The other day I was asked whether I was happy that the US President was…

Never impose austerity in a slump

In September 2013, when the current Conservative government took office in Australia we were told that “At last, the grown-ups are back in charge” (Source). It was the arrogance of the victors who also presumed a sort of divine right to rule as conservatives. They strutted around the media and public events claiming that now was the time to sort things out and to impose fiscal austerity. The economy was already slowing and unemployment had started to rise again as the Labor government had gone back to their now neo-liberal orthodoxy after the success of the fiscal stimulus in 2008 and started cutting into discretionary public spending. They lost office but left an economy that was faltering again and heading towards slump not boom. The conservatives took over with a mission to achieve a fiscal surplus and unleash private spending on the back of the confidence they claimed would accompany the fact that the ‘adults’ were back. They should have read John Maynard Keynes who worked out long ago that a government should never impose austerity in a slump. They didn’t and things have got worse. It was obvious they would. Keynes was right.

Five days before the election, the Conservative leader and soon to be Prime Minister Tony Abbott addressed the National Press Club in Canberra on September 2, 2013. Apart from all the claims he made about the spending areas that he would not cut (and has since proceeded to cut), he claimed that he should be elected because:

… a serious country deserves an adult government.

Despite promising stronger economic growth – the economy is now tanking and growing well below the previous trend.

Despite promising lower unemployment – it has risen sharply as economic growth has stalled.

But the mindless conservatives in the press picked up on the adult theme.

The former Minister in the previous Conservative regime, who then took a sinecure diplomatic position overseas when they lost office in 2007, wrote at the time of the election of the latest version of the Conservative government that:

However you voted, there is reason to feel good today … Thank heavens the political children who wanted us all to be in their image have been voted out of office. At last some adults are running the show again.

The conservative mates in News Limited were quick to pick up on the Adult-theme. The national paper, The Australian were relentless.

The so-called Editor-At-Large claimed in the article (September 18, 2013) – Abbott team goes back to basics – that:

TONY Abbott has signalled a new style of Coalition government based on collaborative ties with business, a clearer set of priorities, less frenetic, more predictable and geared to stability, not fashion … He aspires to deliver what he calls “adult government”. This is Abbott’s version of conservatism … Decoded, this means cutting the spin, delivering his promises and getting the economy ticking in the teeth of rising unemployment.

Abbott reinforced that in an address to the West Australian LIberal Party Annual Conference in November 2013. He said that (Source):

I want to say that we have made a good start, that the adults are back in charge and that strong, stable, methodical and purposeful government is once more the rule in our national capital.

Then there was an onslaught of statements from the new Ministers, particularly the Prime Minister and his buffoon mate the Treasurer about how business and consumer confidence would quickly return as they started to cut the fiscal deficit.

The Government came out with the usual Ricardian Equivalence nonsense, which is an arcane theoretical notion that economic textbooks, that sounds scientific but is anything but.

This is the , the fiscal contraction expansion assertion that has dominated public policy in this era of austerity.

In simple terms, and in contradiction to everything we know about the real world, it refers to the assertion that private spending is weak during a recession because households and firms form the view that the government will have to increase taxes in the future to pay back the debts it incurs due to the higher deficits.

As a consequence, the households and firms deliberately stop spending and save up to ensure they can pay the higher taxes. Once the government starts to cut the deficit, the theory claims that a signal is sent to the private sector that future taxes will be lower and so they start spending again. Problem solved.

There has never been any credible empirical evidence produced by anyone to show that private households and firms behave in this way when deficits rise.

The overwhelming evidence shows that firms will not invest while consumption spending is weak and households will not spend because they scared of becoming unemployed and try to minimise their outstanding debt obligations.

Ricardian agents only exist in the rarefied world of mainstream macroeconomic textbooks and have never been observed at large in the real world.

Our government officials were apeing what they had heard others say in this regard.

In the European debate, the ECB was a prominent exponent of this discredited theory. In its 2010 June Monthly Bulletin they claimed the “beneficial effects of fiscal consolidation are undisputed” because “consumers anticipate benefits arising from fiscal consolidations for their permanent income and consequently increase private consumption” (see Box 6, 83-85).

