The other day I was asked whether I was happy that the US President was…

Unemployment is skyrocketing – but we have treaty obligations!

And that is the problem. The Treaty (of Lisbon) and all the related Eurozone legalities that define the way the Brussels bureaucracy interacts with the member states is incapable of delivering prosperity to its citizens. In the last week, a senior Dutch economics official (boss of very conservative Centraal Planbureau) has delivered a wake-up call to European policy makers. In his departing press briefings the CPB chief, who is no Keynesian (rather he is a rigid supply-sider) has called for flexibility with respect to the application of the fiscal rules and an easing of the planned austerity because his nation’s economic performance is deteriorating fast. The Southern malaise is now impacting on the richer, more smug northern nations, as it always was going too. Many economists remain in denial of what is happening. It is 2013 not 2009. The world has been caught up in this crisis for 5 years. It is an entrenched crisis and the data is now showing us that the recent manifestation of the crisis is being driven by fiscal austerity. The initial impacts of the GFC were large but recovery had commenced and have now been killed off by the fiscal zealots. While the departing CPB boss called on the Dutch government to ignore the Stability and Growth Pact rules for the next few years, he also observed, that the nation had “treaty obligations”. That is the problem. These obligations prevent responsible fiscal positions, which in the current circumstances, would suggest budget deficits of several more percent of GDP than the 3 per cent rule being fully supported by the ECB.

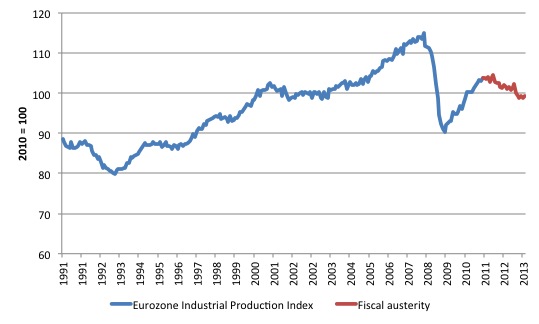

Here is the evidence that austerity kills growth. The following graph uses data from the – ECB Data Warehouse – and shows the Euro area 17 (fixed composition) – Industrial Production Index, Total Industry (excluding construction) Working day and seasonally adjusted.

Obviously, the GFC downturn was very sharp and deep. Then the expansion of the budget deficits, mostly but not exclusively due to the automatic stabilisers, restored growth and a recovery was underway.

Then ideology got in the way and the rest is obvious. Just keep reminding yourself that the economists were advising these Eurozone policy makers that all they had to do was start hacking into public spending to signal to the private sector that they would be bringing deficits (and public debt down) and the latter would be so happy that they weren’t going to be taxed out of existence in the future that they would abandon saving up for the higher taxes and spend, spend, spend.

So confident would they be that they would ignore the deflationary impact of unemployment and lack of orders coming into firms. Soon, they would spend up big. The Ricardian myth was paraded by many political leaders.

Rogoff and Reinhart were touted around the place as the answer. They did lecture tours and conducted interviews telling everyone about the 90 per cent disaster threshold. They forgot to mention that they didn’t work their Excel worksheet in a competent manner. Or was it not a matter of incompetence?

It was obvious what was going to happen. And it did. Keep looking for statements from mainstream economists from 2009, 2010 etc about how fiscal contraction expansion was the way to go.

And the Netherlands …

On April 18, 2013, the Dutch national statistical agency – Statistics Netherlands (Centraal Bureau voor de Statiskiek) announced that – Unemployment rises to over 8 percent.

There were 30 thousand extra unemployed (now at 643 thousand) in March 2013. Those receiving benefits rose by only 3 million (to 380 thousand) putting paid to the mainstream economic argument that the provision of benefits lures people onto the unemployment queue.

In December 2012, the unemployment rate was 7.2 per cent. We are thus seeing the sharp rise in unemployment consistent with a significant turn in the economy.

