The other day I was asked whether I was happy that the US President was…

Germany’s serial breaches of Eurozone rules

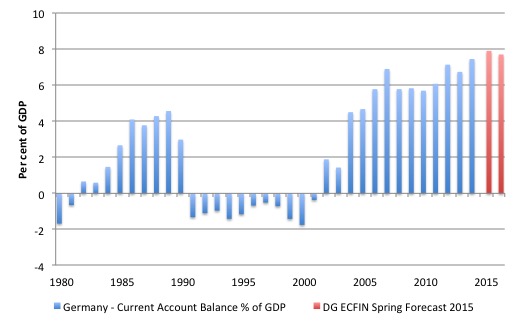

Last week (May 5, 2015), the European Commission’s Directorate-General for Economic an Financial Affairs (ECFIN) published the – Spring 2015 European Economic Forecast – which provide a picture of what they think will happen over the next two years across 180 variables. To the extent that the forecasts reflect past trends (given the inertia in economic time series outside major cyclical events), they provide a clear picture of what is wrong with the Eurozone. The salient feature of the Forecasts is that the European Commission expects Germany to increase its already astronomical Current Account surpluses to peak at 7.9 per cent of GDP in 2015 and falling only to 7.7 per cent in 2017. The Commission has in place a set of rules that require nations to restrict external surpluses to not exceed 6 per cent of GDP. Germany repeatedly fails to abide by those rules, yet lectures the rest of its Eurozone partners about their failures to meet the targets, crazy as they are. The unwillingness of the European Commission to enforce their own rules in relation to Germany is one of the telling failures of the whole Eurozone experiment.

In 2010, the European Council was under increasing pressure to respond to the apparent failure of macroeconomic policy and governance arrangements in the monetary union.

The Council had brutalised Greece by entering a deal with the ECB and the IMF (the Troika) which in its early forms had proposed that a European Commissioner take over running economic policy in Greece, which a British academic lawyer, Costas Douzinas noted in his UK Guardian

article at the time (March 5, 2010) – What Now for Greece – Collapse or Resurrection? “… was more than a little insensitive for a country that has suffered a brutal Nazi occupation”.

Facing increasing hostility, the Troika decided to create a ‘task force’ of inspectors who would rough ride over the democratic process to make sure that the Troika got their pound of flesh.

But the time the European Council met in Brussels in March 2010, the shape of the response that the political leaders would take was clear.

The – Statement by the Heads of State and Government of the Euro Area – issued on March 25, 2010, said that:

We reaffirm that all euro area members must conduct sound national policies in line with the agreed rules and should be aware of their shared responsibility for the economic and financial stability in the area …

The current situation demonstrates the need to strengthen and complement the existing framework to ensure fiscal sustainability in the euro zone and enhance its capacity to act in times of crises.

For the future, surveillance of economic and budgetary risks and the instruments for their prevention, including the Excessive Deficit Procedure, must be strengthened. Moreover, we need a robust framework for crisis resolution respecting the principle of member states’ own budgetary responsibility.

Up to that point, the Stability and Growth Pact (SGP) combined with the Excessive Deficit Procedure were the major expressions of macroeconomic rules and governance in the Euro area.

The German agenda around these 2010 meetings was clearly to make the SGP conditions even more onerous so as to further constrain discretionary fiscal policy, which ensured that only nations with strong export positions would have any chance of sustained growth.

In a Wall Street Journal Op Ed (April 20, 2010) – How to Save the Euro – conservative German academic Hans-Werner Sinn called for a new SGP:

… one that would be formulated to impose ironclad debt discipline. What is needed are modified debt rules, hefty sanctions, and most of all, a system of rules that automates the levying of penalties, leaving no room for political meddling.

Sinn engaged in an incredibly hypocritical attack on Greece profligacy – their unwillingness to pay for their import bill with real resources rather than debt – never noting, of-course, the role that German exports played nor German creditors, in the external deficits of its Eurozone neighbours.

He wanted the European Union to make “an example” of Greece and said that “Only by making an example can the EU hope that the new rules for indebtedness will be adhered to”. Tough talk.

The European Union’s response to this pressure was embodied in three new ‘governance’ measures – the Six-Pack, the Two-Pack and the Fiscal Compact.

All three initiatives sought to further restrict the fiscal flexibility of the national governments. All three took the monetary union further into the mire and further away from an effective solution to its woes.

