The Reserve Bank of Australia (RBA) increased the policy rate by 0.25 points on Tuesday…

Inflation rises on back of health fund price hikes – generally benign

The Australian Bureau of Statistics released the Consumer Price Index, Australia data for the June-2014 quarter today. The quarterly inflation rate was 0.6 per cent and this translated into an annual rate of 3 per cent, up on 2.9 per cent in the March-quarter 2014. The Reserve Bank of Australia’s preferred core inflation measures – the Weighted Median and Trimmed Mean – are still well within the inflation targetting range and are not trending up. Various measures of inflationary expectations is also flat, including the longer-term, market-based forecasts. This suggests that the RBA will probably consider the inflation outlook to be benign and they will probably hold interest rates at their current low level. The evidence is suggesting that the economy is still very sluggish. The benign inflation outlook provides plenty of room for further fiscal stimulus.

The summary results for the June-quarter 2014 are as follows:

- The All Groups CPI rose by 0.5 per cent compared with a rise of 0.6 per cent in the March-quarter 2014.

- The All Groups CPI rose by 3 per cent over the 12 months to the June 2014, compared to the annualised rise of 2.9 per cent over the 12 months to March-quarter 2014.

- The Trimmed mean series rose by 0.8 per cent in the June-quarter 2014 and by 2.9 per cent for the 12 months to June 2014.

- The Weighted median series rose by 0.6 per cent in the June-quarter 2014 and by 2.7 per cent for the 12 months to June 2014.

- The significant price rises this quarter were for medical and hospital services (+4.6 per cent), new dwelling purchase by owner-occupiers (+1.6 per cent) and tobacco (+3.1 per cent).

- The most significant offsetting price falls this quarter were for domestic holiday travel and accommodation (-3.8 per cent), automotive fuel (-2.7 per cent) and telecommunication equipment and services (-1.6 per cent).

Trends in inflation

The headline inflation rate increased by 0.6 per cent in the June-quarter 2014 translating into an annualised increase of 3 per cent for the year to June 2014 which a tad high than the March-quarter 2014 result of 2.9 per cent.

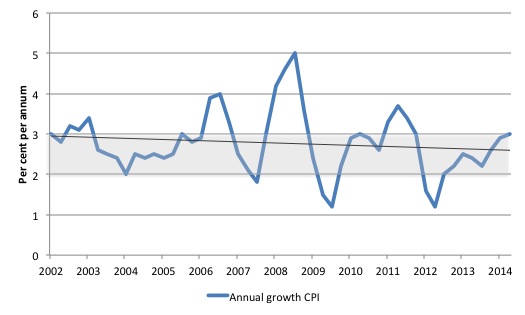

The following graph shows the annual headline inflation rate since the first-quarter 2002. The black line is a simple regression trend line depicting the general tendency. The shaded area is the RBA’s so-called targetting range (but read below for an interpretation).

Does the June-quarter spike signal a dangerous outbreak of inflation is imminent? You just have to reflect on recent labour market data to know the answer to that question is no!

What does it mean for monetary policy? It will probably mean the RBA will sit tight for a while.

The Consumer Price Index (CPI) is designed to reflect a broad basket of goods and services (the “regimen”) which are representative of the cost of living. You can learn more about the CPI regimen HERE.

The ABS say that:

The CPI is a temporal price index for consumption goods and services acquired by Australian resident households. It is an important economic indicator, providing a general measure of price change … The principal purpose of the Australian CPI is to measure inflation faced by consumers to support macroeconomic policy decision making. This is achieved by providing a measure of household consumer inflation by the acquisitions approach.

There are various ways of assessing the general movement in prices depending on the purpose that the measure is being used for. The document I linked to above details some of the approaches. One of these approaches – the “acquisitions approach” – attempts to measure “household consumer inflation” and defines the basket of goods and services as “consisting of all consumer goods and services actually acquired by households during the base period.” The ABS use “market prices for goods and services” (including taxes etc) and make no imputations for “non-monetary transactions” (such as imputed rents). They also exclude “interest rate payments”.

