Today (January 22, 2026), the Australian Bureau of Statistics (ABS) released the latest labour force…

Australian labour market takes a backward step

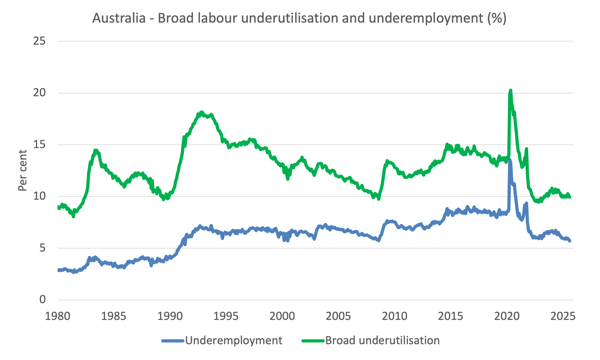

I regularly warn against using the observations from one month to tell a story given that the data jumps around a lot at this frequency over time. It is clear that there is a lot of month-to-month variation in the data at present. The Australian Bureau of Statistics (ABS) released the latest labour force data today (September 18, 2025) – Labour Force, Australia – for August 2025, which reveals that the slowdown that has been signalled for some months and was interrupted by last month’s stronger result appears to have reasserted itself. Employment fell overall as did the participation, which saved the unemployment rate from rising. Without the fall in the participation rate, the official unemployment rate would have been 4.4 per cent (rounded) rather than its current official value of 4.2 per cent. That means some workers are likely to have moved into hidden unemployment (outside the labor force) as job opportunities have stalled. Underemployment fell 0.1 point, which was surprising given the significant loss of full-time employment. I expect a revision to this result next month. It remains a fact that with 9.9 per cent of available labour not being used it is ludicrous to talk about Australia being close to full employment. There is substantial scope for more job creation given the slack that is present.

The summary seasonally-adjusted statistics for August 2025 are:

- Employment fell 5.4 thousand (-0.04 per cent).

- Full-time employment fell 40.9 thousand (-0.4 per cent).

- Part-time employment rose 35.5 thousand (0.8 per cent).

- Unemployment fell 0.9 thousand (0 per cent) to 647,400.

- The unemployment rate was steady at 4.2 per cent.

- The participation rate fell 0.2 points to 66.8 per cent.

- The Employment-population ratio fell 0.1 point to 64 per cent.

- Monthly hours worked fell 8 million (-0.4 per cent).

- Underemployment fell 0.1 point to 5.7 per cent (falling 22.2 thousand to 871.1 thousand).

- The Broad Labour Underutilisation rate (the sum of unemployment and underemployment) fell 0.1 points to 9.9 per cent.

- Overall, there are 1518.53 thousand people either unemployed or underemployed.

The ABS press release – Unemployment rate steady at 4.2% – noted that:

The seasonally adjusted unemployment rate was steady at 4.2 per cent in August …

Employment fell by 5,000 people and the number of unemployed fell by 1,000 people in August …

This meant that the unemployment rate remained steady at 4.2 per cent whilst the participation rate fell by 0.1 percentage points to 66.8 per cent …

The employment-to-population ratio fell by 0.1 percentage points to 64.0 per cent.

A fall in full-time employment (-41,000 people) drove the overall drop in employment numbers. Meanwhile, part-time employment saw a 36,000 person rise …

Hours worked fell 0.4 per cent in August, supported by less people working full-time hours this month …

The underutilisation rate, which combines the unemployment and underemployment rates, fell by 0.1 percentage points to 9.9 per cent. This was 0.7 percentage points lower than August 2024, and 4.0 percentage points lower than March 2020.

Summary

1. Just as last month’s data represented a slight reversal on the deteriorating outcome from June, this month’s data reverse that outlook.

2. There is still a downward bias away from full-time employment, which suggests a trend weakening.

3. There is now 9.9 per cent of the available and willing labour supply being wasted.

Employment growth negative in August

- Employment fell 5.4 thousand (-0.04 per cent).

- Full-time employment fell 40.9 thousand (-0.4 per cent).

- Part-time employment rose 35.5 thousand (0.8 per cent).

