I have been thinking about the recent inflation trajectory in Japan in the light of…

Japan’s growth slows under tax hikes but the OECD want more

The OECD yesterday released their interim Economic Outlook and claimed that real economic growth around the world was slowing because of a lack of spending. Correct. But then they determined that structural reforms and further fiscal contraction was required in many countries, including Japan. Incorrect. The fact that they have departed from the annual release of the Outlook (usually comes out in May each year) indicates the organisation is suffering a sort of attention deficit disorder – they just crave attention and their senior officials love pontificating in front of audiences with their charts and projections that attempt to portray gravitas. No one really questions them about how wrong their last projections were or that cutting spending is bad for an economy struggling to grow. All the participants just get sucked into their own sense of self-importance because the event generates headlines and the neo-liberal deception rolls on. The OECD needs a reality check on Japan, but it isn’t the only organisation that is pumping out nonsense this week.

On September 8, 2014, the Japanese government Cabinet Office – released the latest – Quarterly Estimates of GDP April – June 2014 (they are the Second Preliminary Release).

The press seized on the results and there were some sensationalist headlines. “Economy of Japan Contracts More Than Expected” (Financial Buzz), “Japan GDP growth collapses amid sales tax shock” (CNN

Both of these reports focused on the fact that Japan’s real GDP “has shrunk at an annualized rate of 7.1 percentage points in the last three months from June.”

CNN reported that – Japan GDP growth collapses amid sales tax shock:

Japan’s economy suffered its worst contraction since 2011 in the second quarter as consumer spending on big items slumped in the wake of a sales tax rise …

Japan’s consumption tax was increased to 8% in April in a bid to improve the country’s fiscal position. If needed, the government has the option to implement an additional increase to 10% by 2015.

Earlier in the year, consumers responded in a big way, bringing forward big purchases — and all the extra shopping contributed to the strong first quarter numbers. But now that the sugar rush is over, economists had expected Japan’s growth rate to return to Earth in the second quarter.

I don’t dispute that the economy has contracted under the weight of the sales tax hike (more about which later).

But the data shows that real GDP contracted in seasonally-adjusted terms by 1.8 per cent in the June quarter 2008 and by zero percent over the year to June 2014.

Where does the 7.1 per cent come from? It is the annualised result of the June-quarter result – so 4 times 1.8 = 7.1 per cent (with some rounding).

Is the 7.1 per cent realistic as a forward looking projection? Yes, if the government persists with its sales tax hike and cuts spending further. No, if it learns from the past and rejects

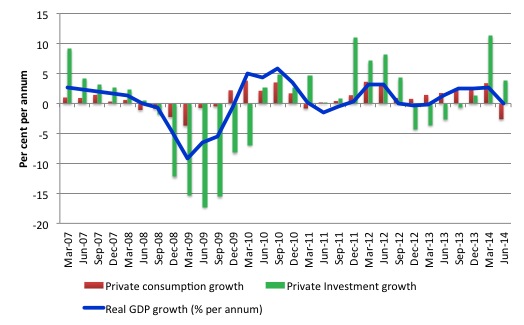

The first graph shows real GDP growth (per annum) in Japan since the March-quarter 2007 (blue line) and private consumption growth (red bars) and private investment growth (green bars) over the same period (up to June-quarter 2014).

Japan was not only hit by the financial crisis (where net exports collapsed in early 2008) but later in 2011 it had to endure the tsunami which devastated its north-east regions.

During the financial crisis, private investment and net exports fell into negative growth for most of 2008-09.

The drop in private consumption spending is a direct result of the sales tax hike. It will get worse.

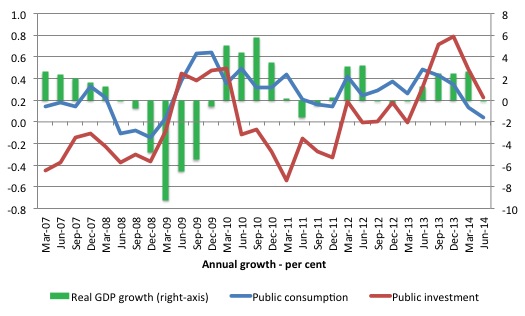

The next graph shows, there was a strong counter-cyclical fiscal response in both public consumption and investment over this period of private spending decline.

The government started withdrawing its fiscal stimulus too early – even though growth in government consumption continued through 2010 as public investment started to contract. While the non-government components of spending were starting to recover they were not strong enough to resist the slowing fiscal impact and so real GDP growth started to moderate.

