The other day I was asked whether I was happy that the US President was…

Making profit from lies – isn’t that illegal?

I recall from my days studying law that there were express terms and implied warranties underpinning every contract. The express terms were those agreed between the parties. The implied terms were binding even if they were not discussed between the parties to the sale or deal. I recall that among the usual implied terms were things like quality of the materials used and fitness of purpose. If a product or service is not sold where the seller knows the materials to be of poor quality or will not perform the functions that are held out to the buyer then a civil claim is open in tort to negate the contract and pursue damages. Anyway there are a number of private sector organisations out there that pump out so-called expert economic and financial analysis for profits that if you actually understand the product would lead you to conclude they are fraudulent products and not fit for the purpose that is held out. The ratings agencies (which threatened Japan again this week) fall into that category. But there are others. Today I consider the so-called Fiscal Risk index put out by a British firm that claims that the austerity campaign being pursued by the British government is helping it reduce its risk of bankruptcy. That is an outright lie! I thought that selling dodgy goods and services was illegal.

I was thinking about that when I read the latest Fiscal Risk 2011 which is produced by a firm of so-called “global analysts” Maplecroft. The firm seems to be obsessed with risk and have some GIS (Graphical Information Systems) tools (that is, they can map data). They clearly construct indexes using statistical tools and public data although I am not in a position to know what techniques they use to determine specific ratings.

I am very experienced at assembling risk indicators and in using GIS. For example, see our Employment Vulnerability Index – which has proven to be very accurate in its descriptive capacity. The problem with compiling these indexes which are typically composite scores using principle components or some other regression-based technique is that it is easy to get output but it has to have meaning. You cannot just throw a number of data time series into a statistical or econometric software package and expect there to be meaning. Meaning comes from judgement and understanding.

But I don’t need to know the specific algorithms that the company behind the Fiscal Risk indicator use to know that the whole exercise is a waste of time from the perspective of providing quality information and knowledge. Clearly, it is not a waste of time for the company who makes money from its (mislead) subscriber database.

But I wondered whether if the subscribers were better educated that they would know that this indicator is based on lies about the way the monetary system operates.

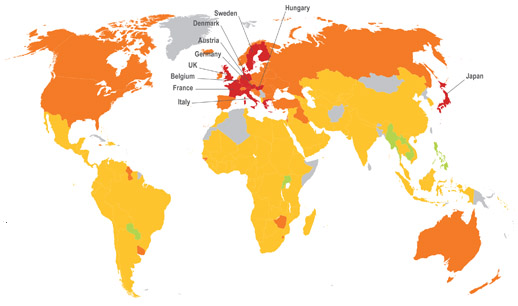

So what is all this about? Consider the following map which Maplecroft says it is representation of fiscal risk 2011. Get the picture? Red, orange and yellow bad in descending order. Lots of Red and orange. Almost the whole world is red or orange. Get the lifeboats out!

The Press release that accompanies the map says that the highest risk ratings arise because:

ageing populations, substantial levels of debt and high public spending on health and pensions.

So the usual lies which I discuss in more detail below.

They then say that the the “Fiscal Risk Index”:

… identifies countries that will come under increasing economic pressure in future years due to low birth rates, high life expectancy and state commitments to look after ageing populations.

So Quiz Question 1: notice the slippage here?

Economic pressure does not equal fiscal risk. That is a major misconception in this whole debate. We have to be very precise in our terminologuy and our conceptual demarcation when discussing these things.

It is clear that a rising dependency ratio and longer lives will present economic challenges in terms of maintaining growth in material standards of living. The major challenge is in terms of being able to achieve sufficient productivity growth – which relates to technology, work-practices, and skill development.

There is no hint that nations which adequately invest in public infrastructure – such as education and training, R&D etc – and maintain high levels of employment will not be able to achieve a desired productivity growth.

If they cannot then it is not the end of the world – we will have to revise our concept of a standard of living and take more walks along the beach!

