The other day I was asked whether I was happy that the US President was…

A tale of two economies – Greece and Iceland

Last Friday (March 9, 2012), the Greek government effectively defaulted on its public debt after the required minimum of 75 per cent of private creditors agreed to the so-called “haircut” or debt swap. I find it amusing how the Euro leaders have attempted to massage the default as a debt swap or some other euphemism. The facts are obvious – close to 100 per cent of those who are holding Greek government debt will lose at a minimum 53.5 per cent of the value of their assets. This was forced on the private sector by the Troika (EU, ECB, and IMF) who apparently think it is preferable to undermine private sector wealth than introduce changes to their the Eurozone monetary system which might actually make it work! The discussions in Europe will quickly move to when Bailout 3 is required because reducing the level of Greece’s debt does very little to alleviate the problem which is the capacity of the Greek government to service the flow of interest payments while simultaneously destroying its tax base with austerity. The recent performance of Iceland serves as a timely reminder of how currency sovereignty (monopoly issuance and floating currency) can assist an economy make substantial structural adjustments without major attacks on living standards. Moreover, such an economy can restore growth relatively quickly in contradistinction to EMU nations which are locked in (variously) to years of recession-cum-depression. This blog is a brief tale of two economies – Greece and Iceland

While the deal was touted as a voluntary arrangement with the code acronym PSI (private sector involvement), the Greek parliament passed legislation in February – the “collective action clauses” – which allows the Government to retrospectively force all debt holders (issued under Greek law) to swap their current bond holdings for the inferior assets. German Magazine Der Speigel says this would mean that “€197 billion of the total of €206 billion in Greek government bonds currently in the hands of private creditors” would be the subject of default.

All the political elites in Europe (or most of them) seemed to be raising their Chardonnay glasses to toast a success. I only saw further failure in the deal.

On Saturday (March 10, 2012) the Sydney Morning Herald reported in the article – Greek problem solved, Sarkozy says – while Germany warns – which predictably had the French leader making political statements in the face of his upcoming election and the Germans – being, well, Germans.

Sarkozy was quoted as saying:

Today the problem is solved … A page in the financial crisis is turning.

Yes, and the next page will be talking about the next EU Summit to discuss Bailout Mark 3.

The article (and news reports I heard and saw over the weekend) had a very sombre German finance minister (presumably taking a break from Sudoku) warning that the Greeks had to continue their austerity push.

He was quoted as saying:

Greece has today got a clear opportunity to recover. But the precondition is that Greece uses this opportunity … It would be a big mistake to give the impression that the crisis has been resolved. They have an opportunity to solve it and they must use it.

The IMF boss, who as French finance minister was a full-on advocate of Greek austerity made a ludicrous remarks that “Spring is in the air” when asked to comment on the acceptance by the vast majority of the private bond holders of the debt swap.

Which really summarises the situation. None of the politicians (the IMF boss is effectively a politician without a constituency) is correct.

If Greece continues to follow the German-austerity model – the so-called “opportunity” – it will be unable to meet even the diminished bond payment requirements of the bailout.

It is very simple really. A government that uses a foreign currency has to generate taxation revenue or issue debt to fund its spending. The bailout packages might be hacking into a wide range of legitimate and necessary government outlays but the interest-burden on the Greek government’s public debt remains.

If they are attempting to cut their primary net spending (that is, the balance between non-interest spending and taxation) at a time when the austerity is killing growth then the on-going taxation revenue collapse is chasing them down the drain.

They simply cannot generate enough revenue to maintain their commitments and as they try to curtail spending even more the situation spirals further into the mire.

So before long the EU leaders will be back around the table realising that wiping off more than 50 per cent of the value of the stock of outstanding Greek government public debt does very little to arrest the situation.

What they need to do if they want to stabilise the situation is to engender growth in taxation revenue. They cannot do that only any reasonable scale without a return to substantial real GDP growth. They return to growth while they are hacking into overall aggregate demand.

The Greek economy contracted by 7.5 per cent in 2011 and 2012 will mark the fifth year of Depression. Things will get a lot worse before any inkling of growth will emerge out of the ashes.

