Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

Saturday Quiz – June 5, 2010 – answers and discussion

Here are the answers with discussion for yesterday’s quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of modern monetary theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

In a fixed coupon government bond auction, the higher is the demand for the bonds

The answer is the lower the yields will be at that asset maturity but this tells us nothing about the effect of budget deficits on short-term interest rates

The option the lower the yields will be at that asset maturity which suggests that higher budget deficits will eventually drive short-term interest rates down might have attracted your attention given that it correctly associates higher demand for bonds will lower yields. You then may have been led by your understanding of the fundamental principles of Modern Monetary Theory (MMT) that include the fact that government spending provides the net financial assets (bank reserves) and budget deficits put downward pressure on interest rates (with no accompanying central bank operations), which is contrary to the myths that appear in macroeconomic textbooks about “crowding out”.

But of-course, the central bank sets the short-term interest rate based on its policy aspirations and conducts the necessary liquidity management operations to ensure the actual short-term market interest rate is consistent with the desired policy rate. That doesn’t mean the central bank has a free rein.

It has to either offer a return on reserves equivalent to the policy rate or sell government bonds if it is to maintain a positive target rate. The “penalty for not borrowing” is that the interest rate will fall to the bottom of the “corridor” prevailing in the country which may be zero if the central bank does not offer a return on reserves.

This situation arises because the central bank essentially lacks control over the quantity of reserves in the system.

So the correct answer is that movements in public bond yields at the primary issue stage, tell us nothing about the intentions of central bank with respect to monetary policy (interest rate setting).

Given that the correct answer includes lower yields the logic developed will tell you why the option “the higher the yields will be at that asset maturity which suggests that higher budget deficits will eventually drive short-term interest rates down” was incorrect.

Why are yields inverse to price in a primary issue? The standard bond has three parameters: (a) the face value – say $A1000; (b) the coupon rate – say 5 per cent; and (c) some maturity – say 10 years. Taken together, this public debt instrument will provide the bond holder with $50 dollar per annum in interest income for 10 years whereupon they will get the $1000 face value returned.

Bonds are issued by government into the primary market, which is simply the institutional machinery via which the government sells debt to “raise funds”. In a modern monetary system with flexible exchange rates it is clear the government does not have to finance its spending so the the institutional machinery is voluntary and reflects the prevailing neo-liberal ideology – which emphasises a fear of fiscal excesses rather than any intrinsic need.

We (Sean Carmody and myself) have decided to introduce a new term into the MMT lexicon – democratic repression – to represent the voluntary constraints that governments impose on their fiscal policy freedoms – which reflect these ideological demands of the deficit terrorists.

We recommend everyone start using the term. Governments are elected to advance a mandate. If that includes maximising welfare of all citizens then we should allow them to do that. If they do not perform well then we can vote them out. We do not need artificial constraints which hinder the government’s capacity to advance public purpose – these ideologically conceived restraints represent democratic repression.

Most primary market issuance is via auction. Accordingly, the government would determine the maturity of the bond (how long the bond would exist for), the coupon rate (the interest return on the bond) and the volume (how many bonds) being specified.

The issue would then be put out for tender and the market then would determine the final price of the bonds issued. Imagine a $1000 bond had a coupon of 5 per cent, meaning that you would get $50 dollar per annum until the bond matured at which time you would get $1000 back.

Imagine that the market wanted a yield of 6 per cent to accommodate risk expectations (inflation or something else). So for them the bond is unattractive and under the tender or auction system they would put in a purchase bid lower than the $1000 to ensure they get the 6 per cent return they sought.

Alternatively if the market wanted security and considered the coupon rate on offer was more than competitive then the bonds will be very attractive. Under the auction system they will bid higher than the face value up to the yields that they think are market-based. The yield reflects the last auction bid in the bond issue

The general rule for fixed-income bonds is that when the prices rise, the yield falls and vice versa. Thus, the price of a bond can change in the market place according to interest rate fluctuations.

The following blogs may be of further interest to you:

- Saturday Quiz – April 17, 2010 – answers and discussion

- Time to outlaw the credit rating agencies

- Studying macroeconomics – an exercise in deception

- Time for a reality check on debt – Part 1

- Will we really pay higher interest rates?

Question 2:

A sovereign government does not have to issue debt to finance its spending. But the more public debt it voluntarily issues

The answer is the greater is non-government wealth held in the form of public debt..

The option “the less is the volume of investment funds in the non-government sector that can be used for other investments”. You may have been tempted to select this option given that the government is withdrawing bank reserves from the system. So a bond issue is a financial asset portfolio swap.

However, banks do not need deposits and reserves before they can lend. Mainstream macroeconomics wrongly asserts that banks only lend if they have prior reserves. The illusion is that a bank is an institution that accepts deposits to build up reserves and then on-lends them at a margin to make money. The conceptualisation suggests that if it doesn’t have adequate reserves then it cannot lend. So the presupposition is that by adding to bank reserves, quantitative easing will help lending.

But this is not how banks operate. Bank lending is not “reserve constrained”. Banks lend to any credit worthy customer they can find and then worry about their reserve positions afterwards. If they are short of reserves (their reserve accounts have to be in positive balance each day and in some countries central banks require certain ratios to be maintained) then they borrow from each other in the interbank market or, ultimately, they will borrow from the central bank through the so-called discount window. They are reluctant to use the latter facility because it carries a penalty (higher interest cost).

The point is that building bank reserves will not increase the bank’s capacity to lend. Loans create deposits which generate reserves. As a result, investors can always borrow if they are credit-worthy.

Further, the option “the more difficult it is for banks to attract deposits to initiate loans from” also reflects the erroneous view of the banking system.

The correct answer is based on the fact that the when the government swaps bonds for reserves (which it has itself created via its spending) it is providing the non-government sector with an interest-bearing, risk free asset (for a sovereign government) in return for a non-interest bearing reserve. Reserves may earn a return but typically have not.

The bonds are thus part of the non-government sector’s stock of wealth and the interest payments comprising a flow of income for the non-government sector. So all those national debt clocks are really just indicators of public debt wealth held by the non-government sector.

I realise some people will say that the stylisation of government funds being provided by MMT doesn’t match the institutional reality where governments is seen to borrow first and spend second. But these institutional arrangements – the democratic repression – only obscure the essence of a fiat currency system and are largely irrelevant.

If they ever created a constraint that the government didn’t wish to accept then you would see institutional change being implemented very quickly. The reality is that it is a wash – net government spending is matched by bond issuance – irrespective of these institutional procedures and the government never “needs” these funds to spend.

The following blogs may be of further interest to you:

- Quantitative easing 101

- Building bank reserves will not expand credit

- Building bank reserves is not inflationary

- Money multiplier and other myths

- Will we really pay higher interest rates?

