Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

Saturday Quiz – November 13, 2010 – answers and discussion

Here are the answers with discussion for yesterday’s quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of modern monetary theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

By increasing tax rates a sovereign government increases its capacity to spend more without increasing inflation.

The answer is True.

This question seeks to tempt the reader to follow a logic such that – Modern Monetary Theory (MMT) shows that taxpayers do fund anything and sovereign governments are never revenue-constrained because they are the monopoly issuers of the currency in use. Therefore, the government can spend whatever it likes irrespective of the level of taxation. Therefore the answer is false.

But, that logic while correct for the most part ignores the underlying role of taxation.

In a fiat monetary system the currency has no intrinsic worth. Further the government has no intrinsic financial constraint. Once we realise that government spending is not revenue-constrained then we have to analyse the functions of taxation in a different light. The starting point of this new understanding is that taxation functions to promote offers from private individuals to government of goods and services in return for the necessary funds to extinguish the tax liabilities.

In this way, it is clear that the imposition of taxes creates unemployment (people seeking paid work) in the non-government sector and allows a transfer of real goods and services from the non-government to the government sector, which in turn, facilitates the government’s economic and social program.

The crucial point is that the funds necessary to pay the tax liabilities are provided to the non-government sector by government spending. Accordingly, government spending provides the paid work which eliminates the unemployment created by the taxes.

This train of logic also explains why mass unemployment arises. It is the introduction of State Money (government taxing and spending) into a non-monetary economics that raises the spectre of involuntary unemployment. For aggregate output to be sold, total spending must equal total income (whether actual income generated in production is fully spent or not each period). Involuntary unemployment is idle labour offered for sale with no buyers at current prices (wages).

Unemployment occurs when the private sector, in aggregate, desires to earn the monetary unit of account, but doesn’t desire to spend all it earns, other things equal. As a result, involuntary inventory accumulation among sellers of goods and services translates into decreased output and employment. In this situation, nominal (or real) wage cuts per se do not clear the labour market, unless those cuts somehow eliminate the private sector desire to net save, and thereby increase spending.

The purpose of State Money is for the government to move real resources from private to public domain. It does so by first levying a tax, which creates a notional demand for its currency of issue. To obtain funds needed to pay taxes and net save, non-government agents offer real goods and services for sale in exchange for the needed units of the currency. This includes, of-course, the offer of labour by the unemployed. The obvious conclusion is that unemployment occurs when net government spending is too low to accommodate the need to pay taxes and the desire to net save.

This analysis also sets the limits on government spending. It is clear that government spending has to be sufficient to allow taxes to be paid. In addition, net government spending is required to meet the private desire to save (accumulate net financial assets). From the previous paragraph it is also clear that if the Government doesn’t spend enough to cover taxes and desire to save the manifestation of this deficiency will be unemployment.

Keynesians have used the term demand-deficient unemployment. In our conception, the basis of this deficiency is at all times inadequate net government spending, given the private spending decisions in force at any particular time.

Accordingly, the concept of fiscal sustainability does not entertain notions that the continuous deficits required to finance non-government net saving desires in the currency of issue will ultimately require high taxes. Taxes in the future might be higher or lower or unchanged. These movements have nothing to do with “funding” government spending.

To understand how taxes are used to attenuate demand please read this blog – Functional finance and modern monetary theory.

So to make the point clear – the taxes do not fund the spending. They free up space for the spending to occur in a non-inflationary environment.

You might say that this only applies at full employment where there are no free resources and so taxation has to take those resources off the non-government sector in order for the government to spend more. That would also be a true statement.

But it doesn’t negate the overall truth of the main proposition.

Further, you might say that governments can spend whenever they like. That is also true but if it just kept spending the growth in nominal demand would outstrip real capacity and inflation would certainly result. So in that regard, this would not be a sensible strategy and is excluded as a reasonable proposition.

The point is that the statement is never false.

The following blogs may be of further interest to you:

- A modern monetary theory lullaby

- Functional finance and modern monetary theory

- Deficit spending 101 – Part 1

- Deficit spending 101 – Part 2

- Deficit spending 101 – Part 3

- Taxpayers do not fund anything

Question 2:

Ignoring any reserve requirements, if the central bank pays a positive interest rate on overnight reserves then it no longer has to conduct open market operations to ensure its policy rate is sustained.

The answer is Maybe.

