies?

Conclusion

Have another look at the graphs at the start of this blog and think about the sort of policies that the Troika have inflicted on Greece in the name of increased productivity. Then try to square that with their latest missives on the topic of fiscal policy.

The IMF is an organisation is in chaos – locked into a dangerous Groupthink but staring at the facts each day which should lead them free from that sort of patterned behaviour.

The IMF also think they are comedians.

In their blog on the subject – Imagine What Fiscal Policy Could Do For Innovation – they conclude:

Can you imagine Keynes and Schumpeter smiling together?

This is an organisation that should be disbanded.

Upcoming Spanish Speaking Tour and Book Presentations – May 5-13, 2016

Here are the details of my upcoming Spanish speaking tour which will coincide with the release of the Spanish translation of my my current book – Eurozone Dystopia: Groupthink and Denial on a Grand Scale (published in English May 2015).

You can save the flyer below to keep the details handy if you are interested. All events are open to the public who are encouraged to attend.

1. Madrid, May 5, 2016 – 19:00 at the Club de Amigos de la Unesco, Calle Atocha 20, 28012.

Speakers:

- William Mitchell, author

- Alberto Garzón, Diputado de IU

- Eduardo Garzón, economist

- Stuart Medina, economist and member of Asociación por el Pleno Empleo y la Estabilidad de Precios

2. Badajoz, May 6, 2016 at 12:00 at the Aula Magna de la Facultad de Economía.

Speakers:

- William Mitchell, author

- Francisco Manuel Parejo Moruno, Profesor de Historia de Pensamiento Económico

- Esteban Cruz Hidalgo, economist and member of APEEP

3. Barcelona, May 9, 2016 at 12:00 at Sala de Graus de la Facultat d ́Economia i Empresa de la Universitat de Barcelona, Av. Diagonal 690, 08034 Barcelona.

Speakers:

- William Mitchell, author

- Antoni Soy, profesor de economía aplicada de la Universidad de Barcelona

4. Barcelona, May 9, 2016 at 19:00 at Auditori del Collegi d ́Economistes de Catalunya, Pl. Gal·la Placídia 32, 08006 Barcelona

Speakers:

- William Mitchell, author

- Antoni Soy, profesor de economía aplicada de la Universidad de Barcelona

5. Valencia, May 11, 2016 at 19:00 at La Nau de Valencia.

Speakers:

- William Mitchell, author

- Jorge Amar, economist, President of APEEP

- Raúl de Arriba, Profesor en la Facultad de Economía de Valencia

FINALLY – Introductory Modern Monetary Theory (MMT) Textbook

We have now published the first version of our MMT textbook – Modern Monetary Theory and Practice: an Introductory Text (March 10, 2016).

The long-awaited book is authored by myself, Randy Wray and Martin Watts.

It is available for purchase at:

1. Amazon.com (60 US dollars)

2. Amazon.co.uk (£42.00)

3. Amazon Europe Portal (€58.85)

4. Create Space Portal (60 US dollars)

By way of explanation, this edition contains 15 Chapters and is designed as an introductory textbook for university-level macroeconomics students.

It is based on the principles of Modern Monetary Theory (MMT) and includes the following detailed chapters:

Chapter 1: Introduction

Chapter 2: How to Think and Do Macroeconomics

Chapter 3: A Brief Overview of the Economic History and the Rise of Capitalism

Chapter 4: The System of National Income and Product Accounts

Chapter 5: Sectoral Accounting and the Flow of Funds

Chapter 6: Introduction to Sovereign Currency: The Government and its Money

Chapter 7: The Real Expenditure Model

Chapter 8: Introduction to Aggregate Supply

Chapter 9: Labour Market Concepts and Measurement

Chapter 10: Money and Banking

Chapter 11: Unemployment and Inflation

Chapter 12: Full Employment Policy

Chapter 13: Introduction to Monetary and Fiscal Policy Operations

Chapter 14: Fiscal Policy in Sovereign nations

Chapter 15: Monetary Policy in Sovereign Nations

It is intended as an introductory course in macroeconomics and the narrative is accessible to students of all backgrounds. All mathematical and advanced material appears in separate Appendices.

