These notes will serve as part of a briefing document that I will send off…

Inflation in Australia falling sharply while the US labour demand collapses

Yesterday (August 29, 2023), the incoming Reserve Bank of Australia governor was confronted with ‘activists’ as she prepared to present to an audience at the Australian National University in Canberra. They presented her with an application for unemployment benefits and had done her the favour of already filling it in with her name. It was in response to her dreadful speech in June where she said the RBA was intent on pushing the unemployment rate up to 4.5 per cent (from 3.5), which means that around 140,000 workers will be forced out of work. The problem is that even if we believed the logic underpinning such an aspiration, the actual empirical evidence doesn’t support the conclusion. Today August 30, 2023, we received more evidence of that as the Australian Bureau of Statistics (ABS) released the latest – Monthly Consumer Price Index Indicator – for July 2023, which showed a sharp drop in inflation. As well as considering that data, today I reflect on the latest JOLTS data that was released by the US Bureau of Labor Statistics yesterday. The two considerations are complementary and demonstrate that central bankers in Australia and the US have lost the plot. To soothe our souls after all that we remember a great musician who died recently.

Inflation continues to decline sharply in Australia

The incoming governor achieved notoriety and probably locked in her appointment through the government when she gave a speech in Newcastle on June 20, 2023 that articulated the Bank’s plan to drive interest rates up until the unemployment rate rose to 4.5 per cent from the level at that time of 3.5 per cent.

That would require, based on labour force size at the time, around 140,000 workers who are currently earning incomes being forced into the unemployment queue.

It was a shameless testament to how far removed from reality these central bankers have become – shrouded in flawed ‘textbook’ fictions.

I wrote about that in this blog post – RBA wants to destroy the livelihoods of 140,000 Australian workers – a shocking indictment of a failed state (June 22, 2023).

Even if we took the ‘textbook’ fictions as the starting point, the plan to deliberately destroy that many thousand jobs in order to set the economy at the so-called Non-Accelerating-Inflation-Rate-of-Unemployment (NAIRU) doesn’t stack up.

Even if we accept there is a definable NAIRU that can be measured somehow, the incoming governor’s plan makes no sense.

I wrote about that issue in this blog post (among others) – Mainstream logic should conclude the Australian unemployment rate is above the NAIRU not below it as the RBA claims (July 24, 2023).

The point is, according to the NAIRU logic, if the unemployment rate is below the NAIRU then inflation should be accelerating and if the unemployment rate is above the NAIRU, then inflation should be decelerating.

The NAIRU, according to the logic defines the state where inflation is stable.

The unemployment rate has been very stable over the last year (although it just started to rise last month) but the inflation rate has been falling since last September.

Which means, ladies and gentlemen, logically that the NAIRU could not be above the current unemployment rate and must be below it.

Which means that the RBA’s insistence on putting 140,000 extra workers onto the unemployment scrap heap has no foundation even in the theoretical structure they believe in.

It just amounts to mindless bastardry.

It was good to see her called out by young activists at ANU last night.

The activists, complete with megaphone and signs, demanded that the incoming governor be the first to join the jobless queue.

The protesters held up a large unemployment benefit application form with the incoming governor’s name written on it.

They called out through their megaphone:

We’ve gone ahead, and we’ve started to fill out your form for JobSeeker … If 140,000 people need to lose their jobs in your hands, we reckon you should go first.

The elites of the university apparently screamed at the protesters “you should be ashamed of yourself”.

Which is what elites who have no job risk would say.

You can see a short film of the protest via the ABC News site – Protesters interrupt speech by incoming RBA governor.

I have often wondered what policies would be forthcoming if the policy makers had to be the first in the queue to bear the consequences – wage cuts, unemployment and all that.

But today we saw first hand why the protesters had a valid point.

