The other day I was asked whether I was happy that the US President was…

Greece goes back into depression – having never left it

Last Friday (March 6, 2015), Eurostat unveiled the latest – National Accounts estimates for the fourth-quarter 2014. All the Greek news this week will be about the – Letter – that the Greek Finance Minister sent to the president of the Eurogroup, in which he outlined 7 reform proposals. But it should be firmly focused on the fact that the Greek economy is back into depression having recorded two successive quarters of negative real GDP growth (despite the September-quarter data suggesting otherwise). The latest National Accounts data for Greece shows it contracted in the December-quarter 2012 significantly and the accompanying Labour Force data confirms that the unemployment rate is rising again and participation is falling. That is the disaster that the Eurogroup should be addressing. While they claim that internal devaluation will spawn growth through a burgeoning exports sector, the December-quarter 2014 data shows that exports contracted over the last three months of 2014. How long do the Greek people have to wait before the trade-led recovery nonsense is consigned to the nonsense bin?

The Greek letter to the Eurogroup was intended to be input into the on-going struggle between Greece and the rest of the Eurozone about the conditions that are to be attached to further bailout payments. It contains some rather odd proposals including one where various “non-professional” sleuths (“inspectors”) on a casual, never-to-be-rehired basis who will pose as “customers, on behalf of the tax authorities, while ‘wired’ for sound and video” to create an environment of fear among VAT tax dodgers.

The Greek government is hoping its Eurozone partners will provide them with some video cameras and training to make this possible.

It will then hire “students, housekeepers, even tourists in popular areas ripe with tax evasion” to send the fear of the tax authorities.

So if you see some fat German in bermuda shorts with a Head Cam wandering around shops in Greece and emitting strange clicking sounds (on and off) then he/she might be one of the Greek government’s new tax enforcers, defraying some of the holiday costs with a bit of casual work.

I wondered who the joke was on!

But lets be kind today and focus on data rather than the political tactics and imbroglios.

The Greek news really should be about its deteriorating economy. Even the hype about its return to growth has been wiped out by the December-quarter data release from Eurostat.

I last addressed this issue in this blog (December 17, 2014) – Alleged Greek growth could be an illusion. The point remains but it gets mirkier.

The day before the National Accounts data was published, the Hellenic Statistical Authority (EL.STAT) published the latest – Labour Force estimates – for December 2014, which showed:

The seasonally adjusted unemployment rate in December 2014 was 26.0% compared to 27.3% in December 2013 and 25.9% in November 2014 … The number of employed … decreased by 24,453 persons compared with November 2014 (a 0,7% rate of decrease).

The labour participation rate fell sharply in December 2014 such that the number of:

Inactive persons -that is, persons that neither worked neither looked for a job- increased … by 20,425 persons compared with November 2014 (a 0,6% rate of increase).

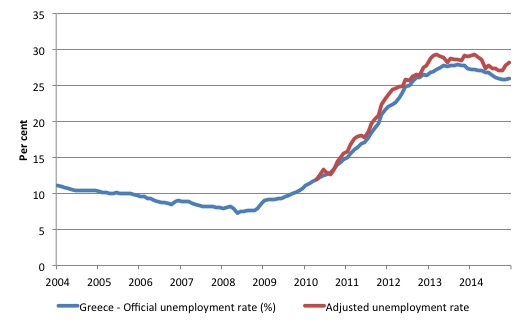

The rise in the unemployment rate would have been much worse had not the inactivity rate increased so much. For example, the unemployment rate would have risen from 25.9 per cent in November 2014 to 26.4 per cent in December 2014, had not the participation rate dropped by 0.3 percentage points.

Further, the peak participation rate was 60.2 per cent in April 2010. It is now at 58.4 per cent. Had the participation rate remained at that peak, then the unemployment rate would be somewhere around 28.2 per cent in December 2014, rather than 26 per cent that is much higher than it was in December 2013.

It is hard to see this as an improving situation.

The following graph shows the official unemployment rate (blue line) using seasonally-adjusted monthly data from January 2004 to December 2014. The red line is the participation effect from April 2010.

Greek employment peaked in October 2008 (4,630.4 thousand) and in December 2014 it was 3505.6 thousand, a loss of 1,124.8 jobs in net terms or a decline of 24.3 per cent.