- A modern monetary theory lullaby

- Hyperdeflation, followed by rampant inflation

Question 3:

When the government borrows from the non-government sector it eventually has to pay the bonds back on maturity. This will:

The answer is be inflationary if the government payments to bond holders at maturity add more to nominal aggregate demand than the real economy can support given other policy settings..

The option “not be inflationary because the sovereign government just has to credit the bank accounts of those who hold the bonds to repay them” describes the operational reality that accompanies the repayment of the bonds and all interest payments. So in the first place, the flow of funds ends up in bank reserves.

So as it stands that option is a correct answer. But is it the best answer?

The option “be inflationary if by the time the bonds mature the economy is growing strongly so there will be too much money floating about” makes no real sense and is a typical mainstream response. What does “too much money” mean? Nothing as it stands.

The best answer is defined by the crucial assumption that is provides you with. That the funds that accompany the maturing bonds (whether they be the return of the face value or the final interest payment) are spent – that is flow into aggregate demand rather than stay suspended in bank reserves.

An increase in bank reserves is not inflationary. Outstanding public bonds do form part of the accumulated wealth of the non-government sector. At any time, they choose, non-government agents can convert the stock of wealth into a flow of spending. So the “inflation risk” inherent in the stock of financial assets is independent of maturity of the outstanding bonds.

In this context, I agree with the point made by regular commentator, Sergei who said:

The spending capacity of private sector is not affected by maturing bonds because bonds by definition represent savings of private sector which can be spent at any moment of time regardless of time to maturity (especially with central bank always standing ready to repo these bonds for reserves).

But that doesn’t negate the validity of the answer in the way I have constructed it. If non-government agents decide to run down some of their financial wealth and start spending then the inflation risk can be realised. I would stress that we should not always focus on that inflation risk as the inevitable outcome. Inflation can result when aggregate demand rises but usually will not.

In this context, it is essential to understand that the analysis of inflation is related to the state of aggregate demand relative to productive capacity. Increased spending, in itself, is not inflationary. Nominal spending growth will stimulate real responses from firms – increased output and employment – if they have available productive capacity. Firms will be reluctant to respond to increased demand for their goods and services by increasing prices because it is expensive to do so (catalogues have to be revised etc) and they want to retain market share and fear that their competitors would not follow suit.

So generalised inflation (as opposed to price bubbles in specific asset classes) is unlikely to become an issue while there is available productive capacity. Even at times of high demand, firms typically have some spare capacity so that they can meet demand spikes. It is only when the economy has been running at high pressure for a substantial period of time that inflationary pressures become evident and government policy to restrain demand are required (including government spending cutbacks, tax rises etc).

Further, spending growth can push the expansion of productive capacity ahead of the nominal demand growth. Investment by firms in productive capacity is an example as is government spending on productive infrastructure (including human capital development). So not all spending closes the gap between nominal spending growth and available productive capacity.

But, ultimately, if nominal demand outstrips the real capacity of the economy to respond to the spending growth then inflation is the result.

The following blogs may be of further interest to you:

- Building bank reserves is not inflationary

- Will we really pay higher interest rates?

- Hyperdeflation, followed by rampant inflation

Question 4:

When an external deficit and public deficit coincide, there must be a private sector deficit, which means that governments can only really run budget deficits safely to support a private sector surplus, when net exports are strong.

The answer is False.

This question relies on your understanding of the sectoral balances that are derived from the national accounts and must hold by defintion. The statement of sectoral balances doesn’t tell us anything about how the economy might get into the situation depicted. Whatever behavioural forces were at play, the sectoral balances all have to sum to zero. Once you understand that, then deduction leads to the correct answer.

To refresh your memory the balances are derived as follows. The basic income-expenditure model in macroeconomics can be viewed in (at least) two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances.

From the sources perspective we write:

GDP = C + I + G + (X – M)

which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

From the uses perspective, national income (GDP) can be used for:

GDP = C + S + T

which says that GDP (income) ultimately comes back to households who consume (C), save (S) or pay taxes (T) with it once all the distributions are made.

Equating these two perspectives we get:

C + S + T = GDP = C + I + G + (X – M)

So after simplification (but obeying the equation) we get the sectoral balances view of the national accounts.

(I – S) + (G – T) + (X – M) = 0

That is the three balances have to sum to zero. The sectoral balances derived are:

- The private domestic balance (I – S) – positive if in deficit, negative if in surplus.

- The Budget Deficit (G – T) – negative if in surplus, positive if in deficit.

- The Current Account balance (X – M) – positive if in surplus, negative if in deficit.

These balances are usually expressed as a per cent of GDP but that doesn’t alter the accounting rules that they sum to zero, it just means the balance to GDP ratios sum to zero.

A simplification is to add (I – S) + (X – M) and call it the non-government sector. Then you get the basic result that the government balance equals exactly $-for-$ (absolutely or as a per cent of GDP) the non-government balance (the sum of the private domestic and external balances).

This is also a basic rule derived from the national accounts and has to apply at all times.

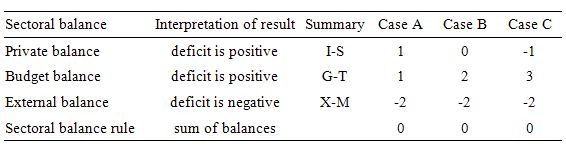

To help us answer the specific question posed, we can identify three states all involving public and external deficits:

- Case A: Budget Deficit (G – T) < Current Account balance (X - M) deficit.

- Case B: Budget Deficit (G – T) = Current Account balance (X – M) deficit.

- Case C: Budget Deficit (G – T) > Current Account balance (X – M) deficit.

The following Table shows these three cases expressing the balances as percentages of GDP. You can see that it is only in Case A when the external deficit exceeds the public deficit that the private domestic sector is in deficit.

So the answer is false because the coexistence of a budget deficit (adding to aggregate demand) and an external deficit (draining aggregate demand) does have to lead to the private domestic sector being in deficit.

With the external balance set at a 2 per cent of GDP, as the budget moves into larger deficit, the private domestic balance approaches balance (Case B). Then once the budget deficit is large enough (3 per cent of GDP) to offset the demand-draining external deficit (2 per cent of GDP) the private domestic sector can save overall (Case C).

The budget deficits are underpinning spending and allowing income growth to be sufficient to generate savings greater than investment in the private domestic sector but have to be able to offset the demand-draining impacts of the external deficits to provide sufficient income growth for the private domestic sector to save.

The following blogs may be of further interest to you:

- Stock-flow consistent macro models

- Norway and sectoral balances

- The OECD is at it again!

