The other day I was asked whether I was happy that the US President was…

There is a great sense of denial in Europe

Over the last week or so I have been in Europe and talking to all sorts of people. In the streets the decay is clear and I am in a relatively rich part of Europe (Maastricht). Unsold properties are multiplying and the there are lots of shopping space vacant in the main centres. It is very apparent to me but when I ask people about this some express surprise – not having noticed it themselves. I concede that when you come here once a year you note the changes but the reality is fairly stark. If we put this anecdotal evidence together with the way in which the Euro bosses are behaving and the overall quality of the policy debate in Europe at present it is clear to me that there is a great sense of denial in Europe. Nowhere is this more apparent than in Germany. Their growth model has failed and must change. But it will be very difficult to achieve the sort of national awareness that will render that change possible. The Eurozone was always going to fall apart as a result of its basic design flaws from its inception. But the German strategy – which they consider to be a source of national pride – actually ensured that once the basic design flaws were exposed by the collapse of aggregate demand, things would be much worse than otherwise.

There are so many narratives going on in Europe at the moment that it is taking time to keep track of all of them. Each day a new development seems to drown the controversy of yesterday. So today as I type (Friday, European time) the headlines are all about the ECB defiance of its German critics. This morning (September 16, 2011) the German “mass-market” Magazine – Bild – carried the article – What the hell happened to the guardians of the euro? – with this picture.

The red sub-title translates to “This ruin was once the proud European Central Bank.”

The story is about the new US dollar swap lines that the US Federal Reserve has set up to provide the European banks to quell any shortage of US dollars in the commercial banking system here. I will consider that development in a separate blog because it raises all sorts of questions – such as, why the hell is the ECB prepared to bail out banks but not countries – with what are effectively unlimited low-cost loans? Similarly, why is the US Federal Reserve prepared to proved unlimited US dollar credit lines to Europe with no firm collateral? The words “appease elites” creep in when I wonder about those questions and “damn the unemployed”.

Anyway, the topic for another blog.

The following Essay from the Centre for European Reform (published October 2010) – Why Germany is not a model for the eurozone – is interesting because it addresses the myths surrounding the German position in the current debate.

The Paper outlines a coherent case why the German model should be avoided. Recently, German Jürgen Stark resigned from the ECB executive board in a move that has been hailed as a German protest of the errant ways of the ECB. Stark is now touting his conservative ideas around Europe in a hope to undermine the central bank’s current interventions. If he succeeded and the ECB followed his advice then the Eurozone would collapse fairly quickly.

The Financial Times (September 16, 2011) – carried an article – ECB fires salvo at German critics – which argues that the ECB “has again shown its boldness as a crisis manager – just when German criticism of its unorthodox interventions has intensified”. The Bild picture above highlights the sentiment in Germany at present.

The dual moves by the ECB – “its unlimited provision of euro and dollar liquidity to eurozone banks” and the “ramped up its purchases of eurozone government bonds” have inflamed the German commentators.

Stark keeps making comments in the press since his departure about the need for fiscal discipline throughout the Eurozone and that “All measures that we take to end the financial and debt crisis in Europe should be orientated towards principles that ensure the long term economic stability of the eurozone.” The mainstream macroeconomic theory considers short-term fluctuations to be of no real importance because in the long-run as long as inflation is controlled, real GDP growth will be optimised and unemployment rate be at its natural rate. This is the neo-liberal fantasy.

The FT also quotes the Italian ECB executive board member, Lorenzo Bini Smaghi who has been critical of the German view. He is quoted as saying:

… we cannot hide behind principles and rules designed for a theoretical situation which no longer corresponds to the reality … [much of the German criticism is] … the result of inadequate economic analysis, of insufficient knowledge of the crisis in which we find ourselves and of anxiety resulting from experiences in the distant past that are not relevant to the current situation.

Bini Smaghi is no lover of government intervention. Please read my blog – Default is the way forward – for a critical analysis of his position in the current debate.

But his point is valid – the deficit terrorists have no grounding in reality. They apply ideologically-tainted models of La-La land which shares no characteristics with the monetary systems operating in the real world and come up with conclusions that are not even remotely applicable or of benefit to anyone but their elite mates. Further, they misrepresent actual trends and outcomes to suit their biased perspective.

The amount of misinformation that it circulating in the public debate about Germany and the other Euro nations beggars belief. We are led to believe that Germany alone has been hard working and frugal and have created a highly innovative and productive economy which underpins its trading superiority. We are also told that Greece is profligate, lazy and overpaid.

The Centre for European Reform (CER) paper provides some insights into these “myths”. It says that:

Since the onset of the global financial crisis in late 2007, previously much-vaunted economies – Ireland, Spain, the US and the UK among them – have been exposed as fools’ paradises built on reckless piles of private-sector debt. Germany, by contrast, looks to many observers to have been the very model of economic virtue.

The financial crisis has impacted badly on nations where the private sector carried huge debt burdens. Germany escaped the worst – or did it?

The CER paper certainly doesn’t think this image is correct and concludes that “an unreformed Germany would be a poor model for the eurozone as a whole. Germany is not the ‘world-beating’ economy of current legend”.

What is a more accurate story of Germany in the Eurozone?

The CER paper says that Germany’s “massive external surpluses … are not evidence of ‘competitiveness’, but symptoms of structural weaknesses”. How do they come up with that? The point is related to the current policy direction in the EMU where the external deficit member states (the southerners) are being pushed into a structural adjustment akin to what Germany imposed on itself in the early years of the Eurozone. The bias is towards Greece, Spain, Italy etc making huge adjustments to be more like Germany.

