I have been a consistent critic of the way in which the British Labour Party,…

British Budget – verging on delusion

The Olympics have come and gone. No doubt the event gave some macroeconomic respite to the British economy because major events bring immediate spending and spending drives output and national income. But the fourth-quarter 2012 real GDP data showed that the British economy had contracted by -0.3 per cent. Household final consumption expenditure slowed throughout 2012 as private investment growth contracted over the second-half of 2012. Further, despite the hope that the fiscal austerity would be painless as a result of a boost in net exports, especially given the depreciation in the British currency, the data showed the the current account deficit increased as a result of a fall in exports over 2012. It was in this context that the British government brought down the – 2013 Budget – which provides no path out of this malaise. At a time when the correct economic strategy would have included a political admission that the previous 3 budgets were detrimental interventions for the British economy and a commitment to some discretionary stimulus, the British government chose to adopt a neutral position in the coming financial year, which when taken in perspective just maintains the contractionary bias of fiscal policy. The mismanagement of the British economy thus continues.

The Budget followed the typical pattern that we have seen in the past in a number of countries riddled with neo-liberal ideology. As the separation between reality and narrative widens, the dogma turns to meaningless catch-cries – such as we saw in the – Budget speech of the Chancellor.

For example, he told the British public that:

“It is a Budget for our Aspiration Nation”.

“unless we fire up the aspirations of the British people, light the fires of ambition within our nation …”

“So this Budget makes a new offer to the aspiration nation”.

“For in the end, aspiration is about living in a country where people can get jobs and fulfil their dreams”.

and claims such as that in the face of dreadful economic data that has been, in no small way, caused by the policies introduced in the Chancellor’s last three budgets.

The substance has gone. The reality is clear. And so it is time to ramp up the abstract – the denial of the reality.

It is the same sort of denial as we heard earlier in the year when European Commission president José Manuel Barroso declared that “the euro crisis is a thing of the past”.

The reality is a disastrous record of forecasting failure by the Government. Rising poverty rates. Falling real wages. Persistently high unemployment. And … a contracting economy.

I agree with the assessment of the New Statement analysis (March 20, 2013) – The real message of Osborne’s Budget: as you were, only poorer.

The article writes that:

So what we heard today was above all a statement of political positioning by the Chancellor. He has no intention of conceding that his own policies are in any way responsible for the parlous state of the national finances (deficit reduction stalled; debt rising) so he is obliged to pretend that the broad outline of the strategy is the right one and that only extraneous and transient factors are to blame for disappointing economic performance.

You should note that from the perspective of Modern Monetary Theory (MMT) terminology such as “parlous state of the national finances” has no meaning. The budget outcome just reflects what is happening in the real economy.

It is the parlous state of the real economy that matters and which the British government should be held accountable for, given that it can hardly blame the past Administration after 3 years of office.

But the blame all sorts of extraneous factors is the tactic the British government has adopted and the Opposition seems incapable of breaking down that myth. That is mostly because the macroeconomic narrative of the latter is only different from the former by degrees. They are both captured by neo-liberalism and cannot see beyond that blindness.

The Budget continues to offer the same rhetoric – the Ricardian dream – that something mystical will happen which will convince the private sector to reverse its current caution – notwithstanding the persistently high unemployment and falling economic growth.

The Government wants the British people to believe that the vast body of evidence from behavioural science that confidence comes with good news and caution and pessimism accompanies (and reinforces) bad news is wrong.

Nothing new was produced to provide a reversal of the current negative trend in the British economy. There was nothing to accelerate that trend. But that isn’t the point.

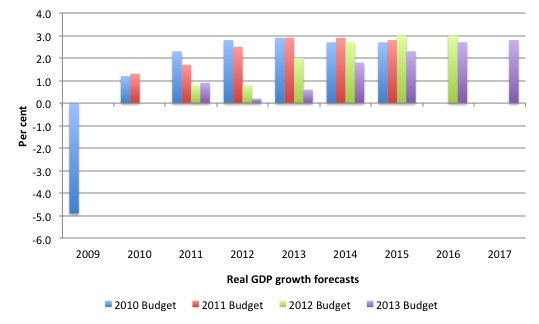

The following graph shows the successive real GDP growth forecasts starting with the 2010 British Budget through to the current Budget. As you scan through the sequence you should realise that the previous year’s bar is the actual outcome (that is, is not a forecast).