So is a headline rate of CPI increase of 0.6 per cent for the June-quarter significant? To examine its lasting significance we have to dig deeper and sort out underlying structural inflation pressures and ephemeral price facts.

The RBA’s formal inflation targeting rule aims to keep annual inflation rate (measured by the consumer price index) between 2 and 3 per cent over the medium term. Their so-called “forward-looking” agenda is not clear – what time period etc – so it is difficult to be precise in relating the ABS data to the RBA thinking.

What we do know is that they do not rely on the “headline” inflation rate. Instead, they use two measures of underlying inflation which attempt to net out the most volatile price movements. How much of today’s estimates are driven by volatility?

To understand the difference between the headline rate and other non-volatile measures of inflation, you might like to read the March 2010 RBA Bulletin which contains an interesting article – Measures of Underlying Inflation. That article explains the different inflation measures the RBA considers and the logic behind them.

The concept of underlying inflation is an attempt to separate the trend (“the persistent component of inflation) from the short-term fluctuations in prices. The main source of short-term “noise” comes from “fluctuations in commodity markets and agricultural conditions, policy changes, or seasonal or infrequent price resetting”.

The RBA uses several different measures of underlying inflation which are generally categorised as “exclusion-based measures” and “trimmed-mean measures”.

So, you can exclude “a particular set of volatile items – namely fruit, vegetables and automotive fuel” to get a better picture of the “persistent inflation pressures in the economy”. The main weaknesses with this method is that there can be “large temporary movements in components of the CPI that are not excluded” and volatile components can still be trending up (as in energy prices) or down.

The alternative trimmed-mean measures are popular among central bankers. The authors say:

The trimmed-mean rate of inflation is defined as the average rate of inflation after “trimming” away a certain percentage of the distribution of price changes at both ends of that distribution. These measures are calculated by ordering the seasonally adjusted price changes for all CPI components in any period from lowest to highest, trimming away those that lie at the two outer edges of the distribution of price changes for that period, and then calculating an average inflation rate from the remaining set of price changes.

So you get some measure of central tendency not by exclusion but by giving lower weighting to volatile elements. Two trimmed measures are used by the RBA: (a) “the 15 per cent trimmed mean (which trims away the 15 per cent of items with both the smallest and largest price changes)”; and (b) “the weighted median (which is the price change at the 50th percentile by weight of the distribution of price changes)”.

While the literature suggests that trimmed-mean estimates have “a higher signal-to-noise ratio than the CPI or some exclusion-based measures” they also “can be affected by the presence of expenditure items with very large weights in the CPI basket”.

The authors say that in the RBA’s forecasting models used “to explain inflation use some measure of underlying inflation (often 15 per cent trimmed-mean inflation) as the dependent variable”.

The special measures that the RBA uses as part of its deliberations each month about interest rate rises – the trimmed mean and the weighted median – also showed moderating price pressures.

So what has been happening with these different measures?

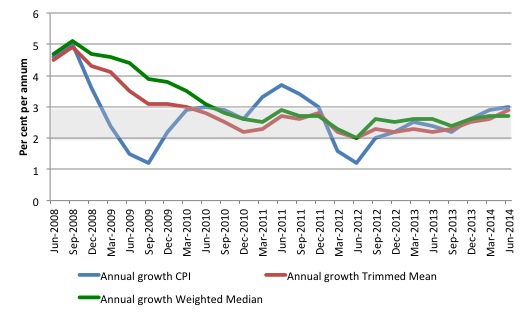

The following graph shows the three main inflation series published by the ABS over the last 24 quarters – the annual percentage change in the all items CPI (blue line); the annual changes in the weighted median (green line) and the trimmed mean (red line). The RBAs inflation targetting band is 2 to 3 per cent (shaded area).

The CPI measure of inflation (at 3 per cent up from 2.9 per cent in the March-quarter 2014) is at the top of the target band, while the RBAs preferred measures – the Trimmed Mean (2.6 per cent and rising from 2.6 per cent) and the Weighted Median (2.7per cent up and stable) – remain within the RBAs band of 2 to 3 per cent.

