I have been a consistent critic of the way in which the British Labour Party,…

The non-austerity British Labour party and reality – Part 2

In Part 1 of this two-part blog I laid out a general analytical framework for considering fiscal rules that might allow governments to borrow for infrastructure as long as all current expenditure is at least matched by taxation and other current receipts. This is more or less the rule that the British ‘Charter of Budget Responsibility’ imposes and the approach that the new (previously called radical left) British Labour Party leadership aspires to obey. I use previously called ‘radical left’ advisedly because as the days pass the utterances of the economic leadership make it difficult to differentiate between Labour and the Tories. The main difference appears to be the worn out “we will tax the rich and the crafty tax dodgers to balance the budget”. A nonsensical stance for a progressive political force and verges on Game Over syndrome. John McDonnell’s presentation to the National Labour Conference yesterday was a further walk into obscurity. By claiming they are not “deficit deniers” and will close the deficit as a priority they have walked right through the Tory framing door. Not lingered on the doorstep and then sought more salubrious premises. But they are right inside – trapped into the same mantra – yes, they will cut the deficit but it will be a fairer cutting. The rich will pay. And pigs might fly.

Part 1 – British Labour Party is mad to sign up to the ‘Charter of Budget Responsibility’.

In his – Speech by John McDonnell to Labour Party Annual Conference – yesterday (September 29, 2015), the Shadow Chancellor said that British labour would stand for:

Straight talking, honest politics.

He then focused on a Labour government that would reject austerity. He said that the human damage of austerity should be recognised and that:

Austerity is not an economic necessity, it’s a political choice. The leadership of the Conservative Party made a conscious decision six years ago that the very richest would be protected and it wouldn’t be those who caused the economic crisis, who would pay for it.

Then he said that by comparison with the Tories:

Unlike them, we will not tackle the deficit on the backs of middle and low earners and especially by attacking the poorest in our society.

We have always prided ourselves on being a fair and compassionate people in this country and we are.

We will tackle the deficit fairly and we can do it …

We will strategically invest in the key industries and sectors that will deliver the sustainable long term economic growth this country needs …

Labour’s plan to balance the books will be aggressive.

We will force people like Starbucks, Vodafone, Amazon and Google and all the others to pay their fair share of taxes.

Where money needs to be raised it will be raised from fairer, more progressive taxation.

If you read this without reading the UK Guardian article I discussed yesterday in Part 1 – John McDonnell: Labour will match Osborne and live within our means – you would be a little lost.

Even in that Guardian report about McDonnell’s intentions you would be somewhat confused by the loose usage of terms, which, in fact, have rather exact meanings.

So on face value this says that:

1. Jeremy Corbyn’s labour are inflicted with deficit fetishism – whether it is because they believe the myths or just want to put out political fires is beside the point – they are buying into the neo-liberal framing despite saying they would be engaging in “Straight talking, honest politics”.

They have blithely accepted that the deficit has to be eventually wiped out because “Labour will always ensure that this country lives within its means”.

Yesterday’s blog analysed the association between a financial ratio or statistic such as the measured fiscal deficit and what we might reasonably call the ‘means’ available to a currency-issuing government to advance well-being.

John McDonnell’s use of the term and inferences about its importance is straight neo-liberal.

This is despite hi saying in his speech that Labour will be a “radical departure not just from neoliberalism”. That is definitely not “Straight talking, honest politics”.

2. They will engender growth through investment in public infrastructure as if that will be sufficient to achieve and sustain full employment. Where is the price anchor going to come from?

3. They believe that taxation (however the burden is distributed) raised money for the government which allows it to spend.

This is the household analogy all over again. Nothing radical at all.

Please read my blog – Taxpayers do not fund anything – for more discussion on this point.

4. What he means by deficit and austerity is unclear but the partner article suggests he is really talking about balancing the current fiscal balance (difference between current spending and receipts) which is, in turn, cyclically-adjusted to take out the automatic stabiliser component and will borrow to fund the infrastructure deficit (see Part 1 from yesterday).

But the public would be forgiven for assuming that he is referring to the deficit – the overall reported fiscal balance and will use taxation to allow for greater spending (on public investment, for example).

His speech certainly used the terms loosely and I think this opaqueness doesn’t help.

Is Labour under Jeremy Corbyn going to balance the overall deficit or just the cyclically-adjusted current fiscal balance?

Is Labour under Jeremy Corbyn prepared to maintain levels of public investment that are sufficient to full employ the workforce on an on-going basis and how will he ensure that the public debt ratio would be held at levels below those prevailing in 2016-17?

Has he really done the sums that will ensure that level of stimulus concentrated on public infrastructure is possible (not in a financial sense but in a practical sense)? I doubt it.

