I started my undergraduate studies in economics in the late 1970s after starting out as…

Ricardian agents (if there are any) steer clear of Australia

Today is a public holiday in Australia where we go to the football or do other things all in the name of the Queen’s Birthday – the Queen of England that is. It remains an expression of our colonial yoke and our lack of confidence as a nation, which continues to harm us, none more than our indigenous population. Anyway, the workers get to have a day off, which can’t be a bad thing. One of the more amazing frauds that the population is exposed to from our political leaders is the claim that if you impose fiscal austerity growth will spring forth as consumers and firms start spending again because they don’t have to save up to pay for higher taxes in the future. It is a crazy theory without an evidential standing. More evidence from Australia since the release of the Government’s May Fiscal Statement (aka Budget) is very conclusive that consumers and firms do not like announcements of major fiscal cutbacks.

Macroeconomics students get exposed to the the so-called Ricardian Equivalence Theorem, an arcane bit of reasoning that claims, in contradiction to everything we know about the real world, that if governments cut their spending and reduce their deficits, private sector ‘agents’ (consumers and firms), who are assumed to have rational expectations, that is, on average they can accurately predict the future, will more than fill the gap because they no longer have to save up in anticipation of future tax hikes which would be required to pay for the deficits.

The theory claims that lower deficits mean lower expected future tax obligations, which mean less saving and more current spending.

Politicians have bombarded the public with this neo-liberal myth even though they do not understand the basis of the theorem. It is also clear that many economists who brush with this theorem also fail to fully understand it.

The modern version of the theorem was developed by Robert Barro at Harvard. Barro said that when the government spends on our behalf it either has to raise money (taxes) to pay for the spending or finance deficits with borrowed money (debt). Barro claimed the latter is really an implicit commitment to raise taxes in the future to repay the debt (principal and interest).

Under these conditions, Barro then proposed that current taxation has equivalent impacts on consumers’ sense of wealth as expected future taxes.

For example, if each individual assesses that the government is spending $500 this year per head and collects $500 per head

‘to pay for it’ then the individual will cut consumption by $500 now because they are worse off.

So the government spending has no real effect on output and employment irrespective of whether it is ‘tax-financed’ or ‘debt-financed’. That is the Barro version of Ricardian Equivalence.

The model suggest that individuals assess the total stream of income and taxes over their lifetime in making consumption decisions in each period.

Barro wrote (in ‘Are Government Bonds Net Wealth?’, Journal of Political Economy, 1974, 1095-1117):

This just means that lower taxes today and higher taxes in the future when the government needs to pay the interest on the debt; I’ll just save today in order to build up a savings account that will be needed to meet those future taxes.

For the idea to work in theory, several assumptions that can never hold in the real world are required. Here are the main assumptions – think about how realistic you think they are.

Bear in mind that these assumptions have to hold in entirety for the logical conclusion of the model to follow? That is the nature of the mainstream economics way of reasoning. The results of the models are extremely sensitive to the starting assumptions.

Should any of these assumptions not hold (at any point in time), then his model cannot generate its conclusions and any assertions one might make based on this work are groundless – meagre ideological raving.

First, capital markets have to be “perfect” which means that any household/individual can borrow or save as much as they require at all times at a fixed rate which is the same for all households/individuals at any particular date. So totally equal access to finance for all.

Clearly this assumption does not hold across all individuals and time periods. Households have liquidity constraints and cannot borrow or invest whatever and whenever they desire. People who play around with these models show that if there are liquidity constraints then people are likely to spend more when there are tax cuts even if they know taxes will be higher in the future (assumed).

Second, the future time path of government spending is known and fixed. Households/individuals know this with perfect foresight. This assumption is clearly without any real-world correspondence. We do not have perfect foresight and we do not know what the government in 10 years time is going to spend to the last dollar (even if we knew what political flavour that government might be).