The decline is worse given where the Greek economy might have been had employment growth averaging around 0.12 per cent per month since January 2004 up to the peak (October 2008).

Had that monthly growth rate been maintained then total Greek employment would be 5,044.3 thousand, or, in other words, there would have been 1,538.8 thousand more (net) jobs on offer. A difference of 30.5 per cent on the actual situation in December 2014.

Remember the analysis I did in this blog – Greece – return to growth demonstrates the role of substantial fiscal deficits?

I calculated that if we conducted a mental exercise to see what would happen if total employment in Greece started to grow steadily from now at the average quarterly rate of growth that was achieved between the March-quarter 2001 and the peak September-quarter 2008.

That average was 0.3 per cent per quarter. I extrapolated that scenario out to the June-quarter 2034. Why did I choose that end-point? Simple: it is the point where total employment would once again equal the September-quarter 2008 peak.

It means that even under favourable growth conditions (which were evident before the crisis), it would take Greece another 20 years from now to regain the employment lost by the imposed policy austerity.

But last week’s Labour Force data shows that things are still going backwards and that ‘break-even’ year will now be even further into the future.

That sort of exercise demonstrates how catastrophic the situation is in Greece and how culpable the Eurogroup is when it forces the Greek government to go cap in hand with a range of what can only be described as ‘lateral’ reform proposals while the elephant – the dramatic shortfall in required aggregate spending – is ignored – more about which later.

So when the Finance Minister writes about various plans, including the amateur Head Cam tax sleuths wandering around Greek tourist areas scaring the be-jesus out of the shopkeepers intent on evading tax, it would be better if the Eurogroup focused their minds on the big-bang-for-bucks – the massive employment loss since 2008.

If all those lost jobs were stimulated back into productive activities, then the tax take would rise dramatically.

It is always better to stimulate a depressed economy if you want the fiscal deficit to GDP ratio to fall. It brings both increased prosperity and the drop in the fiscal balance as a percent of GDP.

The day after all that poor Labour Force news became public we learned that real GDP growth in the December-quarter 2014 was once again negative.

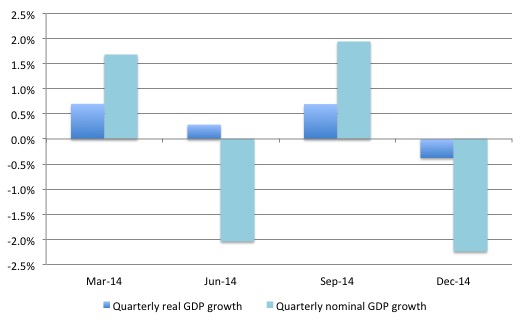

The following graph shows real GDP growth and nominal GDP growth over the four quarters of 2014. In the December-quarter 2014, nominal growth fell by 2.2 per cent and real GDP growth fell by 0.4 per cent, after both recorded rises in the September-quarter.

The contributing factors to the decline in real GDP in the December-quarter was according to – EL.STAT data:

1. Household consumption was flat.

2. Government consumption spending fell by 1.1 per cent after falling by 3.6 per cent in the September-quarter. The fiscal austerity effect biting.

3. Exports fell by 1.3 per cent.

In terms of sectoral shifts, there was a dramatic contraction in ‘Wholesale and retail trade; repair of motor vehicles and motorcycles; transportation and storage; accommodation and food service activities’ – it declined by 25 per cent in the December-quarter 2014 in real terms.

But read this blog – Alleged Greek growth could be an illusion – for analysis of how the September-quarter result could be misleading.

In that blog, you will also learn about the difference between three important concepts (among others) that allow you to understand national accounts data:

1. Nominal or current-price Gross Domestic Product (GDP).

2. Volume measures of GDP.

3. The implicit GDP deflator.

I won’t repeat the discussion here – but rather, just summarise the main points.

The summary result for our purposes is that the expenditure version of Gross Domestic Product – GDP(E) = Final Consumption Expenditure by Households (C) and Government (G) + Gross Capital Formation + Exports of goods and services (X) – Imports of goods and services (M).

That is total spending in the economy from the three major sectors – government, private domestic and external.

