In the annals of ruses used to provoke fear in the voting public about government…

If its bad it must be because of Brexit or MMT or both depending

There is no doubt that the on-going pandemic has left a trail of economic problems including major supply constraints, the growing problem of long Covid and other issues that are challenging policy makers. They have been exacerbated by the behaviour of OPEC+ and the Ukraine situation. We now have a period of inflation, real wage cuts and most central banks doing their best to make matters worse. However, we now have a phenomenon that goes like this. In the UK, everything ‘bad’ that arises is apparently because of Brexit even if the trends were there before the move or the problems are being shared across all countries. I imagine even if the English cricket team loses it is because of Brexit. This phenomenon has generalised however. Now, we have the claim that all bad economic news is because governments ‘followed’ MMT or something akin to it. Those who are insecure about MMT because it does better at explaining the real world than the mainstream theories are the same as the Remainers who predicted that the British economy would crash badly in 2017 and then every year after that. To soothe their worried souls they consider any ‘bad’ news to be because of ‘MMT’ or in the case of Britain because of Brexit. Neither proposition has any foundation.

MMT hate hysteria – a sign of deep insecurity

There is this character Robin Brooks, who works for the important sounding Institute of International Finance, who cannot stop tweeting and writing about the ‘death of MMT’.

He is ex-IMF, Goldman Sachs etc.

The IIS is a peak body of the ‘financial industry’ and advocates to advance the interests of that lot, including financial market deregulation etc.

Basically, anything that makes more money for the hedge funds will fit into their remit.

The most ridiculous recent ‘contribution’ (used as a null) was published in the Financial Times article (November 4, 2022) – RIP MMT – IIF – complete with gravestone “Modern Monetary Theory 2013-2022 Rest in Peace”.

The author and commentators attributed in the article obviously haven’t read much because to them MMT was ‘born’ in 2013.

We started working on this project together in 1995!

The IIS meanwhile has announced the death of MMT after several years of carping about our work with little but more carping to back them up.

In other words, vacuous, self-aggrandising tweets that say things like ‘see Japan has seen a depreciating yen, MMT must be wrong’.

Any trend they interpret – rightly or wrongly – as a retrograde development – is tied in with the conclusion – MMT must be wrong!

Brooks carries on like relentlessly, and, in doing so, reveals how insecure he is about our work.

The FT article basically gives Brooks another platform to push his bile and supplements extensive quotes from him with the usual inflammatory language such as:

1. “government debt kept ballooning around the world” – what does ballooning actually mean – rose? Why not just say government debt has increased.

To which I would say, generally, so what?

2. “even as long-term interest rates kept sagging lower and lower and inflation remained comatose” – how is ‘sagging’ indicative of declining.

Then they started quoting Brooks who opined that:

The illusion of limitless fiscal space has ended abruptly in recent months …

And claiming that “the UK omnishambles as an example of how the market’s patience is not inexhaustible”.

Usual stuff.

And then realising that Japan has been much more capable of resisting the neoliberal pressure to increase rates and cut fiscal deficits (even though the two don’t seem to go together (much to the ‘surprise’ of the New Keynesian advocates of such a move), Brooks concludes that its currency has been “collapsing”.

‘Collapsing’ is a rather catastrophic state one would think – but these guys are not short on the hubris and linguistic overreach.

The US Federal Reserve started increasing interest rates on March 17, 2022 and 6 increments later has increased the rate from 0.25 per cent to 0.5 per cent up to 3.75 per cent to 4 per cent.

Over that time, most of the major currencies have depreciated significantly as the following Table shows:

| Currency | Depreciation (%) | Interest Rate Change (points) |

| Euro – USD | 13.4 | 2.25 |

| AUD – USD | 13.42 | 2.25 |

| £ – USD | 12.1 | 2.9 |

| Yen – USD | 24.7 | 0.0 |

So the depreciation against the US dollar is of a similar magnitude for advanced countries with similar rate hikes relative to the US Federal Reserve hikes.

Japan has experienced a larger depreciation but has held the same policy interest rate throughout.

I ran a rather simple statistical routine to predict what would be the depreciation expected for Japan (with the largest interest rate differential against the US) based on the scale of depreciation and interest rate differentials against the US rate for various other nations. I controlled for energy export status.