The pattern is very clear – a sequence of gross errors of optimism. The more distant forecasts become progressively downgraded as the actual data reveals that the Government’s fiscal strategy is not consistent with the underlying behaviour in the economy.

You should note that I am not against forecasting (I do it) and realise that forecast errors will always be present given the nature of the exercise – making up estimates in the face of endemic uncertainty.

The problem is that the forecasts that come out of organisations such as the IMF and the British government that are driven by macroeconomic modelling, which is more a product of blind ideological belief in the virtues of the market model than any concordance with reality, are systematically biased. That is, the errors tend to be non-random. They are over-optimistic when government is withdrawing its net spending – so as to understate the impacts of austerity.

Year after year they understate the slowdown in economic activity. The lagged response to the actual data in the following year is also biased towards optimism.

However, they will never admit they got it wrong because they were using the wrong model. They blame ructions in Europe and other extraneous circumstances. Sure enough, the failed macroeconomic policies in the Eurozone have undermined world trade conditions. But the same can be said of the British government behaviour.

Please read my blog – Fiscal austerity – the newest fallacy of composition – for more discussion on this point.

Whatever, the external position facing a nation, and whatever the intentions of the private domestic sector, the government remains in the central position to manipulate aggregate demand growth to ensure that these forecast errors are not systematically biased. The systematic bias, in this case, occurs because of the fiscal austerity.

We can make whatever assumption we like about the “faith” of the Office of Budget Responsibility and the British Treasury. That is, do they lie or do they just produce the outcomes of totally inappropriate models. I suspect the truth includes both of these descriptors.

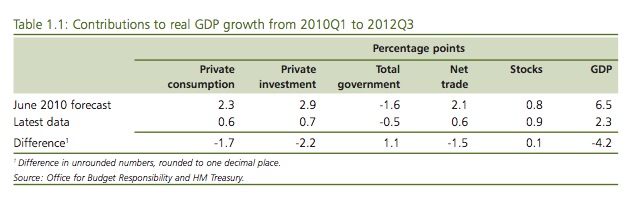

In terms of the forecasts, the – Budget Report – produced a Table 1.1 Contributions to real GDP growth from 2010Q1 to 2012Q3 (Page 11), which I reproduce here:

What is apparent is that when the Government took office in May 2010 and handed down its first Budget in June 2010 it categorically failed to understand the macroeconomic circumstances that it had inherited. Not just the data but the behavioural context which drives the data.

It clearly thought that the private sector would have a greater thirst for more private debt and would drive overall aggregate spending growth. In part this was part of the Ricardian rhetoric that the Prime Minister and his Chancellor pushed out ad nauseum as they tried to justify the imposition of fiscal austerity.

The notion of Ricardian Equivalence – these days captured by the claim of “fiscal expansion contraction” – claims that that private spending is weak because the private sector is scared of the future tax implications of the rising budget deficits.

So if the government spends and borrows, consumers and firms will allegedly anticipate higher future taxes and spend less now, which has the effect of offsetting the stimulus.

The modern “founder” of the idea, Robert Barro claimed that if the individual perceives that the government has spent $500 this year but proposes to tax him/her next year at such a rate that the debt will be cleared then the person will still be poorer over their lifetime and will probably cut back consumption now to save the money to pay the higher taxes.

So the government spending has no real effect on output and employment irrespective of whether it is “tax-financed” or “debt-financed”. That is the Barro version of Ricardian Equivalence.

Please read my blog – Pushing the fantasy barrow – for more discussion on this point.

Every time this notion is advanced to predict real world events, the Ricardian Equivalence models have got it exactly wrong. There has never been any predictive capacity in the models.

Once again this was an example of a mathematical model built on un-real assumptions generating conclusions that were appealing to the dominant anti-deficit ideology but which fundamentally failed to deliver predictions that corresponded even remotely with what actually happened.

Barro’s RE theorem has been shown to be a dismal failure regularly and should not be used as an authority to guide any policy design.

Please read my blog – Deficits should be cut in a recession. Not! – for more discussion on this point.

The overwhelming evidence shows that firms will not invest while consumption is weak and households will not spend because they scared of becoming unemployed and are trying to reduce their bloated debt levels.