It is a measure of all the goods and services produced in some year valued at the prices they sell at and aggregated into a single monetary measure of overall economic activity.

The current-price measure of GDP or nominal GDP is computed by using the prices of goods and services that prevail in each period.

That measure declined by 2.2 per cent in the December-quarter 2014.

However, a rising nominal GDP measure does not necessarily signal that real output is increasing in volume (that is, more goods and services are being produced).

Let’s say that current-price GDP increases over a year by 3 per cent, but over that same period prices have risen by 3 per cent.

So total production was say $100 and grew to $103 but all the change would in this case be due to the rise in the price level – that is, a pure valuation effect. The total real quantity of goods and services produced would not have changed, just their monetary value due to inflation.

To net out the price or valuation effect, statisticians produce constant-price or volume estimates of GDP, which I refer to as real GDP.

The way they have produced these estimates has varied over the years. They are currently produced using so-called “Chain volume measures”, which use the prices from the immediate past period to measure the change in the next period and net them out.

So for our purposes, real GDP (or chain volume measures) purge the impact of current price changes (from the last period) and tell us how much real production has increased in the period under scrutiny.

So real GDP plus the inflation rate (however measured) should be equal (more or less) to nominal or current-price GDP, if the accounting structures are sound.

Alternatively, Real GDP = Nominal GDP – Inflation rate.

The inflation rate can be measured in a number of ways (Consumer Price Index, GDP price deflator etc). I discuss that in some detail in the previously linked blog.

EL.STAT published its latest – Consumer Price Index data – on February 17, 2015, which shows that in the December-quarter 2014, the Consumer Price Index declined by 2.3 per cent (September index number = 108.29 and December = 105.79)

So if the real GDP growth rate was -0.4 per cent in the December-quarter 2014 and the approximate inflation rate was -2.3 per cent then the nominal GDP growth rate should be the sum of the two:

% growth in Nominal (current-price) GDP = % growth in real GDP plus the % inflation rate

Putting the numbers we know into the equation we get:

% growth in Nominal (current-price) GDP = -0.4 + (-2.3) = -0.4 – 2.3 = -2.7 per cent, which compares to the reported result of -2.2 per cent.

The difference will be in the inflation rate measure I have used. The GDP deflator (not available as I write this) would probably be around -1.8 per cent.

But it confirms that Greece’s nominal GDP contracted in the fourth-quarter 2014 as did the volume measure of GDP.

If the analysis in the blog – Alleged Greek growth could be an illusion – is correct (and no-one has found an error – and I know it has been read by Greek statisticians) – then Greece lapsed back into recession in the second-half of 2014.

The message to the Eurogroup is:

1. The current policies are not working and are causing further damage.

2. How long do they have to wait to understand that the so-called internal devaluation measures – cutting wages, pensions etc has only engineered a damaging deflationary spiral with entrenched depression and has done little to improve export competitiveness.

Note that exports went backwards in real terms in the December-quarter 2014.

So when is this cruel hoax going to end? It certainly will not end if the Greek government agrees to any more austerity.

Conclusion

I note that some of the Greek government politicians are now talking about holding some sort of vote (referendum) on what to do next should the negotiations with the Eurogroup fail.

Before they do that they should provide a public education campaign informing the Greek people that their penchant for remaining in the Eurozone is:

1. Inconsistent with their desire for a return to prosperity.

2. Not necessary for them to remain a part of the greater European narrative and all that that brings (relative to military coups etc).

The problem is that the Syriza leadership doesn’t even accept 1. and 2. so what hope is there?

That is enough for today!

(c) Copyright 2015 William Mitchell. All Rights Reserved.

Why are Greeks so keen to stay in the Eurozone? Unemployment wasn’t too bad in Greece in the 20 years prior to their entering the Eurozone.

I am sorry, I meant to wish you a happy birthday last Saturday but I have been busy. So, a late happy birthday and let me say that I do appreciate what you are doing for the world.

Dear GLH (at 2015/03/09 at 19:10)

Thanks very much. I appreciate your comment and wishes.

best wishes

bill

Let’s hope they don’t get the conduit like ” growth” which has been a characteristic of Ireland since EEC entry.