The answer: about the scale of the depreciation that Japan has experienced!

So nothing to see really.

Is that a sign Japan’s currency has collapsed?

The Bank of Japan and the Cabinet Office certainly don’t think so.

They understand that the depreciation has been relatively controlled and consistent with the experience of all oil importing nations as the US interest rates have moved up.

And when comparing these nations it would be hard to find a simple story that satisfies Brooks’ penchant for blaming MMT thinking.

If anything the depreciating currencies are a result of the dependency on imported oil, scaled by how far the respective central banks have reduced the scope for investors to shift to the higher returns in the USD.

You can also see how mindless the Brooks-association of the exchange rate depreciation in Japan with the end of MMT is when you examine this analysis from the ECB – Mind the step: calibrating monetary policy in a volatile environment – (which provides graphs from a speech made by Fabio Panetta, a Member of the ECB Board on November 3, 2022).

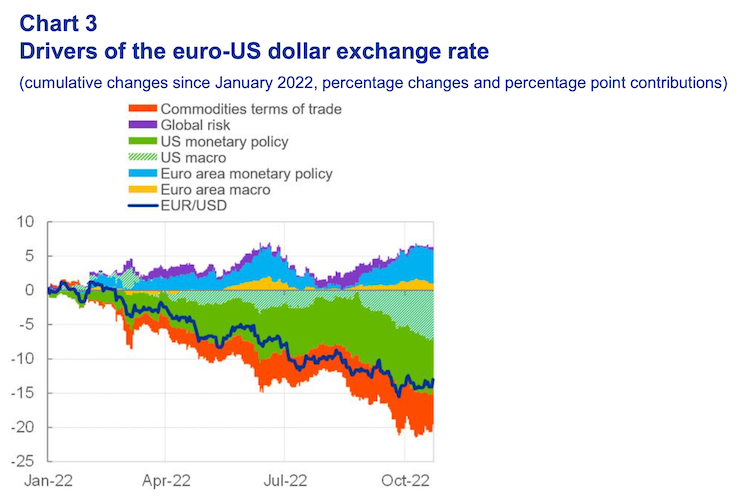

The following graph appears as “Chart 3 Drivers of the euro-US dollar exchange rate” in the slides that Panetta spoke to.

The overwhelming driver of the euro-USD depreciation has been the US Federal Reserve’s rather manic interest rate hikes on top of the deteriorating commodity terms of trade arising from a shift to higher priced energy exports at the expense of energy importers such as the European nations.

You will die trying to find anything in the MMT literature that claims these trends will not impact on exchange rates.

Of course, these shifts in interest rates and terms of trade will work against some currencies in favour of others.

The Bank of Japan has been intervening in the foreign exchange market recently but only to smooth the volatility in the currency rather than worry about the level.

The Japanese government knows that its Real Effective Exchange Rate (REER) – which measures how internationally competitive a country is has fallen and given a massive boost to its export strength.

It has declined by 11.2 per cent since March 2022.

For an exporting nation, that is highly significant.

Brooks was quoted as saying:

… the fact that YCC has pegged Japan’s yields at low levels has meant that rate differentials moved sharply against Japan, sending the Yen into an unprecedented devaluation spiral. This illustrates that a central bank can suppress the fiscal risk premium in the bond market, but – if it does that – the risk premium just shows up in currency devaluation.

So what?

It just says that sometimes exchange rates will depreciate if there are no capital controls and funds shift to higher interest rate assets in other countries.

What that tell us about Modern Monetary Theory (MMT) and fiscal space?

Nothing at all.

There is nothing that anyone could ever find in our writing that says that currencies will not depreciate.

There is nothing that says that there will not be currency flows shifting when interest rate differentials shift.

Does it mean that the Japanese government has run out of the capacity to use fiscal policy to maintain low unemployment?

Certainly not.

And the Japanese government has just announced another major stimulus and will ride on the back of the boost to exports as a result of the decline in the REER.

Brooks is wrong if he thinks the Japanese government have suddenly been forced to shift to a position of fiscal rectitude and will suddenly impose austerity.

They understand their fiscal space has nothing to do with their public debt levels or other financial aggregates.

They know if they harness productive resources with net spending then there is fiscal space, quite independent of what the bond investors think.