They are attempting to achieve this transition by savagely deflating these economies (wage cuts, demolishing working conditions, abandoning job security etc). The theory is that with the nominal exchange rate fixed, the only way that these nations can become export competitive is if they domestically-deflate, however painful that is proving to be.

Quite apart from the erroneous logic which is based on a fallacy of composition – that if all deflate they will export more – the policy push ignores the main culprit in the Eurozone disaster – Germany. The arrogance of the German politicians and press knows no bounds but a careful examination of the data reveals that Germany’s policy stance is one of the contributing factors in extending the crisis. This is not to say that the basic design flaws in the EMU are ultimately to blame and that the system is – in its current form – unworkable and unsustainable.

But within that basic design flaw, the conduct of the German leaders before the crisis set up the conditions where one the basic flaw was tested the resulting collapse would be worse than otherwise.

The reality of Germany is more like this:

1. Over the past decade there have been “extraordinary sacrifices” made by the German workers to ensure that the traded-goods sector would out-compete its EMU neighbours. Please read my blog – Doomed from the start – for more discussion on this point.

2. The “domestic economy remains chronically weak and in urgent need of reform”.

3. Germany is “structurally reliant on dis-saving abroad to grow at all”. The Greek current account deficits are required for German growth. It is the height of hypocrasy for Germans to berate the southern states for over-spending when that spending is the only thing that has allowed Germany’s economy to grow. It is also mindless for Germans to be advocating harsh austerity for the south states and hacking into their spending potential and not to think that it won’t reverberate back onto Germany.

In the blog – Doomed from the start – I discussed the Hartz reforms which were imposed on the German workers in the early years after the Euro was introduced. Germany pursued an aggressive low-wage strategy which hammered their workers to ensure that their export prices relative to the other EMU nations would be attractive.

The Germans have always been obsessed with its export competitiveness and in the period before the common currency they would let the Deutschmark do the adjustment for them. With that capacity gone in the EMU arrangement, they pursued another strategy which was to deflate labour costs not via high productivity growth but rather by punitive labour market deregulation.

But the Germans were aggressive in implementing their so-called “Hartz package of welfare reforms”. A few years ago we did a detailed study of the so-called Hartz reforms in the German labour market. One publicly available Working Paper is available describing some of that research.

The Hartz reforms were the exemplar of the neo-liberal approach to labour market deregulation. They were an integral part of the German government’s “Agenda 2010?. They are a set of recommendations into the German labour market resulting from a 2002 commission, presided by and named after Peter Hartz, a key executive from German car manufacturer Volkswagen.

The recommendations were fully endorsed by the Schroeder government and introduced in four trenches: Hartz I to IV. The reforms of Hartz I to Hartz III, took place in January 2003-2004, while Hartz IV began in January 2005. The reforms represent extremely far reaching in terms of the labour market policy that had been stable for several decades.

The Hartz process was broadly inline with reforms that have been pursued in other industrialised countries, following the OECD’s Job Study in 1994; a focus on supply side measures and privatisation of public employment agencies to reduce unemployment. The underlying claim was that unemployment was a supply-side problem rather than a systemic failure of the economy to produce enough jobs.

The reforms accelerated the casualisation of the labour market (so-called mini/midi jobs) and there was a sharp fall in regular employment after the introduction of the Hartz reforms.

The German approach had overtones of the old canard of a federal system – “smokestack chasing”. One of the problems that federal systems can encounter is disparate regional development (in states or sub-state regions). A typical issue that arose as countries engaged in the strong growth period after World War 2 was the tax and other concession that states in various countries offered business firms in return for location.

There is a large literature which shows how this practice not only undermines the welfare of other regions in the federal system but also compromise the position of the state doing the “chasing”.

In the current context, the way in which the Germans pursued the Hartz reforms not only meant that they were undermining the welfare of the other EMU nations but also drove the living standards of German workers down.

It was a vicious circle – they damaged their own workers standards of living and then relied on the spending of others (Greece etc) but were at the same time undermining the viability of the economies they were reliant on. Juxtapose that madness with the time-bomb that was ticking (the design flaw) and waiting for the first large negative aggregate demand shock to set it off, and you have the current situation in the EMU.

But we can dig deeper than this. The CER paper poses the question “Is Germany a ‘competitive’ economy?” and notes that “(o)ver the past decade, it is one of the rare members of the eurozone to have increased its share of world exports. It has also been running vast trade and current-account surpluses. Its current-account surplus, for example, peaked at a staggering 8 per cent of GDP in 2008 … it is the second largest surplus in the world after China’s”.

The issue is whether this performance reflects strength (as is the popular perception) or weakness.

First, the size of the external balance is not an indicator of productivity. The CER paper notes that relative to Germany, “labour productivity per hour worked is … higher in France – and it runs a current-account deficit”.

Second, German productivity growth is not out of kilter with general Eurozone otucomes over the last decade (it “has been around the eurozone average”.

The CER paper concludes that “Germany does not run external surpluses because it is a more efficient and dynamic economy than others”.

This research paper (published 2009) – Real Wages in Germany: Numerous Years of Decline – provides a good introduction to wage movements in Germany over the several decades.