The flow of interest payments however will not go away. That is the point – the problem is not the stock of debt outstanding but the flow of payments necessary to service that debt.

And stay tuned for revolts in Ireland, Spain, Portugal and Italy as their populations demand to have their public debts wiped off in the same way, even though such a default does not solve the problem.

When the incumbent Prime Minister George Papandreou indicated he would put the earlier bailout plan to a referendum the Troika had him removed post haste. The Germans are even suggesting that Greece should retain its unelected Prime Minister indefinitely (that is, avoid the upcoming elections) in the same way that the Italians are suspending a democratic vote until 2013 at least.

In this blog – Iceland … another neo-liberal casualty – I detailed the decision of the President of Iceland to veto an act of parliament which would have seen the nation “repay” £3.4bn to Britain and the Netherlands. This repayment was in relation to the amount that the British and Dutch governments paid out in 2008 to their citizens who had deposits in a private Icelandic bank which collapsed during the height of the global financial crisis.

The fact that Iceland has its own currency has given it tremendous leverage over the international financial markets. Greece has no such leverage. Iceland could default on foreign currency-denominated debts and let its currency depreciate.

As I will argue, the real costs of that action were substantial but finite. A more rapid return to growth, however, was guaranteed. Greece is now in its fifth year of recession (Depression) with no end in sight.

On February 17, 2012 the rating agency Fitch upgraded Iceland’s rating and said:

The restoration of Iceland’s Long-term foreign currency rating to investment grade reflects the progress that has been made in restoring macroeconomic stability, pushing ahead with structural reform and rebuilding sovereign creditworthiness since the 2008 banking and currency crisis … Iceland has successfully exited its IMF programme and gained renewed access to international capital markets. A promising economic recovery is underway …

Please don’t think that I consider the assessments of the ratings agencies to matter much. But they reflect the way the orthodoxy thinks. The point is that Iceland has a place in the world that the EMU nations would envy right now.

While the Icelandic government certainly didn’t go on a fiscal spree and allowed net exports to reap the advantages of the massive depreciation, the government also didn’t scorch the economy with austerity. They have allowed growth to build its tax revenue rather than exacting harsh tolls on its citizens.

Which then brings into relief recent proposals for Iceland to relinquish its own currency.

The political elites in Iceland have been pushing their nation towards the Euro and that remains the public position. The vetoing of their deal with the European elites in 2008 by the President of their nation was a major blow their plans. They were clearly prepared to mortgage the future of the citizens for their own “European” aspirations.

But mad schemes are always coming up.

An Icelandic-born, but Swiss-based investment banker, Heidar Gudjonsson whose activities have been (or will be) investigated by the Central Bank of Iceland – involving currency bids against the Icelandic currency(Source), proposed the adoption of a foreign currency for Iceland in this article – Afstýrum öðru hruni – which in English is something like “How to prevent another collapse”.

The plan apparently is to use the Canadian dollar which is commonly known as the “loonie”. For non-English speakers, this attribution well describes the Icelandic proposal.

Modern Monetary Theory (MMT) shows that a sovereign government is never revenue constrained because it is the monopoly issuer of the currency. Which means it always has the capacity (given real resources) to improve domestic growth and employment irrespective of what is happening in the private economy and the external sector.

Moreover,a floating currency allows fiscal and monetary policy to concentrate on domestic policy without the need to engage in “official intervention” (central bank transactions in the foreign exchange market) to stabilise a given parity.

It means that external imbalances do not have to be resolved via dramatic domestic deflation (attacks on working conditions).

Here is some graphical evidence which helps support this narrative.

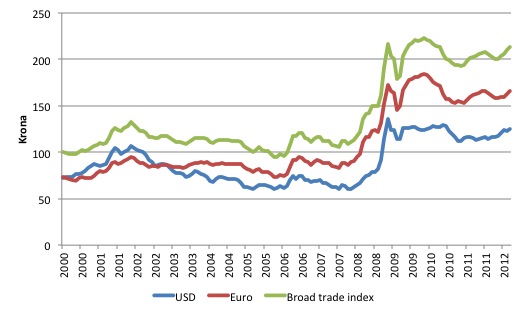

The following graph uses data available from the Central Bank of Iceland and show the USD, Euro and Broad Trade Index exchange rates against the Krona (monthly average, mid-rate) from January 2000 to March 2012.