- Saturday Quiz – May 22, 2010 – answers and discussion

Question 5:

In a situation where the private domestic sector decides to lift its saving ratio we cannot conclude that the national government has to increase its net spending (deficit) to avoid employment losses.

The answer is True.

The answer also relates to the sectoral balances framework developed in Question 4 and the two answers should be read as complements. When the private sector decides to lift its saving ratio, we normally think of this in terms of households reducing consumption spending. However, it could also be evidenced by a drop in investment spending (building productive capacity).

The normal inventory-cycle view of what happens next goes like this. Output and employment are functions of aggregate spending. Firms form expectations of future aggregate demand and produce accordingly. They are uncertain about the actual demand that will be realised as the output emerges from the production process.

The first signal firms get that household consumption is falling is in the unintended build-up of inventories. That signals to firms that they were overly optimistic about the level of demand in that particular period.

Once this realisation becomes consolidated, that is, firms generally realise they have over-produced, output starts to fall. Firms layoff workers and the loss of income starts to multiply as those workers reduce their spending elsewhere.

At that point, the economy is heading for a recession. Interestingly, the attempts by households overall to increase their saving ratio may be thwarted because income losses cause loss of saving in aggregate – the is the Paradox of Thrift. While one household can easily increase its saving ratio through discipline, if all households try to do that then they will fail. This is an important statement about why macroeconomics is a separate field of study.

Typically, the only way to avoid these spiralling employment losses would be for an exogenous intervention to occur – in the form of an expanding public deficit. The budget position of the government would be heading towards, into or into a larger deficit depending on the starting position as a result of the automatic stabilisers anyway.

If there are not other changes in the economy, the answer would be false. However, there is also an external sector. It is possible that at the same time that the households are reducing their consumption as an attempt to lift the saving ratio, net exports boom. A net exports boom adds to aggregate demand (the spending injection via exports is greater than the spending leakage via imports).

So it is possible that the public budget balance could actually go towards surplus and the private domestic sector increase its saving ratio if net exports were strong enough.

The important point is that the three sectors add to demand in their own ways. Total GDP and employment are dependent on aggregate demand. Variations in aggregate demand thus cause variations in output (GDP), incomes and employment. But a variation in spending in one sector can be made up via offsetting changes in the other sectors.

The following blogs may be of further interest to you:

“I realise some people will say that the stylisation of government funds being provided by MMT doesn’t match the institutional reality where governments is seen to borrow first and spend second.”

who would say such a thing …

A quite enlightening take on the Euro that I’m sure you will enjoy:

“Europe’s Democracy Deficit” by Gary Younge | June 2, 2010

http://www.thenation.com/article/europes-democracy-deficit

“In this context, I agree with the point made by regular commentator, Sergei who said:

The spending capacity of private sector is not affected by maturing bonds because bonds by definition represent savings of private sector which can be spent at any moment of time regardless of time to maturity (especially with central bank always standing ready to repo these bonds for reserves). “

Question about this: From the point of view of any individual bond holder, these bonds are very liquid because they can be easily repo’d or sold …. but in aggregate, spending capacity must be affected, right? Because money tied up in government bonds does not circulate until they mature. So if I sell my bond, it just means the person buying it curtails their spending instead of me.

How can we say the spending capacity of the private sector is not affected by maturities … in aggregate?

What could this statement possibly mean? No money is tied up anywhere.

The bonds themselves circulate as money. When they mature, the form of money changes (more cash and less bonds) but the total amount of wealth does not change, neither does spending power.

And because every interest bearing bond can be reduced to a zero coupon bond, the same applies to coupon payments (e.g. image a portion of the bond matures).

This is true for private sector bonds as well as government bonds.

The bonds themselves circulate as money.

OK – this I’ve haven’t heard before. Can you elaborate? What sorts of transactions are routinely done using government bonds with no other form of money changing hands?

According to MMT, if bonds themselves are “money”, I should be able to pay my taxes with them, right?

Also, as far as I can tell, they’re never included in any monetary aggregates … M1, M2, M3 … why not?

Dear Bill,

“Investors can always borrow if they are credit worthy”. I object! In a situation of asymmetry between counterparties in credit markets, there can be “credit rationing”.

Ken,

If you want to get technical, then yes, you can no more pay your taxes with a bond than you can with your deposit claims.

In both cases you must sell the claim first for cash and then purchase the item for cash. There is nothing special about taxes in this regard — the same would hold if you were buying a pencil.

The fact that there is a settlement infrastructure in the background that allows you to use traveller’s checks, credit cards, bank checks (or in my case, a debit card tied to my money market mutual fund) — doesn’t change the basic fact of what happens. The asset is sold for its cash value, the proceeds are used to buy the item or settle the debt, and the receiving party takes the cash proceeds and uses them to purchase some financial asset or extinguish their own debt.

The flow is:

sale of asset –> buyer purchases good or other asset with proceeds –> seller buys asset or good with his proceeds, etc. Cash is used in the arrows.

Because people were confused when they first created the monetary aggregates. They thought they were measuring something useful, but it turned out that they weren’t. This is why the Fed does not target the monetary aggregates.

A good discussion of this is here:

http://www.newyorkfed.org/aboutthefed/fedpoint/fed49.html

[emphasis added]

Unfortunately, the economists are still confused. The cash itself is just a technical device, people buy goods by selling financial assets and they store the proceeds of the sale of goods by buying financial assets.

Panayotis,

If you are talking of rationing in the sense of Stiglitz and Weiss where some agents are unable to borrow even though they can pay the “equilibrium rate”, then that is a New Keynesian view and not the best way to look at how banks work. In such models borrowers may give more collateral but banks wouldn’t lend and such paradoxes may appear. Such models explicitly use the loanable funds approach.

Banks are active about their creditworthiness checks and they may restrict credit by various means such as demanding more collateral and asking borrowers to show income etc to release a new round of payment. Banks may also restrict credit because of lack of confidence, and because of low animal spirits.

I guess credit rationing theory using information asymmetry can describe the credit markets (not sure) but not bank lending. In the comment you quoted, Bill was talking of banks.

If you want to get technical, then yes, you can no more pay your taxes with a bond than you can with your deposit claims.

In both cases you must sell the claim first for cash and then purchase the item for cash.

Well, I can pay them with my demand deposit claims — my checking account. I do it all the time.

If I sell a government bond for cash, the person purchasing the bond from me is giving up spending power in favor of deferred spending power. One of us is forfeiting current spending power — either me or the person who purchases the bond from me — until the bond matures. So in the aggregate, bond maturities must matter, when considering the total nominal dollar spending power available in the economy at a given time.

Sure, and I pay taxes by writing a check on my mutual fund that holds bonds, but in both cases, the check is just an instruction from your bank to supply cash to the Treasury, and they must either sell some of the backing assets or borrow to do this.