I also doubt that an on-going rate of growth in public investment sufficient to smooth the economic cycle and maintain levels of output that would fully employ the workforce is possible. It implies an ever growing public capital goods sector when the reality is that the growth areas will be in personal care services and the tertiary services.

5. What does he actually mean by austerity? The implication he thinks it is a distributional matter – that cutting the fiscal deficit is fine as long as the rich are losing purchasing power and the poor and middle classes lose less purchasing power proportionately) via taxation.

But while austerity has distributional impacts it is not really about equity when macroeconomists use the term.

I touched on this matter yesterday and also in this blog – Jeremy Corbyn’s ‘New Politics’ must not include lying about fiscal deficits.

Austerity occurs when the government runs deficits that are too small relative to the spending and saving decisions of the non-government sector.

In this context, it is moot where the revenue comes from. The impacts of running insufficient fiscal deficits usually does impact on the poor and disadvantaged, most notably, because it causes mass unemployment and/or underemployment. And I don’t diminish the concern we should have for those distributional consequences.

But from a macroeconomics perspective that is not the point. Austerity is about the sufficiency of the deficit contribution to total spending and national income generation.

So in what sense is a fiscal balance of zero appropriate?

Britain will not generate large external surpluses in the foreseeable future, which means the only way that the private debt situation can be brought under control without driving the economy back into recession, is for the government to increase its fiscal deficit.

Now if they plan to balance the ‘current’ fiscal position, then all the work has to be done by the capital component. That imposes a rigidity that might be impossible to maintain and ensure effective use of public resource utilisation.

How does Jeremy Corbyn propose that Britain will create external surpluses that are of sufficient magnitude to meet the desires of the private domestic sector to net save, while at the same time, ensuring overall spending is sufficient to achieve full employment and allow the government sufficient spending scope to provide first-class public services and robust public infrastructure development?

Given history and the current circumstances, I would think an on-going fiscal deficit – larger than it is now – is the correct strategy if the well-being of the British people is to be advanced.

But where the plan fails is that I do not think the capital fiscal balance can do all the work. Further, there is no inflation anchor in this sort of approach.

What happens if the necessary net spending in the economy sufficient to generate full employment is beyond the capital goods sector’s capacity to supply the necessary output and employment to meet the on-going growth in public investment spending? Well inflation happens and John McDonnell presents no solution to that problem.

There are many problems with the use of the ‘Golden Rule’, which effectively John McDonnell claims Labour will sign up for – a la Gordon Brown.

The one advantage is that public investment expenditure does not have to be used in a counter-cyclical manner – cutting when non-government activity is declining – to meet pre-conceived fiscal balance targets.

The cuts to public investment in the 1990s in many European countries as they struggled to meet the convergence criteria that would allow them to enter the final stage of the shift to the common currency were particularly damaging.

It not only undermines current economic activity and pushes up unemployment but by slowing the rate of capital accumulation it also undermines the future growth potential.

In political terms, it is much easier to cut capital expenditure than current expenditure, the latter being more directly noticable for voters on a daily basis (pensions etc).

So within the neo-liberal cutting ideology, the Golden Rule thus might remove the bias against public investment.

But then why isn’t Labour rejecting this ideology outright and educating the public about the capacities of a currency-issuing government and the opportunities those capacities provide?

Proponents of the Golden Rule also appeal to its equity advantages whereby the public expenditure is steadily finances over time as the debt is repaid, which means there is a better matching of who receives the benefits from the services flowing from the infrastructure and who pays for it.

Clearly, once we grasp the essentials of Modern Monetary Theory (MMT) we know that this claimed matching of costs and benefits overtime is somewhat misleading.

The true ‘cost’ of providing public infrastructure is not the flow of financial outlays (including interest payments) over time but the real resources that are deployed to construct and maintain the infrastructure.

For most projects, the cost is mostly incurred upfront in the construction phase, which means the current or near generations still end up bearing most of the costs.

What is capital spending?

Then we get into demarcation issues as to what should be classified as net investment spending. While the split between current and capital is normally defined as some time period in which the benefits of the spending are exhausted (less than or more than 12 months usually), it is more sensible to think of capital expenditure as that which improves the potential productive capacity of the economy.

MMT conceives of productivity much more broadly than the narrow concept that neo-liberals focus on. Productivity is not just the contribution an input makes to the private profit bottom line.

When discussing the Job Guarantee, for example, I often make the point that there is inherent productivity in such a job because the children get to see their parents leave homein the morning and go to work – thus avoiding the well-researched intergenerational disadvantages that children endure from growing up in a jobless household.

So productivity is a very broad term in my view.

This leads me to suggest that the definition of productive capital should also be very broad? One could make a strong case to include much of the spending on health, education, research and development along with spending on bridges, transport and other physical capital.

For example, the public investment in the education of its population delivers massive social and private returns over the person’s lifetime. Why is that not capital expenditure?

