Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

Saturday Quiz – July 11, 2015 – answers and discussion

Here are the answers with discussion for yesterday’s quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern Monetary Theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

We are told that a country is running a small current account deficit and that the private domestic sector is saving overall. However, we cannot tell what the government fiscal balance will be as a percentage of GDP until we know the relative magnitudes of the other two balances.

The answer is False.

This question requires an understanding of the sectoral balances that can be derived from the National Accounts. But it also requires some understanding of the behavioural relationships within and between these sectors which generate the outcomes that are captured in the National Accounts and summarised by the sectoral balances.

Refreshing the balances – we know that from an accounting sense, if the external sector overall is in deficit, then it is impossible for both the private domestic sector and government sector to run surpluses. One of those two has to also be in deficit to satisfy the accounting rules.

The important point is to understand what behaviour and economic adjustments drive these outcomes.

The basic income-expenditure model in macroeconomics can be viewed in (at least) two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances.

From the sources perspective we write:

GDP = C + I + G + (X – M)

which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

From the uses perspective, national income (GDP) can be used for:

GDP = C + S + T

which says that GDP (income) ultimately comes back to households who consume (C), save (S) or pay taxes (T) with it once all the distributions are made.

Equating these two perspectives we get:

C + S + T = GDP = C + I + G + (X – M)

So after simplification (but obeying the equation) we get the sectoral balances view of the national accounts.

(I – S) + (G – T) + (X – M) = 0

That is the three balances have to sum to zero. The sectoral balances derived are:

- The private domestic balance (I – S) – positive if in deficit, negative if in surplus.

- The Fiscal Deficit (G – T) – negative if in surplus, positive if in deficit.

- The Current Account balance (X – M) – positive if in surplus, negative if in deficit.

These balances are usually expressed as a per cent of GDP but that doesn’t alter the accounting rules that they sum to zero, it just means the balance to GDP ratios sum to zero.

A simplification is to add (I – S) + (X – M) and call it the non-government sector. Then you get the basic result that the government balance equals exactly $-for-$ (absolutely or as a per cent of GDP) the non-government balance (the sum of the private domestic and external balances).

This is also a basic rule derived from the national accounts and has to apply at all times.

So what economic behaviour might lead to the outcome specified in the question?

If the nation is running an external deficit it means that the contribution to aggregate demand from the external sector is negative – that is net drain of spending – dragging output down. The reference to a “small” external deficit was to place doubt in your mind. In fact, it doesn’t matter how large the external deficit is for this question.

Assume, now that the private domestic sector (households and firms) seeks to increase its overall saving (that is, spend less than it earns) and is successful in doing so. Consistent with this aspiration, households may cut back on consumption spending and save more out of disposable income. The immediate impact is that aggregate demand will fall and inventories will start to increase beyond the desired level of the firms.

The firms will soon react to the increased inventory holding costs and will start to cut back production. How quickly this happens depends on a number of factors including the pace and magnitude of the initial demand contraction. But if the households persist in trying to save more and consumption continues to lag, then soon enough the economy starts to contract – output, employment and income all fall.

The initial contraction in consumption multiplies through the expenditure system as workers who are laid off also lose income and their spending declines. This leads to further contractions.

The declining income leads to a number of consequences. Net exports improve as imports fall (less income) but the question clearly assumes that the external sector remains in deficit. Total saving actually starts to decline as income falls as does induced consumption.

So the initial discretionary decline in consumption is supplemented by the induced consumption falls driven by the multiplier process.

The decline in income then stifles firms’ investment plans – they become pessimistic of the chances of realising the output derived from augmented capacity and so aggregate demand plunges further. Both these effects push the private domestic balance further towards and eventually into surplus

With the economy in decline, tax revenue falls and welfare payments rise which push the public fiscal balance towards and eventually into deficit via the automatic stabilisers.

If the private sector persists in trying to net save then the contracting income will clearly push the fiscal balance into deficit.

So we would have an external deficit, a private domestic surplus and a fiscal deficit.