The first question starts with a test of basic understandings of how monetary policy is implemented in a modern monetary economy. Contrary to the account of monetary policy in mainstream macroeconomics textbooks, which tries to tell students that monetary policy describes the processes by which the central bank determines “the total amount of money in existence or to alter that amount”.

In Mankiw’s Principles of Economics (Chapter 27 First Edition) he say that the central bank has “two related jobs”. The first is to “regulate the banks and ensure the health of the financial system” and the second “and more important job”:

… is to control the quantity of money that is made available to the economy, called the money supply. Decisions by policymakers concerning the money supply constitute monetary policy (emphasis in original).

How does the mainstream see the central bank accomplishing this task? Mankiw says:

Fed’s primary tool is open-market operations – the purchase and sale of U.S government bonds … If the FOMC decides to increase the money supply, the Fed creates dollars and uses them buy government bonds from the public in the nation’s bond markets. After the purchase, these dollars are in the hands of the public. Thus an open market purchase of bonds by the Fed increases the money supply. Conversely, if the FOMC decides to decrease the money supply, the Fed sells government bonds from its portfolio to the public in the nation’s bond markets. After the sale, the dollars it receives for the bonds are out of the hands of the public. Thus an open market sale of bonds by the Fed decreases the money supply.

This description of the way the central bank interacts with the banking system and the wider economy is totally false. The reality is that monetary policy is focused on determining the value of a short-term interest rate. Central banks cannot control the money supply. To some extent these ideas were a residual of the commodity money systems where the central bank could clearly control the stock of gold, for example. But in a credit money system, this ability to control the stock of “money” is undermined by the demand for credit.

The theory of endogenous money is central to the horizontal analysis in Modern Monetary Theory (MMT). When we talk about endogenous money we are referring to the outcomes that are arrived at after market participants respond to their own market prospects and central bank policy settings and make decisions about the liquid assets they will hold (deposits) and new liquid assets they will seek (loans).

The essential idea is that the “money supply” in an “entrepreneurial economy” is demand-determined – as the demand for credit expands so does the money supply.

As credit is repaid the money supply shrinks. These flows are going on all the time and the stock measure we choose to call the money supply, say M3 (Currency plus bank current deposits of the private non-bank sector plus all other bank deposits from the private non-bank sector) is just an arbitrary reflection of the credit circuit.

So the supply of money is determined endogenously by the level of GDP, which means it is a dynamic (rather than a static) concept.

Central banks clearly do not determine the volume of deposits held each day. These arise from decisions by commercial banks to make loans. The central bank can determine the price of “money” by setting the interest rate on bank reserves. Further expanding the monetary base (bank reserves) as we have argued in recent blogs – Building bank reserves will not expand credit and Building bank reserves is not inflationary – does not lead to an expansion of credit.

With this background in mind, the question is specifically about the dynamics of bank reserves which are used to satisfy any imposed reserve requirements and facilitate the payments system. These dynamics have a direct bearing on monetary policy settings. Given that the dynamics of the reserves can undermine the desired monetary policy stance (as summarised by the policy interest rate setting), the central banks have to engage in liquidity management operations.

What are these liquidity management operations?

Well you first need to appreciate what reserve balances are.

The New York Federal Reserve Bank’s paper – Divorcing Money from Monetary Policy said that:

… reserve balances are used to make interbank payments; thus, they serve as the final form of settlement for a vast array of transactions. The quantity of reserves needed for payment purposes typically far exceeds the quantity consistent with the central bank’s desired interest rate. As a result, central banks must perform a balancing act, drastically increasing the supply of reserves during the day for payment purposes through the provision of daylight reserves (also called daylight credit) and then shrinking the supply back at the end of the day to be consistent with the desired market interest rate.

So the central bank must ensure that all private cheques (that are funded) clear and other interbank transactions occur smoothly as part of its role of maintaining financial stability. But, equally, it must also maintain the bank reserves in aggregate at a level that is consistent with its target policy setting given the relationship between the two.

So operating factors link the level of reserves to the monetary policy setting under certain circumstances. These circumstances require that the return on “excess” reserves held by the banks is below the monetary policy target rate. In addition to setting a lending rate (discount rate), the central bank also sets a support rate which is paid on commercial bank reserves held by the central bank.