While the politicians on both sides of the English Channel promoted Ricardian notions – either explicitly or implicitly – the recent data is once again showing that the concept of a “fiscal contraction expansion” is deeply flawed.

The 2010 forecasts reflect the belief of the British government in Ricardian effects. The real world outcomes which are compared with the forecasts in this Table once again provide the refutation of that belief. The Table spans 2 years, which would have been enough time for the reversal of private sector intentions. The evidence is consistent with years of research in psychology – pessimism builds on itself and high unemployment and flat spending growth undermines confidence among private households and firms.

The other myth promoted by the current British government was that net exports would boom and lead the economy out of its malaise. That has now been revealed to have been a serious error of judgement.

The flip side of all that is that they also failed to understand that attempts to reduce its net fiscal position would be thwarted by the fact that anticipated GDP growth was much less than has actually occurred. The automatic stabilisers work against attempts to reduce budget deficits at a time when the other sectors are not in a position or do not want to provide the offsetting spending boost.

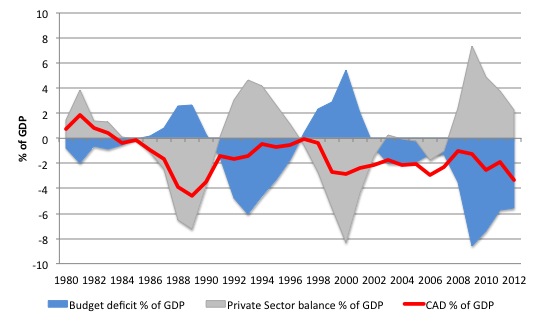

To dig into what is happening at the sectoral level, the following graph shows the sectoral balances for the UK from 1980 to 2012 (the 2012 observation is an estimate and the budget deficit will be slightly larger than depicted here).

The brief statement of these balances is:

(S – I) = (G – T) + (X – M)

The three balances have to sum to zero as a matter of national accounting. The sectoral balances derived are:

- The private domestic balance (S – I) – positive if in surplus (overall private spending is less than income), negative if in deficit (overall private spending more than income).

- The Budget Deficit (G – T) – negative if in surplus, positive if in deficit.

- The Current Account balance (X – M) – positive if in surplus, negative if in deficit.

The private domestic and the current account balance sum to be equal to the non-government balance. The basic result that the government balance equals exactly $-for-$ (absolutely or as a per cent of GDP) the non-government balance (the sum of the private domestic and external balances).

The familiar pattern is evident. There is a reciprocal relationship between the budget deficit and the private sector balance. When the British government ran surpluses in the late 1980s and then later in the period 1997-2001, the private domestic sector moved sharply into deficit.

More recently, the larger deficits driven both by discretionary stimulus measures in 2008 and 2009 and the automatic stabilisers associated with the downturn in the cycle, allowed the private sector to achieve higher savings overall.

The highly indebted private sector is now being squeezed again by the attempted fiscal reduction. in the 2012 British Budget, the implicit strategy was that growth would come from an increase in private sector debt driving consumption and investment spending (refer back to the Table 1.1 above) and net exports.

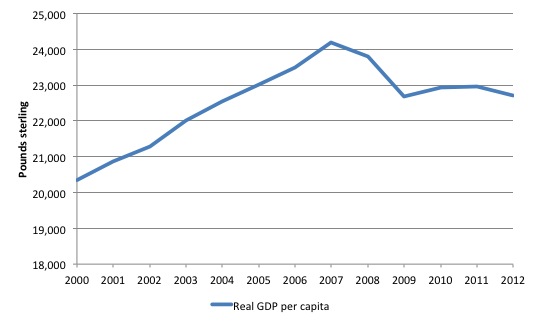

The upshot of the failure of the policy to address the economic reality the Government faces is that the British people are becoming poorer (on average).

The following graph shows real GDP per capita in Britain from 2000 to 2012 (using IMF World Economic Outlook data). It is obvious that, on average, the British population has become poorer under this government, quite apart from the impact of the Global Financial Crisis, which saw a plunge in real living standards in 2008 and 2009.