If education and health expenditure on teachers and nurses and libraries and books, for example, are considered as current spending, then the Golden Rule biases total public spending against it in favour of ‘building bridges’, which might be a poor use of the society’s real resources.

The bias towards physical infrastructure and financial assets is reflected in what governments put in their so-called financial statements – specifically their balance sheets or statements of financial position.

Consistent with World practice, the British National Audit Office (NAO) publishes a – Whole of Government Accounts – the most recent being for 2013-14 published on March 26, 2015.

The NAO says that the:

WGA is one part of a wider set of processes which the Treasury uses to manage risks to the public finances … The WGA has the potential to help the Treasury manage longer-term risks to the Government’s assets and liabilities. These do not feature as prominently in these other frameworks as they tend to focus on Government spending, cash requirements or individual, rather than overall, financial assets and liabilities. The WGA is already being used to help manage these longer terms risks. For example, the Office for Budget Responsibility draws on the WGA, among other sources, in its consideration of the risks to the sustainability of public finances when developing its long-term projections of Government spending and receipts

Neo-liberal commentators use this information to judge, according to their faulty logic, whether a government is insolvent or not. This approach is just another string in their anti-government bow, which builds on the deficit and debt hysteria.

Two aggregates are assembled – net worth and net financial worth. The former is the difference between total measured assets and liabilities.

What sort of assets are included? Public land and buildings, infrastructure, plant and equipment, etc. The liabilities typically include outstanding government debt, future liabilities (for example, superannuation for government workers).

They use net financial worth as a measure because many physical assets cannot be easily sold for cash. This measure is the one that commentators use to judge the so-called ‘financial viability’ of government.

For Britain, the National Audit Office estimated the net worth to be negative:

The Government’s net liabilities (the shortfall between asset and liabilities) increased to £1,851 billion as at 31 March 2014 from £1,627.9 billion at 31 March 2013, largely due to increases in public sector pension liabilities of £130 billion and Government borrowing of £99.9 billion.

Oh dear! As a result of the “reduction in public sector staff numbers” that formed part of George Osborne’s first attempt at austerity, the net liabilities did not rise as much as they might have.

That is how screwy these ratios are – an improvement or a lesser deterioration corresponds to creating unemployment!

The British Office of National Statistics also publishes an annual – National Balance Sheet, 2014 – (last published November 20, 2014). It claims that the:

The National Balance Sheet is a measure of the wealth, or total net worth, of the UK. It shows the estimated market value of net financial worth, for example shares and deposits, and non- financial assets, for example dwellings and machinery. Market value is an estimate of how much these assets would sell for, if sold on the market.

According to the latest data the British government was thoroughly broke in 2013! Its total financial assets amount to £512,589 million whereas its total financial liabilities amount to £1,637,669 million given a net financial worth of £1,125,080 million.

I should add that this figure has been negative since the data was first published in 1994!

The same applies for Australia and elsewhere.

The conservatives claim that this signals that the government is insolvent because if it liquidated all its assets it would still not be able to meet its liabilities.

But of course, the government is not a household nor is it a financial corporation – both of which are always financially constrained in their spending.

The British government could liquidate all its liabilities whenever it wanted to – although such an action would not be sensible. But the capacity is there to do it.

Even the conservatives admit that a government is not a corporation – because according to them it has the taxation powers. They then wade in with their usual nonsense about the damages of taxation.

The point is that if Labour broadened what it would consider to be capital expenditure then the Golden Rule is less rigid than otherwise.

The whole framework is based on a false notion that taxes and bond-issuance fund government spending. But even with that obvious observation, Labour could overcome some of the obvious problems of relying on capital infrastructure spending to drive the necessary growth to keep the current balance at zero and maintain full employment.

But then they would not have a chance of keeping the public debt ratio below the 2016-17 level, given McDonnell is committed to issuing public debt to match the capital deficit.

He could get around that by avoiding debt issuance altogether and instructing the Bank of England to honour all cheques HM Treasury issues but if they are prepared to embrace that then they should just be able to abandon the whole charade and admit that the deficit (current, capital, whatever) is a ridiculous financial balance to target and obsess about.

Some data considerations

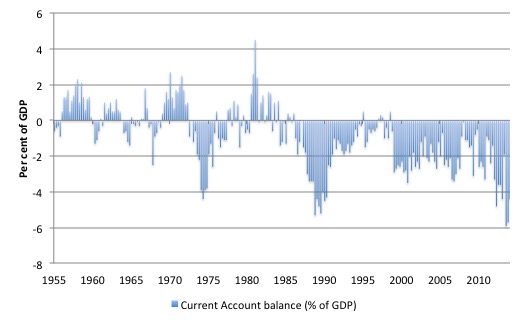

For context, the following graph shows the external balance (as a per cent of GDP) for Britain from 1955 to 2014. Prior to the OPEC oil crisis, Britain usually ran an external surplus with exceptions. This was true even if we went back to the 1920s, bar the Second World War period.