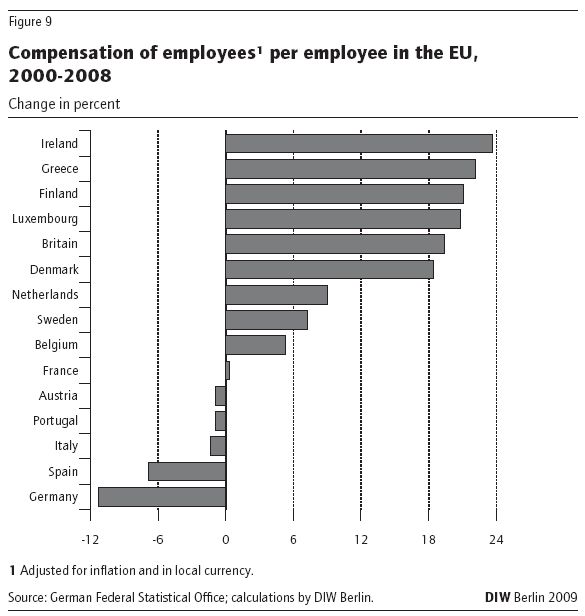

The following graph is a reproduction of their Figure 9 and shows the percentage change in real compensation of employees in the EU between 2000 and 2008. It is interesting that Spain, Portugal and Italy were also real wage cutters over this period.

The CER paper says that:

If German competitiveness reflects anything, it is the heroic discipline of the country’s workers, not the world-beating efficiency of its economy … With pay settlements systematically undershooting the rate of productivity growth, real unit labour costs (wages adjusted for productivity) fell consistently between 2001 and 2007.

Germany was one of the leaders in the rush to redistribute national income to profits and away from wages. Please read my blog – The origins of the economic crisis – for a general discussion on this point.

As I have noted regularly, one of the hallmark of the neo-liberal period has been the fall in the wage share in national income in most nations. I am working on a paper with Joan Muysken at present on this topic and tracing the redistributed income to the finance industry (we will unveil the research at the – 13th Path to Full Employment Conference/18th National Unemployment Conference (aka the CofFEE conference) – which will be held between December 7 and December 8. The Conference also serves as an annual Australian gathering of the Modern Monetary Theory (MMT) clan.

The systematic redistribution of income – aided and abetted by governments in a number of ways: privatisation; outsourcing; pernicious welfare-to-work and industrial relations legislation; etc to name just a few of the ways. – was been one of the building blocks of the crisis.

The problem that arises is if the output per unit of labour input (labour productivity) is rising so strongly yet the capacity to purchase (the real wage) is lagging badly behind – how does economic growth which relies on growth in spending sustain itself? This is especially significant in the context of the increasing fiscal drag coming from the public surpluses or stifled deficits which squeezed purchasing power in the private sector since over the last few decades.

In the past, the dilemma of capitalism was that the firms had to keep real wages growing in line with productivity to ensure that the consumption goods produced were sold. But in the lead up to the crisis, capital found a new way to accomplish this which allowed them to suppress real wages growth and pocket increasing shares of the national income produced as profits. Along the way, this munificence also manifested as the ridiculous executive pay deals and Wall Street gambling that we read about constantly over the last decade or so and ultimately blew up in our faces.

The trick was found in the rise of “financial engineering” which pushed ever increasing debt onto the household sector. The capitalists found that they could sustain purchasing power and receive a bonus along the way in the form of interest payments. This seemed to be a much better strategy than paying higher real wages.

The household sector, already squeezed for liquidity by the move to build increasing federal surpluses were enticed by the lower interest rates and the vehement marketing strategies of the financial engineers.

The financial planning industry fell prey to the urgency of capital to push as much debt as possible to as many people as possible to ensure the “profit gap” grew and the output was sold. And greed got the better of the industry as they sought to broaden the debt base. Riskier loans were created and eventually the relationship between capacity to pay and the size of the loan was stretched beyond any reasonable limit. This is the origins of the sub-prime crisis.

So the dynamic that got us into the crisis is present again and with fiscal austerity emerging as the key policy direction the welfare of our economies is severely threatened. This is a dramatic failure of government oversight.

In Germany’s case, they suppressed domestic spending and relied on the increasing indebtedness of other nations to keep their “export miracle” going.

The CER Paper notes that the punitive real wage cuts and redistribution of income to profits has led to a “marked decline in Germany’s real effective exchange rate” which:

… has been a central factor behind Germany’s rising share of world exports … Germany is not ‘supercompetitive’ because it is uniquely productive or dynamic. In some respects, the reverse is true. Germany, which accounts for over a quarter of eurozone GDP, has contributed only modestly to the region’s economic growth since 1999. For most of the period since the euro was launched, it is Germany that has slowed European growth – not the other way round.

To see this point more adequately, an examination of the sectoral balances for the EMU is helpful. The CER paper seeks to understand the “causes of Germany’s current-account” and notes that:

Germany has been running a current-account surplus because it has been saving more than it has been investing (or, which amounts to the same thing, because it has been spending less than it earns). The difference between Germany’s domestic rate of savings and investment (or income and expenditure) has flowed abroad as capital to fund countries that have been running current-account deficits (that is, where spending has exceeded income).

Regular readers will immediately relate this to the sectoral balances which tell us that: (a) a government deficit (surplus) equals a non-government surplus (deficit); and (b) an external surplus (deficit) equals a domestic deficit (surplus). Surpluses mean the relevant sector is spending less than they are earning and vice versa.

One of the tasks we are undertaking in the paper I mentioned above on wage share movements is to refute the claim that the rising profit share provided more real income for productive investment and this spawned stronger growth. The reality is that the investment ratios did not go up much (if at all) in nations with large redistributions from wages to profits.

The CER paper specifically notes that the “out-sized external surpluses that Germany has generated since 2000″ were the result of both sharp rises in domestic savings and been the product of a sharply rising saving rate and weak business investment spending at home”. In Germany, the investment ratio fell “from 21.5 per cent og GDP in 2000 to 17.4 per cent in 2005”.

They also note – in orthodox mode I should add – that the rise in the domestic saving had nothing to do with government “saving”:

… was not because the German government was being more fiscally virtuous than its EU counterparts. Between 2002 and 2005, in fact, the German government consistently posted budget deficits in excess of the 3 per cent limit laid down by the EU’s Stability and Growth Pact (during the same period, Spain was running largely balanced budgets).