The current challenge is in the poorer nations which typically have young populations – finding enough food to feed the children.

None of these challenges is a “fiscal challenge”. The national governments who are sovereign in their own currencies will be able to invest in the future productivity of their workforces if they have the political will to do so. The reality is that most governments are now willing to allow unemployment to remain at persistently high levels because they are deluded into thinking that austerity is the path to riches and are thus failing to invest in the future.

Leaving around 25 per cent of your youth idle (not in school or working) as Australia is doing at present is a total abrogation of the responsibility of our governments to help us ease the economic strains of an ageing population.

Also note in the quote above that “state commitments to look after ageing populations” are not an economic pressure unless you are intending to outline a scenario that says that says that there will be a declining food and housing stock. But even then we are largely talking about political choices.

Maplecroft also says:

Europe is home to 11 out of the twelve countries rated ‘extreme risk.’ These include: Italy (1), Belgium (2), France (3), Sweden (4), Germany (5), Hungary (6), Denmark (7), Austria (8), United Kingdom (10), Finland (11) and Greece (12). Japan (9) is the only other country in the highest risk category.

So Quiz Question 2: notice the error in reasoning here?

Lets all say it together – you cannot conflate monetary systems which have different characteristics particularly in relation to the opportunities and risks pertaining to the government (and especially when one monetary system (EMU) renders a government non-sovereign).

There is no valid comparison based on an understanding of the way these monetary systems work between France and Japan or Greece and the UK. Zero! Japan and the UK are fully sovereign and have no fiscal risk in the sense that they are exposed to possible debt default. All the EMU nations face significant fiscal risk because they do not issue their own currency.

The Maplecroft press release claims:

Fiscal sustainability is commonly seen as being the government’s responsibility to prudently manage public income and expenditure, ensuring it can honour future payments … However, in high risk countries, it is increasingly likely that the private sector will be called upon to contribute in the form of pensions and private healthcare. This could prove vital in preserving productivity in an ageing workforce and reducing government liabilities in the future.

That is the neo-liberal argument based on the wrongful assumption that sovereign governments are financially constrained and a confusion between a real cost and a budget outlay.

Fiscal sustainability has nothing to do with the capacity to “honour future payments”. Please read my suite of blogs – Fiscal sustainability 101 – Part 1 – Fiscal sustainability 101 – Part 2 – Fiscal sustainability 101 – Part 3 – for more discussion on this concept.

The other problem with their conception is this. The constraints that societies face in terms of making economic decisions relate to the availability of real resources to meet the nominal demands expressed in the market place. If there is a shortage of titanium then neither the government nor the private sector will be able to provide as many hip replacements that are demanded. But if there is titanium available in the market then the government will be able to purchase it whenever it wants.

The decision to purchase it will be political – that is, who provides hip replacements? The public, private or both sectors!

As to pensions – the government will always be able to honour its pension payments. A simple click of the keyboard to credit the bank accounts of the recipients is all that will take. The question will be whether the nominal pension entitlements (which the government can always provide) will purchase the things the pensioners desire. That is not a fiscal issue but once again relates to the availability of real resources.

You see how mindless Maplecroft are when they claim that:

Without significant adjustments, such as raising taxes or reducing spending, countries risk going bankrupt. One such adjustment has already been seen in the UK and Germany where recent government initiatives have increased the state pension age to encourage people to work for longer as a way to alleviate pressure on public finances.

So agents for austerity!

The British government can never go bankrupt in its own currency. To suggest otherwise is a lie. To sell that information for profit is a fraud. The product is does not satisfy fitness for purpose.

More worrying to me was when I read the UK Guardian article (February 23, 2011) – Britain rated ‘extreme’ fiscal risk because of ageing population and debt – which seemed on the face of it to be presenting bad news.

Upon further inspection, the article’s substance was about as worrying as “policeman rescues cat stuck up tree”.