A Kindle version will be available by April 11, 2016.

Note: We are soon to finalise a sister edition, which will cover both the introductory and intermediate years of university-level macroeconomics (first and second years of study).

The sister edition will contain an additional 10 Chapters and include a lot more advanced material as well as the same material presented in this Introductory text.

We expect the expanded version to be available around June or July 2016.

So when considering whether you want to purchase this book you might want to consider how much knowledge you desire. The current book, released today, covers a very detailed introductory macroeconomics course based on MMT.

It will provide a very thorough grounding for anyone who desires a comprehensive introduction to the field of study.

The next expanded edition will introduce advanced topics and more detailed analysis of the topics already presented in the introductory book.

That is enough for today!

(c) Copyright 2016 William Mitchell. All Rights Reserved.

Not to question any of your charts, your facts, anything at all you have written, and it’s a given that everything is absolutely 100% true:

The Eurozone member states today are similar to the ragtag shape that the US states were in during those several years after winning the Revolutionary War / before ratifying the US constitution. The Eurozone setup is still incomplete. There is only a strong centralized monetary policy authority without a strong centralized fiscal policymaking authority. There was no consolidation of Eurozone member state debt into one, single, ‘federal’ debt. There is no Eurozone ‘federal’ bond.

Just like US states today, the Eurozone member states are ‘users’ of currency. Eurozone bonds are not actually ‘sovereign’ bonds, not anymore. Eurozone bonds are more like US state muni bonds. Imagine the optics if then Fed chairman Bernanke bought the muni bonds of San Bernandino and Detriot for LSAP?

My question) Isn’t the technocratic squawk squad (SS) only playing the cards it was dealt (?)

In the news at the weekend Bill there was a wikileaks cable saying that the IMF was pushing for a crisis or “event” to force the country into deciding on new reforms.

http://www.telegraph.co.uk/business/2016/04/02/greece-challenges-imf-over-wikileaks-revelations/

To me and I know it sounds off the wall, the IMF are just neoliberal guard dogs that grease the way for American Imperialism. They are the infantry in the bankers army in this new type of warfare. Which is why Wall Street never got reformed after the crash. Reform Wall Street like the old days and it wouldn’t of been able to carry out these financial attacks.

The American power brokers know very well the power Wall Street has over the world. Never in a million years were they going to nulify that power. Deregulation sole purpose was to let Wall Street off the leash.

Put a neoliberal puppet in charge and get them to borrow in $ then let the hedge funds do the rest. Then send the IMF in to share the spoils of war. You could list dozens of countries where this has happened all based and developed from the original blueprint in Chile.

They haven’t just realised it works Bill. They knew all along.

They’ve been instructed to do it first at Davos and then at the G20 when you look at the press releases that came out of these meetings. They are worried about the far left and far right groups popping up all over the Europe and what’s happened to establishment politics in their own back yard.

People are waking up. There plan is to put them back to sleep.

Bill

The problem is that imf sometimes publish articles/research like that but when they have to deal with a country in recession they suddenly suffer from selective amnezia and they return to their failed policies again and again.

As Albert einstein said Insanity: doing the same thing over and over again and expecting different results.

Well i guess imf and neoliberals are really insane then.

And here in OZ the neo-liberal LNP propagandists were all over the news claiming “we have to live within our means!”

Hi Bill,

A couple of times in this blog post you suggest that higher deficits follow from the automatic stabilisers.

My confused understanding is that the government fiscal ‘deficit’ is exactly the net non-government fiscal surplus (saving). That being so, is it not the case that the ‘deficit’ follows from reduced private consumption (= higher savings rate) and government reactions whether automatic or discretionary are a lesser factor?