The data does not indicate an inflation break-out notwithstanding the spike in the June-quarter 2014. See also analysis of contributions below.

But if we dig a little deeper we can understand the current result a bit better.

Annualised growth calculations are affected by two things: (a) the current value, and (b) the base or starting value. If there is an unusually low observation in the base quarter then the current annual inflation rate will appear higher than it might otherwise be once we take the influence of the unusually low base quarter.

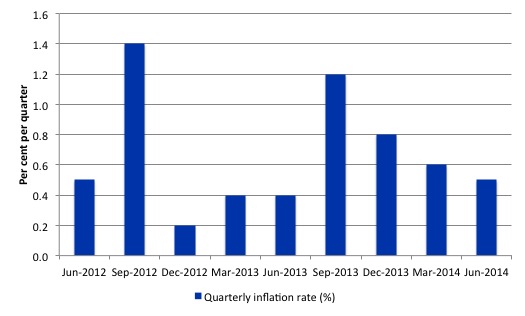

It turns out that the June-quarter 2013 result (1.2 per cent) was such a quarter (check it in the graph below). This distorts the annualised inflation calculation for the next three quarters.

The quarterly growth in the headline CPI (the ALL Groups) for the June-quarter 2014 was 0.5 per cent (compared to the trimmed mean and weighted median growth of 0.8 and 0.6 per cent, respectively).

The RBA-preferred measures – trimmed mean and weighted median – are also mostly stable or, in the case of the weighted median, falling.

How to we assess these results?

First, there is clearly no upward trend in any of the measures. The “core” measures used by the RBA have been benign for many quarters even with a relatively large fiscal deficit and record low interest rates.

Second, it is clear that the RBA-preferred measures are well within their inflation-targeting band. It is unclear whether what the RBA considers when determining their interest rate decision each month, but given inflation is benign, it may turn its attention to the failing labour market and ease interest rates as a result of that.

Not that the real economy is very sensitive to movements in rates anyway, given that it is hard to discern who wins and who loses from rate changes (the distributional effects across fixed income recipients, creditors and borrowers) and hence it is hard to work out the overall impact on aggregate demand. We know the effect is lagged, uncertain and within normal ranges probably small.

Third, the underlying price pressures (say from wages) are well within the space provided by productivity growth. There is no inflation threat in Australia arising from wages at present given that productivity is rising faster than nominal wages (that is, there have been real wage cuts in recent years).

Fourth, the Australian dollar has been very stable around 94 cents US over the June-quarter and has appreciated a little from its average values in the previous quarter. This has also taken some pressure to the domestic price level.

What is driving inflation in Australia?

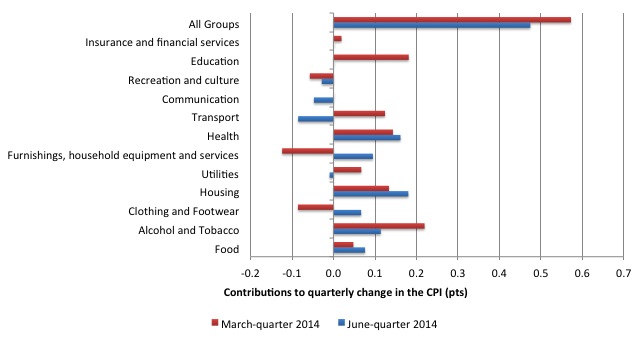

The following bar chart compares the contributions to the quarterly change in the CPI for the June-quarter 2014 (blue bars) compared to the March-quarter 2014 (red bars).

The ABS reports that for the June-quarter 2014, the largest price rises were for medical and hospital services (+4.6 per cent), new dwelling purchase by owner-occupiers (+1.6 per cent) and tobacco (+3.1 per cent).

The ABS reports that the most significant offsetting price falls this quarter were for domestic holiday travel and accommodation (-3.8 per cent), automotive fuel (-2.7 per cent) and telecommunication equipment and services (-1.6 per cent).