The main worry was the fact that the UK Guardian has reduced its journalistic standards by uncritically reiterating the nonsense pumped out by a commercially-oriented firm who is pushing a “product” onto unsuspecting consumers.

The first question I would ask is whether this product is fit for purpose? The UK Guardian, instead, just repeats the propaganda provided by the company and puts a British interest on it with the headline “Britain is now one of 12 nations rated ‘extreme risk’ in the Fiscal Risk Index”.

I found that disturbing to say the least. Doesn’t the journalist know how to ask questions? Like – upon what basis can you claim that Britain is in danger of default when it issues its own currency?.

Instead, the Guardian says:

The UK’s ageing population and huge debt have propelled it into the top 10 of countries threatened by unsustainable public finances, new research has found.

When is research credible? That is the first question you have to ask before you start publicising the results.

If I was writing that article for the Guardian my opening line would have been something like this – “So-called experts lie for profit by claiming the British government is in danger of sovereign debt default”.

The Guardian claims that the compilers of the fiscal index:

Maplecroft highlighted the UK’s soaring government debt, up from 43% of GDP in 2006 to 77% in 2010, and relatively low number of over-65s in the workforce – only 7.71% compared with an average of 28% across all the countries surveyed.

The more relevant thing to highlight about Britain over that period was the plunging real GDP growth rate and the resulting labour market malaise that followed. Further, the public debt didn’t rise far enough as a consequence of the inadequate fiscal intervention by the national government.

Further, tying in demographic change with fiscal risk is not sensible. The British government is fully sovereign in its currency and will always be able to provide pensions and health care etc if such care is available for sale.

Whether a nation can afford first-class health care depends only on the real resources that are available. Britain can clearly afford that level of care for all of its citizens at this stage. There is never a financial constraint on the national government (where it is sovereign) from providing that level of health care. Subject to real resource availability, the only issue then is political.

The idea that the public fiscal position has to “seek savings” to make fund future spending (on pensions, health care and other programs) is a fundamental misconception that is often rehearsed in the financial and popular media.

This misconception has been driving the so-called intergenerational (ageing population) debate where governments are being pressured to run surpluses to pay for the retirement of baby boomers and the growing healthcare costs for them as they age further.

Modern Monetary Theory (MMT) demonstrates categorically that public surpluses do not create a cache of money that can be spent later. Currency-issuing governments spend by crediting bank accounts. There is no revenue constraint on this act. Government cheques don’t bounce!

Additionally, taxation consists of debiting a bank account. The funds debited are ‘accounted for’ but don’t actually ‘go anywhere’ nor ‘accumulate anywhere’.

The concept of pre-funding future liabilities does apply to fixed exchange rate regimes, as sufficient reserves must be held to facilitate guaranteed conversion features of the currency. It also applies to non-government users of a currency. Their ability to spend is a function of their revenues and reserves of that currency.

In fact, the pursuit of budget surpluses by a sovereign government as a means of accumulating ‘future public spending capacity’ is not only without standing but also likely to undermine the capacity of the economy to provide the resources that may be necessary in the future to provide real goods and services of a particular composition desirable to an ageing or sick population.

By achieving and maintaining full employment via appropriate levels of net spending (deficits) the Government would be providing the best basis for growth in real goods and services in the future. In a fully employed economy, the intergenerational spending decisions on pensions and health come down to political choices sometimes constrained by real resource availability, but in no case constrained by monetary issues, either now or in the future.

All governments should aim to maintain an efficient and effective medical health system. Clearly the real health care system matters by which we mean the resources that are employed to deliver the health care services and the research that is done by universities and elsewhere to improve our future health prospects. So real facilities and real know how define the essence of an effective health care system.

Clearly maximising employment and output in each period is a necessary condition for long-term growth. It is important then to encourage high labour force participation rates and maintain job opportunities for older workers. There is a strong correlation between unemployment and health problems.