[Reference: European Central Bank (ECB) (2010a) Monthly Bulletin June, Frankfurt am Main].

Former ECB Chairperson Jean-Claude Trichet made many memorable interventions into the debate in his last years as ECB boss in the style of an evangelical minister.

At the Jackson Hole gathering of central bankers in August 2010, he told the audience he didn’t believe the argument that cutting government spending would damage growth because:

… the strict Ricardian view may provide a more reasonable central estimate of the likely effects of consolidation. For a given expenditure, a shift from borrowing to taxation should have no real demand effects as it simply replaces future tax burden with current one.

[Reference: Trichet, J.C. (2010b) ‘Central banking in uncertain times: conviction and responsibility’, Speech at the Symposium on Macroeconomic challenges: the decade ahead, Jackson Hole, Wyoming, August 27, 2010].

Not to be outdone, the French Finance Minister and soon to be IMF boss, Christine Lagarde told the American ABC program ‘This Week’ on October 10, 2010 that:

If we do not reduce the public deficit, it’s not going to be conducive to growth. Why is that? Because people worry about the public deficit. If they worry about it, they begin to save. If they save too much, they don’t consume. If they don’t consume, unemployment goes up and production goes down.

Our political leaders just channelled that nonsense.

Prior to election, the now Treasurer told a business gathering in Sydney (July 4, 2013) that (Source):

We will restore confidence.

Well that hasn’t happened.

The current surveys show that business and consumer confidence are plunging and are now at their “lowest level since before the Abbott government was elected in 2013” (Source)

We were warned before the election how incompetent they would be. For example, at a – Media Briefing – in August 2013 (just before the election) a interview, the then Shadow Minister for Finance, Deregulation and Debt Reduction, Andrew Robb made this definitive claim in relation to the Australian government deficits at the time:

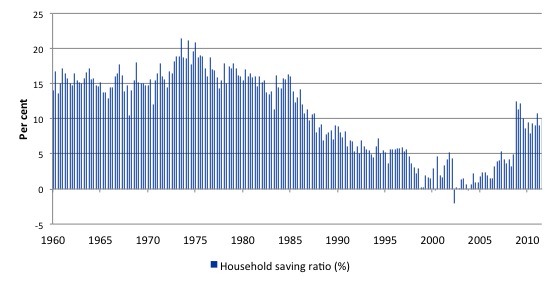

This is killing so much business confidence – it is killing consumer confidence. People are anxious about it. That is why they are saving 10% of their disposable income when historically we saved one or two per cent.

I guess his ‘history’ only spans a decade or so.

The following graph shows the Household saving ratio (per cent of disposable income) from the third-quarter 1959 to around 2012.

Prior to the financial deregulation, the ratio averaged close to 16 per cent, which is a long way from “one or two per cent” and fiscal deficits were continuously around 2 per cent of GDP.

The return to 10 per cent (which has been more or less sustained until the December-quarter 2014 when it was 9 per cent) was a return to normality for private households after the decade of credit bingeing.

None of the Ricardian dynamics predicted have come to pass. Where austerity has been harsh private confidence has plummeted.

Where fiscal consolidation has been large, private spending has not filled the gap. Saving ratios are rising generally. Confidence is low.

John Maynard Keynes wrote an Op Ed for the Times, January 12-14, 1937 called – How to Avoid a Slump – which was subsequently published in his Collected Writings.

He was writing at a time of modest recovery on the back of substantial fiscal stimulus – in Britain and the US. He said that the economies were “well advanced on the upward slopes of prosperity” but that the public debate was “prooccupied with what is to come”.

In modern language, this is the so-called ‘exit-strategy’ – how much print has been wasted talking about ‘Fed exit strategies’ and ‘required fiscal consolidations’.

Nothing is new, that sort of talk was all the vogue back in 1936 and 1937.

Keynes noted that the policy response to the Depression, had:

… entirely freed ourselves … from the philosophy of the laissez-faire state. We have new means at our disposal which we intend to use.

He was talking about the new found faith in fiscal policy to stabilise total spending and save the economy from a private sector spending reduction and recession. He also noted the use of liquidity measures by the central banks to stabilise the financial sector and the capacity of exchange rates to move to restore trade imbalances.