Regarding efficiency in R&D investment, I like to contend that private R&D is necessarily inefficient because such decisions are not being made by those with the best knowledge of the state of the art. Universities have the best chance of making efficient R&D funding decisions because they should have the people most familiar with what problems are most ripe to be addressed, ie the people who will do the actual work. Put more directly, hire smart people and let them do what they think will be most effective. Of course hard to know who are the smart people, but that is why it is an investment risk.

Derek Henry, I hate to buy in to conspiracy theories generally but I think there is some truth to what you say. It seems too setup as a controlling mechanism of all the world particularly the poor countries over the years that have suffered at the hands of the IMF and world bank.

That said, I do also believe that sometimes the simplest answer should be considered as playing out here and groupthink and stupidity have to share the blame too. Mainstream economists actually believe the garbage the IMF have been saying. Until enough economists in positions of power have the correct economics backing them there doesn’t seem to be a way out.

It appears that most of the sensible information coming out if the IMF is usually on blogs or posted on sites with disclaimers about it being an individual’s view point not the IMF. So there are people inside questioning things it seems but Cristine Lagarde and other people at the top surely need to go or nothing will change.

I imagine If the IMF had a psychological analysis it would surely be not only schizophrenic but a sociopath. I don’t know how these people at the IMF can sleep at night looking at the destruction of Greece alone let alone the other Southern European countries.

Brendanm, the higher deficits following a collapse in private spending is caused by the increase in unemployment benefits (due to firms laying workers off) and decrease in tax receipts (those laid-off workers no longer pay tax, and firms also push for wage decreases to offset the reduction in profits).

It is weird, isn’t it, the sudden change in policy advice by the IMF. Equally i was reading a paper yesterday by a leading pro-EU think-thank that says more or less the same. Although much of what they say is still very much within the confines of the current madness, they propose a change of the Maastricht Treaty and the SGP.

[Bill edited out a link to a ‘think tank’ that is part of the problem and which I do not wish to promote]

Same here Jason but many economists have written books about it in great detail. The history of it all is very telling. David Harvey nailed it years ago.

New York – Chile- Rest Of the World.

Bill,

Please don’t take this the wrong way. This hit me instantly upon seeing your article title, and it’s about your aggregate audience, not you.

“Fiscal policy is a potent instrument for productivity growth”

even our MMT friends don’t realize how comically revealing that statement is

Just stop and think about the context here.

Oh the devious webs we spin for ourselves.

Even cave men 100K years ago would laugh at someone formally addressing compatriots & stating

“Group Initiative is a potent tool for productivity growth.”

[I can just picture a group of grubby knuckle-walkers, sitting around a fire, experiencing the aggregate anti-climax.

What? Don’t tell me that some CURRENT humanoids have to be told that Fiscal Policy = Public Initiative?

Seriously? Weepin’ Buddha on a Decline! What’s become of us? If we have kids passing classes by age 10 who don’t grasp this intuitively … then no amount of cultural repair efforts will fix this later on.]

Even Neanderthals hearing this statement would take their newfound tool of language and hoot “WELL DUH!” Heck, pack animals long before chimps knew the value of teamwork.

Uh … isn’t that the DEFINITION of a social species?

Yet here, 100K years later, we have learned gentlemen having to patiently remind their supposedly cognizant compatriots of this apparently novel idea. 🙁 [Maybe you should ease the shock, by leading with an admission that the Earth isn’t flat?]

Upon noting that citizens today have to be told this bit of the obvious ….. the sinking feeling is palpable.

The collective ability of homo sapiens to keep themselves from thinking is truly arresting.

So arresting that there’s clearly something even more deeply provocative stirring here.

Any genetic/cultural/network trait appearing at higher than chance rates .. you have to consider has an adaptive (or at least PERSISTENT) feature!

Is this part of the process of scaling up a massively multi-citizen culture? Seriously. Just like the brain needs to be able to rely upon ~40trillion “dumb” heart/muscle/kidney/etc cells, does a scalable governance structure need to rely upon dumbed-down, idiot-savant masses?