You can read about the Broad Trade Index – HERE – but suffice to say it represents a weighted exchange parity based on the trading proportions of its partners. The Central Bank of Iceland regularly update the currencies in the “basket”, which is used to calculate the Index as trading patterns change.

In 2010, Iceland’s major trading partners were United States (14.4 per cent of total trade), China (13.8 per cent), Russia (8.6 per cent), Switzerland (6.6 per cent), and Norway (4.2 per cent) (Source).

The depreciation in the Icelandic currency against the major world currencies during the crisis has been dramatic. The same sort of adjustments would quickly happen in Greece should it exit the Eurozone and restore its own currency sovereignty.

But note that the depreciation is finite! Those who claim that nations which run counter to the sentiments of the financial markets will experience a currency collapse and never recover fail to understand the dynamics of an exchange rate crisis. Sure enough, major depreciations occur. But historically, the parities stabilise and begin to improve once the structural adjustments that the depreciation brings (changing terms of trade, changing industry composition etc) start to occur.

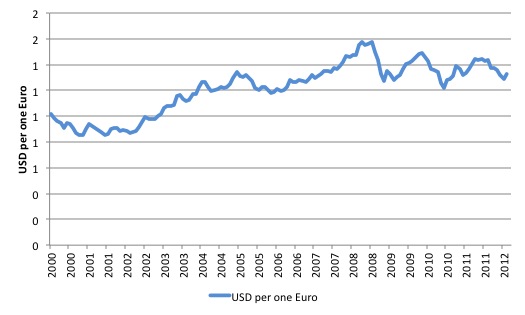

Then consider this graph (taken from data available at the St Louis Federal Reserve FRED database, which shows the USD to Euro exchange rate over the same period (monthly averages).

It illustrates how the EMU nations are trapped and cannot exploit the flexibility of their currency (collectively, given that for any single EMU nation the currency is foreign) relative to other currencies.

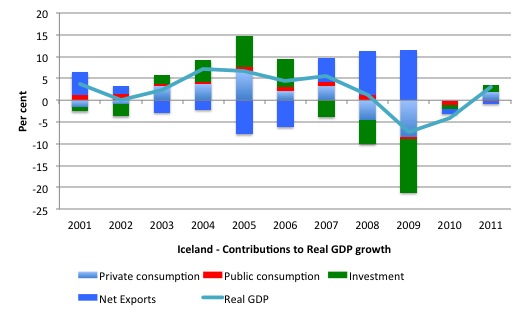

Now consider the following graph (taken from the National Accounts data available from Statistics Iceland) which shows the contributions to real GDP growth since 2001 by major expenditure category (bars) and the overall real GDP growth rate (blue line).

It paints an interesting picture of how an economy can make adjustments relatively quickly if they have a floating exchange rate.

What about inflation? Many commentators claim that flexible exchange rates are dangerous because they will result in accelerating inflation. The claim is only partially true and forgets to take into account the internal (substitution away from imports) and external (improvement in export competitiveness) adjustments that occur when the terms of trade change – especially when they are as drastic as depicted in the graphs above.

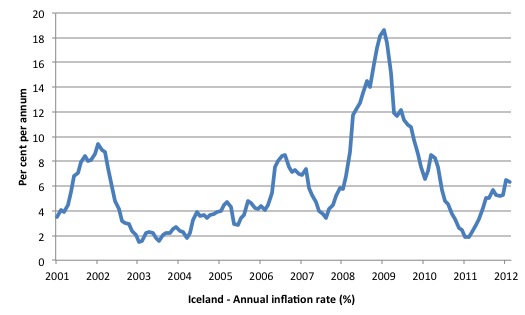

The following graph shows you what happened to the annual inflation rate in Iceland between 2000 and 2011 (data from Iceland Statistics).