Third, there is infinite concern for the future generations. This point is crucial because even in the mainstream model the tax rises might come at some very distant time (even next century). There is no optimal prediction that can be derived from their models that tells us when the debt will be repaid. They introduce various stylised – read: arbitrary – time periods when debt is repaid in full but these are not derived in any way from the internal logic of the model nor are they ground in any empirical reality. They are just ad hoc impositions.

So the tax increases in the future (remember we are just playing along with their claim that taxes will rise to pay back debt) may be paid back by someone 5 or 6 generations ahead of us. Is it realistic to assume that I won’t just enjoy the increased consumption that the tax cuts now will bring (or increased government spending) and leave it to those hundreds or even thousands of years ahead to ‘pay for’.

Certainly our conduct towards the natural environment is not suggestive of a particular concern for the future generations other than our children and their children.

There was a lovely insight into the poverty of these type of models provided by Leonard Rapping (now deceased). Please read my blog – Islands in the sun … – for more discussion on this point. The essence is that he was a leading proponent in the early 1970s of the mainstream reasoning and wrote several very influential articles.

As a member of the University of Chicago Economics Department he was caught in the Groupthink that dominated that school of thought. On methodology, he told an interviewer in 1984 (after he had seen the light) that:

… we were in the Chicago tradition, so we assumed perfect competition and profit and utility maximisation. Every single proposition had to be consistent with those assumptions. There were certain rules of logic that had to be followed, and the discussions were very tight and logical. We would try to explain everything in terms of the competitive equilibrium models …

Sometime later, Rapping became extremely disillusioned the training he had received at Chicago, and was, as a professor passing on to students himself. He said:

In all my training at Chicago there was no serious mention of the global system. Chicago training, like training elsewhere, was closed economy training. I knew that the Chicago world vision was inappropriate for the problems I was concerned with … So I did the only thing I could: I jettisoned Chicago economics …

This led Rapping to initially abandon his burgeoning career as one at the forefront of mainstream neoclassical thinking and he later turned to radical economics losing the ‘friends’ he had fraternised with in his Chicago and Carnegie-Mellon days.

Further, the Ricardian Equivalence theorem has never worked out in practice. When Barro released his paper (late 1970s) there was a torrent of empirical work examining its predictive capacity.

It was opportune that about that time the US Congress gave out large tax cuts (in August 1981) and this provided the first real world experiment possible of the Barro conjecture.

The US was mired in recession and it was decided to introduce a stimulus. The tax cuts were legislated to be operational over 1982-84 to boost aggregate demand.

Consistent with the Ricardian Equivalence theorem, the proponents of Barro’s ideas all predicted that saving would rise to pay for the so-called ‘future tax burden’ which was implied by the rise in public debt at the time (associated with the rising deficit).

What happened? If you examine the US data you will see categorically that the personal saving rate fell between 1982-84 (from 7.5 per cent in 1981 to an average of 5.7 per cent in 1982-84). In other words, Ricardian Equivalence models got it exactly wrong.

In the recent policy debate, the concept has been used by austerity proponents to justify their so-called ‘fiscal contraction expansion’ claim.

Accordingly, the ‘Ricardian’ effects are alleged to be reversed once fiscal austerity is imposed and governments cut deficits because consumers and investors will realise that tax rates will not have to rise and, consequently, will increase their spending and more than offset the loss of government spending.

Of-course, this denies basic psychology. Why would households go on a spending spree as unemployment skyrockets and pensions and wages are cut? Why would firms suddenly invest in new capacity when the existing capacity is more than enough to meet current demand and sales are falling fast?

Basic psychology predicts exactly the opposite will happen, which is what the real world data has indicated many times over.

Please read my blogs – Deficits should be cut in a recession. Not! and Pushing the fantasy barrow – for more discussion on this point.

But for the neo-liberal zealots, the theory is correct no matter what the facts might be.