Keynes was interested in determining what stage of the cycle the government should withdraw the stimulus that was injected at the bottom of the private spending cycle.

In today’s language the question might be – when should fiscal austerity be introduced?

He said:

It is true that there is a phase in every recovery when we need to go slow with postponable investment of the recurrent type, lest, in conjunction with the non-recurrent investment which necessarily attends a recovery, it raises aggregate investment too high. But we must find other means of achieving this than a higher rate of interest. For if we allow the rate of interest to be affected, we cannot easily reverse the trend. A low enough long-term rate of interest cannot be achieved if we allow it to be believed that better terms will be obtainable from time to time by those who keep their resources liquid. The long-term rate of interest must be kept continuously as near as possible to what we believe to be the long-term optimum. It is not suitable to be used as a short-period weapon.

He thus considered it a “fatal mistake” to use monetary policy to attempt to choke off a boom in spending.

He thought there were better measures available to policy makers.

First, they could increase taxation.

Second, they could postpone capital expenditure.

Third, they could promote import spending.

In that section of the paper he made his now famous conclusion:

The boom, not the slump, is the right time for austerity at the Treasury.

[Reference: Moggridge, D. and Johnson, E. (eds) (1971) The Collected Writings of John Maynard Keynes, London, Macmillan, 21, 384-398].

As it happened, the conservatives forced the US President (FDR) to make the large public spending cuts in 1936 which plunged the US back into Depression.

This was to Keynes exactly the wrong time to be cutting back public spending and/or increasing taxes.

He said that:

Thus our main preoccupation should be concerned not so much with avoiding the perils of a somewhat hypothetical boom as with advance precautions against that sagging away of activity which, if it is allowed to cumulate after the usual fashion, will once again develop into a slump. Too much alarm about a hypothetical boom will be just the way to

make a slump inevitable. There is nothing wrong with the very moderate prosperity we now enjoy. Our object must be to stabilise it and to distribute it more widely, not to diminish it.

Wise words indeed.

Remember back in 2008 and 2009 how leading politicians around the globe were still invoking the fear of overheating and inflation and justified delaying fiscal stimulus packages for fear they would excite the inflationary process.

Their poor policy responses ensured the recession would become huge and has left nations with a deflationary spiral to deal with and massive unemployment.

Keynes was surely correct – you should never impose austerity in a slump.

Which brings me to a research paper I re-read yesterday which came out in September 2013 – The Time for Austerity: Estimating the Average Treatment Effect of Fiscal Policy – published by the Federal Reserve Bank of San Francisco.

[Reference: Jordà, O. and Taylor, A.M. (2013) ‘The Time for Austerity: Estimating the Average Treatment Effect of Fiscal Policy’, Working Paper 2013-25, Federal Reserve Bank of San Francisco].

The authors took an innovative methodological path to investigate the “effects of fiscal policy shocks on output”, which in plain language means – under what conditions does policy austerity damage output growth?

They note that economic “policy debates are now littered with medical metaphors”. I considered that issue in the following blog – Framing Modern Monetary Theory – if you are interested.

I noted how conservatives like to portray the economy as a patient that gets sick if the government intervenes too much and that deregulation is the path to restoring its health (to allow the ‘free’ market to work).

The FRBSF authors list several examples of the weird metaphorical language that arose during the GFC:

1. “2011 German Finance Minister Wolfgang Schäuble wrote that ‘austerity is the only cure for the Eurozone'”.

2. “Paul Krugman likened it to ‘economic bloodletting'”.

3. “In the FT, Martin Wolf, cautioned that ‘the idea that treatment is right irrespective of what happens to the patient falls into the realm of witch-doctoring, not science’.”

While the use of these medical metaphors skews the public understanding of the role of the economy etc and plays into the hands of conservatives who convince voters that the only way to make the economy ‘well’ again is to introduce austerity.

However, the FRBSF authors took a different angle and drew on the treatment-control design methodology common in epidemiology and medical statistics.

They considered that this:

… approach provides a transparent and consistent framework which encompasses the key conflicting views (and the empirical designs behind them) in the current debate over expansionary versus contractionary austerity. This helps to clearly isolate the main driver of these different findings: the appropriate identification of the response to fiscal policy interventions.

