I started my undergraduate studies in economics in the late 1970s after starting out as…

Clowns to the left, jokers to the right

… and we are stuck in the middle. In some US states they are rationing street lighting because they have run out of “money” even though the electricity generators have spare capacity. Hospitals are cutting services even though there are plenty of bandages idle. In the US, the federal government is now crowing about its “historical” health care victory which imposes new taxes now and no new spending until 2014 – it is still enduring the impact of a deep recession – some victory. Private spending remains very weak in most economies and fiscal interventions dominate the modest growth in aggregate demand that we are witnessing in some countries. In almost all countries unemployment has risen sharply and will persist at higher levels for some years to come. So what does my profession say … the fiscal cuts need to be even bigger because growth is slower and the deficits are “worse” than expected. So clowns to the left, jokers to the right … or whatever.

Thanks to Roger for the title! It is very apt even if some progressives go along with the neo-liberals in thinking that the left-right dichotomy is out-dated! [(-: <= JOKE!]

The IMF wasn’t sorry for very long

In China yesterday (March 21, 2010), one of IMF bosses gave a Speech to the China Development Forum where he outlined the “particularly acute” challenge facing governments in advanced economies to reduce deficits and public debt ratios – but at the same time achieve a “global rebalancing of savings patterns”.

So it has come to this sort of equation – we are being led by mad people who will standby as a woman is raped due to the lack of street lighting or a child dies from lack of nutrition or some disease breaks out because health systems are being compromised as long as they satisfy the meaningless requirements of an impoverished body of theory – mainstream economics.

Far from being shamed by this recession which demonstrated beyond any doubt the poverty of the orthodoxy in my profession, my mainstream counterparts are once again strutting the centre stage with their austerity plans emboldened by the fact that governments still care to listen to them. Total folly.

Anyway, the IMF were not sorry for very long – please read my blog – We are sorry – for more discussion on this point.

I would have thought they should have stayed silent – begging our forgiveness for being so arrogant and so wrong.

Anway, the speech was given by one John Lipsky, First Deputy Managing Director and was entitled Fiscal Policy Challenges in the Post-Crisis World. This raises the interesting question: when do we enter the post-crisis period? What signals tell us that we are there? Modest GDP growth (like creeping along the zero line)? Some particular public debt ratio? Some particular deficit to GDP ratio?

For me, the crisis is not over until all those who lost their jobs have satisfactory employment and income security again and the price level is not deflating. They are the signals that I would base any recommendations for fiscal adjustment on.

I would never look at the public debt ratio for information. What actually does it tell us other than when it rises it just reinforces the ridiculous voluntary constraints that we retain from a past historical period – the convertible currency days. That is all it tells me. How unimaginative we are.

But the labour market gives me real information about peoples’ lives and their ability to realise their potential.

Anyway, the IMF is all about meaningless ratios. Why would we be surprised about that?

In their November 2009 State of Public Finances Cross Country Fiscal Monitor present information that is now being used by a leading bank to create public debt stress rankings which are crude assemblages of the size of public sector debt levels, public sector deficits and public sector net interest payments as a percentage of GDP. Very crude indeed!

This bank then bombards its clients with this version of nonsense. The ranking combines non-fiat and fiat currency nations together without any qualification. Why bother with detail? Greece is currently on top with the UK in 6th place and the US in 7th position. The related narrative is all about impending defaults, demographic blowouts and … hell on Earth.

These bank publications are in fact becoming charactures of themselves as their vision of the approaching Armageddon get more extreme by the month. They are very amusing in fact – to think that some suit and tie somewhere is sitting in an air-conditioned office on high pay in front of a whole array of screens dishing out a massive amount of economic information and writing this stuff without understanding the basis of the monetary system that is generating that information. Our education systems have failed us!

As an aside, this particular bank publication is approving of the Rogoff and Reinhart nonsense without qualifying what those authers actually said. Please read my blog – Watch out for spam! – for more discussion on this point.

Back to the IMF speech.