Many countries (such as Australia and Canada) maintain a default return on surplus reserve accounts (for example, the Reserve Bank of Australia pays a default return equal to 25 basis points less than the overnight rate on surplus Exchange Settlement accounts). Other countries like the US and Japan have historically offered a zero return on reserves which means persistent excess liquidity would drive the short-term interest rate to zero.

The support rate effectively becomes the interest-rate floor for the economy. If the short-run or operational target interest rate, which represents the current monetary policy stance, is set by the central bank between the discount and support rate. This effectively creates a corridor or a spread within which the short-term interest rates can fluctuate with liquidity variability. It is this spread that the central bank manages in its daily operations.

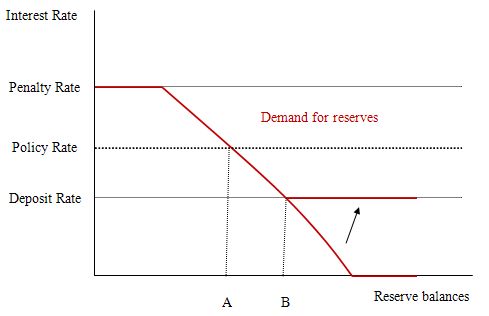

So the issue then becomes – at what level should the support rate be set? To answer that question, I reproduce a version of teh diagram from the FRBNY paper which outlined a simple model of the way in which reserves are manipulated by the central bank as part of its liquidity management operations designed to implement a specific monetary policy target (policy interest rate setting).

I describe the FRBNY model in detail in the blog – Understanding central bank operations so I won’t repeat that explanation.

The penalty rate is the rate the central bank charges for loans to banks to cover shortages of reserves. If the interbank rate is at the penalty rate then the banks will be indifferent as to where they access reserves from so the demand curve is horizontal (shown in red).

Once the price of reserves falls below the penalty rate, banks will then demand reserves according to their requirments (the legal and the perceived). The higher the market rate of interest, the higher is the opportunity cost of holding reserves and hence the lower will be the demand. As rates fall, the opportunity costs fall and the demand for reserves increases. But in all cases, banks will only seek to hold (in aggregate) the levels consistent with their requirements.

At low interest rates (say zero) banks will hold the legally-required reserves plus a buffer that ensures there is no risk of falling short during the operation of the payments system.

Commercial banks choose to hold reserves to ensure they can meet all their obligations with respect to the clearing house (payments) system. Because there is considerable uncertainty (for example, late-day payment flows after the interbank market has closed), a bank may find itself short of reserves. Depending on the circumstances, it may choose to keep a buffer stock of reserves just to meet these contingencies.

So central bank reserves are intrinsic to the payments system where a mass of interbank claims are resolved by manipulating the reserve balances that the banks hold at the central bank. This process has some expectational regularity on a day-to-day basis but stochastic (uncertain) demands for payments also occur which means that banks will hold surplus reserves to avoid paying any penalty arising from having reserve deficiencies at the end of the day (or accounting period).

To understand what is going on not that the diagram is representing the system-wide demand for bank reserves where the horizontal axis measures the total quantity of reserve balances held by banks while the vertical axis measures the market interest rate for overnight loans of these balances

In this diagram there are no required reserves (to simplify matters). We also initially, abstract from the deposit rate for the time being to understand what role it plays if we introduce it.

Without the deposit rate, the central bank has to ensure that it supplies enough reserves to meet demand while still maintaining its policy rate (the monetary policy setting.

So the model can demonstrate that the market rate of interest will be determined by the central bank supply of reserves. So the level of reserves supplied by the central bank supply brings the market rate of interest into line with the policy target rate.

At the supply level shown as Point A, the central bank can hit its monetary policy target rate of interest given the banks’ demand for aggregate reserves. So the central bank announces its target rate then undertakes monetary operations (liquidity management operations) to set the supply of reserves to this target level.

So contrary to what Mankiw’s textbook tells students the reality is that monetary policy is about changing the supply of reserves in such a way that the market rate is equal to the policy rate.

The central bank uses open market operations to manipulate the reserve level and so must be buying and selling government debt to add or drain reserves from the banking system in line with its policy target.

If there are excess reserves in the system and the central bank didn’t intervene then the market rate would drop towards zero and the central bank would lose control over its target rate (that is, monetary policy would be compromised).

As explained in the blog – Understanding central bank operations – the introduction of a support rate payment (deposit rate) whereby the central bank pays the member banks a return on reserves held overnight changes things considerably.

