The other day I was asked whether I was happy that the US President was…

Austerity as law not political discretion

I agree that we should have speed limits and other traffic regulations to prevent mayhem and carnage on our roads. There are other laws I agree with such as protecting children from sexual predators and laws protecting citizens from police brutality and processes to allow us to monitor and prosecute corruption in public office etc. They all make sense to me. Many other laws I would scrap because they are petty infringements on our liberty. But I would never enshrine a particular fiscal policy stance in law or even in codes such as fiscal rules. Such practice defeats the purpose of having the fiscal policy capacities, which is to respond to economic circumstance such that public purpose including full employment can be maintained at all times. Creating legal frameworks that stop governments from exercising their discretion are not only counter-productive but also highly destructive as we are seeing now in the Eurozone. I prefer the people to be able to tell politicians what they should be doing in this respect not judges. However, the Euro elites have been moving towards making austerity law and eliminating political discretion that disagrees with them. And, come to think of it, when some judges disagree with them on a matter of law, the EU elites just instruct their puppets to ignore the courts and proceed as before.

When the Germans embedded a balanced-budget law into their constitution, which will outlaw budget deficits, austerity became law. Sure enough the Swiss government imposed a debt brake on itself in 2001 but I would not hold Switzerland out as an example of anything worthy given the way its economy is aided by the criminal money flows.

Please read my blog – Fiscal rules going mad … – for more discussion on this point.

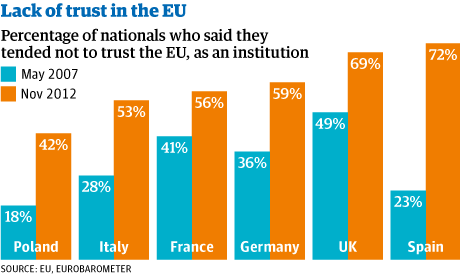

The UK Guardian article (April 24, 2013) – Crisis for Europe as trust hits record low – reports on a new public confidence survey in Europe, which it says shows that confidence in the EU “has fallen to historically low levels in the six biggest EU countries, raising fundamental questions about its democratic legitimacy more than three years into the union’s worst ever crisis”.

The latest survey of the – Eurobarometer – shows “a vertiginous decline in trust in the EU in countries such as Spain, Germany and Italy that are historically very pro-European”.

The Survey found that:

After financial, currency and debt crises, wrenching budget and spending cuts, rich nations’ bailouts of the poor, and surrenders of sovereign powers over policymaking to international technocrats, Euroscepticism is soaring to a degree that is likely to feed populist anti-EU politics and frustrate European leaders’ efforts to arrest the collapse in support for their project.

The Guardian graphic is self-explanatory:

So what began as a financial crisis, which could have been relatively easily contained and the real economy insulated, if the Euro leaders had have:

1. Acknowledged the basic design flaws in their monetary system and instructed the ECB to fund expansionary deficits throughout the Eurozone.

2. Scrapped the pernicious but unworkable Stability and Growth Pact fiscal rules and allowed the deficits to rise to whatever level of GDP was necessary to keep growth going and employment high.

3. Quickly nationalised the banking system throughout Europe and stopped further speculative behaviour by the banks.

There would have been the slightest of downturns if at all and the relatively high deficits would have been required for many years while the housing markets were sorted out and the private sector restructured their balance sheets.

While the Euro monetary system is deeply flawed it would have survived if the ECB filled the gap where a properly functioning federal fiscal agent should have been created in the first place.

But the incompetence of the leaders has created so much damage, which will now endure for years to come, that they have not only destroyed their economic system but have now eroded the very thing that the whole European effort was set up to achieve – a sense of common purpose and trust between nations.

Germany is hated now – again! The racial divisions have widened. And crackpot right-wing extremists have credibility on the political stage. Wealth and income inequality has risen. And – the citizens, on average are much poorer.

The Guardian claims that:

EU leaders are aware of the problem, utterly at odds over what to do about it, and have yet to come up with any coherent policy proposals addressing the mismatch between the pooling of economic and fiscal powers and the democratic mandate deemed necessary to underpin such radical policy shifts

They won’t let go of the neo-liberal ideology. They read too much R&R. They need to radically abandon the whole Eurozone machinery and restore currency sovereignty to member states in an orderly manner. Otherwise, the wreckage will continue to stack up.