The agency confirmed that the crisis is now penetrating those typically the last affected – the prime-age workers:

In the last three months, the increase was strongest among 25-44 year-olds. In this age group an average 11 thousand people per month became unemployed. Unemployment among over-45s rose by 8 thousand a month, among under-25s it increased by 4 thousand a month. Unemployment according to the definition used by the ILO was 6.4 percent, up from 6.2 percent in February.

On April 19, 2013, the Dutch Volskrant newspaper ran the story – Teulings: verlaat 3 procent, schrap extra bezuinigingen – (Teulings: Forget the 3 per cent, do not make the extra cuts).

Coen Teulings is the retiring head of the – Centraal Planbureau (CPB) – which is part of the Dutch Ministry of Economic Affairs and provides the government with economic analysis and forecasting, and advises the Dutch Cabinet.

It was established in 1945 and the great economist Jan Tinbergen was appointed as its first director. Tinbergen, by the way, had a war with an intolerant John Maynard Keynes about matters econometrics and I did some work on that debate some years ago, which I might reprise at some point because it is very interesting.

By way of background, – de Volkskrant – it started life as a Catholic politicial daily newspaper (in 1919, although it only went daily in 1921). After the Second World War, it became a left-wing paper for the more intelligent reader (by contrast with De Telegraaf, for example). But in this neo-liberal era, it has progressively diluted its political slant and is now a centrist paper, which means in this era of the shifting centre, that it is a vehicle for right-wing (but toned-down) economic propaganda.

While the CPB had noble origins, it went downhill over the last 30 years or so as it became one of the spearheads of the neo-liberal onslaught against welfare entitlements, minimum wages, job protection etc.

I was very critical of it some years ago (with my co-author Joan Muysken) for publishing work that wasn’t that far removed from the fudged Rogoff and Reinhart standards of excellence.

For example, there were a series of papers from CPB (Broer et al, Van Horst etc) which sought to establish the proposition that the so-called equilibrium unemployment rate was driven by structural factors. This was in the context of the persistently high European unemployment rates and the release of the 1994 OECD Jobs Study, which sought to blame welfare entitlements and labour market protections (regulations).

The CPB led the charge and produced some extremely shoddy analysis across a number of papers to support the OECD line and the prevailing neo-liberal orthodoxy against using aggregate demand policies to bring down the unemployment.

Unlike the recent problem of getting hold of the data that Rogoff and Reinhart used (and now we know fudged), the CPB database was available so we could replicate the results relatively easily although we had to do a lot of reverse engineering of rather complex equations to understand what restrictions (a technical term describing setting unknown parameters that would normally be estimated to a given value) had been imposed to get the final forms of the equations in their models.

While our attacks were very technical in nature the substance can be summarised in the following way:

1. The final equations were highly restricted by prior beliefs consistent with the theory they were claiming to be shedding light about.

So, as an unrelated example, if I contend that A impacts on B but I am unclear how (negative, positive, magnitude) then I have an conjectured relationship such as A = xB where x is the parameter of interest but is unknown. The task of econometrics is to estimate x – that is, put a number on it using real world data for A and B.

Further, the value of x might be the difference between two competing theories of the relationship and so assumes central importance in the enquiry.

If I then just impose the value x = 1 on this study then clearly I am saying that all changes in B immediately impact fully on A in a positive manner. That restriction might suit my particular theory but in imposing the restriction I am not allowing the data to tell me anything about the plausibility of the hypothesis.

The underlying data might tell me that x = -0.0001, for example, which would mean the theory was implausible, given the data.

Imposing restrictions on econometric models in the process of estimation is a legitimate practice and allows us to simplify otherwise complex relationships so that we can get to the heart of what is going on.

But good practice tells us that you have to perform special statistical tests on these restrictions to ensure they are “data accepted”. That means we can say that the data supports a particular hypothesis about the value of x and so we can impose that value to simplify matters.

I realise that will not be fully appreciated by the average reader but it relates to much more complex models than our simple A-B model here and we get more precise results when there are fewer unknowns to estimate. So by eliminating some of the unknowns we do ourselves a favour. But that is only acceptable if the formal tests of the restrictions have been satisfactory.