This means that after the mid-1970s, for the private domestic sector to save overall, the public sector had to be in deficit overall of varying magnitudes.

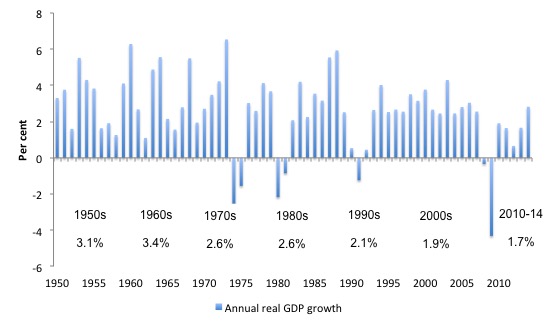

Also for context is the following graph, which shows average annual real GDP growth since 1948.

The numbers corresponding to the decades (1950s etc) are the average growth rates for the periods. The last entry is from 2010 to 2014.

The pattern shown is similar for most advanced nations. The Post World War II period initially spawned high real GDP growth rates with strong productivity growth and real wages growth. National government fiscal deficits were the norm and supported strong private spending and saving patterns.

That all came to an end once Monetarism antagonism to fiscal activism took hold in the 1970s and deregulation was pursued, first with large-scale privatisation, then attacks on the unions, and then full-scale financial market and labour market changes.

The growth performance of the economy started to slide (as did productivity growth). As the neo-liberal policy mentality firmed in more recent decades growth took a further step downwards and politicians claim success at growth rates that are nearly 50 per cent below what was the norm during the Keynesian period.

The period since 2010 in the UK has been a relative disaster in this sense.

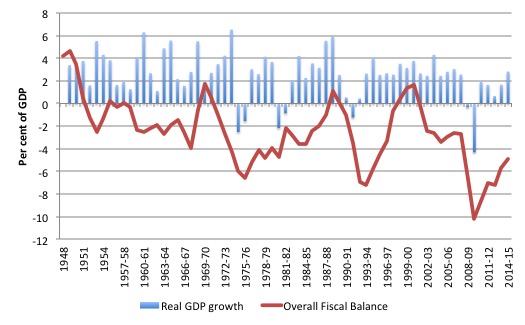

The next graph shows the overall fiscal balance (the sum of the current and capital balances) as a per cent of GDP since 1948 for Britain (red line) and annual real GDP growth (blue bars). The GDP growth is not aligned against financial years in Britain (March to April) which alters the perception of lags a little but to no great extent.

The fiscal balance is written as Total Public sector receipts minus total public sector expenditure and so a positive number is a surplus.

You can see the in the Government achieved a fiscal surplus in 1969-70 and a declining surplus in 1970-71 with Roy Jenkins as Chancellor under Harold Wilson.

While Jenkins was very socially liberal he was the first real austerity wielding Labour Chancellor hiking taxes in 1968 and again later in 1968 and again in 1969 as Britain struggled in vain to remain in the Bretton Woods system.

That surplus was short-lived and a major recession followed in 1974 and 1975.

Recession also soon followed the next period of fiscal surplus under the Chancellorship of Nigel Lawson and the financial crisis followed Gordon Brown’s fiscal squeeze.

These surpluses were recorded as the external deficit was increasing, which meant they were also associated with rising private domestic indebtedness.

The accumulation of that position ultimately has caused the period of appalling economic performance since the GFC. The real GDP growth that was recorded under Brown’s period as Chancellor was driven by unsustainable private debt accumulation.

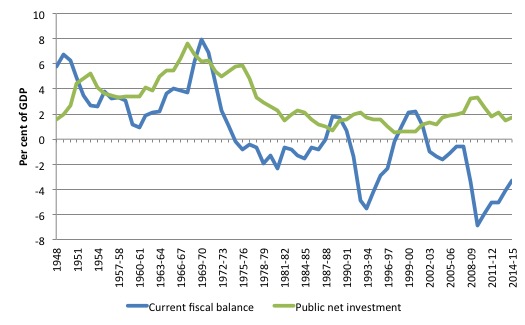

The next graph then shows the Current fiscal balance for Britain (as a per cent of GDP) and Public sector net investment (as a per cent of GDP) since 1948.

Two things are very obvious.

1. Public net investment as a share of the economy has fallen dramatically in the neo-liberal years (as discussed above it was easier to cut than current spending). This drop has coincided with the slow down in real GDP growth and has, in part, caused that.

Please read my blog – The damage of the Thatcher sea-change – for more discussion on this point.