The presumption was that if the fiscal rules were tighter and behaviour more closely monitored and controlled, the SGP would be enforceable and the so-called fiscal crisis would dissipate. The European leadership was clearly prepared to let higher unemployment and poverty become the adjustment mechanism rather than government spending.

In late 2011, the Commission proposed a major revision of the SGP, which was approved by the Member States and the European Parliament in October 2011. The so-called ‘reinforced Stability and Growth Pact (SGP)’ became operational on 13 December 2011.

The – EU Economic governance “Six-Pack” enters into force (European Commission, 2011).

European Commission (2011) ‘EU Economic Governance “Six-Pack” Enters into Force’, MEMO/11/898, Brussels, 12 December.

The Official Memorandum – EU Economic governance “Six-Pack” enters into force – issued on December 12, 2011, said the so-called ‘Six-Pack’ comprised “five regulations and one directive.”

The innovation was the creation of a new “Macroeconomic Imbalance Procedure”, which was described as a “new surveillance and enforcement mechanism”.

Essentially nations would move into the Excessive Deficit Procedure more quickly and there would be harsher sanctions for compliance failure.

Among other changes, the Six-Pack introduced a series of interventions under the so-called Excessive Imbalances Procedure (EIP), which aimed to reduce macroeconomic imbalances (particularly unit costs, external imbalances and so on) and force nations to submit “a clear roadmap and deadlines for implementing corrective action”.

The whole system became subject to a huge surveillance operation (EU monitoring) with rigorous enforcement (fines equal to 0.1 per cent of GDP) and central intervention in a nation’s budgetary process.

The Two-Pack, which became enforceable on 30 May 2013, extended the surveillance mechanisms by requiring national governments to submit detailed fiscal plans to the Commission prior to their own enacting legislation. The Commission would not have the right to veto the plan, but could warn a national government of potential for breach. Further, any government receiving bailout money or in an EDP, would be subject to more detailed scrutiny by the Commission. In other words, more centralised bullying.

But the Eurozone leaders were still not satisfied with these new restrictions. They decided to introduce an even more onerous set of fiscal rules under the guise of the Treaty on Stability, Coordination and Governance in the Economic and Monetary Union (TSCG), also known as the ‘Fiscal Compact’.

These changes were driven by the Germans, who in 2009 enshrined a ‘balanced budget rule’ or ‘debt brake’ in their Basic Law (Constitution).

Predictably, the Bundesbank October 2011, Monthly Report article – The Debt Brake in Germany – Key Aspects and Implementation – considered the move to be “a very welcome development and a clear improvement”.

Consistent with their deflationary bias, they recommended that all levels of government “incorporate a safety margin below the constitutional ceiling” to avoid “the need for short-term adjustments that could have a procyclical impact, particularly given unexpected adverse developments”.

In other words, they wanted the government to run fiscal surpluses as a matter of course, imparting a constant fiscal drag on economic growth independent of the state of the economy.

In the context of German domestic policy, this means the only source of growth would be net exports. Further, the only way the government would be able to consistently produce fiscal surpluses would be to have continuous and large external surpluses, given the high saving propensity of German households.

The ‘Macroeconomic Imbalance Procedure’ (MIP) embedded in the Six-Pack exposed the inherent, anti-people biases that dominate European policy making.

The MIP procedure was outlined in the Occasional Paper No 92 (February 2012) published by the European Commission – Scoreboard for the Surveillance of Macroeconomic Imbalances.

The stated aim of the MIP surveillance mechanism is:

… to identify potential risks early on, prevent the emergence of harmful macroeconomic imbalances and correct the imbalances that are already in place.

The so-called MIP Scoreboard uses ten “early warning” indicators that provide information about “macroeconomic imbalances and competitiveness losses” which are easy to compute and communicate.

Threshold values (positive and negative) are provided to assess when there is an imbalance.

The priorities are clear.

A nation that had endured an unemployment rate of say 9.9 per cent for the last three years is not considered to be imbalanced, given the warning threshold is 10 per cent.

The Commission chose this very high threshold due to a “focus on adjustment in labour markets and not on cyclical fluctuations”.

In other words, they do not consider the unemployment problem in terms of insufficient jobs being caused by deficient levels of spending but rather consider the only policy concern to be so-called “structural” issues. This in turn concentrates their attention on “market impediments”, the standard neo-liberal, supply side bias that has failed since it became the dominant approach in the early 1990s.