There will always be a fiscal deficit at any national income level, if the private domestic sector is succeessfully spending less than it earns and the external sector is in deficit.

The following blogs may be of further interest to you:

- Barnaby, better to walk before we run

- Stock-flow consistent macro models

- Norway and sectoral balances

- The OECD is at it again!

Question 2:

Modern Monetary Theory (MMT) explains how central banks sell bonds to drain excess bank reserves in order to maintain their given interest rate setting. We know that the same outcome can be achieved by paying interest to the commercial banks on the same reserves. Ignoring any reserve requirements, this means that there is no need for the central bank to sell debt when the government net spends.

The answer is False.

Mainstream macroeconomics textbooks tells students that monetary policy describes the processes by which the central bank determines “the total amount of money in existence or to alter that amount”.

In Mankiw’s Principles of Economics (Chapter 27 First Edition) he say that the central bank has “two related jobs”. The first is to “regulate the banks and ensure the health of the financial system” and the second “and more important job”:

… is to control the quantity of money that is made available to the economy, called the money supply. Decisions by policymakers concerning the money supply constitute monetary policy (emphasis in original).

How does the mainstream see the central bank accomplishing this task? Mankiw says:

Fed’s primary tool is open-market operations – the purchase and sale of U.S government bonds … If the FOMC decides to increase the money supply, the Fed creates dollars and uses them buy government bonds from the public in the nation’s bond markets. After the purchase, these dollars are in the hands of the public. Thus an open market purchase of bonds by the Fed increases the money supply. Conversely, if the FOMC decides to decrease the money supply, the Fed sells government bonds from its portfolio to the public in the nation’s bond markets. After the sale, the dollars it receives for the bonds are out of the hands of the public. Thus an open market sale of bonds by the Fed decreases the money supply.

This description of the way the central bank interacts with the banking system and the wider economy is false. The reality is that monetary policy is focused on determining the value of a short-term interest rate. Central banks cannot control the money supply. To some extent these ideas were a residual of the commodity money systems where the central bank could clearly control the stock of gold, for example. But in a credit money system, this ability to control the stock of “money” is undermined by the demand for credit.

The theory of endogenous money is central to the horizontal analysis in Modern Monetary Theory (MMT). When we talk about endogenous money we are referring to the outcomes that are arrived at after market participants respond to their own market prospects and central bank policy settings and make decisions about the liquid assets they will hold (deposits) and new liquid assets they will seek (loans).

The essential idea is that the “money supply” in an “entrepreneurial economy” is demand-determined – as the demand for credit expands so does the money supply.

As credit is repaid the money supply shrinks. These flows are going on all the time and the stock measure we choose to call the money supply, say M3 (Currency plus bank current deposits of the private non-bank sector plus all other bank deposits from the private non-bank sector) is just an arbitrary reflection of the credit circuit.

So the supply of money is determined endogenously by the level of GDP, which means it is a dynamic (rather than a static) concept.

Central banks clearly do not determine the volume of deposits held each day. These arise from decisions by commercial banks to make loans. The central bank can determine the price of “money” by setting the interest rate on bank reserves. Further expanding the monetary base (bank reserves) as we have argued in recent blogs – Building bank reserves will not expand credit and Building bank reserves is not inflationary – does not lead to an expansion of credit.

With this background in mind, the question is specifically about the dynamics of bank reserves which are used to satisfy any imposed reserve requirements and facilitate the payments system. These dynamics have a direct bearing on monetary policy settings. Given that the dynamics of the reserves can undermine the desired monetary policy stance (as summarised by the policy interest rate setting), the central banks have to engage in liquidity management operations.

What are these liquidity management operations?

Well you first need to appreciate what reserve balances are.

The New York Federal Reserve Bank’s paper – Divorcing Money from Monetary Policy said that:

… reserve balances are used to make interbank payments; thus, they serve as the final form of settlement for a vast array of transactions. The quantity of reserves needed for payment purposes typically far exceeds the quantity consistent with the central bank’s desired interest rate. As a result, central banks must perform a balancing act, drastically increasing the supply of reserves during the day for payment purposes through the provision of daylight reserves (also called daylight credit) and then shrinking the supply back at the end of the day to be consistent with the desired market interest rate.