In other words, most of the large external surpluses generated by Germany since 2000 was because of strong private domestic saving and low business investment (at home). There are various reasons for the strong private domestic saving but as the Hartz reforms started to undermine real pay and job security “uncertainty about future income and job prospects” grew which pushed up precautionary savings.

The upshot is that it “is deeply misleading, therefore, to look at Germany’s external surpluses through the prism of the country’s ‘competitiveness'”.

The CER Paper argues that with German households saving more each year because they are in fear of their future, and firms finding it “more attractive to invest abroad than at home” there is a drastic need for reform:

… a conclusion that is radically at odds with the now common view that improving ‘competitiveness’ in peripheral countries is all that is needed to reduce imbalances within the eurozone.

With the Germans are in denial about the way their government is ripping them off by (a) suppressing their real wages; and (b) exporting their real resources to other nations without commensurate return via imports, the national psyche is resistant to any talk of domestic reform.

But they appear to think that if all countries “live within their means” then there will be no problems. The problem is that Germans do not live within their means. They rely on other nations living (in their accounting logic) “beyond their means” for what little growth they achieve.

Germany’s mercantilist mind-set is characteristic of the surplus nations under the Bretton Woods system. Within that system, all the adjustment required to maintain exchange rate parities was forced on the external deficit nations in the form of domestic deflation and persistent unemployment. The fact that the surplus nations were deliberately suppressing the real standard of living of their own citizens was not as greater political issue as the unemployment and stagnation in the deficit nations.

The end result was that the political pressures in the deficit nations led to strategies (competitive devaluations etc) which ultimately brought the fixed exchange rate system down because it was unworkable.

Given the high containment of trading within the Eurozone, the same sort of pressures are clearly destroying the monetary union.

According to World Trade Organisation data, 72.1 per cent of European exports are intra. The share of European exports in world trade has been falling since the Eurozone began.

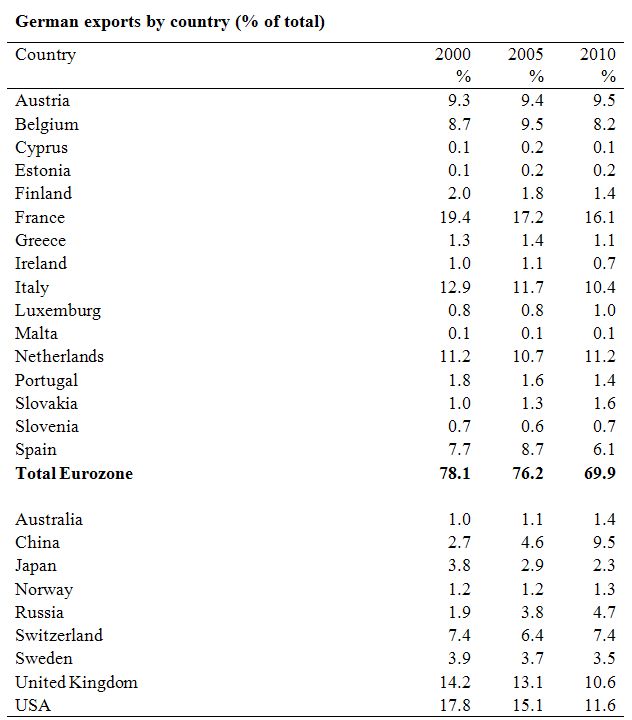

You have to go to the German Federal Statistical Office to get detailed export data. For my own purposes I did some analysis of the changing composition of German exports since the inception of the Eurozone and came up with this summary Table.

Exports to the Eurozone dominate the total – 78.1 per cent in 2000, 76.2 in 2005, falling to 69.9 by 2010 courtesy of the crisis as German exporters more than doubled their total value of exports to China between 2005 and 2010.

The point is clear – Germany might export high-quality manufactures which the rest of the world (particularly its Eurozone partners) enjoy and that is not the issue. The issue is that they have only been able to do that because other nations (especially the Eurozone nations) have been running current account deficits. It is thus odd that the popular German rhetoric is to kill the goose that laid the golden egg.

But moreover, what Europe (and the World) needs now – desperately – is increased aggregate demand. Greece needs it as much as Germany needs it. It is a falsehood to think the problem is that the Germans have their house in order and Greece needs to behave more like them. If that logic was carried through then German exports would fall as well.

If Greece left the Eurozone, then its “new” currency would clearly depreciate. How much is impossible to tell although the hysterical claims by the conservatives that it would drop to 1/6 of a 1:1 with the Euro is nonsensical. The German tourists would make sure that its downward spiral was resolved relatively quickly. I intend to write a blog about the implications of a Euro-exit sometime in the future.

But the point is relevant to the current blog. If the Germans paid their workers more appropriately – at least allowing real wages to track productivity growth – then the demand dynamics in the Eurozone would change dramatically. Germans would spend more on holidays and Greece is a desirable tourist destination. The impacts would be broader than this. As the CER Paper notes “stronger German demand would also have indirect effects (since a rise in German demand for, say, Dutch goods might later result in more visits by Dutch tourists to Greece)”.

The other reality that hasn’t sunk into the German brain is that as they try to shunt ever-increasing volumes of their real resources out of their country the rise in their real living standards has been very partial. The growth in income per capita has been modest over the last decade and towards the bottom of the EU nations. In other words, the export-led growth model hasn’t produced much economic growth per se, hasn’t done much for income per capita and has been associated with virtually zero growth in real wages for workers.

Who is benefiting? In each of the nations which have engineered a major redistribution of national income away from wages towards profits, it is the elites who have usurped what growth has been achieved.

