The other day I was asked whether I was happy that the US President was…

What part of the word failure don’t the Euro elite understand?

The – Eurostat homePage – today (May 1, 2012) told the story of policy failure. On April 30, 2013 there were two major data releases – Euro area unemployment rate at 12.1% and Euro area annual inflation down to 1.2%. Record unemployment and a contracting and very low inflation rate. That is recession. That is the average. Some nations are now experiencing the Great Depression Mark II. And still the policy leaders make public statements that things are easing because borrowing rates are down and fiscal consolidation is bringing deficits down. On May Day 2013 it would be appropriate for a major workers’ revolt throughout Europe to protest over the continued rise in unemployment and the failure of the elites to deal with it. The question that the riot could pose is: What part of the word failure do these leaders not understand?

It is – International Workers’ Day – today, aka May Day, which remembers the – Haymarket Affair – in Chicago (1886).

In May 1894, there were – May Day riots – in Cleveland, Ohio as a result of the unemployment rate increasing sharply due to policy failures in the wake of the – Panic of 1893 – which was caused by the collapse of the railroads (due to ridiculous free market expansion).

Maybe a May Day Riot of 2013 is in order, given the latest unemployment estimates from Eurostats and recent statements made by the EU/EC political leaders.

For example, the President of the European Council (EC) Herman Van Rompuy has been visiting Romania in the last week – presumably staying in very well appointed hotels, dining and drinking good faire and not in the slightest threat of losing his salary or pension when he retires soon (about a decade too late!).

He issued a press release during this stay in which he said that Europe had to:

First of all related to the economic and social situation in Europe, which remains a priority on the European agenda. In respect to that there are good news and bad news too. The good news is that we can see a substantial improvement of the situation, with higher financial stability in the Eurozone. Moreover, as regards the fiscal and economic fronts, we have received substantial positive signals, in terms of increased competitiveness, increased exports and safer public funding, with lower deficits. That’s why, we can say that the existential threat to the euro has been overcome. However, there are still bad news to be dealt with. The economic crisis continues, despite the success recorded in cutting unemployment, the situation in Europe is less than good, especially in what concerns the young people …

His media staff must struggle for creative ways of lying about the situation because Van Rompuy was quoted by Bloomberg (January 10, 2013) – Van Rompuy Sees Increasing Signs EU Will Resume Growth in 2013 – that Europe was poised for growth:

There are increasing signs that 2013 is likely to mark the end of the recession in the euro area … As growth returns, it also takes time before perceptible effects on employment start kicking in … [2012] … marked a turning point in the crisis: the euro zone is no longer in ‘existential threat’ mode … The gloomiest of expectations are slowly fading, and the integrity of our monetary union is no longer called into question, whether by the media or the markets … steadily decreasing … [budget deficits] … [and borrowing costs] … going down substantially in almost all euro-area countries … [are positive indications] …

But what about the claim that Europe is enjoying “the success recorded in cutting unemployment”.

Where in Europe does he actually mean? More later on that.

The Eurostat estimates show that:

The euro area (EA17) seasonally-adjusted unemployment rate was 12.1% in March 2013, up from 12.0% in February … rates have risen markedly compared with March 2012, when they were 11.0% … Compared with February 2013, the number of persons unemployed increased by … 62,000 in the euro area … In March 2013, 5.690 million young persons (under 25) were unemployed in the EU27, of whom 3.599 million were in the euro area. Compared with March 2012, youth unemployment rose by 177,000 in the EU27 and by 184,000 in the euro area. In March 2013, the youth unemployment rate was 23.5% in the EU27 and 24.0% in the euro area, compared with 22.6% and 22.5% respectively in March 2012. In March 2013 … the highest in Greece (59.1% in January 2013), Spain (55.9%), Italy (38.4%) and Portugal (38.3%).

Greece will exceed 60 per cent in the coming months.