So you are trying to distinguish between how many steps are needed for you to perform an operation (e.g. does your bank or brokerage supply you with check writing abilities) versus how many operations actually occur. There is a whole settlement system in the background that does all these operations on your behalf, and it seems as if you are paying taxes with your deposit, whereas really there is a conversion to cash first — and deposits are not 100% backed by cash. This conversion necessarily requires either the sale of some paper asset (e.g. a bond) or borrowing cash. Just because those operations are hidden from you and/or mostly net out does not mean that they are not performed.

No, he is not giving up any spending power, because the bond is a store of value that can be converted into cash at any point in time, just like any other liquid asset.

Nope — this is where aggregation fallacies come into play. If the world consisted of a single borrower and a single lender selling a zero coupon bond, then you would be right.

But as soon as there are many agents involved that interact in credit markets, the bond itself is a store of value that can be sold for cash at any time. The bond is wealth.

If the bond comes due in 10 years, then no one needs to hold the bond to maturity — as long as they each hold it for a non-zero period of time, it can circulate very quickly among many people without anyone needing to defer consumption for any fixed positive period of time. And of course banks and other institutions can borrow in the overnight or repo market to buy the bond, without giving up any consumption opportunities.

This is really a key difference — to borrow is to spend, as borrowing creates the income necessary to buy the debt, just as government spending creates the income necessary to buy government debt. Even though on an individual level, each person does defer consumption to buy assets, but in aggregate consumption is not deferred to fund lending.

Well said, RSJ. The erroneous belief that “spending power” is equivalent to “deposits” is so deep-seated. As I’ve said many times, nobody is ever constrained in their spending by the fact that they own a Tsy security–it’s the most liquid, risk-free asset to hold, and is the best possible form of collateral if you are going to borrow. One other thing I’d add to your explanation of the Tsy purchasing process is the fact that a good many primary mkt purchases of Tsy securities are done by dealers who are borrowing in repo mkts to finance these purchases. And those lending to these dealers are frequently just looking to invest overnight. Further, with the dealer’s purchase of the Tsy in the primary mkt, there are multiple additional credit creating transactions that will occur using it as collateral. In short, the view that the investor in the Tsy security is “giving up spending power” is a popular myth that is completely divorced from reality, as it’s an integral part of how the dealer makes a profit. It’s a bit like claiming that a bank making a loan is “giving up spending power.”

Ramanan,

This is not correct! Asymmetry is not an equilibrium concept but a source of imperfection, see my comment on imperfection. Banks have less information regarding the financial condition and credit risk of borrowers than the borrowers and available collateral is not sufficient to correct that discrepancy. In this situation it is rational for the lender to ration the loan or reserve it for the customers that has a relationship with. If you do not believe me ask any small businessman in your country! He will tell you the reality of the situation!

Ken:

Remember that for savers with excess dollars, the bond is just another savings account form. No additional money is being “withdrawn” from the money supply. Otherwise, you would just keep in under the mattress. If you were going to spend it, it wouldn’t be available to be saved.

For large holders of excess dollars (China, corporations, not me) they have the financial infrastructure to use the bonds as collateral in simple and complex transactions (Scott explains some of those). In fact, if you have T-bills in your possession, you can use them as collateral for a personal loan – that is if banks ask for collateral any more 🙂

As RSJ and Scott both indicate, spending is actually enhanced by savings – not that savings function as the source of “funding”, but to serve as collateral and leverage. Just don’t get over-leveraged.

“nobody is ever constrained in their spending by the fact that they own a Tsy security”

maybe, (see below), but how many people owning a Treasury security are motivated to spend instead?

not many; most Treasury owners are investors, institutional and individual, looking to manage risk in their portfolios

these investors aren’t looking to “spend” anything; they’re managing money and risk and just changing their portfolios around when they move from treasuries to cash (instantaneously or short term) to something else

that’s less the case for holders of cash instead of treasuries – many of them are motivated to spend as their next move – corporations and individuals. Corporations and individuals don’t hold many treasuries. Corporations don’t want to repo bonds in order to buy their next supply stock, and individuals mostly don’t want to repo bonds period. And both prefer cash to avoid the interest rate risk associated with selling bonds to raise cash.

All assets have purchasing power. However, they differ in liquidity facility as a hoard protection against pure uncertainty! They also differ in credit risk/expected shortfall, interest rate risk, inflationary expectations effect, if they are foreign assets they are also face a foreign exchange risk and if they are traded in well developed secondary markets. Assets are heterogeneous and this is a source of imperfection which you should pay attention of what it means. So they are not trully equivalent! Some more discipline is needed!

And I doubt there’s much household borrowing collateralized by treasuries – certainly not compared to total household borrowing, and not compared to total treasuries outstanding. The relative contribution of treasuries to household spending has to be insignificant.

By the way what happened to Tom Hickey that added a lot of wisdom in comments. No offence to those who trully want to learn (including my self).

Hi Scott,

Absolutely agree re: PDs — but now the question is — do you accept that the same principle holds for private sector bonds, equities, and paper? These are not as good sources for collateral, nevertheless, you can still have the following (simplified) dynamic:

Firm A sells a bond to an investor. The investor sells a treasury of similar maturity to buy the bond. The treasury is sold to a money market fund.

Firm A buys shares of the money market fund with the proceeds.

So all that happened was an asset shift, and this was how the firm got funded, without anyone deferring consumption.

Then the firm begins to spend, selling shares of the money market fund to pay wages/goods, and the sellers of the wages/goods park the proceeds of the sale into the money market fund. Some of the buyers decide to sell their money market fund and buy a longer term bond mutual fund, which will buy bonds of the next firm to get funded, etc.

So here you have credit growth without bank lending and without government securities, generated by risky assets.

I think any asset for which there is a credit market — basically any asset that can be resold — can cause credit expansion in this way.

Moreover, if there are no risk-free assets — i.e no treasuries/agencies — and if banks are not allowed to hold credit market instruments, you will make it harder for private debt to be placed via balance sheet expansion, and this will push up yields somewhat.

None! That’s the point — the firm selling bonds (or the government selling treasuries) is not funded by households deferring their consumption, but by portfolio shifts and balance sheet expansion on the part of institutional players.

Then the firm/government takes the proceeds of the sale and spends, and this creates an added flow of income to the household sector, and households buy the some of the assets from the institutional/financial sector with this income flow, and the remaining assets are stored as household deposits, backed by the unsold bond assets of the firms/governments.

“None! That’s the point”

you’ve completely missed the point

investors in treasuries are managing asset risk; they aren’t planning on spending “using” treasuries and therefore they aren’t planning on selling/repoing/borrowing against treasuries

No, I haven’t.

