The other day I was asked whether I was happy that the US President was…

When you’ve got friends like this – Part 8

I noted a proposal overnight from so-called progressive American economist Dean Baker on Al Jazeera (November 28, 2011) – Time for the Fed to take over in Europe – which suggests that the US Federal Reserve Banks should insulate the US economy from the bumbling leadership crisis and “step in if the European Central Bank fails to deal with the debt crisis”. The proposal is that the US central bank should fund EMU nation deficits. This is another one of cases when friendly fire shoots the progressive movement in the foot. You can read the previous editions When you’ve got friends like this to see what the problem is. The simple point that far from protecting the US economy this proposal would likely cause a collapse in the currency and an inflationary surge that would divert attention of the US government away from creating employment, undermine the real standard of living of workers, and provide new ammunition for those who want to implement damaging austerity. For all that, the US government would only put the EMU nations into a holding pattern anyway.

I agree with the substantive claims that Dean Baker makes:

1. “The European Central Bank (ECB) has been working hard to convince the world that it is not competent to act as a central bank”.

2. “One of the main responsibilities of a central bank is to act as the lender of last resort in a crisis” – although I would note that the concept of lender of last resort has never been applied in the way that Dean Baker uses the term.

As I noted in this blog – Wir wollen Brot!, when economists talk about the central bank playing the role of “lender of last resort” they are referring to the capacity of the central bank to lend to its member (private) banks – that is, provide reserves in return for collateral at some discount (penalty) rate.

That is quite a different concept to the proposal (which I support) of the ECB purchasing government debt (that is, funding budget deficits). This proposal is really to convert the ECB into a “fiscal authority” to fill the gap left by the poor initial design choices made when the currency union was established.

Central banks usually do not play that role although I consider they should. It is clear that the Euro area as a whole does have the monetary resources available to fund all government spending at the member country-level. After all, the ECB issues the currency under monopoly conditions.

If we consider the Eurozone to be a single economy, then the ECB becomes the default fiscal authority in the absence of that capacity being created. The problem then is that as an unelected and unaccountable (to voters) institution, it is unsatisfactory for this role to be devolved to the ECB.

I consider the proposal that the ECB bails out member governments is a short-term palliative initiative to stop the crisis and get growth going again. Ultimately, I consider, as I have been saying for many years, the Eurozone is a failed construct and should be abandoned.

As it stands, the ECB is the only show in town to save the Eurozone from a very drawn out and damaging recession.The member states in the EMU cannot spend without taxation revenue or debt-issuance. The only institution in the EMU that can spend without recourse to prior funding is the ECB. That is the consequence of the flawed design of the monetary system that the neo-liberal conservatives in Europe forced upon the member states at the inception of the union.

In relation to the current reluctance of the ECB to take a major role, Dean Baker says:

It is arguing instead that it would sooner see the eurozone collapse than risk inflation exceeding its 2.0 per cent target.

In fact the ECB is not saying that and is already actively making secondary bond market purchases of bonds from governments which the bond markets will not lend to at reasonable rates at present.

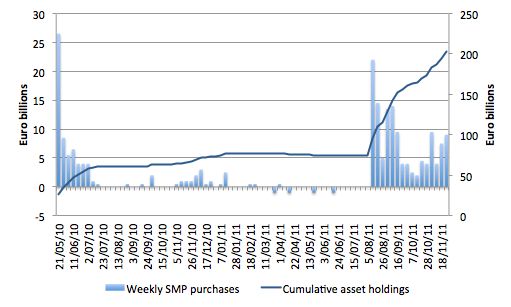

In this recent blog – The ECB is a major reason the Euro crisis is deepening – I provided the most recent data applicable to the ECBs so-called Securities Market Programme (SMP) which was established on May 14, 2010.

You can read more recent information about the programme HERE. The ECB provides the weekly Data (click on the Ad-hoc communications Tab) about the SMP purchases.

As of November 25, 2011 the ECB has bought 203.5 million euros worth of bonds under the programme. The purchases are accelerating each week.

