The other day I was asked whether I was happy that the US President was…

Euro malaise heads to the core

Yesterday (December 26, 2012), the French Ministère du Travail, de l’Emploi et de la Santé (Ministry of Labour, Employment and Health) released the latest labour market data for November 2011 which showed that the number of people seeking jobs (demandeurs d’emploi) had risen sharply in the last month. The data shows that the Euro malaise is now penetrating the core large economies in the Eurozone as the impacts of fiscal austerity spreads. It is interesting that the continued fiscal support in the US which is only surviving because the politicians have created a temporary impasse is seeing unemployment falling whereas the trend is now in reverse in the Eurozone. The neo-liberal infested Euro bosses are proving to be much more adept at destroying their economies than their counterparts across the Atlantic.

The latest publication says that “Les données sur les demandeurs d’emploi sont présentées selon divers regroupements statistiques (catégories A, B, C, D, E)” which describes the employment categories the French use to collect and disseminate the data relating to job seekers:

Category A – Actes positifs de recherche d’emploi, sans emploi = an unemployed person who is actively searching for work and is immediately available for work.

Category B – Actes positifs de recherche d’emploi, en activité réduite courte = a person who is actively seeking more work but has worked less than 78 hours the previous month.

Category C – Actes positifs de recherche d’emploi, en activité réduite longue = a person who is actively seeking more work but has worked for more than 78 hours the previous month.

Category D – Sans actes positifs de recherche d’emploi, sans emploi = a person who is not actively seeking work (nor is required to) who might be in an internship or training or have health issues. They are not immediately available for work.

Category E – Sans actes positifs de recherche d’emploi, en emploi = a person who is not actively seeking work (nor is required to) and receiving a wage subsidy.

The latest data shows that:

Le nombre de demandeurs d’emploi inscrits à Pôle emploi en catégorie A s’établit à 2 844 800 en France métropolitaine fin novembre 2011. Ce nombre est en hausse par rapport à la fin octobre 2011 (+1,1 %, soit +29 900). Sur un an, il croît de 5,2 %.

Which tells us that the number of Category A unemployed workers registered with employment centres in mainland France rose by 29,900 in November (level = 2,884.9 million) which was a rise of 1.1 per cent in the last month and 5.2 per cent in the year to November 2011.

This result means that the registered unemployed are now at the highest level since November 1999 – that is all the gains made during the early years of the Eurozone have been wiped out.

The latest monthly data is available HERE.

The more detailed monthly national series – Séries mensuelles nationales cvs-cjo

The official statement from the French government was:

Xavier BERTRAND, Ministre du travail de l’emploi et de la santé, prend acte de cette progression, conséquence directe du ralentissement de l’activité économique.

That is, unemployment is rising because economic growth is falling. He might have added that the latter is occurring because the French government is deliberately undermining its economy by joining the fiscal austerity club.

The Ministère makes is clear by dint of the following warning that the:

Les données présentées concernent les demandeurs d’emploi inscrits en fin de mois à Pôle emploi.

La notion de demandeurs d’emploi inscrits à Pôle emploi est une notion différente de celle de chômeurs au sens du Bureau international du travail (BIT) : certains demandeurs d’emploi ne sont pas chômeurs au sens du BIT et certains chômeurs au sens du BIT ne sont pas inscrits à Pôle emploi.

Which means that these are the data presented refers to job seekers who are registered at the end of the month at an employment centre (Pôle emploi) and thus provides a different indicator to the concept of unemployment that is used by the International Labour Office (ILO) and which underpins the labour force survey measures of unemployment.

They note that there are some job seekers who would not be classified as unemployed according to ILO but who are registered at the employment centre and vice versa.

There have been, for example, changes made in the minimum age eligibility for exemption from job search since 2009 which has increased the number of registered unemployment but has not increased the activity of those persons (job search and availability).

Eurostat provides an excellent – explanatory page – for those who are unsure how unemployment statistics are calculated.