The CPB would impose all sorts of key restrictions, which supported the natural rate view of unemployment (in essence, the neo-liberal party line), That is, they created estimating equations that replicated the theoretical specification that they were advocating.

This practice immediately carries with it the interpretation that if the restriction(s) fail then the empirical work cannot reasonably be concluded to support the theoretical structure. To avoid this sort of confrontation, the restrictions were simply imposed by the CPB authors without further ado and the discussion of the empirical results proceeded at a pace as if there were no basic issues.

Upon examination we found that the key restrictions could not be maintained. The restrictions were mostly invalid.

Further, we found that once we relaxed the restrictions (that is, were forced to estimate these key unknown parameters), the results from the exercise were very sensitive. That is, the key outcomes reported in these CPB papers were no longer consistent with the data when produced using more general (but valid) representations of the relationships.

That might sound very technical but the bottom line is this. Just as Rogoff and Reinhart’s results collapsed once the Excel coding error was addressed (and additional data that they had excluded was included), the CPB results collapsed and the opposite message was produced from their dataset.

In other words, the results were fudged, made-up, connived, use whatever word you like. Motivation? It is hard to tell but when a researcher who knows full well that restrictions should be tested and also knows the importance of the particular restriction in terms of the theoretical and policy debates, imposes the restriction and doesn’t test its validity, then you can might conclude that that is rather deliberate behaviour and contrary to best practice.

The problem is that the press releases sound scientific and the headlines reported by the co-opted journalists don’t ever penetrate the smokescreen. And so we read next morning – Welfare benefits too high, inducing people to remain on the dole – for example.

2. We also found that the estimates that the researchers at CPB produced – key results to substantiate their claim that structural variables were highly significant determinants of the persistent unemployment – were highly sensitive to the sample period used to estimate the equations. That is, they seemed to exclude data observations without justification.

In one case, the AMECO dataset was used. This is an annual dataset and at the time the studies were being conducted (late 1990s, early 2000s) the number of observations were barely sufficient to meet the minimum sample size requirements for best practice (for example, central limit theorem requirements).

In that context, one would want to use the maximum number of observations available, given the study was precarious anyway.

We replicated their results and found they had used shorter samples than were available. That aroused suspicion immediately given the issue just noted. When we estimated the models over the longest sample available what do you think we found?

Many of the so-called key structural variables lost their statistical significance (meaning they had no impact in the equation) and the coefficients no longer had the same sign (direction of impact) or magnitude (size of impact).

In other words, the CPB equations, upon which the policy advice was being based were sample dependent – which means in English they were unreliable and worthless.

3. If all that wasn’t enough, the crowning glory of this interrogation of their work revealed that the so-called “structural” variables – replacement ratio, tax wedge etc – which were found by the CPB to be statistically significant factors driving their estimates of the equilibrium unemployment rate up, were, in fact, highly cyclical once we did the correct time series decompositions including spectral analysis.

What does that mean? It means that they moved with the economic cycle – with movements in aggregate demand. So fiscal policy interventions, previously excluded as being ineffective by this “structural” hypothesis, actually drove the so-called structural variables.

Once the cyclical component was taken out of the variables and the regressions repeated there was no remaining statistically significant effect. What does that mean? That their hypothesis was totally rejected by their data.

That is, there was no basis for the claims that governments could not reduce unemployment using expansionary fiscal policy. It meant that attacks on the welfare system and/or attacks on workers’ protections and job security and/or attempts to cut the minimum wage could not be supported by the evidence.

It was clear that the persistent unemployment was because aggregate demand was being starved by ideologically misguided policy.

At the time, the late Franco Modigliani, who introduced the term NAIRU to the economics profession (Modigliani and Papademos, 1975), seriously reconsidered his position. He wrote in 2000:

Unemployment is primarily due to lack of aggregate demand. This is mainly the outcome of erroneous macroeconomic policies … [the decisions of Central Banks] … inspired by an obsessive fear of inflation, … coupled with a benign neglect for unemployment … have resulted in systematically over tight monetary policy decisions, apparently based on an objectionable use of the so-called NAIRU approach. The contractive effects of these policies have been reinforced by common, very tight fiscal policies.

