In the annals of ruses used to provoke fear in the voting public about government…

British Labour Party – U-turning towards oblivion

When Jeremy Corbyn first came into prominence to take over the leadership of the British Labour Party, his offsider, now Shadow Chancellor John McDonnell started talking about “deficit deniers” and he and the Labour Party were avowedly not so inclined, as if questioning the fiscal surplus obsession was a demonstration of stupidity. In fact, for a political group claiming to be the ‘end of austerity’, who aimed to seize control of the Party from the neo-liberal Blairites – those austerity-lite mavens – I thought he was sounded distinctly neo-liberal himself. His defenders who also understood perhaps a bit of Modern Monetary Theory (MMT) wrote to me and said we should be patient – that this was just a political ploy designed to snare the Conservatives in their own hubris. After all, George Osborne has categorically failed to achieve his goals of fiscal cutbacks. I noted that it was actually good that he had ‘failed’ because the U-turn Osborne made in 2012, albeit rather subtle, saved the British economy from a triple-dip recession and has allowed it to continue to grow. Britain is not an example of a successful austerity implementation. It looks rather Keynesian to me. John McDonnell decided he had better make a U-turn of his own in the last few days. This one won’t save the nation and will probably sink British Labour further into the mire. Why McDonnell supported Osborne’s crazy ‘Charter of Budget Responsibility’ two weeks ago is one question. It showed a monumental lack of understanding of what it would mean for the nation to lock the government in, legally, to achieving overall fiscal surpluses. The U-turn now betrays a capricious approach to policy and one that will fail to cut through and offer a truly progressive path. Very sad really.

Neo-liberalism is in the Labour Party’s DNA now after the years of Blair and his cronies. It will take a serious effort to reorient the narrative.

The day or so after Labour lost the election they should have won, given the appalling performance of the Tories, one of the Blairite hopefuls, Chuka Umunna came out and said that Labour lost because it was not “Pro Business” enough.

Which really says it all – he wanted the party of workers to actually become the party for the top-end-of-town, but, of course, in the context of their ‘austerity lite’ positioning, he would have lead a fairer party.

It you believe that you will believe anything.

His day in the sun was short-lived and he dropped out of the candidacy quick smart and was one of ‘Tony’s men (and women)’ who spat the dummy and refused to serve on Jeremy Corbyn’s Shadow Front Bench once he was elected.

Whether he is plotting with the others in the background to restore the New Labour glory days is another question. You can make up your own mind on that. Blind ambition doesn’t die easily as John Dean can attest.

Umunna recently wrote an Op Ed in the Independent (October 13, 2015) – George Osborne has given the nation a lesson in how not to balance the books.

The aim of the article is to discredit the Tories, and Chancellor George Osborne, in particular, for failing to deliver “budget surpluses” and reduce the public debt ratio (to GDP) in the time period that was originally laid out when they took office in 2010.

But in railing against this slow track to surplus, Umunna has to rehearse the standard New Labour line – that the Tories are about to fast-track their move to surplus “by punishing the poorest and most vulnerable in society”. And … Labour (under him ??) would achieve the same fiscal result more fairly.

He says that:

… reducing the debt and our deficit is a progressive endeavour.

Since when?

He does acknowledge that the government can achieve a smaller fiscal deficit if it oversees a growing economy with higher wages.

Surely. But then he talks about the rising household debt as a sign of the sort of problems that Britain faces at present without connecting the dots.

We know he is not connecting the dots because he closes by saying that:

Aiming to reduce the national debt in the long term and running small surpluses when the economy is operating close to full capacity is sensible.

Why is running a small surplus at full employment sensible? Why is it progressive to deliberately aim to create fiscal drag in the economy when the economy is “close” to full employment and rising household debt is a problem?

Presumably, he wants household debt to fall (as a per cent of disposable income). That would require a shift in the saving to disposable income relationship.

Further, does he really believe the Britain will be running current account surpluses any time in the foreseeable future? I doubt you will find anyone who thinks that will be a possibility.

So piece this together.

1. External deficits will persist and worsen if Britain picks up its growth rate given the rise in imports that would follow. But rising investment incomes from abroad could offset that increase. The Office for Budget Responsibility certainly thinks that.

The external deficit is currently around 5.5 per cent of GDP. The OBR is forecasting the external deficit to be around 3.2 per cent in 2016.

2. What would a small fiscal surplus (say of 1 per cent of GDP) by 2016 imply for the private domestic sector, where households are already over-indebted? We are presuming for argument sake that the OBR forecast will be realised (I doubt it will but still).

The sectoral balances tell us that (S – I) = (G – T) + (X – M).

Substituting the values where appropriate we get (S – I) = -1 + (-3.2) = -4.2 per cent of GDP. That means the private domestic sector would be running a deficit of 4.2 per cent of GDP and accumulating further debt.

We do not know what the drivers of that private domestic deficit would be (Household saving plunging and/or a rapid investment growth rate).

The current private investment to GDP ratio is very poor (11.6 per cent of GDP) having falling dramatically during Blair’s period from 14.8 per cent in 1998.

A reasonable surmise is that the private domestic deficit will be driven by a drop in savings and a rise in household indebtedness beyond the already excessively risky levels.

Is this the Britain Mr Umunna aspires to? He is worried about the buildup of household debt but is advocating fiscal outcomes that would make that debt worse. I guess he doesn’t really understand the inconsistency in his story. That is the problem – political statements are continually made to elicit support from an ignorant public that cannot possibly be realised.

But in trying to realise the impossible, fiscal policy becomes skewed towards austerity and full employment shifts further away from the reality.

While Umunna was penning his latest piece of stupidity, the big U-turn was in progress. John McDonnell, the Shadow Chancellor, has demonstrated that his rejection of “deficit denial” is not some canny political strategy but a ‘me-too’ stance that the inferiority complexes that go deep within the Labour Party seem to hang on to.

The interchanges go something like this –

Osborne: I will achieve a surplus by 2018.

McDonnell: I will achieve a bigger one by 2017.

That sort of ‘me-too-ism’ – mindless and like Umunna’s demonstration of stupidity stupid!

On September 26, 2015, John McDonnell wrote that the Labour Party would go along with George Osborne’s fiscal surplus plans as outlined in the ridiculously titled Charter of Budget Responsibility (Source).

This was just ‘me-too-ism’. I was told to be patient. That is was just a cunning political ploy to trap Osborne.

I provided a critique of that position in this blog – British Labour Party is mad to sign up to the ‘Charter of Budget Responsibility’.