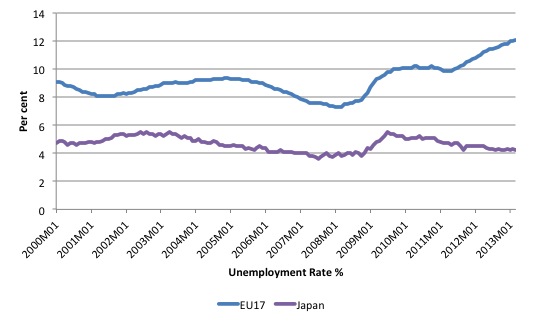

The evolution of this disaster is clear from the first graph. The first part of that rise was between March 2008 until May 2010. Then with the rising budget deficits some stability was provided to aggregate demand and unemployment started to fall. The Eurozone would have then slowly recovered and followed the path of the US economy (probably).

But the second round of increasing unemployment was entirely policy induced. The policy makers, hiding behind the flawed fiscal rules, deliberately pursued fiscal policy changes which everyone knew would drive unemployment up. There will be no end in the process until they reverse the policy stance.

This is a monumental failure and all the talk of having to consolidate and achieve fiscal sustainability is meaningless when there has been no coherent analysis presented by any of the government agencies (anywhere) to show the temporal paths of the costs and benefits of their actions.

It is clear to see the massive costs – they are staring us in the face and are mounting every day. There can be no benefits great enough to justify this social massacre.

The following graph shows the evolution of the EU17 unemployment since the inception of the common currency compared to Japan over the same period.

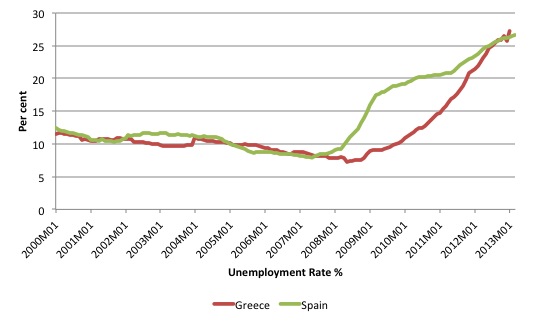

These are the Great Depression Mark II nations, with more to fall into that category in the coming year.

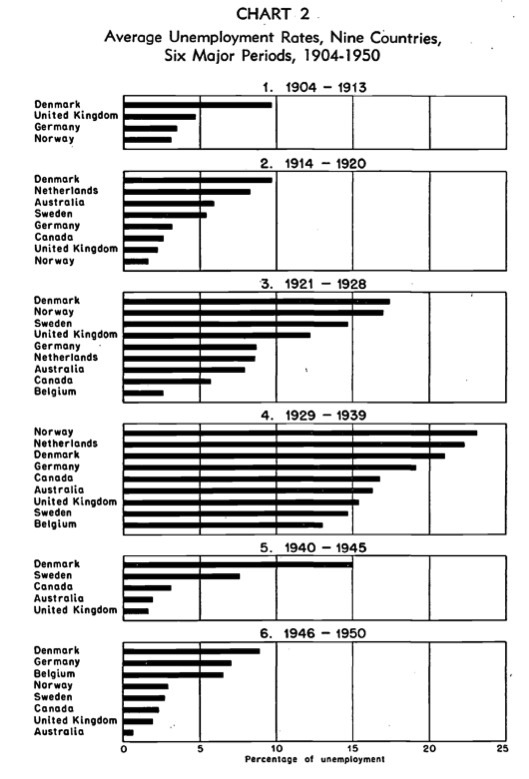

The American economists, Walter Galenson and Arnold Zellner wrote a very interesting paper in 1957 – International Comparison of Unemployment Rates – which examined the historical behaviour of unemployment rates across a number of nations. It is one of the few sources of unemployment rate data (with documentation) for the inter-war period – that is, the Great Depression.

[Reference: Galenson, W. and Zellner, A. (1957) International Comparison of Unemployment Rates, in: The Measurement and Behavior of Unemployment, NBER, 439-584.]

The following graph reproduces their Chart 2 and shows the average unemployment rate for nine countries for six major periods from 1904 to 1950.

The graph shows the impact of the Great Depression on unemployment in the selected nations. It also shows how the massive fiscal stimulus that accompanied the prosecution of the war effort effectively eliminated the 1930s problems (in most nations).