It is clear that there was a spike in inflation (the annual rate went from 3.4 per cent in August 2007 to the peak of 18.6 per cent in January 2009 as the Krona depreciated. Since the economy resumed growth, the inflation rate has averaged around 4 per cent per annum.

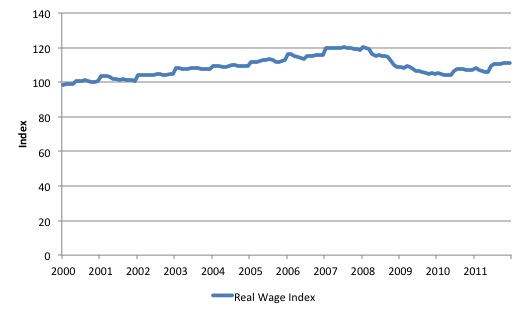

Statistics Iceland also publish a Real Wage Index which is shown in the following graph (from 2000 to 2011). It peaked at 120.2 in January 2008 and then reached a trough in May 2010 at 103.9 (down 13.6 per cent on the peak). It has now recovered some of the loss and in December 2011 was standing at 111.1 (down 7.6 per cent on the peak).

This is a predictable pattern. The exchange rate depreciation erodes the real wage as import price rise.

The nominal wage index continued to grow in Iceland throughout the crisis although the rate of growth slowed appreciably in 2008 and 2009. This point goes to an important aspect of the dispute between Keynes and the Classical writers who urged wage cuts during the Great Depression. It also bears on what is happening in other economies as the austerity mavens push large nominal wage cuts onto workers as part of the so-called structural adjustment.

Keynes noted that workers would resist real wage cuts if they were delivered via cuts in money wages but would tolerate them if they were induced by general inflation. The rationale was that the former would disturb relativities while the latter impacted on the wage structure more or less uniformly.

But there is another reason why preserving nominal wages growth is important. Most of our contractual commitments are denominated in nominal units ($ or whatever currency is applicable). So when real wages are being cut by rising inflation (in this case by a depreciating exchange rate) but nominal wages are preserved, workers can then make adjustments to the composition of their spending without, in the first instance, undermining their capacity to meet their weekly contractual liabilities (for example, their mortgage payments).

Attacking nominal wage levels, more readily undermines the capacity of workers to meet these nominal contractual obligations and opens the possibility for further instability (credit collapse etc).

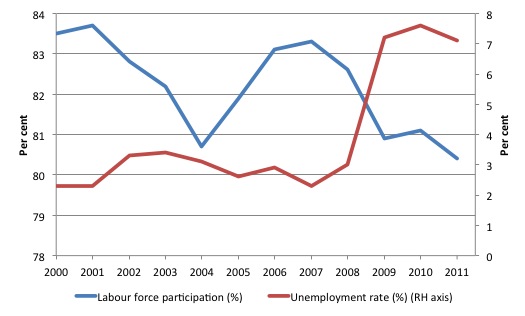

To complete this graphical assault, the following graph shows the labour force participation rate (% left axis) and the official unemployment rate (% right axis) from 2000 to 2011 for Iceland. The cyclical decline in the participation rate suggests there is still some hidden unemployment in Iceland although the stabilisation in the unemployment rate will see participation rise over time.

The current unemployment rate is down to 6 per cent (as at November quarter 2011) and falling (from a high of 9.1 per cent in the May 2009 quarter. So a very substantial recovery although a lot still needs to be done to restore full employment and reabsorb those lost from the labour force (as evidenced by the declining participation rate).

You can learn a lot about the descriptive features of Iceland’s economy via the Central Bank publication The Economy of Iceland (latest issue October 2010).

Dean Baker’s recent article (March 8, 2012) Counterpunch article – The Icelandic Follies (which was originally published by Al Jazeera) – was a useful contribution to this discussion.

Dean Baker said of Iceland:

If they had any sense, the people of Iceland would be thanking the god of small currencies every day for the fact that the country had its own currency, as opposed to say, being part of the eurozone at the time that its financial system imploded.