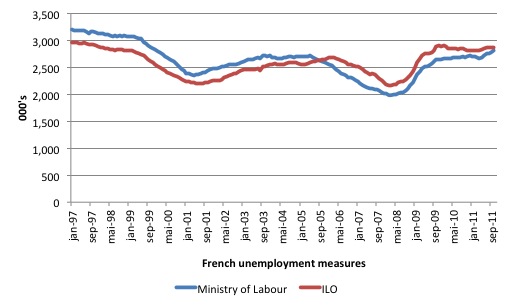

The following graph is prepared using the Ministère data (registered unemployed – Category A) and the standard Eurostat measure of unemployment derived from the French labour force survey (along ILO guidelines).

In terms of rates, the ILO-based measure provided by the French National Institute of Statistics and Economics Studies (INSEE – the national statistics office) showed that the unemployment rate had risen to 9.3 per cent in mainland France in the third-quarter 2011 from 9.1 per cent in the second quarter. Underemployment had also risen in the year to third-quarter 2011.

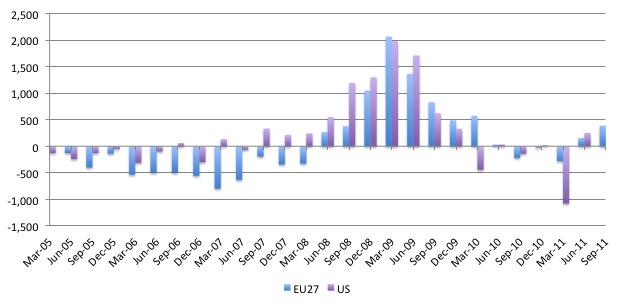

It might be noticed that earlier in the crisis the impact of the crisis on unemployment in Europe was less severe than in the US, for example. Eurostat released a report (May 11, 2010) – Impact of the crisis on unemployment so far less pronounced in the EU than in the US – which sought to analyse that issue.

Eurostat said:

The unemployment rate in the European Union has risen sharply since the first quarter of 2008 as a result of the economic crisis. However, the increase has been much smaller than in the United States, where the rate has overtaken that of the EU despite having been much lower at the start of the crisis

Eurostat said (based on analysis to the first-quarter 2010) that “the latest developments appear to be more favourable in the US”. I updated Figure 2 in that publication to the third-quarter 2011 and the trends are now clear. The graph uses Eurostat data (quarterly averages) from March 2005 to September 2011.

The reality is that while the US polity is crippled and slowly getting around to imposing austerity on the national economy they have not yet withdrawn the fiscal stimulus and that is providing a basis for growth. The stimulus was and remains inadequate for the purpose (given the private demand situation) but it unquestionably put a floor into the contraction.

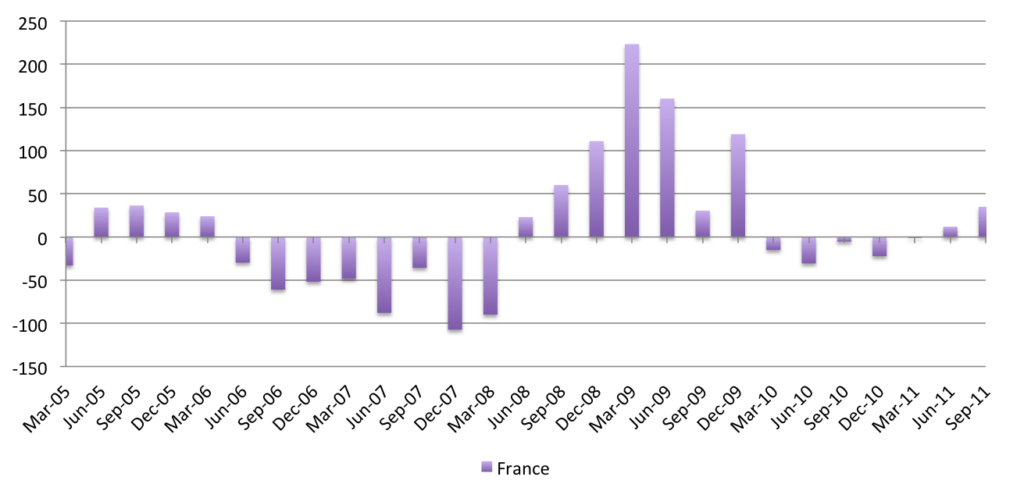

However, in Europe, the growing austerity is now spreading and wiping out the growth gains that were made in several economies, including France in 2009. According to the Eurostat government finance statistics published October 2011, the French government’s deficit rose from 3.3 per cent in 2008 to 7.5 per cent in 2009 (rising from 64,299 million Euros in 2008 to 142,540 million Euros in 2009).