The IMF official said:

I will begin by addressing the role of fiscal policy during the crisis. First, automatic stabilizers were allowed to operate fully in almost all countries on both the revenue and expenditure side. This is a marked difference with respect to the 1930s, and generally is not well appreciated: most of the increase in the fiscal deficits expected in 2009-10 reflects the revenue decline resulting from the downturn in activity …

we estimate that about four fifths of the stimulus is temporary, implying that it will tend to diminish more or less autonomously as the recovery takes hold.

Note “most of the increase in the fiscal deficits” is caused by the automatic stabilisers. Yes, which means that the fiscal balance will go into reverse as growth ensues.

Then he becomes irrelevant and introduces terminology like “deep scars in fiscal balances” and “this surge in government debt is occurring at a time when pressure from rising health and pension spending is building up”.

But after acknowledging that the discretionary fiscal stimulus components “accounted for only about one-tenth of the projected debt increase” he says:

Thus, merely winding down the stimulus will not come close to bringing deficits and debt ratios back to prudent levels, considering the projected increases in health care of other entitlement spending.

First, conflating the the demographic trends with the current fiscal position is flawed reasoning. As I have explained often the ageing population issue is not a financial matter. It is a political issue subject to their being enough real resources available. Please read my blogs – Democracy, accountability and more intergenerational nonsense and Another intergenerational report – another waste of time – for more discussion on this point.

Second, what he is saying is that public net spending has to be even lower than it was going into the crisis (which in many cases means higher surpluses) because the unwinding of the automatic stabilisers will still leave the governments unable to pay for future health care and aged pensions.

So no reflection on what this means for the private balances going into the recession which were in deficit in many countries. External positions are not likely to alter very much in the coming decade – deficit countries will remain that way even as the Chinese currency inches up in value. So the IMF is suggesting that it is going to be prudent – “fiscally sustainable” – for governments to deliberately push their private domestic sectors into even greater deficits than before.

They don’t say that because they never think in those terms. But that is what the inevitable outcome of their reasoning (if translated into policy action) will deliver.

That will mean a reduced capacity within the private sector to pay for their own retirements and health care. It will also mean a reduced capacity for private deleveraging. And … ultimately … it is just setting the scene for the next crisis.

The reality is that once growth returns and the automatic stabilisers go into reverse, fiscal positions in most countries will be too tight in terms of being able to support the deleveraging processes underway in the private sector. This is because going into the crisis, fiscal positions were largely too tight.

The rest of the speech is the usual recital of the erroneous mainstream economic mantra about deficits undermining “confidence in the economic recovery” and the high debts raising “sovereign risk premia … sharply” and default risks etc. He says that the deficits will increase interest rates and stifle growth.

So all we can conclude from that is that he doesn’t understand how the monetary system and the banking system operates. Deficits depress interest rates. Central banks set interest rates. Even longer-maturity rates can be completely managed by the central bank. There is no default risk in countries with non-convertible currencies.

The only reason that sovereign risk premia are rising sharply in Greece, for example, is because it signed up to a flawed monetary arrangement. It has nothing to do with the size of its deficit per se or relative to GDP. The Greek central bank could maintain zero rates and the Government could issue debt at zero rates if it wanted to – but first it would have to withdraw from the EMU. It is the EMU that is the problem.

But, of-course, the IMF are never going to acknowledge any of that. It would have to retrench thousands of its staff who inflict this nonsense on countries around the World on a daily basis if it was to admit that the monetary system doesn’t operate the way they claim it does.

Interestingly, he then went on to say that fiscal adjustment cannot be achieved via inflation. If you recall the Sorry statement (linked above) – they were advocating a position where the central banks should relax their inflation targets to allow for easier demand conditions.

But this official is arguing that only “robust and sustained growth — if combined with appropriate spending controls — can make a major contribution to reducing debt ratios”. I agree that debt ratios will fall with growth but public spending will be required to maintain that growth.

The IMF agenda is then rehearsed – “liberalization of goods and labor markets and the removal of tax distortions therefore should be pursued vigorously”. But because these are lagging reforms, the urgency is to cut primary fiscal balances immediately. He claims that on average there has to be an 8 percentage point swing in deficits to GDP over the next 10 years (so 4 per cent of GDP surpluses) and they should be maintained until 2030.

