I started my undergraduate studies in economics in the late 1970s after starting out as…

Myths regarding sovereign funds

There was an article in the Australian edition of the UK Guardian last week (September 4, 2014) – Oil tax: Norway could teach Australia a thing or two about managing wealth – which demonstrates the myths that pervade the public debate about fiscal policy and monetary systems. This particular myth relates to the opportunities that so-called sovereign funds offer currency-issuing governments and the calibration of national assets as something being

While not wanting to get personal, I do think that journalists should be educated in the area that they choose to write Opinion pieces in. Op Ed articles are not merely reporting news. They are intending to provide analysis, which one would hope would be based on a deep understanding of the issues involved.

In this case, the journalist has a degree in Media Writing from – Southampton Solent University – (which ranks 57th out of 90 in Media courses). Prior to joining the Guardian (Australian edition) he was the Soccer match reported for the regional newspaper the Geelong Advertiser. There is no evidence in his CV of any economics education. You can judge those facts for yourselves.

The Guardian article sets the scene by claiming that:

Thanks to natural resources, Norway is a country of five million trustifarians – with each person theoretically being a millionaire. In Australia, mining benefits a selected few …

Anyone involved in policy formation in the Nordic country would probably have been baffled and even dismayed that an advanced democracy such as Australia could’ve strayed so far from Norway’s stellar example on how to manage the dumb fortune of a resources boom.

We will consider the accuracy of these claims presently.

By way of background, The Government Pension Fund for Norway was created in 1990 by the Government Petroleum Fund Act and for the first six years acted as a “bookkeeping exercise” (petroleum revenues accounted for and handed over to the government to cover its deficit). Its “first net allocation” was in May 1996 and it has grown in size since then.

You can learn more about the Fund from its annual report to the Storting (Parliament) – The Management of the Government Pension Fund in 2013 (big file, 6.1 Mb), published by the Norwegian Ministry of Finance.

The Fund is in fact, two funds – the Government Pension Fund Global (GPFG) and the Government Pension Fund Norway (GPFN). The Fund “has no governing bodies or employees of its own, and is not a separate legal entity”. The GPFG is managed by the – Norges Bank, the central bank of Norway and the GPFN is managed by – Folketrygdfondet (National Insurance Fund), which is a state-owned company set up to manage the Government Pension Fund.

The largest fund is the GPFG. Its self-stated purpose is:

… to facilitate government savings to finance pension expenditure under the national insurance scheme and support long-term considerations in the spending of government petroleum revenues

Essentially, all revenue from petroleum activities are immediately transferred into the GPFG. The Norges Bank then seeks “to maximise the international purchasing power of the capital over time” with moderate risk parameters. There are environmental and social criteria used to supplement the financial objectives when the investment strategy is being determined.

The Fund then makes transfers to the Government (sending itself money) to “cover the non-oil budget deficit” under a strict “fiscal policy guideline”, which “calls for the spending of petroleum revenues over time to correspond to the expected real return on the Fund, estimated at 4 percent.”

The GPFG’s assets are spread between Equities (61.7 per cent in 2013), Bonds (37.3 per cent) and Real Estate (1 per cent). It is now worth 5,038 NOK billion and increased by 1,222 billion in 2013 alone (NOK 291 billion being as a result of exchange rate changes).

The assets are held in 58 approved countries and in recent years there has been an emphasis on so-called emerging markets. The real estate assets are mostly in the US and Europe and include “office properties, shopping centres and logistics properties”.

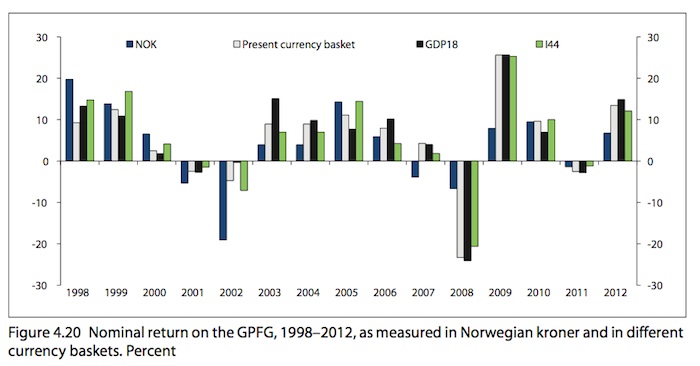

The following graph is drawn from the Report to Parliament (Figure 4.20) and shows the performance of the GPFG since 1998 (to 2012). The big cycles in asset prices are clearly evident but by any measure the fund managers are doing well.