They considered the “treatment-control design” approach … offers an even more promising way to identify the effects of fiscal policy”.

One of the problems in assessing whether fiscal policy is effective or not is that it is hard to isolate its effects and to insulate the fiscal balance from the target of the policy.

So we know the deficit rises in bad times because tax revenue declines and welfare spending rises, with no change in policy parameters.

Thus a rising deficit might correlate with falling real GDP growth.

Similarly, a rising deficit might come from a discretionary fiscal stimulus package which drives real GDP growth. If that effect was dominant then the correlation would be the opposite.

It is thus difficult to disentangle those effects.

Further, in terms of the economic cycle, is the poor performance in the Eurozone, for example, in 2012 the impact of the GFC or the fiscal austerity or both?

How to we decompose these separate effects.

That is a problem that medical researchers face all the time in terms of trialling drugs and procedures. What is actually driving the medical response?

The authors are interested in investigating how there is such a difference of opinion among economists. On the one hand they identify the the “‘expansionary austerity’ idea” (this is the Ricardian line) is in contradistinction to the “contractionary austerity” view (Modern Monetary Theory (MMT) line etc).

I won’t go into their method in any detail – you can read up on it yourselves if interested.

Their findings, however, are interesting and easily explained at the lay level:

1. “austerity is contractionary … the effect in slumps is stronger and of even higher statistical significance; and even in booms there are signs of drag.”

2. “the output response to fiscal austerity is less favorable the weaker is the economy”.

They then wonder whether this makes Keynes right in his claim that “The boom, not the slump, is the right time for austerity at the Treasury.”

After some more statistical gymnastics they conclude that:

Our results underscore that austerity tends to be painful, but that timing matters: the least painful fiscal consolidations, from a growth and hence budgetary perspective, will tend to be those launched from a position of strength, that is, in the boom not the slump. This would seem to require moderately wise policymaking and/or fiscal regimes (councils, rules, etc.) …

And so their overall conclusion is that:

… in the slump, austerity prolongs the pain, much more so than in the boom. It appears that Keynes was right after all.

Interestingly, in an analysis (case study) of the British economy they conclude that about “three fifths” of the “dismal performance can be attributed to the fiscal policy choice of instigating austerity during a slump” rather than the GFC itself.

That is a damming assessment of the current British government.

They also project that the policies introduced by the Cameron government between 2010-12 “will also continue to be felt into 2014-15, even not allowing for any further austerity”.

Conclusion

I wonder how many of you read press reports in the usual places about this research? Not many. Do a Google search on Jordà and Taylor and see how many news stories you come up with. Close to none.

The reason is that the research findings are both hard to understand (from a technical perspective) but also counter to the mainstream Groupthink.

This wonderful article from December 5, 2014 from John Pilger – War by media and the triumph of propaganda – is worth reading in this regard.

He wonders “Why has so much journalism succumbed to propaganda?”. Indeed.

He asks “Why are millions of people in Britain are persuaded that a collective punishment called “austerity” is necessary?”

He considers the “economic crisis” to be “pure propaganda” in the sense that “extreme policies” are being used to reinforce the position of the elites and the Fourth Estate is largely avoiding exposing it, being content to mouth press releases etc from flaky think tanks and conservative politicians.

He reminds us of this historical snippett:

It’s 100 years since the First World War. Reporters then were rewarded and knighted for their silence and collusion. At the height of the slaughter, British prime minister David Lloyd George confided in C.P. Scott, editor of the Manchester Guardian: “If people really knew [the truth] the war would be stopped tomorrow, but of course they don’t know and can’t know.

That is the purpose of my blog – to spread “the truth” to as many people as I can. To build radical networks which will challenge the mainstream and educate the public of the lies and myths that are used to weaken their prosperity and subdue their understanding.

Whether I will succeed is another question. But it is still growing in numbers and Modern Monetary Theory (MMT) is unquestionably growing.

So we keep typing, day after day.

That is enough for today!

(c) Copyright 2015 William Mitchell. All Rights Reserved.