The fiscal response in the most recent crisis has been strong and even though net exports once again started to drain growth the overall slump instigated by this devastating natural disaster was relatively modest and short-lived. Once again the recovery has been led by a strong counter-cyclical fiscal response which has also boosted private consumption growth.

But with the IMF and OECD all hectoring Japan to reduce its deficit the growth in public consumption and investment spending has declined dramatically and that is reinforcing the effects of the sales tax and related austerity measures on private spending.

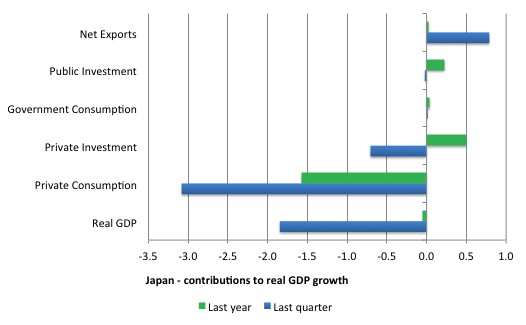

The next graph shows the contributions (in percentage points) to real GDP growth in Japan over the last quarter and the last 12 months (to the June-quarter 2014). Once again you observe the strong negative effect on private consumption of recent sales tax changes.

That’s the real world folks. The IMF better get out of their so-called ‘golden cage’ in Paris occasionally. The golden cage is so named because OECD staff are so well-paid and enjoy zero tax obligations that they find it difficult going back to real world jobs that most of us have to work in.

Struggling for recognition given they have departed – a sort of attention deficit disorder that afflicts these institutions –

The OECD claimed in its latest Economic Outlook briefing document that:

In Japan, by contrast, the necessary consolidation is only beginning and the challenge to ensure debt sustainability is substantially greater. The planned second round of consumption tax increases in 2015 should be implemented, supported if necessary by other measures, particularly further monetary expansion, to manage demand.

To which any sensible person will say – here we go again – 1997 revisited.

The OECD are coming in behind the IMF who has also been berating the Japanese government to increase sales taxes to raise more government revenue.

We keep hearing about “growth-friendly” fiscal consolidation. By their very nature, discretionary cuts to fiscal positions kill growth. I note the OECD is calling on Japan to engage in more quantitative easing, as the offset to the fiscal cuts.

Once again, these ideologues continue to propagate the myth that monetary policy is an effective expansionary tool, despite all the evidence over the last several years that it is not. Fiscal policy is effective, monetary policy is not – for that purpose.

So effectively, they are advocating a cut in domestic demand.

I remind readers of what happened in 1997. A full analysis is to be found in this blog – The last eruption of Mount Fuji was 305 years ago..

Any fiscal contraction will just take the nation back to 1997, where these same debates were rehearsed then and led to tax hikes – and – a dive back into recession.

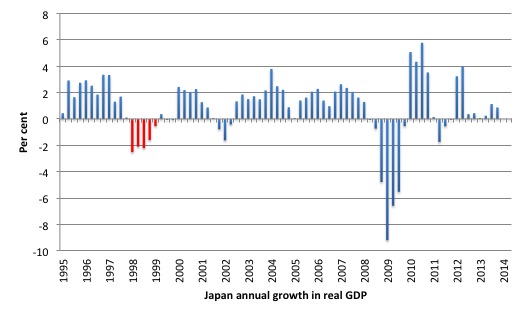

The following graph shows the annual rate of real growth in Japan from the March-quarter 1995 (at the onset of the asset price crash) through to the March-quarter 2013.

The property crash in the early 1990s caused a severe contraction in household consumption and private investment spending which culminated in a brief real contraction in 1994. Once the stimulus from the expanding budget deficit began to work real GDP growth regained momentum.

By 1996, the same calls for austerity (fears about public debt ratio etc) that dominate the policy debate today were rampant in Japan and the government eventually bowed to political pressure and raised taxes in an attempt to reign in the budget deficit.

The public contraction on top of very fragile private sector spending – akin to the situation that most nations face today – caused a massive contraction in 1997 and 1998 – which increased the budget deficit (via the automatic stabilisers) and added to the public debt ratio (given both debt was rising and GDP was falling).

Peter Tasker, in his article – Hegel on Abenomics (August 2, 2013) notes that after the Japanese government bowed to the pressure and increased consumption taxes in 1997, real GDP growth collapsed:

In the event they drove the Japanese economy off a ten trillion yen fiscal cliff. If you tax something you are likely to end up with less of it. So it was with Japanese consumption. In a matter of months outright deflation had reared its ugly head. Retail sales fell into a protracted slump from which they have yet to emerge.