There was also a survey just released (April 2013) from the European Social Survey – Economic Crisis, Quality of Work and Social Integration.

This is a very detailed report but re-affirmed the following points:

1. “commitment to employment has come to be seen as a core aspect of social integration” in Europe. Employment is still seen as the “key to reducing levels of poverty and preventing social marginalization”. So for all those who claim my advocacy of full employment is outdated and not reflective of current sentiments I say, politely, think again.

2. For those who claim that the unemployed developed habits contrary to the work ethic, think again. The Survey found that:

… there is no evidence that the unemployed are less committed to employment than the employed. This was the case even for those with relatively long

spells of unemployment. In fact the unemployed tend to show higher commitment in some countries than those in paid work, especially in the countries that had experienced persistently high unemployment in the 2000s.

Okay, we won’t hear the claims that the unemployed are lazy again. They want to work but the policy makers are deliberately stopping them from working.

They have laws in place – austerity laws – to stop them working.

3. We also learned that those in insecure jobs have low commitment to them and this phenomenon is “particularly marked among young adults under the age of 30” which is problematic “given the importance of early attitude formation for longer-term orientations”

In other words, the combination of dramatically (obscenely) high youth unemployment and then access to poorly paid, insecure work is undermining the future productivity of European economies. The capacity to provide high standards of living in the future has nothing to do with the debt ratios etc but all to do with how productive the future workforce will be. The signs are not looking good.

4. “There is now consistent evidence that unemployment has a severe effect in reducing life satisfaction and that its scarring can persist over long periods of time. It also has a spill-over effect, reducing the life satisfaction of other members of the household”. The Survey found that the principle reason for the link between unemployment and life satisfaction was “financial deprivation”.

The Survey also found that in the Scandinavian nations this link is weakened because the “Nordic countries have welfare systems that provide much more generous financial support to unemployed people and this sharply reduces the financial deprivation brought by unemployment.”

In Southern European countries the experience is very different with very damaging effects of unemployment.

So not only are the political leaders in Europe aggressively pursuing austerity laws which they know pushed people into long-term unemployment but then, as they twist the knife a little more, they make the brutality of that unemployment experience greater by cutting the flimsy benefits they receive.

Sociopaths!

The Survey also considered issues of political legitimacy. They found:

5. “Sharply rising rates of unemployment and heightened job insecurity” undermined the “political trust and satisfaction with existing democratic institutions”:

There was indeed a decline between 2004 and 2010 in overall levels of political trust and satisfaction with democracy quite widely across much of Europe, but the extent to which this was the case varied considerably by country. It was significant in Britain, Belgium, Denmark and Finland; particularly notable in France, Ireland, Slovenia and Spain and reached truly alarming proportions in the case of Greece. Further, changes in political trust and satisfaction with democracy are significantly correlated with changes in GDP growth over the period

It was not just those who “those who had experienced its costs personally” that lost trust in the political system. There is now a broader malaise in Europe with “widespread anxiety about a country’s future even among those who did not experience hardship directly.”

The impact of the crisis on “satisfaction with democracy” is highest in the Eurozone nations. The citizens in those countries are finally realising that their governments signed away power to the bullies in Brussels, who have little stake in the prosperity of their nations. The bullies’ salaries don’t get cut, their travel is probably increased and they still eat and drink well and accommodate themselves in the best hotels.

A European legal reporter, Leigh Phillips wrote an interesting article earlier this month (April 8, 2013) – Portugal vs the Joffrey Baratheon of economic policies – and reminded us that:

… the European Court of Justice radical new powers to ensure compliance with permanent austerity in the eurozone and most of the not-so-eurozone (the UK and the Czech Republic excepted).

He now refers to the ECJ as the ” mouth-breathing, club-wielding mob enforcer for austerity” in Europe.

The European Union’s Fiscal Compact urges nations to make the so-called “implementation laws” permanent, in their constitutions. I wonder where they got that from (Germany).

And any breach of the revised SGP rules will see the ECJ penalise (fine) the “offending” nation a percentage of the current GDP.

Leigh Phillips says that:

The reason the court was given these powers was to remove the exiguous remaining sliver of democratic control over such matters. EU leaders of course don’t put it quite this way. They say instead that giving the court these powers will ‘depoliticise such decisions’. But it is exactly the same thing. De-politicise = de-democratise.