That article leads to the question….where should we get our information in this day and age of corporate agenda

So we keep typing, day after day.

Thanks Bill …..!

“One of the secrets of life is that all that is really worth the doing is what we do for others”.

“No good fish (pisces) goes anywhere without a porpoise”.

“We called him Tortoise because he taught us”. [Lewis Carroll ]

🙂

” . . . As a consequence, the households and firms deliberately stop spending and save up to ensure they can pay the higher taxes. Once the government starts to cut the deficit, the theory claims that a signal is sent to the private sector that future taxes will be lower and so they start spending again. Problem solved.”

Are not the proponents of the Barro/Ricardo proposition implicitly assuming a ‘Keynesian’ type model when they assume that a decline in spending brought about by ‘austerity’ will be offset by an an increase in aggregate demand by the ‘private sector’?

‘He asks “Why are millions of people in Britain are persuaded that a collective punishment called “austerity” is necessary?” ‘

“That is a damming assessment of the current British government.”

It is a damning assessment of their economic advisers who did not see ‘austerity as a collective punishment?

They ‘believed’ in the new ‘voodoo’ economics – the Barro/Ricardo equivalence?

This is from the O.B.R..

“Box 1.3: Economic impact of fiscal consolidation

The overall economic impact of fiscal consolidation depends on the combination of:

• direct and indirect effects, from reduced public spending or increased taxation. These will tend to reduce demand growth in the short term; and

• wider economic effects, which depend on the reaction of the private sector and monetary policy to the changed fiscal environment. These will tend to boost demand growth, could improve the underlying performance of the economy and could even be sufficiently strong to outweigh the negative effects.”

http://webarchive.nationalarchives.gov.uk/20130129110402/http://www.hm-treasury.gov.uk/d/junebudget_complete.pdf P19

Excellent lead into Pilger- I read that link, its inspiring as usual from a great man.

For anyone wondering like me about the context of the Lloyd George quote- it was after hearing a moving speech by Philip Gibbs- a war reporter frustrated by war censorship. Heres the end of the quote ”The correspondents don’t write and the censorship wouldn’t pass the truth. What they do send is not the war, but just a pretty picture of the war with everybody doing gallant deeds. The thing is horrible and beyond human nature to bear and I feel I can’t go on with this bloody business.”

even more interestingly if you go on wikiquote to view it, the next one is DLG at his finest and most noble, expressing desire to help the poor and malnourished of England- almost immediately followed on the page and in chronological terms by him stating that Englands last guinea would be spent on the navy if required.. the elite schizophrenia is almost never better presented than by that ..liberal..

Postkey said ” Are not the proponents of the Barro/Ricardo proposition implicitly assuming a ‘Keynesian’ type model when they assume that a decline in spending brought about by ‘austerity’ will be offset by an an increase in aggregate demand by the ‘private sector’? ”

No Postkey, this it is no sense a Keynesian model. The assumption that austerity (reduction in government spending) will lead to increased private sector spending assumes, inter alia, that funds will be freed up by a reduced level of government borrowing and that these funds will then be available to the private sector to provide a financial springboard for expansion. This so-called “crowding out” hypothesis is complete nonsense.

Dear Bill

The spelling mistake: “”prooccupied with what is to come”.

Anybody know? What ever happened to Smokin Joe’s pile of ‘gravel’ the Reserve Bank Reserve Fund? (I can imagine the publicity stunt rolling up his sleeves, brandishing a shovel just like the poor people whom drive cars and hoarding the stuff)

https://billmitchell.org/blog/?p=26544

“The Treasury actually borrowed from the private sector an equivalent amount to that which was put back in the Reserve Bank Reserve Fund (RBRF)”

One would imagine this private sector money is from a commercial bank. Which must have deemed the reserve bank ‘credit worthy’ 😉 then created a deposit in AUD based on its ability to do so as permitted by the central bank in the first place.

Is the government paying commercial interest rates for this?

Barro/Ricardian practitioners never seem to have picked up on the mountain of evidence that shrinking government and passing its operations into the private sector usually makes said service more expensive less efficient. Hence private sector spending will not pick up even if they were to rationalise the future savings to be true anyway because they’re paying increased power bills, healthcare, education, water, garbage collection etc etc.