[Reference: Modigliani, Franco (2000), “Europe’s Economic Problems”, Carpe Oeconomiam Papers in Economics, 3rd Monetary and Finance Lecture, Freiburg, April 6, Page 3, emphasis in original]

Anyway, that was our dealings with the CPB! There was more to this dispute and we wrote several papers.

A lot of this discussion (the technicalities etc) appeared in our 2008 book – Full Employment abandoned.

Coen Teulings has just stepped down as the director of the Centraal Planbureau and his interview really brings into relief the conflict between ideology and praxis in the Eurozone at the moment.

He told the interviewer:

De komende drie jaar moet het kabinet het oorspronkelijke bezuinigingsprogramma voortzetten zonder op de Brusselse eis van 3 procent te letten. Ook extra bezuinigingen horen daar niet bij, zoals het pakket van 4,3 miljard euro dat het kabinet tot augustus in de ijskast heeft gezet.

That is, the Dutch government should continue for the next three years with its current plan and not try to satisfy the SGP requirement imposed by Brussels of a 3 per cent deficit. They should not make further cuts and that includes the 4.3 billion package of cuts that the government has put on hold until August.

The new Dutch government, which came to power on March 1, 2013 proposed cuts of 4.3 billion Euros because the CPB had told them that their budget deficit would come in at 3.4 per cent of GDP, which would then bring them into a Excessive Deficit Mechanism process, such is the mindless rules that these nations have signed up to.

It was interesting that he acknowledged in the interview that, on the hand, it would not be sensible to be slaves of the 3 per cent rule, but then he said that the nation still had obligations under EU treaties.

The clear intent of his message was that these treaties are political and ideological statements and are too rigid to provide for prosperity. It is clear that he considers the Dutch economy is going backwards fast and any attempt to cut further as a way of delivering the agreed 3 per cent of GDP budget deficit would make things worse.

I think this is a very important statement in the debate because as I noted above the CPB has been at the forefront of the promotion of neo-liberal thinking in Europe. Their research has continually promoted deregulation and welfare reform and budget surplus obsessions.

Now, it seems, the evidence that has accumulated, which shows that this policy approach has dramatically failed, is almost too difficult to deny, even by the CPB.

Teulings also said:

Houdt Nederland Brussel een tekort voor dat groter is dan 3 procent, dan wekt dat de toorn van eurocommissaris Olli Rehn die de eurolanden tot begrotingsdiscipline moet bewegen. Rehn heeft juist mede door Nederlandse druk meer bevoegdheden gekregen. Uiterlijk 30 april dient het kabinet Rehn een ontwerpbegroting te sturen waaruit moet blijken dat Nederland zich aan de Europese normen houdt.

That is, if the Dutch deficit is greater than 3 per cent then it will arouse the wrath of the European Union’s Commissioner for Economic and Monetary Affairs, Olli Rehn who will demand that the Euro countries maintain fiscal discipline. Rehn will demand that the Dutch government comply by the SGP standards by April 30.

This is the same Rehn, who on June 1, 2011 addressed the Council on Foreign Relations on – Debt, Governance, and Growth: A Eurozone Perspective.

There he blithely told the audience:

… we are convinced that putting the debt-to-GDP ratios on a downward path is a pressing priority for all EU member states …

He then channelled the Witch with her TINA bullying:

For some member states, like Greece, there has simply been no alternative to fiscal consolidation.

Which is a lie. The alternative was clear. Within the Euro, the ECB could have announced it was funding a growth strategy and allowed Greece’s deficit to move with the cycle.

But, more preferable, would have been for Greece to show some national pride and leadership and exit the corrupt and dysfunctional monetary arrangement.