In the current debate, the ECB was a prominent exponent of this discredited theory. They devoted a section of their June 2010 ‘Monthly Bulletin’ to justifying their conclusion that the “beneficial effects of fiscal consolidation are undisputed” because “consumers anticipate benefits arising from fiscal consolidations for their permanent income and consequently increase private consumption” (EBC, 2010: Box 6, 83-85).

Former ECB boss, Jean-Claude Trichet made many memorable interventions into the debate in his last years of tenure as ECB boss in the style of a evangelical minister.

At the Jackson Hole gathering of central bankers in August 2010, he told the audience he didn’t believe the argument that cutting government spending would damage growth because “the strict Ricardian view may provide a more reasonable central estimate of the likely effects of consolidation. For a given expenditure, a shift from borrowing to taxation should have no real demand effects as it simply replaces future tax burden with current one” [see – Central banking in uncertain times: conviction and responsibility, August 27, 2010]

Not to be outdone, the then French Finance Minister and soon to be IMF boss, Christine Lagarde chimed in against fiscal stimulus. She told the American ABC program ‘This Week’ on October 10, 2010 that:

If we do not reduce the public deficit, it’s not going to be conducive to growth. Why is that? Because people worry about the public deficit. If they worry about it, they begin to save. If they save too much, they don’t consume. If they don’t consume, unemployment goes up and production goes down.

References to the term ‘Ricardian Equivalence’ have been common during the recent crisis. Economists and financial commentators regularly invoke it as an authority for their claims that fiscal stimulus measures will not be effective in increasing economic activity.

The current Australian federal government was elected in September 2013 and immediately started talking tough about cutting the fiscal deficit.

Here are a selection of quotes from the Federal Treasurer in the last year:

1. “Our future depends on what we as a nation do today.” – Budget Speech, May 13, 2014.

2. “The age of entitlement is over.” – Budget Speech, May 13, 2014.

3. “Honesty does not come when a government excuses its past profligacy on the promise of a surplus ― then not only fails to deliver one, but delivers a $19bn deficit with more to come.” – Address to the National Press Club, May 14, 2014.

4. “The objective of the Coalition, over time, is to reduce the overall tax burden on business and taxpayers, not to increase it.” – Address to the National Press Club, May 14, 2014.

5. “We have to make the decision to reduce government expenditure and we have to find ways to try and increase revenue as well” – Australia axes free advice for asylum-seekers – Channel News Asia, March 13, 2014.

6. “The May budget will be focused on growth. It doesn’t mean you can’t have some fiscal consolidation.” – First budget will aim for growth: Hockey – February 13, 2014.

7. In response to the IMF report that “to achieve the aim of returning to and maintaining a budget surplus, sizeable cuts in projected spending would be required”, the Treasurer said “This message reinforces the government’s position that difficult decisions will need to be made in order to put the budget back on a sustainable path.” – Keep interest rates low, IMF says – – February 13, 2014.

8. “You can’t build budgets on what is popular or not” – Brisbane Times – May 19, 2014.

9. On the government’s announcement that it was cutting 16,500 federal public service jobs, the Treasurer said a “smaller, less interfering government won’t need as many public servants.” – Federal budget puts Canberra on the razor’s edge with 16,500 public service jobs cut.

And so on.

The Government certainly showed plenty of intent of public intent that it was going to cut the fiscal deficit and move into surplus as soon as possible and that there would be less public debt and lower taxes.

The message was very clear.

So one might think that in terms of the Ricardian Equivalence theorem, this would be an excellent test case. The public would have no doubt that the government was going to try to cut the deficit and reduce their tax burdens. Consumer confidence should have gone through the roof in anticipation of our renewed consumption spending boom as we anticipated having a reduced need to save for the expected higher future taxes to ‘pay the deficit back’.

What happened? Exactly the opposite.

