I have been thinking about the recent inflation trajectory in Japan in the light of…

Mainstream logic should conclude the Australian unemployment rate is above the NAIRU not below it as the RBA claims

Let’s put ourselves in the shoes of a mainstream New Keynesian economist for a moment. We would never want to walk in them for long because our self esteem would plummet as we realised what frauds we were. But suspend judgement for a while because to understand what is wrong with the current domination of macroeconomic policy by interest rate adjustments one has to appreciate the underlying theory that is guiding the central bank policy shifts. The New Keynesian NAIRU concept, which stems from work published in 1975 by Franco Modigliani and Lucas Papademos is pretty straightforward. Accordingly, they define an unemployment rate, above which inflation falls and below which inflation rises. So that unique rate (or range of rates to cater for uncertainty of measurement) is the stable inflation rate – where inflation neither falls or rises. They called it the NIRU (“the noninflationary rate of unemployment”). So if the unemployment rate had been stable for some period, yet inflation was continuously declining, then they would conclude that the stable unemployment rate must be ABOVE the NIRU and vice versa. Apply that logic to Australia at present and you will see why the RBA’s claim that the NAIRU (the modern term for the NIRU) is around 4.5 per cent and this is why they are hiking rates in order to stabilise inflation at the higher unemployment rate. They are frauds.

This is a follow-up post to this blog post – RBA wants to destroy the livelihoods of 140,000 Australian workers – a shocking indictment of a failed state (June 22, 2023).

In that post, I referred to a speech that the Deputy Governor of the RBA, soon to be the Governor gave in Newcastle (June 20, 2023) – Achieving Full Employment – Newcastle – where she waxed lyrical about the NAIRU:

When discussing full employment, in the context of a central bank’s mandate, economists typically talk about the non-accelerating inflation rate of unemployment – the NAIRU …

AS I noted in the previous post, she became hopelessfully confused when trying to bridge the gap between using the NAIRU to guide policy and being committed to full employment where all who want to work can find a job.

The new RBA boss does not consider full employment is about providing a job for all who want to work.

Her version of full employment is a bastardised concept that has little to do with satisfying the preferences of the workers for hours of work:

For monetary policy, our price stability mandate requires a narrower concept of full employment.

So this is a ‘full employment’ concept which is the unemployment rate that is associated with stable inflation.

The NAIRU in other words.

And so if corporations have market power and use it to push higher mark-ups to gouge more profits, then the RBA would try to stop that inflationary pressure by pushing up unemployment.

The unemployment that finally stopped the profit push might be very high yet the RBA would call that full employment even though millions of workers would be without work.

That is what all this means.

The reason I say the incoming RBA boss was hopelessly confused is that she also claimed that:

It is hard to overstate the importance of achieving full employment. When someone cannot find work, or the hours of work they want, they suffer financially … However, the costs of unemployment and underemployment extend well beyond financial impacts; work provides people with a sense of dignity and purpose. Unemployment – particularly long-term unemployment – can be detrimental to a person’s mental and physical health … The costs of not achieving full employment tend to be borne disproportionately by some groups in the community – the young, those who are less educated, and people on lower incomes and with less wealth. In fact, for these groups, improved employment outcomes and opportunities to work more hours are much more important for their living standards than wage increases.

These are all points I have made repeatedly throughout my career, which is why I consider governments should do everything to prevent mass unemployment and that statement provides, in part, the rationale for my advocacy of a Job Guarantee and was influential in my original conception of the approach to full employment in 1978.

But the incoming RBA boss doesn’t advocate ‘achieving full employment’ at all in the sense that the costs of joblessness would be minimised and those measured as unemployed would be workers moving between jobs only.

Her goal is to find the unemployment rate where inflation is stable at some low level – the so-called “inflation target”, which in RBA terms is an annual inflation rate somewhere between 2 and 3 per cent.

Which as I noted above could be an unemployment rate where millions of workers are forced into involuntary unemployment.