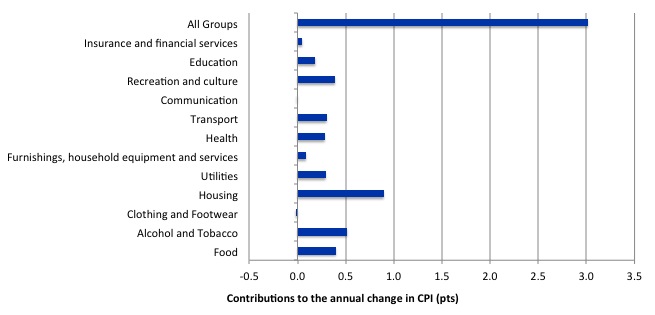

The next bar chart provides shows the contributions in points to the annual inflation rate by the various components.

In the twelve months to June 2014, the major drivers of inflation were housing and alcohol and tobacco prices.

Health costs in Australia

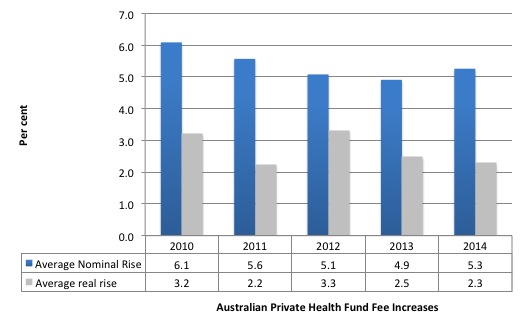

One of the drivers in this quarter’s result was the rise in Private Health Insurance Premiums, which took effect from April 1, 2014.

The Federal Department of Health reports that they approved an increase for 2014 of 6.2 per cent.

The following graph shows the nominal approved rate increases since 2010 and the real equivalent (deflating by the national inflation rate).

It is clear that the private health insurers are running well ahead of the inflation rate. The question is why?

For readers who are unaware, the private health insurance funds are parasites and remain profitable because the Australian government forces citizens to join them. If we do not join then the Government imposes a prohibitive tax penalty.

This policy was brought in because people were choosing to leave the funds and rely on the public national health system in response to the high insurance charges, the poor payouts for claims, and the excessive management fees that the funds imposed.

The funds would have largely gone broke had not the Government introduced membership coercion. And this was a so-called liberal government that continually touts the market and free choice.

The Government then approves ridiculously high real increases year after year to further support the huge management fees that are taken out by the executives of these funds.

The Private Health Insurance Market is dominated by two for-profit providers and the concentration is increasing. Around 70 per cent of the market is occupied by for-profit providers.

The 2013 State of the Health Funds Report published by the Private Health Insurance Ombudsman (a federal agency) reveals the so-called management expense ratio (MER), which is a measure of efficiency (the lower the better) and the capacity of management elites to gouge the fund.

The average MER for not-for-profit funds was 9.6 per cent in 2013 and 10.5 per cent for the for-profit funds.

Inflation and Expected Inflation

The fear of inflation, in part, drives this mis-placed faith in monetary policy over fiscal policy.

If we went back to 2009 and examined all of the commentary from the so-called experts we would find an overwhelming emphasis on the so-called inflation risk arising from the fiscal stimulus. The predictions of rising inflation and interest rates dominated the policy discussions.

This May 2009 New York Times article by US monetarist economist Allan Meltzer – Inflation Nation – is representative.

Meltzer claimed that the “printing money” obsession of the Federal reserve and the high deficits “could see a repeat of those dreadful inflationary years”.

In all these terror stories two words dominate “could” and “may”. They impart images of danger and dysfunction to the reader but hedge with these conditional-type words. The fact is that there was no basis for those predictions in 2009 and four years later inflation is benign or falling other than where some cartel controls the supply-price.

Meltzer said:

Besides, no country facing enormous budget deficits, rapid growth in the money supply and the prospect of a sustained currency devaluation as we are has ever experienced deflation. These factors are harbingers of inflation.

When will it come? Surely not right away. But sooner or later, we will see the Fed, under pressure from Congress, the administration and business, try to prevent interest rates from increasing. The proponents of lower rates will point to the unemployment numbers and the slow recovery. That’s why the Fed must start to demonstrate the kind of courage and independence it has not recently shown.