As a result of having its own currency, the country was able to make much of the necessary adjustment to the crisis by allowing the value of its currency to decline relative to the currencies of its trading partners. This made imports more expensive, sharply reducing the volume of imports. The lower-valued Icelandic kroner also made its exports cheaper, leading to a surge in exports.The effect of this change in relative prices was that Iceland’s massive trade deficit, which soared to more than 28 percent of GDP in 2008, is projected to be turned into a surplus of more than 3.0 percent of GDP this year. This incredible turnaround restored the economy to growth in 2011 and has started to bring Iceland’s unemployment rate down.

He also provides some detailed analysis of why the “choice of Canada is especially bizarre”. I wouldn’t have bothered. No sensible currency would adopt the currency of another nation nor peg their currency against that of another nation.

Iceland would then not be able to float freely. Further, when they finally rid themselves of their neo-liberal infected political elite, they might set about using its own currency to expand domestic growth some more and bring its unemployment rate down to full employment.

The qualification I have about the way the Icelandic recovery has been managed is that the modest fiscal cutbacks have allowed the unemployment rate to hover at higher rates than are necessary. The major structural adjustments would have still proceeded with some fiscal support given the scale of the exchange rate depreciation.

Increasing the deficit would not have caused inflation to be any worse than it was for the short-period it spiked because that was driven by the terms of trade shock (that is, the depreciation).

Conclusion

The advantages of a nation issuing its own currency and floating it on the international markets are immense. Iceland is clearly not a dream economy and still faces major issues.

But it is growing again and the composition of spending is moving back towards consumption and investment as the export sector has done its trick.

By avoiding a major assault on workers’ entitlements (wages and conditions) and relying on a massive shift in competitiveness without major fiscal austerity, the Iceland economy positioned itself for a recovery in private domestic demand.

The problem for the EMU nations is that they cannot exploit the exchange rate adjustment to trigger a revival in net exports and are instead attacking the remaining sources of growth – private spending capacity and the fiscal capacity of the national government. The austerity will undermine the capacity of the private sector to mount a revival in spending for years to come.

Iceland shows what the alternative path might look like for Greece should it take the prudent step and exit the Eurozone.

Please note that this analysis of Iceland is far from complete – I will write more in due course – exploring some of the more complex issues. But the more detailed analysis does not negate the basic point being made here.

That is enough for today!

Dear Bill

Iceland is a small country and its share of of the world economy is neglible. What if every country in the world had its own currency and flexible exchange rates? Then the benefit of devaluations must be limited if there is a world-wide economic crisis. If every currency in the world depreciates, say in terms of a virtual currency called the global, then the effects of all these devaluations will cancel each other out. Aren’t we dealing with a fallacy of composition here?

If Greece reintroduced the drachma and devaluated it, more tourists would go to Greece. However, fewer would go to other Mediterranean countries, thereby lowering their aggregate demand. In light of this, isn’t a currency devaluation a sort of beggar-thy-neigbor policy which can be easily practiced by a few small countries but not by all countries at the same time?

Regards. James

James Schipper says:

“What if every country in the world had its own currency and flexible exchange rates? Then the benefit of devaluations must be limited if there is a world-wide economic crisis.”

The economic cricis across the whole of Eurozone is a debt crisis. Can we, at least, agree on this point? It is not a crisis of inflation, of banking fraud, of euro parity, etc. It is a debt crisis. When we say “economic crisis in Europe,” we mean, as a matter of fact, the growing inability of Eurozone member-states to service, repay or recycle their government debt.

This crisis would not have existed if Eurozone member-states had kept their national currencies and were issuing debt only in them. This is something that MMT demonstrates quite conclusively and Bill Mitchell has shown time and again, on this blog and elsewhere. Can we agree on this second point, as well?

Reverting to national currencies is not the only way forward. Another way the crisis would have been avoided, as again Mitchell and the rest of the MMT crowd have been arguing (to no avail, yet) is with ECB acting as as true federal, central bank and undertaking the financing of the economy of the “country of Eurozone” as a whole. ECB, however, remains focused on “fighting inflation”.

In other words, Rome is burning but ECB is playing the lyre. (Or solving Sudokus – see billyblog March 6, 2012.)

.

“Iceland is a small country and its share of of the world economy is neglible.”