Dijsselbloem has been videoed talking to a Greek student about debt and stuff recently.

Presenting the model pupil again that is Irelande.

The young fellow seemed naively perplexed by it all and overly polite to a piece of usurious scum.

The fact that he was talking to a rep of typical orange based usury capitalism went completely over his little head.

GDP growth in Europe orbits around the maximization of profits for the connected super companies at the expense of small and medium enterprises of a more local nature.

The Florentine multinationals of the modern era are extracting all of the industrial surplus as can be witnessed by looking at the Irish conduit.

Almost all of the increase in Irish sales was cars and consumerized women buying home furniture for their atomized akea lives.

Bill,

You ask “The problem is that the Syriza leadership doesn’t even accept 1. and 2. so what hope is there?”

The hope is that they’ll learn from their experience. Politically, it could have been too much to exit the Euro within weeks of winning an election on a pro-Euro platform. They need to take stock of the situation in the coming months.

Their best tactic is to not resign from the EZ. It is to push the EU ruling class as far as they possibly can and see what happens. If the ECB set limits on on the amount of Euros which can be issued by the BoG , for example, the Greek government should see to it that the limit is exceeded! If they are given a deadline for payments. they should be late. What are the ECB going to do? Pull the plug? If and when they do that, it will be its decision. Not Syriza’s.

The key issue is that probably Germans and their supporters insist on imposing the same Prussian social order on the Greeks which is supposedly working charms for themselves.

This itself is not true – but I think that people like Merkel and Schauble genuinely believe that austerity is the only way. It is a conflict of cultures. The Greeks would like to salvage the membership in the EU by transforming the rules but for the Germans the EU can only exist with the current monetary and fiscal framework. They are as stiff as the Germans can be because for Merkel economics is a branch of “objective” knowledge similar to physics or chemistry and someone explained to her that printing money leads to hyperinflation as in Weimar republic, Amen.

She is defending not only moral rules coming from Luther – as a daughter of a pastor (repent, the debt must be paid back or die you lazy thief and bastard and rot in hell with the Teufel) but also The Immutable Scientific Truth – as a PhD. There is no way you can convince people like this to anything. They have no doubts. I am debating my old ex-Polish (currently German) friend and he behaves in exactly the same way so he is a good model.

I think that in the end if the Greek government does not actively collaborate with the Troika in imposing the new Teutonic social order – the bankruptcy and ejection from the Eurozone is inevitable. They will simply run out of money – either the banks or the Treasury. But if they collaborate – nothing will change for the better in Greece for years or even decades (what is the main point of the blog). Varoufakis will be a Samaras with a human face. But this is not the end of the story.

According to The Telegraph the right wing Greek defence minister has pulled the ace card from his sleeve.

“If they deal a blow to Greece, then they should know the the migrants will get papers to go to Berlin,” he said.

“If Europe leaves us in the crisis, we will flood it with migrants, and it will be even worse for Berlin if in that wave of millions of economic migrants there will be some jihadists of the Islamic State too.”

At least he is trying to negotiate, not just surrender at the beginning of the process by accepting the mental framework of being a beggar asking the overlord for mercy and forgiveness – and the “objective” fiscal modelling framework with the loanable funds theory attached.

I am afraid the language spoken by Kammenos is the only language the German intellectual elites may understand to abandon implementing yet another crazy project. Last time it was the noise of Soviet tank engines roaring through the Brandenburg Gate. Let’s hope this time the experiment will not lead to innocent people being killed.

«one where various “non-professional” sleuths (“inspectors”) on a casual, never-to-be-rehired basis who will pose as “customers, on behalf of the tax authorities, while ‘wired’ for sound and video” to create an environment of fear among VAT tax dodgers.»

Syriza know very well that they were not elected to be the first greek government to make affluent greeks, or any greek voters, pay more taxes. That is political poison.

If they wanted they could switch to, or at least create also, a serious land-value tax scheme… Or other tax schemes based on what is difficult-to-hide.

