Last Friday (December 5, 2025), I filmed an extended discussion with my Kyoto University colleague,…

Australia – inflation benign and plenty of room for fiscal stimulus

The Australian Bureau of Statistics released the Consumer Price Index, Australia data for the March 2013 quarter today and while the inflation rate rose a little, this was mainly due to the fact that the base March-quarter 2012 was unusually low, thus distorting the annualised figure. When we continue the most plausible recent trends the annual inflation rate is below 2 per cent and falling. The Reserve Bank of Australia’s preferred core inflation measures – the Weighted Median and Trimmed Mean – are now well within the inflation targetting range and are probably trending down. This suggests that the RBA will probably consider the inflation outlook to be benign or “too low” and will instead have to shift their focus to the failing labour market, which in the last month showed signs of considerable deterioration after a flat 12-15 months. The inflation trend clearly contradicts the commentators who have been predicting the opposite on the basis of the (modest) rise in the budget deficit over the last few years as the downturn hit Australia. Their standing in the predictions stakes continues to be dented by the data. The evidence is suggesting that the economy is slowing under the weight of the federal government’s obsessive pursuit of a budget surplus. The benign inflation outlook provides plenty of room for further fiscal stimulus.

The summary results for the March-quarter 2013 are as follows:

- The All Groups CPI rose by 0.4 per cent in the March-quarter 2013 compared with a rise of 0.2 per cent in the December-quarter 2012.

- The All Groups CPI rose by 2.5 per cent over the 12 months to the March 2013, a rise from the annualised rise of 2.2 per cent over the 12 months to December 2012.

- The All Groups CPI, seasonally adjusted rose by 0.1 per cent in the March-quarter 2013 and by 2.5 per cent for the 12 months to March 2013.

What does this mean?

The Sydney Morning Herald article (April 24, 2013) – Subdued inflation lifts chance of rate cuts – reported that the inflation results were “lower-than-expected”.

The first-quarter of each year usually delivers a seasonal boost to the inflation rate via increased spending on education (start of the academic year) and to a lesser extent health. But once the seasonal factors are adjusted for, the quarterly inflation rate was 0.1 per cent, which is a dramatically low annualised figure.

Does this figure provide room for the inflation-targetting RBA to cut interest rates when it has its monthly meeting in two weeks time?

The ABC business reporter thinks so. The ABC News article (April 24, 2013) – Low inflation gives scope for more rate cuts:

Official inflation figures show consumer prices remain well under control, giving the Reserve Bank scope to cut interest rates further.

The ABC news story quoted a bank economist, most of whom forecast a higher inflation figure, as saying “It is clear that at present inflation is not an issue, meaning that rates can stay lower for longer”.

The RBAs inflation target range is defined as 2 to 3 per cent annualised inflation. As I show below the current inflation data is suggesting that inflation is actually below the lower bound of 2 per cent, although all the commentators are focusing on the 2.5 per cent figure and concluding that inflation is in the centre of the RBA range.

Trends in inflation

The headline inflation rate increased by 0.4 per cent in the March quarter translating into an annualised increase of 2.5 per cent for the year to March 2013 which is up from the December-quarter 2012 result of 2.2 per cent.

What does it mean for monetary policy?

The Consumer Price Index (CPI) is designed to reflect a broad basket of goods and services (the “regimen”) which are representative of the cost of living. You can learn more about the CPI regimen HERE.

The ABS say that:

The CPI is a temporal price index for consumption goods and services acquired by Australian resident households. It is an important economic indicator, providing a general measure of price change … The principal purpose of the Australian CPI is to measure inflation faced by consumers to support macroeconomic policy decision making. This is achieved by providing a measure of household consumer inflation by the acquisitions approach.

There are various ways of assessing the general movement in prices depending on the purpose that the measure is being used for. The document I linked to above details some of the approaches. One of these approaches – the “acquisitions approach” – attempts to measure “household consumer inflation” and defines the basket of goods and services as “consisting of all consumer goods and services actually acquired by households during the base period.” The ABS use “market prices for goods and services” (including taxes etc) and make no imputations for “non-monetary transactions” (such as imputed rents). They also exclude “interest rate payments”.

So is a headline rate of CPI increase of 0.4 per cent for the March-quarter significant? To examine its lasting significance we have to dig deeper and sort out underlying structural inflation pressures and ephemeral price facts.

The RBA’s formal inflation targeting rule aims to keep annual inflation rate (measured by the consumer price index) between 2 and 3 per cent over the medium term. Their so-called “forward-looking” agenda is not clear – what time period etc – so it is difficult to be precise in relating the ABS data to the RBA thinking.