While the French economy contracted 2.7 per cent in 2009 and the stimulus (a combination of automatic stabilisers and discretionary fiscal intervention) in 2009 saw the economy recover somewhat in 2010 (growing 1.4 per cent in real terms).

The deficit was reduced to 136,513 million Euros in 2010 on the back of the growth (with the automatic stabilisers working favourably). The result can be seen from the graph that follows which shows the quarterly change in unemployment for France from the March-quarter 2005 to the September-quarter 2011. The more recent data (monthly) is showing a deteriorating labour market situation in France.

The growth supported by the deficits saw the unemployment rate decline (as the earlier graph demonstrated happened in the EU27 countries as a whole). Now the austerity is killing growth and causing unemployment to rise.

On November 20, 2011 – the Financial Times article – Le Pen calls for France to quit euro – reported that Marine Le Pen, daughter of Jean-Marie and his successor as the leader of France’s far-right National Front:

… has made abandoning the euro one of the pillars of her presidential election campaign, launching a powerful attack on the ailing single currency as she seeks to bolster her already strong showing in the opinion polls.

Presenting her “presidential project”, Ms Le Pen said Europe should give up the euro, which had “asphyxiated our economies, killed our industries and choked our jobs” for years, as well as causing France to accumulate “Himalayan” debts. In any case, she added, the country should prepare a planned exit from the currency union. “We need to anticipate the collapse of the euro rather than suffer from the collapse of the euro,” she said in a television interview on Sunday.

She also said that “she would empower the Bank of France to lend to the treasury” to reduce the call on private debt markets.

These are policies that enlightened progressive left-wing parties should be championing. As I noted the other day, the populist parties that are gaining increasing attraction in Europe at present meld these “progressive” economic policies with what I would call non-progressive cultural and social agendas (anti-gay marriage, tough on law and order etc).

The fact that movements like the French National Front is pushing the only sensible strategy for the French economy is a sign that the left in that nation has failed.

I am doing more research on this topic at present.

Conclusion

The point is obvious – the Eurozone will see higher unemployment in 2012 as a result of the policies the national governments are now taking – seemingly in concert – or should I say lock-step with the Germans.

With various national elections approaching (France in May 2012) the potential for rather “nasty” populist parties to make inroads is high. The formerly progressive left parties are so captured by neo-liberal macroeconomic ideology that they have vacated their traditional policy space and allowed the populist parties to move in.

That is a very retrograde move in world politics.

A shorter blog than usual today in recognition of the holiday period.

That is enough for today!

Bill, I am curious to see an analysis on the German employment. What seems somewhat strange to me is that German GDP is barely above the pre-crisis level and yet the unemployment rate is so much lower. My 5 min digging into data revealed that population in Germany is contracting quite fast which might be the driver behind declining unemployment rate. But I would be curious to know whether it IS the driver, or whether it is productivity which is declining, or work sharing, or if it is population then whether it is migration, aging or anything else. Maybe you have data at hand (you surely know the data sources better) and could do an analysis on the real causes of declining unemployment in Germany? Because German GDP and unemployment rate to do not seem to dance too smoothly together. Tnx a lot.

Uhhhh… treading dangerous ground there. In saying that the extreme right is proposing the only sensible economic options you are effectively bringing forward the biggest ghost of the past, that of Germany in the 30’s… The fact that it is Le Pen & Co advocating such measures would be enough for no government in France to follow it. Specially with an election looming nearby…

Just imagine the uproar and the drums beating if Merkel started to follow economical advice from the NPD…

Also, in saying that the left has failed, you ignore the fact that the left in France has failed it’s people ever since the dark days of the WW2. Singer in ‘Whose Millennium? Theirs or Ours?’ has got a chapter in which he gives quite a good picture of the failure of the left in France. It’s nothing new. What is new is that the traditional left parties are running around like a headless chicken without being able to provide any type of valid option for what is happening. They are not only failing to act, they are showing themselves to be an empty box with pretty labelling outside. Going back to Singer, unfortunately it does not seem the left will have a generation to re-organize itself, the time is now, and the clock is ticking.