These developments have been aided and abetted by the hasty removal of the Greece Prime Minister by the Troika, bullying visits by the the Troika to struggling nations demanding they delay elections and get on with carrying out their instructions etc.

But what would we expect. The whole Eurozone treaty was an undemocratic affair. They were going to affirm each nations membership with national referendums (where appropriate) but that was soon abandoned after the bosses realised the common currency would be rejected if put to the popular vote.

Remember how vilified the Icelandic President was when he vetoed kowtowing legislation, which the politicians had agreed to and would have made that nation’s crisis even worse.

And then along comes a few judges in the Portuguese Constitutional Court who seem to understand the limits of how far the government can undermine the well-being of pensioners, and those on sickness benefits and others better than the pro-Brussels government – the puppets of Brussels.

Note the puppet masters in Brussels are themselves bullied by those to the east of them! Bullies bullying bullies.

The puppets were told by the bullies – okay – the Portuguese Constitutional Court is irrelevant – you can just cut harder in other areas – like education and health. The latter will sort out those on sickness benefits anyway – don’t deny them access to food and shelter – just cut their medicines and kill them that way!

This was clearly a case though of the unelected judges going feral. The EU bosses wanted these undemocratic institutions to take over decision making and push the austerity line, in the same way as the ECJ.

They didn’t want the design of policy to be determined by the people via the ballot box. They wanted austerity laws that police would ultimately enforce and it wouldn’t matter which flavour of politics was in power, all would obey.

The Portuguese Constitutional Court went a bit feral.

But never mind. Leigh Phillips reminds us of how the EC responded. Classic!

The attitude of the European polity and the bureaucracy it supports is exemplified in the April 7, 2013 – Statement by the European Commission on Portugal – which was its reaction to the decision by the Portuguese Constitutional Court to declare the 2013 national budget illegal.

The Statement is one of those extraordinary demonstrations of how deeply entrenched the dysfunction is in Europe these days.

The EC applauded the decision of the Portuguese Government to largely ignore the decision of the Court and to confirm:

… its commitment to the adjustment programme, including its fiscal targets and timeline … The Commission therefore trusts that the Portuguese Government will swiftly identify the measures necessary to adapt the 2013 budget in a way that respects the revised fiscal target as requested by the Portuguese Government and supported by the Troika in the 7th review of the programme.

The Commission reiterates that a strong consensus around the programme will contribute to its successful implementation. In this respect, it is essential that Portugal’s key political institutions are united in their support.

In other words, business as usual. And don’t worry about what the opposition will say to the people – Brussels will co-opt them too to make sure austerity is law and TINA prevails.

As Leigh Phillips notes:

Just so we’re clear here: Voters cannot be trusted with electing the right people, so we are taking fiscal decisions out of their hands and giving these powers to judges instead. Courts shall enforce austerity. Except of course if they don’t. In which case, courts shall be disregarded.

Austerity is the law. It is the permanent and irreversible law. Should any other laws conflict with this, austerity rests above these laws.

Basically, austerity has crowned itself king, untrammelled by the laws of men. It’s the Joffrey Baratheon of economic policies.

Which then makes it obvious why the citizens are expressing deep mistrust in their political systems and the quality and operation of their democracies.

Europe is no longer free (if it ever was). It is run by an oligarchy of socio-paths.

And these maniacs still receive plenty of support from the other side of the Atlantic.

One of the morons that became a mouthpiece for those Excel Champions R&R was Erskine Bowles, a former cabinet member in the Clinton Administration, who most recently co-chaired the National Commission on Fiscal Responsibilities and Reform with Alan Simpson. He then started the – Fix the Debt campaign – which is supported by a host of conservative organisations that demonstrate an advanced lack of understanding of how the economic system operates.

The National Commission on Fiscal Responsibility and Reform put out a report in 2010 – The Moment of Truth.

The plans they advocated, if implemented (including getting the US federal budget into surplus by 2015) would certainly drive the US economy back into recession and damage the prospects of millions of Americans in their search for work.

Bowles thinks the US government can go broke. Apparently, his “own personal experience – in both the public and private sector” has taught him that. Hmm, I wonder what planet he has been on.