Which raises the question? Does any of that matter?

The Guardian article seems to think this is a big deal. It correctly notes that “Companies looking to extract Norwegian oil pay handsomely for the privilege”, which is in contradistinction to the approach taken by the Australian government. The latter virtually gives the resource wealth to the mining companies.

The author performs a quick calculation (dividing the current value of the Fund by the Norwegian population) and concludes that:

… with each person theoretically being a millionaire (in kroner, that is).

But, of course, no single Norwegian has any legal claim on the Fund – now and never. Which means the statement sounds emotionally appealing but has no substance. It is the same as saying that each person has some share of the public debt. Equally meaningless.

The Report to Parliament claims that:

The Government Pension Fund has over time become an important financing source for government expenditure.

And the Guardian writer buys into that by claiming that the Fund will provide “for future disasters that may befall the Scandinavian country”.

Both statements are deeply misleading.

Of course, there are accounting mechanisms in play that give the impression that the government is drawing (for example, NOK139 billion in 2014) money from the Fund and using it for spending as part of fiscal policy.

But the reality is that these accounting trails are just a chimera of what underlies the fiscal position of the government.

The term funding means that money is being provided to allow some spending to occur. Funding allows for spending that otherwise could not occur.

However, the the Norwegian government is sovereign in its own currency and is therefore never revenue constrained.

It makes no sense to say that such a government uses the returns from the Petroleum Fund to provide itself with more capacity to spend than it otherwise would have – which is the meaning of the term funding.

The Fund provides no more or no less capacity of the Norwegian government to meet a natural disaster with one exception that I will come back to.

The Guardian author observes that “Norway’s publicly funded safety net is lavishly embroidered”, which he somehow implies is associated with the assets held by the Fund.

The truth is different. The excellent public services that the Norwegian population enjoys are the result of political choices and a sense of collective will among its population. They have chosen this level of public provision.

The revenues flowing from the Fund now or in the future are irrelevant to that choice, given that the Norwegian government is a monopoly issuer of its own currency.

The Guardian author contrasts the Norwegian experience with the situation in Australia. He claims that Australia has foregone the chance to build up a Norway-style sovereign fund “largely because of the botched way Australia has managed its once in a generation mining boom”.

He cites the “scrapping the mining tax” as an example. Despite being deeply flawed in its design (for example, there were too many concessions), the Australian mining tax was one avenue for forcing, mostly foreign-owned mining companies to pay for the national assets that they exploit for their private gain.

All of that is true. The mining sector gets massive concessions from government, employs very few people, ravages the natural environment, and provides significant funds by way of lobbying to support policies that erode workers’ rights, undermine the operation of trade unions, and cut pay rates etc.

But to claim that having a properly functioning mining tax in this country would help fund Norwegian style public services is false.

The Guardian says:

When you consider the Norwegian example, it seems farcical that parliament has spent the week squabbling over associated superannuation and childcare benefits when the obvious source of revenue was turned down for short-term political expediency and then abandoned entirely.

This wasted opportunity extends to other areas. The outcry over changes to university fees, or welfare or payments to see the GP would surely be rendered unnecessary if the previous government had crafted a proper mining tax and spent it wisely.

Australia does have a sovereign fund of sorts – the so-called Future Fund. Please read my blog – The Future Fund scandal – for more discussion on this point.

The basic point is that whether there is a fund or whether it rises or fall in value makes no fundamental difference to the underlying capacity of the Federal government to fund any services it chooses as long as the resources deployed are expressed in Australian dollars.

The national government’s ability to make timely payment of its own currency is never numerically constrained by revenues from taxing and/or borrowing.

In Australia, all the talk is about funding future public service superannuation liabilities that will clearly accrue. But the creation of a sovereign fund to ‘put’ away money in no way enhances the government’s ability to meet these future obligations.

In fact, the entire concept of government pre-funding an unfunded liability in its currency of issue has no application whatsoever in the context of a flexible exchange rate and the modern monetary system.

The misconception that “public saving” is required to fund future public expenditure is often rehearsed in the financial media.

The concept of pre-funding future liabilities clearly appies to non-government users of a currency. Their ability to spend is a function of their revenues and the reserves they might hold of that currency.