Two weeks or so later, the ploy gets more complex – its a U-turn. I guess to confound the Tories. Bob up here one moment, then bob up there next – a sort of Rope-a-dope strategy to get Osborne off-guard.

Well from where I type the U-turn looks like one of those confused monumental stuff-ups rather than a savvy political manouevre.

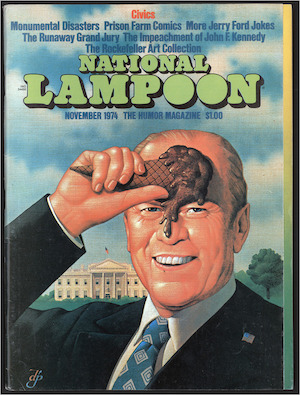

Remember the ill-fated Gerald Ford?

He looks a little like John McDonnell – n’est-ce pas!

John McDonnell wrote a letter to Labour MPs on Monday entitled – Charter for Budget Responsibility and the Fiscal Mandate

Among other things it said:

There is a significant difference between the charter and the mandate which the Labour Party agreed to support in January in that the Government’s proposal to require a continuing surplus on public sector net borrowing constrains the ability to borrow for future capital investment, a key plank of Labour’s growth strategy and one supported by the great majority of mainstream economists …

I suggested we vote for it nevertheless in support of the principle of tackling the deficit but to demonstrate that our approach would not involve austerity measures and we would seek to exclude capital investment from its severe and arbitrary constraints …

In the last fortnight there have been a series of reports highlighting the economic challenges facing the global economy as a result of the slowdown in emerging markets. These have included warnings from the International Monetary Fund’s latest financial stability report, the Bank of England chief economist, Andy Haldane, and the former Director of President Obama’s National Economic Council, Lawrence Summers …

Although we need to continue to bear down on the deficit, they believe that this is not a time in any way to undermine investment for growth strategies …

So I believe that we need to underline our position as an anti-austerity party by voting against the Charter on Wednesday. We will make clear our commitment to reducing the deficit in a fair and balanced way by publishing for the debate our own statement on budget responsibility. We will set out our plan for tackling the deficit not through punishing the most vulnerable and damaging our public services but by ending the unfair tax cuts to the wealthy, tackling tax evasion and investing for growth.

In subsequent press interviews, McDonnell was keen to stress that “Labour will tackle the deficit – we are not deficit deniers” (Source).

Did he really misunderstand that the Charter required an absolute rather than a current fiscal surplus to be the goal?

The general point remains. There is nothing canny about this U-turn. It was wrong to endorse the Charter in the first place even if he believed it only constrained the current fiscal balance to be in surplus.

Deficit deniers, if that is the term he wishes to use, are the ones who actually understand the relationship between the fiscal balance, the external balance and the private domestic balance and the implications of movements of one for the others.

I am a deficit denier using their terminology. To say that the Labour Party will still be “tackling the deficit” indicates that he thinks it is a policy target.

The fiscal balance should never be a policy target. It should just respond to the pursuit of the more legitimate policy targets such as full employment.

Further, there is no salvation to be had in saying that the Labour Party will bear down on the deficit but do it in a fairer way.

The equity implications of the government mix of spending and taxation are not at all important from a macroeconomic perspective although it is clearly very important from a progressive perspective.

By that I mean, that the fiscal deficit has to be large enough to satisfy the non-government sector’s desire to net save overall at levels of income and output which would generate full employment.

Not a penny more or less than that.

For Norway, that means a fiscal surplus is appropriate because the spending impulse it receives from its external (resource) sector is so strong.

For Britain, which an external deficit, unless domestic investment by firms is very strong (which it hasn’t been for a long time), a fiscal surplus is the anathema of responsible macroeconomic policy.

So a fairly sizeable deficit is required if the government wants to provide the space for the private domestic sector to run down debt, given the external deficit.

Once that is accepted then equity issues might be entertained. But that sort of reasoning is light-years away from austerity-lite.

McDonnell should be educating the public to understand that fiscal deficits will be the inevitable outcome of the nation achieving important goals such as social inclusion and full employment. A nation that can sustain those things should celebrate and realise that the fiscal deficit is the reason they can enjoy such success.

Why not start with that sort of narrative rather than getting trapped into all this Tory anti-‘deficit denial’ nomeclature and construction and then being forced to make embarassing U-turns because it becomes clear that the Scottish will never support you again among other things.

Conclusion

My inside sources tell me that the U-turn demonstrates that policy-on-the-run decisions by British Labour are now being made without much consultation with other colleagues – those outside the inner circle. How large is the inner circle? Not very large is what I have been told.

When that sort of centralisation occurs within political parties and the policy announcements begin to appear more U-turnish (which is my new euphemism for astoundingly ridiculous) then the tenure of the inner circle starts to become increasingly precarious – grass roots groundswell support notwithstanding.

And then, British Labour would be back to a dog fight between the even more ridiculous policies advocated by Liz Kendall or, spare the thought, Chuka Umunna.

That is enough for today!

(c) Copyright 2015 William Mitchell. All Rights Reserved.

Dear Bill

Britain has been deindustrializing for a while now. That may explain at least some of the decline in the investment share of GDP. If the capital/output ratio for services is lower than for industry, then a transition from industry to services will lead to smaller investment requirements. Suppose that the capital/output ratio for industry is 4 and for services 2, and that the useful life of capital in both industry and services is 10 years, then a transfer of 5% percentage points of GDP from industry to service should reduce replacement investment by 1%, (5 x 4) – (5 x 2) divided by 10.

Has any high-ranking government official ever contacted you in order to receive advice about economic policy?

Regards. James

Bill,

I have to say you’re being rather harsh on John McDonnell. Sure, he should never have used the word “deficit denier” and he should never have signed up to the Charter for Budget Irresponsibility , but just suppose he’s been reading your blog or he’s being advised by those who’ve read your blog.

He’d be thinking that he was on the wrong track. He’ll be thinking he needed to change his mind. Sure, the Tory press are going to give him a hard time but we should be supporting him for finally moving in the right direction not using terms like “U turn”.

“I have to say you’re being rather harsh on John McDonnell.”

I disagree. I think he’s being rather kind. Given the ‘pillars of the establishment’ he’s put on his ‘advisory committee’ I think it shows that he is, at the core, an old style tax and spend infrastructure obsessed Keynesian Socialist that believes the sort of dated rubbish that is published by part time Marxists.

And of course because he is Corbyn’s friend, Corbyn will struggle to see that he is actually the problem.