Rehn, who I am forming the view has lost perspective completely, then channelled his modern mentors:

Carmen Reinhart and Kenneth Rogoff, in their wonderful book, “This Time is Different,” have coined the 90-percent rule, or should I say rule of thumb, that countries with public debt exceeding 90 percent of annual economic output grow — tend to grow more slowly. High debt levels can crowd out economic activity and entrepreneurial dynamism, and thus simply hamper growth. This conclusion is particularly relevant at a time when debt levels in Europe are now approaching the 90-percent threshold — it’s currently, on average, around 85 percent — and when the U.S. has already passed this threshold.

Which is another lie. We now know to be the product of research incompetence, fudged results, which do not hold when the data is examined correctly. And all of that is not to mention the obvious causality issues, which I have written about, as have others, several times in the past.

But it is clear Rhen hasn’t much idea himself.

As Wolfgang Münchau wrote in his recent (April 21, 2013) Financial Times article – Perils of placing faith in a thin theory:

Policy makers, such as Mr Rehn, are always on the lookout for economic theories that seem plausible and accord with their deep beliefs. In Europe, most of them have little exposure to macroeconomists who think out of the box … If two of the world’s most respected economists then come along and tell them that their gut instincts have been right all along, this is the conservative policy maker’s equivalent of birthday and Christmas coinciding. At last, the message they always wanted to hear.

Hopefully, these two economists will be significantly less respected now as a result of the discovery of their Excel shenanigans.

Teulings also thinks that while Rehn may have the strict legal framework of the Eurozone on his side, just looking at the numbers is not very sensible. He thinks that if he was Rehn he would just say something like “your doing okay on the budget front and these are exceptional circumstances” – like your unemployment rate is going through the roof – we can be a bit flexible.

Finally, Teulings now admits that the benefits of European integration could have been gained without the common currency:

Teulings stelt dat door de ‘3 procent’ Nederland ‘bij ieder wissewasje het begrotingssaldo politiek gaat sturen. Met weer een nieuwe bezuinigingsronde.’ De Europese eisen zijn bedacht bij de invoering van de euro. Europa is wat Teulings betreft weinig opgeschoten met de eenheidsmunt. ‘Uit onze analyse blijkt dat als je de euro niet had ingevoerd en door was gegaan als handelsunie en die had uitgebreid, dan had je het leeuwendeel van de voordelen van de Europese integratie ook wel geïncasseerd. Maar ontbinding van de monetaire unie is nu buitengewoon kostbaar.’

Which says that the SGP rules were devised for the common currency but he considers there has been very little positive progress as a result of its introduction. He believes that a simple expansion of the European trade area would have allowed the nations to capture the lions’ share of the benefits of European integration (“dan had je het leeuwendeel van de voordelen van de Europese integratie ook wel geïncasseerd”).

In other words, he is admitting the failure of the currency arrangement.

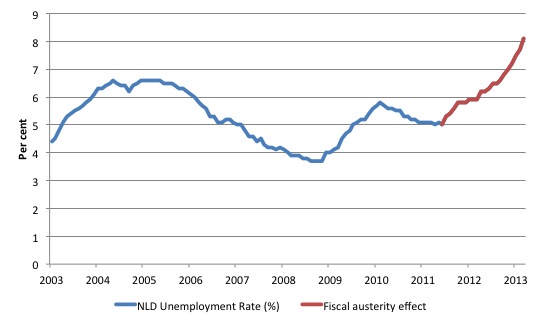

This is why he is coming clean and admitting to the failed strategy. The following graph shows the national unemployment rate in the Netherlands since January 2003.

The impact of the GFC and the following recovery courtesy of the rising budget deficit is clear. But the stark fact is that the subsequent damage from the fiscal austerity is now worse than the initial downturn in 2009 and the rising unemployment is accelerating upwards now.

When we observe a sharp rise in unemployment like that of the last three or so months it is a sign that the economy has turned and will get worse if there is no policy intervention to arrest the deterioration.

That is what Teulings is seeking. However, he is not seeking a reversal in the austerity – just a delay in adding more spending cuts into an already depressed situation.