«how catastrophic the situation is in Greece»

Greece has a large number of immigrants from other countries, both within and outside the EU. As to the EU, not coincidentally Greece after years of crisis still has higher GDP per capita than 7 (25%) other EU countries (“EL” is the symbol for Greece in the following):

http://ec.europa.eu/eurostat/statistics-explained/index.php/GDP_per_capita,_consumption_per_capita_and_price_level_indices

That does not indicate a “catastrophic” situation, but rather that greek voters feel entitled to the standards of living of Slovenia rather than Hungary…

«Their best tactic is to not resign from the EZ. It is to push the EU ruling class as far as they possibly can and see what happens.»

The difficulty with that is that Syriza were elected on an explicit platform of “end to austerity”, which greek voters straightforwardly intend to mean higher consumption, and that means a higher trade deficit. But someone has to finance that higher consumption, and the greek state has run out of money. Yannis Varoufakis made it clear what the situation is in his blog 2-3 years ago:

http://yanisvaroufakis.eu/2012/05/16/weisbrot-and-krugman-are-wrong-greece-cannot-pull-off-an-argentina/

«In sharp contrast, idle productive resources in Greece cannot produce much for which there is increasing demand.»

and rather more recently:

http://www.bloomberg.com/news/articles/2015-03-08/greek-tensions-revived-as-creditors-reject-reform-list

«”I can only say that we have money to pay salaries and pensions of public employees,” Greek Finance Minister Yanis Varoufakis told Italy’s Il Corriere della Sera in an interview Sunday. “For the rest we will see.”»

«greek voters feel entitled to the standards of living of Slovenia rather than Hungary…»

«”end to austerity”, which greek voters straightforwardly intend to mean higher consumption»

I’ll explain these and how they are related in some way.

One crucial fact of “austerity” is that in two critical ways it has *succeeded*: the greek government primary deficit has disappeared, and the greek trade deficit has also disappeared.

That is Greece are actually “living within their means” even if this means a depression, and yet a GDP per capita higher than 7 other EU members.

The greek problem is that “living within their means” in the sense above (government budget primary balance, trade balance) implies a standard of much reduced standard of living for greek voters compared to the recent past where the trade deficit and the government deficit were financed by eager “core country” bank loans, a standard of living rather more similar to that of the poor hungarians than of the middle class slovenians, even if still much higher than that of bulgarians and romanians.

The greek problem is how to go back to consuming like slovenians while maintaining a government budget primary balance and a trade account in balance, that is without external financing.

As Keynes sort of said usually if a government fixes unemployment that also balances the budget, the major problem in the greek situation is the trade balance, as Varoufakis wrote in his post in 2012. if they don’t solve that problem the greeks will have to adapt to permanently reduced imports of oil, food, medicines, durable goods, and make do with less of everything like the hungarians (and the romanians and bulgarians) already do.

But that is not Syriza’s political platform, so they are a bit in a difficult position.

Petermartin – That is something like tactics that Varoufakis has sometimes outlined and may be following.

Adam K: The problem is not really that your friend, Merkel etc believe in immutable scientific truths – good for them – but that what they believe makes no sense. and. is. not. true. As German philosophers & economists once led in understanding.

Debts should be paid – OK. But what if the creditor systematically prevents debt repayment? – Which is what the Euro does. Germany, the leading debt-defaulter of the 20th century should understand this in particular. Post WWI – indebted to not-so-nice, illogical creditors behaving like Germany & the Eurocracy today. Post WWII- indebted to nicer, more logical creditors. Which worked out better for all concerned, which should be emulated?

On Bill’s question:The problem is that the Syriza leadership doesn’t even accept 1. and 2. so what hope is there?

What the Syriza leadership really believes, which way they will finally jump, is not 100% clear. But look at this poll: Table 4

If you were given the choice, would you prefer to have the Euro or your own national currency?

32% of Greeks say Euro, 52% say national currency.

«internal devaluation measures – cutting wages, pensions etc has only engineered a damaging deflationary spiral with entrenched depression»

Not just “engineered a damaging deflationary spiral”, but also balanced the government primary budget and the trade account, that counts for a big victory for “austerians”.

«and has done little to improve export competitiveness.»

But Varoufakis himself in comparing Greece with Argentina has made it very clear that there is not even sufficient demand for greek exports, so export growth cannot be used to pay for higher imports or for higher employment.

The choices before Greece are:

* Higher consumption and imports financed by more borrowing,

if they can find a lender willing to finance in effect

Syriza’s re-election budget.

