The other day I was asked whether I was happy that the US President was…

Beyond austerity

I stole the title of today’s blog from an article I wrote for the US weekly – The Nation – which will come out on April 4 in print. The on-line version is out now. It comes out in the same week that the nations that are leading the austerity charge – Ireland and Britain – publish disastrous labour market data. The Irish data is nothing short of atrocious some 2 years after their government led them down the austerity path promising salvation. Where are the economists who from the desks of their safe jobs were highly vocal in promoting the myth of the “fiscal contraction expansion”? Still sipping Chardonnay from their safe jobs I dare say. The article, in part, is about how these liars have convinced governments to push their economies over the brink. It is also about how the same lies that are being to used to justify the austerity barrow were used to justify the massive deregulation that led to the financial sector feeding frenzy and caused the crisis in the first place. When we will ever learn? In today’s blog I offer a video commentary on the thoughts behind the article in this blog (which as it turns out didn’t save me much time – I seem to type faster than I speak!).

Here is the front cover of today’s on-line edition of The Nation:

I was very happy to be invited to write for this publication and it might extend the coverage of the ideas that I push out into the world on a regular basis. Thanks to Don, Molly, Roane, and Lisa for all the help in getting it to press.

There was an accompanying piece – Sound Bites for a Sick Britain – written by Aditya Chakrabortty who is a columnist for the UK Guardian newspaper that is worth reading.

The article came out in the same week as the latest labour market data from Ireland and Britain was released. You will see practical evidence of what I am talking about in the article in that data.

Ireland was an early (and eager) austerity proponent – starting to cut in early 2009. We were told that things would be improving as a result of the public cutbacks because all those tax-fearing consumers and investors were poised ready to spend their savings – which were being earmarked to pay back the higher taxes that were going to be inevitably imposed to pay back the deficits.

This idiocy was all the rave as mainstream economists, public finance commentators all supported the Irish government’s manic decision to impose fiscal austerity on its near-ruined economy.

It was obvious what was going to happen – as plain as day. The denials were thick and fast from the conservatives. But you can only lie about data a few times – eventually as trends develop the penny has to drop. The performance of the Irish economy has gone from bad to worse since they imposed austerity.

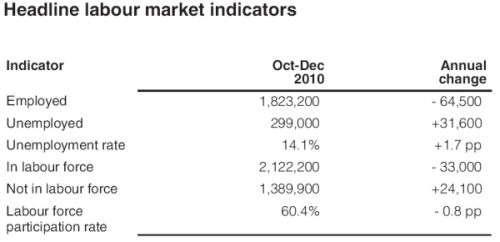

Most recently, on March 15, the Irish Central Statistical Office released the – Labour Force data – for the December 2010 quarter. There is no other word for the trends revealed – atrocious.

On UK Guardian report (March 16, 2010) – Growing dole queues expose fragility of Irish economy – actually had the audacity to suggest the further deterioration in the Irish labour market was a surprise.

The data outcome would only surprise an observer who didn’t understand macroeconomics and how the monetary system operates.

The following table is taken from the CSO Report.

The unemployment rate is now at 14.7 per cent the highest in 17 years.

In 2010, employment fell by 80,700 or 4.2 percent. This followed losses of 171,100 or 8.1 per cent between 2008 and 2009. 64,500 jobs were lost in December 2010 quarter alone and an additional 31,600 were added to unemployment queue in that quarter.

It is even more dire than that because the labour force is contracting as an estimated 1000 people a week are emigrating in search of work – a lot coming to Australia given how bad the British labour market is. The labour force participation rate is also falling.

You can quote all the financial data you like but the labour market data is about real people, their families, the aspirations of the next generation, and demonstrates that the Irish government has failed.

The recent election threw the perpetrators of the crisis in Ireland out but replaced them with a coalition that is just as bad in the sort of policies they are advocating. Ireland should leave the Eurozone immediately and re-establish their own currency and start using that power to get people back into work. If there isn’t enough private sector work at present then the public sector should start employing people and putting them onto socially useful projects.

The neo-liberal position – and the austerity push in general – has no credibility. We have to go beyond austerity and realise that the neo-liberal policy advice is based on a sequence of well-orchestrated lies!

The same goes for Britain which is now following Ireland down the plug hole. The austerity cuts are just about to hit and already the economy is heading backwards.

On Wednesday (March 16, 2011), the UK Office for National Statistics put out the – Labour Market Statistics – for March 2011.