So at the heart of all this nonsense is the false analogy neo-liberals draw between private household budgets and the government budget.

Households, the users of the currency, must finance their spending prior to the fact. However, government, as the issuer of the currency, must spend first (credit private bank accounts) before it can subsequently tax (debit private accounts). Government spending is the source of the funds the private sector requires to pay its taxes and to net save and is not inherently revenue constrained.

In Norway’s case, the creation of the Fund was sensible in the context of avoiding inflation while maintaining full employment.

That is, the nation has experienced such a strong external sector activity (and forced private companies to pay for access to the collective energy assets) that has been able to maintain high levels of domestic spending and employment and first-class public services and infrastructure provision, that its fiscal position has to have been in surplus mostly to keep aggregate spending growth in line with the real capacity of the economy to produce.

So the revenues taken out by the Fund are better seen in terms of inflation control rather than any future funding capacity.

Unemployment remains very low (currently 3.3 per cent) and has only risen slightly during the period of the GFC and after.

In the case of Australia, the broad labour underutilisation rate is around 15 per cent and the quality and scope of public services and public infrastructure is degrading as successive governments pursue fiscal austerity.

Last week, GDP growth was down to a (projected) 2 per cent per annum well below the trend rate of around 3.25 per cent and well below the required rate to bring unemployment down.

In that case, trying to squeeze the economy to generate fiscal surpluses that can then be allocated to a sovereign fund is very damaging.

I have no problems with the Government levying a Norwegian style mining tax. As the Guardian article suggests, conservative claims that such a tax undermines investment and growth are not supported by the evidence.

The author notes that Norway’s growth rate is superior to Australia and:

There was no stampede of resource investment away from Norway due to its high tax rate, and it managed to insulate itself from any recession for coming generations to boot.

The other point to note is that levying a mining tax would be to force the private users of the collective resources to pay for that access not to raise revenue for government. It would however provide more space for the government to increase its real expenditure.

Not because the revenue gave it more cash but rather that the non-government sector had less revenue available to spend and so the government could command more real resource use without compromising any inflation barriers.

The other point to note is that the claim that running surpluses provides the funds to create these sovereign funds is also mis-leading.

You can think of this in two stages. First, the national government spends less than it raises in tax revenue and this leads to ever decreasing levels of net private savings unless the external sector is so strong that it offsets the fiscal drag. The latter is the case for Norway. The former is the case for Australia.

In the case of Australia, the non-government deficits are manifest in the public surpluses and increasingly run down the wealth held by that sector and force higher private debt levels in order to maintain non-government spending.

The deteriorating private debt to income ratios which result will eventually see the system succumb to ongoing demand-draining fiscal drag through a slow-down in real activity.

Second, while that process is going on, the national government is actually spending an equivalent amount that it is draining from the private sector (through tax revenues) in the financial and broader asset markets (domestic and abroad) buying up speculative assets including shares and real estate.

That is what a sovereign fund does. It amounts to the government competing in the private equity market to fuel speculation in financial assets and distort allocations of capital.

However, as you can see from pulling it apart, this behaviour has been grossly misrepresented as providing “future savings” to pay for the future government spending.

But, if the sovereign government claims it has achieved a fiscal surplus yet simulataneously has purchased and equivalent value of financial assets in the domestic and international capital markets then from accounting perspective the Government can not reasonably say it has run the surplus.

Buying financial assets has an equivalent flow of funds to building a school. Both constitute government spending. In these situations, the public debate should be focused on whether this is the best use of public funds. It would be hard to justify this sort of spending when basic infrastructure provision and employment creation has been ignored for many years by neo-liberal governments.

The final point to note relates to the exception I made above in relation to Norway’s sovereign fund.

The Report to Parliament says that:

The assets accumulated abroad by Norway through the financial investments in the Fund shall finance future imports …

And I also noted that the Fund provides no more or no less capacity of the Norwegian government to meet its current or future spending choices with one exception.

Clearly, massive holdings of foreign currency-denominated assets provide the nation with a ready supply of foreign exchange without the need to engage in the foreign exchange markets (by selling NOK).

In that case, the public sector can purchase goods and services for sale in say US dollars or Yen or Euro or whatever directly and not create any inflationary pressures in the domestic economy.

That is an advantage other nations without significant holdings of foreign currency assets do not enjoy.

But this advantage only accrues to Norway government import purchases rather than any individual private citizen.