Okay, kids … you don’t have a future.

Once again think about what would mean for private sector balances in external deficit nations! Massive buildup of private indebtedness … in that sense, this plan is unsustainable even if pursued over the next decade much less the next. Not every country can run an external surplus!

So how we are going to achieve a “global rebalancing of savings patterns” within this sort of policy regime? It simply isn’t possible.

National self-flaggelation underway in Britain

Except the flaggelators are the ones with the well-paid jobs.

In the UK, attention is focused on the up-coming Budget presentation (on Wednesday). As a precursor you should appreciate that the British government sponsored legislation late last year which legally forces it to abandon its fiscal responsibility to its citizens.

This quaint demonstration of national self-flaggelation was called the Fiscal Responsibility Act 2010 and was finally passed into law in February 2010.

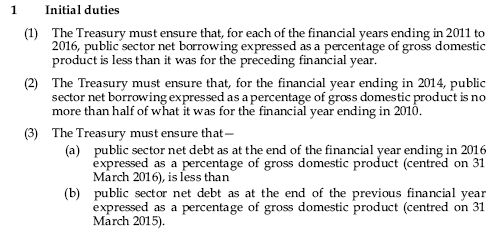

Here is Section 1 which forces the British government to adopt a formulaic fiscal retrenchment – one which it will not be able to control given the endogenous nature of the national budget.

In the debate leading up to the approval of the Act, Chancellor of the Exchequer was asked “how deflationary those changes in public spending could be? Is there not a danger from the straitjacket that is being introduced through this legislation?” He replied (in part) (Source):

… I believe that the changes are manageable, and they are the right thing to do … if we are going to get sustainable growth in future, it is important that we get that borrowing down. To halve it over a four-year period is a reasonable thing to do and a reasonable rate at which to do it. To go further than that-and to make that judgment at the present time, when there is so much uncertainty-would be hugely damaging to the economy and would present a terrible risk, especially when the Opposition are contemplating spending even more money on top of that.

So you might have the impression that the UK government is confident that the spending aggregates will shift in favour of private consumption and investment (with modest only improvements in exports apparent) and reduce the need for public spending more or less in line with the contraction that they have made a force of law.

That would be an extraordinary situation if it was true given how badly the UK economy has been affected by the collapse in private spending driven by the financial crisis.

But you soon realise that this is all “seat of the pants” stuff. Later in the Parliamentary debate over proposed bill, he admitted (Source):

… there was still a lot of uncertainty about. We still do not know what unemployment will be this coming year … we still think that unemployment will rise during the course of this year, so there is a lot of uncertainty about … That is why we have not done a spending review just now, and that remains the case.

So they don’t really have any solid basis for the rules they have imposed on themselves. They are designed for political purposes to appease the electorate which is sick of them and also to stop the credit rating agencies from making threats – threats which carry no weight for a sovereign government anyway despite what people will have you believe.

The point about these type of rules is that they are virtually impossible to deliver upon when you are also aiming to promote employment and income growth. The budget balance is endogenous which means that it is significantly driven by private spending intentions. The public sector balance really has to support those decisions in both good and bad times.

In good times, the fiscal position will move towards surplus and unless the government has a political mandate to alter the final public/private proportions of final output, then this movement is desirable. The last thing the government should be doing when private sector spending is expanding (unless it wants more public command over resources) is to running a fiscal position that was appropriate when private spending was weak.

Alternatively, when private spending is weak and is likely to remain so, trying to cut public net spending will deflate the economy even further and via the automatic stabilisers is likely to push the deficit up again.

Governments have to support the saving desires of the non-government sector or else income adjustments will occur. In the current UK situation, these adjustments will be negative.

The other point is that legally binding governments to mindless fiscal rules like that outlined in the graphic above creates new institutions which make it even harder for governments to act responsibily to attenuate the fluctuations in the private spending cycle.

When you read an article like this – Chancellor must find extra £10bn in savings (March 22, 2010) you realise that structures like the Fiscal Reponsibility Act become self-reinforcing “truths” that are no longer questioned but cruel the policy landscape even further.