If Brooks wwas right there should be raging inflation in Japan and rising unemployment.

Quite the opposite is the case.

The day before the FT article was published, the Australian Financial Review published an article that claimed that Modern Monetary Theory (MMT) was effectively dead as well.

The article – To advance Australia, ignore Rod Sims (behind a pay wall and not worth paying a cent to read) -is one of the most preposterous representations of our work.

We get gems such as:

1. “Voters should elect politicians prepared to make tough decisions, and ignore experts offering easy solutions” – so he cannot be talking about my work (that is, MMT) because there is nothing easy about the solutions I propose based on my MMT understanding.

2. “A couple of years ago, an economic approach called modern monetary theory got some traction in the Australian media … MMT offered the easiest of solutions to the hardest of problems. Money could be created, almost at will, to fund government spending, without stimulating inflation”.

This is the problem of providing a public platform to someone with limited knowledge and an inability to know they have limited knowledge.

MMT is founded on the notion that all nominal spending carries an inflation risk and effectively the inflation ceiling represents the limit on government net spending because in most situations – that is, where tight supply constraints are not binding as they are now – without exhausting the productive capacity of the economy to response with extra production rather than by raising prices.

To suggest otherwise renders the author (some character named Aaron Patrick) either dishonest, stupid or asleep.

3. Apparently “both sides of politics dismissed the theory as a dangerous fantasy. It quickly departed the public debate”.

Well I am still around as are other MMT colleagues – debating just as hard as we have for the last 25 years.

And after an extended diatribe about the virtues of unfettered competition, the author decides that:

Modern monetary theory, in different forms, is everywhere.

Which seemed curious given that a few hundred words previously he had dismissed MMT and concluded it had “quickly departed the public debate”.

Consistency and continuity of thought is apparently a bit difficult for these characters.

And I would love to know what all the “different forms” of MMT are.

I am aware of just one body of thought – that which Warren Mosler, Randy Wray and yours truly set about creating 25 years ago and remains coherent and consistent.

It also remains very congruent with the current data movements.

All of this stuff is like the Brexit story in the UK.

Those who are insecure about MMT because it does better at explaining the real world than the mainstream theories are the same as the Remainers who predicted that the British economy would crash badly in 2017 and then every year after that.

To soothe their worried souls they consider any ‘bad’ news to be because of ‘MMT’ or in the case of Britain because of Brexit.

Neither proposition has any foundation.

And let me assure you, MMT is not going anywhere.

We are still researching, refining, educating.

Paradigm shift is slow.

I am patient by nature.

Skills shortages update

On October 6, 2022, the National Skills Commission published the – 2022 Skills Priority List – Key Findings Report.

“The National Skills Commission (NSC) provides expert advice and national leadership on Australia’s labour market and current, emerging and future workforce skills needs.”

Section 1.2 is entitled “A tight labour market has implications for skill shortages”.

They write:

An important conclusion is that a tightening labour market will generally indicate that employers will increasingly compete for workers, resulting in a greater number of occupations in shortage as employers are unable to fill advertised vacancies.

Okay, they got that out of a Microeconomics 101 textbook.

And if they had have then read the next paragraph in the same text, they might have reported something along the lines of ’employers will start to offer higher wage bids in the labour market in order to attract labour resources into their workplaces’.

The Report goes on to detail what they claim are skill shortages although vacancy to unemployed ratio is still above 1 – which means there are more workers unemployed than unfilled vacancies.

But apparently surveys find employers saying they cannot fill their vacancies with suitable workers.

One problem, which I have written about previously, is that the employers’ definition of suitability includes their own prejudices – which might be racially, gender, age, or other related.

The second issue is whether they have actually tried to find suitable workers.

In a tight labour market, an important signal to attract workers is the wages offered.

What does the NSC research reveal about that?