What we do know is that they do not rely on the “headline” inflation rate. Instead, they use two measures of underlying inflation which attempt to net out the most volatile price movements. How much of today’s estimates are driven by volatility?

To understand the difference between the headline rate and other non-volatile measures of inflation, you might like to read the March 2010 RBA Bulletin which contains an interesting article – Measures of Underlying Inflation. That article explains the different inflation measures the RBA considers and the logic behind them.

The concept of underlying inflation is an attempt to separate the trend (“the persistent component of inflation) from the short-term fluctuations in prices. The main source of short-term “noise” comes from “fluctuations in commodity markets and agricultural conditions, policy changes, or seasonal or infrequent price resetting”.

The RBA uses several different measures of underlying inflation which are generally categorised as “exclusion-based measures” and “trimmed-mean measures”.

So, you can exclude “a particular set of volatile items – namely fruit, vegetables and automotive fuel” to get a better picture of the “persistent inflation pressures in the economy”. The main weaknesses with this method is that there can be “large temporary movements in components of the CPI that are not excluded” and volatile components can still be trending up (as in energy prices) or down.

The alternative trimmed-mean measures are popular among central bankers. The authors say:

The trimmed-mean rate of inflation is defined as the average rate of inflation after “trimming” away a certain percentage of the distribution of price changes at both ends of that distribution. These measures are calculated by ordering the seasonally adjusted price changes for all CPI components in any period from lowest to highest, trimming away those that lie at the two outer edges of the distribution of price changes for that period, and then calculating an average inflation rate from the remaining set of price changes.

So you get some measure of central tendency not by exclusion but by giving lower weighting to volatile elements. Two trimmed measures are used by the RBA: (a) “the 15 per cent trimmed mean (which trims away the 15 per cent of items with both the smallest and largest price changes)”; and (b) “the weighted median (which is the price change at the 50th percentile by weight of the distribution of price changes)”.

While the literature suggests that trimmed-mean estimates have “a higher signal-to-noise ratio than the CPI or some exclusion-based measures” they also “can be affected by the presence of expenditure items with very large weights in the CPI basket”.

The authors say that in the RBA’s forecasting models used “to explain inflation use some measure of underlying inflation (often 15 per cent trimmed-mean inflation) as the dependent variable”.

The special measures that the RBA uses as part of its deliberations each month about interest rate rises – the trimmed mean and the weighted median – also showed moderating price pressures.

So what has been happening with these different measures?

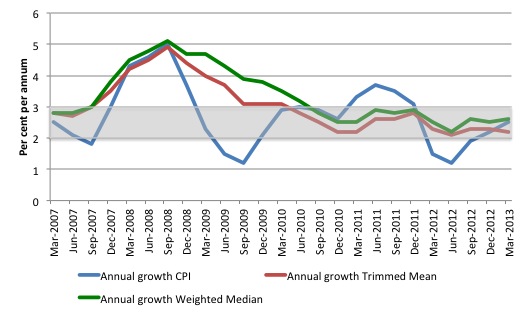

The following graph shows the three main inflation series published by the ABS over the last 8 quarters – the annual percentage change in the all items CPI (blue line); the annual changes in the weighted median (green line) and the trimmed mean (red line). The RBAs inflation targetting band is 2 to 3 per cent (shaded area).

The CPI measure of inflation (at 2.5 per cent is up from 2.2 per cent in the December-quarter 2012) is in the centre of the target band, while the RBAs preferred measures – the Trimmed Mean (2.2 per cent) and the Weighted Median (2.6 per cent) – are also well within the RBAs band of 2 per cent.

In seasonally adjusted terms, the annual growth in the weighted median rose from 2.5 per cent in the December-quarter 2012 to 2.6 per cent in the March-quarter 2013. The trimmed mean fell to 2.3 per cent in the December-quarter 2012 to 2.2 per cent in the March-quarter 2013.

But if we dig a little deeper a different picture emerges.

Annualised growth calculations are affected by two things: (a) the current value, and (b) the base or starting value. If there is an unusually low observation in the base quarter then the current annual inflation rate will appear higher than it might otherwise be once we take the influence of the unusually low base quarter.

It turns out that the March-quarter 2012 result was such a quarter (check it in the graph below). This has distorted the current period’s annual outcome.

The quarterly growth in the headline CPI (the ALL Groups) for March 2012 was 0.1 per cent (compared to the trimmed mean and weighted median growth of 0.4 per cent). In seasonally-adjusted terms the All Groups CPI index fell by 0.2 percentage points in the March-quarter 2012.