With the support of the expanding fiscal deficit, the British economy started to recover in 2010. Then in May 2010, the current Government took office and as the deficit effects dissipated through 2011, the underlying impact of the current fiscal stance started to be defined – and that impact is negative.

Conclusion

The macroeconomic spending system is like a river flowing. For the river to maintain its level the inputs into that river system have to remain constant. The British river is being drained by net exports. The overall private sector flow is also negative now as it retreats from its previous credit-driven spending binge.

The river level is falling. There is only one other net source of spending to offset the failure of non-government spending to drive growth – government deficit spending.

At present the deficit is not falling as fast as the Government desired and that is helping to moderate the decline in real GDP growth.

But this Budget should have been about admitting the policy mistakes – exemplified by the sequence of biased forecast errors over the last 3 Budgets – and committing the Government to ensuring the river level rises rather than continuing to allow it to fall.

I thought the UK Guardian conclusion (March 20, 2013) was apposite:

Above all, Osborne’s budget relied on closing one’s eyes to the wider picture of an anaemic, ailing economy. Cheaper beer is nice, but makes little dent when wages are falling in real terms, by 9% since 2009 on one estimate. Nor does cheaper petrol much help public sector workers now facing a below-inflation pay freeze for a further year

A long flight south awaits me … so

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

Opposition leader came out fighting yesterday which was nice. He showed some spunk, no policies but he looked suitably pissed off with the Govt’s performance to make an impression.

Oh and the Shadow Chancellor Mr Balls keeps mention Brad de Long. That’s where we’re headed in 2 years when we kick the current bunch out. Could be worse I suppose.

Ed Balls (the opposition shadow chancellor) did talk some sense I thought this morning. He said that he would replace some of the VAT (sales tax) with a mansion tax and also build houses rather than giving a government guarantee to mortgages.

What strikes me though is that the current policy is exactly the policy you would want if you held a vast stock of risk free financial assets. Someone holding such a stock of risk free financial assets wouldn’t be worried at all about economic depression. It would actually be a good thing. Gilt prices have done wonderfully whenever a deflationary depression scenario has reared its head. Risk free financial assets suffer if the economy recovers.

Bill here says that we need deficits to get the economy moving BUT the consequence of those accumulated deficits is a vast stock of risk free financial assets. Those empower those who hold them and induce them to lobby for economic depression and casino financialization. We reap what we sow.

“Bill here says that we need deficits to get the economy moving BUT the consequence of those accumulated deficits is a vast stock of risk free financial assets. Those empower thise who would hold them and induce them to lobby for economic depression and casino financialisation. We reap what we so.”

Good point. Whether it is cash or gilts it stays a good point. Bill here is commenting about the overall budget balance and the direction of movement. Elsewhere he has commented on how government should get the money into the economy, because of his specialism his detailed policy recommendations are the Jobs Guarantee.

The Budget is about government finances, but as GB government expenditure does not need to be financed it is an institutional relic. Economic policy is a much broader issue than the Budget. And you are right this is a government – in common for most others – who cannot or will not differentiate between “cash-hoarding” and productive investment that creates either a good or service that did not exist before.

By “cash-hoarding” in this context I mean at least any financial asset asset that is traded on a secondary market, but also – (through the process of financialisation) a number of existing real assets but particularly residential properties. Economic policy too often has the goal of increasing the prices of existing assets to produce a “wealth effect”.

Instead economic policy has to include an active fiscal policy and a concentration on productive investment (public and private) over and above cash hoarding. New productive investment creates new income streams including wages.

In this context the meddling by the government in the mortgage market is anathema. It is not confined to buying new build and includes expensive properties that cannot be about fulfilling a housing need that is a reasonable priority for social policy. In fact I am not even clear that its proposals are confined to main residences.

If I am reading chart 3 correctly, ‘CAD% of GDP’ has been negative since 1984. This should mean that imports have exceeded exports since 1984. If correct,, then the national money supply has been moving increasingly into the hands of other economies since 1984. Presumably, the British have worked less, other economies have worked more and have become larger shareholders in the British economy.

So, yes, I would agree that the British have been getting progressively poorer since 1984 when ownership of the money supply is the measure of wealth considered.

I think we can expect GDP to fall if production shifts to other economies because only the final sale of import product will show in the GDP accounting. All of the steps of production will show in the GDP of the exporting economy.