Soon afterwards Hashimoto was forced from office, his reputation for competence in tatters. The story goes that he bitterly regretted following the advice of his bureaucrats right until his untimely death in 2006.

After that collapse, the ratings agency, Moody’s then started to play games by downgrading the sovereign debt. Fortunately, the Japanese government did not take any notice, and, realising the mistake of 1996-1997, expanded their net spending again. The renewed fiscal stimulus saw real GDP grow very strongly in the ensuing years despite the rating agencies decision.

The Japanese government never had any trouble finding buyers for the debt it was issuing, they held complete control over interest rates, inflation fell, unemployment remained relatively stable and real GDP growth was strong through the period of the downgrade.

The decision by Moody’s was rendered irrelevant by the Japanese government who just exercised the power they had as a sovereign issuer of the currency.

You might wonder what happened in 2002? The recession that occurred then in Japan was largely driven by an export collapse (remember the US went into recession during this period) and a tightening of net public spending. This then provoked a fall in private investment spending and a rising saving rate. It had nothing to do with the ratings decision.

Once exports recovered and public spending support resumed the economy then grew relatively strongly despite the lower sovereign debt ratings.

And then the 2007 crisis arrived.

Any attempt to engage in fiscal austerity now will take them back into recession.

Japan is not Greece!

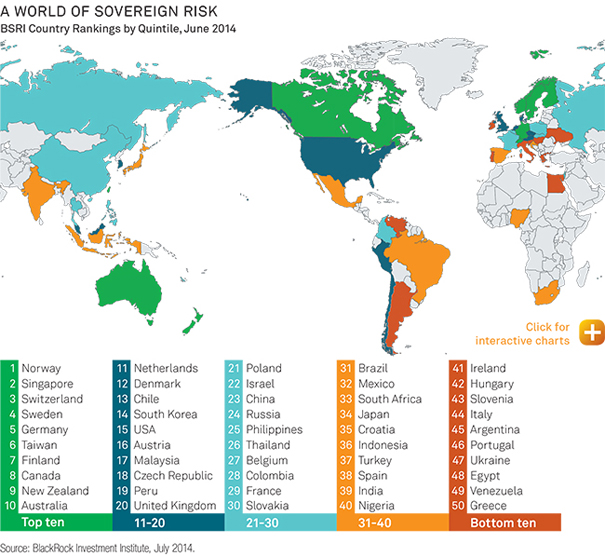

But try telling that to BlackRock, which makes money by spreading rumours under the guise of their nonsensical BlackRock Sovereign Risk Index.

The only thing going for the BSRI is that it allows some nice coloured maps to be produced. Humans gain an affinity for colouring in during their childhood but most of us gain a deeper conceptual understanding as we move into adult life.

I cannot say that there has been much conceptual development at the BlackRock offices.

Their latest rankings – released with a sense of self-importance to their client base – produced this lovely map. Pity it has not meaning.

The accompanying document has photos of various ‘strategists’ and ‘modellers’ etc in suits, all looking erudite and important. But there isn’t much that I would take from their Report if I was attempting to understand the world of government bond markets. About zero, in fact.

The BSRI is a weighted-index and its construction is explained in this document – Introducing the BlackRock Sovereign Risk Index.

They use four components, each comprised of a number of individual time series indicators. The components are:

> Fiscal Space – This category assesses if the fiscal dynamics of a particular country are on a sustainable path. It estimates how close a country is to breaking through a level of debt that will cause it to default (i.e., the concept of proximity to distress), and how large of an adjustment is necessary in order to achieve an appropriate debt/GDP level in the future (i.e., the concept of distance from stability).

> External Finance Position – The factors in this category measure how leveraged a country might be to macroeconomic trade and policy shocks outside of its control.

> Financial Sector Health – This category considers the degree to which the financial sector of a country poses a threat to its creditworthiness, were the sector were to be nationalized, and estimates the likelihood that the financial sector may require nationalization.

> Willingness to Pay – In this category we group factors which gauge if a country displays qualitative cultural and institutional traits that suggest both ability and willingness to pay off real debts.

The weightings (see Figure 1) are Fiscal Space (40 per cent); External Finance Position (20 per cent); Financial Sector Health (10 per cent) and Willingness to Pay (30 per cent).

Take a currency-issuing nation first, such as Japan. It has zero ‘fiscal space’ risk. Japanese government debt carries zero credit risk and nothing the ratings agencies do will alter that. There are always more bond investors lining up each bond auction to purchase Japanese government debt than the government issues. The same investors have been buying Japanese government debt while deficits have been rising and gross public debt ratios heading up beyond 200 per cent for the last 20 years.