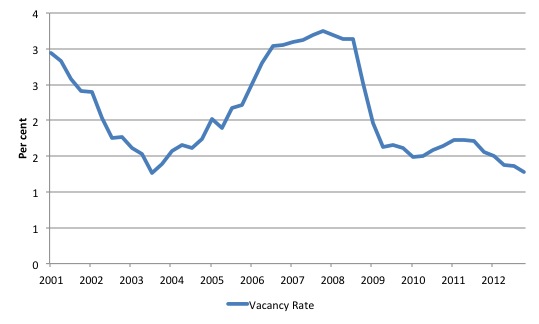

To see what is happening on the demand-side of the labour market, the next graph shows the vacancy rate (Vacancies as a % of labour force) from 2001 to December 2012.

The very sharp impact of the GFC is evident and the recovery was weak and barely underway before the austerity mania killed it.

Anyone who looks at data like this who actually knows what is going on would conclude that this is a massive aggregate demand failure. The collapse of labour demand pushes up the excess supply (unemployment). There is no structural explanation that is plausible. What changed within a month or so to cause vacancies, that had been growing nicely for several years, to collapse?

Why did the nascent recovery collapse? These are demand-side effects and nothing at all to do with welfare entitlements, minimum wages, job protection, and the rest of it.

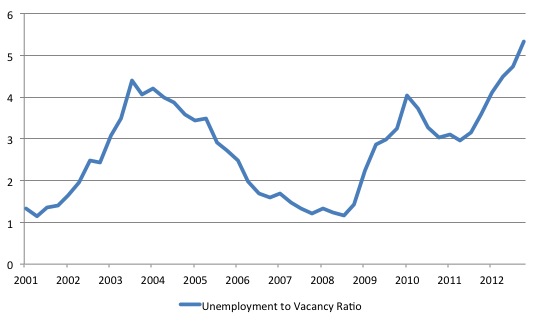

The third graph brings this information together and shows the unemployment to vacancy ratio for the Netherlands from 2001 to December 2012. Before the imposition of austerity, the ratio fell to 1.2 persons per vacancy. It has risen sharply in recent months and is now at 5.3 and rising.

Conclusion

The departing CPB chief is no Keynesian. He is a rigid supply-sider. But that makes his calls for flexibility and an easing of the planned austerity quite compelling.

Many economists remain in denial of what is happening. It is 2013 not 2009. The world has been caught up in this crisis for 5 years. It is an entrenched crisis and the data is now showing us that its recent manifestation is being driven by fiscal austerity.

The initial impacts of the GFC were large but recovery had commenced and was then killed off by the zealots, like Rehn and his ilk.

They should fade into oblivion like Rogoff and Reinhart surely should and let the world have new leaders who have a sense of purpose and an understanding of how things operate.

Even a semblance of comprehension would be better than we are enduring at present.

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

ISTM that if you want to make a few Euros in economics all you need to do is get a commission to curve fit some data to your clients beliefs in a pseudo-scientific manner.

I know for certain that happens in the UK, cos I’ve hired them. Pay them money and they’ll attach their ‘expertise’ credentials to anything you want them to justify.

Conservative economists don’t get it

http://trueeconomics.blogspot.ie/2013/04/2242013-government-latest-hair-brained.html

Sure – the above government policy is hair brained and stinks of corporatism and of course will not work in the super hard but brittle euro.

But a government could pay the dole and farmers could add 100 euros to a local lads pay….

Given the scale of the crisis in Irish agri intermediate consumption …..why not ?

E.g. The loss rate of Irish Sheep on the hills is now extreme given the lack of time and labour inputs.

Farmers need young lads that can move around the place without a quad and its costs.

Keep it simple stupid , forget about hi – tech crap.

What about a strategy that combines austerity in the southern countries and fiscal expansion in germany? could it work?

“Unemployment is primarily due to lack of aggregate demand.”

Surely, this is what was ‘believed’ by the current U.K. government?

The fall in aggregate demand brought about by ‘austerity’ would, they believed, be offset by expansionary monetary policy, supply side policies and the new ‘voodoo economics’: The Barro/Ricardo equivalence proposition?