There is no way Labour can win with this strategy. This idea that the fabian left have that people actually vote for taxation is utterly bonkers.

The only way Labour can win is show that taxation isn’t the only space making tool they have in their box. They can stop the banks lending so much and they can delay and ban activities in the private sector to make space for publi works.

Unfortunately the left is obsessed with the Holy Power of Taxation. It’s a clear character flaw and a religious belief. They are far more interested in taking a club to the rich than actually solving the problems of the poor once and for all.

It does look hopeless.

But it’s the only game in town at the moment.

Your are right Neil-but we have to take into account where the populace is coming from rather than project our own clarity onto them. The populace has had 40 years of intravenous bullshit delivered to them and coursing through its veins, you can’t wean them off this with a flash of ‘instant enlightenment’-the argmument here is that mcDonell is NOT as canny as that and not psychologically astute so we can’t assume he’s using reverse psychology which would be a good approach.

The big elephant in the room is housing-how is that going to improve even if everyone became MMTers overnight-there would have to be a compensated engineered crash in house prices (with negative equatiers bailed out) or a trebling of wages-so it looks like rentier Britian wojuld continue even with the sea change-any thoughts on that?

100% agree with Bill and Neil, I am afraid. I fear Mr McDonnell came into the job with no idea, and is being very slow to understand macroeconomic reality. There is an impression he isn’t taking this seriously enough, and perhaps that he and his supporters are reluctant to admit to their confusion – even to themselves. My experience has been that some of these people react to gentle suggestions that they might not yet understand the appropriate role for fiscal policy as though we are insulting them. There are plenty of Labour people with a good grasp of the principles of MMT, but they aren’t part of the inner circle. I think only the appointment of Bill, or one or more of his close colleagues, as a senior adviser, would give me some faith that this can be turned around. It is very hard to back away from extraordinarily foolish statements about ‘deficit deniers’ once they have been made though.

Someone like Bill has to say these things, many Labour members have to read them and absorb them, and action has to be taken, or this golden opportunity will be squandered – perhaps for many years.

I hate to say this about the “new” Labour Party shadow chancellor, but I agree with Neil. I don’t think McDonnell knows what he is doing. And he hasn’t shown any indication so far that he wants to learn either. He wrote me during the leadership election that “he got it”. Well, so far he has failed miserably to show that he has got even the fundamentals right, let alone setting traps for the Tories. You can only successfully set traps if you know what you are doing.

The Independent article today is full of howlers.

“Our underlying commitment to tackling the deficit has not deviated and nor has our vow not to do so on the basis of unprecedented attacks on our public services or by punishing middle and low income earners for a crisis they did not cause. We will balance the country’s finances by ending the unfair tax cuts to the wealthy, opposing austerity, tackling tax evasion and avoidance and investing for growth.”

“Of course, we recognise that the long-term financial welfare of our people relies on ensuring that the public finances are on a sound footing.”

“We will soon be consulting with our Economic Advisory Committee on a statement of fiscal principles and a detailed strategy for reducing the deficit.”

It’s just fiscal balance obsessed nonsense from start to finish. The only bright bit is a mention of productivity and lack of investment. No mention at all about the structural lack of jobs and why the state has to deal with that directly. You’d think the events in Redcar would allow him to make that lack of jobs in the right area a main policy proposal.

If this approach persists, then the whole operation is still born. About the only bright spot is that it may stop the Tories moving ever rightwards.

Bill,

Expect a fragmentation of the Labour party -SDP Tory lite party – seems only SNP canny enough to outflank the Tories at the moment.

Still Tory majority not that large over life of parliament and political splits over EU membership a major distraction. Tories on their own – no hiding behind a coalition so all glory or hubris now!

Whilst the economic analysis is unarguable, as Peter says the overall assessment seems rather harsh… and too despairing. As Andy says ‘This is the only show in town’, and there are another 4.5y in which the narrative can change.

John McDonnell did not expect to be shadow chancellor 3m ago. His previous relevant experience was balancing the books for Ken Livingston in the GLC. However, his parliamentary career has been solely devoted to fighting neoliberalism in both the Conservative Party and New Labour. ‘Politics’ not macroeconomics has been his focus.

I don’t think I’m saying anything controversial when I say that the ignorance of economics amongst MPs is unbelievable and has allowed the City to lead governments by the nose, time and again.

John McDonnell is really up against it. The PLP (Labour MPs) are for the most part outrageously hostile and trying to undermine him… and that’s without Osborne, the MSM and the pervasive ‘false consciousness’ of the public at large. I doubt that he is in the position now to do a FDR ‘You have nothing to lose but fear itself’ speech. My real complaint is that John was being too clever by half in saying that he would back Osborne’s charter with caveats/amendments. IMO his aim was to stop the hostile MPs making a scene at the LP conference… which it did more or less. It is also true that the u-turn has facilitated a lot of media coverage, featuring Danny Blanchflower, Ha-Choon Chang, Ann Pettifor, Richard Murphy et al attacking Osborne’s Charter as economically illiterate.

John McDonnell’s primary advisor, apart from his committee, is Andrew Fisher who wrote ‘The failed experiment’ which I think essentially explains the agenda. The position is clearly not MMT but unquestionably intends to reject neoliberal economics. Someone should be arguing the contradictions with Andrew… and let’s hope that John McDonnell will now play with a straight bat instead of trying to do small-p ‘politics’.

It’s necessary to consider the bigger picture. We are in the era of late-stage, global capitalism. Political power is ebbing away from Parliaments (in those countries that have them) and towards corporate and oligarchic capitalist power. Bourgeois democracy is failing as Marx et al. predicted.

“Classical Marxist theory viewed the petit bourgeoisie as a class with a tendency to appear to be taking the side of the workers in opposition to the interests of the bourgeoisie, but in reality the petit bourgeoisie did not have an interest in creating a worker-controlled socialist state. The objective interest of the petit bourgeoisie was in the reform of the capitalist system, improving the standard of living of the workers and peasants, and thus providing the foundation for political stability. A less conflictive and more stable capitalist system, with a higher standard of living that would include increased access to petit bourgeois commercial and professional services administered by ever growing public and private bureaucracies, would expand and empower the petty bourgeoisie. Thus, according to classical Marxist theory, the petit bourgeoisie proclaimed its support for the worker-led socialist revolution, but in actuality it tried to serve as a mediator between the proletariat and the bourgeoisie, directing the revolution toward reform and thus undermining the possibility of socialist transformation.” – Global Learning.