It clearly can – under certain circumstances – eliminate the need for any open-market operations to manage the volume of bank reserves.

In terms of the diagram, the major impact of the deposit rate is to lift the rate at which the demand curve becomes horizontal (as depicted by the new horizontal red segment moving up via the arrow).

This policy change allows the banks to earn overnight interest on their excess reserve holdings and becomes the minimum market interest rate and defines the lower bound of the corridor within which the market rate can fluctuate without central bank intervention.

So in this diagram, the market interest rate is still set by the supply of reserves (given the demand for reserves) and so the central bank still has to manage reserves appropriately to ensure it can hit its policy target. If there are excess reserves in the system in this case, and the central bank didn’t intervene, then the market rate will drop to the support rate (at Point B).

So if the central bank wants to maintain control over its target rate it can either set a support rate below the desired policy rate (as in Australia) and then use open market operations to ensure the reserve supply is consistent with Point A or set the support (deposit) rate equal to the target policy rate.

The answer to the question is thus maybe because it all depends on where the support rate is set. Only if it set equal to the policy rate will there be no need for the central bank to manage liquidity via open market operations.

The following blogs may be of further interest to you:

- Understanding central bank operations

- Building bank reserves will not expand credit

- Building bank reserves is not inflationary

Question 3:

Ignoring any reserve requirements, the payment of a positive return on overnight reserves held by the commercial banks equal to the current policy rate will tend increase the overall level of reserves held by the latter.

The answer is True.

This question was clearly related to the Question 2 and so some of the essential information required to understand the answer here is presented there.

The payment of a positive return on overnight reserves equal to the current policy rate will significantly reduce interbank activity. Why? Because the banks will not have to worry about earning non-competitive returns on excess reserves. When there are excess reserves in the system, which means the level of reserves is beyond that desired by the banks for clearing purposes, the banks which hold excesses seek to lend them out on the interbank (overnight) market.

In the absence of a support rate (positive return on overnight reserves) and any central bank liquidity management operations (open market purchases in this case), the competition in the interbank market will drive the market rate of interest down to zero on overnight funds. It should be noted that these transactions between the banks will not eliminate a system-wide excess reserve situation.

The competition will redistribute the excess between banks but will not eliminate it. A vertical transaction between the government and non-government sectors is the only way such an excess can be eliminated.

Please see the suite of blogs – Deficit spending 101 – Part 1 – Deficit spending 101 – Part 2 – Deficit spending 101 – Part 3 – for a detailed explanation of the difference between vertical transactions (between the government and non-government sectors) and horizontal transactions (between non-government entities).

Clearly, the central bank loses control of its monetary policy setting in this case (unless the target is a zero short-term interest rate) unless it steps in and eliminates the excess reserves by selling government debt to the banks. This provides the banks with an interest-bearing financial asset in exchange for the zero-interest bearing reserves.

Once the central bank offers a support rate the situation changes If the support rate on overnight reserves is set equal to the current policy rate then the banks have no incentive to engage in interbank lending. Some banks may still seek overnight funds in the interbank market if they are short of reserves but in general activity in that market will be significantly reduced.

Further, the opportunity cost of holding excess reserves is eliminated and so the banks have less need to minimise their holdings of reserve balance each day.

Any bank with reserves in excess of their short-term perceived clearing house requirements will still earn the market rate of interest on them.

As a consequence, the incentive to lend these funds is substantially reduced. Banks would only participate in interbank market if the rate they could lend at was above the market rate and below the central bank penalty rate.

So in this case, banks will tend to hold more reserves than otherwise to make absolutely sure they never need to access the discount window offered by the central bank which carries the penalty.

The following blogs may be of further interest to you:

- Understanding central bank operations

- Building bank reserves will not expand credit

- Building bank reserves is not inflationary

Question 4:

Other things equal, larger fiscal deficits as a percentage of GDP squeeze the availability of real resources that the private sector can use for other productive uses.

The answer is True.

It is clear that at any point in time, there are finite real resources available for production. New resources can be discovered, produced and the old stock spread better via education and productivity growth. The aim of production is to use these real resources to produce goods and services that people want either via private or public provision.

So by definition any sectoral claim (via spending) on the real resources reduces the availability for other users. There is always an opportunity cost involved in real terms when one component of spending increases relative to another.