So is Greece. However, it’s not just that there’s a serious issue of inter-connectedness in the banking system that would amplify the effects of a “disorderly” default by either country. (I must note that the ongoing effective default, whereby millions of people are thrown into abject poverty, is seemingly preferable to anything “disorderly.”) The point is that these “small” countries’ problems are emblematic of the inherent, systemic fault of the Euro contraption.

As such, the Eurozone’s leaders should be treating the crises in Greece and other “small” countries as a fortunate early warning – and not treating them as hapless guinea pigs for Europe’s new barbarism.

.

“If every currency in the world depreciates, say in terms of a virtual currency called the global, then the effects of all these devaluations will cancel each other out. “

Why should countries with full monetary and fiscal sovereignty act to devalue their currencies?

Eurozone member-states stand almost unique among nations, right now, in having abandoned their sovereignty over both fiscal and monetary policies.

It is not a coincidence that the debt crisis is hitting Eurozone member-states practically all at once, thus disproving arguments about particular, ethnic disadvantages, i.e. Irish “foolhardiness”, Greek “laziness” or Portuguese “failure in Europe 2004” (or whatever – I don’t know the mainstream’s excuses for Portugal!)

Cheers.

Dear James Schipper (at 2012/03/12 at 21:30)

It would just mean that there would be more room and necessity for fiscal policy to promote growth.

best wishes

bill

You might find this amusing: By Dean Baker in Al Jazeera English ‘The Iceland Follies: Loony Currency Schemes’

http://www.aljazeera.com/indepth/opinion/2012/03/20123695537108259.html

Baker points out exactly what you have. The difference between a currency-issuing entity and a currency-using entity. He then describes what he calls a lunatic idea that some in Iceland are proposing; to adopt the Canadian Dollar.

Sorry. You obviously addressed the issue of the Canadian Dollar … Dean’s article is still interesting though as he points out that the Canadian dollar would be a particularly bad choice for Iceland.

James, I think exporting is just one option, but a sovereign country could always promote internal growth only limited by its own resources and/or access to external ones

If it’s not an official default, then the credit default swaps won’t be triggered?

James Schipper : What if every country in the world had its own currency and flexible exchange rates? Then the benefit of devaluations must be limited if there is a world-wide economic crisis. If every currency in the world depreciates, say in terms of a virtual currency called the global, then the effects of all these devaluations will cancel each other out. Aren’t we dealing with a fallacy of composition here?

No, there definitely is no fallacy of composition here. There is no “global”. Every currency depreciating simultaneously means – no depreciation at all. It is not really a meaningful concept.

If Greece reintroduced the drachma and devaluated it, more tourists would go to Greece. However, fewer would go to other Mediterranean countries, thereby lowering their aggregate demand. You’re forgetting why they would go to Greece – because it is cheaper. Tourists would have more Euros left in their pockets to spend on other things than if they had to pay pre-neodrachma prices. And the euros which had been converted to neodrachmas would return to the Eurozone because Greek demand and imports would increase because of Greek prosperity because of the return to full employment only possible when the artificial constraint is removed.

In light of this, isn’t a currency devaluation a sort of beggar-thy-neigbor policy which can be easily practiced by a few small countries but not by all countries at the same time?

How can selling your stuff for less foreign dough, and paying higher prices for his stuff be considered beggaring your neighbor? It’s because the taboo against common sense – domestic expansion – is so strong that people convince themselves of up is down economics.

The true benefit of devaluation – really of floating currencies – is simply that it removes a purposeless, harmful constraint on the currency that can force enormous numbers of people to not work. It’s always good to have a strong currency, but artificial means used to achieve this are far worse than the problems from currency weakness. This is something like the scary ghost story of the currency war, which for obscure reasons is supposed to be a catastrophe. This section of the wiki article on currency wars actually gets things right:

” If all nations try to devalue at once, the net effect on exchange rates could cancel out leaving them largely unchanged, but the expansionary effect of the interventions would remain. So while there has been no collaborative intent, some economists such as Berkeley’s Barry Eichengreen and Goldman Sachs’s Dominic Wilson have suggested the net effect will be similar to semi-co-ordinated monetary expansion which will help the global economy.”

