I started my undergraduate studies in economics in the late 1970s after starting out as…

There is no solvency issue for a sovereign government

Yesterday, I indicated that I would provide some commentary on the latest Morgan Stanley briefing (August 25, 2010) – Sovereign Subjects – which received a lot of press coverage in the last few days and roused the interest of many of my readers. I cannot link to it as it is copyrighted. But the MS document is another example of how you can spread nonsense by ignoring the elephant that is sitting in the corner of the room. The MS briefing is essentially a self-aggrandising rant which perpetuates the standard neo-liberal myths and offers nothing new. I sincerely hope that the author’s company and all of their clients take his advice and lose significant amounts of their investment funds. The more losses are made in this respect the more quickly people will see through the cant that is served up by these clowns.

The report was written by one Arnaud Marès who you can telephone and set him straight on (44 20) 7677 6302. He used to work in the United Kingdom Debt Management Office and before that worked at the European Central Bank (from 1999 to 2004). Prior to that he worked in various banks.

Somewhere along the way he became sure he had something to say that was important but forgot the important bit.

Marès claims the:

The sovereign debt crisis is not European: it is global. And it is not over.

There is no debt crisis in sovereign nations. The only public debt problems that have emerged in the current crisis have been in non-sovereign countries and even then with appropriate “fiscal support” those crisis were managed. I am referring to the intervention by the ECB when they decided to purchase outstanding public debt in the secondary bond markets – which amounte to a fiscal act within a flawed monetary system.

But blurring the distinction between sovereign and non-sovereign nations is the starting gate for this absurd journey in self-importance that Marès has produced.

The report is “the first issue of Sovereign Subjects” which is “a new Morgan Stanley publication focusing on sovereign risk in advanced economies”. Please write to Morgan Stanley and tell them that the publication is a crock and they should save their time by not producing a second issue.

The first issue of this propaganda document perpetuates some classic myths and then some.

Marès starts by breaking out of the mould and asserting that:

… debt/GDP is the most widely used debt metric, but we believe that it is a very inadequate indicator of government solvency.

From a Modern Monetary Theory (MMT) perspective public Debt/GDP ratios have no relevance at all. What exactly do they tell us? The implication is that the bigger the economy the larger the tax base and so the government can support more debt. But a sovereign government does not need to tax to spend and its taxation powers serve different functions. Please read my blog – Functional finance and modern monetary theory – for more discussion on this point.

It might be that the size of the economy limits nominal government spending because it provides some indication of the real resource base but that doesn’t tell us anything about the capacity of the government to service any outstanding debt. A sovereign government can always service its nominal debts. It simply credits a bank account when the interest or maturity payments are due.

So I agree with Marès the debt/GDP ratio is a “very inadequate indicator of government solvency”. The MMT indicator of government solvency is to determine the nature of currency issuance and the currency composition of the public debt held (foreign or domestic currency) – more about which later.

Marès list four reasons why what might look like sustainable debt/GDP ratios are misleading.

His first reason is that you should focus on net rather than gross indebtedness. He rightfully notes that usually the former is a much lower figure. But still any financial ratio of this ilk is irrelevant to assessing solvency or not. Marès certainly doesn’t appreciate that.

Second, he claims that debt/GDP ratio:

… only accounts for part of a government’s contractual liabilities. There exists a broad range of liabilities that are debt, yet are not captured in national accounts. To take one example, in March 2008 the UK Government Actuary Department valued the government’s unfunded civil service pension liabilities – that is, the contractual claims on government accumulated to date by civil servants – at £770 billion. That is 58% of GDP, not captured by the debt/GDP ratio. Debt/GDP does not capture contingent liabilities either.

Response: so what? None of the liabilities (public service pensions) are of any concern unless of-course the whole public service was closed down immediately and the government had to suddenly spend very large amounts relative to the capacity of the economy to absorb the increased nominal demand.

But even in that case, the pensions would, in all likelihood, be held in the form of savings and would not enter the spending stream anyway. Further, liabilities such as public service pensions are actuarially assessed each year and there is no risk to the government.

The overriding point, however, is that a sovereign government can always fund its liabilities as long as they are denominated in the currency that it issues under monopoly conditions.

To put a finer point on this – at the height of the recent financial crisis, when pension entitlements were being written off as wealth collapsed, the government could have protected all recipients 100 per cent if it thought it was politically and socially useful to do so. There was never a financial constraint on the government from bailing out all funds that made losses. I wouldn’t have advocated it doing so but it could have.

Marès then really starts clutching at the straws of ignorance. He claims that:

It is not GDP but government revenues that matter: Whatever the size of a government’s liabilities, what matters ultimately is how they compare to the resources available to service them. One benefit of sovereignty is that governments can unilaterally increase their income by raising taxes, but they will only ever be able to acquire in this way a fraction of GDP. Debt/GDP therefore provides a flattering image of government finances. A better approach is to scale debt against actual government revenues … An even better approach would be to scale debt against the maximum level of revenues that governments can realistically obtain from using their tax-raising power to the full. This is, inter alia, a function of the people’s tolerance for taxation and government interference. Seen from this angle, the US federal debt no longer compares quite so favourably with that of European governments.

Where do you start with that nonsense? Continuing yesterday’s theme – there is a huge elephant hovering nearby. State and local governments that do not have currency issuing powers have to worry about their revenue bases.

The financial resources available to a sovereign government (defined in the MMT sense) are, if you like, equal to infinity minus 1 dollar. The concept of a revenue base has no meaning to a truly sovereign government. The only limitations on government spending are political in the first instance, and then, ultimately, the availability of real goods and services to buy.

Scaling public debt against a current or prospective tax base has no meaning in this context. A sovereign government can always fund any of its liabilities (that are denominated in its own currency) independent of the state of the business cycle (and its tax revenue).

Taxation does not function to raise funds to permit spending. It helps free real resources in the private sector and in that sense provides non-inflationary space for governments to spend and pursue their socio-economic programs. But that is quite a different matter to being necessary to raise funds that the government can then spend.

The government does not need funds to spend. It credits bank accounts courtesy of its unique position as the monopoly issuer of the currency.

That is the elephant. The reason the likes of Marès cannot mention it is because then they would have to have a discussion about the relationship between currency and inflation. They prefer just to assert the totally discredited Quantity Theory of Money which claims that any expansion of the money supply is inflationary. The theory does not accord with what we know from the real world.

The Quantity Theory of Money is written in symbols as MV = PQ. This just means that the money stock (M) times the turnover per period (V) is equal to the price level (P) times real output (Q). The mainstream assume that V is fixed (despite empirically it moving all over the place) and Q is always at full employment as a result of market adjustments.

So in applying this theory they deny the existence of unemployment and excess capacity. The more reasonable mainstream economists admit that short-run deviations in the predictions of the Quantity Theory of Money can occur but in the long-run all the frictions causing unemployment will disappear and the theory will apply regardless.