So the central bank must ensure that all private cheques (that are funded) clear and other interbank transactions occur smoothly as part of its role of maintaining financial stability. But, equally, it must also maintain the bank reserves in aggregate at a level that is consistent with its target policy setting given the relationship between the two.

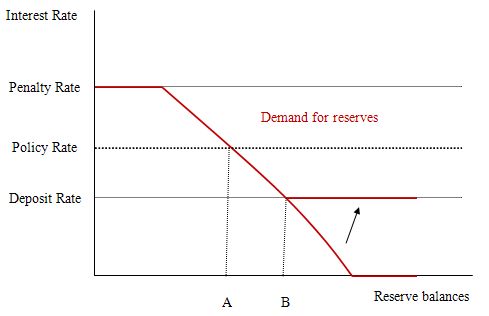

So operating factors link the level of reserves to the monetary policy setting under certain circumstances. These circumstances require that the return on “excess” reserves held by the banks is below the monetary policy target rate. In addition to setting a lending rate (discount rate), the central bank also sets a support rate which is paid on commercial bank reserves held by the central bank.

Many countries (such as Australia and Canada) maintain a default return on surplus reserve accounts (for example, the Reserve Bank of Australia pays a default return equal to 25 basis points less than the overnight rate on surplus Exchange Settlement accounts). Other countries like the US and Japan have historically offered a zero return on reserves which means persistent excess liquidity would drive the short-term interest rate to zero.

The support rate effectively becomes the interest-rate floor for the economy. If the short-run or operational target interest rate, which represents the current monetary policy stance, is set by the central bank between the discount and support rate. This effectively creates a corridor or a spread within which the short-term interest rates can fluctuate with liquidity variability. It is this spread that the central bank manages in its daily operations.

So the issue then becomes – at what level should the support rate be set? To answer that question, I reproduce a version of the diagram from the FRBNY paper which outlined a simple model of the way in which reserves are manipulated by the central bank as part of its liquidity management operations designed to implement a specific monetary policy target (policy interest rate setting).

I describe the FRBNY model in detail in the blog – Understanding central bank operations so I won’t repeat that explanation.

The penalty rate is the rate the central bank charges for loans to banks to cover shortages of reserves. If the interbank rate is at the penalty rate then the banks will be indifferent as to where they access reserves from so the demand curve is horizontal (shown in red).

Once the price of reserves falls below the penalty rate, banks will then demand reserves according to their requirments (the legal and the perceived). The higher the market rate of interest, the higher is the opportunity cost of holding reserves and hence the lower will be the demand. As rates fall, the opportunity costs fall and the demand for reserves increases. But in all cases, banks will only seek to hold (in aggregate) the levels consistent with their requirements.

At low interest rates (say zero) banks will hold the legally-required reserves plus a buffer that ensures there is no risk of falling short during the operation of the payments system.

Commercial banks choose to hold reserves to ensure they can meet all their obligations with respect to the clearing house (payments) system. Because there is considerable uncertainty (for example, late-day payment flows after the interbank market has closed), a bank may find itself short of reserves. Depending on the circumstances, it may choose to keep a buffer stock of reserves just to meet these contingencies.

So central bank reserves are intrinsic to the payments system where a mass of interbank claims are resolved by manipulating the reserve balances that the banks hold at the central bank. This process has some expectational regularity on a day-to-day basis but stochastic (uncertain) demands for payments also occur which means that banks will hold surplus reserves to avoid paying any penalty arising from having reserve deficiencies at the end of the day (or accounting period).

To understand what is going on not that the diagram is representing the system-wide demand for bank reserves where the horizontal axis measures the total quantity of reserve balances held by banks while the vertical axis measures the market interest rate for overnight loans of these balances

In this diagram there are no required reserves (to simplify matters). We also initially, abstract from the deposit rate for the time being to understand what role it plays if we introduce it.