He thinks the US government run out of dollars? Maybe, if they pass a law saying they have run out of dollars and obey the rule of law, unlike the bankers on Wall Street and the Ratings Agencies who seem to think the law is a meagre inconvenience.

For more on Mr Bowles, please read my blog – The brightest minds can be so dumb in particular circumstances.

Anyway, he is back into the news this week. Him and his partner in moronity Simpson released another Report – same story, new front cover. The last report went in the bin as its predictions became irrelevant before they had even finished typing them. So, with their egos clearly in need of stimulation, they had to get a new report out, attract some new press headlines and get paid a heap for some public speaking engagements.

The new Report seems to advocate getting the US public debt ratio below some sort of threshold around 90 per cent. I wonder where they got that from?

In an interview with the Financial Times (April 19, 2013) – US fiscal hawk warns on excessive debt – he admits to referencing the disgraced work of R&R “a number of times”. Many times in fact – do a Google search.

When you examine the proposals – same old same old – you will see they want to hack into medicare support for the poor, health care for the low income elderly, peg public retirement pensions, cut public agencies.

Who would have guessed?

Anyway, with R&R in disgrace now and likely to become irrelevant in the public debate (how will they respond to the press each time when they are asked to show their spreadsheet?), Mr Bowles has another angle to justify his austerity calls:

I know [Rogoff-Reinhart] had a worksheet error in the report – my understanding is that it does make a difference. But what it doesn’t change is the common sense,” said Mr Bowles. “My own personal experience – in both the public and private sector – is that when any organisation has too much debt, that is an enormous risk factor. If your risks go up, people who are lending you money will want more money for their money

On the errors that “common sense” lead one into please read this blog – When common sense fails.

Some questions for Mr Bowles:

1. What experience has he with a currency-issuing nation without foreign currency denominated debt and a floating exchange rate defaulting on its debts?

2. What experience has he with such a government running out of the currency it issues?

We could pose many more but I suspect he wouldn’t quite grasp the import of the two noted here.

Another highly esteemed public figure has also urged further austerity. His company, of-course helped cause the crisis and can hardly claim to be the exemplars of virtuous conduct.

Lloyd Blankfein invoked the now dead Witch’s TINA claim during an interview with the BBC (April 23, 2013) – Goldman Sachs boss says UK has no choice but austerity.

Here are his words of “wisdom”:

You would like at this part of the cycle not to cut, to push out austerity and not to shrink the economy … But if you have a big deficit you lose that optionality. The choices get taken away from you.

I guess his company has investments that pay off when unemployment and poverty rise.

The only question I have is why the border control in London let him in!

Conclusion

The austerity policy has failed in its narrow aims. But the unintended consequences will be great. The EU leaders are risking undermining the whole meaning of “Europe” which was, in part, to stop wars.

Speaking of which, today is – ANZAC Day – in Australia and New Zealand – a public holiday to commemorate the deaths and sacrifices of our soldiers in various wars, some legitimate (First and Second World Wars), some not so (Vietnam oblige!).

It is a day of conflict in many respects. We acknowledge how brave our soldiers were. They were definitely that.

But some of us also consider how used they were by colonial masters in Britain and later the US. Why were we fighting in the dank northern fields of France in 1917? Why did we get sent to our slaughter by British generals in Galipoli and a few decades later in Singapore?

Why do we treat the people of East Timor so ruthlessly now when they were angels to our soldiers during the Second World War?

Why do we not acknowledge how our own soldiers misbehaved with respect to local women in areas they were fighting in and were party to war crimes?

The book by Allan Clifton “Time of Fallen Blossoms” provides a detailed account of the rapes by Australian troops in Japan during the occupation. Here is a 2007 Review – Australian Military Gang Rape of ‘Fallen Blossoms’.

So it is a very complex day – some choose to just focus on the bravura and celebration, while other thinks a little more deeply.

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

“The only question I have is why the border control in London let him in!”

They’re short staffed due to the austerity cuts.

Bill,

Contrary to your claims, I suggest Euro problems have virtually nothing to do with Rogoff and Reinhart. Much the biggest problem in the EZ is lack of competitiveness in the periphery. And the periphery cannot deal with that problem the way a monetary sovereign does, i.e. via devaluation. So the periphery has to endure years of austerity in order to get it’s costs down. Completely daft, but that’s an inherent problem with a common currency.