The CER Paper notes another anomaly. The domestic savings in Germany have been pushed into foreign investments – in Greece, etc – and “supplied a sizeable share of the capital that funded housing booms and reckless spending binges” abroad. The speculative investments in failed real estate and construction in Ireland, Spain etc – do not look like very good uses of German savings. The on-going demolition of the southern economies, where a lot of German investment is at stake, will further undermine German returns.

Further, it is the German banks that have “huge exposures” to “poor quality foreign assets like US sub-prime securities or Greek government bonds are a result of the sheer volume of capital that Germany has been exporting”.

All of these impacts are intrinsic to the export-led growth model which is now unsustainable.

This BBC article (September 8, 2011) – German exports fall sharply in July – outlines the future for German if their insistence that the deficit nations pursue fiscal austerity is realised.

Conclusion

There are more aspects to this issue that I will deal with in future blogs. But the only way forward for the world economy is to stimulate aggregate demand. The high savings of Germans (and the Dutch for example) which then rely on the dis-saving of other nations to maintain some semblance of growth is not consistent with the way in which the Euro bosses are handling this crisis.

There is a great sense of denial here in Europe which I have picked up strongly over the last week. The dots are not being connected. Somehow analysts think that killing off Greece will help Germany maintain its export-led growth strategy.

That is enough for today!

Hi Bill,

Did you see this?

“What we found was that the impact of government expenditure shocks depends crucially on key country characteristics, such as the level of development, the exchange-rate regime, the country’s openness to trade, and public indebtedness. Specifically:

the output effect of an increase in government consumption is larger in industrial than in developing countries;

the fiscal multiplier is relatively large in economies operating under fixed exchange rates but zero in economies operating under flexible exchange rates;

fiscal multipliers in open economies are lower than in closed economies; and

fiscal multipliers in high-debt countries are zero.”

http://cep.lse.ac.uk/pubs/download/dp1016.pdf

“Greek Crisis Exacts the Cruelest Toll – Wall Street Journal

http://online.wsj.com/article/SB10001424053111904199404576538261061694524.html?mod=WSJ_hp_LEFTTopStories

“Two years into Greece’s debt crisis, its citizens are reeling from austerity measures imposed to prevent a government debt default that could cause havoc throughout Europe. The economic pain is the price Greece and Europe are paying to defend the euro, the center…

The most dramatic sign of Greece’s pain, however, is a surge in suicides.

Recorded suicides have roughly doubled since before the crisis to about six per 100,000 residents annually….About 40% more Greeks killed themselves in the first five months of this year than in the same period last year…

Suicide has also risen in much of the rest of Europe since the financial crisis began, according to a recent study published in the British medical journal The Lancet, which said Greece is among the hardest hit…”

One of many social consequences in times of crises, severe child batter rise and so on. The euro bosses and the rest of the troika are literarily walking on corpses in their attempt to persevere their beloved euro and European super state utopia project (and banksters). For utopian’s who want to create their version of paradise no sacrifice is to big then the utopia is so beautiful.

Taliban’s are utopian’s, also Saddam was utopian who had great plans for his state, no sacrifice was too big. We can only hope the American don’t get the idea that they should bomb the European utopian’s to obliteration.

Your German-exports table doesn’t add up, unless I’m missing something about the way the number are presented. The percentages sum to over 100%.

«Germany is “structurally reliant on dis-saving abroad to grow at all”. The Greek current account deficits are required for German growth.» «Germany might export high-quality manufactures which the rest of the world (particularly its Eurozone partners) enjoy and that is not the issue. The issue is that they have only been able to do that because other nations (especially the Eurozone nations) have been running current account deficits» «The domestic savings in Germany have been pushed into foreign investments – in Greece, etc – and “supplied a sizeable share of the capital that funded housing booms and reckless spending binges” abroad.»

All that can be summarized very easily with the concept of “vendor financing”: German banks have been encouraged by the government to finance German exports by doing unsecured lending to importer countries. As we have seen in other parts of the world “vendor financing” usually results in massive trouble as the vendors could not care less about loan quality, they only care about selling.

The German government is not stupid and they knew this day would come, so why have they done it? I suspect because the vendor financing of exports has resulted in better German accumulation of productive capital, better ability to pay for imports of commodities, and they hope that at least some of the vendor financing will be repaid.

As to your point that «but the only way forward for the world economy is to stimulate aggregate demand» only makes sense if there is no commodity bottleneck and resource cost push, because if there is, increased demand of commodities will result in accumulation of deflationary surpluses in commodity exporting countries, and that’s the so called petrodollar recycling problem all over again. And that’ difficult to solve, because it is a global change of terms of trade, not a mere monetary maladjustment (and those are bad news already).

If the German etc. actions make any sense, they have been targeted at the commodity supply issue. Germany want to make sure they can afford to outbid Greece for commodities, and that can be done in different ways, such as doing what they can to maintain export competitiveness.

Sometime I think that some countries may be quite deliberately pushing other countries into recessions to moderate global commodity prices, even if this will hurt their own exports.

There are several signs that the world economy is bumping on a commodity supply ceiling…

BTW, the most dramatic news of the year are these:

http://theenergycollective.com/ansorg/63481/saudi-arabia-s-nuclear-energy-ambitions

«The Kingdom of Saudi Arabia (KSA) plans to build 16 nuclear reactors over the next 20 years spending an estimated $7 billion on each plant.

The $112 billion investment, which includes capacity to become a regional exporter of electricity, will provide one-fifth of the Kingdom’s electricity for industrial and residential use and, critically, for desalinization of sea water.»