There is a difference between deflation (a negative inflation rate) and a decelerating inflation rate, which the US is experiencing. But the so-called harbingers of inflation have not led to accelerating inflation, which is really what Meltzer is predicting “sooner or later”.

Right around the world, these sort of predictions came to nought because they were made by people who didn’t really understand how the macroeconomy works.

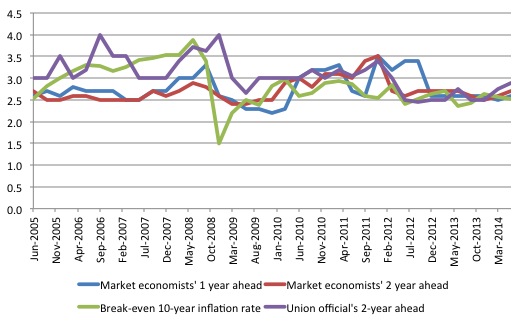

The following graph shows four measures of expected inflation expectations produced by the RBA – Inflation Expectations – G3 – from the June-quarter 2005 to the June-quarter 2014.

The four measures are:

1. Market economists’ inflation expectations – 1-year ahead.

2. Market economists’ inflation expectations – 2-year ahead – so what they think inflation will be in 2 years time.

3. Break-even 10-year inflation rate – The average annual inflation rate implied by the difference between 10-year nominal bond yield and 10-year inflation indexed bond yield. This is a measure of the market sentiment to inflation risk.

4. Union officials’ inflation expectations – 2-year ahead.

Notwithstanding the systematic errors in the forecasts, the price expectations (as measured by these series) are stable in Australia, which will influence a host of other nominal aggregates such as wage demands and price margins.

How will the RBA respond?

The RBA will not push interest rates up on the back of this data release. The underlying series are not yet trending upwards.

The impact of the health insurance price rises will be gone next quarter and the deterioration in the labour market (with very subdued) wage rises and stronger productivity growth will also reduce inflationary pressure.

Once the Senate has dealt with the fiscal proposals from the Government, we will have a clear idea of how much cutting is actually going to occur as opposed to the tough talk from the Treasurer.

At any rate, the economy is not booming and will remain well below trend growth whatever happens in the Senate.

We are in currently in a situation where the Government is deliberately undermining growth and pushing unemployment up, which is forcing the RBA to use inferior counter-stabilising tools (interest rate management) to stop a recession. The end result is a sluggish economy, rising unemployment and a bias towards pushing up household debt.

The latter point is important. The private domestic sector is presently carrying too much debt and that explains its subdued spending patterns (and the rise in the saving ratio). The Government’s policy is relying on private spending to fill the gap left by the contraction in public spending, given that any expected export revenue growth will be insufficient to drive growth.

The strategy thus relies on the same dynamics that led to the crisis in the first place – too much private debt and inadequately-sized deficits.

Conclusion

Inflation in Australia is not yet trending upwards despite the occasional spike. On an annualised basis, inflation remains within the lower-bound of the RBA’s inflation targetting range.

The RBA-preferred measures are benign and inflationary expectations are also not presenting any issues.

The data continues to suggest that the national economy is subdued as a result of excessively tight fiscal policy and declining private spending.

That is enough for today!

(c) Copyright 2014 Bill Mitchell. All Rights Reserved.

Re health insurance – In Australia there is a dual hospital and health services system – one private funded largely by private health insurance. Then there is the public system,run by the states but funded primarily by the federal government.

There is no intrinsic benefit in this dual system as far as I can see. It entails duplication at the hospital and health services level and ripoffs at the insurance level as per the article above.

For many years,under both Liberal and Labor federal governments,the public health sector has been seriously underfunded. This will continue and increase as long as the present neolithic Cretins In Charge are in power. No doubt they would just love to see an American style health system here.

This retrograde excuse for a government should be forced to front the electorate by the Senate. Unfortunately there are enough spineless retrograde Senators to prevent this happening.