Or is there a better way?

As you so clearly show, Bill, there is a way to reduce the deficit and that is to fiddle with the fiscal stabilizers. This is Osborne’s way. His recent Budget was to give a tax break for the rich and to reduce payments to the disabled. This caused such a ruckus that he had to backtrack after disappearing for a while. Meanwhile, he was supposed to be raising taxes from those who evade taxation – to help reduce the deficit and make Britain a fairer nation [oh, dear]. This turned out to be a joke. In effect, Osborne has been inconsistent in his approach to deficit reduction, in his attempt to get Britain to “live within its means”, a phrase that has no meaning whatsoever at the level of the nation state.

Derek, it is unnecessary to go to conspiracy theory territory to explain what you wish to explain. In fact, such an explanation is weak, unless nothing else works. It requires too much coordinated, concerted action to be effective in virtually all of the cases where such a theory has been deployed. In the case of the IMF, its research department has for many months advocated fiscal stimulation, while simultaneously Lagarde has been saying the opposite. The organization appears to be (metaphorically) schizoid.

Jason H, while an organization can not itself be psychopathic except in a metaphorical sense (See Bakan, The Corporation.), its various managers can be. Organizational psychopathy among higher level managers appears to have increased over the neoliberal time period. It seems to have become so rampant that Robert Hare, one of the world’s experts on psychopathic behavior, has turned his attention from criminality to corporate behavior.

This fits with the way senior Tories seem to view Osborne. While they don’t say so outright, they seem to view him as some kind of robot, which is the way some, and only some, psychopaths appear to others. During the latest Budget debacle, it has become known that many Tories apparently dislike the chancellor so much that some have even said that his plans to become leader of the Tory party when Cameron goes, which may be sooner rather than later, are toast. Let it be so.

Derek, it is possible to achieve behavioral convergence without appealing to coordinated, concerted action of otherwise disparate groups.

Larry it is not Conspiracy theory terriorty.

Read the books from economic professors. They lay it all out in great detail.

All you need to do is see what they did when they entered Iraq never mind Chile or New York.

Michael Hudson who is also an expert on these things says the same things. This train of thought is from professors of economics not Alex Jones.

Are these economic professors conspiracy theorists as well ?

Do you honestly believe for one second the establishment believe taxes fund government spending. Yet, look how they frame it. Is that a conspiracy theory ? Or are they just stupid ?

There’s been plenty of coordinated, concerted action to be effective. What do you think these lobby groups are for ? All started by powell as Bill says.

Larry even if you only read pages 40 -44 http://www.sok.bz/web/media/video/ABriefHistoryNeoliberalism.pdf

If that’s not coordinated action I don’t know what is and it certainly aint no conspiracy theory.

Larry do you honestly believe in a rose tinted view that the IMF don’t understand why this is happening after 46 years because they are stupid.

http://www.epi.org/productivity-pay-gap/

C’mon on !!!!

And you don’t need much cordinated action when it’s the same 2 banks and a the same couple of hedge funds that do all the dirty work.

In the case of the IMF, its research department has for many months advocated fiscal stimulation, while simultaneously Lagarde has been saying the opposite. The organization appears to be (metaphorically) schizoid.

It’s simpler than the Larry Lagarde has a boss who says NO !

The IMF research department might as well be a concierge up against the management of a Sofitel hotel. Ask Dominique Strauss-Kahn.

Thanks Larry, I’ve seen the corporation so I meant it in that context. Schizophrenic is a new one to me though. More like cognitive dissonance possibly?

Jason H, cognitive dissonance will do for me.