On the last point, Please read my blogs – S&P decision is irrelevant and Moodys and Japan – rating agency declares itself irrelevant – again – for more discussion on this point.

So all the components listed under this category – Debt/GDP, Per Capita GDP, etc are irrelevant. It doesn’t matter how large the Debt/GDP ratio is, how low Per Capita GDP is, how much debt is held by foreigners, how old or young the population is, how strong the ‘tax base’ is, etc.

Any government that issues its own currency carries zero financial risk in terms of meeting any outstanding liabilities denominated in the currency it issues.

The only vulnerability enters if such a government issues debt in a foreign currency. Then it faces sovereign debt because it cannot guarantee it will have holdings of that currency at appropriate times and in viable magnitudes. The index takes this into account as one of the factors under the External Finance Position.

It rightly says that:

The currency in which debt is owed can be important for a sovereign, as it may limit options for repayment. If debts are denominated in local currency, a government may have the option to reduce those debts by “printing” money …

A more correct statement is that it would always be able to credit private bank accounts. No printing press would be involved. But the point is clear.

In terms of the other factor influencing ‘External Finance Position’, the usual myths are rehearsed. They claim a nation with a large Current Account faces higher sovereign debt risk but then talks exclusively about private debt. There are no implications for the viability of government debt for a nation running a large current account deficit.

On Financial Sector Health – again, the usual myths about bank viability etc. A sovereign, currency-issuing government can always bail out its banking sector should it desire to. It can always guarantee creditors in the currency of issue.

Again, the authors claim private debt buildup under creidt bubbles expose the nation to higher sovereign debt risk. That assessment is completely false. The whole private sector credit structure could fail and plummet the nation into a private crisis and still the debt of a currency-issuing government would be safe.

Consider the early 1990s in Japan when the property market collapsed in a very significant way. There were no constraints on government debt viability as a result.

Finally, there is some sense in considering Willingness to Pay, given the crackpot politics that we are seeing in recent years from Tea Party types in America. The type of components they cite – such as “transparency of data”, “a country’s fiscal credibility” are largely irrelevant here. There is no real way of knowing that a currency-issuing nation will become so nonsensical that its political class will choose to default.

Perhaps a Tea Party Ratio weighted by how many times Paul Ryan get cited in the press could help. But then when push came to shove that lot were gutless and unprepared to push their stupidity into voting action.

For an advanced, currency-issuing nation, this risk is minimal if not close to zero.

Clearly, for a Eurozone nation, they are exposed to financial default risk because the government has voluntarily chosen to use a foreign currency, issues debt in a foreign currency and cannot bail out its banking system.

But then despite all that, since the PSI disaster in Greece, the ECB has made it clear that it will do what it takes to keep all governments in the Eurozone solvent in euros. So there is little risk there. The political will of the ECB to keep the zone together is outweighing all other considerations at present.

The fact is that the list of 50 is not to be relied on. There is some comparability between currency issuing nations and those, say, in the Eurozone, if you really think that ‘Willingness to Pay’ is a factor that shifts on a quarterly basis. I don’t! It would be an extraordinary event for the Japanese government to say the debts were a gift – piss off! It has happened but not in times of peace.

I also note that Argentina has adopted a solution that I outlined in this June 2014 blog – Argentina versus the Vultures – simple solution but leave morality out of it. I am not claiming credit because the solution was obvious to all but those besotted by neo-liberalism.

The UK Guardian article (September 12, 2014) – Argentina enacts law restructuring government debt – outlines the way the Argentine government will maintain payments to the bond holders that accepted a restructure but have been blocked from receiving cash by the US vulture court decision in June.

They are proposing to convert the debt into local currency and pay through their own banking system (or via the French system). Simple. The exchange rate has been very stable against the US dollar so the exchange exposure is minimal to bond holders.

Losers: the vulture funds – they lose everything!

Back to BlackRock. Where do they get their data from? Well, in part from IMF quarterly growth projections. Stop laughing, we are trying to be serious.

This web of nonsense is so interlocked. The IMF projections are notoriously poor. For example, Please read my blog – The case to defund the Fund – for more discussion on this point.

Applying a flawed methodology (BRSI) to shockingly inaccurate but systematically biased IMF projections is a recipe for a void of meaning.

Take Japan, for example.