In the Commission”s annual “Alert Mechanism Report”, which is based on a review of the MIP scoreboard, any reference to unemployment is usually accompanied by some conclusion that wages are too high and need to be reduced in line with productivity growth. There is no recognition that the enduring recession has caused both productivity growth to slump and jobs to disappear due to a lack of spending.

The European policy makers are thus “content” with very high levels of unemployment yet they hide their intent in a language of deception.

Another bias is evident in the way they deal with current account deficits and surpluses. They conclude that “sustained current account surpluses do not raise the same concerns about the sustainability of external debt and financing capacities, concerns that can affect the smooth functioning of the euro area” as do current account deficits.

The MIP thus accords “a greater degree of urgency” to “countries with large current account deficits and competitiveness losses”.

The upper warning threshold (for a surplus) is 6 per cent of GDP. If the balanced budget rule is satisfied by a nation sitting on the current account surplus threshold, then its private domestic sector will be saving overall 6 per cent of GDP. Where will those savings go?

Germany worked out early in its Eurozone membership that had to find a new way to maintain its external competitiveness once it could no longer manipulate the exchange rate.

The Hartz reforms reduced the capacity of workers to gain real wage increases which would allow them to share in the productivity growth of the economy. They also suppressed domestic spending. Profitable investment opportunities were limited in the German economy as a result and capital sought profits elsewhere.

The persistently large external surpluses (and 6 per cent is large) were the reason that so much debt was incurred in Spain and elsewhere.

On March 5, 2014, the European Commission published its – Communication from the Commission to the European Parliament, Teh Council and the Eurogroup – which summarised the findings of its “Alert Mechanism Report 2014” that had been published in November 2013.

The European Commission concluded that Germany had a macroeconomic imbalance as a result of its current account surplus being above the 6 per cent threshold.

The Commission acknowledged that the large surpluses have been, in part, due to the suppression of domestic spending and hence imports. But it praised the surpluses because they “provide savings to be invested abroad”.

The conclusion was that Germany will have to find ways to “strengthen domestic demand and the economy”s growth potential”.

However, it dodged the main issue. Higher domestic demand will require faster wages growth both to boost the very modest consumption performance and to attract investment into the domestic market. But such a change would be at odds with the mercantile mindset that dominates the nation because it would reduce the competitive advantage that Germany enjoys over other nations that have treated their workers more equitably.

This also raised the question of inequality. There is no indicator for national income or wealth inequality in the MIP Scoreboard. Despite the neo-liberal denial, income inequalities undermine economic growth.

According to the German Socio-Economic Panel (SOEP), which is a wide-ranging representative longitudinal study of private households, located at the German Institute for Economic Research, DIW Berlin, income inequality in Germany has risen sharply since it joined the Eurozone.

According to the Inequality Watch article (June 4, 2012) – The Evolution of Income Inequalities in Germany – while the poorest 10 per cent of income earners in Germany achieved 15 per cent gains in their annual median incomes between 1997 and 2008, the richest 10 per cent enjoyed gains of 28 per cent.

The Hartz reforms and the export imperatives were an important part of this rising inequality. A substantial redistribution of income is required within Germany if domestic spending is to increase and the nation obey the dictates of the MIP.

Which brings us to the Spring Forecasts 2015.

Spring forecasts and Germany

In the Spring Forecast, we read that:

Structural reforms implemented so far are starting to bear fruit in some Member States but overall remain insufficient to definitively overcome legacies of the crisis and significantly increase medium-term growth potentials.

There is no mention in the introduction that contains that assessment about Germany’s massive and expanding current account surplus.

Later on, we read that:

Germany’s surplus increased further due to muted corporate investment, which offset a slight improvement in household demand.

The Forecast says that:

… the current account surplus is nonetheless set to rise further in 2015 due to improvements to the terms of trade

The DG ECFIN Spring Forecast suggests that the current account surplus will rise to 7.9 per cent of GDP in 2015 and 7.7 per cent in 2016.

The first graph shows the Current Account balance for Germany as a per cent of GDP from 1980 to 2014. The DG ECFIN Spring Forecast 2015 are shown in the red bars for the years 2015 and 2016.

The history shows how Germany transformed its economy in the early days of joining the common currency by embarking on a massive export surplus.