It is, of-course, trivial to conclude that if V and Q fixed, then changes in M will be reflected in P – which is the basic Monetarist claim that expanding the money supply is inflationary. They say that excess monetary growth creates a situation where too much money is chasing too few goods and the only adjustment that is possible is nominal (that is, inflation).

One of the contributions of Keynes was to show the Quantity Theory of Money could not be correct. He observed price level changes independent of monetary supply movements (and vice versa) which changed his own perception of the way the monetary system operated.

Further, with high rates of capacity and labour underutilisation at various times (including now) one can hardly seriously maintain the view that Q is fixed. There is always scope for real adjustments (that is, increasing output) to match nominal growth in aggregate demand. So if increased credit became available and borrowers used the deposits that were created by the loans to purchase goods and services, it is likely that firms with excess capacity will respond by increasing real output and employment. The empirical world provides that lesson over and over again.

So while Marès is pretending to offer new insights that should bias us against government spending (and debt issuance) he is really just operating within the tired and irrelevant orthodox (gold standard/convertible currency) paradigm which is known as the government budget constraint (GBC) in the literature.

This framework is based on the accounting relationship linking the budget flows (spending, taxation and interest servicing) with relevant stocks (base money and government bonds).

This framework has been interpreted by the mainstream macroeconommists as constituting an a priori financial constraint on government spending and by proponents of Modern Monetary Theory (MMT) as an ex post accounting relationship that has to be true in a stock-flow consistent macro model but which carries no particular import other than to measure the changes in stocks between periods.

As noted above, these stock changes are also not particularly significant within MMT given that a sovereign government is never revenue constrained because it is the monopoly issuer of the currency.

The way the mainstream macroeconomics textbooks build their flawed narrative is to draw an analogy between the household and the sovereign government and to assert that the microeconomic constraints that are imposed on individual or household choices apply equally without qualification to the government.

The narrative then shifts, without explanation, from an ex post sum that has to be true because it is an accounting identity, to an alleged behavioural constraint on government action.

The GBC is always true ex post but never represents an a priori financial constraint for a sovereign government running a flexible-exchange rate non-convertible currency.

The GBC literature emerged in the 1960s during a period when the neo-classical microeconomists were trying to gain control of the macroeconomic policy agenda by undermining the theoretical validity of the, then, dominant Keynesian macroeconomics.

The neo-classical attack was centred on the so-called lack of microfoundations (read: contrived optimisation and rationality assertions that are the hallmark of mainstream microeconomics but which fail to stand scrutiny by, for example, behavioural economists).

This was a very technical debate (beyond today’s blog) but the whole agenda was total nonsense and reflected the desire of the mainstream microeconomists to represent the government as a household and to “prove” analytically that its presence within the economy was largely damaging to income and wealth generation.

Anyway, just as an individual or a household is conceived in orthodox microeconomic theory to maximise utility (real income) subject to their budget constraints, this emerging approach also constructed the government as being constrained by a budget or “financing” constraint. Accordingly, they developed an analytical framework whereby the budget deficits had stock implications – this is the so-called GBC.

So within this model, taxes are conceived as providing the funds to the government to allow it to spend. Further, this approach asserts that any excess in government spending over taxation receipts then has to be “financed” in two ways: (a) by borrowing from the public; and (b) by printing money.

You can see that the approach is a gold standard approach where the quantity of “money” in circulation is proportional (via a fixed exchange price) to the stock of gold that a nation holds at any point in time. So if the government wants to spend more it has to take money off the non-government sector either via taxation of bond-issuance.

However, in a fiat currency system, the mainstream analogy between the household and the government is flawed at the most elemental level. The household must work out the financing before it can spend. The household cannot spend first. The government can spend first and ultimately does not have to worry about financing such expenditure.

From a policy perspective, they believed (via the flawed Quantity Theory of Money) that “printing money” would be inflationary (even though governments do not spend by printing money anyway. So they recommended that deficits be covered by debt-issuance, which they then claimed would increase interest rates by increasing demand for scarce savings and crowd out private investment. All sorts of variations on this nonsense has appeared ranging from the moderate Keynesians (and some Post Keynesians) who claim the “financial crowding out” (via interest rate increases) is moderate to the extreme conservatives who say it is 100 per cent (that is, no output increase accompanies government spending).

So the GBC is the mainstream macroeconomics framework for analysing these “financing” choices and it says that the budget deficit in year t is equal to the change in government debt (ΔB) over year t plus the change in the monetary base (ΔH) over year t. If we think of this in real terms (rather than monetary terms), the mathematical expression of this is written as:

which you can read in English as saying that Budget deficit (BD) = Government spending (G) – Tax receipts (T) + Government interest payments (rBt-1), all in real terms.

However, this is merely an accounting statement. It has to be true if things have been added and subtracted properly in accounting for the dealings between the government and non-government sectors.

In mainstream economics, money creation is erroneously depicted as the government asking the central bank to buy treasury bonds which the central bank in return then prints money. The government then spends this money. This is called debt monetisation and we have shown in the Deficits 101 series how this conception is incorrect. Anyway, the mainstream claims that if the government is willing to increase the money growth rate it can finance a growing deficit but also inflation because there will be too much money chasing too few goods! But an economy constrained by deficient demand (defined as demand below the full employment level) responds to a nominal impulse by expanding real output not prices.

But because they believe that inflation is inevitable if “printing money” occurs, mainstream economists recommend that governments use debt issuance to “finance” their deficits. But then they scream that this will merely require higher future taxes. Why should taxes have to be increased?

Well the textbooks are full of elaborate models of debt pay-back, debt stabilisation etc which all “prove” (not!) that the legacy of past deficits is higher debt and to stabilise the debt, the government must eliminate the deficit which means it must then run a primary surplus equal to interest payments on the existing debt.

Nothing is included about the swings and roundabouts provided by the automatic stabilisers as the results of the deficits stimulate private activity and welfare spending drops and tax revenue rises automatically in line with the increased economic growth. Most orthodox models are based on the assumption that full employment prevails continually anyway, which makes them nonsensical depictions of the real world.

Finally, you can now see why conflating the fiscal situation in the US with that of a Eurozone nation which is not sovereign is a sign that Marès doesn’t understand the way different monetary systems operate. He clearly does understand or doesn’t want his readers to understand that the Eurozone is an entirely different monetary system to that operating in nations where the national government has a currency issuing monopoly and floats that currency in international markets.

The fourth argument he makes about the lack of relevance of debt/GDP ratios is that:

Debt/GDP looks at the past. The main problem is in the future: The fourth and largest flaw of debt/GDP is that it is an entirely backward-looking indicator. It only accounts for the accumulation of past deficits. This captured reasonably well the magnitude of the fiscal challenge at the end of World War II because at that time the challenge did indeed result entirely from the past: large wartime deficits had pushed debt ratios higher, but governments were no longer running deficits, nor were there expectations of them doing so in subsequent years.