* Making do with permanently lower consumption and imports,

within the EU or outside the EU in a regime of autarky.

* Shifting a lot of consumption from affluent greeks with

lots of euros in freezers and in Swiss banks to poorer

greeks with little cash, by raising the fiscal pressure,

which is political suicide even if selective.

The latter point as hinted at by Varoufakis 3 years ago:

yanisvaroufakis.eu/2012/05/16/weisbrot-and-krugman-are-wrong-greece-cannot-pull-off-an-argentina/

«the ongoing crises has led Greek savers to withdraw oodles of their savings from Greek banks and either shift them offshore (London, Geneva, Frankfurt) or stuff them in their mattresses, or hide them in their freezers (in ‘bricks’ of 500 notes).»

Blissex:

Warren Mosler’s response to Varoufakis’s confused comments on Weisbrot in your link: Mosler trolling Varoufakis with damn good arguments

Mosler, Weisbrot & Krugman are right and logical. It is Varoufakis who is “profoundly wrong.”

“If nothing happens in the United States, if nothing new is created to challenge systemic excesses and empire, it will be a bad situation for all of us. One is doomed if nothing happens in the U.S.” – Tariq Ali.

I think we can interpret this as “No revolution in the USA = No revolution anywhere.”

This proposition flows from the USA’s hegemonic power over the entire globe excepting the Russian landmass, the Chinese landmass and some near satellites like Nth. Korea and East Ukraine.

And what are the chances of revolutionary change in the USA? I would say vanishingly small. Maybe in 50 years time, when limits to growth and climate change have largely wrecked the world economy, the (remaining) people might rise up.

SYRIZA was voted into power by people in fear of penniless starvation from cut wages, pensions lost and a nil basic tax allowance with multiple taxation on the cashless.

Austerity kills. It is as simple and stark as that.

If the Eurogroup insists on this threat to life of Greeks, then either the communists or the fascists will overthrow government.

At no time in history has an elite survived when the people are left to starve.

The Eurogroup are starving people everywhere, from Spain to the Ukraine.

Austerity in a recession breaks the age old bond between the elite and the people, of the wealthy feeding the people in lean times.

From all the most ancient civilisations around the globe, far back into the mists of time.

This is not a political economics thesis. This is the lives of babes in wombs of new mothers, families and their kids and the elderly. Why should they meekily go quietly into the night, just for the few to live a life of wealth and privilege.

No.

The Germans are acting too much like their forebears to much of Europe and causing the same fatal result.

The Eurgroup should ignore Germany altogether and take it out of the leadership of Europe.

Not for nothing did we have two world wars not to be ruled by German politicians.

We now know why.

Ikonoclast – You state that the USA has hegemonic power globally then contradict yourself with an abbreviated list of exceptions which represent at least half the global landmass,including Antarctica. The USA has never had hegemonic power and never will.

“What are the chances for revolutionary change in the USA?”

You wouldn’t know and neither would anybody else.

Just remember – There are only 2 certainties in this universe. One is the certainty of uncertainty.

The other is death.

«SYRIZA was voted into power by people in fear of penniless starvation from cut wages, pensions lost and a nil basic tax allowance with multiple taxation on the cashless.»

GDP per capita in Greece is higher, even much higher, than that of 7 other EU countries, never mind non-EU countries.

If greeks are realistically “in fear of penniless starvation”, what about the bulgarians who are emigrating to Greece in large numbers in the past few years?

“GDP per capita in Greece is higher, even much higher, than that of 7 other EU countries, never mind non-EU countries.”

And the distribution of that GDP in reality is what?

GDP is a convenient fiction. It doesn’t necessarily relate to anything real or mean that Greeks are living well.

The real evidence I’ve seen is that some Greeks are doing very well and most are not.

@Blissex

“””The greek problem is that “living within their means””””

“””Greece after years of crisis still has higher GDP per capita than 7 (25%) other EU countries (“EL” is the symbol for Greece in the following)”””

“””That does not indicate a “catastrophic” situation, but rather that greek voters feel entitled to the standards of living of Slovenia rather than Hungary.”””

Im interested… How does one associate downgrading aspirational consumption to entrentched hard constraints of insolvency?