Without the deposit rate, the central bank has to ensure that it supplies enough reserves to meet demand while still maintaining its policy rate (the monetary policy setting.

So the model can demonstrate that the market rate of interest will be determined by the central bank supply of reserves. So the level of reserves supplied by the central bank supply brings the market rate of interest into line with the policy target rate.

At the supply level shown as Point A, the central bank can hit its monetary policy target rate of interest given the banks’ demand for aggregate reserves. So the central bank announces its target rate then undertakes monetary operations (liquidity management operations) to set the supply of reserves to this target level.

So contrary to what Mankiw’s textbook tells students the reality is that monetary policy is about changing the supply of reserves in such a way that the market rate is equal to the policy rate.

The central bank uses open market operations to manipulate the reserve level and so must be buying and selling government debt to add or drain reserves from the banking system in line with its policy target.

If there are excess reserves in the system and the central bank didn’t intervene then the market rate would drop towards zero and the central bank would lose control over its target rate (that is, monetary policy would be compromised).

As explained in the blog – Understanding central bank operations – the introduction of a support rate payment (deposit rate) whereby the central bank pays the member banks a return on reserves held overnight changes things considerably.

It clearly can – under certain circumstances – eliminate the need for any open-market operations to manage the volume of bank reserves.

In terms of the diagram, the major impact of the deposit rate is to lift the rate at which the demand curve becomes horizontal (as depicted by the new horizontal red segment moving up via the arrow).

This policy change allows the banks to earn overnight interest on their excess reserve holdings and becomes the minimum market interest rate and defines the lower bound of the corridor within which the market rate can fluctuate without central bank intervention.

So in this diagram, the market interest rate is still set by the supply of reserves (given the demand for reserves) and so the central bank still has to manage reserves appropriately to ensure it can hit its policy target. If there are excess reserves in the system in this case, and the central bank didn’t intervene, then the market rate will drop to the support rate (at Point B).

So if the central bank wants to maintain control over its target rate it can either set a support rate below the desired policy rate (as in Australia) and then use open market operations to ensure the reserve supply is consistent with Point A or set the support (deposit) rate equal to the target policy rate.

The answer to the question is thus False because the simple act of paying interest on reserves does not necessarily eliminate the need for open market operations. It all depends on where the support rate is set. Only if it set equal to the policy rate will there be no need for the central bank to manage liquidity via open market operations.

The following blogs may be of further interest to you:

- Understanding central bank operations

- Building bank reserves will not expand credit

- Building bank reserves is not inflationary

Question 3:

The Troika wants Greece to stimulate economic growth by restoring export competitiveness through domestic deflation (reducing domestic wages and prices relative to other nations). However, Greece’s export competitiveness may still fall no matter how much it deflates.

The answer is True.

The temptation is to accept the rhetoric after understanding the constraints that the EMU places on member countries and conclude that the only way that competitiveness can be restored is to cut wages and prices. That is what the dominant theme emerging from the public debate is telling us.

However, deflating an economy under these circumstance is only part of the story and does not guarantee that a nations competitiveness will be increased.

We have to differentiate several concepts: (a) the nominal exchange rate; (b) domestic price levels; (c) unit labour costs; and (d) the real or effective exchange rate.

It is the last of these concepts that determines the “competitiveness” of a nation. This Bank of Japan explanation of the real effective exchange rate is informative. Their English-language services are becoming better by the year.

Nominal exchange rate (e)

The nominal exchange rate (e) is the number of units of one currency that can be purchased with one unit of another currency. There are two ways in which we can quote a bi-lateral exchange rate. Consider the relationship between the $A and the $US.

- The amount of Australian currency that is necessary to purchase one unit of the US currency ($US1) can be expressed. In this case, the $US is the (one unit) reference currency and the other currency is expressed in terms of how much of it is required to buy one unit of the reference currency. So $A1.60 = $US1 means that it takes $1.60 Australian to buy one $US.