The following graph updates my previous graph and shows the history of the SMP since May 2010 (up to the most weekly statement from ECB – November 25, 2011). The bars shows the weekly purchases (or redemptions) while the blue line shows the cumulative asset holdings associated with the program (now at 203.5 billion Euros).

Clearly they accelerated at times when the private bond markets were withdrawing from tenders (as evidenced by the widening spreads of member state bonds against the bund). The SMP is unambiguously a fiscal bailout package which amounts to the central bank ensuring that governments can continue to function (albeit under the strain of austerity) rather than collapse into insolvency.

I think the correct interpretation of the ECB’s actions at present is that in return for providing the SMP which is keeping the currency union afloat in the short-term, they are enforcing austerity on governments which is really fast-tracking the demise of the union in the medium-term. A series of economies (the member states), which are heavily interlinked in terms of trade, cannot grow by cutting public spending when private spending is weak.

Private spending is weak because there is rising unemployment and no incentive to invest in new productive capacity. The public spending cuts are exacerbating that weakness.

The ECBs role in this stupidity is outlined in some detail in this blog – The ECB is a major reason the Euro crisis is deepening.

Dean Baker then wrote:

It would be bad enough if the ECB’s incompetence just put Europe’s economy at risk. After all, there are tens of millions of people who stand to see their lives ruined because the bureaucrats at the ECB don’t understand introductory economics. But the consequences of a euro meltdown go well beyond the eurozone.

I agree largely with this comment although in what follows we might also be asking who actually understands “introductory economics”.

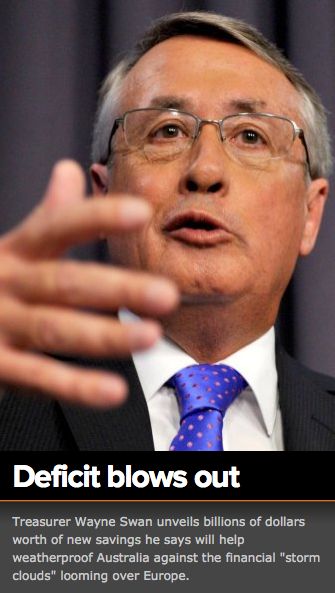

The fact is that the Australian government’s ridiculous announcement today (November 29, 2011) in its = Mid-year Economic and Fiscal Outlook 2011-12 – to further cut public spending in a slowing economy because the latter is pushing the budget deficit up and they are”determined” to deliver a surplus next year – to hell or high water – has been directly influenced by the Euro crisis.

The substantial loss of tax revenue to the Australian government has arisen because sharemarkets are down on the back of the Euro uncertainty.

It doesn’t justify the response of the Australian government who should stimulate when confronted with an economy that is slowing but it proves Dean Baker’s point that the Eurozone crisis is extending well beyond its borders.

The introductory point that he considers that the ECB fails to understand is that they will not create inflation if they fund all the deficits in Euro and allows them to grow in the short- to medium-term to underpin growth.

There is no inflation risk in the Eurozone at present – rather the opposite is the threat. There are massive reserves of idle productive capacity which can be brought into use as nominal demand rises.

The ECB has inherited the Bundesbank obsession about “printing money” causing hyperinflation.

I have some sympathy for the ECB though in one respect. They were not created to provide validation to the spending and taxation decisions that different governments have made. They are not accountable or responsible for those decisions. I am sure that is not their concern but it should be the only concern.

Monetary systems that are consistent with democracy should always located the fiscal responsibility and the currency issuing sovereignty in the one unit.

Dean Baker is concerned that the Eurozone crisis will damage the US recovery and push into int a second-dip recession because of the “loss of the European export market, and the likely surge in the dollar”.

Unlike all the member states in the EMU, the US government has the ultimate capacity to deal with a slowdown arising from the export sector. It can simply stimulate domestic spending either directly through its own spending or via the private sector by tax cuts, increased transfers and other means.

There should be no knock-on effect to the US economy. If that is happening (and it certainly is in the Australian context) then it becomes the fault of the sovereign government of that nation and has nothing much to do with the ECB.