The ABS released the latest – Monthly Consumer Price Index Indicator – for July 2023 which showed:

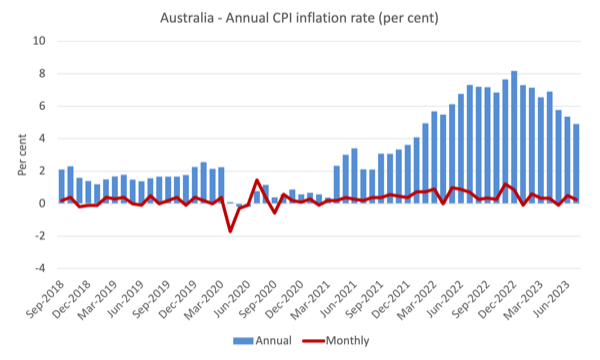

1. The CPI rose 4.9 per cent over the last 12 months down from 5.4 per cent and continued the continual decline in the rate of inflation.

2. Housing continued to be a major contributor although the inflation rate for new dwelling purchases by owner-occupiers has fallen dramatically – it was 8.3 per cent in May 2023 (over 12 months), then 6.6 per cent in June and now 5.9 per cent in July.

3. But the rental component of housing has risen from 6.3 per cent (May), to 7.3 per cent (June), and then for July 7.6 per cent. The rental component can be traced to the RBA’s rate hikes themselves which have pushed up the cost of investment loans and landlords have passed those costs on to the tenants.

Interest rate hikes causing inflation not the other way around.

4. Electricity prices also are increasingly rising courtesy of the government allowing the highly concentrated industry bosses to gouge profits.

However, as it stands, it still provides good information for assessing where the inflationary pressures are heading.

The ABS Media Release (August 30, 2023) – Monthly CPI indicator rose 4.9 per cent annually to July 2023 – noted that:

This month’s annual increase of 4.9 per cent is down from 5.4 per cent in June. Annual price rises continue to ease from the peak of 8.4 per cent in December 2022.

The next graph shows, the annual rate of inflation is heading in one direction – down and quickly.

The blue columns show the annual rate while the red line shows the month-to-month movements in the All Items CPI.

The next graph shows the movements between December 2022 and July 2023 for the main components of the All Items CPI.

In general, most components are seeing dramatic reductions in price rises.

But overall, the inflation rate is declining as the supply factors ease.

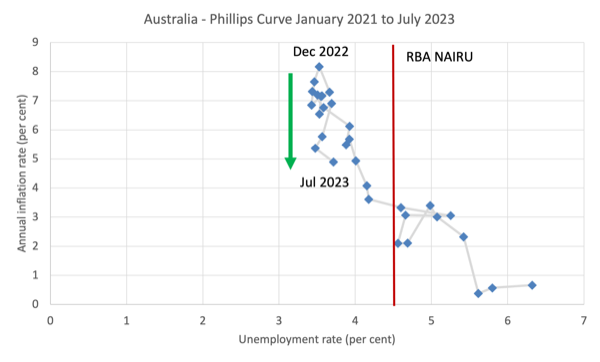

To help you see what has been going on, the next graph is a Phillips curve graph from January 2021 (just before the inflation rate accelerated) to July 2023.

The official unemployment rate is on the horizontal axis while the annual CPI inflation rate is on the vertical axis.

The solid vertical line (at unemployment rate of 4.5 per cent) is the current RBA NAIRU estimate.

It coincides with an inflation rate of just over 3 per cent but at that inflation rate there is a wide range of unemployment rates shown – from 4.1 per cent to 5.3 per cent (about) and if I was to do the econometric modelling to estimate the NAIRU formally, I would get a wide confidence interval within which I could not statistically discriminate – in other words the NAIRU estimates are useless for policy.

They are just the tool of the ideologues who want higher unemployment and more bargaining power to the corporations.

The most recent inflation peak was in December 2022 and it has been declining steadily since with a blip in April 2023.

The green arrow traces that decline.

But look at the range of the unemployment rate within which that decline has been taking place?

Very narrow.

So the NAIRU cannot be at 4.5 per cent if at the current unemployment rate (3.7 per cent) inflation is systematically declining.

It must in a logical sense be lower than 3.7 per cent.