Anything that has a positive impact on the dependency ratio is desirable and the best thing for that is ensuring that there is a job available for all those who desire to work.

But this is about political choices rather than government finances.

The ability of government to provide necessary goods and services to the non-government sector, in particular, those goods that the private sector may under-provide is independent of government finance. Any attempt to link the two via erroneous concepts of fiscal policy ‘discipline’, will not increase per capita GDP growth in the longer term.

The reality is that fiscal drag that accompanies such ‘discipline’ reduces growth in aggregate demand and private disposable incomes, which can be measured by the foregone output that results. Fiscal austerity does help low inflation because it acts as a deflationary force relying on sustained excess capacity and unemployment to keep prices under control. Fiscal discipline is also claimed to increase national savings but this equals reduced non-government savings, which arguably is the relevant measure to focus upon.

Please read my blogs – Democracy, accountability and more intergenerational nonsense and Another intergenerational report – another waste of time – for more discussion on this point.

The UK Guardian also chose to uncritically quote the CEO of Maplecroft who said:

At the very least, governments will need the private sector to recruit and retain older workers and provide for more generous pension arrangements.

I love the use of the term “at the very least” as if the worst you can imagine is just the beginning.

In a mixed economy, the government always requires some private employment (by definition). So what? The record of the private sector in providing enough hours of work (and job opportunities per se) over the last 30 years is not good. How do we know that? Entrenched unemployment and rising underemployment – they are facts that tell us something interesting as opposed to rising public debt ratios.

But it would be a political choice not a “need” for the government to push more pension responsibilities onto the private sector. A society could function perfectly well with a 100 per cent public superannuation (pension) scheme. In fact, I have always advocated a national superannuation scheme to do away with the corrupt, management-fee seeking private firms.

The reality is that over the last 10 odd years the private superannuation industry in Australia has provided lower returns than if we had all held the same funds in cash. Please read my blog – Eliminating the great superannuation rip off – for more discussion on this point.

The point is that a society can choose the private-public mix of everything – as a political decision. There is no financial urgency for governments to abandon or reduce or defray their public pension obligations.

List of Academic Economists in Germany that you should not study under

189 German economists have voted to support a petition to the German government which calls on it to oppose any further Eurozone bailouts and demands the German government intervene to prevent any further expansion of the rescue fund. For German readers – the original site and voting is HERE.

An English summary is outlined in this article – The plenum of German economists on the European debt crisis.

The German economists claim that when one of the member states has a liquidity problem – meaning they cannot cover their deficits through private borrowing (given the financial constraints on government that are intrinsic to the flawed design of the EMU) – they

… must then be considered insolvent.

Okay, so they then default and bring the French and German banks down with them. Then what?

The Germans think that if you have a rescue fund then it “would give over-indebted countries a powerful incentive to repeat the mistakes of the past and to continue a policy of indebtedness at the expense of their EU partners”.

My response: probably which is why the only solution is to abandon the concept of individual member states and install one fiscal authority (not a likely option) or abandon the EMU and reinstate currency sovereignty at the individual member state level which also carries with it the implication that sovereign states are responsible for all liabilities in their own currency themselves.

It also means that the bond markets would lose any traction on any individual member state. The Greek and Irish governments could spend what they liked (subject to the constraints of real resource availability) and take the consequences if they pursued poor policy options. Which is the way it should be in a democracy. The people elect the state to act on their behalf. They do not elect the ECB or the EU bosses in Brussels who are clearly not acting on behalf (that is, in the best interests) of the people in the member states.

The Germans want the private bond markets to have more control on member states – forcing them to bear some of the loss should a state default which would then mean “that the bonds of over-indebted states will be traded with appropriate risk premiums that will counter a further increase in the national debt much more effectively than political controls or the threat of sanctions are able to achieve.”

Yes, the bond markets will then screw those nations and fiscal policy would become unworkable. It is a stupid option for an member state to agree to.