Unless you subscribe to the extreme end of mainstream economics which espouses concepts such as 100 per cent crowding out via financial markets and/or

Ricardian equivalence consumption effects, you will conclude that rising net public spending as percentage of GDP will add to aggregate demand and as long as the economy can produce more real goods and services in response, this increase in public demand will be met with increased public access to real goods and services.

You might also wonder whether it matters if the economy is already at full capacity. Under these conditions a rising public share of GDP must squeeze real usage by the non-government sector which might also drive inflation as the economy tries to siphon of the incompatible nominal demands on final real output.

You might say that the deficits might rise as a percentage of GDP as a result of a decline in private spending triggering the automatic stabilisers which would suggest many idle resources. That is clearly possible but doesn’t alter the fact that the public claims on the total resources available have risen.

Under these circumstances the opportunity costs involved are very low because of the excess capacity. The question really seeks to detect whether you have been able to distinguish between the financial crowding out myth that is found in all the mainstream macroeconomics textbooks and concepts of real crowding out.

The normal presentation of the crowding out hypothesis which is a central plank in the mainstream economics attack on government fiscal intervention is more accurately called “financial crowding out”.

At the heart of this conception is the theory of loanable funds, which is a aggregate construction of the way financial markets are meant to work in mainstream macroeconomic thinking. The original conception was designed to explain how aggregate demand could never fall short of aggregate supply because interest rate adjustments would always bring investment and saving into equality.

At the heart of this erroneous hypothesis is a flawed viewed of financial markets. The so-called loanable funds market is constructed by the mainstream economists as serving to mediate saving and investment via interest rate variations.

This is pre-Keynesian thinking and was a central part of the so-called classical model where perfectly flexible prices delivered self-adjusting, market-clearing aggregate markets at all times. If consumption fell, then saving would rise and this would not lead to an oversupply of goods because investment (capital goods production) would rise in proportion with saving. So while the composition of output might change (workers would be shifted between the consumption goods sector to the capital goods sector), a full employment equilibrium was always maintained as long as price flexibility was not impeded. The interest rate became the vehicle to mediate saving and investment to ensure that there was never any gluts.

So saving (supply of funds) is conceived of as a positive function of the real interest rate because rising rates increase the opportunity cost of current consumption and thus encourage saving. Investment (demand for funds) declines with the interest rate because the costs of funds to invest in (houses, factories, equipment etc) rises.

Changes in the interest rate thus create continuous equilibrium such that aggregate demand always equals aggregate supply and the composition of final demand (between consumption and investment) changes as interest rates adjust.

According to this theory, if there is a rising budget deficit then there is increased demand is placed on the scarce savings (via the alleged need to borrow by the government) and this pushes interest rates to “clear” the loanable funds market. This chokes off investment spending.

So allegedly, when the government borrows to “finance” its budget deficit, it crowds out private borrowers who are trying to finance investment. The mainstream economists conceive of this as the government reducing national saving (by running a budget deficit) and pushing up interest rates which damage private investment.

The analysis relies on layers of myths which have permeated the public space to become almost self-evident truths. This trilogy of blogs will help you understand this if you are new to my blog – Deficit spending 101 – Part 1 – Deficit spending 101 – Part 2 – Deficit spending 101 – Part 3.

The basic flaws in the mainstream story are that governments just borrow back the net financial assets that they create when they spend. Its a wash! It is true that the private sector might wish to spread these financial assets across different portfolios. But then the implication is that the private spending component of total demand will rise and there will be a reduced need for net public spending.

Further, they assume that savings are finite and the government spending is financially constrained which means it has to seek “funding” in order to progress their fiscal plans. But government spending by stimulating income also stimulates saving.

The flawed notion of financial crowding out has to be distinguished from other forms of crowding out which are possible. In particular, MMT recognises the need to avoid or manage real crowding out which arises from there being insufficient real resources being available to satisfy all the nominal demands for such resources at any point in time.

In these situation, the competing demands will drive inflation pressures and ultimately demand contraction is required to resolve the conflict and to bring the nominal demand growth into line with the growth in real output capacity.

The idea of real crowding out also invokes and emphasis on political issues. If there is full capacity utilisation and the government wants to increase its share of full employment output then it has to crowd the private sector out in real terms to accomplish that. It can achieve this aim via tax policy (as an example). But ultimately this trade-off would be a political choice – rather than financial.