- Alternatively, e can be defined as the amount of US dollars that one unit of Australian currency will buy ($A1). In this case, the $A is the reference currency. So, in the example above, this is written as $US0.625= $A1. Thus if it takes $1.60 Australian to buy one $US, then 62.5 cents US buys one $A. (i) is just the inverse of (ii), and vice-versa.

So to understand exchange rate quotations you must know which is the reference currency. In the remaining I use the first convention so e is the amount of $A which is required to buy one unit of the foreign currency.

International competitiveness

Are Australian goods and services becoming more or less competitive with respect to goods and services produced overseas? To answer the question we need to know about:

- movements in the exchange rate, ee; and

- relative inflation rates (domestic and foreign).

Clearly within the EMU, the nominal exchange rate is fixed between nations so the changes in competitiveness all come down to the second source and here foreign means other nations within the EMU as well as nations beyond the EMU.

There are also non-price dimensions to competitiveness, including quality and reliability of supply, which are assumed to be constant.

We can define the ratio of domestic prices (P) to the rest of the world (Pw) as Pw/P.

For a nation running a flexible exchange rate, and domestic prices of goods, say in the USA and Australia remaining unchanged, a depreciation in Australia’s exchange means that our goods have become relatively cheaper than US goods. So our imports should fall and exports rise. An exchange rate appreciation has the opposite effect.

But this option is not available to an EMU nation so the only way goods in say Greece can become cheaper relative to goods in say, Germany is for the relative price ratio (Pw/P) to change:

- If Pw is rising faster than P, then Greek goods are becoming relatively cheaper within the EMU; and

- If Pw is rising slower than P, then Greek goods are becoming relatively more expensive within the EMU.

The inverse of the relative price ratio, namely (P/Pw) measures the ratio of export prices to import prices and is known as the terms of trade.

The real exchange rate

Movements in the nominal exchange rate and the relative price level (Pw/P) need to be combined to tell us about movements in relative competitiveness. The real exchange rate captures the overall impact of these variables and is used to measure our competitiveness in international trade.

The real exchange rate (R) is defined as:

R = (e.Pw/P)

where P is the domestic price level specified in $A, and Pw is the foreign price level specified in foreign currency units, say $US.

The real exchange rate is the ratio of prices of goods abroad measured in $A (ePw) to the $A prices of goods at home (P). So the real exchange rate, R adjusts the nominal exchange rate, e for the relative price levels.

For example, assume P = $A10 and Pw = $US8, and e = 1.60. In this case R = (8×1.6)/10 = 1.28. The $US8 translates into $A12.80 and the US produced goods are more expensive than those in Australia by a ratio of 1.28, ie 28%.

A rise in the real exchange rate can occur if:

- the nominal e depreciates; and/or

- Pw rises more than P, other things equal.

A rise in the real exchange rate should increase our exports and reduce our imports.

A fall in the real exchange rate can occur if:

- the nominal e appreciates; and/or

- Pw rises less than P, other things equal.

A fall in the real exchange rate should reduce our exports and increase our imports.

In the case of the EMU nation we have to consider what factors will drive Pw/P up and increase the competitive of a particular nation.

If prices are set on unit labour costs, then the way to decrease the price level relative to the rest of the world is to reduce unit labour costs faster than everywhere else.

Unit labour costs are defined as cost per unit of output and are thus ratios of wage (and other costs) to output. If labour costs are dominant (we can ignore other costs for the moment) so total labour costs are the wage rate times total employment = w.L. Real output is Y.

So unit labour costs (ULC) = w.L/Y.

L/Y is the inverse of labour productivity(LP) so ULCs can be expressed as the w/(Y/L) = w/LP.

So if the rate of growth in wages is faster than labour productivity growth then ULCs rise and vice-versa. So one way of cutting ULCs is to cut wage levels which is what the austerity programs in the EMU nations (Ireland, Greece, Portugal etc) are attempting to do.

But LP is not constant. If morale falls, sabotage rises, absenteeism rises and overall investment falls in reaction to the extended period of recession and wage cuts then productivity is likely to fall as well. Thus there is no guarantee that ULCs will fall by any significant amount.