This passage below you are investigating in your new paper is the antidote to Bernanke’s “global savings glut” story. Not only did real wage growth fail to keep up with labor productivity growth – violating the neoclassical theories of income distribution based on marginalism – thereby yielding a sustained swing toward a rising profit share in developed market economies and an increasing reliance on falling gross household saving rates and household debt to maintain consumer spending growth, but the reinvestment rates of profits in tangible nonresidential capital in those countries fell as well (with the exception perhaps of the New Economy Bubble). So of course, once policymakers can no longer generate serial asset bubbles with monetary policy and once they run into self imposed or bond investor imposed constraints on fiscal policy, domestic private demand growth is piddling at best, chronic current account deficits are revealed, and the sucking sound of debt deflation is reaching everyone’s ears. The shift of income distribution to the profit share along with the falling reinvestment rate of profits is the key, it is deadly to economic growth, and it is tied into the control fraud and looting by insiders and financiers, all ostensibly in the name of liberalized capital markets and shareholder value uber alles. Would love to see an advance copy of the paper when it is in good enough shape. This is an important message to get out as the fiscal consolidations are proving less than expansionary, as originally advertised.

“One of the tasks we are undertaking in the paper I mentioned above on wage share movements is to refute the claim that the rising profit share provided more real income for productive investment and this spawned stronger growth. The reality is that the investment ratios did not go up much (if at all) in nations with large redistributions from wages to profits.”

Excellent article. The German exports table would have been even more revealing if you used the trade balance instead. That would show that countries like China are still in a large surplus position with Germany while Eurozone periphery states are some of the largest trade deficit partners for Germany (the rest being US, UK and Switzerland).

Just to be fair the article does make an omission. Labor productivity in manufacturing increased substantially in Germany during 2000 – 2008. What did not follow was productivity for the whole of the economy. That means that:

1) Domestic sectors did not follow the exporting manufacturing sector in productivity growth creating a ‘drag’ for the economy.

2) The gap between real wages and productivity in the manufacturing sector is even wider which allowed this export oriented sector to enjoy very large profits.

“But the only way forward for the world economy is to stimulate aggregate demand.” At current rates of resource consumption coupled with low recycling and toxic management, our current aggregate demand is unsustainable let alone feasible to increase beyond one-off economies. Not only do we need a new sustainable economic model, we need visionaries to transition the failing economic model in a world mosaic not prepared for such change.

@Kostas Kalevras

Ill guess that is according to “the plan”, squeeze an starve the domestic sector to create high unemployment and keep wages in general down and of course suppress import to create export surplus. This will keep export industry profits up. The domestic sector is usually the dominant sector for employment, if you want full employment the only reasonable way to do it is expanding the domestic sector. In advanced industry nations the export sector is producing more and more with less and less employed. Too believe that export sector could create full employment is simply unrealistic.

With the domestic sector on an anorectic diet different service sectors will be over crowded with desperate people whom try to escape the unemployment curse. And productivity will decline and prices not really being lower then more people shall share the possible revenue there is.

In moderns industry the labor cost could be maybe at the level of 10-15%, the ones that want to compete with lower wages have to be significantly lower if it should be any meaning to relocate. 2005 GM put up a fake contest between its Saab factory in Sweden and Opel in Germany to get an new production line of cars. Well the completion revealed that the wage cost in Germany was 30-50% higher, despite that the production did went to the new factory in Germany. So how much does Greece and others have to internal devalue to be “competitive”?

I became immediately suspicious when I read Centre for European Reform:

“The CER’s advisory board includes two former British ambassadors Lord Hannay and Lord Kerr as well as two past or present European Commissioners, António Vitorino and Pascal Lamy. Lord Robertson, former head of NATO, is also a board member.”

All experts in economics I guess. But thanks for the reminder that German workers with zeor wage growth should not bailout Irish and Greeks, who got their pension with 52. What a useless contribution to the Euro debate.

Are you one of the banksters Trojan horses Bill?

The key question is: What would happen if germany would pay higher wages to the workforce?

a) More Unemployment or b) More purchasing power of the workforce?

This depends on how countries like Greece will react: Will they buy domestic products OR will they now buy the products they have bought from germany from China or Japan?

In my opinion it is more important to talk about some basic concepts like “growth in the productivity in the service sectors” – well – what exactly is your idear? Shall the people in call centers talk faster? Or shall they clean faster? Or should we throw ower garbage on the streets to create new jobs?

Sorry to be so frank, but that mindset was the reason why UK and US have their problems. Let us face the truth. We have an Overproduction crisis. And it will get worse. And we have a linked crisis of “we dont need people without the wrong education”.

To be honest, the only sector that will be always in need of people is the scientific domunity. I mean real scientist not economists. That is not bad, that is the simple procuct of industrial growth and scientific growth.

The only problem we face, is the limit to our ressources. But btw germany has done its fair share to solve this problem by investing a lot of money in renewable energy. The feed in tarrif of germanys is one of the few intelligent things the politicans have done.

I’m sorry for my bad english, and i hope you will forgive my – wrong spelling and my rude tone. It’s a side effect of being german & bad in learning langugages. Would love to hear a feedback. Thanks.

Very good. Look forward to your paper with Muysken. That could be a game-changer.

Another great post.

Regarding:

“Quite apart from the erroneous logic which is based on a fallacy of competition…”

I’m pretty sure you meant ‘fallacy of *composition*’.

Cheers

«current rates of resource consumption coupled with low recycling and toxic management, our current aggregate demand is unsustainable let alone feasible to increase beyond one-off economies. Not only do we need a new sustainable economic model»

That’s unfortunately a fantasy for deeply rooted cultural reasons.