Dean Baker thinks that the Eurozone crisis has the potential to push US unemployment “into a 14-15 per cent range” which he says “would be a really serious disaster”.

Again, the US government would be the cause of that not anything that happened in Europe. I also was curious about the descriptor – I count 9 per cent – the current rate of unemployment in the US as being a really serious disaster. A rise to 14-15 would be a catastrophe.

But we shouldn’t get stuck on style differences.

What we should get stuck on though is Dean Baker’s proposal to counter all of this Eurozone malarkey. He says:

Fortunately, the Fed has the tools needed to prevent this sort of meltdown. It can simply take the steps that the ECB has failed to do. First, and most importantly, it has to guarantee the sovereign debt of eurozone countries. The Fed simply has to commit to keep the interest rate yields on debt from rising above levels where it risks creating a self-perpetuating spiral of higher debt leading to higher interest rates, which in turn raises the deficit and debt.

This doesn’t mean giving the eurozone countries a blank check. The Fed can adjust the interest rate at which it guarantees debt, depending on the extent to which countries reform their fiscal systems. For example, if Greece and Italy crack down on tax evasion, this can be a basis for allowing a lower interest rate. If they allow their wealthy to freely evade taxes, then this can be a basis for raising rates. The difference between a 2.0 per cent interest rate and 7.0 per cent interest would be a powerful incentive to eliminate corruption and waste.

I won’t comment much on the idea the US would start telling foreign countries what an appropriate fiscal position is or is not. For f*&k’s sake, the US is languishing with 9 per cent unemployment because it refuses to conduct appropriate fiscal policy.

I obviously do not support foreign nations telling other nations how to conduct their fiscal policy just as I do not support a cabal in Brussels or Frankfurt telling Greece or France how to conduct their policy.

Further, I know it is twee for so-called progressives to keep telling us that the solution to the crisis for governments to “make the rich pay” but the reality is that might sound nice and be a useful policy on equity grounds but it is not the solution to the crisis.

The crisis is being extended because there is not enough aggregate demand to drive growth and income. Taking some purchasing power off the rich will probably worsen that situation although it would not be as damaging as taking cash off the lower income groups.

These distributional matters (whether the rich pay or not) should be separated from the main game – which isn’t to say I don’t support higher tax rates for the rich and lower tax rates for the poor.

But the overall tax take should only be designed to ensure the public/private spending mix is suitable for full employment without inflation.

So what a government “takes” off the rich has to be added back anyway which I suspect is not what Dean Baker is thinking when he says that countries need to “reform their fiscal systems”.

Further, the “difference between a 2.0 per cent interest rate and 7.0 per cent interest” that Dean Baker thinks “would be a powerful incentive to eliminate corruption and waste” is smaller than some of the spreads now and hasn’t had that effect as far as we can tell.

What we can say is that “differences” of that magnitude are driving the Eurozone to insolvency. So there is really no US bargaining tool available in terms of this “difference”. Do as we say or go broke is what the idea suggests! Not a very sound basis for policy reform.

However, the substantive objection I have to Dean Baker’s proposal – which amounts to the US Federal Reserve selling US dollars in the foreign exchange market and buying Euros so that they could buy Eurozone government debt – is that it would almost certainly lead to a collapse in the US dollar collapse which would then have a range of consequences – some good (increased trade competitiveness) others bad (increased inflation).

Overall, I assess these consequences as being undesirable at this point and totally unnecessary.

Why would that be the case?

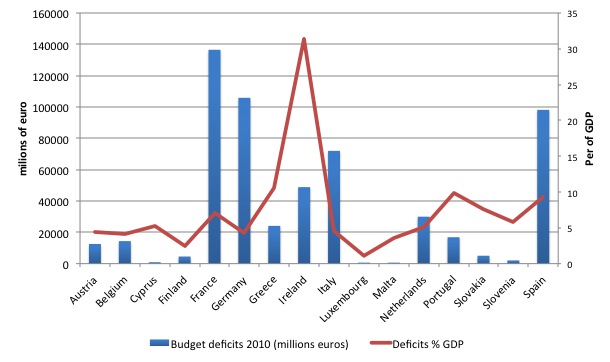

The size of the current deficits in Europe for those nations that are under attack from the private bond markets are substantial.