There is nothing surprising with British Labor. Labor is a petit bourgeois party movement and it is running true to form. Indeed, it is now transitioning from serving as an inter-class mediator to serving as a straight up apologist for and implementer of bourgeois (capitalist) policy (Tory Lite). The Western petit bourgeois became (as well as small business owners and self-employed) bureaucrats and an “aristocracy of labour” (these latter received good wages made possible from the exploitation of third-world resources and peoples (colonialism and imperialism).

Capitalism has now reached that stage where global wage arbitrage is possible. Jobs are being moved to the third world and developing world for much cheaper wages. The “aristocracy of labour” in the West now face real wage competition and will be pushed down to wage-peon levels to match wages elsewhere around the globe. A party with a reform agenda cannot understand this process nor can it act in relation to it. This is a process which cannot be reformed as it is structurally guaranteed and systemically “baked in” under capitalism. You can’t change or avoid these processes while keeping capitalism.

if the Corbyn ‘movement’ is still born, which it might be, then neo-liberalism will lead us to 19th Century V.2-the risk here is of rising extremism, in the from of xenophobia, bashing the poor and ill as scapegoats because the real power mongers can’t be touched.

The great irony is that the Tories have tried to label Corbyn as a ‘national security threat’ whereas it will ultimately be neo-liberalism that leads there.

Neal,

“No mention at all about the structural lack of jobs and why the state has to deal with that directly. You’d think the events in Redcar would allow him to make that lack of jobs in the right area a main policy proposal.”

Redcar (and steel, generally) has been a problem on and off for 40 years. A government (any government) tackling this industrial (and employment) problem would have been committed to restoring the prospects of this important regional powerhouse. But international market factors outweigh attempts to improve productivity and a host of other elements that are influential.

No matter how laudable a Job Guarantee scheme (allied or otherwise to specific industry remedies), a government making promises of solutions is in the end battling against a market that is not within government control – or are you actually arguing that the liberal freedom of economic activity should be curtailed; is that possible on an international scale?

from the guardian.

Osborne said: “A fortnight ago, Labour told voters they were ready to back our plans. But now, they have confirmed they want to go on borrowing forever – LOADING DEBTS ONTO OUR CHILDREN THAT THEY CAN NEVER HOPE TO REPAY. This is not socialist compassion – it’s economic cruelty. As LABOUR’S GREAT RECESSION showed, those who suffer most when government run unsustainable deficits are not the richest but the poorest.

am not economically savvy but the problem labour face as much as anything is the battle of words. correct me if am wrong but the UK deficit has been twice what it is today in the fifties with out effecting future generations. And was not the great recession really the great neo-liberal recession.

I think Bill is right to stick the boot in you can’t win an argument using the language of the opposition, the Tory’s real advantage over labour is their idealogical devotion to neo-liberalism. They appear more congruent because they believe what they are saying (even when lying because they believe the lie will ultimately be subordinate to their true values) whilst Labour are, and have been court in a trap of opinion poles that have misshaped their policies. this is ultimately reflected in this current farce.

It should, on paper be easy to challenge Osborne-for example why hasn’t Britain paid of it’s national Debt since 1694 and why hasn’t the US (with the exception of 1831-one year!) paid of its National Debt since 1791-both countries grew and innovated since those dates!!!

I don’t get why no-one challenges the blighter, it’s as if they are all dumbstruck as soon as the word ‘borrowing’ is mentioned which creates a hypnotic spell -perhaps only psychopathology can explain this.

Corbyn needs a loudhailer in the Commons that shatters eardrums with “The Government isn’t a ****ing household.”

“No matter how laudable a Job Guarantee scheme”

The Job Guarantee scheme solves the problem. You don’t have to put the steelworks back (although I would argue that government should facilitate and allow the steelworkers to form a co-operative/company to operate the plant if that is what they want), but you do need to make sure that people who lose their jobs can get alternative work and an income (not necessarily at the same pay level as the job lost – but obviously enough to live on in a reasonable manner).

What worries me about Labour is that they are still trying to prop up dying industries that have a lot of jobs in a single place. I didn’t notice them making a song and dance about the number of fast food workers that lost their jobs across the country in the same week. But I can pretty much guarantee that there were more.

All the evidence points to the truth of Bill and Neil’s comments. The lack of understanding of public finances is everywhere, from the TUC through Corbyn’s lieutenants and Post Keynesian economists to the very heart of academic orthodoxy. However, as Osborne turned away from austerity once before we can expect him to do so again. When that moment comes, it will be very important to explain as best we can the significance of what is happening and celebrate it. The point is that Osborne in a way understands the policy space a sovereign currency allows. His change of course in the last government reveals an incidence of politics trumping economic ideology.

Also important to speak out against the focus on investment as the route out of austerity. As, for example, Wray has discussed, investment as a source of growth is not sustainable as it, for one, produces more capacity than demand and so if the rate investment does not always accelerate, such an approach will only result in a slump, i.e., secular stagnation. So many of the UK’s treasured institutions are threatened by cuts in current expenditure, from the NHS to our national parks. We should be arguing for overt monetary financing to plug these gaps on an on-going annual basis.

This (from Sue Davis) surely hits the nail on the head – for my money anyway:-

“I don’t think I’m saying anything controversial when I say that the ignorance of economics amongst MPs is unbelievable and has allowed the City to lead governments by the nose, time and again”.

It’s all very well for MMT freaks (meant in the nicest possible way of course) to wring their hands over how stupid, obtuse, clueless, etc, etc everyone else is and about how we’d all be saved if only everyone became born-again MMTers overnight (Hallelujah!), but I for one am getting just a wee bit browned-off with that. It gets to seem somewhat self-regarding after a time, like a mutual-admiration society. Why antagonise people you’re trying to persuade?

The sad fact is that what Sue is pointing-to isn’t going to change any time soon and is, moreover, characteristic of all public debate. Sure, academia performs an invaluable role in providing a source of ideas, and it’s understandable for theorists to claim superior perspicacity for their own pet prescriptions, but other people – viz politicians – still have to make, sell and carry-out actual policies. If academics think they could make a better job of THAT than the current crop of politicians is doing then, fine! – let them put themselves forward as political candidates (as Warren Mosler has). I won’t say how high I rate their chances of getting elected though.

Setting that aside, what the public mostly hears from economists is – sorry! – a Babel of mutually cancelling-out noise. Why is the public supposed to simply swallow “sectoral balances” as the holy grail of rectitude any more than any of the jargon being spouted by rival schools?

OK, silly question. “Because it’s the only one that’s right”…?