If we erased that outlier from our outlook and considered an annualised extrapolation of the last two-quarters, for example, then the current headline inflation rate would be 1.2 per cent.

If we take the average core rate for the last six months then the annualised core inflation rate would be 2.0 per cent.

That is, at the bottom of the RBA’s target range.

How to we assess these results?

First, there is clearly no upward trend in any of the measures. The “core” measures used by the RBA have been benign for many quarters despite the budget deficit and swings in interest rates (up and down).

Second, it is clear that the RBA-preferred measures are well within their inflation-targeting band. It is unclear whether what the RBA considers when determining their interest rate decision each month, but given inflation is benign, it may turn its attention to the failing labour market and ease interest rates as a result of that.

Not that the real economy is very sensitive to movements in rates anyway, given that it is hard to discern who wins and who loses from rate changes (the distributional effects across fixed income recipients, creditors and borrowers) and hence it is hard to work out the overall impact on aggregate demand. We know the effect is lagged, uncertain and within normal ranges probably small.

Third, the underlying price pressures (say from wages) are within the space provided by productivity growth. There is no inflation threat in Australia arising from wages at present.

Fourth, the strong Australian dollar is clearly taking pressure of the domestic price level. The latest data shows that the price of ” international holiday travel and accommodation” fell by a very large 5.2 per cent in the March-quarter 2013.

Why the RBA will consider cutting interest rates in the next two months relates to the increasingly worrying state of the labour market and the slowdown in real GDP growth.

The Treasurer’s obsession with getting the federal budget back into surplus has failed but in trying the Government has clearly not supported the emerging recovery. The latest real data (National Accounts and Labour Force data) show that fiscal policy is running in a pro-cyclical direction – that is, making the slowdown in real GDP arising from the slowdown in mining investment and the subdued private household consumption growth worse.

If we went back to 2009 and examined all of the commentary from the so-called experts we would find an overwhelming emphasis on the so-called inflation risk arising from the fiscal stimulus. The predictions of rising inflation and interest rates dominated the policy discussions.

Well, those predictions came to nought because they were made by people who didn’t really understand how the macroeconomy works. The RBA is now having to deal with providing some support for aggregate spending, which is in retreat, rather than trying to reign spending growth in with higher rates.

When will these commentators start acknowledging that we have memories and they were totally wrong?

What is driving inflation in Australia?

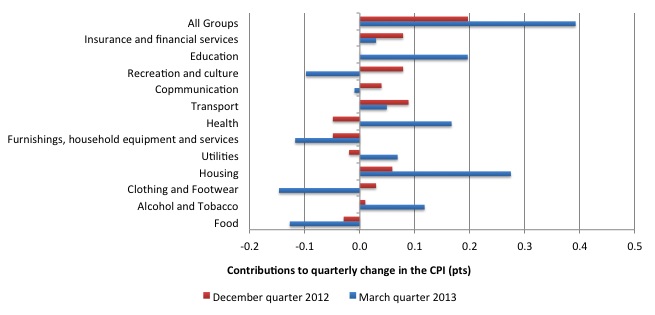

The following bar chart compares the contributions to the quarterly change in the CPI for the March-quarter 2013 (blue bars) compared to the December-quarter 2012 (red bars).

The ABS reports that for the March-quarter 2013, the largest price rises were for “new dwelling purchase by owner-occupiers (+1.7%), pharmaceutical products (+7.6%), tertiary education (+6.5%) and tobacco (+3.7%)”.

The ABS reports that for the March-quarter 2013, the “most significant offsetting price falls this quarter were for international holiday travel and accommodation (-5.2%), furniture (-6.8%) and fruit (-7.0%)”.

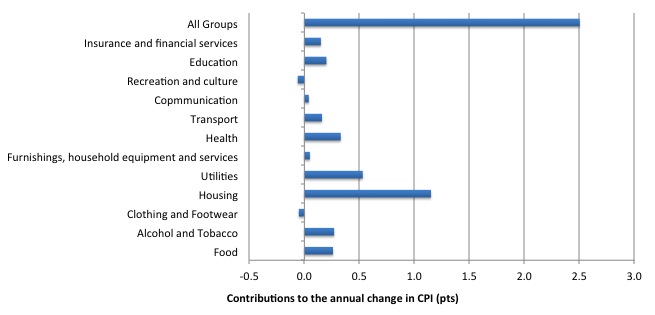

The next bar chart provides shows the contributions in points to the annual inflation rate by the various components.