Question 1 asks for the government fiscal balance as a percent of GDP. What (in percentage of GDP) is the answer? How can that be answered if the percent of GDP of the current account deficit and the private domestic sector savings are not known?

Dear Bill, on Q 1 this week the proposition was that we cannot know the government fiscal balance ‘as a percentage of GDP’ until we know the relative magnitudes of the other two balances.

The answer demonstrates that we can know the government must have a deficit if there is a current account (external) deficit and the private domestic sector is saving. Necessarily this is so: there can only be an external deficit if there is correspondingly a domestic one, and if the private domestic sector is saving then there must be a larger government deficit to produce an external deficit.

But how big is the government fiscal deficit ‘as a percentage of GDP’? If I know the current account (external) deficit as a percentage of GDP and the private sector overall saving as a percentage of GDP, I can work out the government fiscal deficit as a percentage of GDP arithmetically. If I don’t know the others as a percentage of GDP (or measured in currency, but with a currency measure of GDP too) then I can’t work out the government fiscal deficit as a percentage of GDP.

So the answer to question 1 as asked is clearly ‘True’: we cannot know government fiscal deficit as a percentage of GDP if we only know that there is a current account deficit and private sector overall saving. We can be very sure there is a government fiscal deficit: but we don’t know what it is as a percentage of GDP.

To understand question 2.

I think I would need a simple diagram to explain it in the fashion of DJ Alt. It is very confusing. We need Something that really concentrates on these horizontal transactions when we explain it to others who have not come across MMT before.

A working model would be better showing how….

a) The reserves between HM Treasury and the commercial banks going up and down within the reserve accounts at the Bank of England. Is that all we are talking about here 1 reserve account for HM Treasury and a number of reserve accounts for the commercial banks?

b) Then shows what happens to these reserve accounts at the end of each day and would these double ? So what we would have at the Bank of England is a reserve account and a savings account for HM Treasury and a reserve and saving account for each of the commercial banks ?

c) That shows what happens to each of these accounts when HM Treasury buys or sells bonds. Do the bank of England buy or sell bonds ?

I also have two questions regarding this.

Are we saying here that no matter what happens during the day. If the bank of England sets the support rate equal to the policy rate then no bonds need to be sold at all ?

Does this then mean that daily deficits or surpluses are extingushed every night if they done this ? Which would then also means that at the end of each year there would be no deficit or debts (accumulation of deficits) as a % of GDP for the UK. As the deficts and debts are not sold onto the private markets ?

Or is it the sectoral balances that decides the deficit and gives us our yearly defict to GDP number ? If they did this would it show a zero on the sectoral balance ?

Any help pointing me in the right direction on this would really help.

In question 1 we are not informed about any magnitudes. We are merely told that:

X-M < 0 (current a/c deficit)

I-S 0 (fiscal deficit, implied through accounting definitions).

But we can’t deduce anything about the SIZE if the the fiscal balance.

So contrary to the answer give above, it is TRUE that “we cannot tell what the government fiscal balance will be as a percentage of GDP”.

Yep, on Q1, I have to agree with Kingsley and Jerry as above!

I am disconsolate at having got Q2 wrong because I misunderstood it. Instead of “…there is no need for the central bank to sell debt when the government net spends.” I thought it meant “…there is no need for the GOVERNMENT to sell debt when the [it] net spends.”

That said, I still do not understand why or indeed whether the government does ever have to sell debt (in the form of T-bonds). I have reread the chapters on bonds in Wray’s MMT and Mosler’s 7DIF, but although they, and in particular Mosler, fully explain the processes involved, they do not answer this question as far as I can make out.

Can anyone out there help?