Wren Lewis is in the inner circle. He is explaining his reasoning here:

http://mainlymacro.blogspot.co.uk/2015/10/when-economists-play-political-games.html?m=1

@Robert – it’s entirely understandable the general public does not grasp the nuance of economic debate, but for elected members of parliament to demonstrate their ignorance is unforgivable. I, as a layperson with no academic or economic background understand the theory, simply by having read numerous books, articles and blogs, and following the debate closely.

My interest started 5 years ago, when i literally knew nothing about how money and the economy worked. Bank loans are savers deposits – check. Government budget is like a household budget – check. Taxes pay for government services – check, and so on and so on.

What astonishes me is not my previous ignorance, but that someone would want to enter parliament and decide the fate of the country and economy and not have a clue about how it works.

Current Politics anywhere in the west is both poor theater and an impossibly fragmented and contentious. Thus it must be outflanked by a mass movement. Preferably this movement would philosophically be an integration of the policies and intentions of MMT, Public Banking and Social Credit. Ideas are always more important and more powerful than structural reform and hence an awakened general populace in alliance with the small to medium business community would have a much greater impact on politicians and they could be herded in the correct direction of those integrations.

@jeff

Fair point.

I still think Sue is the only one here on the right lines. This nose-in-the-air snootiness from MMT purists strikes me as navel-gazing (says he, mixing anatomical metaphors promiscuously). If MMTers can’t bring themselves to cut Corbyn and McDonnell some slack then who the hell else can we expect to do so?

It’s only diehard MMTers who care about strict observance of MMT incantations like “The sectoral balances tell us that (S – I) = (G – T) + (X – M)”. Contrary to what they seem to take as an article of faith, MMTers do not have a monopoly of wisdom. No one has.

“If MMTers can’t bring themselves to cut Corbyn and McDonnell some slack then who the hell else can we expect to do so?”

Plenty of slack has already been cut to them I can promise you, and yet we still have the pronouncements, and a team of establishment lackeys as ‘advisors’ straight out of the central bank fan club.

It’s very simple. Unless they change narrative the Tories will kipper them in any election – because they are playing away from home at Tory united.

The first step is to start explaining to people that government surpluses steal their savings and force them to go cap in hand to the bankers. It’s an easy line that puts a clear message into people’s mind that the Tory’s want to sell the public’s immortal soul to their Tory mates at the banks.

Yet they won’t even use this simple soundbite.

You’re either destroying a myth, or reinforcing it. The current tone just reinforces Tory myths. It’s poor politics never mind economics.

The point about self-regarding MMT academics is bogus.

Anyone who has followed Bill Mitchell’s efforts over the last, however many, years knows that.

I’d say the same about Wray and Mosler although the same argument comes up time and time again.

So let’s turn it around Robert. Which camp are you in ?

Do you get MMT and, if so, how are you influencing the debate ?

Or are you in the, not yet convinced, try a different approach and see how you get on, camp ?

Don’t buy the argument. Sorry.

Dear Robert (at 2015/10/15 at 3:57)

First, Warren Mosler was never an academic. He has always operated within the private financial markets.

Second, you misunderstand the role of the academic. I am not a marketing agency. I am not a politician or an activist. My role is very different. It is to try to develop pure knowledge and to debunk other propositions that claim to be knowledge. I do not even have to engage in a language that is accessible to anybody but those who are highly educated and au fait with the jargon that disciplines within the academy use.

Others have the role of taking this knowledge (or the finding of non-knowledge) to the public sphere. The neo-liberals have layers of such people – their ‘think tanks’ deploy many hundreds of people in language, messaging, framing, marketing, distribution and they have the advantage of having the media on side.

If you want all of those things to be present in a one person blog then you will be obviously disappointed. It is not my role to be a ‘spin merchant’. My role is more distant from that.

But in saying that I do try to use my blog to make some of the ‘knowledge’ I generate with others (under the rubric of MMT) more accessible to the public so that activists can more easily take it up and run with it. But I should never accept people mis-using the ‘knowledge’ just to make political points. That would be a violation of the same knowledge and the start of the slippery slope to ignorance. In that regard, I feel the necessity to criticise that tendency when I see it occurring in the field of endeavour I would claim expertise in.

best wishes

bill

Dear Robert (at 2015/10/15 at 5:31)

Unfortunately, the statement “(S – I) = (G – T) + (X – M)” is not something that can be disputed. It is an accounting fact and therefore does monopolise ‘wisdom’ (as you term it). There can be no dispute about the veracity of that statement or the implications that flow from it.

Mainstream economists regularly violate that knowledge constraint and therefore end up making spurious statements which are internally inconsistent and can never hold up in reality.

It is nothing at all to do with the vehemence of held views (‘diehard’ in your words). If you are not making statements and drawing conclusions based on – (S – I) = (G – T) + (X – M) – then I am sorry to say you know nothing about macroeconomics and should desist from commentary on such issues. How you might express consistent views is another matter but ignorance disqualifies one from being heard.

best wishes

bill

To add to Neil’s answer & partly repeat his points:

Gogs: But international market factors outweigh attempts to improve productivity and a host of other elements that are influential.

No matter how laudable a Job Guarantee scheme (allied or otherwise to specific industry remedies), a government making promises of solutions is in the end battling against a market that is not within government control – or are you actually arguing that the liberal freedom of economic activity should be curtailed; is that possible on an international scale?

The point is that the market is quite sufficiently within government control. There is no great need to curtail “the liberal freedom of activity”. Using MMT/FF/JG is not “battling” against a market, which doesn’t really exist – Thinking it does is like thinking that boxing with your own shadow is boxing against a real opponent. What MMT/FF/JG does is make “the market” work much better for the things it does well, while remembering to do the very important things that “the market” doesn’t and can’t do well.

It is very, very common to wildly exaggerate the power of “capital” or “the market”, the power, extent and influence of international trade and finance, the foreign sector. And to wildly, ridiculously minimize, belittle the power of a modern state. Most people here or elsewhere who think they have found a flaw in MMT, FF or the JG commit these errors, which are everywhere in the mainstream of economics and the media, but are never reasoned out carefully and consistently.

Yes, MMT, a Job Guarantee can make things worse: How? if little country A decides on a JG, which would make things better there very fast – except for the fact that big country B has decided to bomb any country that has a JG. There is pretty much no other way for MMT & the JG to fail. This doesn’t apply to countries like the US, UK, Japan, Canada etc, which are too big or important or powerful militarily and otherwise to crush that way. The main modus operandi of the bad guys is fraud, not force, subverting economic or political “elites” to get each country to destroy itself. This kind of thing is remarkably successful until everyone wises up. And then it isn’t.