The most recent Eurostat Euro area budget data (published October 21, 2011) reports a government deficit (in millions of Euro) for 2010 of 572,526 or 6.2 per cent of GDP.

The following graph shows the budget deficits (bars) in millions of Euro and as a percent of GDP (red line – right axis) for the EU16 nations (before Estonia joined on 1/1/2011) in 2010.

If we only consider the so-called PIIGS then their 2010 deficits were 259,990 million euro or 45 per cent of the total outcome noted above.

Note that the ECB has already purchased 203.5 million euros worth of government bonds in the secondary markets and most of those purchases were before Italy came under attack.

To be clear deficits are flows not stocks so these flows have to be funded (in the EMU situation) every year. The numbers will be larger by the end of 2010 but the 2010 figures are sufficient to give you some idea of how large the US Federal Reserve spending (currency exchange) program would have to be.

As of today, the 1 Euro = 1.3294 U.S. dollars. So just purchasing the PIIGS debt to fund their 2010 deficits would have required the US Federal Reserve sell around 347,024 million USD which is about 5.8 per cent of the US GDP over the last four quarters.

That is a huge injection of US dollars into the world foreign exchange markets.

The volume of spending that would be required are even larger than the estimates provided here. That is, because to really solve the Euro crisis the deficits in (probably) all the EMU nations have to rise substantially.

What do you think would happen to the US dollar currency value? The answer is that it would drop very significantly. The word collapse might be more appropriate than drop.

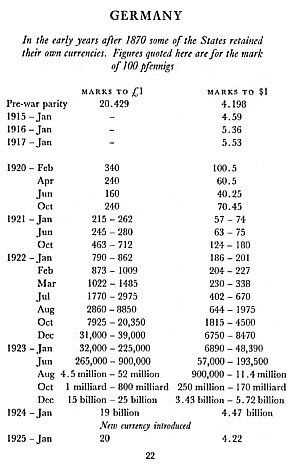

Mainstream economists regularly use the example of the Weimar hyperinflation to express their assessment of the likely impacts on the ECB funding the Eurozone deficits.

Their assessments are erroneous. A rising “money supply” isn’t inflationary. Spending creates inflation.

However, in relation to the proposal that the US Federal Reserve might fund all the Eurozone deficits the experience of the Weimar years is not that inapplicable.

This book – R.L. Bidwell (1970) Currency Conversion Tables: A Hundred Years of Change, London: Rex Collings) – contained the following table which shows what happened to the German mark (against the US dollar and the British pound) during the 1920s.

The Treaty of Versailles was responsible for an acceleration in the depreciation of the Mark although one needs to be a little careful here because the Treaty (through the Reparations Commission set up by the Council of Four) demanded payment of the reparations in gold marks rather than the paper mark plus a cut of Germany’s exports (26 per cent).

The London Ultimatum changed things significantly and essentially ensured that the German currency would collapse and hyperinflation would emerge. On May 5, 1921, the British Prime Minister David Lloyd George demanded that the Germans pay in gold or foreign currencies.

While it is debatable what actually happened (whether the hyperinflation was a deliberate German ploy to undermine the reparations or was caused by the reparations) it is clear that to meet the demands of the London Ultimatum, the German government started selling marks for US dollars at a preposterously increasingly rate.

It was at this point that the currency started to dive which only exacerbated the problem because it increased the amount of markets required to meet the Reparations Commission demands.

By 1922, the currency was in freefall, productive capacity was shrinking fast, and hyperinflation emerged.

The proposal that the US Federal Reserve bail out EMU nations would cause a plunge in the US value. It is not akin to the Central Bank currency swap arrangements that the US Federal Reserve has engaged in since 2007.

