Today (January 22, 2026), the Australian Bureau of Statistics (ABS) released the latest labour force…

Australia’s “change” of government inherits old destructive narratives

Australia recently acquired a new (old) Prime Minister and a new Treasurer (Chris Bowen) as a result of the on-going machinations within the Australian Labor Party. It seems to have done the trick – at least at present – with the two-party preferred vote split 50-50 now instead of 42-58 in favour of the moribund conservatives who were steaming into office, it seemed, with no credibility at all – just a generalised dislike for the previous PM and her cabinet. Within two days, however, of taking his post, the new Treasurer agreed that it was the Government’s policy to drive unemployment up by maintaining its totally inappropriate (and failed) strategy to achieve a budget surplus. This was in the same week as more disastrous labour market data has been released. It seems that our “change” of government has just taken on all the old destructive narratives of the “former” regime. One neo-liberal Treasurer walks out and a clone walks in.

Within days of taking office, we read headlines such as – “Bowen stands by Swan’s budget, surplus plans”. In a major – Australian Agenda Interview – last Sunday (July 7, 2013) on Sky News, the new treasurer was interviewed at length about his fiscal strategy.

After admitting that he was happy to be described as a “fiscal conservative” who takes “a fiscally orthodox approach” he was asked whether the current budget settings (brought down by the previous Treasurer in May 2013) were appropriate. He replied:

Well, I’ve said the Budget remains the Government’s Budget. It’s Treasurer Swan’s Budget, but I stand by it as the new Treasurer. It remains the Government’s Budget, and that means the forecasts are also the Government’s forecasts. And I’ve also said, very clearly, that I support the fiscal strategy of the Government to return to surplus over the medium-term cycle …

So that is clear.

He then admitted that the economy faced “challenges” because the “terms of trade have fallen since the Budget. We’ve seen iron ore, and gold, and coal – both metallurgical and thermal – come off the boil in terms of trade since the Budget”.

He was then asked whether, in the context of slowing growth that is now apparent whether it was “realistic” to see that “unemployment creep upwards”, to which he replied:

Well we’ve already seen Budget projections, Budget forecasts, with 5.75 per cent – that’s one you didn’t ask me before, Peter. You dropped the ball there, you could have asked me that one as well. Five point seven five per cent is the Budget forecast for unemployment, and that remains the Budget forecast. Unemployment with a five in front of it is still very good compared to the rest of the world, but it is creeping up from where we are at the moment.

An unemployment rate with a “5” in front of it also means hidden unemployment rises to over 150,000 and underemployment rises to above 8.5 per cent or around there. It means that total labour underutilisation rises to around 14 per cent of the available labour force at least.

How can a Labor Treasurer have the audacity to rely on it being “still very good compared to the rest of the world” as a justification for the fiscal inaction?

The fact is that the rest of the world is wracked by fiscal austerity and massive damage is being caused in the form of millions of workers being impoverished through unemployment.

That experience serves as no valid reference benchmark for our government, which issues its own floating currency, does not borrow in foreign currencies and has all the spending capacity to ensure that we have an unemployment rate with at least a “3” in front of it (and the associated gains in reduced hidden unemployment and lower underemployment).

The Australian government could eliminate labour underutilisation above frictional levels if it wanted to. It is choosing to drive more people out of work.

The Treasurer was then asked: “well in this situation, what are the appropriate macro settings in relation to both fiscal and monetary policy as far as you’re concerned?”. He replied:

I think the appropriate macro settings are the current macro settings, which is to return to surplus over the medium-term cycle. That means you don’t rush to surplus now, because that would be bad for the economy, if we rushed to surplus this year or next year. That would be bad for the economy, it would be very contractionary, it would be a judo chop, if you like, to the economy, because it would contain growth. But it is appropriate to return to surplus over the medium term.

That is, pro-cyclical fiscal stance – further undermining the contraction in spending coming from the private sector. Further undermining the capacity of the private sector to save (out of a declining disposable income). Further undermining the capacity of the household sector to reduce its massive debt levels.

Further undermining the capacity of our youth to gain employment.

The only nuance in rhetoric is that the new Treasurer is adopting this more cautious budget surplus obsession – rather than this year – a few years.

The reality is that the government needs to increase its deficit overall not adopt a policy that just kills the economy more slowly than previously planned.