2. The current fiscal balance has fluctuated substantially but is now substantially in deficit.

So a case can be made that John McDonnell has a fair amount of ‘room’ to operate in given how low the public investment ratio is. But if he is also wanting to reduce the public debt ratio (as per the ‘Charter of Budget Responsibility’) then the scope is extremely limited, especially as he will have to keep issuing debt to match the current deficit that he will inherit later in the decade if elected.

But then he also will have a major job on his ‘non-austerity’ hands if he thinks he can drive growth fast enough or tax the rich hard enough to close the current fiscal deficit without cutting current spending significantly.

In 2014-15, the Office for Budget Responsibility reported total Public sector current receipts at £646 billion (35.8 per cent of GDP), Public sector current expenditure including interest payments was £669.3 billion (37 per cent of GDP), Depreciation on ‘used up’ capital was £37.4 billion (2.1 per cent of GDP) which gave ‘Current Budget Deficit’ of £59.8 billion (3.3 per cent of GDP).

The reported figure was £56.9 billion (there is some internal inconsistency in the data provided).

Even on current estimates the ‘Current Budget Deficit’ will be £38.7 billion in 2019-20, when Jeremy Corbyn will take office if elected.

Public sector net investment was only £30.4 billion in 2014-15 or 1.7 per cent of GDP.

Overall, the fiscal deficit was £87.3 billion or 5 per cent of GDP (adding the capital and the current balances).

Conclusion

We can conduct arithmetic projection experiments to our hearts content but they essentially avoid the main issue.

All this talk about “deficit denial”, “living within our means”, “getting the budget back into balance” is irrelevant once we understand the capacities of the British government and the problems that a focus on the ‘deficit numbers’ brings.

I doubt they will be able to achieve sustained growth, full employment, stable inflation, a balanced current fiscal position and keep the public debt ratio stable or reduce it.

I do not think the capital expenditure opportunities exist to rely on ever increasing growth in public net investment for sustaining full employment.

The real challenge facing British Labour is the political one that they have been caught in the neo-liberal framing trap. They want to be anti-austerity but they also want to pursue the fiscal targets that only make sense if one is wedded to the austerity mindset.

It is starting to look like the trap Syriza set for itself – anti-austerity yet stay in the Eurozone. That couldn’t be done politically.

I could write a lot more but time is short today.

I also recommend reading Neil Wilson’s analysis – Corbynomics and the Current Budget Balance – which covers additional issues.

That is enough for today!

(c) Copyright 2015 William Mitchell. All Rights Reserved.

Disagree with almost everything in this article.

The children get to see their mother travelling back and forth to a corporatist job designed to give the excuse of motion so as to consume external mercantile goods.

Bill is yet another headless man of the woods.

A man who likes us all to go and work for the machine and its endless exponential depreciation.

The function of production is consumption.

There may be a chronic lack of fairness in the UK but it having difficulty absorbing the present (mainly Eu28) surplus.

UK goods deficit with the EU 28 2011 -2014 ,in £

40 billion

56 billion

68 billion

76 billion…..

The great question is why work for something that is free ?

http://www.gracesguide.co.uk/Black's_of_Greenock

The best quality tents in the British market is now a company with Swedish origins (Hilldeberg )

Its manufacturing is done in Estonia.

This is a good example of how the present supply chain operates.

The depression of the early 80s was a deliberate policy so as to adjust the UKs economy

for mainly European mercantilism and its surplus.

PS – I have recently come to acquire a old blacks tent from the early 1970s.

Its fabric quality is the best I have ever seen in a tent.

It was not a cheap product although its design made it difficult to put up in a storm or while drunk……..

Anyhow it remains a real cracker of a object and will become a cherished and well used item.

The Irish landlord agents have just announced a 27 billion “capital plan”.

Why not give 27billion to people so as to reduce their mortgage.

This will prevent the need for both mother and/ or father to work in modern satanic mills.

As a added benefit ( if you believe in such things) it will reduce greenhouse gases massively as diesel cars needed for the communte to non jobs will not be needed.

No need to build more roads.

The roads will be empty you see……..

I’m slowly coming round to Larry’s view on this but, as always reserve the right to flip-flop. Don’t we need to have some regard for the internal battle that is going on within the Labour party?

All economists today (headless men of the woods) think you must work or speculate to gain access to the industrial surplus.

Work or speculation is forced on you given the absurd dynamics of the finance capitalistic system but this slavery is very much contrived from the top down.

@the dork of cork

What is it that you disagree with in the article.bill says he has a broad view of productive investment,which should include education, healthcare,research and development.

Highlighting the need social care and tertiary services.

There is sufficient resource space and sufficient levels of unemployment in the economy to facilitate all this.And a demand deficit which can be countered through a fiscal deficit to meet all those spending goals,described above.