On May 27, 2014, the – ANZ-Roy Morgan Consumer Confidence Survey – was released which showed that:

Confidence fell a further 1.1% to 99.3 in the week ending 25 May. Confidence is now down 15% over the past five weeks when various Budget policies first made news headlines. While the decline was relatively more modest compared to previous weeks, confidence has now dipped below 100 – the ‘neutral line’ – for the first time since May 2009.

A spokesperson for the survey said that the:

… consumer confidence index declined further last week after falling sharply in response to news related to the Commonwealth Budget.

So not many Ricardian agents in amongst us Australian consumers.

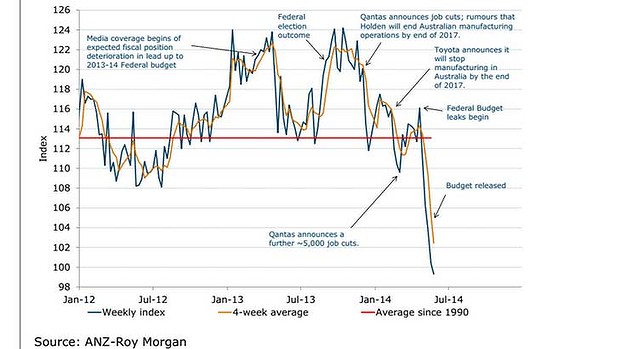

Here is a graph that the survey company produced with annotations. The fiscal statement had a huge negative impact on confidence.

But maybe business firms are acting as Ricardian agents? Perhaps their confidence is booming now that the government is hacking into its deficit? Hardly.

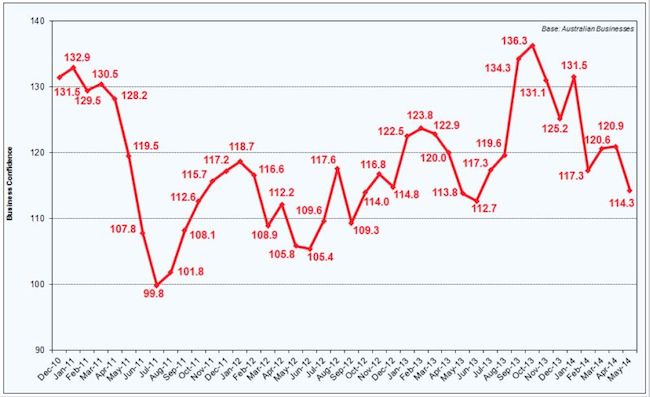

The Roy Morgan Research company also compiles a monthly – Business Confidence survey and found that the index:

… in May 2014 fell 5.5% from April … following the release of the National Commission of Audit Report and the Federal Budget. Business confidence is now 16.1% below the peak of 136.3 in October 2013 following the new government and 7.4% below the average over the last 12 months.

The National Commission of Audit was the stunt the Government created to condition us to spending cuts. The NCA came out with a ridiculous program of cuts, which then allowed the Government to look moderate as it was hacking into government spending, albeit, on in areas which benefit the most disadvantaged (generally).

Here is the Business Confidence graph from Roy Morgan’s survey:

It seems that the business sector, despite having a government that is willing to do its bidding against workers and trade unions, still isn’t impressed.

The Roy Morgan poll found what any reasonable economist (and person) would expect. That the “main reason for loss of confidence in May was the decline in the proportion of businesses feeling that economic conditions in Australia would improve over the next 12 months. This is now at its lowest level since July 2012.”

Basic psychology and business sense. If consumers are pessimistic and sales flat – why would anyone be confident!

The cutbacks announced in the Government’s fiscal statement reinforced the gloomy environment.

Conclusion

When was the last time you saved up to pay for future tax increases? Another failed neo-liberal theory.

For me, back to editing my Europe book. Enjoy the holiday.

That is enough for today!

(c) Copyright 2014 Bill Mitchell. All Rights Reserved.