The purpose of this discussion — the point, as you will, is whether households in aggregate defer consumption when they purchase assets, or whether borrowers create the income that allows assets to be purchased. I.e. does a surge in borrowing require a surge in saving, or will the surge in borrowing create the surge in savings.

Therefore, claiming that *household* investors do not borrow from the repo market is meaningless. BDs, Banks, pension funds, hedge funds — these clearly do. They are able to absorb the new issue of debt simply via balance sheet expansion and/or portfolio shifts without any ex-ante deferral of consumption on the part of households.

When the borrower — either the government or the business sector — spends the proceeds of the asset sale, this adds to to the income of the household and non-financial business sector, allowing them to buy the assets and fund the borrowing ex-post without any need to defer consumption ex-ante.

Really this boils down to the economic question of whether interest rates reflect time-preference on the part of households, so that the borrowers must adequately compensate households for consumption deferral, or whether for any time preference, incomes adjust, rather than rates.

If you believe that interest rates adjust, then you must believe that the Japanese were incredibly impatient prior to 1989, and suddenly became extremely patient after that point. If you believe that, regardless of the quantity borrowed, risk-adjusted profit expectations determine these rates, then you believe that the Japanese economy was undergoing a period of high expected expected returns followed by a period of low expected return.

Anon,

Your point is well taken and legitimate one. Assets are differentiated and do not perform aparticular job equally well. The rest is phantasy and circular thinking!

Anon,

In case there is a misunerstanding the phantasy and circular thinking is not about your comment!

I’m with everything RSJ has said here.

“No, I haven’t.”

I defined the point in question in my comment re Scott F.’s piece.

Your comment above has nothing to do with that.

The point was to what degree were holders of treasuries doing so because they planned on spending from their treasury positions. The answer is very few. Institutional investors don’t hold treasuries or other assets for the purpose of spending in the national accounts sense; similar for households on a relative basis, as I explained above. So the usefulness of holding treasuries instead of cash is moot.

Whatever you’ve written about borrowing in general above is irrelevant to that point. I’ve already said that households and others do lots of borrowing for spending purposes, without using treasuries as collateral.

So you’re off point. Please go away unless you have something on that point.

Scott Fullwiler,

Circular arguments and phantasy?

“borrowing creates the income necessary to buy the debt”

nice accounting; do you agree with that?

Panayotis . . . such as?

anon . . . the accounting’s not difficult, and quite standard within PK endogenous money theory used by horizontalists, chartalists/MMT, and circuitistes. It’s also standard Keynes GT. Investment spending–often via borrowing–creates the income that results in saving. The borrowing didn’t require prior saving. When the borrowing stops, so does the aggregate income stop growing, and the saving as well. That’s exactly where we are now in the US and many other countries.

the act of borrowing is entirely separate from both income and saving

borrowing is not a part of national income accounting at all

borrowing is a transaction in financial assets and liabilities – not income and saving

emphasized in the fact that some borrow to invest or to buy financial assets – which again has nothing to do with income and saving

borrowing does not “create income”

pretty simple accounting

spending creates income

that I can buy

Scott,

You surprise me! As an economist should realize not to follow to the trap that everything is everything! Such as the previous discussion………. A conversation across purposes and all assets are money without risk qualification, transaction costs etc. Behavior, my friend is needed beyond accounting (which I find legitimate for its purpose and I respect your work in that). However, lets shed some light in the “black box”.

Panoyotis . . .I don’t find that relevant to my points. Of course you need behavior beyond accounting. But we’re talking about accounting and payment settlement, and how transactions are actually done and by whom. What we are doing is shedding light in the black box, actually. If you want to suggest it works differently than RSJ and I are suggesting, then please directly say so and explain why. Criticizing me for believing “everything is everything” isn’t worth responding to.

anon . . . looks like you’re missing the point now.

The accounting is just

net borrowing = net lending

among whatever sectors are involved.

Not difficult at all. But accounting tells you nothing about causality — this is a discussion about the causality.

Scott,

All — most? — of the “inapplicable” stuff in the RBC models boil down to this flaw, IMO — they confuse the “real” income flow with the actual income flows. As a result, the stock of financial assets is exactly equal to the stock of capital in whatever capital accumulation equation they use, and the real income is goop that is transmuted to either an increase in real capital or into consumption.

The inability of actual incomes to deviate from this “real” goop is what forces loanable funds, and assuming government does not add to the capital stock, they get crowding out.

But if your micro-foundations are such that borrowing creates sufficient incomes to generate savings whatever the discount factor and marginal utility happens to be, then you can still use the DSGE toolset of intertemporal optimization and get Keynesian effects, right? All you would need would be downward sloping demand curves — which are widely accepted. You don’t even need rigid prices. With a downward sloping demand curve, a decrease in borrowing would lead to a decrease in output. Fiscal policy becomes stimulative, and you no longer get crowding out, as government deficit spending adds to income.

Your capital accumulation function would be a function of actual incomes that drives the “real” variable, where the slope of the demand curve would give you the conversion factor from actual to “real”. So a surge in borrowing would be partially inflationary and partially stimulative. And a decline in borrowing would be partially deflationary and partially contractionary. This would give you persistence if you assume a random error between the expected return and the actual return, but without assuming negative productivity shocks as the errors.

I know, this is approach very simple — just a toy — but still, it would express the types of dynamics that you see in the accepted DSGE language, only with different micro-foundations. Am I missing something, or is this possible? Desirable?

“looks like you’re missing the point now”

so what did I say that you disagree with?

With so many people missing the point, there is probably a joke in there.

But that would be beside the point. 😉

RSJ,

I’m mostly with you on the RBC/DSGE “fixes.” You could do all that, and it would certainly be an improvement. You still have to bring stock/flow consistency into DSGE, instead of the current method of simply summing up all the agents’ consumption, etc. (some of that’s covered by getting rid of loanable funds, as you note). And you would need to get rid of some things like the transversality condition (Goodhart’s done some research with microfoundations trying to do this). There are some trying to do micro optimization methods with heterogeneous actors, as in the asset-based computation literature. These are better, but I’ve still not seen them ever discuss having consistent accounting–if someone has seen that. let me know, because I’ve been looking for it (not so hard the past few years, so I may have missed something, for sure). Anyway, most of what you’re describing are similar to the microfoundations behind the Fairmodel, but that’s a structural model, not DSGE, obviously. And you generally get the results with the Fairmodel that you are describing (and it’s also stock-flow consistent).

Min,

point taken

So… at the risk of missing the point (non-econ person here), with due apologies:

Spending the proceeds of borrowing creates income? Borrowing per se, does not? (This is what I have always supposed to be the case)

“Spending the proceeds of borrowing creates income? Borrowing per se, does not? (This is what I have always supposed to be the case)”

Yes.