Jan,

Your suggestion is very close to what is happening at the moment. A variation on your theme that would solve the problem would be “fiscal expansion” throughout the EZ combined with a pay freeze in the periphery, while allowing inflation in Germany to run at above normal levels for a few years.

That would allow higher levels of employment in the periphery, while the pay freeze would not greatly influence living standards in the periphery and for the simple reason that the main cost involved in producing stuff consumed in a periphery country is the cost of labour in that country. I.e. the pay freeze would tend to result in a price freeze in those countries.

That would get the competitiveness of the periphery back in line with Germany. Unfortunately I don’t see the uber cautious Germans agreeing to the above excess inflation.

Signs and portents! Birds of night that fly at noon. Words of wisdom from the mouths of VSPs:

“Socially and politically, one policy that is only seen as austerity is, of course, not sustainable” José Barroso, president of the European commission.

“The UK and almost all of Europe have erred in terms of believing that austerity, fiscal austerity in the short term, is the way to produce real growth. It is not. You’ve got to spend money.” Bill Gross, Co-Chief Investment Officer of Pimco.

Beware the ides of May!

Austerity is europe’s new religion, and Olli Rehn is the Pope of Austerity.

European Union has became Austerity Union

2 neo liberals walk into a Irish Bar……………..

http://www.irisheconomy.ie/index.php/2013/04/23/financieel-dagblad-on-ireland/#comment-416526

What can one say.

The extraction of labour value in Ireland is the most extreme in Europe.

Ryanair Irish operations nosed dived and have never recovered.

Irish airline passenger numbers has seen the biggest declines in Europe.

Its hide was saved by diversification out of Ireland.

Eventually when Ryanair takes over the world the economic world will in that instant no longer exist.

As their profits are mere extraction of the commons.

Irelands other companies copied Ryanair like operations.

Especially in high energy input jobs such as construction.

Eventually when the credit ran out people no longer had the cash flow or time to fly.

The Dublin to London route – once the busiest in Europe was no longer so.

Guys like Micheal o Leary act very much like super efficient spud farmers.

They can produce more spuds per acre then any other.

For some funny reason their entire crop will collapse at some future point as they lack any form of redundancy.

What a pox.

The Irish economy blog is a sad joke of a site.

But the joke is on the Irish people.

`Direct comment and criticism clearly doesn’t seem to be working. Therefore, it seems that a flanking movement might be a better strategy. For example, to undercut the assumptions underwriting the manner in which the European Union and its currency setup was initiated in the first place. It seems that its founders acted as if the currency system in play was akin to a Metallic currency system, although they knew it really wasn’t, and that they wanted the system they were creating to act like one. A number of different reasons were in play and I won’t go into them here (mainly bec it isn’t fresh in my mind). Just to raise it as a possible way of proceeding against the austerity program as opposed to a direct confrontation. Which doesn’t seem to be working.

On the Irish economy site a few years ago I pointed out that the Golden Vale ( the biggest and most productive dairy area in the country) needed a rail hub / spur in the town of Cahir via Waterford Port so as to transport feed and fertilizer as truck shipping costs will become too expensive relative to the now limited cash flow of farmers………

Well look what has happened now.

“One 70-cow farmer said he is down €21,000 over the past 70 days alone. His fodder costs have spiralled. Ration is 25% dearer, and his usage is up 50%, while his milk output has halved. Thus, he has no income to pay his mounting debts”

http://www.irishexaminer.com/text/ireland/cwcwsnkfsnau/

More Agri rail hubs are needed in areas such as Silvermines rail spur and perhaps somewhere in the midlands.

Ralph: “fiscal expansion” throughout the EZ combined with a pay freeze in the periphery.

That basicallly amounts to a Euro JG. The pay freeze is the JG’s fixed wage. The JG applies to the unemployed and low paid, who are concentrated in the periphery. The fiscal expansion in Germany would be the main thing that might feed German inflation, but surely there is a good amount of leeway there, even with demand from the periphery increasing, even with German wages increasing. Aside from that there is no reason to think that this will be more inflationary, especially in the long run, than the endless nightmare of stagnation/ austerity.