“(S – I) = (G – T) + (X – M)”

This is one of the basic functions of economics. It is used by MMT, perhaps, to make some points, but these are general points always valid in economics.

Here how it is derived:

http://www.socialeurope.eu/2011/06/government-deficits-and-national-accounting-identities/

@Bill

I’ll grant that my outburst was intemperate, and I defer to your definition of the academic’s role (which I think is admirably to the point). By the way I know Mosler isn’t an academic (I’ve read “The Seven Deadly Sins…”) but he is no less for that an exponent of a certain body of theory which forms part of the literature of the MMT branch of the economics discipline, so I lump him in with it. But let’s not get hung-up over taxonomy.

I admire much of the output of the MMT school (and I loved your Helsinki University lecture). What I get frustrated-by is what I see as MMTers’ tendency to put doctrinal purity ahead of more practical real-political-world (tactical, if you like) objectives – which your lecture most certainly did not do. Instead it demolished political myths, in everyday language. No one in the audience needed to be an MMT devotee in order to understand your exposition.

To my mind though to attack McDonnell and through him Corbyn is not at this juncture a very sensible thing for a progressive to do tactically. Regardless of how far they may have strayed from what MMT teaches, from a progressive’s point of view they’re on the same side. I suggest it’s a bit early in the game to savage them, and moreover I can’t for the life of me see what doing that is supposed to achieve. Given enough time they might come round to a more “MMT-compatible” policy-position, and if they don’t then by all means savage-away then but now is in my opinion too soon to jump in with both feet.

You may not agree with that but I hope I’ve succeeded in explaining my position.

Regards and thanks for responding

Robert

(S – I) ≡ (G – T) + (X – M) ex post?

(S – I) = (G – T) + (X – M) occurs when the economy is in equilibrium?

After PMQs, on both the Andrew Neil show and Newsnight, Labour MPs were supporting a balancing of the budget “in this parliament” though some tried to wriggle out of committing themselves outright by pointing out that they weren’t in government. This was not ignored by the journalists. And in PMQ itself, it could be said that Corbyn and McDonnell were made something of a laughing stock. By not dumping the Blairites and educating themselves in the macroeconomics they need in order to effectively counteract Tory contentions about how the economy works and making ridiculous decisions like the most recent ones surrounding Osborne’s fiscal charter, which passed and many Labour MPs stayed home, will only lead to further ridicule.

So, now the country is saddled with an unworkable statute until it is repealed. An absurd state of affairs. And a Labour party that is deeply divided. When McDonnell stated on Monday night that he was no longer in favor of the fiscal charter, and Richard Burgon admitted that on Newsnight that he didn’t know anything about any policy change until the Monday night meeting and he is in the inner circle, another MP stormed out of the meeting claiming it was a f***ing shambles (in the words of the Independent). This looks like policy being made on the hoof. While some may be right that Corbyn and McDonnell are learning as they go along, they are failing to learn some of the most basic principles, one of them being that a balanced budget should never be a policy objective. And Osborne is making the most of it.

But they aren’t the only ones. Others have made a mess of this. Both Caroline Lucas and Nicola Sturgeon have both shown that they lack any understanding of this simple point. Another principle is also seemingly misunderstood. All are against austerity, but all fall at the first hurdle when asked how they would pay for their programs, which involves understanding another basic principle, that of the nature of money in a fiat currency situation. So far, all fudge this and appear thereby to look economically inept.

If Wren-Lewis is one of McDonnell’s advisors, then he is making the same error Obama did – relying on the wrong people for advice. The result will surely be similar, a catalog of erroneous macroeconomic decisions by McDonnell, one of which has already been made, taken back, and then used against him, to the delight of the Tories. Why does history appear to be repeating itself here?

@Matt Usselmann

A technical point. In the discussion of the accounting “identity” by George Irvin of SOAS (University of London), no derivation was involved. All Irvin did was to apply the principle to a concrete example. He then claims, correctly, that the principle has nothing to do with Keynesianism, thereby implying that some think it does while providing no indications of who might have thought this.

Addendum:

Irvin, after applying the accounting principle to his concrete example, he confuses the issue by referring to households and firms as doing something similar. But this accounting principle applies to national sectoral balances which are not under the same constraints, so the analogy fails, which is all it is. Then, as I mentioned above, he irrelevantly brings in Keynes to further muddy the waters. Better to read Bill on sectoral balances or Stephanie Kelton.

@ Neil,

” They {the left} are far more interested in taking a club to the rich than actually solving the problems of the poor once and for all.”

Of course I understand where you’re coming from with this comment, Neil. But, the presumption is that the left do have the option of leaving the rich alone. Presumably just expect them to stand by and not use their wealth and influence in ways which they perceive will maximise that wealth and influence.

History shows that when the chips are down, like they were in WW2, when it was their necks on the line, they are just as happy as any MMTer to run the economy to its maximum potential and run whatever budget deficit it takes to get those tanks and aircraftcarriers built. When there was a clear political alternative just the other side of a wall in the postwar period the politicians and economists of Western Europe had to be on their best behaviour to demonstrate the advatantages of what they would describe as the “free market”. So it’s not that they don’t understand, or disagree with, the economics we are advocating. It’s more that they don’t like anything like Keynesianism or MMT. They don’t see the need for it right now, and they’ll try to do what it takes to discredit anyone like Bill who threatens their position.

So unfortunately those clubs are sometimes necessary!

Poor macroeconomics by governments is really just a symptom. The systemic disease is capitalism. While the system remains capitalist (specifically global corporate, oligarchic and crony capitalism), MMT, even if implemented, could supply only symptomatic relief just as Keynesian economics did for a time. This relief would be worthwhile, albeit a second-best course, if it could be implemented. However, there is little to no chance of MMT prescriptions ever being implemented under late stage capitalism. The entire world system works against macroeconomics that would held wage earners and poor people.

I have to say his candour at admitting his own embarrassment was refreshing. But his reasoning for the change in policy doesn’t give me any hope at all he understands the issues.

What seems clear to me a lack of expertise in parliament as a whole – how many MP’s of any political stripe would be sympathetic to MMT’s propositions ? I’d be amazed if there was even one.

I hope for all our sakes that Bill et al are inspiring a new generation of economists with a willingness to go into politics and argue the case.

“So unfortunately those clubs are sometimes necessary!”

I disagree. You are alienating the very people who will help you succeed.