Here is a sample:

The unemployment rate for the three months to January 2011 was 8.0 per cent, up 0.1 on the quarter. The total number of unemployed people increased by 27,000 over the quarter to reach 2.53 million, the highest figure since 1994. The unemployment rate for those aged from 16 to 24 increased by 0.8 on the quarter to reach 20.6 per cent, the highest figure since comparable records began in 1992. The number of unemployed 16 to 24 year olds increased by 30,000 on the quarter to reach 974,000, the highest figure since comparable records began in 1992. In

This will get worse …

In one word – atrocious. Surprised? Not at all.

Austerity damages private expectations (encouraging risk averse spending patterns and more saving) and directly reduces aggregate demand. The only thing that drives output, income and employment growth is spending!

So my The Nation article should be read with these trends firmly in mind. The neo-liberals and the bulk of my profession are liars and advocate policy positions that damage the opportunities for most of us.

Some Thoughts

I am thinking of doing a regular video commentary one day a week instead of writing. This 12-minute video was recorded using a pretty low quality camera/microphone so I plan to improve that side of it. But then I think I prefer writing – so we will see.

Saturday Quiz

The Saturday Quiz will be available some time tomorrow as usual.

That is enough for today!

Congratulations on getting your message out to a broader audience, this is very good to see.

I’m doing the little I can to help by talking to people in my little corner of the world.

If I dare to say so: I prefer writing. Not that I don’t want to see you ;~) Nice tie by the way. But it is more convenient for me. I can later look up things with a Google search on your site. I can copy & paste paragraphs into Evernote where I keep my notes. More generally I also do think video blogging reduces the audience. I know a lot of people who do divert some time at work to read stuff on the net. If it’s not excessive this diversion is tolerated by most employers. But you don’t want everybody to turn on the stereo and fire up youtube. Except of course you work at the SEC in a nice sound-proof office to enjoy some hot porn movies while supervising the financial world.

It will be interesting to see the online comments section for your story at the Nation. To quote one person already “Brilliant article. Best I have read in The Nation in years. Thank you. I learned a lot”. It seems that many people are going to be opened up to the realities of the monetary system for the first time!

It seems that every time you mention MMT and a sovereign government’s ability to spend, you point out that the spending must be conditioned on the ability to supply. My question is that when you point out that a sovereign government should run a budget deficit to stimulate the economy, shouldn’t you immediately say that the deficit should be directed to jobs instead of to fictional capital? After all, the deficit needs direction the same as the spending and taxes need to be adjusted for jobs and inflation. I know you are a supporter of job creation.

The reason I ask is because I read some blogs (not yours) where the commentators seem to think that it makes no difference where the deficits are aimed as long as there is a deficit. I think that idea caused many of them to advocate an extension of the Bush tax cuts, which seems to be saying that tax cuts that will be used mainly for speculation will help the economy.

Taking a cue from Bill’s pronouncement yesterday that “Printing money does not cause inflation”, I remind myself that “Printing useless prose does cause wastage”. I’m referring of course to the official document released by the EU, containing the Conclusions of the Heads of State or Government of the Euro Area, dated 11 March 2011.

http://www.consilium.europa.eu/uedocs/cms_Data/docs/pressdata/en/ec/119809.pdf

An excellent article in every way. I hope it helps to move the debate among American progressives in a better direction. Here (in Wisconsin), people are on fire to recall Republicans and roll back the worst abuses of the Walker regime. But most folks are still in thrall to the deficit hysteria in spite of that. The fact that the unions capitulated on economic give-backs is considered honorable and civic-minded. Our most well-intentioned public liberals repeat neoliberal mantras at every turn. Nominally socialist Bernie Sanders is as shrill as any Republican in bemoaning the “mountain of debt” we are “leaving to our grandchildren”. Congressman Dennis Kucinich, than whom no liberal is more so, recently became sufficiently bemused to call for a return to – the gold standard.

We have so far to go. But, thanks again, Bill, for a great contribution.

Very good Bill!

I am one of those who read at work, so I prefer writing, by far. I also prefer the articles where you expose theory, with equations and graphs (I am a physics PhD), and I tend to skip the rants (although I agree with them for the most part), and you can only do rants on TV so I think I will be skipping these.

Great article, I hope you do more!

Congratulations on your circle of cheeleaders. But seriously, ‘professor of economics’, while it may be imperically true that deficits in and of themselves do not cause inflation, and it’s also true that no government which controls its own money supply will ever “run out of money”, your central arugument that ‘none of this really matters’, is reprehensible.