How come it seems never to be understood that it is an accounting identity that a [federal] government surplus is exactly matched by a non government deficit?

I mean, how simple is that? No need for medical analogies or Ricardo based talk!

Not radical enough – Keynes was a bankers hack working in the bowels of the establishment since the Bradbury Great war era.

The solution is to return purchasing power to people.

Not to engage in “growth” policies (junk production) that is depreciating at a faster and faster rate.

The solution is to expose and then back the Tudor police state.

THE CASE FOR REMOVING HUMAN LABOR FROM OUR ECONOMIC THEORIES

The flaw in our thinking, today, is that human productivity-Jobs-are included in our economic equation. When us humans are thrown into the mix it leads to our going down all kinds of blind alleys that undermine our finding a solution to insidious unemployment.

Unemployment is a “social” problem, with adverse social consequences-both for the larger society, as well as the individual- 95% of our social ills would be corrected by ending unemployment-and given “automation” alone, the adverse consequences are exacerbated going forward–but because this pernicious social problem is currently integral to our economic policies-the data, alone, shows us to be impotent/incompetent in finding a solution-

For instance, in the U.S., our current job creation is to stand on one foot and then the other-waiting on a market in recovery to fix our unemployment crisis since the 2008 meltdown-with the result that during much of this time, as we inched downward, we have had 25 million unemployed/under-employed-and under this model, if the market fails, the jobless are out of luck!

The problem is not limited to the U.S.– “High and persistent unemployment has pervaded almost every OECD country since the mid-1970’s” [Dr. William Mitchell]–and laboring under the erroneous belief that “the market can provide anybody wanting a job, with a job”– 10% unemployment is common in the Eurozone, and one in four are jobless in Greece and Spain.

Unemployment is a “No One Wins”– the jobless lose, civility loses, and the market loses, to wit:

THE LAW OF DIMINISHED INCOME TO THE MARKET FROM UNEMPLOYMENT [hereafter the D/UE LAW]

3% is the zero-sum threshold above which unemployment triggers inflation by diminishing labor training and skills, under-utilizing capital resources, reducing the rate of productivity advance, increasing unit labor costs, reducing the general supply of goods and services–and the loss in income to the Market is compounded exponentially with each percentage point of increase in unemployment, above 3%.

It seems improbable this will occur anytime soon….but that doesn’t mean that it shouldn’t occur……

Jim Green, Democrat opponent to Lamar Smith, Congress, 2000

Pilger has some worthwhile things to say sometimes but he also has a history of following his ideology to the exclusion of truth at times.

So,who to believe? Nobody. Approach all things human with caution and scepticism. Try to think outside the square and reason from first principles.

On a lighter note,if this pack of raving twits who call themselves the Australian government are adults then I must have lost 60 years or so.

I’d better climb onto my tricycle and go find them.

What is JimGreen talking about?

Is 3% the NAIRU? Um, I don’t think so.

As someone who reads a bit of Paul Krugman, I think you are being unfair to him, his quote about blood letting was in full

“And economic bloodletting isn’t just inflicting vast pain; it’s starting to undermine our long-run growth prospects.”

I’m not sure how this is playing into the hands of conservatives? Most of his article would agree with you about the govt needing to increase spending to stimulate the economy.

Dear Hamish (at 2015/03/12 at 7:55)

The Krugman quote was as the authors of the article I was reviewing rendered it. There was no bias on my part.

But you also miss the point I think. The use of the term “bloodletting” conveys the metaphor that the economy is a system that can get sick, like a human, and needs medicine. It is a classic neo-liberal metaphor designed to provide scope for harsh policies (‘bitter pills’) that damage prosperity without need.

The analogy is false.

Language matters. So even if the full quote is anti-neo liberal, the damage is done with the continued use of the metaphor. That is what my blog on Framing (cited in the blog) is all about. The point has strong foundation in social psychology and cognitive linguistics.

best wishes

bill

The conservatives view is a strict father model. If people are what they call “dependent” they are punished, whereas adults should be left alone.

It is an odd mindset. You even see them personify countries like Greece as children.