Yes the UK can continue to run a trade deficit with the EU28,yes there are sectors which we don’t really need to invest in as we can import and consume from the continent.But we still have a public purpose to pursue and Other needs that german/Swedish/Estonian goods don’t meet,and living standard to improve for low to low/middle income earners to improve(and those who can’t work)

So how can you characterise those as endorsing endless work for ‘the machine’

As an aside the two main physical infrastructure the government should invest in to lower the cost of living and improve living standards would be to invest in Britain’s non-pollutive energy production capacity and in social housing (high quality energy efficient housing).

‘Don’t we need to have some regard for the internal battle that is going on within the Labour party?”

I don’t think we do. Ultimately they were wrong at the general election and lost, and they were wrong on the leadership and lost. Game over as far as I can see.

I like Jeremy Corbyn a lot. His approach is spot on, but we need to get McDonnell around to telling the truth. If “Straight talking. Honest Politics” is to mean anything then the trick has to be revealed. You can’t have Wren Lewis et al going around pushing the ‘noble lie’ – which is primarily about ennobling the economist priest class.

There is no reason to pay government money to bond holders – particularly as over 50% of them are foreigners. If the banks spread widen too far because they are are no longer being subsidised, then you simply get the National Investment Bank to issue loans at the price you want to see. The commercial banks compete or lose market share.

Why mess around in the middle ground jiggling interest rates? There is no need to do things indirectly when you can go straight for the jugular.

I’m going to join Labour Members . net to try and see if there is any desire amongst members for an affiliated MMT group to try and influence economc policy.

Agree with Neil also.

Every single iota about “living within means”, “balancing budget” should be deconstructed and shown up for what it is.

The language should be attacked not embraced then later clarified. (Even this said Corbyn is so much better than anything).

Cameron, Osborne should be challenged about what this ‘balance’ really means with an eye to juxtaposing taxing to balance a government balance sheet versus investing to maintain adequate private wealth (if not growing it). The math says you cant do both. As per usual Bill has done a wonderful job even by showing the sectorial balances of such realities.

All this is just meaningless shouting into empty space. A cacophony of echoes.

You can have whatever color of government you like along with whatever fake hero leads it.They are just puppets dancing to the tune played by the plutocracy.

Get rid of the plutocrats by any available means and you might make some progress.

Ultimately the plutocrats,as always, will self destruct but they will drag everybody else down with them.

“try and see if there is any desire amongst members for an affiliated MMT group to try and influence economc policy.”

Ask them if they are happy as Labour supporters to have an economic policy that *requires* 5% of the population in permanent unemployment and penury, with an economy managed by maintaining people constantly in debt.

Because that is what Pettifor, Stilgitz and Wren-Lewis stand for.

MMT means no unemployment and no under-employment. Nobody who wants a job short of one. Nobody with less than full hours. Everybody at the living wage.

It also means less debt and more savings – better distributed. Not by ‘soaking the rich’ but by forcing the assets they own to compete and provide the best value for money for consumers. Make the rich fight for their wealth in the white heat of competition.

Jobs add to costs of production.

We have come to the point where we cannot remotely afford to consume industrial products.

This cannot be denied.

We must have inflation in the current monopoly of credit system but if we junk it we can have deflation for all.

“It also means less debt and more savings”

This is a major problem with MMT. Far too many supporter make statements like this.

Less debt and more savings is impossible. If you mean less non Govt debt say it. One party can not save unless another party takes on debt. The non Govt sector NET SAVING = Govt debt.

The brainwashing that debt is bad bad bad goes so deep. It’s no wonder politicians and the public are confused.

I have also been toying of with the idea of joining but McDonnell’s recent tactics to choose to have his economic policy framed within the neoliberal framework has annoyed me – there is no need for these tactics with 4 years to educate on the true nature of deficits and surpluses.

Corbyn and McDonnell are only where they are because they tell the truth as they see it. They cannot win the argument by telling lies. How can they repeal a ludicrous charter if they have agreed with the premise, even if it for political expediency?

Tell the truth or lose.

Neil,

If the electorate was convinced that large state owned enterprises, for example, would singularly fight for their survival in the white heat of competition (in contrast to the mid 1960’s torpor) it might actually be game over; or are you working on a completely different set of economic values than we have experienced since the industrial revolution?

“There is no reason to pay government money to bond holders – particularly as over 50% of them are foreigners.”

I disagree.

If the UK runs a current account deficit. Bonds give the holders of these £s an option to invest in. It also gives the likes of pension funds a safe interest earning asset to hold.

But I think you have fallen into your debt is bad trap again. Interest on Govt debt is created by a JE for a monetary sovereign Govt like the UK. This irrelevant interest expense journal is essential interest revenue for the holders of this debt. UK Govt interest payments make us all wealthier. Why throw it away chasing the balanced budget, debt is bad, dangerous nonsense.

@Mike

“Tell the truth or lose.”

Which is?

“Tell the truth or lose”

Devils advocate here but….