The Great Depression taught us that without government intervention, capitalism is inherently unstable and prone to delivering lengthy periods of unemployment.

The Hooverian and British Treasury orthodoxy of balanced budgets, tried during the 1930s, failed. Full employment came only with the onset of World War II, as governments used deficit spending to prosecute the war effort. The challenge was how to maintain this full employment during peacetime.

Western governments realised that with deficit spending supplementing private demand, they could ensure that all workers who wanted to work could find jobs. As a result, very low levels of unemployment in most Western nations persisted until the mid-1970s.

If you look at Spain and Greece (with Portugal in pursuit) they are now recording unemployment rates of Great Depression proportions – both in level and persistence.

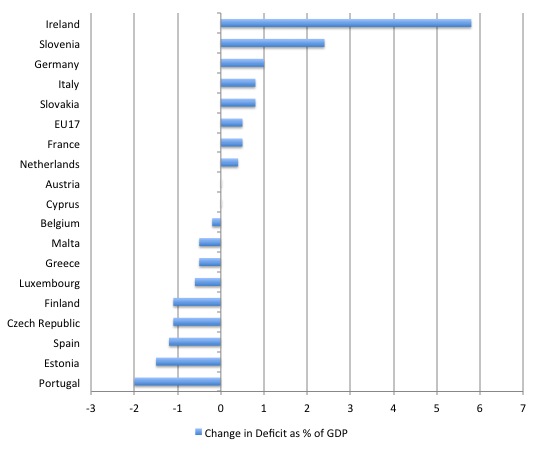

I also decided to check the claim by Van Rompuy about deficit reduction and unemployment reductions. The first graph shows the change between 2011 and 2012 (using the Government Finance data from Eurostat) in the budget deficit as a per cent of GDP.

Data such as this is difficult to interpret because of the cyclical component of the budget outcome. We do not know without further information whether the budget deficit increases are due to austerity killing growth on the back of some discretionary cutbacks or a due to the automatic stabilisers swamping attempts to stimulate the economy.

In the Eurozone case, we know that all the nations that have increased their budget deficits have been trying to reduce them. But there are complexities such as lagged effects, the relative strength of the automatic stabilisers and the such that need a case by case analysis.

The fact is that the countries that are mostly heading into Great Depression II are engaged in self-defeating cuts in discretionary net spending and

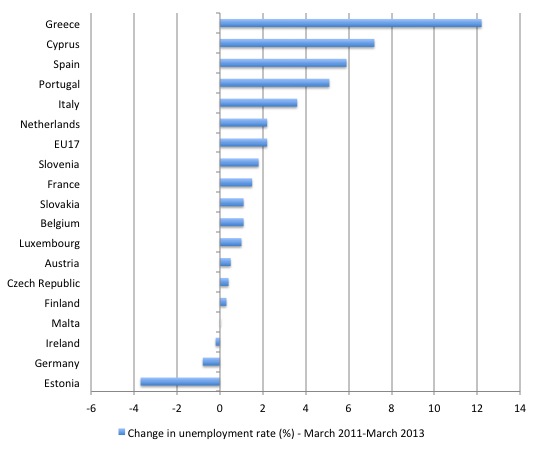

Van Rompuy’s claim – that Europe has enjoyed “the success recorded in cutting unemployment” – is pure delusion.

Maybe he has been spending too much time in Estonia or Germany. Estonia, you will note had the second largest increase in its budget deficit to GDP ratio and now has a ratio around 10 per cent of GDP. So there is a very strong stimulus coming via that deficit and that helps to explain why its unemployment rate is falling relatively quickly.

Also of interest is the above-average rises in some of the core Euro nations – Netherlands and Italy. While they are unlikely to head into Greek territory, their situations have deteriorated badly since 2011.

And when you consider this event started in 2007 and has a long way to play yet – the evidence of policy failure is acute.

Conclusion

As I said when last month’s Eurostat Labour Force data came out – it is hard not to conclude that the member states in the Eurozone are being governed by maniacs who have lost all sense of common purpose and have become so entrenched in their ideological madness that they are oblivious to the incredible costs that are arising around them (manifesting as massive human damage).

