My blog is on holiday until Tuesday, January 6, 2026. We are planning to finish…

Where is Bill?

In case you are wondering what is going on with my blog today you might care to read the following.

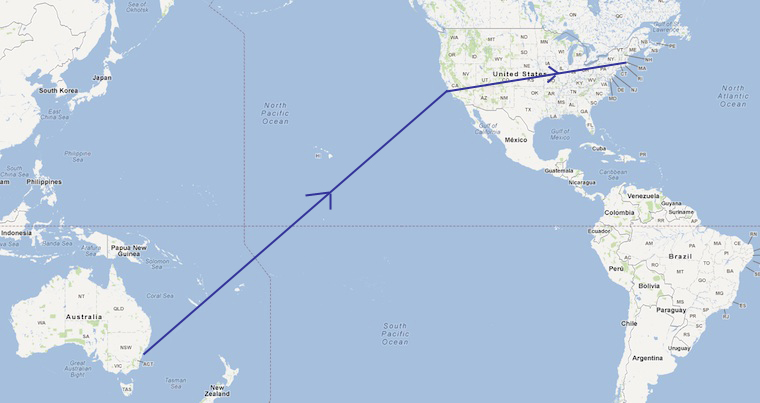

I am travelling to the US today to work with Randy Wray on our Macroeconomics textbook which we hope to have completed by the new Northern teaching year of 2012.

I will be in the US for the whole week and blogs might appear at strange times during that period – given the time difference.

In the next 24 hours or so I will have limited capacity to respond to E-mails and moderate any comments. I moderate all comments which contain links so if it is sitting in the queue for some time you will understand why.

I will be able to deal with some issues when I arrive in Los Angeles but I will regain connectivity when I reach New York sometime later.

Welcome back to the U.S., Bill.

Try going over my idea here with Randy Wray:

https://billmitchell.org/blog/?p=18026

“I said: “Is there any reason a no private debt, no gov’t debt, no current account deficit economy isn’t possible?”

bill said: “Dear Fed Up (at 2012/02/03 at 10:38)

There is no reason why all the individual balances could be zero. Except it is very unlikely because of the different patterns of production, trade and resource availability.

best wishes

bill”

And, that is why there are currencies that can adjust? Targeting NGDP and/or price inflation misses those other things and can allow a currency to be overvalued or undervalued in relation to time.”

I tried something similar at New Economic Perspectives but did not get very far.

The most common scenario is:

savings of the rich = dissavings of the gov’t (preferably with debt) plus dissavings of the lower and middle class (preferably with debt) and if it becomes necessary allow the currency printing entity to “bail out” the owners of the gov’t debt (the rich)

I want to go with:

savings of the rich plus savings of the lower and middle class = the balanced budget(s) of the various levels of gov’t plus the dissavings of the currency printing entity with “currency” and no loan/bond attached

That would allow for more medium of exchange to be created and allow for it to be distributed evenly between the major economic entities and evenly in time.

Great to hear!

Fed Up.

What you describe is how things should be but aren’t. MMT and Bill in particular seem to deal with what actually happens. The degree of state control that would be required for your no debt economy would be alarming.

Excellent.

I look forward to reading that. The situation from 2007 got me interested enough to read ‘Understanding Modern Money: The key to Full Employment and Price Stability’; it has been a bit of an adventure every since.

Paul

When is the new northern teaching year of 2012 ?

Is he obfuscating?

Dear Bill,

Will you give any public lectures around the NYC area? Where and when?

Best regards

bill40 said: “The degree of state control that would be required for your no debt economy would be alarming.”

Why would that be? The currency printing entity would be in charge of the amount of medium of exchange with no debt involved. Other than the no debt part, is it really any different than what the central bank (the fed) does now?

@fed Up

How would anyone ever buy a house? Surely debt is required for such large outlays. Unless you are suggesting we just ask the government and they put the necessary funds directly into our bank account. But that means government involvement in every private transaction above a small sum. Which is perhaps what Bill40 was referring to?

Your chart indicates you’re going to Boston, not New York 😛

Teaching years tend to start in Autumn/Fall.

Bill,

I hope you and Randy will take a look at doing an ipad version of your textbook with the new (free) iBook Author app from Apple.

It would be cool to see some simplified and graphically cool explanations of MMT that could spread the word.

I had been thinking of doing an animated short but a multimedia ebook might be better.

Something along the lines of that Al Gore ipad ebook explaining MMT would be awesome.

Zoltan Jorovic said: “@fed Up

How would anyone ever buy a house? Surely debt is required for such large outlays.”

Not necessarily. It was either Denniger, Big Picture, or Zero Hedge who said people should save up for about 10 years to buy a house at about 1 times (wage) income instead of having a 30-year mortgage (debt) to buy a house at 3 to 5 times (wage) income.

Also in the USA, somewhere between $1 million and above to $2 million and above, the housing market is mostly ALL CASH. Read that somewhere.

Zoltan Jorovic said: “Unless you are suggesting we just ask the government and they put the necessary funds directly into our bank account. But that means government involvement in every private transaction above a small sum.”

I believe the more fundamental question is if an economy needs more medium of exchange, how should that happen?

Debt is an integral part of our community, its how we deal with most of our social relations. A society without debt us against human nature. I suggest you read David Graebers excellent book: Debt, the first 5000 years.

It would be very ineresting to hear Bills opinions of it. It more or less proves that all money has always been chartalist.

zach, I believe borrowing medium of exchange and paying interest in medium of exchange is different from other things, like repaying a favor, repaying a backstratch, and/or borrowing a cup of sugar.

One of the most common uses of money for most people on Earth is still paying dowries or bride price. And some societies still contain many parts of gift economies, where gifts were used for power and influence.

But personally I think we will never get rid of debt because people will never learn to wait for houses or other things they need. Loans are sometimes also of necessity like for medical costs. But the benefits for creditors to use usury are also to great to get rid of debt.

zach said: “But personally I think we will never get rid of debt because people will never learn to wait for houses or other things they need.”

imo, that is a matter of attitude(s) and budgeting that can be fixed.

And, “Loans are sometimes also of necessity like for medical costs.”

Better health insurance and more savings for deductibles and other things.

And, “But the benefits for creditors to use usury are also to great to get rid of debt.”

Some creditors may need to get their benefits in another way. Some creditors need to lose their benefits.

Bill,

I’ve copied 3 paragraphs of yours onto my own website http://www.unemployedaustaliansunite.com. I hope you don’t mind. Email me back if you do and I’ll delete them.

Dear Brett Frome

Thanks for alerting me and I am fully supportive of your efforts.

But I also request you credit the paragraphs as is usual. I do not accept plagiarism. So please put the paragraphs in quotation and a link to where you copied them from.

best wishes

bill