The Germans talk about “over-indebtedness” among member states of the EMU. That construction has effect only because the nations are not sovereign in their own currencies. I find it odd that economists would first advocate placing nations in a straitjacket where they are prone to default risk at any time (as in the EMU framework) then suggesting that when any particular nation gets into strife they just default and start again.

The intent clearly is to limit fiscal policy and with it typically entrench unemployment and loss of public services. Placing rules on fiscal policy limits its flexibility and effectiveness when responding to a crisis.

You also learn that they want to scorch the domestic economies of those member states that are forced into debt default. They say:

Finally, a key question is how after a concluded debt rescheduling procedure an over-indebted state can regain its competitiveness. Since the Eurozone does not allow nominal devaluations, international competitiveness can only be restored by means of structural reforms in the affected states. The IMF has extensive experience in this area and can also provide technical and administrative assistance, for example in the area of tax administration. Nevertheless, recessionary reactions to structural adjustments will not be completely avoidable.

The phrase “the IMF has extensive experience in this area” reminds me of those thriller movies where a captive is being interrogated by some evil oppressors who claim in a chilling and menacing voice “we have ways to make you talk”!

The problem is that the IMF does torture nations with their structural adjustment packages. They cause poverty, unemployment, suicide, death from malnutrition and crime and more.

The way to international competitiveness – if that matters – is to ensure the currency floats on international currency markets. That requires the abolition of the EMU and the reinstatement of individual sovereign currencies. The well-being of the domestic economy should never be held to ransom by the external sector. That is not to say that the latter doesn’t influence the former. Clearly it does. But domestic policy has to target domestic goals and not be dominated by external fluctuations. That is what a flexible exchange rate is for.

I guess what the exercise provides us with is a LIST of academic economists in Germany (189 in all) who signed the petition and who you would never want to study economics under. I am adding their institutions to the list to boycott. Has anyone kept track of all the places we have blacklisted to date? (-:

Conclusion

Anyway, I wonder if the purchasers of this fiscal index information from Maplecroft know that it is built on lies and has no fitness of purpose. I wonder why they choose to pay for a product that is unfit to inform about the probability of sovereign debt default.

I put this product in the same league as all the other dodgy products for sale that appear on TV between the hours of midnight and dawn and typically have no use or function at all but promise the world.

Making profit from lies – isn’t that illegal?

Saturday Quiz

The Saturday Quiz will be back sometime tomorrow for your interest.

That is enough for today!

There’s such a huge volume of fraudulent and deceitful information in the ether I wouldn’t know where to start prosecuting.

I love the idea of taking some of these people to court. Let them squirm in front of an audience and show their naked lies.

Bill, what academics and degree level institutions would you recommend in the UK?

I thought “making profit by lies” was the prescriptive definition of profit.

The entire capitalist system is reliant on making people pay far above cost for all goods and services. Profit is the cream for the property owners and rent for the rentiers. The biggest irony is that the so called “wealth generators” are in fact the least productive segment of society. How absurd their claims to deserve preferential tax reductions.

Totally unrelated but I just watched last weeks episode of ‘real-time with Bill Maher’ and they spent most of the show talking about how to reduce the deficit. Even the liberal Bill Maher wants to cut social security and medicare because cutting the deficit is the main priority. This is crazy. I used to like watching his show but it annoys me too much now.

I discovered MMT through a bunch of internet searches because I constantly had 2 questions nagging at me (thank you Bill and Randy). The first was “why do government deficits have to be paid back?” and the second was “If money is created out of nothing by the government, how could they ever run out of it?”. Why don’t democrats, who are supposed to be about all about helping the little guy, have these same questions?

I’m really frustrated after watching that show.

Bill Maher makes a ton of money. He is afraid of being taxed and would rather cut spending.

Someone send him Warren’s book to straighten him out and help him over his neoliberal tendencies.

“Why don’t democrats, who are supposed to be about all about helping the little guy, have these same questions?”