Fortunately (for you) in Australia you may not suffer the consequences of my government’s policies (both democrat & republican), but I suppose that’s ‘par for the course’ when it comes to prgressives looking out for the working classes.

Did you catch the statement by French Finance Minister Christine Lagarde about how Europe could “help” Japan by buying its bonds?

Interesting how all the comments (so far) at The Nation are positive. It’s getting a lot of tweets, too. Previous experience publishing this stuff in left-leaning media (though The Nation does well more than lean, of course) has not always been good–we get skewered in HuffPo, for instance, unless Jamie’s the author (which in itself is rather interesting).

That’s great!!

Don, Molly, Roane, and Lisa, thank you for your efforts!!

The report indicates that the construction sector accounts for 40% of the overall employment drop, and 50% of the male employment drop. A Michael Lewis article (http://www.vanityfair.com/business/features/2011/03/michael-lewis-ireland-201103?currentPage=2) indicates that a fifth of the country was employed in construction, and it was 25% of GDP.

We definitely want to get people back to work, but is it fair to say that they should not be going back into construction, which no longer seems socially useful?

Still unclear how one can keep spending if there’s no money. Surely you have dug yourself into a hole whereby austerity is the only thing you *can* do. At some point, you surely have to get control of your finances. This article and video clip did not do anything to explain why this view is not correct.

Austerity proponents didn’t lie.

They reckon that things will get worse in the short run but claim they will improve in the long run.

So far they’ve been right in the short run. 😉

But calling then liars is just a lie.

Woo hoo!

Ricardian Equivalence, Say’s law, Loanable-funds, money multipliers, exogenously determined money supplys…and so on.

How the hell is that not telling lies ?

Don’t EU nations have to use austerity since they can print or spend?

I spoke too soon. Darn.

That video thing is a great idea, I’m sure it will get a major breakthrough the day Australians pick up English as a common spoken second language. 😉

Dear Scott,

The fact that there are negative comments only means that people started reading the article. Nothing more. Somebody needs to engage these people in a discussion and carefully debunk their arguments using simple examples and avoiding jargon. Even when this happens, the success rate might be quite low. Please be aware that economics and finance are considered extremely boring or dodgy for the most of the normal (average) people but almost everyone has strong views about these issues and thinks that he/she is an expert. These who are familiar with basic concepts might have been brainwashed thoroughly enough to make them unable to think outside of the box. Of course some of the commentators may be trolls but their presence is the price which has to be paid for freedom of speech.

My main concern is still that “rediscovering” the lost principles of functional finance may lead to morphing of neo-conservatives into outright fascists trying to restore the old glory of the Global Empire. But I may understand very little about America as I have never lived there…

Scott: I spoke too soon. Darn.

Exactly the wrong way of looking at it. If you only get agreement, you are uselessly preaching to the choir. One MMTer outnumbers a thousand mainstreamers.

Adam(ak):Mostly ditto. My main concern is still that “rediscovering” the lost principles of functional finance may lead to morphing of neo-conservatives into outright fascists trying to restore the old glory of the Global Empire.

Enough neocons – including Cheney, G W Bush, Laffer know Functional Finance perfectly well, and have already morphed. That’s the problem in the US – either sane economics is used for insane ends, or people allow insane economics to fool them into thinking sane ends are unattainable.

Srah:Still unclear how one can keep spending if there’s no money. Surely you have dug yourself into a hole whereby austerity is the only thing you *can* do. At some point, you surely have to get control of your finances.

But there IS money. It was invented in the Middle East about 6000 years ago. We’re just getting the hang of how it works now, although I suspect there is a cuneiform tablet buried somewhere explaining MMT.

All money is created by “printing” it, by just saying “here’s an IOU”. Governments go through lots of stupid human tricks to disguise this fact, but that how it works. Unless we run out of paper for bills and checks, metal for coins, wood for tally sticks, mud for shubati or electrons for computers, it will never be true that austerity will be the only thing we can do.

Getting control of finances is what MMT is all about. (Functional finance (=MMT) founder Abba Lerner’s first book was the Economics of Control(1944) ). The government should allow the private economy, ordinary people to control their finances, and not starve them of the money, the government IOUs that the gov has an infinite supply of, which they need to survive.

Dear Tim (at 2011/03/19 at 1:22)

Getting beyond your spelling errors, if it is empirically true then how can it matter? What is reprehensible about it? Your comment only just made it through – please consult the comments policy. You need to tell us all why stating empirical facts is reprehensible. Perhaps you think it is reprehensible to bring home to you facts that injure your ideological position.

best wishes

bill

AK and Some Guy,

All true. don’t read too much into my comment there. I’ve been on the front lines of engaging with others on these issues as long as anyone.