The interviewers then reminded him that the Government will not entertain any new spending initiatives unless there are offsetting cuts elsewhere. He agreed:

What it means, and that is part of the fiscal strategy we outlined before, obviously for returning to surplus over the medium cycle, if you’re going to have new spending to stick to that strategy then you do have offsetting savings as well.

Earlier he had claimed the Government would “keep monitoring economic activity” to ensure the budget was on track to reach surplus. At present the fiscal stance is draining aggregate demand. So if he sticks to the dollar in-dollar out approach, the fiscal mindset is to maintain contraction – that is, undermine growth.

So the change in Prime Minister has not really changed anything with respect to macroeconomic policy and when the election is finally announced (or re-announced) I hope the electorate judge a government that deliberately creates unemployment accordingly.

Perhaps data that is now starting to come out will shock them out of this neo-liberal mindset.

Last week, the Australian Bureau of Statistics released its Labour Force Survey-based estimates that showed that in the 12 months to May 2013, total job vacancies had fallen by 19.3 per cent.

I covered that data release in this blog – Latest Australian vacancy data – its all down to deficient demand.

Yesterday, we received further information on the vacancies front in the guise of the – ANZ Job Advertisement Series – which provided data up to the month of June 2013.

This data analyses advertisements in newspapers and on the Internet so adopts a totally different methodology to the survey-based ABS Job Vacancy series. However, over the years, the ANZ data has been a very reliable indicator of the state of the demand side of the labour market and produces results that are not dissimilar to the ABS series

The news is poor.

1. Job ads overall are down 19 per cent on where they were in June 2012.

2. “Job advertisements are now close to 30% below their most recent peak at the end of 2010 and just 8% higher than the lowest level reached during the Global Financial Crisis”.

The mining boom state of Western Australia now appears to be in semi-free fall with the ANZ chief economist saying:

Job advertisements declined for the fourth successive month, with weakness particularly evident in Western Australia in recent months. WA is now recording the sharpest trend decline in newspaper job advertisements of any state, with job advertising nearly 50% lower than a year ago.

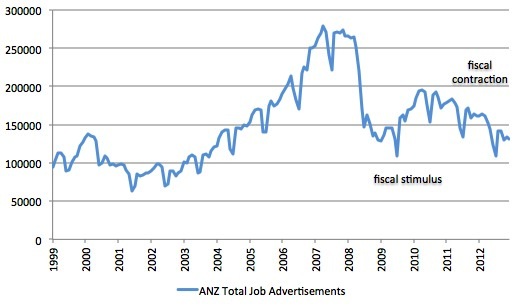

The following graph shows the ANZ series and the extent of the recent plunge. My annotations record the period of fiscal stimulus and its withdrawal. It is no surprise that the switch in fiscal policy has led to the labour market at first improving after the initial downturn in 2008 and then reversing in recent years.

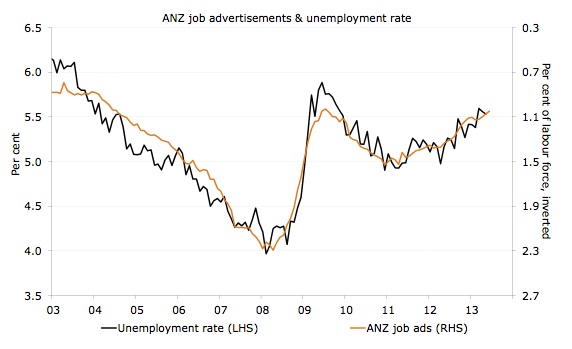

The next graph is taken from the ANZ publication for June 2013 and shows the official ABS unemployment rate and the ANZ job ads series (as a percentage of the labour force, inverted). Clearly there is a close correspondence which tells you that movements in the unemployment rate are almost exclusively driven by demand-side events – that is, fluctuations in aggregate spending.

These graphs (and related modelling) are more than enough evidence to undermine the credibility of neo-liberal style supply-side programs aimed at making the unemployed more “employable”. They might increase the skill level of the unemployed but they do not create jobs.

And inasmuch as the “employability” is enhanced in some and not others, these sort of programs merely shuffle the unemployment queue when there is a shortage of jobs being created overall.