If I knew some other descriptors that would build on “maniacs” I would use them now.

This is really an extraordinary epoch in recorded human history. The triumph of ideology over evidence.

I also recently produced a working paper of the same title that you might be interested in reading – Full employment abandoned: the triumph of ideology over evidence. It is just a draft but errors aside it tells the story.

Now it is back to my Fantasy Budget 2013-14 preparation. I am making deep cuts to all forms of corporate welfare. That cohort often tell us they believe in the market and lecture all and sundry to get their snouts out of the public trough and work harder.

So my Budget will help them live up to their words. Billions (a few percent of GDP) are involved. That means I can switch a lot of dollars as I simultaneously expand the deficit to close the output gap (about 4 per cent) into areas that help people not greedy multinationals and the conservative wealth in Australia.

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

Looking forward to your Fantasy Budget! Been wondering what an MMT-centred, progressive budget would look like for a while.

Dear Bill

I was under the impression that a capitalist economy can get out of a depression without government intervention but that it takes too long. Isn’t that what Keynes was referring to when he famously said that “in the long run we are all dead”? If a toothache will go away after 4 weeks without a visit to a dentist but can be eliminated right away by a dentist, then a visit to a dentist is worthwhile. Likewise, if a depression can cure itself in 10 years but can be cured by the government in 18 months, then the case for government intervention is a good one.

Also, in this connection, I think that we should make a distinction between employment and consumption. Consumption is the primary goal of economic activity. Increasing employment without increasing consumption is not desirable. That’s what happened in WWII. Suppose that in Ruritania, the labor force consists of 10 million people, of whom 2 million are unemployed. Of the 8 million employed ones, 500,000 are in armed forces or in the arms industry. 2 years later, all 10 million are employed, but 4 million of them are in the armed forces or in the arms industry. Sure, unemployment has been eliminated, but consumption declined by about 20%. Have Ruritanians really become better-off now that they have full employment?

A similar problem exists with the use of exports to create employment. When exports are increased without increasing imports (the only way in which they can create aditional jobs), then consumption remains the same despite the job creation. That’s the German policy. With a trade surplus of about 200 bilion euros, the Germans are living well below their means. If that trade surplus had been produced for the domestic market, each German could have consumed about 2500 euros more. By the way, apart from Norway, which is a special case because of its abundant oil and small population, it is Sweden and Switzerland that have the highest trade surplusses realtive to GDP in Europe. Sweden’s cumulative trade surplusses since 2000 are about one year’s GDP.

Regards. James

Bill, instead of “maniac”, you could use “obsessive-compulsive psychotic”. Some of what we are witnessing seems to be much like a mass induced psychosis with an obsessive-compulsive component attached. Not all psychoses are neurologically or drug induced conditions. Some are situationally induced in some ways that are not well understood. What we are witnessing is a mass obsessive-compulsive psychosis on the part of members of a certain group of people who have social relations with one another. These social relations tend to reinforce this mass delusion.

Not everyone is completely deluded. Some engage in this “delusion” for reasons of vested social interests. Their delusion consists in thinking that they will be immune to the consequences. Some of them probably will. But who? And how many? Looking back at history may lead them to think that they will be among the fortunate ones. But this way of thinking is the consequence of grotesquely biased sampling coupled with a lot of wishful expectations. And in their own lights, this isn’t rational. So, the culprits in question are not just inconsistent, they are irrationally inconsistent.

@James Schipper

I think a better term than “consumption” is “exchange”. The reason I suggest this is two-fold. One is that economics is fundamentally about exchanges of a particular kind. The other is that the term “consumption” has acquired certain unfortunate connotations that have become dominant and center around buying things. Not all economic exchanges are purchasing transactions of the type most people think of when they use or hear or see the term.

I think you misjudge this.

The crisis has allowed huge a huge amount of net physical wealth to flow into the UK & France (Germany does not count as it merely rexports these goods (much of it back to the UK & France).

The crisis has been good for France.

For example its rail investments are the biggest seen for 100 years……..

The UK can buy more cars and stuff.