I also haven’t analysed the problems for the Norwegian exchange rate should the Fund ever liquidate in large volumes. Having the assets that can be converted back in NOK is one thing. But the impacts of any conversion is another.

Conclusion

The Guardian author suggest that Australia could have had strong “investments in education, research and infrastructure” if it had taxed the mining sector along the Norwegian lines and built up a similar sovereign fund.

You should now know that that conclusion is erroneous. We can still have all those investments without raising any tax revenue given that the Australian government issues its own currency.

If pursuing those investments pushed the real economy through the inflation barrier then the government would have to reduce the private sector’s purchasing power to take pressure off spending.

But we are a long way from that.

That is enough for today!

(c) Copyright 2014 Bill Mitchell. All Rights Reserved.

“I also haven’t analysed the problems for the Norwegian exchange rate should the Fund ever liquidate in large volumes. ”

Correctly they shouldn’t liquidate and should instead concentrate on those assets that provide a large foreign income. To the point of voting for income distribution rather than share buybacks (Share buybacks benefit those that want to leave the asset – often CEOs with big share options. Income distribution benefits those that want to stay in the asset. For a sovereign infinite horizon holder capital values shouldn’t matter that much).

Besides the subject someway but an excerpt from an small independent progressive magazine that has an interview with what is most likely to be our next finance minister after the election next week. Social democrats “socialist” economic spokesperson Magdalena Andersson.

http://www.etc.se/inrikes/magdalena-andersson-vid-ritbordet

Mine and Google translation from Swedish.

http://en.wikipedia.org/wiki/Magdalena_Andersson_(economist)

“Eva Magdalena Andersson is a Swedish economist and politician.

Andersson was educated at Stockholm School of Economics and pursued graduate studies there from 1992 to 1995. From January 1995 to June 1995, she was educated at Harvard University.”

“J: We have crisis in Europe. The first question is very simple: Can the public sector get out of the crisis by saving?

M: The problem with the euro crisis is that many countries entered the crisis with large public debts. They already had a deficit in the budgets and they had already built up large debts. It had been amazingly lot easier to solve the euro crisis if it had not been that way. If we had a surplus in public finances and public debts had been low, well then of course it had been easy to gas out of the crisis, common in Europe.”

“J: Honk and run?

M: Yes then could one honk and run. The problem is that the recipe is not as easy when public debt is already high. We see that with to big public debt it creates imbalances and there has been a report from the IMF, I think it was, about the risk when public debt is unsustainably high. It will be difficult to refinance State debt. You may have large debt if you have very high credibility, or if it is internally owned as in Japan or Italy. But if it’s not that way and there is concern about pay back then you can quickly end up in a situation where it becomes difficult to refinance.”

—

The problem is that she doesn’t distinguish between debt in foreign currency or sovereign.

—

Question If EU/EZ has acted in a balanced way.

“M: no, I think absolutely not. And I think the requirements we had in these countries has been to much directed toward the cutting in the systems that are good for the common people. Too much cut in unemployment benefit, too much cutting in the … Yes in the central systems. Instead, they should have focused more on raising taxes, especially for those groups that have slightly higher incomes. Overall, look at whether they could increase the tax intake. …

What we did in Sweden [early 90s real estate bubble crash and unsustainably fixed currency] was that we saved on everything, but we also carried out some investment. We carried out for example the “knowledge lift”, so that you also can instill hope in somewhere that there’s a better future.”

“knowledge lift” is one of the social democrats key election things in this election. As it was the last time it was another trimming of unemployed for jobs that aren’t there, but transfer people out of the unemployment statistics. As it was then there was also a lot of scam “educators” making money on the unemployed.

Question about public debt.

“M: as far as the one-sided austerity that essentially has hit ordinary people I think they have come to realize that it was too one-sided. On The Other Hand, … As it is with high public debt you cant say you should just stimulate, make it easy for oneself. that is what will be really hard for a long time to come, to find a reasonable balance in order to stimulate the economy and not pull away with public debt in a way that is … That is unsustainable.”

She also refuse to count sovereign funds like pensions as something that make room for more public spending, as its now about 25 -30% relative GDP. Maybe there could be a discussion on using some of it to long term investment.

The questions come if it is better to place these public “savings” on capital markets than to invest in infrastructure and sustainable energy shift and so on. It’s a hard one for her to slip away from, those investments is of course very important but she repeatedly come backs to how important it is with abundance of money on the capital markets as e.g. “our” stock market. She obviously think that is a key object for public “savings” to supply speculative financial markets with money.