This is in much the same way that very few commentators are daring to question the nonsenscal Maastricht treaty rules. Germany even decided they weren’t tough enough and has constitutionally banned deficits after 2020.

The Times article discusses the upcoming British Budget speech on Wednesday and says that “leading economists” (that lot again!) have to find even greater spending cuts and tax rises to satisfy the Act and placate the credit rating agencies.

At the same time, two major economic forecasts have been released in the past week which paint a grim outlook.

The Confederation of British Industry (CBI) released its latest Economic Forecast where they predict “economic recovery will be slow and sluggish into 2011”. They said:

… growth prospects for the economy will be fragile in the near-term now that certain stimulus measures, such as the VAT cut and car scrappage scheme, are ending. Growth in consumer spending will remain subdued this year, as people save more and worries about job security persist … the lack of a clear driver for growth will make for a bumpy ride in the months ahead … To convince international investors that the spiralling budget deficit will not derail the economy, the Government must set out a credible plan to balance the books by 2015-16, two years earlier than currently planned … Unemployment is expected to continue rising … consumers remain worried about job losses, see weak ongoing wage growth and opt to increase savings and cut debts … The state of the public finances means this recovery will be led by the UK consumer, private sector investment and the re-building of stocks. But headwinds from tight credit conditions and the desire to borrow less and pay down debt will hold this back somewhat.

So there is the nonsensical corner they have painted themselves into. They can see clearly that private spending is going nowhere and consumers are doing what they should be doing and that is increasing saving and paying down private debt. They realise that the stimulus measures assisted in putting some floor into the GDP losses.

They know that without that stimulus support growth will creep along and the real damage will continue to accumulate and suppress wages growth and spending.

And all because of the “state of public finances”. What state? At present it is clear that the fiscal expansion in the UK has been insufficient (and in part poorly targetted).

Despite a significant depreciation in the sterling, the export sector has only modestly responded. It will not drive the next growth phase despite many economists claiming that Chinese growth will bail the UK economy out in the coming year. It will not.

If that wasn’t enough another leading British forecasting service, the Ernst & Young ITEM Club says in its latest quarterly forecast that:

… after years of relying on domestic spending and overseas borrowing, it is vital that the UK now boosts its overseas earnings. UK companies have spare capacity and are in a strong financial position to benefit from the 23% growth in world trade that ITEM projects over the next three years. But UK export performance has been dire for the last three years, and companies must now get out there and sell, especially to fast-growing economies like China. As it is, the short-term prospects are bleak, with UK GDP growth struggling to reach 1% this year, consumer spending forecast to grow by only 0.4%, and fiscal policy destined to tighten.

So you read this statement as one of religious hope – sort of “clutching at straws”. Yes, there is significant excess capacity in the UK economy which could be diverted to supplying the traded-goods sector. But at present there is not much going on in terms of significant growth in exports to China.

It is also clear that the “short-term prospects are bleak”.

If that is so, why would yo uthen be advocating a “more aggressive plan” of fiscal retrenchment which is what the ITEM club official told the press was required?

And the irony is that when the UK Government brought in the Fiscal Responsibility Act in February (first proposed late 2009) its growth forecasts were inflated. So what? This means that its revenue predictions were over-inflated (via the automatic stabilisers) and so the budget deficit is likely to be larger than claimed. Yes, that just indicates a very sick economy.

But now ITEM is now claiming is that this outcome really means that the British government needs to:

… find another £10 billion by drastically cutting spending and raising taxes in the next Parliament in order to meet its commitment under the Fiscal Responsibility Act

Conclusion

We can conclude the logic is something like this:

- Private sector spending falls through the floor and the economy goes into a tailspin and income and job losses go through the roof.

- The Budget deficit rises partly automatically and partly because of discretionary measures designed to board up the floor and keep the roof intact.

- Some fool economists who were responsible for the events that led to the collapse in private spending then quote from their gold standard textbooks that the budget deficit is out of control. All of these economists have well-paid and secure jobs and sound pension plans.