At this point in the crisis, there is nothing to be gained by a massive US dollar depreciation and the inflationary impulses such a large depreciation would probably impart.

Who said budget outcomes were under government control?

This headline appeared on the front page of the ABC news portal this afternoon (November 29, 2011) in relation to the story – Swan swings the axe as revenue falls – which reported the Federal Treasurer’s decision to cut government spending (and increase taxes) at a time the Australian economy is slowing.

The Government has been pursuing an austerity program aiming to get the budget into surplus next year. It is a demonstration of ideological obsession with surpluses rather than any sound appraisal of where the budget should be. They have been doing that at a time when private spending is incapable of supporting growth and so aggregate demand is declining.

With the Euro crisis hitting tax revenue, it was obvious that the deficit would rise no matter how hard they attacked spending to get to surplus.

When we will characters learn that you reduce deficits via growth and that requires supporting aggregate demand rather than undermining it?

The only question that seems relevant in relation to the Treasurer’s photo is when did he start modelling his ties on the ECB statue?

Digression

I was reading the material associated with the latest OECD economic outlook and noticed this graphic on the OECD Home Page which they say are their key issues. Each carried a little caption which didn’t seem to copy over (-: so I added my own which I think captured the message they were trying to portray to the world.

It would be hard to come up with anything different.

Conclusion

Progressives should stick to the main game – nifty solutions like the US Federal Reserve bailing out Euro nations – are not only poorly crafted but they divert attention away from the problem – which is a poorly designed monetary system that cannot withstand large negative aggregate demand shocks.

Further, the Eurozone cannot support rising deficits at present unless the ECB intervenes. Progressives should be demanding higher deficits to spur growth. The Europeans can support that themselves while they work out how to dismantle the bodgy monetary system they created.

The former should be their first focus which will give them time to work out the second in a co-operative manner.

That is enough for today!

Is it time to rename the blog “When you’ve got friends like these”?

While I agree with your general point of view I do not understand your technical objections. Why would the FED turn to FX markets to purchase €s if they can arrange a huge US$ € swap with the ECB? They can use these €s to buy distressed bonds for a considerable discount. Wouldn’t the FED make tons of money by doing so? It seems to me such a swap arrangement would be a win win for both parties. The ECB can maintain its ideological position of being an immaculate pure central bank while the FED does the dirty work and earns some money by doing so. What is wrong my reasoning?

It’s more can kicking.

The problem with the progressive commentators is that they refuse to say it as it is:

The fiscal authority needs to buy real output that is stood idle and it needs to keep doing that until the private sector has clearly reached its ‘ignition point’ as demonstrated by the figures on unemployment and inflation.

All this messing around the side subsidising private bank lending, off balance sheet government borrowing, trying to influence spending via increasingly weird monetary policy arm waving, are all complete distractions from the key question that needs to be asked.

Given that we spent tomorrow’s income yesterday, who is going to buy today’s output?

What is wrong my reasoning?

Why would the US government want to make a profit in forex and bond markets?

All they have to do is type a number, type a bank account and press return…. Instant profit.

@Andrew

Thanks. Maybe I’ve not phrased my question precisely enough? It is not whether the FED should do this. And I do understand that the FED can credit bank accounts in US$ by typing on a keyboard. It is about the technical objection Bill raises if the FED chooses to do so. I do not understand why doing so would cause the US$ to collapse in Foreign Exchange Markets.

Bill, I agree totally. The ECB has the tools to help itself. It just need political will to back it.

By the way, wouldn’t currency swaps, borrowing dollars at a set exchange rate, amount to EU sovereign debt in a foreign currency. As if it isn’t already?

“I consider the proposal that the ECB bails out member governments is a short-term palliative initiative to stop the crisis and get growth going again. Ultimately, I consider, as I have been saying for many years, the Eurozone is a failed construct and should be abandoned.”

Thank you, Billy Mitchell, for being one of the few voices to utter sense with regard to the current predicament of people in the EZ.

A currency union is a contradiction in terms. The only serious question about it is how the destructive arrangements created on its basis can be winded down minimizing costs to all affected?