For the past few hundred years the way to MAKE MONEY FAST (which is the real definition of the American Dream) and become a big man has been to move west to America or in America, find some weak suckers (e.g. first nations, dark skins, brown skins, …), and take their assets and strip mine them faster than anybody else. It is the logic of the locust. Almost (because there is also the Yankee Production System, but that is rather less popular nowadays) the whole culture of the most powerful and culturally leading nation is based on taking someone else’s assets and strip mining them. Oil, water tables, rivers, agricultural land, buffalos, forests, all strip mined. More recently american elites have been strip mining middle class americans because their savings are the last of the Black Hills where gold is buried. Nearly everybody in the USA have been in a race to strip mine faster than everybody else. A large part of USA history has been in essence a conflict between ranchers/planters and farmers/workers; both have been into strip mining, the farmer side a bit less ferociously (farming is a more intensive activity, ranching a more extensive one), but still entirely short-sightedly.

Hundreds of years of cultural leadership based on ripping assets off suckers and strip mining them is very hard to reverse. It will take some big unpleasant change to reset cultural values about the primacy of asset stripping, including a loss of power for the elites who have based their primary on being the fastest asset strippers in the West.

Logik-Ratio,

Germany has very high levels of pension savings but refuses to run budged deficits to finance those. They are trying to run current account surpluses vis-a-vis other eurozone countries, which is a stupid idea because it just drives them bankrupt. Until this problem is solved that Germany either reduces it’s pension saving or somebody, like German government or some sort of EU fiscal authority runs deficits to finance them, there can be no recovery.

Bill

If real wages must grow in line with increasing labour productivity, and increased GNI should be shared ‘appropriately’ between wages and profit, what’s an ‘appropriate’ share for profit? And is there a way of expressing the optimal (average) rate of return on capital in a given economy?

It strikes me that if somebody could work this out it would be a useful benchmark.

Ta

Postkey says:

Wednesday, September 21, 2011 at 1:42

Hi Bill,

Did you see this?

I’d really like to see some commentary on the paper Postkey links to. One thing I noticed is that they excluded Japan from their sample. It also seems that they are discussing government spending, be it consumption or investment, but not net government spending.

I read a blog post by Richard Rahn using the paper to argue that stimulus doesn’t work, displaying a graph of employed % of civilian labor force versus government spending (again, not net spending) as a % of GDP over the last 30 years, showing that government spending is high when employment is low (duh).

I’ve also read some vehement criticism of their methodology and assumptions, mostly saying that they put a veneer of (apparent) mathematical rigor on top of an ideologically driven pseudo-analysis (and that, even then, the veneer wasn’t so great, even if the underlying assumptions and data set weren’t suspect.)

At any rate, I’d like to hear from some MMTers on this paper (especially bill).

Thanks.

Bill,

From your Summary Table one can understand that Germans would not accept that Greece’s or Ireland’s woes were caused by Germany. Exports to Greece only accounted for 1% of Germany’s exports.

France and Germany trade a lot. How to explain France’s near zero growth?

«trying to run current account surpluses vis-a-vis other eurozone countries, which is a stupid idea because it just drives them bankrupt. Until this problem is solved that Germany either reduces it’s pension saving or somebody, like German government or some sort of EU fiscal authority runs deficits to finance them»

I don’t like this reasoning because it is just a blind application of MMT as a set of accounting identities.

MMT has two roles: to unmask the ridiculous arguments often used by mainstream economists in their tireless propaganda work, and to actually help in understanding what’s going on. But MMT in the latter role is a bit limited, because vulgar MMT is just a set of ex-post accounting identities mostly as to monetary aggregates. What really matters in political economy is ex-ante decisions mostly as to real aggregates.

As to german pension, the fundamental issue is that if germans are “saving” massively, what they really aim at is to spend a period of their life consuming but not producing, and that means either to build either a set of assets they can draw down when they retire, or a set of claims on streams of value added. And these may be internal to Germany or in the rest of the world.

When you write «German government or some sort of EU fiscal authority runs deficits to finance them» you are basically arguing that German pensions should be financed by claims on future taxes collected by the German government or some EU fiscal authority. That’s one position.

The other position, that has happened so far, is that German pensions have been financed by Germans buying future claims against abroad (Greek, Irish, Portoguese) assets. Those selling those future claims have in effect decided that they had a relative scarcity of BMWs now and a future abundance of their own goods and services and assets, so they wanted to sell some of those future good and services and assets to get BMWs now. The German government has been encouraging German banks to buy assets abroad to finance the sales of those BMWs that German workers need to build in order to buy pension assets. The vendor financing was largely meant to build up German sales abroad to create pension assets abroad.

The complication is that the Greek etc. have never intended to make good on those vendor financing loans, and sell claims on a large chunk of their country so in the future hordes of beer swilling German pensions could retire to it. They wanted the BMWs and then “can’t pay won’t pay”.

Put another way, the Greeks know that if they default they blow up a good chunk of Germany’s pension system, and they know that talk of bailing out Greece is really about bailing out their creditor banks and suppliers and thus pension funds in Germany. They have read Keynes and his immortal principle that if you owe a bank a small debt you have a problem, but if it is a large debt the bank has a problem.

Just like the extraordinary flood of free money to USA banks in 2008-2009 was meant to bailout their creditors in the pension fund and life assurance industry, and not just to replenish the bonus pools of those banks.

So the question remains: where should BMWs be sold to create claims against future goods and services and assets so that the German workers now producing those BMWs can consume without producing in the future when retired? That is not an MMT question that has a facile answer based on ex-post accounting identities like «Germany either reduces it’s pension saving or somebody, like German government or some sort of EU fiscal authority runs deficits».

It is a big question about the real economy and lots of politics.

«an understand that Germans would not accept that Greece’s or Ireland’s woes were caused by Germany. Exports to Greece only accounted for 1% of Germany’s exports.»

That 1% is not the number that matters, for two reasons.