The following blogs may be of further interest to you:

Premium Question 5:

For a nation running a small current account deficit, the government budget will always be in deficit if the domestic private sector overall successfully saves.

The answer is True.

This question requires an understanding of the sectoral balances that can be derived from the National Accounts. But it also requires some understanding of the behavioural relationships within and between these sectors which generate the outcomes that are captured in the National Accounts and summarised by the sectoral balances.

Refreshing the balances (again) – we know that from an accounting sense, if the external sector overall is in deficit, then it is impossible for both the private domestic sector and government sector to run surpluses. One of those two has to also be in deficit to satisfy the accounting rules.

The important point is to understand what behaviour and economic adjustments drive these outcomes.

So here is the accounting (again). The basic income-expenditure model in macroeconomics can be viewed in (at least) two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances.

From the sources perspective we write:

GDP = C + I + G + (X – M)

which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

From the uses perspective, national income (GDP) can be used for:

GDP = C + S + T

which says that GDP (income) ultimately comes back to households who consume (C), save (S) or pay taxes (T) with it once all the distributions are made.

Equating these two perspectives we get:

C + S + T = GDP = C + I + G + (X – M)

So after simplification (but obeying the equation) we get the sectoral balances view of the national accounts.

(I – S) + (G – T) + (X – M) = 0

That is the three balances have to sum to zero. The sectoral balances derived are:

- The private domestic balance (I – S) – positive if in deficit, negative if in surplus.

- The Budget Deficit (G – T) – negative if in surplus, positive if in deficit.

- The Current Account balance (X – M) – positive if in surplus, negative if in deficit.

These balances are usually expressed as a per cent of GDP but that doesn’t alter the accounting rules that they sum to zero, it just means the balance to GDP ratios sum to zero.

A simplification is to add (I – S) + (X – M) and call it the non-government sector. Then you get the basic result that the government balance equals exactly $-for-$ (absolutely or as a per cent of GDP) the non-government balance (the sum of the private domestic and external balances).

This is also a basic rule derived from the national accounts and has to apply at all times.

So what economic behaviour might lead to the outcome specified in the question?

If the nation is running an external deficit it means that the contribution to aggregate demand from the external sector is negative – that is net drain of spending – dragging output down. The reference to a “small” external deficit was to place doubt in your mind. In fact, it doesn’t matter how large the external deficit is for this question.

Assume, now that the private domestic sector (households and firms) seeks to increase its saving ratio and is successful in doing so. Consistent with this aspiration, households may cut back on consumption spending and save more out of disposable income. The immediate impact is that aggregate demand will fall and inventories will start to increase beyond the desired level of the firms.

The firms will soon react to the increased inventory holding costs and will start to cut back production. How quickly this happens depends on a number of factors including the pace and magnitude of the initial demand contraction. But if the households persist in trying to save more and consumption continues to lag, then soon enough the economy starts to contract – output, employment and income all fall.

The initial contraction in consumption multiplies through the expenditure system as workers who are laid off also lose income and their spending declines. This leads to further contractions.

The declining income leads to a number of consequences. Net exports improve as imports fall (less income) but the question clearly assumes that the external sector remains in deficit. Total saving actually starts to decline as income falls as does induced consumption.

So the initial discretionary decline in consumption is supplemented by the induced consumption falls driven by the multiplier process.

The decline in income then stifles firms’ investment plans – they become pessimistic of the chances of realising the output derived from augmented capacity and so aggregate demand plunges further. Both these effects push the private domestic balance further towards and eventually into surplus

With the economy in decline, tax revenue falls and welfare payments rise which push the public budget balance towards and eventually into deficit via the automatic stabilisers.

If the private sector persists in trying to increase its saving ratio then the contracting income will clearly push the budget into deficit.

So we would have an external deficit, a private domestic surplus and a budget deficit.

The following blogs may be of further interest to you:

Bill –

Your solution to question 5 seems to ignore foreign investment.

Suppose a foreign company increases its Australian investments. Doesn’t that increase the private domestic balance without destroying either the current account deficit or the domestic private sector’s success at saving?

I’m pretty sure foreign direct investment counts as a plus on your balance of payments.

But on the larger point, foreign direct investment should more properly be thought of as moving part of the capital stock of one country into another. And I’m not quite convinced that the MMT framework handles stock variables in a satisfying manner.

– Jake