Well, just to keep the most excellent conversation going…what would borrowing without spending look like?

How about borrowing in order to repay principal of another loan?

Andy Harlass wrote a really nice essay about the relationship between investment, savings, and borrowing called “Investment makes Savings Possible.” I’d recommend it to anyone still confused about why prior savings is not required to fund future investments. The essay is here:

http://blog.andyharless.com/2009/11/investment-makes-saving-possible.html

Not sure if Andy Harless understands it well.

Here are two tables on how investments creates saving (taken from a book)

Stage 1 – Loans make deposits

Stage 2 – Investment leads to saving

Panayotis @8:16,

Your statements such as “reserve it for the customers that has a relationship with.” implicitly assumes a loanable funds market. There is no reserving it for customers. Banks can lend the old customers as well as new ones. Banks lend by expanding their balance sheets and the statement such as “reserve it for …” is very neoclassical because it means there is scarcity of funds for banks to lend.

I am not denying the possibility of rationing -better to call it credit restriction. Banks may/will lend to old customers even in times of low animal spirits because they know their creditworthiness because of the relationship. Bank loan market is not a competition on who gets the loan etc. They may restrict credit growth – but not because of shortage of funds – just because of lack of animal spirits and their view about creditworthiness of borrowers.

The NK credit rationing theory misses the point.

Ramanan,

I find most of your comments thoughtful and careful. Your last comments on credit rationing and the interpretation of what I say are not in that category. You have the theory wrong. Asymmetry and the concept of credit rationing that I propose is NOT LOANABLE FUNDS THEORY. I did not say anything about competition of who gets the loan. Reserving the loans to the customers based on relationship that reveals information in situations of asymmetry does not mean scarcity of funds. I have not said anything against animal spirits and MEC and lending to customers based on the perceived credit worthiness. I suggest you examine again what I said and the concept of asymmetry. Just because some neoclassical economists have attempted to use the concept it does not mean that we should not use it. I suggest you go back into the serious comments and your interest of circuit theory with which we share a common interest!

Scott,

Iam not going to continue this because is leading nowhere. Your statements have no behavior in them. Unrealistic assumptions, tautology and circular thinking cannot pass as scientific analysis. I suggest that you read my brief comments more carefully. I criticized statements that did not realized heterogeneity, risk differentials and transaction costs and other factors I mentioned in my comment at 8:51. I suggest you read it. Do you have a definition of money? As about accounting my point is that is not enough. Your statement, I am afraid is not shedding any light on the “black box”. Stock-flow consistency is needed but does not give an answer to the issues of behavior and the feedback dynamics neccessary for any analysis.

By the way,

DSGE models and RBC models are not equivalent. The stochastic dynamics, Brownian motion or not are not limited to RBC. Micro-foundations? Error term? I have not seen any by this discussion! “Downward sloping demand curves” can be consistent with several microfoundation assumptions. “This approach is very simple”…….Where is the approach? What assumptions, what hypothesis what logic? It takes discipline to do scientific analysis. Enough with generalities, tautologies, phantasy and circular thinking. “everything is everything”…………

I am not a professional economist but I can try to weigh in some practical points:

1. Corporations DO hold treasuries. They might not use repo to obtain cash but they do invest into securities any short-term liquidity surplus. Moreover, it is enough to open any balance sheet of any big corp and check the respective item. This fact is independent from the balance sheet size. Next, nobody is forcing a corporation to sell its stock of treasuries even if it has to pay taxes as it can clearly borrow cash with bonds as collateral.

2. Household DO hold treasuries (often via a fund). They use it as collateral when they take mortgages. This substitutes a down-payment and compounding should cover part of principal payment at maturity. This is NORMAL practice where I live though not sure about global scale. Is it spending? Yes, it is because they are acquiring a real asset.

3. Banks are too mechanical to consider any behavioural aspects of lending. They ARE doing rationing but do for a completely different reason which is diversification of risk which in turn is very much driven by (expected) regulations. It is not about relationships with good/better customers. Business lines can cut credit to 20 years old relationships because they got an order to do it. You can ask any business owner in the country you live!

Sergei,

Diversification of risk is one reason and I am not arguing against it or against credit worthiness. The relationships are important because they provide answers to the information asymmetry problem. They help learn more about customers. As about mechanics there is always some reasoning behind them and they do not deny my point. Ask your local banker! I have asked many small businessmen in several countries and I have personal experience with banks with small and very large loans! I hope it helps clrear the misunderstanding of what I said.

“Corporations DO hold treasuries; Household DO hold treasuries”

Does anyone actually read anymore?

Apart from that, corporations only hold 1 per cent of treasuries (Z1 report)

Sergei,

Regarding your first and second comments about who holds treasuries and other securities it was not a point I debated. However, the use of securities as collateral for loans differs by their type and coverage they provide, based on the characteristcs so the size of loans is bounded by them. This is one aspect about the heterogeneity of securities.

Food for thought on the Savings function.

The savings function of a unit of analysis can be specified as a joint function of the following relationships as bounded by the ASSUMED sources of imperfection(asymmetry,heterogeneity,disintegration,dispersion), friction and complexity (entanglement of the tropies of the mechanisms of completion, variation and disclosure. (These mechanisms are given and not explained here but explained elsewhere).

The generation process of savings, a vertical behavioral relationship of praxis for the savings PROPENSITY, is based on “leakages” from income either as constant or variable. The key parameter of this relatioship is “animal spirits” or expectations that determine the bounded spending propensity whose leakage residual is the savings propensity.

The allocation process of savings, a horizontal behavioral relationship of praxis for the saving PREFERENCE, is based on scarcity differentials (scale,scope,mobility) and an intercept factor of tradition/custom based on convention. Please do not confuse here liquidity preference of the behavioral aspect of decision allocation which is based on danger differentials (risk.doubt,fear) and an intercept factor of ignorance based on pure uncertainty. Or the liquidity propensity of the behavioral aspect of decision generation which is based on “animal spirits” and expectations. Furthermore, notice that the intercept expressions can be specified by a Bernoulli equation altough other specifications are possible.

Panayotis,

I have re-read your comments. They were not relevant to the discussion we were having about the payment settlement system, the basic business model of a primary dealer. and also how institutional investors invest in Tsy securities ONCE THEY’VE ALREADY MADE THE DECISION TO INVEST IN TSY SECURITIES. Of course credit rationing and asymmetry matter. Of course the various aspects of different assets matter for portfolio allocation. Nobody disputed that (and I would argue that Bill did not dispute that, as “creditworthy” is a label determined by the lender, not the borrower). But those issues were not relevant to our specific discussion. Further, there is a large academic literature on the areas we were discussing using the same language we were using. If you have a problem with that literature’s “scientific” legitimacy, then feel free to email them all and tell them. And, yes, RBC and DSGE are not the same thing. But DSGE’s incorporate a good deal of RBC frameworks. Again, I find your comments here irrelevant to our discussion.