I completely agree with this analisys. Here in Spain, our brand-new Economy Minister has said that we will face a tough 2012 with unemployement rising. Fortunately, we do not have yet any populist party here as they have in France.

I would expect from Italy’s Liga Norte party the same type of reasoning in populism as National Front in France.

Hello Sergei, I think these two links could provide some insights about “low” German unemployement:

http://www.worldcrunch.com/germany-cooking-books-its-low-unemployment-rate/3833

http://www.dw-world.de/dw/article/0,,15032531,00.html

The question is, how an employement is defined? Is a mini-job a job?

European households got low rates thanks to monetarism.

I’ve seen Conservatives call those “far-right” parties, leftists over economic policy. That’s true, in economic policy, they have the most sensible economic approach. In social policy, that depends. Some proposals are acceptable or even desirable when others are totally off.

go far enough left or right and you end up in the same place anyway … extremism is dangerous in either direction as history has proven repeatedly.

jmlima … are you saying the blog was championing right wing policies and parties?? I didn’t get that impression at all …. because it didn’t.

@apj

Not at all. I was merely noting that from an European perspective, denoting the validity of the far right’s parties economic solutions is not acceptable to any government.

Marine Le Pen is not as bad as she is painted. She’s not anti gay or anti women’s rights, but she is anti Europe, anti immigration, and she is fiercely pro France. I really sympathise with a lot of what she says, especially on the economy and the Euro. However, she is painted as racist, against the Jews, Muslims etc, because she is her father’s daughter. She says she’s not anti-Muslim, for example, rather anti-islamification of France and French institutions. You do worry that she is hiding it all, that she really is a fervent racist, but it’s hard to know.

someone can tell me how the ltro works

i mean banks can get funds from the ecb posting collateral

for example if the collateral is an italian BTP 5%

and the interest for the repo is 1%

but who gets the 5% coming from the BTP

the bank or the ECB?

Sergei,

the low unemployment in Germany is a product of massive fiscal stimulus imposed by German government shortly after 2008. However, the German economy is dominated by manufacturing sector and therefore the unions are pretty strong. This is the primary reason that the jobs were protected rather than some miracle in form of neo-liberal dogma. One example of the measures was the so-called Kurzarbeiten – check in Wiki for details. You should not forget that “cash for clunkers” used by other EU governments went straight to Germans etc. The Germany would be in much worse shape if not the unions.

Germans by the way are exceptionally good with fiscal stimulus and level of help to small and middle size companies is unprecedented. The reason is the resistance to embark on service economy…

Jan, the ECB gets it (ie. -ve carry for the bank). Repo to the bank in this case is like selling the bonds (for a period) to the ECB, who accrues the interest (the bank gets cash rate or thereabouts). Think about a repo that is continuously rolled short term for 3yrs on a 3yr bond. It’s like a sale for all intents and purposes. It’s another reason why the “LTRO = banks buying sovereigns” is a daft idea. So now banks are depositing cash at the ECB at 0.25% (still a loss on 1% funds, but less -ve carry). This is a sure sign of a broken credit system where there is not only poor demand for debt, but little interest in taking credit risk either. A credit crunch is occurring before our eyes. MMT has been all over this, but at the same time, I don’t think you really need MMT tools to appreciate that pro-cyclical austerity is just mental.

Dear Dr. Mitchell:

On the subject of Europe, I note in the Dec. 28 NYTimes this news item:

ROME – Financial market pressure on Italy eased temporarily on Wednesday, with borrowing rates on some government-issued debt dropping by half. But the political pressure on the government of Prime Minister Mario Monti remained high – and rising.

Last week, Mr. Monti won final approval of a $40 billion spending package of tax increases and a pension change aimed at eliminating Italy’s budget deficit by 2013. But with Italians starting to feel the pain and dissent growing in Parliament, Mr. Monti must act swiftly to stimulate Italy’s economy, which is already in recession and is expected by some forecasters to shrink in 2012.

It does not get much clearer to this MMT student the insanity; all in the same two sentence paragraph, without a hint of irony. This is beyond parody. Cheers, Jim