This shift from full employment being about enough jobs to a bastardised NAIRU conception where it was about unemployment being used to stabilise inflation occurred in the late 1950s (with the publication of the Phillips curve literature) but really morphed into this NAIRU mentality in the late 1960 with Milton Friedman’s natural rate of unemployment offering.

So let’s step back in time to explore the idea further.

Friedman’s idea of a natural rate of unemployment where inflation was stable was updated in the original article by MIT colleagues Franco Modigliani and Lucas Papademos – Targets for Monetary Policy in the Coming Year – was published in the Brookings Papers on Economic Activity in 1975 (Number 1, pages 141-165).

It is this rendition of the concept that guides the modern central bankers.

And once one understands this rendition, it is clear that the RBA is hopefully misguided in its current approach.

Modigliani and Papademos (MP) introduced the concept of “the noninflationary rate of unemployment (NIRU)” which they define as:

… as a rate such that, as long as unemployment is above it, inflation can be expected to decline …

Their concept really attempted to integrate Friedman’s natural rate idea into a general (Phillips Curve) framework for analysing the relationship between inflation and unemployment.

They were very clear:

… a value of U larger than NIRU must be accompanied by declining inflation …

Where U is the unemployment rate and the NIRU is the rate of unemployment, above which inflation will decline.

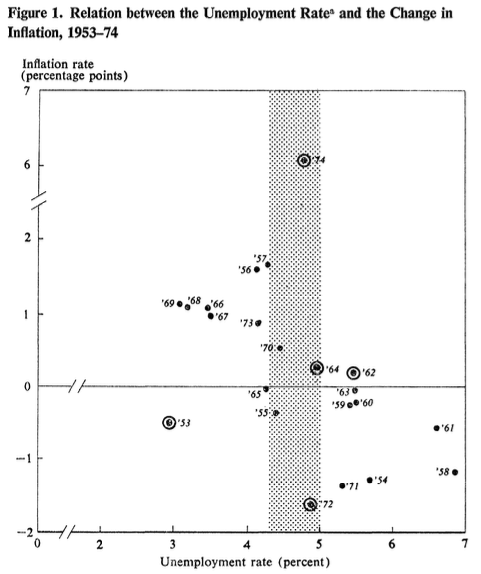

MP presented Figure 1 (which I reproduce) which was labelled in error but actually shows the unemployment rate on the horizontal axis and the change in the inflation rate on the vertical axis for the period 1953 to 1974.

Examining this graph they concluded that unemployment rates above 5 per cent are largely associated with decreasing inflation rates while unemployment rates below 5 per cent are largely associated with noticeable increases in the inflation rate.

The exceptions to this association were explained by MP as special cases.

The shaded area represents the uncertainty in being precise about when the unemployment rate switches from being one that drives inflation down to one that is associated with falling inflation.

I discussed these ’empirical’ judgements in a very early post – The dreaded NAIRU is still about! (April 16, 2009).

In our 2008 book – Full Employment abandoned – we analysed the topic in depth.

For today, here are some updates which continue to demonstrate how flaky the NAIRU concept is as a guide to policy.

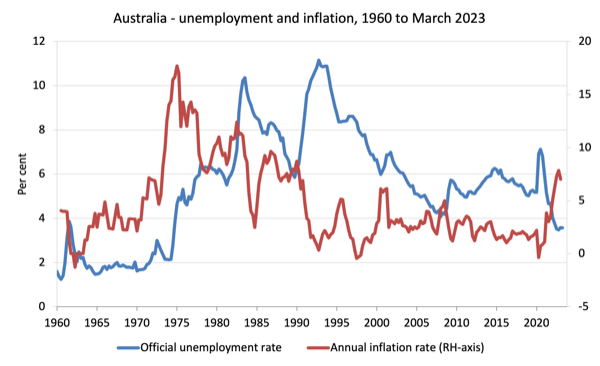

The first graph shows the annual inflation rate and the official unemployment rate in Australia from the March-quarter 1960 to March-quarter 2023.

The experience shown is common for most OECD countries.

What is apparent from the graph is the disparate behaviour of the inflation rate and the unemployment rate.