Derek, the fact that econ professors wrote X does not carry any weight with me in and of itself. What are their arguments? Do they hold water? You are arguing by authority. Such arguments are in and of themselves fallacious. Unless other factors are added in. Dani Rodrik recently wrote that he had an impossibility theorem. He is an econ professor. He does not have such a theorem. He has a claim and that is all. It is an interesting claim and worth further investigation. But a claim isn’t a proof. Kenneth Arrow, on the other hand, does have an impossibility theorem. The argument isn’t air tight, as some of the assumptions are controversial, but he does have a reasonably fleshed out argument. And Rodrik had Arrow’s impossibility theorem in mind even if he never mentioned it in his paper.

As I have said before here, I think Hudson is over egging his pudding here. There aren’t just two banks and a couple of hedge funds involved. You need more than that to pursue a policy objective. Take Iraq. Cheney’s objective was to break OPEC. After the invasion, he was told by the oil companies that they didn’t want the OPEC price structure to be disturbed. Apparently, he didn’t consult them beforehand. And in this case, it may not have made any difference anyway. We won’t know until we see all the documentation, if it exists.

I am not claiming that there are no interest groups that act in concert. What I am claiming is that you don’t need a conspiracy to find countervailing interests acting in a concerted, non-conspiratorial manner in the absence of a conspiracy. But here are two examples where I think a conspiracy did exist. In the 1907 banking crisis, there is evidence that J P Morgan banged heads together in his conference room to deal with the crisis. A group of influential men met in a room and came out of that room with a policy objective that had to be enacted to save the US banking system. This can be called a conspiracy. There was a conspiracy in the 1930s to remove FDR from the presidency by some members of the financial elite, which was foiled by Brigadier General Smedley Butler. Conspiracies do exist but, in the case in hand, I don’t think we need them in order to explain what is going on. And the complexities are greater by some magnitudes in this case than my two examples. This is all I am saying. You could argue that my examples fail to capture the nature of the cases you have mentioned. Maybe that is so. But you have to do more than argue from authority. That is a dubious argumentative strategy.

Sorry i included the link, Bill. I will leave it out next time.

Derek, my contention isn’t that those working for the IMF in whatever capacity are stupid. But people can end up thinking the same things without there being a conspiracy. And because of environmental and cultural factors, groups with differing vested interests can work toward similar if not quite identical ends, whatever differences there may be in their respective ends making no practical difference. This is not to say that there are not groups working together for something akin to common ends. My contention is that, while such groups working together may be a contributing factor, they will not lead to an adequate explanation of events by themselves.

Another conspiracy example. It has recently been contended that the US Air Force aided and abetted the UFO conspiracy theorists for their own ends, which was to hide certain technological developments. Not because they believed in UFOs and aliens. The US Air Force could be said to have been involved in a conspiracy, to aid and abet other conspiracy theorists. What does this explain, other than the obvious?

An example from Engels’ time. Certain manufacturers in Engels’ time paid their workers a certain rate. Engels wanted to raise his workers’ wages. But he couldn’t do it alone. He knew that if he did, his competitors would keep their workers’ wages the same and thereby out compete him and eventually drive him out of business. No conspiracy to pay workers low wages needs to be appealed to in order to explain why none of Engels’ competitors raised their workers’ wages.

Now, had they gotten together to raise their workers’ wages in order to, say, drive Engels out of business, then we would have a clear-cut conspiracy that is explanatory. And we need would it to explain why Engels went out of business in this hypothetical example.

An example from the banking system. Let us say that CitiGroup and Goldman Sachs decide upon a course of action that leads to them making a lot of money. Other less prominent such institutions may feel they have to follow them in order to remain competitive. We don’t need to appeal to a conspiracy in order to explain this behavior.

Infrastructure investment spending of the government will increase both the marginal product of labour and capital [New Keynesianism and Aggregate Economic Activity by Assar Lindbeck – Economic Journal, 108, 1998 pp167-80]

Infrastructure investment spending is 3 times more effective in increasing ‘growth’ than tax cuts.

John Cridland of the CBI.

BBC Sunday Politics 18/03/2012.

It is ironic that euro was sold with tall tales of economic prosperity.