In view of the dynamics above, how can we be so sure that an increase in government deficit spending will, by itself, be an economic cure?

Irish Agriculture, Forestry and Fisheries contribution to GDP declined by 10 per cent in 2012………..

http://www.cso.ie/en/media/csoie/releasespublications/documents/economy/2012/qna_q42012.pdf

Irish farmers don’t go on foreign holidays in the main – they hoard , save or spend their surplus in the local area.

Much of the Irish economy is being kept afloat by growth in call service like jobs , much of whose workers are of a foreign origin.

The question of negative labour remittances is never dealt within Irish economic papers , which is a curious fact as we were a beneficiary of such flows during the Sterling peg years and was under intensive economic study during that time…..with many marginal farmers kept afloat by the sons money from London & New York

In a recent Irish state broadcast about the situation within Irish farming the entire show concentrated on EU farm payments.

Not one mention was made of the farming intermediate consumption crisis which is subtracting from its contribution to GDP (imports)

Irish post war farming was normally stable or growing part of a more rapidly expanding general economy.

Now it is contracting !!!!

This is of course the result of using a non optimum reserve currency for domestic production & commerce which prevents farmers from hiring labour to reduce input costs.

In the above state TV programme nobody mentioned why farming was really subsidized by the euro market state beginning in the 70s

The currency then forming within Europe was simply unsuitable for primary Industrial production.

Delusional indeed.

Ann Pettifor pointed out yesterday that by expanding the Bank of England’s remit to explicitly forewarn markets of the intended future path of interest rates Osborne has completely destroyed his own, and the coalition’s, key economic argument: that the bond vigilantes will drive up UK interest rates unless we cut the deficit.

I think this article sums up his cluelessness perfectly…

http://www.businessinsider.com/george-osbornes-comments-about-cyprus-2013-3

Also worth reading is their report on Financial Times Martin Wolf’s demolition of David Cameron for recently sneering there is ‘no magic money tree’ (NB: I haven’t linked to original article due to FT pay-wall)…

http://www.businessinsider.com/martin-wolf-on-david-cameron-2013-3

I have found MMT economists like Bill Mitchell and some other heterodox economists like Steve Keen to be the most consistently correct in their economic predictions in the last ten years. Their analyses also make the most logical sense and pay due attention to real empirical data.

The MMT predictions that the EU monetary system would lead to disaster (in nations which ceded currency sovereignty) have been bourne out by the empirical experience. The MMT predictions that budget austerity would lead to economic contractions and actual worsening of the budget positions have also been bourne out by empirical outcomes.

In what other discipline are the practitioners with by far the best predictive record sidelined and ignored? Of course, that is the political part of political economy at work. How long can a fallacious and maladaptive theory set (neoclassical economics) persist? It can persist (going on evidence to date) long enough to lead to productive collapse.

I suspect economic collapse on a significant scale will be required to bring about new paradigm. Unfortunately, the existing system must fail and fail obviously for all the misplaced faith in neocon economics to be debunked.

In an ideal world whenever we did what made the most sense financially, then that would become manifest as the greatest possible real world benefit for everyone. To some extent it is the job of government to set a fiscal, regulatory and monetary framework such that that is the case. I’m not sure that MMT fully recognizes the full extent of that responsibility. The whole continuous deficit approach is to a large extent a trick to mobilize everyone by tapping into a human urge to store value. That trick entails uncoupling stores of financial value from the difficult task of creating and maintaining more real productive capacity over long periods of time. Once that uncoupling has taken place and everyone is being herded along chasing a mirage of government created net financial assets, we can hardly complain when the democratic process produces a government that fails to appreciate the fact that the economy has become bull shit and that the most economically productive activities are not actually necessarily those that result in amassing financial assets the quickest. If people devote their lives to accumulating financial assets then they will vote believing that good governance entails preservation of the value of financial assets even if that means ensuring that they are all owned by those who will never need to spend them.

The net average deficit approach (not continuous deficit approach) is a logical necessity in a growing economy. As an economy grows it needs more money in circulation. Money supply growth must be commensurate with economic growth or a money supply crisis will occur and strangle the economy. Deflation, mass unemployment and huge unused productive capacity will be the result. New dollars can only come from fiat creation by government or debt money creation by banks. Fiat creation is preferrable and more controllable for reasons that would make this post too long.