Of course they are not engaged in Keynesian like war spending using all of their local resources to the max.

They don’t need to.

Free goods are flowing into their borders.

The local working and lower middle class is for the most part not needed.

James Schipper,

Re your first paragraph, Keynsian type stimulus is not a cure for the Euro periphery because the basic problem there is lack of competitiveness. K type stimulus WOULD BE a cure if those countries left the Euro and reinstated their own currencies.

A distinct lack of constructive suggestions from Bill as to how Europe can escape its problems. Here are some possibilities.

1. The periphery needs to do an internal devaluation, and they are actually making progress with that. But the process can be boosted by adjusting various taxes within those countries, as explained here:

http://www.project-syndicate.org/commentary/a-devaluation-option-for-southern-europe

2. As I suggested a few days ago on this site, just do a FORCED internal devaluation via administratrive diktat: i.e. enforce a mandatory reduction in wages, profits and prices. That would be horrendously difficut to do – but it might be better than the current disaster.

3. Re-introduce national currencies and run them alongside the Euro. Numerous small countries with their own currencies use the US dollar as a second currency: Argentina being the classic example. So “dual currency” systems are perfectly feasible. For Euro countries that were 100% responsible, their national currency would just become irrelevant: they’d effectively be 100% within the EZ. As to Greece, trade within that country would be dominated by the national currency. In effect, they’d be outside the EZ.

Dear Ralph Musgrave (at 2013/05/02 at 18:14)

You said:

Which is a disingenuous remark indeed.

I have a long published record of detailed plans for the Eurozone nations. In addition to my academic work, my blog is a “worn out record” on what the Euro nations should do.

Please don’t make things up. It doesn’t help anyone and just makes you look poorly.

best wishes

bill

@Ralph

I have just come back from a odd job in the North Cork countryside………

You don’t know what you are talking about.

Fermoy town is basically closed for business with half the main street gone bust.

For many miles huge trophy homes orbit this old garrison-town.

Many have the BMW parked outside.

Most people avoid the new toll road so the old road is very busy…….quite funny really.

The problem in Ireland is one of cash flow or to be more accurate a lack of it.

Wages as a % of GDP is just too low.

You want to decrease wages ?

Why ?

Most of the debt contracts cannot be honoured at the moment……why would you want to increase the damage to business contracts ?

A increase in wages as a % of GDP would turn the towns lights back on again.

The trophy houses would lose value.

Many would return to farmland.

Ralph often points out that the problem is non-competitiveness of the ‘periphery’. But, isn’t that a direct result of German policy? Germans are productive but instead of reaping the benefits they suppress wages, to maintain a trade surplus (as often pointed out by Bill, the ‘Hartz reforms’). So, the answer is to drive down the living standards in the periphery so they can ‘compete’ with Germany. Wouldn’t it be better if Germans simply lived better? How about running a big deficit? I know they don’t like that. Ralph, you know more than I do on this subject … what would you suggest?

James Schipper: Increasing employment without increasing consumption is not desirable. Sure, but them\’s the breaks. Maintaining consumption may be all that you can get, if a nation has to work harder to both defend itself and maintain consumption, again, them\’s the breaks. Independence, sovereignty and self-defense are usually held to be very valuable Goods, worth the extra work.

When exports are increased without increasing imports (the only way in which they can create additional jobs) That is not true. Suppose a nation puts its unemployed to work by some new export industry, say run by the state. All the foreign exchange proceeds of this are used by to buy some new imported good, which is equally distributed. Less unemployment (especially considering the multiplier effect), higher consumption for everyone. Longterm macroeconomic job-destroying financial problems that eventually need to be solved (but can be easily solved) by the government\’s Functional Finance come from imports exceeding exports, not from balanced trade. (And vice versa for job-boosting, unemployment-exportation of surplus nations like Germany.)

For an even simpler, clearer example, imagine two nations who take in each other\’s laundry. They have no domestic economies. All their employment is for the export of goods and services to the other nation. All their consumption is of imports from the other nation, paid for by their exports. This scenario is consistent with any levels of employment from 0 to 100 per cent.