The very large external surpluses explain both why the government can run a fiscal surplus and domestic savings can remain high.

The DG ECFIN argues that the rising external surplus will be driven by the trade balance which is expected to rise further because of favourable euro exchange rate movements and rising prices for export goods (terms of trade).

They think that import growth may rise if investment picks up and domestic consumption strengthens.

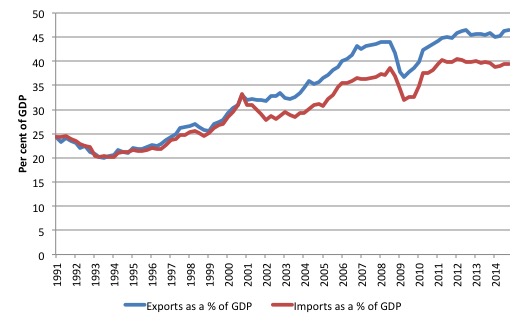

The following graph shows the trade components of the Current Account balance as a share of GDP. But it is clear that in the recent years, imports have fallen as a proportion of GDP. Germany is doing nothing to increase the share of imports.

In its – Country Report Germany 2015 – under the “In-Depth Review of the prevention and correction of macroeconomic imbalances” (released March 18, 2015), the European Commission noted that:

1. “The current account consistently shows a very high surplus, which is projected to increase to 8 % of gross domestic product (GDP) in 2015”.

2. They put this down to a “strong competitiveness …. in the export-oriented manufacturing sector, and high revenues from private sector investment abroad, which have not been offset by increased domestic demand, in particular due to weak investment. ”

3. “Consistently weak business investment and insufficient public investment remain a drag on growth”.

They also concluded that Germany had made only “limited progress in addressing the 2014 country-specific recommendations”. Specifically:

- Germany has not increased public investment as recommended and it is currently “insufficient to address the investment backlog in infrastructure, education and research.”

- Germany has done nothing to reform the high taxation system.

- Germany has not increased the minimum wage sufficiently.

- Germany has not acted “to ensure the sustainability of the pension system.”

- Other disincentives to work remain.

- No “significant efforts” have been taken to implement the reforms recommended for the transport and service sectors.

Now, I should qualify this. Most of the reforms noted above are of a neo-liberal variety, which are designed to tilt the playing field further towards capital and undermine the scope and quality of public service provision. So to some extent it is better that Germany has been a laggard.

The point is that within the logic of the Eurozone and the draconian approach taken towards Greece, Germany appears to be a recalitrant. They don’t walk the talk.

Whatever way one wants to spin it, the external situation in Germany is well well beyond the 6 per cent limit required by the MIP and the divergence is predicted to increase.

The question then is why isn’t Germany being hauled before the Commission and fined under the MIP?

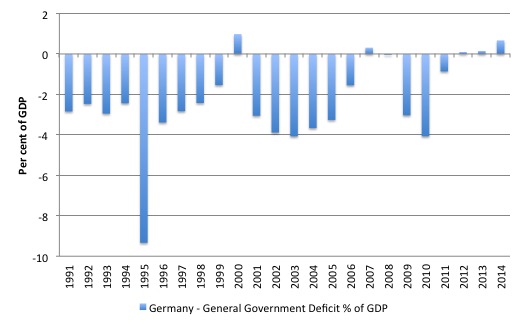

The next graph shows the General Government fiscal balance (deficit is negative) as a per cent of GDP for Germany from 1991 to 2014 (using the Maastricht criteria).

Germany struggled in the early years of their membership of the Eurozone with deficits well in excess of the Maastricht fiscal rules (maximum of 3 per cent of GDP), which I wrote about that in these blogs – Eurozone battle lines being drawn again with Germany on the other side and

Germany contracts as the French suggest defiance – among others.

But while Germany lectures the rest of Europe about its fiscal superiority, the only way they can run these surpluses now, given it is suppressing domestic demand and reducing the well-being of its own people, is because it is exploiting the current account deficits of other nations, many of them its own Eurozone partners.