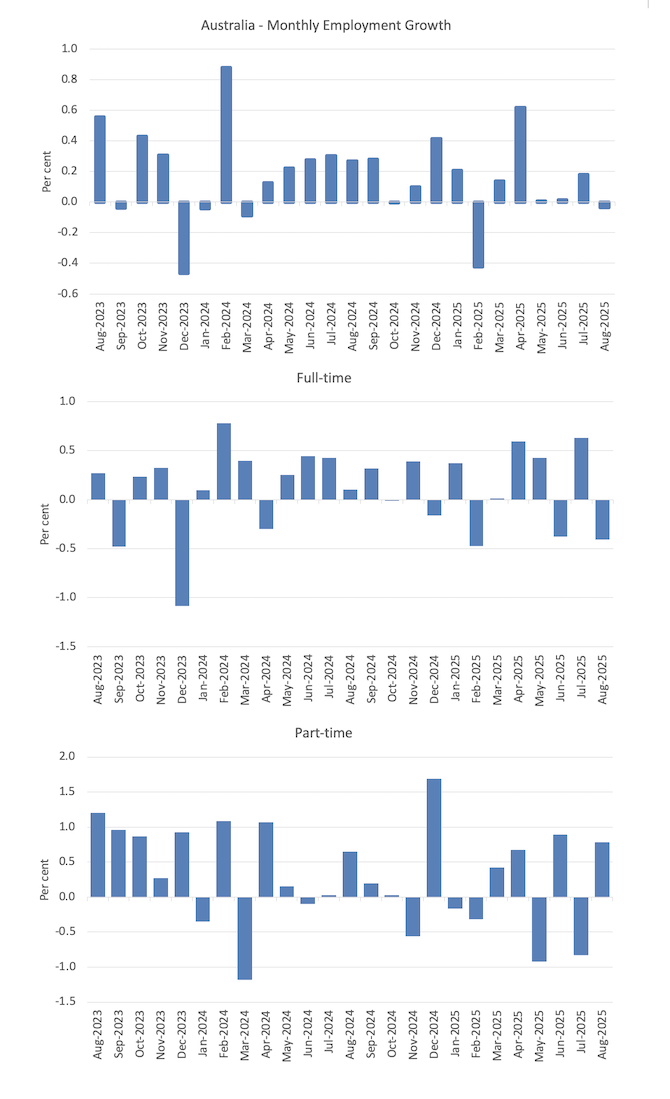

The following graph shows the growth in total, full-time, and part-time employment for the last 24 months.

The following table shows the shifts over the last 6 months which helps to see the underlying trend.

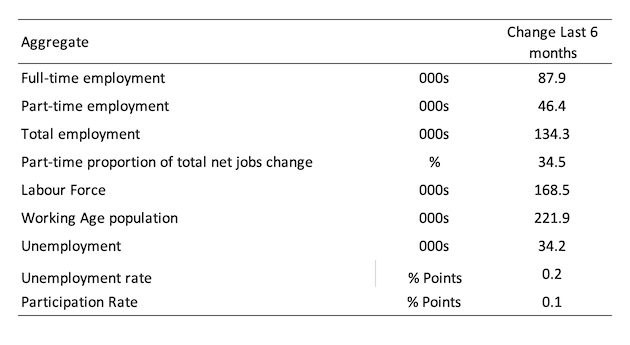

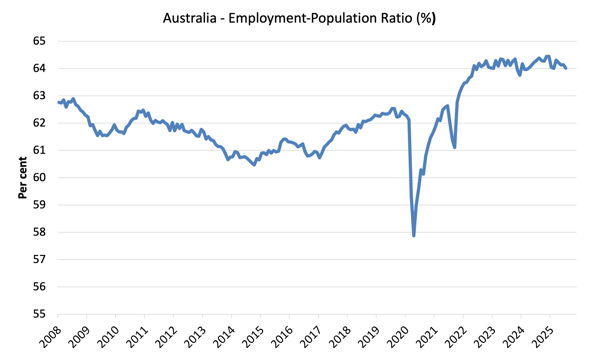

The Employment-to-Population ratio provides a measure of the state of the labour market that is independent of the supply shifts in the labour market (driven by the shifts in the participation rate).

The underlying working age population grows steadily while the labour force shifts with both underlying population growth and the participation swings.

The following graph shows the Employment-Population ratio was steady at 64.2 – which provides some counter to the other variables that are indicating a systematic slowdown is underway.