- The irrelevant credit rating agencies looking for a new way to make a buck declare that the fool economists are right and that they will do damage to the government despite the fact that they cannot damage the UK government unless the latter voluntarily bends over and accepts the caning.

- The UK government then, running scared because these economists have the backing of the conservative media (which includes the UK Guardian these days), decides to bring in an Act of Parliament to show everyone they mean business.

- The UK government also set out a fiscal retrenchment plan knowing that unemployment will continue to rise.

- It turns out that their forecasts that are used to map out the plan are wrong because the real economy is actually worse than they admit.

- The stupid economists then say that this means the fiscal retrenchment just has to be larger because the deficit is higher.

- The UK government announces a larger retrenchment (my prediction for Wednesday’s British Budget speech).

- The citizens of outer-space, much more advanced than us, chuckle when they receive the news. Their children use Earthling as a epithet for mindless stupidity.

Finally, thanks to Peter Martin I became a cartoonist today. My limitations are obvious. I invite further submissions from readers and prizes will be awarded for the best creation. Go to Batman comic generator and send me your efforts. I will devote a special page to all entries. Prizes will be announced sometime but with everyone having to pull their belts in these days don’t expect much!

That is enough for today!

My batman comic? This one works:

http://drop.io/hidden/dinh0ki0b1fval/asset/YmF0bWFuLWpwZw%253D%253D

I think you’re too tough on the IMF. It takes some time to change institutional thinking. Especially given that there are still so much economic dinosaurs populating Washington. I go along with Dani Rodrik: “… what happened on February 19 can safely be called the end of an era in global finance.”

Batman cartoon: http://bayimg.com/image/kalocaacg.jpg

OMG, another case of chicken little or just plain market irrationality: the most popular story this morning on Bloomberg.com

Obama Pays More Than Buffett as U.S. Risks AAA

Here we go – the battle is heating up.

I’ve read several articles by the “Item Club” over the years. They are usually rubbish. Ernst and Young are a firm of accountants and I’m sure they’re good at doing what accountants do: bean counting. But when it comes to macroeconomics, they’re useless.

Are these neo-liberals or Schumpeterians? Seem like they think that growth can only occur by reallocating misallocated capital through “creative destruction” aka liquidationism. I wonder if they will have the will to see it through as debt bombs explode and depressions sets in. They apparently think that they can keep the threshold of pain acceptable, but I don’t know about that.

@Tom Hickey

“Are these neo-liberals or Schumpeterians?” Definitely neo-liberals. The late work of Schumpeter can be summarized in two sentences as thus: “Will capitalism survive? No, I don’t think so. Can socialism work? Of course!” And Schumpeter was a conservative. Nowadays we would call him more probable a reactionary.

So much for all of the pretensions about being an empirical science rather than a theology. I suspect that it is really across the board for the majority of economists. This comes back to a lack to understanding of the connection between monetary principles and fiscal policies., which should be fundamental. The real question should be is it going to take revolting mobs to cause a shift to the functional finance model, or what ? It seems all about the willingness to seek real solutions to real problems, rather than merely maintaining a particular social ordering of usury.

Stephan, I was suggesting that the neoliberals are likely unsuspecting Schumpeterians and may get something they are not bargaining for. The developed world is now going through a transition from an industrial society to an information society, and this is resulting in a realignment of capital, as well as the nature of employment, based on innovation, as well as a recognition of the need for sustainability with respect to the environment and resources.

The trend is also away from economic liberalism toward the “socialism” of the welfare state, in the sense of policy oriented toward the general welfare. The rugged individualism of the frontier exists now only in novels and people’s imaginations. This trend is unfolding in spite of tremendous resistance from the economically neoliberal/politically conservative faction that is still powerful. However, in my view, this is the dialectical denouement of this view, and it will be replaced by the emerging Zeitgeist, the shape of which is not yet entirely clear. However, it is going to be based increasingly on globalism and knowledge as this century unfolds historically.

But if the economic downturn becomes more serious instead of less owing to the machinations of this faction, the impetus toward more government intervention will only grow as conditions deteriorate. So the push toward fiscal discipline would just serve to undermine the conservative/neoliberal agenda.