You could argue that Germany is being too cautious – or adhering a bit too much to Rogoffism. But inflation in Germany is only a little below the 2% target, so they cannot go wild with extra stimulus. Plus their unemployment rate is a very respectable 5% or so.

In short, I don’t think that you (along with dozens of other commentators) make a clear enough distinction between the reasons for austerity in the EZ and in contrast, in monetarily sovereign countries. The words “competitive” and “devaluation” don’t appear in the above article.

Dear Ralph,

sorry, the March unemployment rate (Arbeitslosenquote) is 7.3% which equates to 3,097,813 unemployed people as provided by the Bundesargentur für Arbeit and published in the latest Spiegel Online.

And you call 5% “respectable”? Please, please! Auf dem Teppich bleiben, as the Germans would say.

In Australia we had less than 2% between WW2 and the early 70s. That might be called respectable!

Best wishes

Graham Wrightson

@Ralph

“competitiveness in the periphery”

Ah yes………..

You do realize that wages in Ireland was 70% of GDP in 1980 and reached the mid 40% ~ during the height of the boom.

Bill touches on the people really behind the euro when he states that the commission are not really the top boys in the school yard.

The question is as always who benefits ?

I would suggest London runs European monetary policy

Paris does the administration , energy policy etc etc

Berlin does the industry thingy with Frankfurt the middleman.

Huge wealth continues to flow to these areas at the expense of their hinterland.

Thats the policy………keep up the good work and all that.

The objective is the destruction of former national redundancy both from a cultural , energy and monetary perspective.

As a example :

In todays Cork Examiner.

“Eirgrid plans 1 billion link to France”

The operators of the Irish grid said they were in advanced talks with the operators of the French grid with regards to a interconnector………

“Eirgrid received substantial support from Europe , Eirgrid chairperson Bernie Gray said Europe was generally supportive of such projects……………..”

Anybody who knows anything about Irish energy knows thats we need a second coal fired power station and extra peat stations but carbon policy coming out of European think thanks have plans to tax all carbon based lifeforms and redirect the surplus to London and Paris.

They will continue to extract from these hinterlands until the food and energy stops flowing into these international cities.

@Ralph & Graham,

Not to mention that the official unemployment rate does not really reflect what happens there. 7% unemployment may seem less catastrophic than other countries (I guess everything is relative, except the absolute lack of jobs!), but it is rising. Besides, what are the figures for hidden unemployment and underemployment? How many working poors does Germany have?

Also why do you think a stimulus would cause inflation there? What’s the output gap?

So the plan is believe it or not is to charge huge rents from the UK and French interconnectors…….profits & net consumption will be directed towards London and Paris.

The wind thingy in Ireland is just a sick joke to make this extraction plan creditable to the poles with surplus energy flowing from Ireland for only a few days in the year.

This is a example of the neo – feudal society they are building.

Ireland was indeed better off with the cattle for coal trade.

Its was probably the 6th or 7th circle of hell in terms of human freedom ( the farmers had a OK life , the people living in the cities of Ireland a terrible existence)

Now we are being pushed right to the very bottom again.

During the Euro bliss years post 73 /79 we became a Imperial market.

Now in the present energy situation our hinterland and people are ripe for net energy extraction.

The destruction of Italy & the rest of us explained.

http://www.youtube.com/watch?v=V77FoE54RNU

“So the periphery has to endure years of austerity in order to get it’s costs down.”

No it doesn’t. Currency unions work both ways.

In order for Germany et al to have somebody to sell their stuff to in Europe they need to give money to the periphery to buy that stuff and keep them employed.

Which is the same system used in any other federal structure or currency union.

You’ll get the same moaning – London vs. everywhere else in the UK for example. But it is the same answer. If London wants to remain prosperous within the UK then it needs to stimulate the periphery of the UK.

Ultimately there is more periphery with more people in it than there is in the core. If the core doesn’t realise how its bread gets buttered, then it will eventually be ejected via the ballot box – or worse via the jack boot.

Graham,

Re the unemployment rate in Germany, one can argue about that till the cows come home. E.g. this US Department of Labour site gives the rate adjusted to US concepts as being just under 6%.

http://www.bls.gov/fls/intl_unemployment_rates_monthly.htm

As to whether the rate is “respectable”, it’s certainly respectable by current EZ standards. Though as you say, it’s poor compared to the 1950s and 60s.