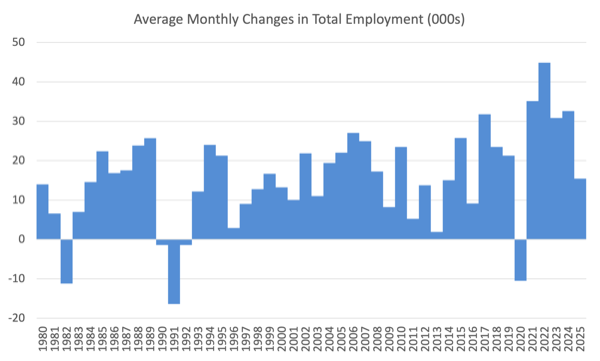

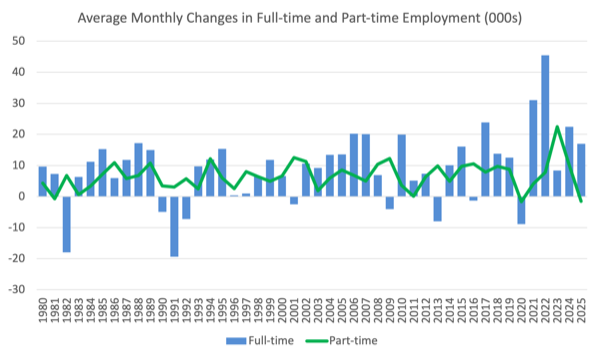

The next graphs show the average monthly change in total employment (first graph) and full- and part-time employment (second graph).

For total employment the monthly average changes were:

- 2022 – 44.8 thousand

- 2023 – 30.8 thousand

- 2024 – 32.6 thousand

- 2025 so far – 15.5 thousand

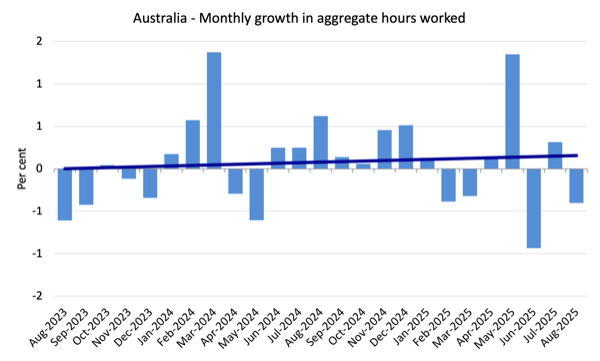

Monthly hours worked fell 8 million (-0.4 per cent) in August 2025

A reversal from last month.

The following graph shows the growth in monthly hours worked for the last 24 months, with the straight line being a simple linear regression to indicate trend.

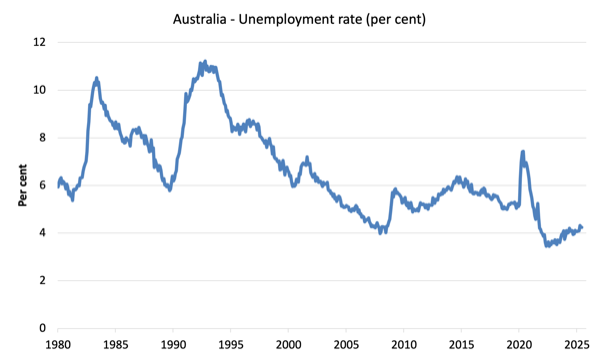

Unemployment fell 0.9 thousand (-0.1 per cent) to 647,400 in August

The small decline in official unemployment (those workers classified as seeking work) was offset by the rise in hidden unemployment as the participation rate fell in the wake of declining job opportunities.

The following graph shows the evolution of the official unemployment rate since 1980.

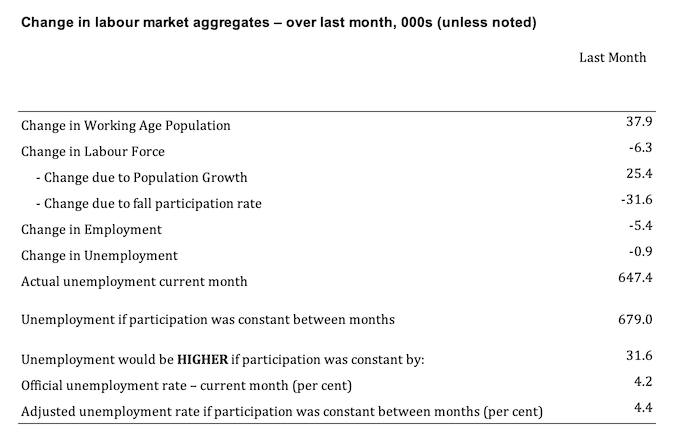

What was the impact of the declining participation rate on unemployment in August 2025

The question is what would the unemployment rate have been, given the employment decline in August, if the participation rate had not also fallen?

These concepts help us answer this type of question:

- The labour force is a subset of the working-age population (those above 15 years old). The proportion of the working-age population that constitutes the labour force is called the labour force participation rate. Thus changes in the labour force can impact on the official unemployment rate, and, as a result, movements in the latter need to be interpreted carefully. A rising unemployment rate may not indicate a recessing economy.

- The labour force can expand as a result of general population growth and/or increases in the labour force participation rates (and vice versa).