By contrast, the accumulation of past deficits now represents only part of the problem for advanced economies’ governments. The other part consists of coping with the large structural deficits opened up by the crisis and compounded by the fiscal consequences of ageing. What raises questions about debt sustainability is not so much current debt levels as the additional debt that will accumulate in coming years if policies do not radically change. Debt ratios do not capture this part of the problem.

First, governments in most nations ran deficits in the post World War II period and everyone (including the markets) came to expect deficits as being normal. It is false to claim otherwise. It is only in the last three decades as the neo-liberal onslaught ensued that deficits have been demonised.

Second, the accumulation of past deficits in the form of net financial assets including outstanding government bonds represent a significant portion of the wealth held by the private sector. The likes of Morgan Stanley have made profits by using government bonds to their advantage. The interest servicing payments by government on outstanding debt constitute private income. There is no problem.

Third, the “ageing problem” is not a financial issue for government. It may be a political problem if the younger generations rebel against providing increased public care to their parents. It may also be a real problem – that is, there may not be enough real resources to service all the competing needs. Those sorts of problems are always resolved (more or less satisfactorily) by political processes.

A sovereign government will always be able to “buy” health and aged care services if they are available for sale in the currency of issue. There is no financial problem. There are not questions of fiscal sustainability in this respect.

Please read the suite of blogs – Fiscal sustainability 101 – Part 1 – Fiscal sustainability 101 – Part 2 – Fiscal sustainability 101 – Part 3 – for more discussion of this issue.

Marès conducts some analysis of the “costs of ageing” but never once mentions real resources, which are the only actual costs of any economic use.

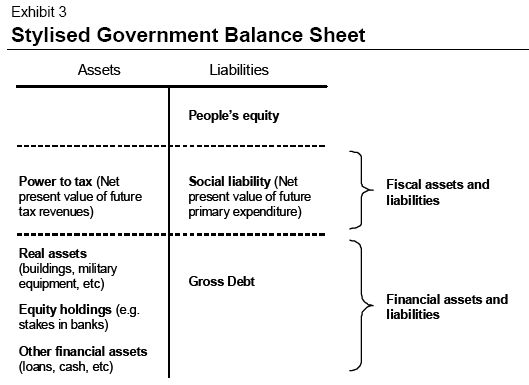

He then decides to present Exhibit 3 (reproduced below) which purports to show “a stylised representation of the government balance sheet”. Marès claims that:

On the asset side is the power to tax, which is the main asset and resource of any government. It can be conceived as a variable rate claim on GDP, where the rate depends on the level of taxation. Its value on the balance sheet is therefore the net present value of all future tax revenues. On the liability side appears a ‘social’ liability, which represents the promise of the government to its electorate to spend resources on defence, justice, education, health and any other existing government policy. Its value is the net present value of all future primary expenditure. The difference between the power to tax and the social liability is the net present value of all future structural primary deficits (by definition, the cyclical component of the deficit should sum up to zero over time).

This extraordinary piece of deception ignores the fact that the main economic asset a sovereign government has is it monopoly over currency-issuance.

This asset allows the government if it has the political will to pursue public purpose and create full employment.

The power to tax is an important aspect of gaining currency legitimacy (creating a demand for the currency) and is an important counter-stabilising policy tool. But it should never be set against the public liabilities that are serviced by government spending as if it “funds” that spending.

Marès then confuses the fiscal position of a sovereign government with that of a revenue-constrained corporate entity:

The residual is represented on the balance sheet as the people’s equity, by analogy to a corporate balance sheet. This is effectively the net worth of the government in the broadest sense, and a measure of its solvency.

There is no legitimate comparison here. The meaning of capital in the balance sheet of a private corporation has no carry over to the public space when we are considering a sovereign government.

It is not a measure of the solvency of a sovereign government. By definition a sovereign government is always solvent unless it takes on debts that are not denominated in the currency of issue. Then solvency issues may arise.

Marès claims that if the residual if the residual (the gap between its tax revenue and its liabilities) is:

… negative, the government is insolvent. In other words, some or all of its stakeholders must suffer a loss: either taxpayers (through a higher tax burden), or beneficiaries of public services (through lower expenditure) or bond holders (through some form of default).

That is a preposterous claim. A sovereign government can run permanent deficits forever. It may not be desirable to do that – given the state of the external and private domestic sector spending but that is a different matter.

What might constitute prudent policy aiming to maintain full employment doesn’t negate the fact that there is no solvency risk for a sovereign government. The only risk ultimately is inflation if the government spends too much relative to the real capacity of the economy to absorb it. Then taxation may place a counter-stabilising role.

The final section of the MS paper is focused on the form in which governments will default. Marès says:

It is not whether to default, but how, and vis-à-vis whom. What this means is that – as indicated above – governments will impose a loss on some of their stakeholders and have in fact started to do so (across Europe at least). The question is not whether they will renege on their promises, but rather upon which of their promises they will renege, and what form this default will take.

Once again conflating non-sovereign nations such as exist in the Eurozone with fully sovereign nations is not valid.

Further, the only “defaults” that have occurred in Europe with respect to the stakeholders have been driven by the neo-liberal obsession with austerity. The Eurozone problem is not one of debt default but rather a flawed monetary system that does not have adequate fiscal responsiveness to crisis and places too much power into the hands of the bond markets.

Having said that, the ECB has demonstrated in recent months that it can engage in what is essentially a fiscal operation and take all pressure of national governments within the Eurozone to “finance” their spending.

So the only reason that other governments will start punishing stakeholders (via tax increases or otherwise) is if they believe the sort of nonsense that Marès is propagating and think they have a financial problem that has to be dealt with.

If they fully understand the nature of the monetary system they oversee and the capacity they have within that system as the monopoly issuer of the currency then there will be no reason to renege on any promises.

But Marès acknowledges that “(t)his is ultimately a question of political economy” but doesn’t seem to realise that this also means it is not a financial question.

At the end of the paper, he decides that governments may not engage in outright default but will deflate the debt burdens away. He had to get the inflation threat in there somewhere. He says:

Outright sovereign default in large advanced economies remains an extremely unlikely outcome, in our view. But current yields and break-even inflation rates provide very little protection against the credible threat of financial oppression in any form it might take.

“Unlikely”, “might” – all the weasel words that the neo-liberals use when the empirical world doesn’t support their arguments. It is interesting that bond investors keep queuing up for more debt because they know it makes them wealthier. As it has been doing for years.

Conclusion

There is no credible threat of default and inflation is not a policy threat at present.

Digression: this weekend

My old band from Melbourne – Pressure Drop – has decided to reform and this weekend I am flying to Melbourne for our first get together in 29-odd years. The band was very popular in the Melbourne scene in the 1970s and early 1980s. It went into its long hiatus when I decided that I wanted to do a PhD and drop out of the professional music scene for a while.