Best,

Scott

Scott,

I suggest you read my previous comment on savings. I am not debating credit rationing with you but the loose language about savings, the definition of money, etc., which were not my points to begin with. You defended some comments of another commentator whose circular, tautological and evasive arguments have no scientific merit! As you decided to defend someone, I intervened because I feel we need some more discipline in our analysis. I have said before that I have read some of your work on financial accounts that I fount to be a significant contribution. However, in this discussion where are the assumptions, the behavioral relationships the consistent hypothesis with invariant logic? The comments about RBC and DSGE were not meant for you! So before you decide on irrelevance read again what I have said. Also read the previous comment so you can see what I mean by hypothesis. You can agree or disagree but states a reasoning!

Panayotis,

Ok apologies and peace! Didn’t really mean to upset you 🙂

I opposed “asymmetric information” in lending because according to me there is only one sense it seems to have been used in Macroeconomics which is the New Keynesian theory. “Asymmetric information” is not just the fact that information is asymmetric, but all the story which comes with it. I opposed the usual theory which comes under the banner “asymmetric information” not the phrase. I wanted to say that it may have some use in other places not bank lending where banks reject applications on various criteria decided by them, which changed time to time.

If you have your version of the use of asymmetric information, I’ll be happy to see it.

I wasn’t talking about a savings “function” or a saving “function.” Yes, you need to make assumptions about behavior to talk about that. My understanding was that we were talking about how saving itself WAS NOT the point at all. And that was what we were trying to demonstrate. No behavioral assumptions necessary for that. Just a correct description of the causation (again, not the motivations for the actions, but taking the actions as given–for instance, if a firm DECIDES to borrow to invest, is prior saving required? No behavioral assumptions necessary to consider that point) and how the actions are accounted for in financial statements.

Thanks Scott,

” There are some trying to do micro optimization methods with heterogeneous actors, as in the asset-based computation literature” — you mean “agent-based” computation, right? I’ve never heard of asset-based computation, but I am the hobbyist here. But I think the transversality condition is not a problem, since you can look at overlapping generations, or it’s single agent equivalent, which would be a terminal (constant) Asset/Income ratio — and then you can shock the model by shifting this ratio around. If you have multiple generations, then selecting the equilibria is similar to selecting what the long run asset/income ratio would be. Now, I am purely speculating, but this seems to be the role that the transversality relation would play if you get rid of loanable funds. Do you have any specific references for Goodhart? I did just a bit of googling and found some yield curve/house bubble econometric work, but no micro-foundations.

Getting back to my original point…

If the bond comes due in 10 years, then no one needs to hold the bond to maturity – as long as they each hold it for a non-zero period of time, it can circulate very quickly among many people without anyone needing to defer consumption for any fixed positive period of time. And of course banks and other institutions can borrow in the overnight or repo market to buy the bond, without giving up any consumption opportunities.

It had seemed to me that this was kind of a shell game … sure the bond is liquid from the point of view of any individual holding it, but ultimately someone has to hold it instead of spending money in the real economy.

However, there is something here I hadn’t thought about before …. the very existence of the bond may serve to collateralize a bank loan that would not otherwise be viable in the absence of this collateral. By this means, the bond could indeed be monetized with bank created money in advance of its actual maturity. I need to think about it some more, but maybe this is the answer to my perceived problem.

Thanks all.

Ken

Doesn’t the above statement apply equally well to cash?

Is cash a shell-game, in which one person’s spending means that someone else (the seller) has cash? And then they spend it so someone else has cash. Etc.

So no, it’s not a shell game, it’s just the definition of a store of value:

You get it by spending less than you earn and then you keep it until you decide to spend more than you earn at some later point. The fact that you bought it today means nothing about how long you will keep the bond — or the cash, or the deposit, etc.

In fact, in earlier times, government’s used to sell consols, which *never* expired. Most famously Britain. To this day, there are still some people holding consols, receiving incomes from the British government, and those consols were sold during the time of the revolutionary war. So what? The fact that the store of value may or may not instantly converts to some other store of value in 10 years is besides the point. In all cases, people keep that store of value until they decide to spend it.

OK, let’s say we have a 10 person economy, plus the gov (consolidated Treasury and Central Bank). Say nine of those people each hold $1000.00 in cash, and the tenth holds a $1000.00 T-Bill which matures in three months. The maximum amount total amount that these 10 people could spend at any moment is $9000.00, up until the time the bond matures and gets monetized by the gov. (I’m ignoring any interest payments). Number 10 may feel unconstrained in his spending, because he can always sell his bond to one of the other nine, but the total spending by all of them can only be $9000.00 …. with whatever implication that has for “inflation” in this “micro-economy”. That’s why I say it’s a bit of a shell game. The bond is still a form of wealth and a store of value to whoever holds it, but total spending is still contained until it matures and is monetized. Of course, it may be that these ten people don’t wish to spend the entire $10,000.00 in any case, but would rather hoard (save) some of it, in which case the fact that a portion of this “savings” is in the form of a currently non-monetized bond won’t make any difference, since they would just hoard cash instead if the bond wasn’t part of the equation.

So … that was my thinking, and the basis of my original question … but I think I was missing the fact that by introducing a “bank” into this micro-model, a means of monetizing the bond in advance of its maturity date would be realized.

Ken

You also need to introduce a government to issue/redeem the bond.

Also, the 10-people could decide to issue private bills of exchange, say they have enough stuff to trade and can’t wait for the money to circulate among the 10 of them. So you could have in excess of $9,000 total medium (only a maximum of $9,000 of which could be currency) circulating at any time, even if some decide to save their currency. This is part of the velocity problem and also why you it is difficult/impossible to control the money supply even with only 10 people in your economy.

Yes, at any moment. But the next moment they can spend $9000 again. So you are confusing stocks with flows. The flow of spending is not constrained by the stock of money. In any given period of time — say one day — an arbitrary amount of money can be spent. After all we run the whole economy on about a trillion dollars of currency outside bank reserves. And half of that is probably overseas in europe. That trillion seems to be more than enough to support a 14 Trillion GDP, and that is only consumption of final output. Several trillion worth of dollars are traded just in the forex markets each day.

No, spending is a flow. The total *amount* of money is a stock. The flow of spending is not constrained by the size of the stock of money. Neither does an increase in the stock of money necessarily cause the flow of spending to increase. They are two separate concepts.

That’s well written, RSJ

Agreed. That was even better than the essay by Andy Harlass. I’m going to have to save these comments somewhere.