Using this logic perhaps private sector debt/debt constraints can be underwritten to the level of Hungary too perhaps:

Private sector debt ratio.

Greece: 122.6%

Albania: 37.6%

Bosnia: 62%

Serbia: 37%

Hungary: 50.8%

Starting to notice a pattern that invalidates said logic used. Yes you can rank Greece per capita gdp all you like and say they are living beyond their means but thats ignoring aggregate ‘debt’ which (ask an irishman with a home loan) did not get downgraded post GFC .

Put another way some of the commenters ago seem to be arguing that a lot of money should be spent by the richer EU members to cancel the debts owed by Greece where average GDP per capita is 77% of the EU average, and not one euro should be spent to relieve poverty in Bulgaria where GDP per capita is 50% of the EU average.

The reasoning seems to be that the greeks are entitled to go back to the higher standard of living they got so well used to and then lost when the borrowing stopped, but the bulgarians have always been very poor, so for them remaining poor is not as painful as for the greeks to become poorer than they used to be, even if they still are not as poor as the bulgarians… 🙂

Blissex,

Poverty is a relative concept. The necessary level of income for an individual to effectively function in Australia or the USA is much higher than in many other countries. Greece isn’t a cheap country either.

You can probably be in the top 10% of world incomes and still find yourself unable to afford the rents and so end up homeless, in London or New York for example.

So the poverty in Greece cannot be solely judged on the 77% figure you quoted. It depends on how that wealth is distributed.

«The necessary level of income for an individual to effectively function in Australia or the USA is much higher than in many other countries. Greece isn’t a cheap country either.»

«the poverty in Greece cannot be solely judged on the 77% figure you quoted. It depends on how that wealth is distributed.»

That to me seems just futile handwaving, and rather ill-informed too, becuase the link I gave earlier contains PPP GDP per capita figures, and others are easily available, for example here:

http://ec.europa.eu/eurostat/statistics-explained/index.php/GDP_at_regional_level

http://ec.europa.eu/eurostat/statistics-explained/images/f/f3/Primary_income_of_private_households%2C_in_purchasing_power_consumption_standard_%28PPCS%29%2C_by_NUTS_2_regions%2C_2011_%281%29_%28PPCS_per_inhabitant%29_RYB14.png

and it is damn easy to be informed as to the Gini coefficients of various countries, for example here:

en.wikipedia.org/wiki/List_of_countries_by_income_equality

ec.europa.eu/eurostat/tgm/table.do?tab=table&language=en&pcode=tessi190

“Gini coefficient of equivalised disposable income”

For Greece and Bulgaria it is the same and that of Hungary is quite similar.

Also the ratio between the income of the top and bottom decile is 7 or 9 in Bulgaria, 10 in Greece and around 5.5 in Hungary; sure Greece is a bit more unequa, but the poor people of Bulgaria (or Hungary) are in a much worse situation than in Greece, and indeed there are between 1-2 million immigrants in Greece, many of them from Bulgaria and other nearby poor countries, because even in a deep depression standards of living in Greece are still better.

This table here shows that Greece’s conditions has worsened a lot, but is still not as bad as much poorer countries:

ec.europa.eu/eurostat/tgm/refreshTableAction.do?tab=table&plugin=1&pcode=t2020_50&language=en

Sure the greek state is out of money and probably not paying welfare to the poorest, but the greek story is one of becoming poorer, not of being as poor as Hungary or Bulgaria.

That explains a lot why the governments of the countries in the EU that are doing worse than Greece are among the most determinedly opposed to using EU funds to subsidize Greece.

Blissex, IMO the problem is the unemployment. It is such a waste at over 25% and not taking into account participation rate or underemployment. But yes Greece will have to take a cut in standard of living, ideally via exiting the euro (“Grexit”) or via austerity. But after this living standard will rise with productivity if the right policies are put in place.

And LVT is excellent for property redistribution and demand for the new drachmas.

“That explains a lot why the governments of the countries in the EU that are doing worse than Greece are among the most determinedly opposed to using EU funds to subsidize Greece.”

This is why the ECB needs to step in and use OMF.

i completely agree with your article. too bad for our beautiful country to no be able to import and export products and in more general terms to flourish. thank you