Nigel Hargreaves,

Steven Hail (MMter from Adelaide Uni) had something to say about this on Facebook.

https://www.facebook.com/groups/MMTDeficitOwlCommittee/900034616736357/?notif_t=like

He originally said Q2 was easy. But then he found out he was in respectful disagreement with Bill! I hope Steve doesn’t mind me quoting his remarks:

” Well, Bill’s answer is a bit unfair this time. The correct answer to the question he set is actually’True’, as long as the rate paid on exchange settlement funds by the central bank is equal to the policy rate. There is no need – absolutely. To say there is a need if you set the policy rate above the rate paid on exchange settlement funds (as now) is in my opinion (a most respectful opinion, as Bill is a hero and inspiration) to answer a question Bill did not set 🙂 ”

Incidentally I took Bill to mean longer term debt. Ie Sale of 10 year bonds etc by auction. I think there is a case to be made for this type of sale as the auction price sets the yields and therefore longer term rates.

NH, the government could just allow excess reserves, that would drive interest rates to zero.

I agree with those above. The question asked “as a percentage of GDP”, not whether we knew what the government balance would be.

Also question 2 noted “ignoring any reserve requirements.” Just sayin’

Anybody help me with my queries ?

Much appreciated

Thanks

I think we’re in the unprecedented situation of Bill having got all three questions wrong! Here’s my reasoning:

1) As others have said, the addition of as a percentage of GDP in the question means that knowing that the government will be in deficit isn’t enough: we need to know how big that deficit will be and we can’t calculate that until we know the relative magnitudes of the other two balances.

2). The objective is not actually to achieve the policy rate, but rather to achieve some other outcome (usually inflation based, but could be employment based) by varying interest rates. And that’s something that paying interest to the commercial banks on the same reserves allows us to do, therefore the answer is TRUE.

3). If morale falls, sabotage rises, absenteeism rises and overall investment falls in reaction to the extended period of recession and wage cuts then productivity is likely to fall as well. While that much is true, the amount productivity falls by will be limited – some people will comply because they can’t afford to lose, others, because they can’t see any better alternative. And some will actually support the measures. The question relates specifically to Greece, where a referendum has proved beyond doubt that there’s a significant minority who support that strategy. And the question says Greece’s export competitiveness may still fall no matter how much it deflates. At some point the effects of the lower wages will exceed those of the lower productivity.

Question 1 is very tricky. Surely the government’s fiscal balance is the easiest of the 3 balances to be directly measured (try keeping track of all transactions between the private and the foreign sector), but who are “We” to know (as in “We are told that…”).

If “we” get told the government fiscal balance as percentage of GDP directly then of course we know what it is without needing to know the relative to GDP percentages of the other sectors.

Wait, sorry the question is about “what the government fiscal balance will be”, and not about what it currently is, so even trickier.

Dear All

I altered question 1 in last Saturday’s quiz to match my intention. It was compiled quickly from a previous quiz where numbers were mentioned. But thanks to all who pointed out the discrepancy. If it makes you think then I am happy to be in error sometimes.

But Aidan your bow is way to long.

best wishes

bill

In what way, Bill?

It’s fixed on the Saturday quiz, but not on the answers page here.

Derek Henry

No Alt style diagrams here, just some responses to your questions. Neil Wilson no doubt has posts on the specifics of UK operations, but I’m not sure they’ll have the sort of diagrams you want. Also, reserves stay within the reserve system; they move between accounts held at the BoE by the commercial banks, and get drained by the BoE, but they don’t get transferred to Treasury.

Yes. Or just forget about the policy rate, since it is largely ineffective, and let the rate settle at zero.

No, nothing would get extinguished. Deficits are never sold, there’s nothing to sell; a deficit is just the difference between government spending and taxation. In a situation where bonds are not being sold to match those deficits then reserves would build. If the government was running sustained deficit spending then at the end of the year – or quarter or whatever you want to measure – that deficit would appear in the sectoral balances, as would the non-government net saving driving it.

Yes, specifically net saving. It is non-government net saving that drives the government’s deficit/surplus position. That saving will appear as a non-government surplus and a government deficit in the sectoral balances.

No, it wouldn’t be zero unless non-government net saving was zero.

AS, if wages are falling everywhere competitiveness will not improve. It is relative.

Bob, that’s moot because wages are not falling everywhere. But even if they were, it wouldn’t invalidate the proposition because Greek wages could fall faster than those elsewhere.