We have all been playing in other bands since then and have now decided to come back together and do gigs as Pressure Drop about once a month for the time being. We will also release a CD in the months ahead. So for me it is a chance to play with my old professional colleagues and good friends again but without having to endure the financial strains that trying to survive as a professional musician used to bring.

Saturday quiz

It will appear sometime tomorrow with Answers and Discussion being available on Sunday.

That is enough for today!

Hi,

A great post.

On the discredited quantity theory of money, I have my own post here:

http://socialdemocracy21stcentury.blogspot.com/2010/07/quantity-theory-of-money-critique.html

Regards

A sovereign government has no solvency issue because it is not currency constrained. OK

A sovereign government that is not currency constrained is real resource constrained. OK

Can a sovereign government that is not currency constrained be interest rate constrained? I think so.

What happens if no one wants to rollover the debt and no new buyers are found?

What happens if the debt can only be rolled over at a higher interest rate?

Government can pay off all existing debt, by crediting bank accounts. it doesn’t need to rollover debt, just as it is never required to get into debt in the first place.

Bill, I do hope someone will forward on to Mares your commentary. I had sent an email yesterday (Thursday 26 Aug 2010), the minute I heard the Bloomberg television reporters gushing about the importance of this new report (and how the reporter claimed she looked forward to reading it through thoroughly this coming weekend–how could she know it was so important if she had not read it yet? There is tremendous need to educate the talking heads of the financial press, I am afraid).

Here is the email I sent:

Mr Mares,

Since you invited comments on your new research series, let me make a few:

First, your comparative statistics did not include Japan. Japan have had for many years egregious debt levels by many measures, including those you recommend, and yet their currency is approaching 15-year highs, with confidence spilling over to the re-allocation of investment of Chinese reserves. Might not this give you some pause to reconsider your views?

Secondly, I would recommend that you make a distinction between sovereign currency issuing countries (eg USA, Japan, UK, Australia, Canada) and countries that have surrendered that sovereignty (eg Eurozone countries). I think some of the points you make might be appropriate for the second group, but you should not assume that these metrics are meaningful for sovereign currency issuing countries.

Lastly, have you immersed yourself, by chance, in any of the literature that today is collectively discussed under the term “Modern Monetary Theory”? As you may know, this is an extension of “Chartalism” first introduced by the German, Georg Knapp in the first decade of the twentieth century, which was taken up by Keynes, Lerner, and many other economists that have not subscribed to the neo-classical synthesis. I would suggest that any discussion of sovereign debt defaults that 1) does not distinguish between those countries that can issue their own currency and those that cannot and 2) does not incorporate or refute Modern Monetary Theory for sovereign currency issuing countries is incomplete, misleading, and dangerous.

I invite you to spend the equivalent of a graduate school seminar of time (about a week, really) reading and studying Modern Monetary Theory before you continue with your bold series. If, in light of a genuine understanding of this heterodox view, you are able to formulate serious and reasoned arguments for propagating “debt-a-phobia” amongst the sovereign currency issuer countries, including Japan, I will be a most interested reader.

Otherwise, might we readers assume your publications will be no more than bits of fluffy smoke screens designed to distract from the mea culpas issued by Morgan Stanley about the firm’s incorrect rate calls?

Best regards,

William Blair Santos Allen

Executive Managing Director

Global Markets Consultants, Ltd.

Re QTM: Since 1966, in the UK, {if I the M4 statistics I have are correct} M4 has increased by 8,679%, prices have risen by 1,242% and real income has increased by 171%.

Great post (AGAIN!) Bill

Ive seen a lot of recent talk about the long run this and long run that. The response that has started to come to mind, which doesnt rival Keynes’ quip about us all being dead, is that the long run is a simple accumulation of short runs. If you admit that the short run.

Seems that all the long run analysis is simply backward looking which lends itself to a lot of data fitting and confirmation bias.

Andrew

Really enjoyed your post on quantity theory of money. Well done.

Didnt finish one of my sentences, sorry.

“If you admit that the short run behaves differently than the long run, that makes it difficult to make broad claims about the long run”

For us non economist, can you please explain simply what on earth you’re saying?

What’s the difference between a sovereign and a non-sovereign county; and how come a sovereign country can’t become insolvent?

I’m not arguing, I just don’t understand.

Thanks.

Bill:

I think there should be little question or debate on the solvency of a sovereign country with its own currency issuing debts in its own currency. I also do not think there should be much debate on the need for fiscal action to keep up the aggregate demand when there are evidences that the aggregate demand is falling in the absence of destruction of production capacity and capability. However, I believe that debates should focus on the inherent skills and capabilities of the government or its structure and incentives to be able to manage the fiscal action. As well, one may question the structures and skills to drain the reserves thereafter (when the private sector picks up the aggregate demands).

Elizabeth

I can answer that one for you.

A sovereign country has its own currency which only it issues and additionally there are no pegs to any other currency. So since only you create and issue the currency you can never run out (insolvency). In fact the currency only exists after you create it. Those that use it need you to issue it first and can become insolvent if they dont have enough of the currency to pay a debt.

USA, UK, Australia, China, Canada and Japan are all soveriegn. No Euro using countries are sovereign.

China has decided to peg to our currency but they do not have to, they can remove the peg whenever they want.

So MMT says that the public debt can keep rising faster than the GDP and this is not a problem ? Or it denies this possibility due to some miraculous cancellations whereby any small amount of growth can act to sustain increased indebtedness to foreigners ? Or that exchange rates can miraculously adjust to prevent this from happening ? What if interest paid to foreigners keeps exploding both from the public sector and the private sector ?

External sector here 🙂 And it may not be desirable to do that which means throw the domestic sector into higher unemployment when it is never at full employment ?

Sorry, Bill

Monetarist view here.

Not to defend the Quantity Theory thereof, it is of no consequence, meaningless to the important discussions to be had.

And I want to observe as a separate matter that Mares didn’t bring it up, you did in the context of ensuring a lack of inflation and deflation with Fiscal-sustainability.

For some reason MMTers, and most others rely upon the interest rate to manage economic growth, are dismissive of the matter of the amount of money in existence in any way being important to economic stability, or any relevant measure to be used to gauge the success or failure of our public policy goals.

Today’s well-done chase down another of the Peterson-esque rabbit holes involves the issue of sovereign default; to be, or not to be. MMT is a well-thought argument that any nation with monetary sovereignty is capable of preventing default, ABSENT the self-imposed very legal constraints that it brings to bear on that sovereignty. This is an argument that is very easily won by the Austerians, and for good reason.

These discussions ignore the largest elephant in the room, which is one of those self-imposed constraints.

While it is readily arguable that the GBC is a false and inapplicable economic concept, every one of your opponents gets to retain the viability of their arguments and scare the shit out of everybody, not because they do not understand MMT.