Ken,

Would like to add that people don’t spend “out of” money. People spend out of income. Whatever is not consumed is allocated into time deposits, bonds etc. If you look at it that way, things will look different to you.

So you are confusing stocks with flows.

OK — I can envision different scenarios — staying with my 10 person toy economy with initially 9000.00 in cash and 1000.00 in bond.

Scenario #1. This community has no savings desire at all … they wish to spend it all. In that case, the price level of whatever is to be had for sale in this micro-economy will be bid up to whatever is appropriate given the 9000.00 available to buy it. Assuming that the same quantify of goods and services is available for sale at the time the bond gets monetized, the price level will be further bid up to whatever is appropriate to 10,000.00. There will be inflation.

Scenario #2. The community has a net desired savings of say, 2000.00. This 2000.00 would be your “stock”. The initial price level will be at whatever 8000.00 will buy, and the net savings “stock” will consist of $1000.00 in “cash” and “$1000.00” in “bond”. When the bond is monetized at maturity, the composition of the savings “stock” will change to “all cash” and “no bond”, but the overall price level will not change. No inflation.

Other combinations are possible, but let’s stick with two scenarios for now to keep it simple.

Yes, of course the velocity can vary … all the stuff available for sale may turn over once a week, or three times a day, but until more stuff can be produced, the price level at any given time will be determined by how much money is **actively** (the flow) chasing it around … 9000.00/10,000.00 in Scenario 1, or 8000.00 in Scenario 2.

Would you agree with that analysis?

“…but until more stuff can be produced …”

You are assuming a equilibrium – that all goods are cleared with your $9,000. In which case, I would argue that you would have NO savings – if the entire economy is cleared (all produced is sold and consumed and value realized) in each “cycle”, then you come to the question of surplus and accumulation – your model will get very complicated whether there is 3 people or 10 people.

In other words, the economy has to work to produce all goods in a cycle, all goods are cleared in each cycle, therefore in the next cycle everyone has to work again to produce all the goods. What would savings do? It could not substitute for deferred consumption, because all consumption is fully realized in each cycle. Savings would have no meaning.

The reason I mentioned velocity was to detail out the model you had in mind. If everything clears in one “cycle”, velocity is 1. It cannot increase or decrease (with respect to a production/consumption cycle). But without surplus, there is no savings, no bond, etc.

In equilibrium, prices will be bid to the total money is in circulation – whether it is $9 or $9,000 – otherwise you don’t clear, so there is no desire for savings – anyone who “saved” the currency would just see lower prices for their fellow citizens who desired to spend, once the saver put their money into circulation, prices would rise – savings would have no function – it’s just a matter if you can work the next cycle even though you didn’t eat.

Money is a relationship between people, not a thing – this is analogous to saying it is a flow not a stock.

OK, if the simple model is too simple and not really useful, let’s drop it and talk about the real economy. My original question was “why do bond maturities not matter”.

If I understand correctly, the reason is that during a downturn, participants in the economy are attempting to stockpile (create a larger stock) of net financial assets. The Government (consolidated Treasury and Central Bank) must supply these assets to prevent a continuing downward spiral (due to the paradox of thrift). Since, overall, the participants want to save (stock) these assets rather than spend them, it doesn’t make much difference whether they come in the form of spendable cash, or unspendable bonds of whatever maturity. Therefore, maturities aren’t important.

Are we on the same page now, or am I still missing something?

Ken

Ken,

You are right in that the best way to make the stock/flow distinction clear is to view households as diverting a proportion of their cash income into stockpiling financial assets. The remainder of the cash income is spent on goods/services. This happens at all times — not just during downturns.

Some actors in the economy spend in excess of their income and decrease their financial net worth, while others spend less and increase their financial net worth.

Maturity does matter for portfolio management purposes, as shorter duration assets are less interest rate sensitive. All these characteristics are important: liquidity, risk, duration, convexity, etc. — but for purposes of determining aggregate demand and inflation, all that really matters is the cash value of the financial claim that was purchased, as that is exactly the amount of cash that you agreed not to spend on goods. The purchase of $100 10 year bond or the purchase of a $100 3 month bond still means that you elected to stockpile $100 rather than spend it. The rest of your income was spent and this will affect aggregate demand and inflation.

In both cases, should you decide to drawn down your financial assets and deficit spend then you will do so. When the bond matures, the investors will roll the proceeds over into some other bond. So its best to view the decision to spend a proportion of your income and save the rest as separate from the act of portfolio management or rolling over debt.

You can ask, what happens when their is a surge in the desire to save? Incomes adjust. An increase in the desire to stockpile assets does not, in and of itself, coerce would-be borrowers into borrowing more. Instead, it causes the would-be savers to experience a loss of income and this continues up until they no longer wish to stockpile more assets than are available to purchase — because they don’t have any funds to do so. Unfortunately, it causes aggregate incomes to decline — not just the incomes of the would-be savers, and so there are feedback effects, and this can be deflationary.

In the same way, if there is a surge in the desire to dissave (or borrow), then again, incomes adjust, recruiting enough new savers (with higher incomes) to purchase the assets that the borrowers want to sell. Again, the aggregate income increases, and some of this may be inflationary.

Neither of these inflationary or deflationary tendencies are influenced by the amount of cash in the economy per se. If government boosts incomes by spending more, then it does not matter whether the government is financing that spending by issuing cash or bonds. What is important is changes in household income, as well as changes in the desire to save or dissave a proportion of your income.

Scott Fullwilwer.

I have been preoccupied and I did not see your answer until now.

1. Every action must have some behavioral hypothesis behind it, regardless if it is automatic or discretionary. The fact that you admitt to offer none is problematic for a trained economist. I gave you an example with savings to show you my hypothesis in order to have an INTELLIGENT discussion.

2. As about the self-claimed “hobbyist” and his comments as I said and objected, SOME of them are circular, tautological and evasive with no scientific merit. For example, about all assets are money and similar comments of phantasy that suggest that “everything is everything”. OTHER of his comments like the stock and flow concepts are elementary and discussed in Economics 101. Some more discipline is needed in certain (not all) of your comments since the mainstream economists we are ALL attacking are more sophisticated than you think! Even if you are ‘HOBBYISTS”!

ANYWAY THAT IS ALL i HAD TO SAY AND i WILL NOT RETURN AS THE DISCUSSION IS GOINT TO THE 10th DERIVATIVE TERM!

Ramanan,

I did not see your comment earlier. I did not ask for apology although I appreciate your kindness. What I do expect is that you do not include statements in my comments that I did not make! Regarding asymmetry I have explained it in several comments and there is no need to go to the more elaborate treatment in my work. As I have said before we share interest in circuit theory and the work of Godley.