Then she get the question why not borrow now for long term investments to alleviate the high unemployment when interest rates is ridiculously low.

“M: If we increase debt now, we need some time to pay it back. What you do when you are borrowing now is that you pinch on the future welfare …”

You wrote;

“And I also noted that the Fund provides no more or no less capacity of the Norwegian government to meet its current or future spending choices with one exception.

Clearly, massive holdings of foreign currency-denominated assets provide the nation with a ready supply of foreign exchange without the need to engage in the foreign exchange markets (by selling NOK).

In that case, the public sector can purchase goods and services for sale in say US dollars or Yen or Euro or whatever directly and not create any inflationary pressures in the domestic economy.

That is an advantage other nations without significant holdings of foreign currency assets do not enjoy.

But this advantage only accrues to Norway government import purchases rather than any individual private citizen”.

If all the Norwegian resource rent tax was obtained in foreign currency and spent on buying income yielding overseas assets surely the foreign currency debts that Norway’s citizens create when they buy German produced goods can be settled out of that income by Norway’s Central Bank without running a future current account deficit.

The only real problem you have highlighted is that the Norwegian Government used some of the tax to doctor its budget. If that was a tax provided in domestic currency then the potential benefits of that amount of resource rent tax was definitely forgone.

Australia’s mistake with the mining tax was to aim to spend it on internal items. Had the money been paid in $US, Euros, or whatever, and spent to buy assets to replace the assets being exported (coal and ore)then the future outlook for Australia would be much brighter. Australia has lost it whitegoods, rail rolling stock and shortly all its motor vehicle manufacturing. With those losses and with Bluescope losing its base load for steel flat products, and particularly with less and less domestic liquid fuel resources and no refining capacity, Australia will shortly have major current account problems.

This Federal Government appears to have no vision of what is on the horizon.

the country will have major current account problems in the near future,

Dear Bill

My understanding is that the purpose of a sovereign fund is to avoid too many imports today and more imports tomorrow. Foreign currency ultimately can only serve to buy foreign goods. If for some reason a country suddenly gains access to an abundance of foreign currency, it may be preferable to invest most of it abroad and thereby avoid a steep upvaluation of its currency and the destruction of much of its import-competing industry.

Suppose that a farmer has an annual after-tax income from his farm of 50,000. Then an oil company pays him 100,000 in after-tax royalties a year to use his land for an oil drill. Instead of living it up by spending the full 100,000, he invests it all and only spends the return on his investment, which goes up annually because his capital increases each year by 100,000. The farmer does this because he knows that the oil well will eventually run dry. By investing the money, his children and descendants can also benefit from the oil revenues as long as the investment doesn’t go bad. As I see it, the Norwegian government is behaving like our hypothetical farmer.

Regardless. James

A couple of countries became novel oil extractors when the 70s oil price boom made it economical to extract oil at sea. Norway, UK, Australia and some more. Only Norway decided that this was the (Norwegian) people’s property and the gains was to benefit all of them. So the control of the resources and the big oil companies is state owned. The surplus from selling oil is accumulated in the oil found. Not just to save but also to try to staunch inflation of al the money was flooding in to the Norwegian economy.

There also is critic that more could have been used for public investments infrastructure and education. Not that they really need foreign currency for that, but they also are in the neoliberal dogma of finite money supply and inflation fight.

The question is will the foreign (USD dominated) financial assets be there when they need them in the future. Or had it as it have been for a while been better if they invested in tangible foreign assets. E.g. “colonized” its neighbors and bought up natural resources and big high tech savvy companies.

Here are some relevant URLs I posted here some time ago, to papers written by MMTers Michael Hudson, Arno Mong Daastøl and Norwegian billionaire Øystein Stray Spetalen.

Norway squanders much of its oil money by financial speculation abroad instead of directing it at imports used to build up its domestic economy. Norway is rich, but it would be richer still if it shrank its sovereign fund. As Bill states in his exception, the advantage of using the oil fund foreign money instead of domestic currency is that there is no danger of inflation, but this is something that Norwegian politicians do not understand.

Daastøl: “Almost any degree of risk of loss and unprofitability on projects in infrastructure cannot possibly be worse than the oil fund’s losses of 800 billion during the recent financial crash” The fund lost that much in krone by gambling on Wall Street in 2008.