The following Table shows the breakdown in the changes to the main aggregates (Labour Force, Employment and Unemployment) and the impact of the fall in the participation rate.

The change in the labour force in August 2025 was the outcome of two separate factors:

- The underlying population growth added 37.9 thousand persons to the labour force. The population growth impact on the labour force aggregate is relatively steady from month to month; and

- The fall in the participation rate meant that there were 31.6 thousand LESS workers in the labour force (relative to what would have occurred had the participation rate remained unchanged).

- The net result was that the labour force fell by 6.3 thousand.

Assessment:

1. If the participation rate had not have fallen in August 2025, total unemployment, given the current employment level, would have been 679 thousand rather than the official count of 647.4 thousand as recorded by the ABS – a difference of 31.6 thousand workers (the ‘participation effect’).

2. Without the fall in the participation rate, the official unemployment rate would have been 4.4 per cent (rounded) rather than its current official value of 4.2 per cent.

Broad labour underutilisation – down 0.1 point in August

- Underemployment fell 0.1 point to 5.7 per cent (falling 22.2 thousand to 871.1 thousand).

- The Broad Labour Underutilisation rate (the sum of unemployment and underemployment) fell 0.1 points to 9.9 per cent.

- Overall, there are 1518.53 thousand people either unemployed or underemployed.

The following graph shows the evolution of underemployment and the Broad labour underutilisation rate since 1980.

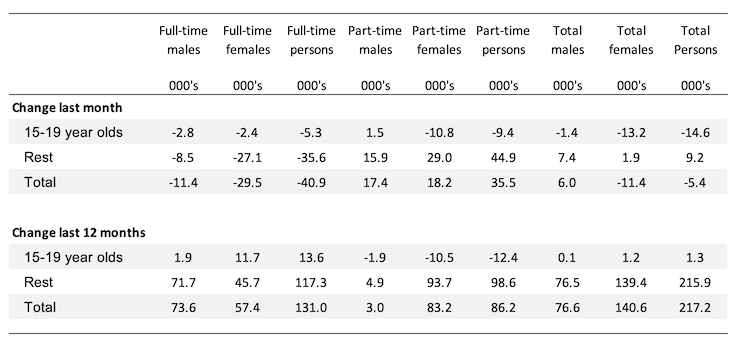

Teenage labour market – deteriorates

- Total teenage (15-19) employment fell 14.6 thousand (-1.7 per cent) in August 2025.

- Full-time employment fell 5.3 thousand (-2.7 per cent).

- Part-time employment fell 9.4 thousand (-1.4 per cent).

The following table summarises the shifts in the teenage labour market for the month and over the last 12 months.

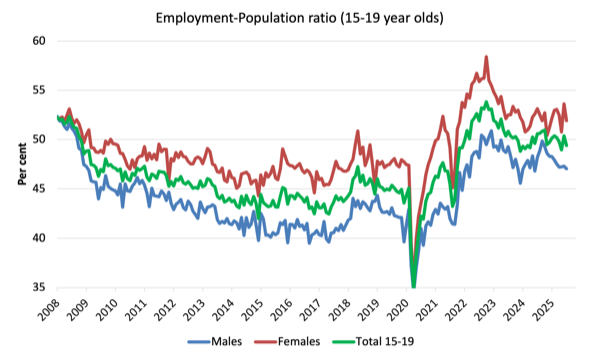

To put these changes into a scale perspective (that is, relative to size of the teenage labour force) the following graph shows the shifts in the Employment-Population ratio for teenagers.

The Teenage Employment-Population ratios and their monthly changes in August 2025 were:

- Males: 47 per cent – down 0.2 points.

- Females: 51.9 per cent – down 1.7 points.

- Total: 49.4 per cent – down 1 point.

Conclusion

My standard warning to take care in interpreting monthly labour force changes – they can fluctuate for a number of reasons and it is imprudent to jump to conclusions on the back of a single month’s data.

- The slowdown that has been signalled for some months and was interrupted by last month’s stronger result appears to have reasserted itself.

- Employment fell overall as did the participation, which saved the unemployment rate from rising.

- That means some workers are likely to have moved into hidden unemployment (outside the labor force) as job opportunities have stalled.

- Underemployment fell 0.1 point, which was surprising given the significant loss of full-time employment. I expect a revision to this result next month.

- It remains a fact that with 9.9 per cent of available labour not being used it is ludicrous to talk about Australia being close to full employment. There is substantial scope for more job creation given the slack that is present.

That is enough for today!

(c) Copyright 2025 William Mitchell. All Rights Reserved.

They will be partying hard on those figures at the RBA – Xmas has come early for them.