Which they clearly do not understand.

It is very simply and very clearly to me based on the fact that the so-called sovereign United States Government has passed a law requiring that its budget be “balanced” by the debt-funding of its non-taxed expenditures. Magnanimous-sized elephant here.

So, to me, Bill, THAT is the largest obstacle to making any progress.

The sovereign government is not obliged by its sovereignty to borrow any money, yet by law, it must.

I am repeating myself here, I know, but until you and the other MMT proponents deal with this fact, and the sovereign government removes that so-called self-imposed constraint, we can’t make progress.

If the people are not aware of the voluntary nature of this restriction, it is mislabeled as a self-imposed constraint; it is a constraint of exactly the same neo-liberal economic policies that you say you abhor, but for some reason choose to ignore.

At the FS Conference in DC, I asked for a layout of the self-imposed constraints that prevent the supposedly-sovereign governments from achieving their public policy goals that MMT claims are achievable in today’s modern (floating/fiat) economies, and their relative importance in making progress.

The list of self-imposed constraints that must be removed to make any social progress in a neo-liberal dominated economic system is:

whatever.

Then. let’s get to work on that list.

Thanks, Bill.

Hope you record your new music. We could sure use it.

Elizabeth says:

Saturday, August 28, 2010 at 1:49 For us non economist, can you please explain simply what on earth you’re saying?

What’s the difference between a sovereign and a non-sovereign county; and how come a sovereign country can’t become insolvent?

Hi Elizabeth. I can add a bit to Greg’s help.

Imagine you are the Country USA. You borrow one Billion from China. The borrowed money is repayable in US dollars. You the USA can simply print USD anytime you want and repay the Chinese.

Therefore there is no risk for a soverign country that borrows in its own currency. Contrast that with Greece who dont have a currency of their own. Greece cant print Euro’s and it cant devalue. So Greece is a non Sovereign country. I expect that a Sovereign Country like Australia that borrows in USD could be insolvent if it could not find anyone in the world to swap AUD for USD to allow it pay the loan back in USD.( Someone else may help here.)

Below are extracts and dirctions to some of Bills material that may interest you.

“There is no credit risk for a sovereign government August 17th, 2010

But the more important point is that students should understand very early in a macroeconomics course that a sovereign government is never revenue constrained because it is the monopoly issuer of the currency. That is a basic starting point in exploring the differences between spending and taxation decisions of a sovereign government and the spending and income-earning decisions/possibilities of the private sector entities (households and firms).

and

Steven Major chooses to term a government in the former category a “true sovereign” because it:

… can issue freely in its own currency, has full taxing power over the population and ultimately, if required, can create more of its own money. None of this means that true sovereigns can afford to be profligate, far from it, but it does mean there is no externally imposed timetable on fiscal retrenchment.

I am 100 per cent in agreement with this construction.

Note that in saying a (true) sovereign government is never revenue constrained because it is the monopoly issuer of the currency one is not advocating reckless net spending by the same government.

A (true) sovereign government should define its sense of public purpose which in my view will always include full employment using technologies that are environmentally sustainable. Then its fiscal position should enable the economy to achieve levels of activity that are commensurate with this idea of public purpose.”

Also see: Fiscal Sustainability 101 Part 3 June 17 2009

A modern monetary theory lullaby. about half way through a passage called Understanding what a Sovereign Government is.

You can find these blogs by clicking on the “one page archive” button on the home page.

It took me a while to get it so I hope this helps you speed up your understanding.

Aaron said: “Government can pay off all existing debt, by crediting bank accounts.”

What happens if the people take their credited bank accounts and buy real assets to use as a savings vehicle driving up their price?

Great post Bill

Couldn’t resist posting this recent article written by the very confused Mort Zuckerman which is titled,

The Most Fiscally Irresponsible Government in U.S. History

Current federal budget trends are capable of destroying this country

Here are my favorite quotes from the article

1. On the national debt, the money the government has spent without the tax revenues to pay for it has produced mind-numbing numbers so large as to be disconnected from reality. Zeros from here to infinity. The sums are hard to describe; it is hard to describe an elephant, but you know one when you see one.

2. The government will be writing more IOUs on top of those we already can’t afford. Why plan a second stimulus if the first stimulus couldn’t prevent high unemployment?

3. An old saying that can apply to the deficit is called the “rule of holes” and goes as follows: “When you’re in one, stop digging.”

4. Hope may lie in a new bipartisan panel headed by Erskine Bowles and Alan Simpson, two unique, wise, and centrist political leaders whose characters raise some degree of confidence that they might be able to come forth with productive programs.

http://www.zerohedge.com/article/zuckerman-loses-it-releases-most-scathing-criticism-obama-yet-most-fiscally-irresponsible-go

“What happens if the people take their credited bank accounts and buy real assets to use as a savings vehicle driving up their price?”

The same as what would happen if they take their government bonds and buy real assets with them. Remember that government bonds are tradeable assets with currency value in the hands of the holder and that there is a liquid market in them.

Once you realise this, you realise that what we call ‘cash’ is really just a non-interest paying government issued bearer bond. It’s the same promise as any other bond.

“The same as what would happen if they take their government bonds and buy real assets with them.”

Not true. In fact, you cannot buy much with bonds — try going to a store and buying that nice and truly useful flat screen TV with your bonds, or try stopping by your friendly dealership and buying a car, try settling closing on a house with bonds, etc.

1. You have to sell the bonds first

2. You can buy whatever with the proceeds after you have sold the bonds.

Holding a bond means saving aka deferring your consumption for the duration of bond holding. Selling a bond means acquiring cash for presumably immediate consumption at the expense of another bond holder, to whom you sold your bond, deferring his consumption.

One would imagine that was pretty obvious !

The “fiscal support” of the ECB is conditional on austerity measures that European states were forced to take, and it was taken to assist European bank liquidity and capital ratios. It is not a plan to ease revenue constraints of European fiscal policy.

Holding a bond means saving aka deferring your consumption for the duration of bond holding. Selling a bond means acquiring cash for presumably immediate consumption at the expense of another bond holder, to whom you sold your bond, deferring his consumption.

I’ve tried to make that argument here, VJK. Although it seems solid at first, there are some holes in it. One that comes to mind is the fact that government bonds make first class loan collateral. That means that the banking system, which always stands ready to lend to any well qualified borrower, can easily monetize these bonds with freshly created bank money. Therefore, it isn’t necessarily true that I have to defer consumption/spending if I hold a government bond.

Ken

“Holding a bond means saving aka deferring your consumption for the duration of bond holding”

Holding cash means saving aka deferring your consumption for the duration of cash holding. £50 in your wallet is savings. Only when there is a transaction is that converted into a flow. At any point in time all the cash in existence is savings for somebody.