It is difficult to construe an unemployment rate over the period where you would witness accelerating inflation if the actual unemployment rate were lower or decelerating inflation if the unemployment rate was higher.

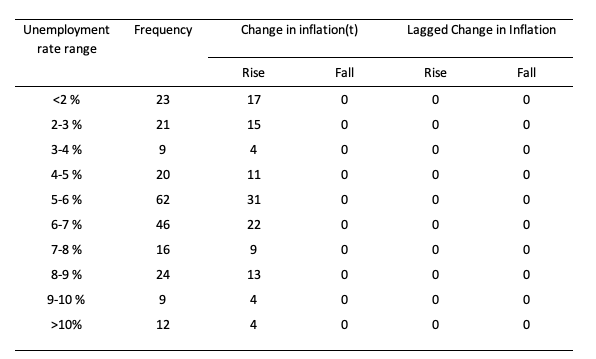

To make more sense of this I constructed the following table.

I segmented the quarterly data from the March-quarter 1960 to March-quarter 2023 into unemployment ranges and computed the quarters when inflation was accelerating (increasing) and quarters when it was decelerating (falling) at each unemployment range.

Just in case the relationship was better described by lagged unemployment (so it might take a while for the impact to feed through to the inflation rate), I also examined that.

Overall, if there were a well-defined and stable NAIRU we would expect to find some unemployment rate range where all the changes in inflation were negative and below that range most of the changes in inflation positive.

Just in case

The results clearly do not support the existence of such a rate. We are unlikely to get any definitive information from the unemployment data about the likely movements in the inflation rate.

I can attest that much more sophisticated econometric work by myself and others similarly cannot establish any definitive information.

And, the next graph replicates the MP Figure 1 (above) for Australia using quarterly data from the March-quarter 1960 to the March-quarter 2023.

Note that the vertical axis depicts the change in the inflation rate.

There is no clear bifurcation depicted whereby above some unemployment rate, inflation is declining and below it, inflation is increasing.

Application to current RBA monetary policy justifications

The incoming RBA boss told the audience in the Q&A section of the speech I cited above that to stabilise inflation:

… the unemployment rate will have to rise … the NAIRU … 4½ probably looks, we think, maybe in the ballpark.

In the Speech-proper, she said:

The unemployment rate is expected to rise to 4½ per cent by late 2024 … While 4½ per cent is higher than the current rate, this outcome would still leave us below where it was pre-pandemic and not far off some estimates of where the NAIRU might currently be. In other words, the economy would be closer to a sustainable balance point.

So it is clear that the RBA is justifying its interest rate hikes with the assertion that the current unemployment rate of 3.5 per cent is below the RBA’s NAIRU estimate and so if their mission is to achieve price stability they have to hike rates to drive the unemployment rate up to 4.5 per cent.

They implicitly believe that higher unemployment will reduce unit costs and hence price pressure.

Their models that produce these NAIRU estimates have no allowance for profit-gouging.

But we all know the NAIRU estimates are imprecise – which I have examined in detail previously.

Today’s point is different.

Go back to the original MP work on what they called the NIRU (which today is the NAIRU).

They were very clear:

1. When the unemployment rate is above the NAIRU, inflation will decline.

2. When the unemployment rate is below the NAIRU, inflation will accelerate.

Their theoretical work is central to the New Keynesian macroeconomic framework and provides the basis for central bankers appealing to the NAIRU concept as a guide/justification for their interest rate policy decisions.

So, think about it.

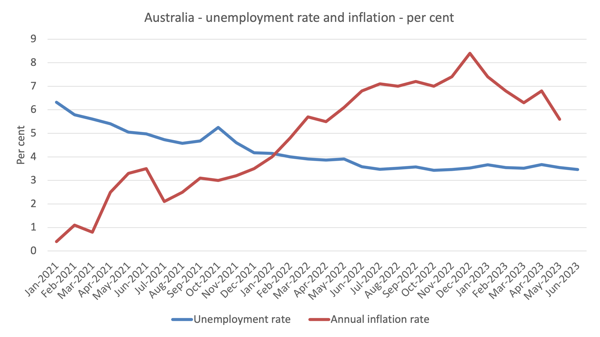

The next graph shows the official unemployment rate and the annual inflation rate for Australia from January 2021 to June 2023 (using Monthly CPI data).