I’ll be interested to see what you have to say about last nights interview on Lateline with Hockey in which he states that he does not see youth unemployment as a crisis

TONY JONES: Could I just put a couple of figures to you? These come from the Foundation for Young Australians. They say having so many young Australians out of work costs the economy half a billion lost hours of work this year – that’s $13.6 billion lost in GDP. Has the Treasury done this sort of modelling for you?

JOE HOCKEY: Well, it’s obviously a major issue, but, you know, when you talk about crisis, I’d say a crisis is 50 per cent youth unemployment like Spain, or, you know, something much larger than what it is. Having said that, I’m not downplaying it. But the question that I keep asking myself is: how are we going to make sure that younger Australians have the same opportunities that you and I have and you and I have better opportunities than our parents had before us? That’s been the focus. Now there’s some fantastic statistical data in the Intergenerational Report that makes comparisons with other countries, it makes assumptions about longevity, which is really important, but it also encourages us to think about how we can delay the ageing process. That means longevity is one thing and age expectancy is one thing – that’s terrific. But the other thing we need to think about is how active we are during the course of our lives.

TONY JONES: But that’s a message for them when they get old. I mean, if you’re 18 years old, you haven’t got a job now, you’ve got very few prospects of getting one – what’s the message today? And I suppose going back to my question about is this a crisis?, I mean, why don’t you have some sort of national youth summit and try and bring all the forces together of politics, business and so on to try and deal with this because otherwise we’ll end up with a lost generation?

JOE HOCKEY: Well I think you’re overplaying it. I think you’re going too far in that regards. I don’t see it as a crisis.

source: http://www.abc.net.au/lateline/content/2015/s4195936.htm

“But the question that I keep asking myself is: how are we going to make sure that younger Australians have the same opportunities that you and I have and you and I have better opportunities than our parents had before us? That’s been the focus”

Yah. I’m pretty sure I’ve worked a hell of a lot harder for what little I have than Joe Hockey ever did.

I also paid for my degrees working crap jobs for very little money.

The reward is $38k a year. for me – which probably wouldn’t last Joe Hockey a month.

He should be comparing himself to a prize winning pig at the easter show rather than those of us that have worked very hard just to obtain low income jobs.

The opposition are no better unfortunately.

There is a lot of Weasel words in the press. Soft words used that mask real results.

I would like to read real words.

eg. We will introduce austerity that will result in the loss of 20,000 jobs to cool the economy.

or We will introduce stimulus that will result in 20,000 new jobs to assist the economy.

My point is reduce everything to the most real: jobs or no jobs created from policy.

We can all understand that.

micky9finger–what I am saying is that the acronym NAIRU is an excellent example for why “human labor” should be deleted from our economic theories-unemployment is a “social” problem, we, the larger society have an absolute responsibility to address….instead we leave the solution to the whims of the market, with disastrous results-in the U.S., only once since WW II, has this resulted in a UE rate below 3%–in 1953-and since 1978 we have had the “legal authorization” to limit our UE rate to “3%”–i.e., at no time should our UE rate exceed 3%–[and our current true rate is around 11%]….this will probably muddy the waters even more, but could not agree more with Bill “Never impose austerity in a slump”. Best regards, Jim Green

Of course Hockey doesn’t believe youth unemployment is a crisis. He’s neither youthful or unemployed therefore it’s nothing to worry about.

You may be interested to know this article has been picked up on Reddit, with a fair bit of debate (of varying quality 🙂

Thanks, Bill. I appreciate your hard work here, this is first macroeconomics blog I’ve ever read that 1) maps to empirical reality as I observe it and 2) doesn’t sound like it was written by a shill for an ideology. Post after post, I read things that actually educate. You make sense, and point towards an economic science of the future, rather than an economic wish fulfillment of yesterday. Type on Bill, we’ll get out and teach them, one by one, person to person, because that’s the only way new awareness is going to gain critical mass.

I just read the comments on Reddit.

Most of it was garbage [ a lot of those Austrian numpties] but I did find this gem of a quote:

“Austerity is like telling a starving person they need to go on a diet”.

HURRAH! I am so pleased to have stumbled across your blog. Information spot on! Thank you.