But much the most important question is whether Germany can achieve a substantial reduction in unemployment simply by a burst of stimulus. If they are going to stick to their 2% inflation target, and given that inflation in Germany is just under 2%, I doubt it. But I’d be delighted to be proved wrong.

Neil,

I agree that periphery problems COULD BE dealt with by the core “giving money” to the periphery, or subsidising employment in the periphery, or something like that. But the brute political reality is that isn’t going to happen. Core voters wont stand for it.

My enjoyment comes from hearing the people who have been calling for austerity in the US crying about being three hours late in their flight schedules. It is so comical to hear the very people who would cut spending for the aged, the poor, education, and other services whine about having to spend a little extra time sitting on the tarmac. I know that it has inconvenienced others and I regret it for them but I have no sympathy for the “rise above” crowd. I would really like to say what I think of those people but I don’t think it would be allowed.

Spanish unemployment now 27.2%. That’s austerity at its very best!

Dear GLH

It would definitely not be allowed here. But we know you think they are F*#king lousy bas&@4ds who should f*@k themselves. And I suspect we all agree, more or less, although I am sure my moderate description of them could be topped with more florid language.

But equally, we don’t really want to get into the them and us. The problem is systemic and ideological. We are trapped into our own stances. It is just that the dominant ideology is so harmful of the majority. We need to change that. Educate these characters as they sit stranded on the tarmacs because there are not enough flight controllers any more to get the flights out on time. That is better than wishing them poorly.

best wishes

bill

@Graham

My German is quite rusty, but what does Stay on the carpet really mean?

It is well known that when the LOT (Lack of Trust) ratio hits 80%, then social chaos is virtually certain to follow.

And, in fact, I have an Excel sheet somewhere around here … ah, here it is … that shows exactly that (or it soon will). It will be published in the upcoming Journal of Confidence and Trust Relations, available for $750, which is required reading for the freshman sociology class at the University for which I am tenured.

@Neil

The stuff Germany and its eastern plantations make is stuff we don’t need & the stuff we need can be made at home.

Before euro , before 1980 /86.

Before EMU :Euro countries internal goods cheap / external (China ,Germany, oil ?) goods expensive relative to cash flow.

During euro bliss years : Internal goods expensive / external goods cheap relative to cash flow

Euro 9th circle years : both internal and external goods too expensive for now limited level of cash flow….people go slowly bankrupt.

We need to break from Europe.

We have enough cars in Ireland to keep us going for decades.

@pebird

If this isn’t a joke, you have just put another nail into the coffin of journal publication. A number of academics are now boycotting the usual suspects. Your journal should obviously be added to the list. Having said that, I hope your comment about your journal and the spreadsheet was meant as a joke.

” But the brute political reality is that isn’t going to happen. Core voters wont stand for it.”

Jack boots it is then.

Now that Europe seems to be in real trouble they will bring out those pro Euro left wing liberal leprechauns to give the dark project a veneer of intellectual respectability amongst the left and thus take the harsh Christian democrat light off this demonic construct.

A real president of Ireland would ignore this false forum.

Higgens was / is very much inside this new club.

http://www.youtube.com/watch?v=-PFu1Vj2_GY

As Beppe Grillo said about this horrible elite.

They meet over quiet weekends of vomit.

All politicians which brought us inside this dastardly trap have no credit now.

Dear Larry,

“auf dem Teppich bleiben” is colloquial for “stay with the facts”, “do not exaggerate”.

Dear Tristan,

yes, you are right – relatively speaking 5% is less than 7% is less than the 2-digit figures in some other parts of the EZ. But more than 3 million unemployed is in no way respectable by my use of the English language.

Dear Ralph

The German underemployment rate (Unterbeschaeftigungsquote) includes the unemployment rate as well as those who have One-Euro-Jobs, undertaking further training or who are unable to work for a period. These figures are published with a 3 month delay.