Because they are no longer about helping the little guy, any more than Labour is in the UK. They have both been bought off and are dependent on the corporate teat for their survival.

And he who pays the piper calls the tune. So you get the same tune from all political parties. It’s just the arrangement that is slightly different.

Richard Cooper: “Even the liberal Bill Maher wants to cut social security and medicare because cutting the deficit is the main priority.”

Tom Hickey: “Bill Maher makes a ton of money. He is afraid of being taxed and would rather cut spending.

Someone send him Warren’s book to straighten him out and help him over his neoliberal tendencies.”

Maher is a libertarian (with a small “l” I am pretty sure). He is quite happy to be taxed, and opposed extending tax cuts for the rich, but he has bought the line about cutting the budget. Someone should send him Warren’s book.

Richard Cooper:

“Why don’t democrats, who are supposed to be about all about helping the little guy, have these same questions?”

I think that history has something to do with it. William Jennings Bryan lost. The Dems accepted the cross of gold as a fact. Also, there is a fiscally conservative strain in the Democratic Party that goes back to Andrew Jackson, they only President to pay off the national debt. (It was a campaign promise.) Clinton and Obama are in that camp. More recently, as social programs have come under fire from the Reps, the Dems have defended them by saying that they pay for themselves. Like Social Security. That’s why a lot of them are unhappy with the payroll tax holiday, because it breaks the link. They think that if the electorate think of Social Security as a form of welfare, they may vote against it. (They may have a point, I don’t know.)

Min, why is the deficit, and the SS shortfall a problem for people that think it is a problem? The big reason its a problem is Barro/Ricarcdian cognitive bias; people with money to be taxed figure that taxes will have to rise eventually to reduce the deficit and pay down debt. Now people like Maher may not realize what is going on subliminally, so that speak out two side of their mouths, betraying their neoliberal tendencies. These people are called “Volvo liberals,” “latté liberals,” and “redwood deck environmentalists.” Obummer is another one of them.

The other “reason” is cutting SS, Medicare, etc. now so we don’t have to cut them later – which is just crazy. This is the kind of dumb thinking that Maher makes fun of other people for.

Dumb thinking indeed. I’d really like to know whether they are lying or just haven’t thought through the mechanics of monetary operations. I find it really hard to believe that people like Bill Maher and Jon Stewart (who both advocate higher taxes for the rich) are deliberately misleading the public, but I can’t help but wonder. You’d think someone would have explained how the system works to them by now. On the other hand, it’s possible that people have tried and they just didn’t listen. That’s been my experience if MMT ever comes up in conversation. People usually get defensive and think I’m completely nuts.

It’s a bit like the fundamental errors the Robin Hood tax etc are making about taxes…

http://robinhoodtax.org/

They probably have models in their heads where government borrows from banks, and banks can shut down the government. Hey, it happened in Greece, right?

Will, the Robinhood tax is not a bad idea if one doesn’t think that government should be funding savings at the top. It’s basically a tax on economic rent as unearned and unproductive gains. Here it’s like a windfall profits tax, where the windfall was government stepping into save the financial sector to prevent widespread collapse. Why should the people that caused the collapse profit from the rescue? This and more needs to be clawed back through taxes and fines, and the worst of the lot should be put in the pokey to boot.

I think the argument should be straight up and honest: the rich need to be taxed not because the gov needs their money but because it is vital that the rich are less rich. The rich getting richer does make real and damaging distortions to the economy and to social fabric. Gifted engineers (who could be solving pressing technological problems) have their talents wasted by being co-opted into wealth management. That would not happen if excess wealth was taxed away (ie ablated).

Germany should look at the its private sector debt situation before lecturing others. Striving for low government deficits it has forced the private sector into a deficit. In fact, the German private sector is more indebted than the Greek.

@Tom,

Can I get an email address from you I want to forward you something MMT relevant? matt_franko@mac.com

Resp,