@Stephen

As Bill wrote, supporting EMU debt would require the Federal Reserve to get its hands on euros because that’s what the bonds are denominated in. To do so the Fed would have to buy those euros with dollars which are worth 30% less; i.e. the Fed would end up flooding the FX market with its currency and driving down its value by pushing the supply of dollars well beyond global demand.

@Ben

Thanks. Again: if the FED arranges with the ECB a central bank liquidity swap there’s no need to turn to the FX market. It is a deal just between the two institutions. Where does the FX market enter the equation?

I agree with Stephan, the Fed doesn’t need to get euros unless it is going to buy newly issued bonds from government directly.

But if it buys them from bond holders in the open market it just marks up the USD accounts of bond holders at the Fed, in the same way the ECB marks up their Euro accounts at the ECB.

It doesn’t make much sense to claim that in one case the currency will collapse and that nothing will happen in the other.

@Stephen

How would we inject liquidity without first obtaining euros? Are you suggesting the Fed and ECB enter a special arrangement where they exchange currencies outside the FX market?

Looking at the 1970 table, am I right in thinking that a “milliard” = 10E9, i.e. a modern “billion”, and a “billion” = 10E12, 1.e. a modern “trillion”? My father had German postage stamps with an original face value of some pfennigs, overprinted “100 millarden mark”.

@Ben

Beside what @MamMoTh is saying which I think is correct YES this is the definition of a central bank liquidity swap. Two counter-parties enter an arrangement where they exchange currencies outside the FX market.

@ Stephen

It depends on whether the ECB would cooperate, which I’m not sure is in the cards. That’s the only reason I can think of that the Fed would inject liquidity via open market operations.

When I first encountered Dean’s suggestion, I thought, “Dean wants to turn the Fed into Ireland.”

It’s just a ridiculous suggestion. The Euro is doomed to failure because sovereign governments are users of a foreign currency. When you boil down the proposal, the EU become users of dollars. The Eurozone is so big maybe the US would become users of the Euro?

The US and Eurozone would eventually require full political and fiscal unity. Lets go the whole hog with a one world government.

Why is the collapse of the euro such a bad thing? It will reestablish democracy again in Europe.

@partha shakkottai

>Why is the collapse of the euro such a bad thing? It will reestablish democracy again in Europe.

Excellent question. Very good answer. I’m all for an orderly dissolution of the Eurozone. Although my preference would be to first address the immediate crisis and then start talking about monetary divorce.

Neil Wilson: “Given that we spent tomorrow’s income yesterday, who is going to buy today’s output?”

The Gnomes of Zurich, of course. 😉

It is hilarious to me that the ECB calls itself a “Central Bank”, but then claims it cannot “act like one”. I came across an article published in the Economist wherein Jens Weidmann declared that ” … the ECB could not act as a lender of last resort for countries, because in doing so it would transgress EU treaties banning direct financing of states.” … Then pardon my French, but wtf else is the purpose of a Central Bank? It’s hard to understand how the leaders of the Euro ever agreed to this kind of s*** in the first place.

Dear Stephan (at 2011/11/29 at 19:21) and others that supported his view

The currency swaps that the US Federal Reserve participated in with the ECB and other banks at various times since the crisis began were all pay back with interest arrangements. I noted in my post that I didn’t think the proposal was akin to these arrangements and that is why they would work via the foreign exchange market.

If the ECB declined to purchase enough debt themselves in secondary markets which is their public position (although not their operational reality at present), why would they agree to a currency swap?

best wishes

bill

Aside: Can anyone point me towards any of Bill’s blogs which talk about Keynes’ attitude to surpluses/ balanced budgets. The story going around supply-side commentators is that Keynes believed in running surpluses in the good times. My understanding was that although he may have said that in his early work, he ultimately rejected this.

Can anyone help?

Bill wrote: “However, the substantive objection I have to Dean Baker’s proposal – which amounts to the US Federal Reserve selling US dollars in the foreign exchange market and buying Euros so that they could buy Eurozone government debt – is that it would almost certainly lead to a collapse in the US dollar collapse which would then have a range of consequences – some good (increased trade competitiveness) others bad (increased inflation).”