The latest figure in Der Spiegel is for Dec 2012: 8.9% equating to 3,843,856 persons.

http://www.spiegel.de/flash/flash-12125.html

Cheers

Graham

Today’s offering reminds me of the enthusiasm for a “balanced budget amendment” to the US Constitution, which started back in the 1980s and resurfaces from time to time (the 2012 GOP Presidential nomination campaign being one of the most recent). When one points out that this goal is illusory at best (as the “automatic stabilizers” would prevent it from taking place in our current situation), s/he is confronted with the same tired rhetoric about “living within one’s means.” No need to rehash that here … but I want to know the real reason that so many who cling to “common sense” seem utterly incapable of reaching an understanding of how things actually work.

The best I’ve come up with thus far is that so many of us are wedded to ideology, and when one has an ideology it seems you have abandoned the need to think critically. So they never quite get the ideas of MMT – in particular, those about sovereign debt issuance being voluntary and government spending not needing to be “funded.” Carmen Reinhart would be just such an example, as would those who cite her work (the stooges Simpson and Bowles among them), but even more worthy of opprobrium (sorry Bill, I don’t descend into the scatological) are the “congress critters” who shamelessly court votes by appealing to all that “common sense” out there and vie to be the one to propose the biggest spending cut. This also extends to those hucksters on the radio here (I wonder if there is an Aussie equivalent to Rush Limbaugh) who recycle the same nonsense and contend, much like your favorite author Amity Schlaes (the Forgotten Man turns out to be all those who FDR put to work in the 1930s under CCC and WPA) who doesn’t count someone working for the government as being employed. We have much to answer for here in the good old USA.

@ Melia-

I would liken current neo-liberal sentiments to religious fanaticism. Essentially, if you are raised with a set of beliefs about how the world works, and there are people in positions of power reinforcing those beliefs, you can ignore any number of rational arguments against them – even if there is no rational argument in support of your beliefs beyond reiteration of poorly evidenced dogma.

All you have to is suspend disbelief for long enough to brainwash a society and Bam! your poorly evidenced ideology is widely considered to be fact, and the rational people who actually ask questions become crackpots or eccentrics(no offense Bill).

Still, I feel that a change is coming, governments will inevitably realize that austerity for austerity’s sake is a one way ticket to social & economic oblivion – and that automatic stabilizers essentially destroy a governments ability to do this anyway.

Things will not change until we are are plunged into another Great Depression. Neoliberalism has too great a hold on our government apparatus and on the public’s belief systems. Thus the tragic drama must play out to the end. Most will not accept current neolib economic theory is wrong until it has undeniably and extensively wrecked our Western economies.

It is clear we cannot argue the neolibs and the misled public out of these delusions. They are impervious to evidence and reason. The only thing that will convince them these policies are disatrous is the collapse and plummeting to the nadir of the full-fledged disaster itself. It’s like a crisis in a fever. It has to happen. It might kill the patient or it might resolve and allow the patient to proceed to recovery.

Neil,

I suggest there is more method in “jackboot madness” than you suppose.

As I said above, and as we agree, the problems of a poorly performing region (in the UK, US, EZ or anywhere else) CAN BE solved or ameliorated via regional measures – i.e. “giving money” to such regions, employment subsidies or whatever.

Unfortunately the history of such measures in the UK since WWII is a history of bureaucratic expense and constant arguments between economists as to how best to help poorly performing regions. E.g. should such regions be helped via employment subsidies or via grants for investment or something else? We’ve had both employment subsidies and capital grants in the UK since WWII.

One of the best examples of a c*ck-up here was the capital grant system, which offered firms a fixed percentage grant or subsidy of any capital investment they made. So when the big oil companies made a billion pound investment in the Sullom Voe oil terminal in the Shetlands about 20 years ago, they ended up being given about ten million per job created there: hardly a good use of taxpayers’ money.

In contrast, devaluation (if you have your own currency) is entirely free of bureaucratic expense. Or in the case of an EZ periphery, the equivalent is internal devaluation, and there is much to be said for the latter.

The last Great Depression taught us nothing Ikonoclast.

Even lab rats would’ve remembered something of that.

I think it’s more likely Neil’s jack boots. Science might advance one funeral at a time, but neo-lib economics seems immune to such remedies. I guess that says something about its religious underpinnings.

On another subject, but sort of related, Will Hutton had a half reasonable article in Thursday’s Guardian in which he sought to give Osborne some advice:

Osborne must abandon three false economic tenets. The public sector does not always crowd out the private sector; public debt is not axiomatically bad and raising taxes is not more economically harmful than cutting spending.