If there is a liquid market in any asset then that asset is as good as cash, since it can be converted to a flow on demand and it can be borrowed against.

And if I have assets, you’ll find that I can go into pretty much any store and with a couple of signatures walk away with pretty much anything I want. In fact the sales staff will generally encourage that mode of operation as they get a fat kick back.

And then there is always the Pawn shop for anything else.

Only that fraction of assets that can’t be converted is really deferring consumption. The rest is just a choice not to spend.

Fed Up;

What happens if the people take their credited bank accounts and buy real assets to use as a savings vehicle driving up their price?

I agree that initially they will push up prices, however Bill’s premise has always been that governments will go into debt when there is a shortfall in aggregate demand. Excess money will tend to have market participants attempt to increase market share rather than increase the clearance price. Thus, this private activity should restore aggregate demand, rather than have an inflation bout.

With this private sector activity, the government is no longer compelled to go into any more debt, and its restored tax base should see deal with any nominal debt.

Neil:

You misunderstood the simple argument:

If A holds a bond, he cannot buy anything until he sells the bond to B. A and B cannot buy stuff at the same time. Someone has to wait until someone else exchanges the bond for cash. If A and B held cash, they could buy stuff at the same time thus competing for the same good, let’s say a pair of shoes. Apply the same logic to the totality of bond and cash holders. Simplifying, purchasing power equals amount of cash, bonds defer such power until later.

I’m sorry but I get a real headache reading how MMT works in your fantasy world. So you ‘print money’ to pay back a loan to China. In the real world your currency gets trashed, no one will borrow money from you again and then inflation goes through the roof as your money supply blows out and purchasing power plummets. A high school economics student will tell you that. Your ultra-left views that the government will somehow create full employment just by spending and total disdain for the free market are really nothing short of communist philosophy. You don’t seem to have a shortage of followers however in the public education system.

VJK: thanks for adding some patronising tone to what was a fairly neutral exchange.

Fed Up: yes, if an investor switches from bonds to cash they are at the margin more likely to consume or buy other assets, increasing risk of inflation or asset price bubbles.

However: (a) rates show little sign of this happening any time soon, and (b) a sovereign govt is always at liberty to mitigate such risks with tax policy.

Ray,

Nowhere does MMT advocate printing money.

With respect to high school economics you might want to revise your thinking.

Fixed exrates, gold standard, full employment, perfect competition, full information, Quantity theory, loanable funds, — and the list of false assumptions goes on.

Finally, you only need to look at Japan to see that your text book assessment is a million miles from the truth.

High debt to GDP ration, low inflation, low interest rates, strong currency.

Oh yeah – the orthodox model works a treat – In disney land.

“You misunderstood the simple argument:

If A holds a bond, he cannot buy anything until he sells the bond to B.”

No, you misunderstand the simple argument. In a modern economy with sophisticated credit arrangement nobody has to wait to buy anything. Simply my reputation is sufficient to get money created that will allow me to buy today.

“Simplifying, purchasing power equals amount of cash, bonds defer such power until later.”

No they don’t, because you have ignored the modern credit system and modern communications. I know I have the assets and I can make that liquid right now in numerous different ways. So there is no deferral at both micro and macro level because there is no issue of liquidity. In fact simply knowing I have assets probably makes me more likely to spend.

A bond is as good as cash, a house is as good as cash, even the fact that you have a job and a reasonable reputation is as good as cash.

Plus with the Internet I can probably find a site that will allow me to swap my government bonds directly for what I want via barter exchange. After all I have an entire world of people to go at.

Cash is just oil in the works of the exchange – a good without name. It’s the real stuff that people want to exchange.

you can find MS report here: http://financialcourier.blogspot.com/2010/08/ask-not-whether-governments-will.html

Thanks for your helpful replies, Punchy and Greg.

Is it true to say, then, a state CAN go bankrupt if it links its currency to something over which it has no control, like gold or

other commodities? So ” the Bank of England promises to give the bearer 10 grains of gold.”

They used to say something like that, I think.

So now it’s all funny money.

Any comments?

Thanks,

Elizabeth

And this is starting to get me REALLY interested: if sovereign states just devalue the money, this means those that loaned money at the old rate will get completely stuffed.

Now in some economies (UK, US to a lesser extent, lots of others too), the banks are owned by the public, tax payer.

This really could be the start of the next great Depression.

Thanks for the article! Many interesting articles in this blog.

When people speak of ‘debts’, they tend to do the following: Since [private] individual and [private] business debts are terrible, it stands that [sovereign] government debt is also terrible to behold. It appears that our economics education (thereafter economic policies) either leaves out or jumps over the concepts of sovereign government and its definition which is the power to issue its own currency and demand tax using that currency. If this amount of mental dexterity is too much to handle, then we may have to devolve back into some sort of fixed exchange rate regime, even going back to the gold standard? Not that I am thrilled about the gold standard, but should it not be that a monetary system be in sync with the mindset of its users?

I find the MMT world view interesting, if a bit twisted. The main trouble is this view makes people conclude that a government creating money without end is no trouble. But in real life it causes the currency to go down and often hyperinflation, which is really a form of government bankruptcy. The liabilities of a government are not just X units of their own currency, it is also the support of a large fraction of the population (government employees, people on welfare, people on social security, etc. maybe 40% of the population or more). Much of this support comes from just printing money, which is really an “inflation tax”. In hyperinflation, when the money becomes worthless, the “inflation tax” stops working and governments can no longer support such a large fraction of the population. They are really bankrupt at that point. You can get more of my thoughts on MMT by clicking on my name.

“The main trouble is this view makes people conclude that a government creating money without end is no trouble.”

That’s how it is perverted by people who don’t understand it. Money is just oil in the engine – you need enough to keep the engine at optimal velocity but not too much as to cause smoke. The problem at the moment is that there is too little and the engine is ceasing up.

The restrictions on an economy are real not fiscal. That is the key message that MMT conveys – get away from the numbers on your computers and start looking at the real situation, the real resources and the real people. If a government can do something with the real resources at their command and they have a sovereign currency, then they can always afford to do it.

Hi Vincent,

imo any form of Monetarism or a Quantity Theory has lost much if not all credibilty this time around. This chart tells all (http://research.stlouisfed.org/fred2/series/WRESBAL) . Many prices at least in the US have fallen since the ‘spike’ in ‘money’, and the USD has risen against the Euro, fallen v Yen, unchanged v Yuan…all sorts of price reactions after this 12,000% increase. imo if a 12,000% increase does not have any appreciable predictive effect, then you should at least start to question the Theory if not throw it out.

Resp,

“That’s how it is perverted by people who don’t understand it. Money is just oil in the engine – you need enough to keep the engine at optimal velocity but not too much as to cause smoke. The problem at the moment is that there is too little and the engine is ceasing up.”