However, what happens when the economy can’t physically grow anymore due to limits to growth? This will become a key issue very soon. Qualitative growth can take up some but not all of the slack once quantitative growth ceases. MMT needs to be extended to consider steady state economics (if it has not already done so).

Ikonoclast, your point is exactly what Jean Baptiste B said in the comments on the monetary realism site. I wasn’t convinced because my understanding was that the economy could in principle grow in nominal terms without extra high powered money and without leverage becoming overextended so long as total credit didn’t outpace increases in economic output and revenue circulated where needed.

Imagine a society that progressed from having a nomadic pastorial economy with communal land and a few camels to an advanced solar powered robot based economy where everyone was served by robots. They actually end up with more camels at the end then at the start but those camels are kept for recreation. They also have an immense amount of productive physical capital. All the while the only high powered money available is an original set of ancient gold coins they started with. Prices are extremely sticky such that a camel costs exactly the same amount throughout. By the modern age however everyone has massive asset holdings such that their camels are worth just a fraction of a % of what they now own rather than being everything they own. All the time, the market cost of assets such as factories etc stays slightly below the replacement cost due to obsolescence and depreciation. Assets are owned with a stable ratio of debt and equity financing and the revenue from the assets amply pays for servicing the debt.

From what I can see, that scenario could expand and expand and stay solvent and bountiful. IMO what causes things to not follow such a path is less to do with the type of money or finance and much more to do with how revenue distributes through the economy. As I see it pumping more high powered money into the economy is what we resort to because we are shirking the crucial need to have an economy where revenues circulate and debts are payed using money received as payment from the creditors. What I’m saying is that if we had sufficient sense of community and a more egalitarian economy then there would be no cause for pumping in more high powered money. Perhaps when we do that we just allow things to get even more out of hand- like taking painkillers so as to continue walking on a broken leg.

Stone, where does the money to circulate come from if nobody creates it? There is a limit to the velocity of money (the speed it circulates at). The only essential ways to create money are by government fiat or by allowing banks to create debt money. Debt money is based on a debt that must be cancelled. While debt money can circulate for a while it must eventually be cancelled (paid off). Fiat money may or may not be cancelled at a future date by taxation. Only fiat money can grow long term to match the economy’s growth. Fuelling growth with debt money is fraught with pitfalls. The recent global recession or global financial crisis is an example.

Indeed, debt money creation should also be a government monopoly IMO. Commercial banks should only lend what they have on deposit, no more. If they want to lend more they should have to borrow from the govt at the official rate and then on-lend that. Home owners should get their mortgages with the govt. and pay the official rate and no more. Cut out the parasitic financial middle-men. What do they constribute? Nothing. They produce nothing real. They are 100% parasites on productive enterprise.

Ikonoclast, I’m also a “positive money” enthusiast and like you I worry greatly about unsustainable private debt, usury and financialization. I’m just saying that IF debt financing funds genuine expansion of productive capacity and IF money circulates around from the creditors and bankers to the debtors, then that extra debt load can be sustained indefinitely and need never be paid off, merely rolled over forever being funded by the increased productive capacity. Both of those “IF”s set an extremely high threshold of requirement. I think what I have said is entirely Kosher full-on MMT. Please let me know if it isn’t.

No system stops increasing debt. It just changes the price of debt.

Credit is inherent in the system. Trying to pretend otherwise just ends up with a Cypriot situation somewhere.

You have a government to prevent a ‘big man’ from arising, and you have available credit to prevent loan sharks arising.

It’s not smart to pretend you can make something go away that is inherent to the human condition. We are hairless gorillas who have learned to do each other favours. A ‘civilised’ system has to reflect that underlying reality.

Top secret now. ?…………

“The MRETS publication has been discontinued. The associated (historical) dataset is still available as part of the UK Trade statistical bulletin and online time series.”

http://www.ons.gov.uk/ons/rel/uktrade/monthly-review-of-external-trade-statistics/january-2013/index.html

Figures.

There was a truly massive spike in silver imports reported in the final Dec edition – for 2012 in total distorting the UK trade figures massively.

For the record £ 6.052 billion of imports …..no 19 top import for 2012 !!!

If this is a proxy for Gold movements ????????????