The positive and main reason is that 1% is just the direct exports. Germany exports a large amount of high value added intermediate parts and capital goods to other countries that then add a small bit of value added and export the lot to Greece. For example China: because the chinese value added proportion of chinese exports is fairly low (China exports shampoo) and a large chunk of the value added of Chinese exports is actually Japanese and German value added. In other words Japanese and German exporters “launder” their high value added exports via China just like they used to do the same with Korea and Taiwan.

The negative and important but secondary reason is a bit subtler. Yes, even counting indirect exports, German trade with Greece and German vendor financing to Greece are still not that large, because Greece is a much smaller country than Germany after all. But because German banks and other financial firms are insanely leveraged, even the smallish loans made to Greece represent a large chunk of their capital, and for many they are larger than that capital, therefore Greece defaulting runs a pretty good risk of blowing up the German financial and pension system.

Now the German financial system is heavily leveraged for the same reason why the USA financial system is also heavily leveraged: because everybody in-the-know knows that national financial systems are implicitly (and more recently explicitly) guaranteed by governments, as they are half-nationalized tools of industrial policy (more overtly in countries like Japan and China, less overtly but still pretty clearly so in others).

There is therefore a kind of tension, that bankers ruthlessly exploit to feather-bed their bonus pools, between financial systems being transmission belts for government industrial policy (in the USA it is asset price bubbles, in Germany is it export bubbles), and official pretence that those financial systems are formally independent and stand on their own.

The «great sense of denial» BillM is referring to is really about who the Germans are trying to bailout.

Blissex, what has happened has been that bunch of corrupt banksters have made liars loans to unqualified borrowers – loans that made no sense at all but beefed up their earnings at the build-up phase of the asset price bubble. And German financial people were complicit in this process financing these institutions. Liars loans, ponzi finance, and governments who tried to keep up aggregate demand were all feeding these current account deficits which were current account surpluses from Germany’s perspective.

When you have a situation where there is no currency issuer and all sectors of the economy – households, companies, government – go continuously deeper into debt to outsiders that just can’t last that long.

«bunch of corrupt banksters have made liars loans to unqualified borrowers» «liars loans, ponzi finance, and governments who tried to keep up aggregate demand»

Hey, that’s my line of argument: that there are real imbalances that have been “managed” and have eventually blown up. But I go further than that: the real problem is terms of trade, and the real medium-term consequences are against German pension and insurance funds.

That’s what people are in denial of, and talking about MMT exposes that, but the issue is not financial or monetary, it is in the real economy.

Overall my thesis is that most first-world economies that don’t export commodities have never come out of the 1980s recession, and all the «liars loans, ponzi finance, and governments who tried to keep up aggregate demand» have been attempts to mask that bad story and at the same time help speculators (or workers in China and Germany) with asset price bubbles (or export bubbles for China and Germany).

And if my impression that first-world economies are mostly still in recession since the 1980s, that’s the even bigger denial people are involved in.

I am amused by the idea that Greek etc. sovereign debt is liar loans. I can imagine a German banker negotiating Greek island mortgages with Kanotis Wontpayoupolous, Greek minister of borrowing and telling him “just put in this figure on the line ‘future export revenues’ or we can’t approve the form and I don’t get my bonus” and the minister asking “and if I double that number can I borrow twice as much?” and the German banker saying “yes, and strange but that’s also what your Portuguese and Irish colleagues asked me too”. :-). Right now the Germans are trying to foreclose on those Greek islands, and discovering that Greece is not only a non-recourse state, the local bailiffs are not too keen to carry it out.

Blissex wrote:

“As to german pension, the fundamental issue is that if germans are “saving” massively, what they really aim at is to spend a period of their life consuming but not producing, and that means either to build either a set of assets they can draw down when they retire, or a set of claims on streams of value added. And these may be internal to Germany or in the rest of the world.”

It seems me a strange strategy for a nation to secure the future flow of real wealth (goods and services) for their future retirees on “a set of claims of value added […] in the rest of the world”.

It is uncertain for any nation to secure the future flow of real wealth (goods and services) for their future retirees on “a set of claims of value added […]” by the nation’s future labor.

It seems me that such a strategy is more an invitation to “the rest of the world” to secure the *present* flow of real wealth (goods and services) for their *present* retirees on the products of the nation’s *present* labor.

Excellent article, which I’ve been forwarding on to everyone I know. I noticed tonight that Leigh Sales on 7:30 in discussing the Greek debt crisis and the path ahead for Europe persists in perpetuating the erroneous myth of German frugality and Greek laziness and profligacy. Perhaps they believe a simple narrative is needed; one which resonates with the audience. Certainly Sales and the interviewee, a women from the Financial Times in the UK repeatedly likened Greek debt to household or credit-card debt with the inference being that it would be outrageous for any portion of the Greek debt to be forgiven and would supposedly set a bad precedent, evidently ignorant of the history of debt forgiveness as standard practice throughout much of human history.

Truly I despair at the ignorance on display in the media, even in the more respected quarters. Surely it doesn’t too much too fact-check the predominate economic assumptions especially when they consistently get the call wrong? It was this personal realisation; that mainstream economics as practiced and preached bore no relationship to reality nor could it adequately predict the outcomes of decisions made based on its theories and assumptions which led me to seek out alternative explanations; leading me of course to this excellent blog.

Surely Bill you know someone in the ABC given your position, specifically involved with the 7:30 report who you could contact and set right on this? The narrative given by the media, not least the ABC on Greece, Germany and the sovereign debt crisis is straight out of the prayer-book of neo-classical economics. This needs to be challenged and I would strongly suggest to everyone reading this blog that they should forward this article and others to anyone with whom they discuss the European situation and who trots out the default position on Greece and Germany.