The European Commission claimed in early 2014 that it would review the German external surpluses. There are two aspects. It is true that the external surplus is most

According to the data contained in – Foreign Trade – Ranking of Germany’s trading partners in foreign trade – issued by the German Federal Statistical Office (Statistisches Bundesamt) on April 20, 2015, the following Net Export balances were achieved in 2014:

1. US 47,496,531 (in 000s Euros)

2. UK 41,837,960

3. France 34,440,831

4. Austria 19,755,255

5. UAE 10,658,512

6. Spain 9,984,037

7. Poland 7,992,050

8. Saudi Arabia 7,819,171

9. Korea 7,629,929

10. Sweden 7,445,632

11. Switzerland 6,931,741

12. Turkey 6,001,148

13. Italy 9,942,461

14. Australia 5,774,383

15. Mexico 5,405,176

16. Denmark 4,996,424

17. Canada 4,892,423

18. Hong Kong 4,391,533

19. South Africa 3,415,267

20. Greece 3,213,418

In terms of proportions around 50 per cent of the net exports surplus is due to trading within the Eurozone. But even so, the surpluses reflect the competitiveness of Germany’s manufacturing sector and the suppression of domestic demand.

While Germany preaches to others about structural reforms, it fails to introduce necessary reforms which would not only increase the well-being of its own population but ease the crisis elsewhere in Europe.

It also means that the task facing nations like Greece is even more difficult – impossible in fact.

The Germans demand that Greece continues to grind its population into further poverty while their own policies mean that that the Greeks are chasing an ever elusive goal.

None of the goals – external surpluses, domestic devaluation, austerity – make sense. They reinforce each other and further the crisis.

The other problem is that the on-going German surpluses push up the value of the euro, which means all its talk of export-led growth for Greece and other beleagured nations becomes more difficult to achieve, given they do not have the level of external competitiveness that Germany exhibits.

Germany is clearly capable of addressing these issues. But it consistently fails to and remains in breach of the crazy European Commission rules.

Conclusion

Germany continues to game its Eurozone partners. Its mercantilist approach to the common monetary union generate massive external trade surpluses which then manifest as capital exports to its Eurozone partners, which not only generate low returns for the investors but further complicate the debt dynamics within the union.

The German population do not win, nor do Germany’s partners.

It is an insane situation.

That is enough for today!

(c) Copyright 2015 Bill Mitchell. All Rights Reserved.

Hi Bill thanks for your great and helpful commentary. Off-topic: The CBO here in the U.S. put out a study last year titled “The Long Run Effects of Federal Budget Deficits on National Savings and Private Domestic Investment” (Jonathon Huntley). Citing a variety of studies, Huntley concludes “on the basis of results

published in the empirical literature, CBO concludes that for each dollar’s increase in the federal deficit, the effect on investment ranges from a decrease of 15 cents to a decrease of 50 cents, with a central estimate of a decrease of 33 cents”. Huntley’s logic supporting this result is the mainstream view on “crowding out”, which, of course, is false. However, the empirical studies cited are numerous and they usually attempt to adjust for the business cycle and other factors. As you know, these “beliefs” on crowding out impact the “impartial scoring” of every tax and spending bill coming out of the U.S. Congress. I would like to write to the CBO (Huntley specifically) about their logic errors but I don’t have a good answer to these empirical results. Do you have any insights into what these studies may be missing? Thanks much.

To clarify the last sentence: That is, since these studies show a deficit having an adverse impact on investment, do you have any thoughts on what they might be missing. Obviously, the effect should be at least zero with “second order” effects probably positive. Thanks.

Very good article , Bill.

Whenever I get the chance I like to ask the Germans what they think of their trade surplus. They usually say it’s a good thing. So, if we are at a bar, I suggest that they should give me five beers for every four I give them. Of course, I’m happy to make up the difference with an IOU I tell them . But if you think running a surplus is a good thing you should always run a surplus with me too. You always have to trade more goods and services for fewer goods and services.

That gets them thinking!

I really don’t think its about Germany.

Germany is the capitalist teachers pet for sure but that’s where it ends.

This is a ongoing project to impose a new religious doctrine on the continent.

Liberal materialism.

Its near the terminus of the centuries long road now as can be seen in the adoption of end game liberal laws in Ireland.

But to call these new high priests of Europe German , French , Irish etc is insane.

Let’s first identify who exactly is propagating this belief system on us before blaming it on a previous invented national constructs of the 19 the century banking system.

Top post (again) about the macrodynamics of the euro area.

The function of Germany and China is to produce both high quality and cheap goods for export.