One of the well known facts of politics is that the middle classes aspire to be the aristocrats. That’s what happened in the Victorian era when those in trade started buying country piles. The whole introduction of inheritance tax by the liberals was to neutralise the aristocracy and allow the old middle class to buy up the assets on the cheap.

The ‘captains of industry’ need replacing by the current ‘lieutenants of industry’ who understand that providing services and goods in a bottom up fashion will make them very wealthy while the politicians they work with cripple the rentiers currently skimming off the top.

‘Tax the rich’ offers a simple stick to the rich by which they can frighten the middle classes – ‘and you’re next’.

And it is the fickle middle classes that win elections.

@Larry

More in sorrow than in anger, methinks…?

Can’t disagree with your perceptive critique, however. I only wish I could!

Robert

“Given enough time they might come round to a more “MMT-compatible” policy-position”

They won’t. The ‘advisory committee’ is dyed in the wool Neo Keynesian. Blanchflower is talking about NGDP targeting for example.

That committee is a group of political lobbyists in the ‘expert’ field whose job is to squash any discussion of actual alternatives to the status quo banker/finance led position they espouse. Which means you have to get to the point where that fails catastrophically before there will be any more change.

‘Tax the rich’ will have to fail at the ballot box again, and it will have to be seen to have failed.

Dear Sue Davies and Robert (at various times)

I cannot believe you want the British Labour politicians to be cut some slack because they are on the ‘right’ side. They are holding themselves out to run a nation with some 61 million people in it (save the 5.6 million Scots who I hope see sense and exit). They receive handsome salaries for their efforts and are telling people they are fit to lead this nation. Yet, they demonstrate an appalling understanding of the most basic elements of macroeconomics.

It is not a matter of even understanding the fine points of Modern Monetary Theory (MMT). They make statements that violate basic macroeconomic theory that almost any economist would share.

Why cut them slack when they have ridden the wave of hope of the grass roots rebellion and then surround themselves with orthodox-type economists. Like Syriza, their failure will demoralise the hopes of millions that thought they had something different to offer.

And when I hear John McDonnell articulate that the government deficit is a problem which has to be eliminated I know that British Labour’s leadership is not on any side that I would be part of nor any side that anyone with progressive aspirations in this neo-liberal world would want to associate with.

They deserve all the pillory they get.

best wishes

bill

Precisely why we require a mass movement allying small and medium sized businesses and consumers (there’s a nice little constituency for you) that shows how an integration of MMT, Public Banking and Social Credit is in both their interests and the agenda that will bring free flowingness to the economy as well. That way you can better control/ignore the negative spin and just keep “pouring on the coal” of a resonating and genuine hope.

The good thing though is that those in the ‘advisory committee’ will be politically hanged at the same time as McDonnell.

So the strategy should be to form an alternative within Labour that sits between the McDonnell position and the Blairites, based upon sound fiscal policy strategies and putting banks firmly back in a box.

“They won’t. The ‘advisory committee’ is dyed in the wool Neo Keynesian. Blanchflower is talking about NGDP targeting for example.”

Well, the policy stance of Labour had to be changed if the economists (appointed after McDonnell had committed Labour to the fiscal charter for tactical reasons) are to have any useful input. As no economist can support the fiscal charter.

So we all agree there. Now will they come around to MMT views? Well, MMT is largely a question of how to frame economic discours. And putting more emphasis on accounting identities, I would think. It is not completely new economics.

So it is a new language to be spoken, which McDonnell so far refuses to speak. Keeping on about how Labour are not “deficit deniers”.

Now, NGDP targeting as an aim for a central bank to aim at is not incompatible with MMT. In fact a nomincal GDP target might only be reached if PQE or helicopter money will go ahead. There will not be any other way to reach a NGDP target. In fact monetarist economists who favour NGDP targetting (such as Beckworth) has said as much.

To run deficits to reach an NGDP target in the UK could prove impossible, just by increasing government borrowing.

Also, everyone of the economists knows that a large debt overhang is a real problem to the UK economy (private sector mainly), and that just by the private sector or state sector borrowing more the issues cannot be solved.

Neither can the inequality problem, with the large walth concntrated at teh 0.1% level.

So give these economists some time, I think they will use some MMT principles in their advice, without calling it MMT in the end.

@bill

“They deserve all the pillory they get.”

That is too harsh a view. McDonnell is shadow chancellor of the exchequer, and all of a sudden he has to come up with a valid macroeconomic strategy for the country.

It is all of a sudden, because about one months or two months ago it would have been unthinkable that he is ever in that position. The height of his political ambition up to then would have been to stop a 3rd runway at Heathrow, the constituency for which he is MP. Now he could potentially be the most important politician after the PM, were they elected in 2020.

Cut McDonnell some slack, for a few months, until he finds his feet, there is no harm in reversing cuts to inheritance tax or higher taxation, which would also “eliminate the deficit” whilst at the same time reducing inequality. But I agree, that McDonnell is on a steep learning curve, as are, hopefully, the economists advising him!

Hello… When are we going to get some MMT people on the TV?

Anyway, I’m more or less economically ignorant, but whenever I watch Tory MPs repeating “labor reckless” “reduce deficit” this is what I always think:

(1) “Public sector debt = Net private sector savings” (including foreigners in the private sector) Someone in the public eye needs to re-frame the debate: every time they talk about public sector debt they should not say “public sector debt” but instead say “net private sector savings”. So much of this is based upon the emotional impact of the word debt – if you force the BBC to acknowledge that these two words refer to the same thing the rhetoric would lose its power.

(2) “Britain is not a household, but if it were, it would be in good shape to borrow more” Debt levels about three times tax earnings at a negative interest rate, better than most people’s mortgages.

(3) “The largest owner of British government debt is the British government itself – the government has been lending itself money, and paying itself interest. If I were able to lend myself money, should I have to worry about paying myself back?”

Are those basically good points? If so, why won’t anyone make them?

Bill,

I think it is desperation here in Britain that causes people to want to ‘cut the Labour Party some slack.’ The desperation of those living, effectively in a one party state that pretends it is a democracy. The hope might be misplaced but it has to go somewhere! People (mentally ill/vulnerable/poor) are being vilified and turned into social pariahs buy some of the vilest bunch of thugs we’ve seen in power for some time. We’re back to the 19th Century when unemployment was seen as ‘voluntary’ and we even have deaths that are directly attributable to benefit cuts and systematic hounding of claimants. Not sure what the Australian scene is in this respect but its’s pretty bad round here! Britannia is a cultural and intellectual wasteland with a zombified media and a generalised narcolepsy. I think we can expect worsening mental health; rise of extremism through misdirected anger (hate crimes are on the increase with anti-semitism and islamophobia) – not many light bulbs going on in peoples’ heads.