In the twelve months to March 2013, the major drivers of inflation were housing and utility prices. The impact of food prices, which had driven inflation in 2011, as a result of the floods and cyclone has now dissipated.

International travel is being aided by the high value of the dollar as is audio, visual and computing equipment (Apple products excepted which seem to be getting more expensive).

The overwhelming conclusion is that there is no evidence that there is any likelihood of an inflation outbreak in Australia at present.

Which should give the commentators who a few years ago were predicting rising interest rates and accelerating inflation as a result of the two federal stimulus measures which pushed the budget deficit up.

Conclusion

The core measures of inflation have been trending down since the end of 2011. The impacts of the natural disasters and external factors (petrol prices), which pushed the headline rate up throughout 2011 have now dissipated and the full impact of the declining real growth rate in the economy has started to impact.

Related data shows there are no significant generalised wage pressures in the economy at present.

The data continues to suggest that the national economy is slowing.

That is enough for today!

(c) Copyright 2012 Bill Mitchell. All Rights Reserved.

Bill,

I have doubts about your claim that “the underlying price pressures (say from wages) are within the space provided by productivity growth.”.

According to the chart on this post of yours, productivity increases in Australia are currently around 1% a year.

https://billmitchell.org/blog/?p=13411

In contrast, if this source is anything to go by, wage increases are running at just over 4%pa. Pay increases not matched by productivity increases spell inflation.

http://www.smartcompany.com.au/leadership/050208-4-the-salary-increase-you-should-budget-for.html

It’s the same (or even worse) in the UK and some other countries. That is productivity has actually DECLINED in the last couple of years, meanwhile average pay increases in the UK been running at about 2% a year. See table on p.59 here:

http://cep.lse.ac.uk/conference_papers/15b_11_2011/CEP_Report_UK_Business_15112011.pdf

On second thoughts, there is a possible bright side to my above pessimistic comment. It could be that employees are determined to get a 2% or so pay increase a year TOTALLY REGARDLESS of the size of productivity increases, or lack of. If that’s the case, it’s possible that we could have a big increase in aggregate demand, and that wage increases would stay at the 2% or so level.

Dear Ralph (at 2013/04/24 at 19:39)

The blog you linked to was written two-years ago. Since then productivity growth has accelerated significantly.

See the graph https://billmitchell.org/blog/wp-content/uploads/2013/03/Australia_Annual_GDP_Per_Hour_Mar_2007_Dec_2012.jpg and the accompanying discussion in the latest National Accounts blog – https://billmitchell.org/blog/?p=22896

So my assessment is actually conservative. Nominal wages growth is running at around 3.2 per cent per annum at present and productivity growth is running above that.

It is also not wise to use wage data from private firms (as you have). They always claim things are worse (in their eyes) than they are. Please use the Australian Bureau of Statistics data – it is relatively accurate and free from the lobbyist taint.

Overall, your doubts are unwarranted and based on a mismatch of years.

best wishes

bill

With the latest inflation figures, I would say that these inflation figures are not positive. Essential items such as education, rents, health etc have gone up. Only non essential items have gone down and it makes sense. If your struggling to makes ends meat, then you are going to spend less on non essential items which will cause prices for these items to go down.

Bill :

Today we see S&P threatening to downgrade Oz’ sovereign debt rating if “the government doesn’t show a stronger commitment to eliminating its budget deficit.” Some folks never learn, huh? I was surprised you didn’t allude to that in this blog …

Best wishes from sunny Florida –

Melia

Hi Ralph.

The measures being used in that link of booming wage growth are likely distorted by very high wages in the mining and construction sectors.

I am a resident of a small coastal city whose main industries involve the export of mining products. The growth in wages of those in the mining sector (and now, the construction sector as well, owing to the massive investment boom in new mining plant and facilities) has been nothing short of remarkable. It is not rare for a person here to be earning three times the income of their next-door neigbour for a job not requiring a great deal more skill. Case in point – my boss is a professional person with more than one university degree and over 25 years experience. And yet, the husband of one of our cleaning leadies is paid more – well into the six figure range – for undertaking the “highly skilled” role of driving a mini-bus full of workers back and forward from a job site. My own brother-in-law is paid twice the national full-time median for a mere two days work a week on a mine site.

This situation surely impacts on the wage growth and productivity figures. It needs to be taken into account that these people only represent a relatively small percentage of the Australian labour force.

@Ralph –

Wage growth in excess of productivity growth only creates inflation where real wages exceed the real value of produced goods (plus external factors). A JG is just a mechanism by which the real wage is made to equal the the real output.

I think Australia could stand a few years of excess wage growth, don’t you?