In Robert Barro’s own words from the IMF’s web site:

“Blame it on Richard Feynman,” says Barro, who had been headed for a career in the physical sciences at Caltech. “Feynman was a great inspiration, but what he taught was often way above my head. It made me realize I wouldn’t be close to the top in those fields.” Instead Barro turned to economics, motivated by the possibility of using his “technical and math background to address social problems” and by the example of an older brother who had majored in economics.

Translated to Polish and back to English:

“I was too stupid to understand physics even taught by one of the greatest professors of our time. So I turned to economics where I became like a giant standing among intellectual dwarfs”.

AdamK

Hilarious.

It’s all clear now, Bill.

Squeezing currency users “works” because we supposedly spend more of the imaginary income we don’t get, since the currency issuer is not spending currency into existence, since it hasn’t yet taxed us to get back the currency it hasn’t issued to us.

Capiche?

Call it Farcecardian Equivalence.

Intellectual giants? Comical? We’re crying all the way to the crank.

Isn’t the idea that the debt will be paid back with taxes incorrect in the first place? – making the Ricardian equivalence argument meaningless from the start. My understanding is that the public debt has been, is, can be and always will be redeemed, repaid, or retired in exchange for bank deposits created ‘ex-nihilo” –

no taxpayers are involved.

Thanks Bill. But its remarkable that to recognise a concept as wrong in economics takes so long.

In this horrible piece of news: Now we have IMF apologising to conservative Osborne for something neither of them seems to understand.

http://www.telegraph.co.uk/news/politics/10884632/Do-I-have-to-go-on-my-knees-grovelling-apology-from-IMF-head-for-incorrect-warnings-on-UK-economy.html

Where is that internet pic of captain picard ‘face palm’ when you need it 😉

In my understanding of MMT from a functional point of view, the federal government does not need to ‘finance’ its spending. This is true whether the purpose for spending is the normal type of yearly budget spending such as defense, law enforcement, social services, regulation, infrastructure, etc. – or – special stimulus spending in response to the recent ongoing economic crisis. In other words we neither need to tax nor borrow first before spending.

In fact, before spending the federal government is required only to satisfy the following two things: 1) Legislative authorization. 2) Payment from the treasury’s central bank account to an entity who subsequently spends into the domestic private sector.

As Bill Mitchell has pointed out in this post and others, there is no valid empirical evidence or logical justification that Barro-Ricardian Equivalence is a sound theory.

As MMT proposes, federal government sector deficit spending does have ‘real’ economic effects which lead to real incomes, productive follow-on economic activity, and real wealth accumulation. It also asserts that this spending can occur without excessive inflation (or hyperinflation).

To hypothesize that federal government spending will cause consumers to save money rather than spend it in order to pay anticipated higher taxes in the future has never been justified. Rather, it is just asserted by an economic school that is biased against ordinary citizens. This is especially absurd when economic resources are vastly underutilized – as is currently the case.

Barro-Ricardian Equivalence is equivalent to the doctrine of ‘original sin’ in that is is used to justify our need for a punishment of austerity and deprivation. Similar to ‘original sin’, this theory is a component of a so-called ‘orthodoxy’ – an Orthodox Macroeconomics which is bought and paid for by the top-of-the-food-chain financial establishment. This establishment is only for a government which continues to enable them to ‘finance’ our society in a way which gives them the means for continued financial dominance. This establishment is global, not American. Its playground is the Eurodollar market, not the ‘real’ economy (physical goods and services as opposed to finance transactions).

Government spending is not ‘original sin’. It is not EVIL. Rather government spending into the real domestic economy for real tangible benefits such as health-care, care for the elderly and disabled, community services, infrastructure, space and defense, education and research (ie., that which doesn’t fit within a for-profit model) is GOOD. This spending should be viewed as creating ‘citizen power’ not the empowerment of a global financial elite.

I assume MMT posits that genuinely sensible government budgeting (i.e. counter-cyclical budgets in general) is a necessary but not sufficient condition for a healthy economy. In Australia, MMT prescriptions would currently suggest running a higher budget deficit, running healthy government spending on health, education, welfare and infrastructure and setting up a Job Guarantee. All of this I agree with.