But if you look at the title of this article, it is “There is no solvency issue for a sovereign government” which makes people think that MMT policy is that you can print forever with no trouble. But if the US has hyperinflation, how does it pay for oil for the military or support the 40% of the population that depend on it? Saying that liabilities are no trouble when you can print money is not really accurate. Governments have ongoing liabilities measured in real things, not just debts measured in currency. Even saying “the limits are real not fiscal” make people think you would never worry about printing too much money. Anyway, MMT comes across as thinking that governments making tons of money is no trouble, but anyone who studies any history, or even just reads “This Time Is Different”, knows that when governments print too much money bad things happen. So MMT looks like it is not in touch with reality.

As for the graph showing the reserve balances going up, I have a theory on that. I like the MMT view that the Fed is really part of the sovereign government. So lets view the Fed and the Treasury as in the same box. When the Fed is paying interest on “excess reserves” it is just like the treasury paying interest on bonds. Money is really being loaned to the government. It is really the same thing as if the banks had bought treasury bonds. So this is “crowding out by the government” but hidden in the Fed, or in MMT terms it is reducing aggregate demand. In any case, this is just a new trick that people have not caught onto yet. Maybe MMT types, who are used to viewing the Fed as part of the government, can explain this to people.

http://pair.offshore.ai/38yearcycle/#deflation

” “There is no solvency issue for a sovereign government” which makes people think that MMT policy is that you can print forever with no trouble.”

It does if you misunderstand what the word ‘solvency’ means. It means having enough money to satisfy liabilities as they come due.

You need too much money to get hyperinflation as you point out. By definition, enough is not too much. So the rest of your comment simply cannot occur because the premise is not satisfied.

Now if you’re actually saying the MMT PR needs some work, then I’d agree with you.

The PR problem with MMT is that most people, not just Krugman, think that the MMT view is that deficits don’t matter. Articles like this one add to that perception. Now clearly MMT says that taxes make demand for currency and if there were no taxes there would be no demand for that currency. And in history countries that did not have the tax base and relied too much on printing money got hyperinflation. But has anyone with an MMT mindset tried to quantify the conditions for this? I have seen one MMT paper saying that the US situation is different from Zimbabwe or Germany of 1923, but situations are always different so that is not saying much. Has anyone made a rule like, “if the amount of government money creation divided by the taxes collected each year is greater than X then there is a risk of hyperinflation”. There have been on the order of 100 cases of hyperinflation in fiat currencies so there should be plenty of experiments to look at. Even the US has had hyperinflation twice (in the revolution and civil war). I think such a rule will have an X around 1.

Just saying that deficits only matter after “full employment” is just not clear enough. Imagine that unemployment is partly caused by minimum wage laws and government policies that drive jobs overseas so that no amount of money printing can ever get “full employment”. Would MMT think there is no risk to any amount of money printing in this situation? If a government drives jobs overseas they can print all the money they want at no risk? Most people don’t really expect to ever see full employment again, so saying that is the only danger sounds to them like saying there is never any danger of too much money printing.

If MMT people were very clear about when money printing became a problem (like a math formula) it would go along way to solving the PR problem where everyone thinks that MMT people never worry about money printing.

“I have seen one MMT paper saying that the US situation is different from Zimbabwe or Germany of 1923, but situations are always different so that is not saying much.”

Have you read the facts?

Zimbabwe: https://billmitchell.org/blog/?p=3773

Weimar: http://www.creditwritedowns.com/2010/05/mmt-hyperinflation-in-the-usa.html

‘The inability to tax and dependency on foreign currency are central to hyperinflation or national solvency. Moreover, in Zimbabwe and Weimar, it was the trashing of productive supply that created inflation (think supply versus demand).’

There is no parallel – hence why Japan is bumbling along fighting deflation.

“Has anyone made a rule”

Yes. It’s the same one that is currently used in monetary policy. If inflation starts to take hold then you adjust taxes/spending/interest rates to compensate based upon the political policies in play at the time.

MMT gives us a new set of weaponary against instability and suffering. There is much to do to determine political policies that use those weapons effectively. It’s much like designing the control rod layout of a nuclear reactor.

Personally I prefer automatic systems that require no ‘judgements of Solomon’ – particularly from politicians. My starter suggestion would be that the minimum wage is nationalised and paid to all citizens doing ‘useful work’, disabled or retired. That effectively subsidises all jobs, voluntary work and anything else politically defined as ‘useful’ so that people can earn a living income by doing it. The state then provides buffer positions of ‘useful’ activity where there is a shortage of other ‘useful’ work of the required quality.

Profit taxes are adjusted to compensate for the worker subsidy but at a level that maintains aggregate demand, and the central bank is given a land value levy charged on freeholders that they can wind up and down to control inflation. Interest rates remain at zero. The minimum wage is abolished and the jobs market becomes a ‘pure market’, with the quality of the buffer jobs controlling the minimum standards of employment required from the private sector.

This way everybody has to work to get any money from the state, worker heavy industries get more benefit from the structure than worker light ones (import heavy industries for example), and domestic demand is maintained. The deficit is then automatic, not structural and moves up and down inversely to the waxing and waning of the private sector. So the amount of money created and/or destroyed is always enough, never too much.

MMT has nothing to do with money printing and I’m not at all sure why you’re fixated on it. MMT says that the “We can’t afford it” excuse is invalid if you’re sovereign in your own fiat currency. We can always afford it. The question is whether there are real resource available and whether the idea is a sensible use of those resources.

“If inflation starts to take hold then you adjust taxes/spending/interest rates to compensate based upon the political policies in play at the time.”

Hyperinflation hits hard and sudden. If you wait till it starts it is probably too late. A good economic theory needs to be able to anticipate the future. Do MMT people not draw a distinction between inflation and hyperinflation?

“MMT has nothing to do with money printing and I’m not at all sure why you’re fixated on it. MMT says that the “We can’t afford it” excuse is invalid if you’re sovereign in your own fiat currency. We can always afford it.”

When you say if you issue your own fiat currency you can always afford it you mean creating new fiat money. Us common men calls this “printing money”. When we say this we know that maybe it is just adjusting accounts on computers and no money was actually printed. We are trying to learn the terms of MMT but you guys should also learn our language. To us it looks like MMT is one of the biggest advocates of “printing money”. When MMT guys say things like “we can always afford it” it is coming across as saying “deficits don’t matter” and “we can always print all the money we need”. So is that the real MMT position? Was Krugman right?

There have been something like 100 cases of hyperinflation and they are all different, but the common thing is too much spending and money printing compared to the taxes. I don’t think the hyperinflation of “The Continental” during the US revolutionary war and the Confederate money in the South had anything to do with debts in foreign currency. Arguing that the US is currently different than 2 of the 100 hyperinflation cases is a really a weak argument. Much better is to look at the common things in hyperinflation (too much spending and money printing relative to taxes) and see how the current US situation compares to other cases.