Who said the US labour market was booming?

I noted the speech the other day from Jackson Hole by the Federal Reserve Bank boss, who seems to enjoy flexing his muscles and threatening further rate hikes.

There is some notion that the US labour market is booming and threatening to break out into accelerating wages growth.

The officials keep claiming that the low unemployment rate is signalling an over-full employment situation – all derived from the same perverted NAIRU logic that central bankers are obsessed with.

I haven’t yet fully studied the latest – Job Openings and Labor Turnover Survey (JOLTS) – data which came out in the US yesterday.

But two things caught my attention and I summarise them via graphs.

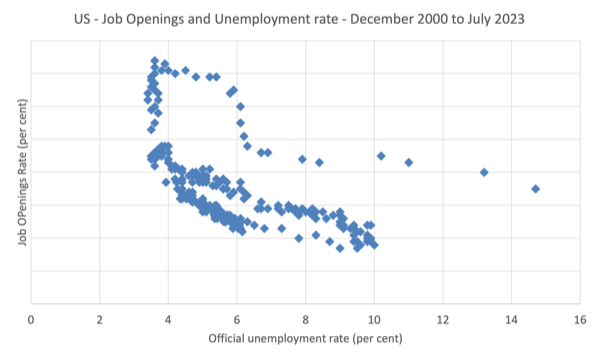

First, the decline in the Job Openings rate in the non-farm sector is staggering.

Covid-19 was a huge shock to the US labour market and displaced the otherwise relatively stable relationship between job openings and unemployment.

As labour demand improved again and the unemployment rate fell quite quickly we reached a peak in job openings in March 2022.

Then the demand side fell off a cliff.

The other staggering thing about the graph is that in the face of a collapse in the demand side of the US labour market, the official unemployment rate has barely moved.

That sheer vertical drop is quite something.

But it indicates that relying on the dynamics of the unemployment rate for a summary estimate of how strong the labour amrket is fraught.

The other interesting happening that I saw in yesterday’s JOLTS data was the behaviour of the quit rate.

I have noted before that the quit rate is a good indicator of how strong the labour market is.

Workers will tend to quit more often when there is a bouyancy of jobs available and then hang onto their jobs when things look bleaker.

The quit rate peaked in November 2021 at 3 per cent and has been in decline ever since.

It would be hard to suggest that the US labour market is overheating with this sort of worker behaviour evident over a sustained period.

Music – Sixto Rodriguez

This is what I have been listening to while working this morning.

In 1970, I acquired the album – Cold Fact – from an import shop in Melbourne.

I used to haunt that shop.

It was the first studio album from a little known performer from the US – Sixto Rodriguez.

The first track was – Sugar Man – which I instantly liked.

The South African Apartheid government banned it – drug references – which I took as a good sign.

It was hard to find anything out about the singer-guitar player and he drifted out of focus.

Then the film – Searching for Sugar Man – came out in 2012, which gave this performer a new audience and I was so pleased to learn more about him – albeit some 42 years after getting his first album.

He died on August 8, 2023 – aged 81.

An engima and a huge talent.

He was impoverished but still defended the rights of the disadvantaged and regularly stood for public office to advance these causes.

That is enough for today!

(c) Copyright 2023 William Mitchell. All Rights Reserved.

RE: The activists, complete with megaphone and signs, demanded that the incoming governor be the first to join the jobless queue

100% spot on, totally agree. Whoever says unemployment needs to go up, Must go first!

Good to know that Australia still has people that take the streets and demonstrate.

The only demonstrations allowed in the media in the EU, are those complying with the official narrative.

One such manif would be ignored here.

I was glad to have caught the Sugarman movie when it was screened in NYC 11 years ago. Truly an overlooked talent.

Bill, I studied engineering in college, so I can read graphs pretty well. I don’t understand where on that scatter plot the last diamond for July 2023 is located. So, I don’t see where the cliff you said is there. That string of diamonds going off to the right at about the 8% line can’t include July ’23. Also, the y-axis has no numbers to tell us what % the lines are.