Is he saying ‘I’m not a deficit denier’ not telling the truth ?

Or is he saying ‘Give me something I can work with ? Who have you guys convinced so far ? Do better. Why should I risk what has been gained on the strength of what you think you know ? Stop telling me what not to say and convince me’

@ Andy,

I would argue the accusation of “deficit-denier” has to be met head on. I’d be saying something like:

“WTF is a ‘deficit denier’ anyway? Is anyone denying the UK and US governments spend more back into their economies than they receive in taxation revenue? No-one is. Also no-one is denying that at times when the government is in surplus then everyone else is in deficit. Someone has always to be in deficit. What is there to deny?

We try to be deficit comprehenders. We try to understand and explain why a sovereign government like the UK can be in deficit for an extended period of time and why the bailiffs aren’t knocking on the door demanding an immediate repayment of all loans.” etc etc

I think the charge of lying is absurd.The fact that chartalism seems so convincing to me

does not make it so for everyone.EVen RJ here does not see debt in the context of vertical

transactions as fundamentally different from debt amongst horizontal transactions .IOU’s are

IOU’s to him for me context is everything and IOUs from monetary sovereigns are qualitvely

different than IOUs from non sovereigns.

All that is largely semantics I am sure we both recognize the monetary power of the state.

My point even amongst people who would frame the deficit issue very differently than the consensus

there is a difference in nuance.The real problem as explained by BILL is the new labour position

will not work in practice they will not be able to oppose austerity and balance the current account

then something will have to give.They may learn by doing they may if the economy generally plods

along and there is no downturn not have a chance of government.There is still so much that is

refreshing in Corbynmania not least a leader of a potential party of government who I truly believe

is not corrupted by wealth and power.

Engage in debate as he suggests.Engage with mutual respect and humility.Make the arguments.

Evangelize for chartalism.Policy is being debated in the Labour Party.

“context is everything … vertical transactions as fundamentally different from debt amongst horizontal transactions”

Content is everything to me too. There isn’t any REAL difference at as regards my comments above. I know when the difference has an impact and when it doesn’t. I think too many understand not by understanding the logic but by understanding by memory. So yes reserves and bank credit are different but the impact of this difference sometimes applies and other times it doesn’t. Many do not fully understand this difference.

You can see this clearly by following the journal entries. They are simple. And starting with no levels. So we all have an account at the BoE and no other banks or notes and coins exist. Then add the banks in and two levels and see the difference.

I stand by comments above

-Debt free money is not possible

-Savings are not possible without increased debt

-Funding Govt deficits with reserves is effectively no different to funding with bonds EXCEPT the impact it has on bank credit.

-More Govt debt is good not bad. In fact it’s essential now in the West. Without it the West will collapse as increasing debt is need to increase savings as we age AND TO GENERATE ONGOING TOTAL COMPANY PROFITS. Otherwise one companies profit will be at the expense of another entities loss.

MMT would be best to drop terms like horizontal and vertical transactions if they ever want to win this battle with the public and politicians (it’s hard enough for the public to understand without making it even more complex).

Use terms that mean something like

-Reserves = level 1 money = the banks and Govt’s money.

-Bank credit = level 2 money = our money.

-Notes and coins = level 3 money = a token for bank credit.

Levels have been set up to allow competition between more than one bank and for bank credit to be transferred outside the banks.

” ‘I’m not a deficit denier’ not telling the truth ?”

Its an idiotic statement. Suggesting unfortunately that McDonnell hasn’t a clue. BUT it does provide an opening for MMT to step into. Explaining why deficits are needed. And how deficits can be easily funded by either issuing bond or using BoE reserves. But it’s essential that MMT does not fall into the savings without debt, debt free money, interest free money or debt monkey traps. Always focus on the positives eg more debt = more wealth = more jobs = better health care etc.

What I have seen of Corbyn interviews it’s basically sort of Robin Hood stuff taking from the rich and give to the poor. And what to do if there wasn’t any super rich to take from. It seems like the post war full employment decades is erased from history. Or at least the history is rewritten and made a very special case that had unique preconditions that can’t be recreated.

The more equal distribution of productivity gains then and so on was created by full employment that gives employees and not least the weakest more power in society. The full employment period wasn’t created by taking from the rich and give to poor afterwards. It was created by taking it at the source on the labour market. To have a system that first make some superrich and employers the winner and then “take” from the rich afterwards and give to the poor is backwards. It’s probably not very effective and too late. Its probably better to take at the source and then tax ordinary people to help the much fewer poor that such a system will create.

Now it’s all about neoliberal export driven economies in the full employment times it was about vibrant domestic economy’s that built society and growing trade was an side effect of that.