The foundations need work and simplification – the sentences before the quote should be understood as “monetary expansion” from deficit spending of new NFA/money or central bank purchases of foreign exchange, as “during the later period devaluations have invariably been effected by nations expanding their money [NFA] supplies”; QE referred to is of course meaningless.

If you free up all currencies, you have a world where every economy can run at full employment. This would increase demand everywhere. Depressions & booms are contagious.

PROBABLE ERROR IN GRAPH ?? for contribution GDP iceland : I found on the Iceland central bank website that in 2009 the import where 11.3 and export 2.9 (contribution GDP) so, the net export number should be negative isn it ?

Bill

How did the gig go ?

Small correction:

Those are not the main trading partners of Iceland – the percentages you quote are from a table about the EU trade with the world, including Iceland (at position 57). The numbers you are looking for are on page 6: the EU is by far and away Iceland’s main trading partner, in 2010 with 66% of the trade, followed at a long distance by Norway with 6.5%, the US with 6.2%, Brazil with 4.1% and China with 3.1%.

Dear vassili

I don’t think that we are dealing primarily with a debt crisis. The most urgent problem of Greece, Spain and many other euro countries is high unemployment. Even if they suceeded in paying every penny of their debt by inflicting hardship on their populations, the unemployment problem would remain. Putting the unemployed back to work is the important challenge. Within the straitjacket of the euro, this is very hard to do. Some of these countries don’t just need demand stimulation through the foreign sector, which is where a devalution plays a role, but also by increasing internal demand.

My point was that all countries can no more simultaneously increase aggregate demand through devalution than they can do it through wage restraint. Germany alone can stimulate aggregate demand by letting productivity growth outpace wage growth, but if all countries did the same, it would no longer work. It is the same with devaluation.

The reason why so many countries are experiencing budget problems at the same time is that they all entered a recession at the same time.

I quite agree with you that Greek “laziness” doesn’t explain anything. Everything else being equal, lazy people will be poorer than diligent ones, but one can be poor and financially solid. I have never been in Greece, but I know that in Canada, Greeks are anything but lazy. Many Greek immigrants here work 60, 70 even 80 hours in their restaurants.

Regards. James

Dear Some Guy

You say that, if all countries devalue simulataneous, and by the same percentage, then there is no real devalution. My point exactly. It is like prices. If every price in the world were to increase or decrease by exactly the same percentage, then nobody would be worse or better off, except creditors or debtors.

By beggar-thy-neigbor policies are meant policies that are aimed at reducing unemployment by increasing exports and or decreasing imports. Since for the world as a whole, exports are always exactly equal to imports, it is logically impoosible for all countries to pursue such beggar-thy-neigbor policies simultaneously.

Regards. James

Iceland is a convenient laboratory and I love the way they told their debtors to shove off.

But what blows my mind is the population of Iceland is 317,000. As someone pointed out, about the size of the city of St. Louis, Mo.

It seems this would make policy easier to agree on.

Does this matter?

Bill

Opps

Bill,

Point me to something which discusses how the money becomes devalued.

I see that one can buy more kroners per dollar but what causes this drop. Is it partly the financial insecurity of the credit of the country. It isn’t because there are more kroners than last week so each is worth less?

@James Schipper

This default also does nothing to address the chronic trade imbalances within the EMU which drained the Greek economy of net financial assets to begin with. If the stucture of the EMU does not change this exact situation will continue to recur, but notice the eurobosses behave as though they aren’t even aware of the problem.

Prof. Bill,

Shouldn´t be, would not resist?

Dear James Schipper,

The myth of inherent cultural characteristics has been refuted many times over, most recently in Ha-Joon Chang’s “Bad Samaritans”. Korea and Japan, the modern paragons of hard work and efficiency were being ridiculed in the West in late 19th/early 20th century as lazy, scheming and corrupt nations. Economic progress makes for better people and culture; not the other way around.

You speak of high unemployment being the main problem in Europe today, rather than debt – but the debt crisis is the one that has brought about recession across the continent, the result of which, among other calamities, is high unemployment. So, unemployment is a consequence of the crisis, not its cause.