Some Guy,

I think there are big differences between what I proposed and a Euro wide JG scheme:

1. JG involves a more or less flat wage: about the same as the minimum wage or what people would have got on unemployment benefits. In contrast, I advocated a “wage freeze” above. I.e. those getting five times the min wage would still get five times the min wage.

2. JG involves what are essentially TEMPORARY jobs until those concerned find viable or non-subsidised jobs. In contrast, there’d be no reason for those with “frozen wage” jobs to seek alternative employment.

Re your claim that there is “no reason to think that this will be more inflationary…”, the whole purpose of my proposal is to raise inflation in core countries relative to the periphery. Indeed, that’s exactly the purpose of the austerity being imposed on the periphery. And it’s working – slowly. That is, periphery costs HAVE COME DOWN relative to core costs.

But obviously the latter policy involves horrendous social costs. My proposal aims to achieve the same DIFFERENTIAL as between periphery inflation and core inflation, but by boosting inflation throughout the EZ. And that would mean more inflation in Germany.

Incidentally, another possible solution to EZ problems is to fiddle around with various taxes (VAT, income tax, payroll taxes, etc). See:

http://www.businessweek.com/articles/2013-02-14/harvard-economist-gita-gopinath-offers-a-euro-cure

@Dork

I like your stuff and it seems well thought out though I’m not sure I follow you most of the time. I’ve no economics training but read Blogs often. I’ve been on Gurdiev’s one but find it depressing and he has been the knight in shining armour in Ireland after the crash. His solution – cut €23bn from the budget and a flat tax. So I tried to find out who he is and discovered that he used to supply the information on Ireland to the Fraser Institute for the “World Economic Freedom Annual Report” which right up until 2008 gave Ireland glowing reports…… dearie me.

Ireland seems to have the most incompetent economists on the planet, which is saying something.

Regarding jobs: In 2007, as soon as the banks came under pressure we should have immediately put everyone losing their jobs on construction sites into a project to build a metro in Dublin and School building projects. Our recession would have been far less harsh and we’d now have a metro in Dublin and better schools with likely a better budget position (certainly so if we’d handled out collapsing banks better). Was this even feasible?

On the farmers: It’s interesting what a harsh winter can do to small producers.

It’s enough to make you wish for the bad old days of World War II when we bartered Guinness directly with the Brits for coal and other necessities!!! That was enlightened compared to today’s policies……

Pardon the use of a link, Bill, but this is relevant, I promise.

It seems the Irish equivalent of our Dutch friends referred to in Bill’s piece are seeing the light as well. Kind of.

http://www.breakingnews.ie/ireland/ifac-drops-call-for-extra-budget-spending-cuts-592358.html

Note, of course, that they believe that the Government should continue with the original adjustments, and not a single admission they got it wrong. I wonder do they have any other ideas we shouldn’t listen to?

@kaiser

Yes well , I don’t agree with most of his stuff but he is a capable guy and produces a interesting take on the stats.

Ireland was clearly in trouble for many years if you look at its domestic high energy (construction) and international airline and ferry operations.

In construction they went so far as shipping Turks in to build a Cork road.

In Irish ferries they did pretty much the same thing.

Keeping labour costs down to disguise the real costs of such operations.

This meant there was a lack of normal wage based demand……in Ireland this meant the local village pubs started to shut down many years before the bust.

The vacuum was filled with credit – chiefly for cars and burb houses.

This started a long long time ago now.

I remember being in posh village down in west cork back in 1990 – the place was filled with BMWs and Volvos.

It was strange to me – that level of wealth & energy waste as the country was going through a so called fiscal austerity thingy was shocking.

I am not sure a Metro would be cost effective from a real capital expenditure angle.

Dublin is not a very dense city , trams are better.

Also Dublin does not produce anything – its a colonial capital / base of operations.

If the country reduced its tax take and became truly a sov entity I imagine Dublin would go into a major crisis.

Its better to save our market towns first.