What do you observe?

1. The unemployment rate becomes very stable around 3.5 per cent from around May 2022.

2. The inflation rate rises during the worst of the pandemic as a result of the massive supply impediments that Covid created exacerbated by the Ukraine situation and OPEC+.

3. The inflation rate peaks in September 2022, after which it declines steadily even though the unemployment rate has remained very stable throughout the rise and fall period.

What do you conclude from that?

Using the Modiglian-Papademos logic (that is, the NAIRU logic), it would be difficult to conceive of the NAIRU in Australia being 4.5 per cent.

Applying that logic would suggest the NAIRU if it existed must be below an unemployment rate of 3.5 per cent given that stable level of unemployment has been associated with a declining inflation rate since around September 2022 (with a short kink in the opposite direction).

Conclusion

The point is that the theory that surrounds the NAIRU concept and its application to monetary policy is relatively clear.

I disagree with it and consider it to be flawed in both theoretical and empirical terms.

But that aside, one cannot just use these concepts to suit themselves.

If one considers the NAIRU concept developed originally by MP to be robust then it means that one would conclude the NAIRU is below the current unemployment rate of around 3.5 per cent.

The RBA claims it is above it.

But then they have to explain why the inflation rate has been steadily decreasing since September 2022 while the unemployment rate has been stable at around 3.5 per cent.

You can’t have it both ways.

That is enough for today!

(c) Copyright 2023 William Mitchell. All Rights Reserved.

The keyword here is FRAUD!

I feel bamboozled when I hear about the NAIRU,

Everything can be skewed, to serve the purposes neoliberals can’t mention.

Even their so-called theories can be distorted.

They knew all along it was nothing vaguely related to any kind of theory, so why bother?

But, the evidence mounts against the fairy tales and it’s a duty to expose them.

Just like the scam of voting intention polls.

Last night in Spain, once again, the deep scam of polls has been exposed.

Far from any kind of analysis whatsoever, polls are paid for to bias the voting process.

If you know in advance who is going to win the election, and you intent to vote in another party, you are given a good incentive to stay home and forget about it.

Well, the Spanish people didn’t stay home, even when election was schedulled to the summer vacations (another incentive to stay home, speccially when so many people are away to the beach, or even abroad).

70% turnout is something of a feat.

NAIRU equals curated lies

Definition of curated lies

Information selected, organized, and presented using professional or expert fake knowledge. (fake economic knowledge in this case)

Cause of curated lies in this case

People wanting to keep their highly paid positions and circle of friends (group think, go with the flow)

What lovely people, destroying people’s lives due to being to gutless to admit monetary policy (raising interest rates) is not what is needed in times of inflation caused by profit gouging.

I believe there are three reasons the RBA is hiking:

– it is following overseas rates to stablise the dollar

– it taking the opportunity to restore a monetary policy buffer, and

– it is increasing profitability of the financial sector.

None of which they would admit to, which I think is why they are tying themselves in knots trying to explain it using economic gobbledegook.

The purpose of an economy is to meet the material needs and wants of people, including the need for work at a level of compensation that is socially inclusive. An economy that doesn’t do that is a failure.

Bullock at the gate from the “more of the same” school at the RBA has been confirmed via her recent speech and Q&A in Newcastle. The RBA cloning of overpaid ignorant Governors continues.

I wonder why Guy Debelle, who appeared to be the clear next in line, departed early? Could it have been that he was in disagreement with RBA decisions and realised that he was never going to be able to change them? The flawed culture within the bank was revealed in the RBA Review. There must be some junior staff at the Bank that well understand the realities of fiat currency that the upper echelons don’t accept. Changing the paradigm is long and painful and not yet in sight at the RBA, despite the mounting evidence of failures of the orthodoxy.

The RBA and the Government should be issuing a public apology to the people becoming unemployed for bearing the brunt of their NAIRU policy.