My question is could MMT prescriptions assist an economy like that of Egypt? Egypt has more real economy problems and financial economy problems than Australia. Egypt has an unemployment rate of about 13.4%. I do not know how they measure it. What is Egypt’s under-employment rate? Egypt has an inflation rate of about 9%. Egypt’s budget deficit is about 9% of GDP. So Egypt has high unemployment, high inflation and a relatively high budget deficit. There seems on first glance no room here for simple MMT prescriptions to improve the economy.

However, am I missing important facts and factors? Does Egypt spend too much on its military? Obviously, infrastructure spending assists the economy whereas excess military spending is a dead loss to the economy. Does Egypt’s corrupt elite take too much of the nation’s wealth leaving too little to develop opportunities for the entire populace?

Egypt is relatively poor in oil and gas (for a M.E. country), now consumes all of its oil domectically and gas is heading the same way. Without oil and gas exports to buy food etc. and with tourism in a slump due to unrest what positives does the Egyptian economy have? How could they turn it around with MMT prescriptions?

This is a hypothetical question of course. I expect no enlightened policies from the Egyptian military junta nor from the Islamic Brotherhood if they ever regain power. I would be interested if Bill could address the above questions.

There is the Perceiver, the organs of perception, the field of perception and the Perception (without error if all goes well). The only thing standing between the Perceiver and the Perception are the organs. Which makes it kind of scary that anybody with high-school maths and a rudimentary understanding of human nature could see the logical consistency in Bill’s post, and yet the guys running countries cannot!

“What I tell you three times is true”. [The Hunting of the Snark]

The different branches of Arithmetic — “Ambition, Distraction, Uglification, and Derision”. [Alice in Wonderland]

“Can you do addition?” the White Queen asked. “What’s one and one and one and one and one and one and one and one and one and one?” “I don’t know,” said Alice. “I lost count.” [Through the Looking Glass]

“Alice laughed: “There’s no use trying,” she said; “one can’t believe impossible things.”

“I daresay you haven’t had much practice,” replied the Queen. “When I was younger, I always did it for half an hour a day. Why, sometimes I’ve believed as many as six impossible things before breakfast.” [Alice in Wonderland]

Truly a madhouse …. after 200,000 years on the road, you would think we could at least think beyond imagination!

@Ikonoklast,

I think that is a great question. I infer from your note that the presence of high unemployment and high (for an OECD country, at least) either contradict MMT theories, or that they prevent any central government action to alleviate inflation or unemployment.

Perhaps there is an explanation for the ‘stagflation’ that Egypt suffers:

1. Political upheval has destroyed property, plant and equipment, has killed or imprisioned key workers or managers, has idled firms with strikes and labor unrest. This led to a loss of productive capacity. The remaining operating firms see high demand for their scare products, so they raise prices. In addition, the shuttering of firms caused them to cast out their workers, leading to a rise in unemployment.

2. Political upheval has frightened away tourists. The CIA World Factbook lists 47% of workers employed in ‘services’, a large fraction I guess are catering to tourists. As restaurants shut, tour busses idle, and hotels empty of tourists, firms will shed workers, increasing unemployment. In addition, fewer tourists exchange dollars or euro for local currency. With the loss of this hard currency, the price of the EGP declines, making purhases of items priced in dollars or euro expensive – items like oil, some food products, medicine, aircraft parts, and some heavy machinery. Since there is no substitution away from many of these products, then the price level will increase.

The Egyptian government could still mitigate unemployment. They could offer a very-low-capital-intensive JG to reduce unemployment.

Since I don’t know the source of the inflation I’m not so sure the route they might take. Perhaps they raise taxes to reduce demand, but raise them in ways to discourage imports? So many options, but we’d have to know more about the economy.

Thanks,

Joel