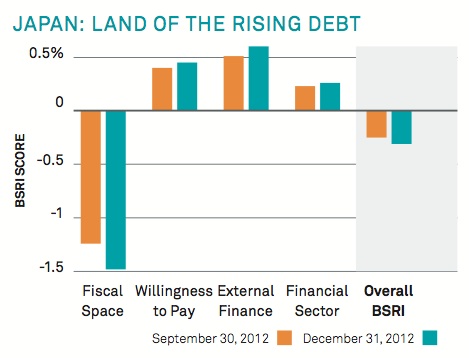

In their January 2013, BSRI Quarterly Update – Mapping Sovereign Risk, they had a special focus on Japan and claimed that:

The fiscal profile of Japan worsened enough to cause it to slip two spots to 35th place, even as its other BSRI components improved. Japan now ranks just ahead of South africa but below the likes of Turkey, Indonesia and Slovakia … This happened as the country’s overall debt rose and its primary balance to Gross Domestic Product (GDP) went downhill.

They produced this chart and announced because Japan’s fiscal space had ‘worsened’ they became more risky. Apparently, Japan became ‘more willing to pay’ in the three months between September and December 2013. Its a joke.

As one of my regular readers (from Florida) reminded me overnight, this sort of logic has led to massive losses among investment funds in recent years.

For example, the so-called ‘Bond Kings’, Pimco made poor bets against US government bonds in 2013 because they were claimed that the quantitative easing would drive up inflation but as inflation remained steady or fell, yield rose and bond prices fell. A big loss ensued all because the mainstream macroeconomic causality was being used.

Why anyone would buy risk assessments from BlackRock is beyond me really. But like a lot of these companies they produce flim flam and get paid heaps to do it.

That is just a manifestation of what has gone wrong with the economies of the world.

Conclusion

Anyway, lets hope Japan doesn’t take the OECD advice.

That is enough for today!

(c) Copyright 2014 Bill Mitchell. All Rights Reserved.

“The only vulnerability enters if such a government issues debt in a foreign currency.”

As ever here in the UK we don’t like being outdone by the Aussies. So you’ll no doubt be pleased to hear that we’ve taken the lead back in ‘idiotic things a National Treasurer can do’.

Osborne has decided to start selling the UK economy down the river to the Chinese.

“Britain will become first Western government to issue an offshore bond in China’s renminbi currency”

So in the line up to run the UK Exchequer next years, we have Osborne who wants to issue foreign currency debt to the Chinese and Balls who want the UK to run a surplus.

Dumb and Dumber.

Dear Bill

Inflation in Argentina is high again, around 40%. High inflation means that the peso has to undergo a nominal devaluation to avoid a real upvaluation. That is a currency risk for foreign bondholders.

Why do Argentina and other Latin American countries so often have 2-digit inflation?

Regards. James

“Why do Argentina and other Latin American countries so often have 2-digit inflation?”

My understanding is that that ultimately tracks the % of GDP that exits the country to be uselessly stashed in Swiss & other “safe” bank accounts. Capital flight is historically high across all colonized nations, esp those looted then & now by Spanish & Portuguese traditions.

If inflated currency stays in country, it usually goes to the 99%, eventually.

If it quickly leaves the country … there’s just pressure for even more inflation?

Speaking of BS – There is a mob of bulls on laxatives in Cairns this week.

Fortunately they are all locked up in a posh hotel under police guard.

“Why do Argentina and other Latin American countries so often have 2-digit inflation?

They work very hard at it in many ways, and succeed!:

In no order: Poor taxation systems esp on the rich who always flight their capital, exercise of pricing power by oligarchical enterprises, indexation, foreign currency borrowing, and high interest rates on government bonds to “fight” (meaning create and sustain) inflation.

“Capital flight is historically high across all colonised nations”

There’s not really capital flight in floating rate areas. There can’t be. Pesos can’t go anywhere else.

The effect happens because saving in a currency acts like taxation. If there isn’t saving in a currency (and foreign bank accounts are just assets like foreign holiday homes from the perspective of any currency area), then you have to do the correct level of taxation to match spending demand to the production/import system and possibly import controls to stop luxury goods being imported ahead of necessities.

Argentina has a weak government that cannot take on the vested interests in the country. But that can be said of the UK that can’t take on the City or the US that can’t take on Wall Street.

Japan is in trouble primarily for two reasons, the ongoing demographic collapse in Japan. You can’t have a growing economy if you are heading toward a population of zero, and along the way have half your people over 70. The second is the incredible bungling of the nuclear power sector, in the design, immediate response, and aftermath. Nuclear power is essential to Japan as it has zero indigenous fossil fuels. To have energy costs so high, and most of that imported, is a fatal drag on Japan. They need to get those plants back online, and revive the plans to build a lot more of them, or they are sunk.