This fills the spiritual void of westerners ( especially in Anglo countries with no village bedrock to fall back on ) who have lost the buying power to engage with their community on a local level.

This consumerist release prevents the populace from asking more basic questions about how the system works……and it does work but sadly not for them as humans …..it works if they continue to see themselves as cattle in feed pens.

Great post. Let me add one final detail: it appears that the share of workers hired by the German Government is one of the lowest in Western Europe. http://www.oecd-ilibrary.org/sites/gov_glance-2011-en/05/01/gv-21-01.html?itemId=/content/chapter/gov_glance-2011-27-en&_csp_=6514ff186e872f0ad7b772c5f31fbf2f

However unemployment (notwithstanding the high rate of subemployment) is relatively low thanks to Germany’s mercantilist policies. In other words, Germany has succeeded in exporting unemployment to the European periphery. I still remember that, when Spain was applying for European Community membership in the late 80’s, the country had to shut down a lot of her less competitive industry. It appears that it was all to the benefit of German, South Korean and Chinese manufacturers who could gain additional market share. Spain failed to ever reindustrialize and only the Basques sustained an aggressive industrial policy.

“The other problem is that the on-going German surpluses push up the value of the euro, ”

Indeed. It doesn’t matter if the exports are in the Eurozone or other countries in this regard.

Why don’t the Germans exit the euro:

1. Reduce inflation

2. Immediate boost to value of German savings

3. Government sovereign it its own countries.

4. No bailouts or further integration.

I have posted your article in a comments section. Some of the responses are quite amazing:

“So when you have a basket case and those that are good get ahead, your solution is to drag back the efficient to allow the incompetent to do better ?

Newsflash : China is laughing at your suggestion of dragging back productive economies to let backwaters find more reasons to live off others.

If Germany is going over the 6%, then its your job to catch up and not others to slow down. It IS survival of the fittest.”

After calling for social Darwinism, the author then sites China as “the most capitalist country on the planet” and saying that Greece should be like China and such drivel and completely ignores the basic point that not every nation can net export.

Some more genius comments:

“Seriously – how old are you ?

Putting prices up and increasing public expenditure increases the cost of output. That means products are less competitive. Germans have things that people ant and will buy but not at any price.

Greece has nothing of significant value – its all low value add stuff because its hostile to the private sector. Thats why its incompetent. It has NO plans for how to employ the 2_ million unemployed as it wants to strangle any viable investor in red tape and ensure its failure.”

Why do people think EU is a good idea? Why give power away to some unaccountable foreigners? Why don’t US give some obscure committee in India power to make US laws that every american has to obey? Because that would be just about same thing.

@Hepion

You have heard about TPP then?

http://en.wikipedia.org/wiki/Trans-Pacific_Partnership

The power to overpower laws – even better.

Interesting historic graphs in the current account Germany had 11 years of CA deficit from 1991 – 2001, but in what i suppose is net export contribution to GDP it is balancing around zero but mostly in surplus. (hard to see precisely in the graph).

Then one wonder what in the CA did cause the deficit. In export/import perspective germany was competitive enough to balance its import.

Sometimes one wonder what would happen to the worlds export “tigers” and global trade i US refused to supply the global market with its huge amount of trade deficit dollars. Alas adopt the German economic ‘wisdom’.

What is Germanys “real” unemployment figures, their system of “mini jobs” and other measures is mostly hidden unemployment.

From 1991 export has grown from 25% relative GDP to 45%, in the 70s it was 1bout 16 to 19%. But how much does it say about the actual size of the German economy. And probably much lower than that in the post war full employment decades. Relative export growth is also due to growing import by the export industry, it’s the value added that is the German part of the export numbers. One can also see at the GFC dip that import dipped simultaneously with export, hardly an effect of German consumers stopped importing that much, an effect of the export industry did need to import less.

Globalization have inflated relative export numbers everywhere, if you want to know how big part of the nation’s economy it is, one have to know the net between export and import in the export industry. The relationship in the German economy between the domestic economy and export industry haven’t changed as the inflated export numbers indicate. The domestic market is still the major dominant for employment. And in an industry structure as the German export industry productivity makes less people produce more and more. Export can’t solve unemployment and any sort of “devaluation” isn’t a magic wand in this structure as it is for raw material exporting banana republics.

Why does Europe that is overall a highly advanced economy with a sophisticated industrial structure act in this insane way as it was a banana republic.