Why doesn’t what goes for left these days truly study the full employment decades and see what really created it and see how it can be adopted now. Robin Hood is fiction and can’t be the model for real life politics.

https://www.youtube.com/watch?v=QZAn7ZEvwek

/L you may want to check out the top income tax rates in the era of the post war

settlement both in the UK and USA.

RJ the problem with embracing the concept of government debt is what does debt in their

own currency actually mean to a currency issuing government?I agree it means savings for

the private sector,whether you issue bonds or not.For a monetary sovereign government Debt

in its own currency is not debt how the private sector understands it.I do sigh inwardly

with the concept of positive money thou.

@Kevin Harding

Yes, but was that the cause for full employment? I don’t believe so, and corporate bosses did anyhow have quite modest pay checks then compared to now. It of course proves that neither high marginal taxes nor modest pay for corporate bosses impede high productivity growth or general welfare for society and country.

But I believe full employment is the most important part for keeping a restrain on exorbitant inequality.

the 90% high tax rate ,lower national insurance and VAT certainly helped

distribution of spending power,raising spending power at the lower end,

cyrtailing saving and asset price speculation at the other but of course you

are right /L there were many other forces for full employment .

Just pointing out the period of full employment is also an advert for

much more progressive taxation than exists today.Although I would

prefer a land value tax to such high rates of top band income tax as

well as less taxation for lower earners

History shows full employment and great inequality are compatible.

RJ:“It also means less debt and more savings”

This is a major problem with MMT. Far too many supporter make statements like this.

Yes, of course you are right, but it is safe to assume that Neil is just being concise – less (private, household. personal, unpayable) debt & more public debt/savings. The important thing is to clearly make distinctions at least once, in the beginning, until the audience understands – then language can be abused. 🙂

The brainwashing that debt is bad bad bad goes so deep. It is not brainwashing. Three “bads” are of course wrong, but one “bad” is absolutely correct. Debt is “bad”, always, for anyone. Pretty much by definition. The point is that it is frequently a very minor “bad”. Like having to part with one penny to save your life. Better not to lose pennies, but not in comparison to losing ones life. Abba Lerner was very careful to make such points; he compared the usual arguments against increasing the national debt – which he explicitly stated was “bad” – were like arguing that the way to avoid getting wet from a gentle rain – is by jumping into a lake.

Kevin Harding: History shows full employment and great inequality are compatible.

No it doesn’t. It shows the opposite. That is why plutocrats hateses full employment. In the long run, even full employment to the limited extent of the postwar era was intolerable for them, and they had to end it. And end it they did. See Victor Quirk’s work. For otherwise the rentiers were being euthanized (i. e. were not far above everyone else), as they damn well knew. (/L- as usual we entirely agree.)

“Debt is “bad”, always, for anyone.”

Of course it isn’t as I’m sure you know. So I’m unsure why you posted this

And increasing national debt makes us all wealthier. So its good so also unsure why this was written by Abba

“which he explicitly stated was “bad””

“Bonds give the holders of these £s an option to invest in. It also gives the likes of pension funds a safe interest earning asset to hold.”

As opposed to the bank deposits they are forced to hold otherwise at near zero percent, or an investment in actual productive businesses?

Sorry it makes *no sense* to allow people to save, cause a paradox of thrift the state then has to counter, and reward the savers for doing so. They either invest, spend it, or watch their money rot under inflation.

Pension funds are there to invest in productive assets. Otherwise they are a waste of time and you are better of simply increasing the state pension and doing away with the whole concept. (Or you can offer a savings account at National savings specifically for pensioners. Why do you need a tradeable asset that allows foreigners and corporates to hold and receive a government income just because some individuals need a pension?)

Do the operational calculations. Then you’ll find that ‘compulsory pension contributions’ are just a tax – which goes to the pension companies who then pay it out to pensioners in payment. You may as well cut out the middleman, scrap the pension company and do it via the DWP – which already exists and pays pensions.

Hi

Long-time lurker, first-time commenter here.

Just wanted to first of all thank Prof. Mitchell for his tireless work on this blog. I’ve been following BillyBlog for 2-3 years now and, although I’m not yet sure that I fully grasp all the ins-and-outs of MMT, I’m increasingly coming to the conclusion that it provides a plausible and consistent explanation, both of macroeconomic processes, and of the opportunities available for currency-sovereign governments to achieve progressive goals like full employment and equity while maintaining price stability. At the very least, I feel strongly that Modern Monetary Theory deserves to be openly discussed and represented as a school of thought in any progressive political party.

Andy: “I’m going to join Labour Members . net to try and see if there is any desire amongst members for an affiliated MMT group to try and influence economc policy.”

That sounds like a very interesting idea. I’ve recently joined the British Labour Party myself, and I was wondering if you’ve had any success so far in your proposal to create an affiliated MMT group. I’ve only just registered with Labour Members . net, and I’m not yet familiar enough with the web site to know how best to find out more details about proposals like this.