As Schumpeter also observed, the bourgeois mind set is attached to the gold standard, i.e., convertible fixed rate currency, since it hates the idea of fiat currency, which it sees as empowering government and bureaucracy at the expense of the private sector. This neoliberal/conservative commitment is driving the debate at the moment and is likely to result in an inevitable transition that is more obviously destructive than creative on the surface. This is needless, since the transition could be handled much less painfully with the knowledge and tools at hand.

I don’t see this transition toward an information-based society and more active promotion of the general welfare as necessarily disadvantageous to innovation and entrepreneurship, although entrepreneuring will change due to changed circumstances. Entrepreneurship is now much more capital intensive and larger scale from the outset, owing to technological advances, instead of staring with inventors in their garages. I suspect that innovation will turn out just fine. Moreover, not only new things will be invented, but new ways of doing things will be discovered, e.g., doing more with less, which is what the knowledge revolution is about.

Tom, good post. BUT … my impression is, that neo-liberals give a shit about economic thinkers of the past (only if it fits with the ex-post claim) and about evidence. Thus my conclusion is the only realistic thing is to engage them head on. There’s no Hegelian ghost walking around and synthesizing the view of laymen with mainstream economists. Laymen believe this bullshit unfortunately.

I’m living in Germany and I hear every single day about the culprits of the € malaise. The Greek and Spaniards enjoying their Siesta and sipping Ouzo or Wine all day long while hard working Teutons build submarines and tanks for these losers and at the end of the day they are only able to pay the bill by taking on another credit 😉 Or even worse: dare to cancel the order due to financing problems.

I think everyone engaged in this debate, including Bill and including the authors of the “Fiscal Responsibility Act 2010” should be clearer on what they mean by government borrowing. Reason is that there are two very different forms of such borrowing.

First there bonds issued by the Treasury of country X to the market and held by entities other than the central bank of country X.

Second, there is what might be called “pseudo borrowing”: that is where the central bank of country X prints money and buys those bonds (e.g. Treasuries in the US or Gilts in the UK). The latter is essentially just money printing, i.e. expanding the monetary base. And the “borrowing” that corresponds to this monetary base is a “debt” owed by one arm of government to another, i.e. owed by the Treasury to the central bank. To count this as government borrowing is a nonsense.

Presumably the Fiscal Responsibility Act is not referring to the latter when it talks about “net public sector borrowing”. But what about monetary base: that appears on the liability side of central bank balance sheets and for that reason is sometimes counted as a form of public sector borrowing. Though as Willem Buiter put it “These monetary base ‘liabilities’ of the central bank are not in any meaningful sense liabilities, because they are irredeemable.”

It is arguable that Bill should not be quarrelling with this Act, because if a country creates lots of extra monetary base and uses some of it to buy back bonds and/or generally reflate its economy, then you would get a combination of declining national debt (in the “bond” sense of the word) and plenty of economic stimulus. Indeed, this is more or less what Warren Mosler advocates, i.e. ceasing to create bonds and just letting any excess of government spending over income accumulate as extra monetary base.

Schumpeter was not an economist in the contemporary sense of a theoretical model-builder. In fact, he criticized Keynes on that score. He was a “worldly philosopher,” in the words of his student Richard L. Heilbroner. I first encountered Schumpeter in Heilbroner’s The Worldly Philosophers, which was required reading in my Econ 101 class, and I have felt affinity with him since then. It is difficult to categorize him, since he was a dialectical thinker rather than a categorical one.

Schumpeter sought to penetrate to key fundamentals like all the truly great economists that rank as worldly philosophers. People who are neither reflective, insightful and broadly educated are incapable of seeing the abstract forces which they are concretizing through their actions based on meme > conventions > institutions. As a result, such people are able to rise above their times as see further.

For example, Hegel was not saying that people are idea-driven. They are not. Rather, unbeknownst to them, most people are entrained by the contemporary mindset and are either acting in conformity with it or in reaction to it, in one form or another. These mindsets, which we now know are based on memes > memplexes > conventions > institutions are the boundary conditions that channel behavior until inevitable reaction to their shortcomings relative to the whole, i.e., “internal contradictions,” is sufficiently strong to form a more powerful mindset, which then becomes dominant, and the process repeats itself.