You are also advocating a boost to domestic demand and I agree – but how do you go about boosting it, when the private sector has given up? Isn’t it obvious that the state has to move in and fill the gap? MMT analysis shows that an expansionary fiscal policy is the most efficient way. (And, yes, as you say, the Euro straitjacket doesn’t allow that.)

Cheers.

Dear p_al,

The quote is correct: Working people resist cuts in their real wages, as you undoubtedly have seen in real life, but, Keynes argues, they tolerate indirect cuts to their wages if these are induced by general inflation (whereby a worker enjoys the same or even a higher nominal salary but a lower real salary).

Cheers.

Thank you Vassilis.

Dear Vassilis

Before 2008, Spain was running a budget surplus and had a small debt/GDP ratio. Ireland had a small deficit. These countries had big current account deficits, yes, but government deficits was not what brought them in trouble. Spain and Ireland have big deficits now, but those are the consequence, not the cause, of the economic crisis. Excessive government debt as the principal cause of the woes of the euro zone is a myth propagated by austerians like Merkel and Schäuble.

Cheers. James

I fail to see what’s to love about refusing to respect the EFTA Deposit Guarantee Directive Iceland signed off on – it certainly didn’t bother them when their banks went after private customers in the UK and Netherlands and let them believe icelandic banks have the same guarantees as the EU-based ones in order to win over their business. Then when the shit hit the fan, they held up their hands and said: weeell, we really didn’t mean it that seriously when we said our government guarantees the deposits in our banks, it’s all just a misunderstanding, can’t we all get along?.

Based on jurisprudence and the treaties Iceland signed, I fail to see how the UK or Netherlands can lose the case they brought against Iceland before the EFTA Court on this matter. In the end Iceland will have to reimburse the money – which I suspect they know all too well themselves, but probably hope that they will be getting a better deal if they drag everything along for years and years in various courts of international right disputes.

It not only matters in terms of policy, it also matters in terms of rescuing the land. What people for some reason seem to forget is that the Iceland tepid recovery was not only due to it having a soveriegn currency, but also to the comparatively immense help & loans they received from the IMF ($2.1 billion through the stand-by agreement of 2008), as well from various nordic countries (close to $2.9 billion through direct bi-lateral agreements).

That’s almost $16,000 per inhabitant, or if we would apply the same measure to Greece and scale the loans up to its population size, it would mean a help package of $180 billion! Not only is that immense in relative terms, it was also agreed upon quickly and paid to a significant amount upfront at the beginning of the crisis, with the remainder spread over 2010 and 2011, with constant supervision from the IMF. Iceland got this package firstly because – altough huge in relative numbers – in absolute numbers it was peanuts and secondly because it quickly agreed to implement a large part of the various reforms that IMF suggested, and they actually followed through on most of their promises, as the various intermediary IMF reports show. It should also be said that the IMF didn’t insist on sudden spending cuts, the fiscal policy was allowed to remain relaxed in the first year, and tightened as needed in the following ones.

James Schipper wrote:

“Excessive government debt as the principal cause of the woes of the euro zone is a myth propagated by austerians like Merkel and Schäuble.”

The German duo are correct – but not for the sado-monetarist reasons they invoke. Sovereign debt is indeed the principal cause of Eurozone’s woes, and clearly so, but only because of the Eurozone itself, of how the whole damn contraption has been set up! That part neither Merkel nor Schäuble will admit.

So, this is not a myth, as such. It is true but it is only half-true. The whole story is as per the above article by Bill Mitchell: Iceland (and Denmark and a host of other European countries – and what about Turkey??) have no problems, as things stand, with their gov’t debt. Debt itself is not the isue, with them. Their major problem is, generally speaking, the European economic crisis, which affects their own economies.

Note that the term “excessive”, used by Merkel &Co., is itself ridiculous. The size of the sovereign debt means little on its own. Can we claim that AC Milan were happy to score 3 goals in the Champions League Final, without taking into account the whole picture, that 3 goals were “good”, “inadequate” or “excessive”? (Liverpool FC scored 4 and won the title.)