Bill,

you rock!

Bill, nice video; interesting and timely article for The Nation.

Also, thanks to Ben Kennedy for the link to Michael Lewis’s story in Vanity Fair:

(‘A Michael Lewis article (http://www.vanityfair.com/business/features/2011/03/michael-lewis-ireland-201103?currentPage=2) indicates that a fifth of the country was employed in construction, and it was 25% of GDP.’)

This description of the consequences of having a country run by selfish ignorant elites is illuminating as regards its illustration of the cultural attitudes which prevent the EU from evolving into a unified political organization which might theoretically have the power to control the ECB; however, Lewis’s style makes for a very amusing story.

Congratulations, Bill! I really got a kick out of seeing you get into The Nation. I thought the article was terrific and commented on it at Warren’s: http://moslereconomics.com/2011/03/18/guest-on-reuters-insider/#comments

In addition, I did a promotional post at these sites:

http://www.correntewire.com/bill_mitchell_austerity_war

http://my.firedoglake.com/letsgetitdone/2011/03/18/bill-mitchell-on-the-austerity-war/#

http://www.ourfuture.org/blog-entry/2011031118/bill-mitchell-austerity-war

and:

http://www.dailykos.com/story/2011/03/18/957903/-Bill-Mitchell-on-the-Austerity-War#comments

Now, I’m going over to The Nation to support you there, and will try to encourage others from the 4 sites to do so as well.

Nice job, as always, Joe!

Tim,

What makes you think the government controls the money supply ? MMT have never made that claim and for good reason. The money supply is endogenously determined.

For what little it is worth Bill, I didn’t think there was anything at all wrong with the sound.

Like the others though I prefer the written word.

Bill – I really enjoyed your article in The Nation and posted about it (and Krugman’s latest column) on MacroBusiness.

Naturally it has generated quite a bit of debate!

http://macrobusiness.com.au/2011/03/questioning-the-wisdom-of-austerity/

Cheers

Like Joe I usually repost these blogs on forums, where deficit hawks prevail:

politicalpanic.com

libertynewsforum.com

Any who care to join and assist please do!

Also read the book called “The Tipping Point” by Malcom Gladwell to learn how to spread ideas!

Something as important as MMT needs marketing!!!

JP Hochbaum

I dropped in at politicalpanic.com for a look following your comment above.

I read some of the commentary on your MMT thread.

You deserve a medal. You stayed on message, and kept it polite and civilsed.

I doubt your antagonist “spacemonkey” will ever get it, but what a useful tool he/she is…asking all those, ahem, “beginners” questions on behalf of others too timid to ask.

bravo, prof. mitchell!

this is all getting boringly repetitive

here’s a very effective commercial: http://joshspector.com/2011/02/13/now-this-is-a-great-commercial/?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+JoshSpector+%28JoshSpector.com%29

MMT needs at least one commercial of this quality & nature – that supercedes tactical trivia & compellingly drives home a unifying vision;

a concept can be developed for free; once envisioned, we can explore how to execute it (a student competition?)

In the meantime, wanna see something that might make you puke, but also motivating? from the Budgie-Tears group

NAF CRFB Video Contest, Compilation http://www.youtube.com/watch?v=A7CWoP2e3hU

In January and February 2011, the Committee for a Responsible Federal Budget launched a fiscal video contest for people across the county to [show how easily deluded they are]

it’s so bad, it will work on many but backfire for some (or gods have mercy on us)

we should make at least one opposing video featuring Bill Mitchell’s TINA, the person who always thinks there is no alternative;

or at least call for a competition for sentient people everywhere to submit videos supporting exploration of group options?

TINA and protagonists through the ages

10K BC – can’t wrestle mastodons!! (uh, run ’em off cliffs?)

5k BC – can’t carry enough water!!1 (uh … dig irrigation canals?)

…

1776 AD – not enough nails to build houses!!! (uh … use pegs? 🙂 )

1933 – not enough gold to allow us to denominate all we want to DO!!!!! Aauuuugh!! (uh … go fiat?)

1971 – not enough US gold to give to all other nations!! (uh … go COMPLETELY fiat?)

2010 – not enough brains in US Congress to make gov work!!!!! [Tina’s got us pegged now! 🙂 ] (uh … vote?)

contact me if you’d like to help organize an initial anti-TINA video competition; Bill knows how (for a few, serious people)