Right now, the neoliberal order has already come to a head and is in decline. The old order seldom goes quietly into the night, however, and desperately stages a last stand. That’s where we are now. It’s a fight to the finish, and time is not on the side of neoliberalism.

Here you go… hot off the press!

http://www.batmancomic.info/gen/20100322144652_4ba7e54ca93c8.jpg

I had to read Heilbroner’s book as an undergrad too Tom. One of my favorite books of all time. Can’t recommend it enough.

Stephan,

I wonder if you’ve actually ever examined the damage that IMF-World Bank policies have done around the world to real living people–in the service of globalist “free trade” capitalism. It’s not possible to be “too hard” on these institutions. Also, I find your remarks about the contrast of “hard working Teutons,” as contrasted with Spaniards and Greeks, to be evidence of a crude and racist mentality.

Bill, looks like you and Randy are on the same wavelength today.

Neoliberal Deficit Hysteria Strikes Again

ADVICE TO PRESIDENT OBAMA AND PRIME MINISTER BROWN: Tell the IMF, the European Commission, and the Ratings Agencies to Take a Hike

By L. Randall Wray and Yeva Nersisyan

bit of batman

http://www.batmancomic.info/gen/20100322192320_4ba82618bfbf4.jpg

http://www.batmancomic.info/gen/20100322192338_4ba8262a7a915.jpg

HAHA… daniel. that’s absolute gold!!

here’s my attempt,

http://www.batmancomic.info/gen/20100322194951_4ba82c4f6db2c.jpg

Not bad Carly, but it’s 1970s batman… you need a bit of sexual innuendo

http://www.batmancomic.info/gen/20100322214125_4ba84675ebe56.jpg

Jim. I’m aware of past damages. My argument was, that given the current reversal of economic thinking by some eminent IMF economists (i.e. Olivier Blanchard) it might be only fair to credit them some benefit of doubt as it takes time to change entrenched institutional thinking. Now in regard to my remarks on Teutons, Spaniards, Greeks, … This was meant as a light comment on the state of affairs. I live in Germany, have a lot of German friends and by no means any racial prejudices. These remarks reflect the stereotypes iterated right now day by day in our media. And it’s not about race, but the age old European ailment of nationalism. It’s dismaying to see, that beside decades of efforts to create some common purpose among European nations, it needs only one “minor” problem to bring to the surface again “us versus them”. And this “us versus them” thinking is gaining momentum in many Europeans nations – not only Germany.

Stephan,

Sorry I jumped on you about race. I see your point about reflecting current media positions. But about the IMF, I think these institutions exist to serve their masters; the rest is tactics and strategy.

We are not attacking the Germans but the Germans are attacking Greeks calling them all kinds of names and use bigotted statements. Germans have to come clean and repay Greeks for the war damages! You might not like it but that is how we feel! As about Europe it has failed to show cohesion and solidarity and it has become a mess! Who really benefits from the EU? Certainly not the southern countries!

Panayotis, Calm down. I’m with you! I totally agree, that the German government and parts of the media are out of their mind. And statements by former Bundesbank gangsters are certainly (to put it mildly) also not helpful. If there’s an issue about WW2 reparations this should be settled too! But I hope you agree, that this question is a very separate one and in no direct connection to the malaise at hand.

I think we must differ between the EU and the EMU. The European Union was and is a benefit for all member countries. I certainly had a lot of benefit from the free movement of people and goods in the EU. Otherwise it would have been a major hassle to move to Germany or before to the Netherlands. The monetary union is a complete different thing and wasn’t such a good idea.

Dear Stefan,

There is nothing personal. I hope you understand that a lot of feelings have been hurt for no reason. As about the EU I think it is based on free market principles that fights worker and social rights. Competition and not solidarity and social cohesion are the foundations og the EU. IT is a market and not a community.

ta na na na ta na na na bat-man

http://www.batmancomic.info/gen/20100323162008_4ba94ca8cbbb8.jpg