If you look at all these governments that had hyperinflation, another common thing is that as their currencies became worthless none of them were in a situation where “they can always afford it”. So I think it is worth understanding how far you can go with “printing money” before things go bad. I think history shows there are limits. When people lose confidence in a currency that country and government are in for much pain. I think the US has a real risk of this sometime in the next few years.

Vincent Cate, government has monopoly over money and as any monopoly it has full pricing power over money. Hyperinflation results when government abuses its pricing power over money in order to get a claim on real resources whatever they are. And by definition there should be a lack of real resources. This is the only “theory” that one needs to understand about hyperinflation.

What you are arguing for (and neoliberalism) is that the constraint on pricing power should be made exogenous to the economy via “independent” central bank, some rules about debt to gdp ratios or budget deficits or similar mechanical levers. What MMT argues for is that this constraint should be made endogenous to the economy which by design also allows fuller real resource utilisation used to advance public purpose defined by political consensus.

US and any country in the world has full risk to use wrong levers or apply proper levers but to wrong points at any point of time in any problem. In particular given current level of economic thought which is actually absence of any thought at all as the only thing I can clear recognize in any macroeconomic debate is pure ideological drive. So who has louder and stronger voice and thicker budget wins the public. In this sense your comments fit 100% to ideology of “how far you can go with” doing things bankers do not like which is allowing government to compete with banks in money creation.

Vincent Cate,

There was massive counterfeiting of the Continental Currency by the British, and therefore it is hardly an example of a sovereign government that is a monopoly issuer of currency. Additionally, the individual state governments also issued Continental currency independently of the federal government. See: http://en.wikipedia.org/wiki/Early_American_currency#Continental_currency

Confederate money was notoriously counterfeited (so much so the Confederacy imposed a death penalty for counterfeiters), and the South’s productive capacity was decimated as the war continued with the lost of its primary resource: African slaves. I don’t see how either of these cases fail to fit the MMT paradigm.

“Hyperinflation results when government abuses its pricing power over money in order to get a claim on real resources whatever they are.”

So the question is when does “printing money” reach the level of abuse? Trader Vic says that when 40 cents out of every dollar a government spends comes from printing money that hyperinflation will follow. He also says the US has reached that point. Sounds plausible to me.

http://www.cnbc.com/id/38313367/Position_for_Rare_Market_Catalyst_Says_Trader_Vic

Dear Vincent (at 2010/09/09 at 21:40)

There is absolutely no basis for your conclusion. You have to analyse how the net financial assets created by the vertical transactions between the government and the non-government sector permeate through the nominal demand structure and the state of excess real productive capacity before you can conclude anything. All the extra currency could simply sit in bank reserves and have been exchanged for other financial assets which would have virtually zero impact on nominal demand (have a look at the US Federal Reserve balance sheet, for example).

Alternatively, a very small net injection of public spending could be inflationary under other circumstances.

Please provide some decent analysis before you continue your “hyperinflation” thread on my blog.

best wishes

bill

Bill lets say there is a fabulous stimulus success and all equity, property, precious metal, etc markets increase 10x over the coming decade then there is a simultaneous asset crash and all the money managers know what to do which is jump into food commodities. Is that a plausible inflation danger?

“There is absolutely no basis for your conclusion.

[…]

Please provide some decent analysis before you continue your “hyperinflation” thread on my blog.”

Trader Vic says he analyzed 30 cases of hyperinflation and that in each case the government first got to printing money for 40% of their spending. I have not done the analysis myself. In Google searches his was the closest I could find to someone claiming to have looked for the common features of hyperinflation the way I was talking about above in “has anyone made a rule”. I am sort of surprised that I could not find any more decent info.

Nice blog and interesting stuff. I really think MMT is a very interesting and different view that more people should try to understand.

Thanks.

It looks like Trader Vic is getting his info from a book by Peter Bernholz called “Monetary regimes and inflation: history, economic and political relationships”. Bernholz studied 29 cases of hyperinflation and came up with the 40% rule. This is the kind of study I was looking for and so I have ordered the book.

http://www.amazon.com/Monetary-Regimes-Inflation-Political-Relationships/dp/1845427785/ref=sr_1_1?ie=UTF8&s=books&qid=1284042213&sr=8-1

@Vincent

I paid a short visit to your page. Just one question: You really intend to sell a 19K 4.23g gold bullion for US$ 200? This means a Vincent 19K 1oz bullion costs US$ 1,340.40. As of today I can buy a 24K 1oz Austrian Philharmonic bullion for US$ 1,309.90. Given that there’s reputation gap between the Vincent and the Austrian Mint, the Austrian 1oz bullion is legal tender and there’s no liquidity in Vincent bullions I must conclude you are either naive or this is another gold scam.

My cheap tester showed it at 19 K. Using XRF test my first 4 coins are 24 K and 5 through 16 are 23 K. I have updated the page. It is just the first 16 coins that are 23 K or 24K and more expensive. These are the first 16 coins ever make in my country, so they will probably be collectors items someday. After this I plan to make 14 K coins, which I will try to sell to tourists at $100. I will probably offer discounts to locals that get very close to the value of the gold.

I believe my coins are harder to counterfeit and easier to verify than any other gold coins. With time I think the reputation gap will work in my favor.

In general small coins, like 1/10th oz, have a higher percentage premium over the gold value than do larger 1 oz coins.

The page we are talking about is http://gold.ai/

Vincent Cate, I guess the message from history is that when an empire collapses the only thing of any value what so ever is the goodwill of your neighbours. The idea that gold or silver can maintain any value in such circumstances kind of flies in the face of the numerous examples of gold and silver wantonly abandoned in such circumstances eg http://www.bbc.co.uk/programmes/b00sfgx8 and http://www.bbc.co.uk/programmes/b00sqw6p.

Buried treasure does not imply people thought it was worthless. Buried treasure means they did not want anyone else to take it. In dangerous times it can be risky to have gold in your house or on you while traveling, so sometimes people bury part of their gold. If they are robbed they have a chance of to dig up the rest of their treasure and being rich again. However, sometimes people are killed or not able to return to a place taken over by invaders. Then the gold stays buried. This in no way implies that they did not want that gold.

Vincent Cate, if I try and put myself in the mind of one of the Romans or Vikings burying the treasure, I’d be thinking “I need to get as far away as I can from the people who know I had all that gold and silver”. To me that does not classify as the treasure having a positive value to me.

Vincent Cate, I think the crucial point is that those elite Romans and Vikings were people who were expelled from their UK homeland at the time they buried the treasure. We do have Viking and Roman genetics remaining in the UK so some descendants were able to survive here but the treasure didn’t help those with treasure.

“I think the crucial point is that those elite Romans and Vikings were people who were expelled from their UK homeland at the time they buried the treasure.”

My guess is they were killed after they buried the treasure. But yes, they never got to spend that money. But people die all the time without first spending all their money.