I thought that Bill believes that inflation only results from too many dollars pursuing too few goods, not a temporary price shock (currency deflation). He has written “It is also not inflation when the exchange rate falls pushing the price of imports up a step. So a depreciation in the currency does not constitute inflation. It might stimulate inflation but is not in itself inflation.”

Bill,

Three points;

I do not think Central bank intervention of this scale will crash the USD – According to the 2010 Triennial Central Bank Survey, coordinated by the Bank for International Settlements, average DAILY turnover in the global FX market was US$3.98 trillion in April 2010. I suspect a large proportion of this would be USD.

Secondly, unlike other open market operations which simply alter bank balance sheets, direct FX intervention by a central bank is “money printing” since there is a transition mechanism for the new money. Buyers of USD are typically private enterprises / individuals, so the newly created USD falls into the hands of the private sector.

So, if the Federal reserve sold the equivalent of 5% of US GDP in USD via the FX market, the monetary result would be the same as deficit spending by the Treasury. That is, money would be spent into existance, which could assist in alleviating the balance sheet recession in the US.

I think its a good idea – but for very different reasons than Dean Baker suggests.

CharlesJ: James Galbraith raised this point somewhere, noting that modern self-styled “Keynesians” say that surpluses should be run in the good times & attribute this view with absolute confidence to Keynes. But Galbraith notes they never say where Keynes said this. I’ll see if I can dig it up.

Dear GaryD (at 2011/11/30 at 14:07)

Good point. But note I said that deficits are flows not stocks. A once-off depreciation is not inflationary as long as the domestic economy wears the real income loss arising from the change in terms of trade (rise in import prices).

But funding growing European deficits for an extended duration which is what the policy proposal implies would suggest an on-going depreciation in the US dollar which would probably be inflationary. How much is questionable and

ultimately an empirical matter.

I hope that resolves what you think is an apparent contradiction.

best wishes

bill

Well, you’re certainly not going to get many readers to side with you- aside from your Uni acolytes by, calling Dean Baker a “so called” progressive.

If you have a case to make- OK then, then make it. But spare us juvenile commentary. All it does is make you look foolish- in addition to your sometimes insufferable long windedness.

Hard Keynesianism is basically a crock. Krugman subscribes to it because he is a debt hawk. He would be well served to review the following:

1817-1821: U. S. Federal Debt reduced 29%. Depression began 1819.

1823-1836: U. S. Federal Debt reduced 99%. Depression began 1837.

1852-1857: U. S. Federal Debt reduced 59%. Depression began 1857.

1867-1873: U. S. Federal Debt reduced 27%. Depression began 1873.

1880-1893: U. S. Federal Debt reduced 57%. Depression began 1893.

1920-1930: U. S. Federal Debt reduced 36%. Depression began 1929.

someguy:

Thanks, if you can find something I would appreciate it. If this is a myth, as I expect, it should be exposed.

CharlesJ : I may have seen it elsewhere, or not, but here is what Galbraith says in the comments to his article “Why not Keynes” :

The recommendation that government run a balanced budget “over the cycle” does not, so far as I know, come from Keynes.

I believe it originated as a recommendation of a moderate-liberal business group called the Committee for Economic Development in the 1950s.

The CED’s formula had a kind of rough-and-ready common sense that won it advocates for many years. But it became obsolete, at best, when the Bretton Woods gold-exchange system collapsed in 1971.

In an age when the rest of the world uses US Treasury bills and bonds as the principal reserve asset, the US has to run a budget deficit, even for the most part in good times, in order to accommodate them.

This has been the reality now for 40 years.

CharlesJ : Bill has a section Did Keynes advocate balanced budgets over the cycle? in Distorting history to appear progressive.

These were not Keynesian stimulus packages & Those bad Keynesians are to blame postpone or don’t address this point, but are good fun.

Thanks for your help Some Guy – really usefull.