Some Guy,

“It is very, very common to wildly exaggerate the power of “capital” or “the market”, the power, extent and influence of international trade and finance, the foreign sector”

Those words, “Capital” and “the market” strike fear into a lot of people. In Redcar they feel it in their souls as well as their pockets – they live (and die) by the repercussions of their impact . They know the benefits that they bring and they know the suffering they inflict, so they would be very pleased to hear some of the practical suggestions that flow from your ideological perspective.

They realise that political policy can promise a solution to their dilemma; a fate that has recurred distressingly often over many generations, and not just in steel. They know also that politician’s promises cannot be relied upon, no matter how sincerely stated – they are the currency of their profession that is easily devalued.

The ordinary voter may be largely ignorant of economic principles, but their antenna can eventually detect implausibility. That is why, despite the harshness of Capitalism and the Market they accept the arbitrariness that is implied in preference to the implausible duality of political statements.

So, by all means castigate and denigrate the party on the other side of the parliamentary chamber, but be careful of your answer; there are a few people up here in this neck of the woods who know what happens when plausibility meets practicality face to face.

and macro, macroeconomics will tear us apart again!

god damn auto spell that was meant to be macroeconomics, but I suppose it could have certain resonances with the field. it does beg the question has microeconomics managed to impose its self above macroeconomics on apples spell check? a new level of propaganda

Would someone like to translate Whiteblob’s comments into plain English.

Judging by the Headlines in The Northern Echo this morning the dialogue in this blog is very much a macro issue that has widespread implications.

Wouldn’t you call a transition from an industrial economy into a largely service orientated one a macro issue. It may have been going on for some time but its trend implications will affect the economy and political policy as a whole for a long time yet.

There may be a small chink of hope in that McDonell wants to achieve the right result for the collective majority. He stated that he would swim through vomit to vote against the welfare cuts bill, and stated that he saw the fiscal charter as a charter for cuts. He said that politicians needed to learn some humility after his own error.

The will to do the right thing, and the ability to see his own mistakes and learn, makes him open to new ideas.

If all he needs is to learn MMT, that is a better position than those carpet baggers who want to work for the finance industry and global corps, and only hear what they want to hear.

Neil Wilsons point that his advisors are not helpful is depressing however. I did note that one of Corbyns friends was in attendance at the talk in London in August at the School of Hygiene (Kelvin Hopkins). I am sure there is an interest in MMT, but this may need pushing by others.

Any MMTers here ever thought of creating a financial account where you’ve credited the value of our heritage of productive capability and the total of the communal nature our national assets and then debited those never extinguished assets into the bank accounts of individuals on a monthly dividend basis? As I said MMT is Social Credit for the government…which is all well and god, but why not extend its policies all the way to the individual???

Steve. Isn’t it an asset debit on the State’s books ?

Matt,

That’d make more sense if you’d put pejorative quotes around the word “knows”.

It’s only so-called state sector borrowing (more accurately, deficits) that can solve the problem of the private sector debt overhang.

@Zoltan

Yes I agree humility and an ethic of graciousness and willing integration regarding economics and monetary system theories is exactly what is called for. That’s actually true for virtually every intellectual pursuit. With all due humility 🙂 , as integration is the very process of Wisdom, and Wisdom has millenially been valued as the best guide for both self development and outward policy…its pinnacle concept would seem to be the most personally edifying and systemically excellent and functional “thing” to contemplate. All of the World’s major Wisdom traditions speak of a graceful oneness and flow. Perhaps thoroughly integrating the psychological aspects of grace would give us a Wisdomics or Gracenomics instead of a fragmented and overly contentious mere economics and money system.

There are two very important things to understand here.

One others have pointed out the new labour leadership and politicians in general

do not understand MMT.Their grasp of economics is little better than the average man

they defer to the economics profession .The labour leadership to the progressive side

of that profession which like the profession as a whole disagree with MMT.They may

accept the accounting identities ,but deny their significance and the veracity of the

MMT proscriptions which follow from them.They think that if the government have to issue

if bonds to match deficits they are beholden to bond investors.They think if wages rise

sharply that prices will rise too(they have a point)

Secondly -there is another point which no one seems to have made.Those eligible for electing

the new labour leader has given Mr Corbyn more support than any other labour leader BUT

he has virtually ZERO support from his mp’s .He only got sufficient nominations by those

wishing a fuller debate.To say this puts him into a difficult position is a master of understatement.

It is regrettable that the new labour leader and his shadow chancellor are as stupid and useless

as they are but their failure to grasp MMT is not a surprise.

The central counter argument to pursue is the household analogy is not applicable.

The government is not the nation.

The goal is for a national private sector surplus (but let us not pretend we know people’s

saving desires or such desires determine outcomes)

All this is of course just a framework for the pursuit of a more egalitarian society for

true progressives (here tax and spend are crucial) and here I hope MMTiers can lower

themselves to find some common ground with the new labor leadership.

BUT functional finance is absolutely right the idea that a government sector surplus

is a policy goal is just plain dumb and any policy framing by the Labour Party in that

direction is plain dumb and a massive own goal (giving a stick for your opponents to

beat you with and they will beat you without mercy)

Having said all that I quite like Mr Corbyn he may be a bit useless but he does appear

to be quite incorruptible and it is corruption that lies at the heart of the political economic

malaise.

At base MMT teaches that Neoliberalism is a Split Personality Disorder.

So, for example, to encourage hard work Neoliberals would have the poor paid less and the rich more.

This culminates in the slow recovery from the Great Recession because lack of purchasing power for consumers has led to a lack of pricing power for companies.

The majority of British people and their politicians are a long way from discovering they suffer from a form of mental illness in supporting Neoliberal ideology. A very small chink of hope has emerged with the new Labour Party leadership but they need to be encouraged to recognise their cognitive illness.

A suggestion: I agree the UK and the US require a new approach. If they took the idea to both the public and the small business community that placing more money directly into the hands of the consumer would be in both of their interests….and then started a coordinated grass roots movement to communicate this mutual interest, maybe they could interest them in an alternative to monetary austerity, change the all too common and attending self blaming puritan obsession toward having to earn one’s keep…when sufficient jobs are not going to be forthcoming anyway and finally herd the entirety of the political apparatus toward an alternative.