Following Hutton’s article however were 375 comments of which only 2 touched on the subject of how the monetary system actual works, and the myth of “living within our means”.

: (

@John

In the UK public debt would crowd out private debt.

Why ?

The UK is getting a oil surplus from austerity Euroland.

The strange dynamics between a sov country and a currency union is very important to understand.

However this private asset creation is not very useful in the long run because of the general rapid depreciation and non productivity of these capital investments.

I.e. would you want another Sizewell B PWR which would have a 50 year lifetime of production or a Ford transit (now imported) with a 10 year lifetime of fuel burn.

“Brussels, 26/04/2013 – In March, new commercial vehicle registrations dropped for the fifteenth consecutive month in the EU* (-9.8%), totaling 166,402 units. Most markets contracted, including France (-10.2%), Germany (-18.5%), Spain (-20.2%) and Italy (-20.3%). The UK was the only major one to post growth (+7.7%). In the first quarter of the year, downturn prevailed across segments, leading to an overall 11.0% decrease in the EU*. Except the UK (+6.6%), all major markets faced a downturn, ranging from -10.7% in France, to -16.4% in Germany, -18.7% in Spain and -25.0% in Italy. In total, 401,838 new vehicles were recorded in the first three months of 2013”

Local Primary production crowds out banking profits …………its best for banks to import the stuff until the euro system collapses ………..however you are left in a right pickle when this happens as your workforce consists of fanny the hairdresser and bob the apartment builder.

very few miners , nuclear tech guys , fishermen , farmers etc etc

http://www.acea.be/news/news_detail/commercial_vehicle_registrations_-_11.0_in_first_quarter_-9.8_in_march/

@Ralph

What you’re pushing, in a round about way, is the old “every country should be like Germany line” which the Germans themselves push in relation to peripheral Eurozone countries. The truth is that if they were like Germany (poor consumers but big exporters) then Germany couldn’t be like Germany because it would involve them running surpluses with Germany so Germany would find itself running permanent deficits. The German counter to that is that all Eurozone countries could generate surpluses from trade with non-Eurozone countries but the non Eurozone countries, e.g UK are not likely to be entirely compliant with that idea. Non Eurozone countries finding themselves on the receiving end of such a policy are likely to match Peripheral Eurozone development to at least maintain their current relative level of competiveness & have an adavantage in achieving that because they have control of their currencies.

Hi D O’C

You might have to spell all that out for this thick antipodean…

I see public debt as an antidote to the private debt hangover, whether or not that flow is used to retire debt or simply invest in assets.

The rego numbers for the UK are curious however, discounted beemers perhaps for those financial types from The City still pulling their bonuses ? Or anticipating their tax cuts ?

PWR’s don’t generally excite my curiosity but I’m open minded about about anything Generation IV. I’m with James Hansen.

@John

Private debt creation is generally very input heavy for the amount of output you can get out which is generally very little

In the age of oil banks create burb & car housing “assets”

In contrast a fiscal authority could use money to make a Nuke plant.

(A private utility would never do this as it would reduce scarcity and therefore profits.)

But there is no real apparent need for British fiscal investment as the eurozone is providing surplus oil for British banks high street operations.

i.e.

Germany produces surplus BMWs

British banks capture this physical surplus by producing credit to buy this product.

The money /credit supply rises.

However after 10 or so years the capital is gone – depreciated into dust.

You can clearly see the UK running out of road as its Euro colony goes under.

The UK will be the last country standing – but it is standing on quicksand.

The above vibrant van sales in the UK is probably a result of Tim the Toolman home improvements, flower delivery & god only knows what other pointless activities.

The UK had higher van sales then Italy , Spain ,Netherlands , Portugal ,Ireland Greece & Cyprus combined. (67,005)

UK (68,882)

France post war has always been a major van user because of its input /output heavy agricultural makeup but in this major market of Europe its numbers are declining also at 91,815 (- 10.4%) as the modern suburban life becomes a nightmare.

For neo-liberalism made into law, one has to look back at the 1973 Pompidou-Giscard Law in France which obliges France to fund spending by borrowing from the markets, a relatively simple law that puts all French governments, regardless of political persuasion or mandate from the electorate, at the mercy of the markets