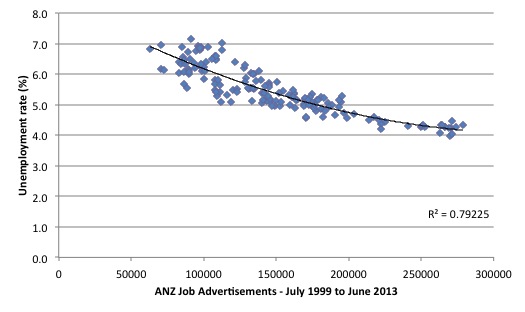

Another way of demonstrating the strong correspondence between the unemployment rate and the demand side of the labour market is shown in the next graph.

It shows the very strong (scatter) relationship between the ANZ series (horizontal axis) and the official unemployment rate (vertical axis) from July 1999 to June 2013. So when the job ads fall we would expect the unemployment rate to rise. The simple quadratic regression line (black) delivers an R2 of 0.79 (a fairly close fit between the series).

There is not much room in this data for so-called structural explanations of the persistently high unemployment in Australia. The fact is that when job vacancies rise due to increased aggregate spending the unemployment rate falls – without question.

I did an interview last night for the national ABC current affairs program PM on this topic. The full transcript is available from the program segment – Economists warn of more labour pains as job ads fall again.

The audio is available – HERE. The total interview went for about 12 minutes and went into the deficit question much more deeply than came out in the segment. But that is par for the course in these types of exercises.

All of which would tell any reasonable economist that the fiscal settings which are contractionary at present are totally inappropriate to the circumstances that are presenting in the Australian economy.

Conclusion

I didn’t have much time today. Long flight turned longer because of delays at two airports and then heavy head winds between Sydney and Darwin. So a shorter blog than usual.

The point is that the Government cannot continue to run its mantra that the economy is travelling well and needs no fiscal support. The evidence is mounting that the labour market is slowing fairly quickly.

The mining states, in particular Western Australia, have until now been the holding the overall growth rate as a result of the significant investment that has been flowing into the mining sector. But that is clearly coming to an end.

Will the exports that materialise from the increased infrastructure maintain strong growth rates? Unlikely. There should be a boost in export income but I do not think it will make up for the subdued consumption, the declining investment and the contractionary government policy.

The government should be planning to increase the deficit with some well-targetted, employment-rich spending measures. As I noted in the radio interview last night – it could start by redressing the massive shortage in public (social) housing, which would boost jobs and provide better outcomes for the disadvantaged who are caught in a major housing crisis.

Of-course, it should also announce its intention to introduce a Job Guarantee and clear away the unemployment forever.

On Thursday this week, the ABS release the June Labour Force estimates. I am expecting a deteriorating situation.

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

Dear Bill,

…ensure that we have an unemployment rate with at least a “3″ in front of it…

A may be wrong, but I think you meant “at most“.

“The total interview went for about 12 minutes and went into the deficit question much more deeply than came out in the segment.”

At one time Chomsky explained that one reason he wasn’t on TV was because it would take too long to explain any statement that he made since very few viewers understand the background to his comments. Other commentators only have to give sound bites that are readily understood because they fit with accepted dogma. I suspect that you have the same problem when you are questioned by the media.

Nice observation, GLH.

Chris Bowen, Wayne Swan and Kevin Rudd are all from the right wing of the ALP, so one should not be too surprised to discover that they are fiscal conservatives. All you can say about them is that they are less illiterate on economic matters than their counterparts in the two conservative parties. Swan was always the weak link in the chain of government ministers, and it seems that neither Kevin nor Julia were perceptive enough to discover that reality. Swan stuck a dagger into the government’s credibility on economic matters, and ended up with much egg on his face, when he was eventually obliged to accept that a budget surplus – at least in the shorter term – was a pipe dream. Blind Freddy could have told him that, but his eyes and ears were closed to any messages which contradicted his driving ambition to achieve a surplus, which he always imagined represents fiscal responsibility.

I am sorry to see that our new Australian federal treasurer Chris Bowen also seems intent on perpetuating the nonsense about seeking a budget surplus. Ideally there should be a budget deficit on average, equal to the annual growth in productivity. And Australian federal budget records demonstrate that this has been the case, fairly accurately. Treasurer Bowen should study budget statistics over the past 100 years, and he might learn something to his advantage.