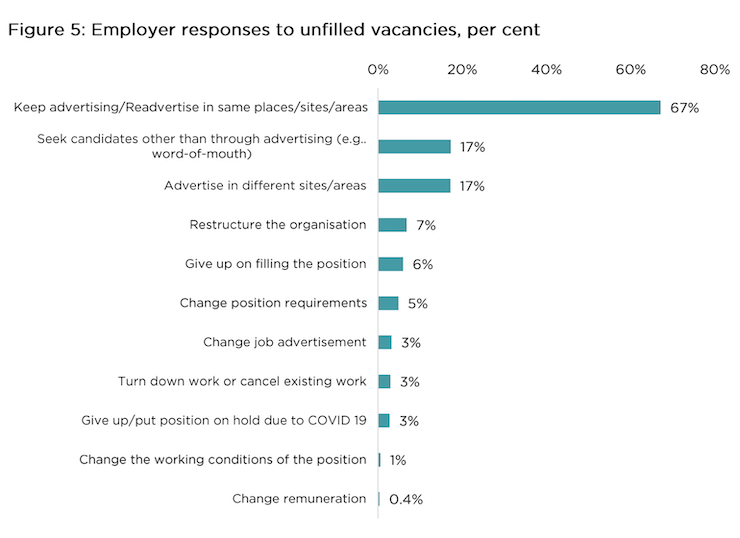

As well as publishing a long list of occupations allegedly in short labour supply, they produced this graphic (Figure 5).

In common language the right expression is – go figure!

Of the employers claiming that they cannot attract labour only 0.4 per cent of them had offered a “Change remuneration”.

They are big on rhetoric when the media has a microphone or camera in their faces but when it comes to the most obvious strategy when the usually recruitment methods fail (like advertising), the most obvious thing is to offer higher wages.

The fact they are not prepared to do that tell us a lot about the veracity of their narratives and their claims they want to support a higher wage economy.

Yeh, all the way to bank their profits!

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

We need a political response to all this nonsense, and frankly better stories and narratives for the ‘tight’ period of the economy that resonate better with the public.

Rather than ‘capital controls’ for the exchange rates moves, what we should suggest is that a sovereign nation should think about subsidising ‘needed’ imports (food and fuel) by transferring the cost to ‘discretionary’ imports (luxury import items). Then there can’t be any forced price rises by exchange rate moves because by definition if something is discretionary you are not a price taker.

The cost of the change in the terms of trade is then born by luxury import consumers rather than domestic workers and young people trying to set up home – as is the case with the alternative MMT Brooks is touting – the Monetarist Mortgage Tax.

We put the adjustment on the rich, not the poor.

Nothing in economics is about science. It’s all rhetorical devices pushing a religious belief. The monetarist snake oil flourishes in an era where prices are rising because their rhetoric resonates.

The voting public don’t like price rises and want them to stop. They won’t allow semi-inflation to work itself out.

Japan is fighting a speculatory atack on its currency, because of the low interest rate.

It’s called carry trade and essencialy, is about speculators borrowing Japanese currency at low rates, buying USD with it and invest in US treasuries bonds, where rates are much higher.

This puts a stress on the Japanese Yen, but the Japanese government is fighting back, selling USD to offset the effects of the attack.

Apparently, they have plenty of it.

This means that the Japanese government has decided not to follow the order of suicide, as the ECB did.

No more harakiri in Japan.

The ECB is following the Fed’s rate hikes, ruining the economies of all euro zone, with the exception of the Germans, who are making every effort to pass the brunt of the economic debacle to the PIGS – AGAIN!

Portugal is in a spending spree, borrowing money to dodgy projects.

In the end, we’ll have a much bigger debt than that we have right now – which is already above 120% of GDP.

And then, we’ll be at the mercy of the Germans once again, begging money to keep oligarchs alive.

What’s left of the flimsy economy will go down the drain and we’ll see shantytowns again, those that we were so ashaimed of in the past and worked so hard to get rid of.

That’s the EU.

The Brits should be thankful for leaving the blob.

The problem is not Brexit, but the tory government.

Unfortunately, if they decide to swap the tories for Keir Stramer’s labour, the problem will remain.

Just one more thing: MMT was never applied in the UK.

Robin Brooks has a job to do and he’s beeing paid to do it in the benefit of those who pay him.

I used to read his tweets (when I was in Tweeter, which I am no more) and they always have a catch.

That catch is simple: the message is that neoliberalism works fine. Bad outcomes have causes and none of them are attributable to the mainstream fairies.

I have but one simple question for the 2nd most insane Mr. Brooks: what does he think will be the impact to the terms of trade thanks to the brilliant common sense response of the Fed, and what it the geopolitical fallout which will further affect it? Well, that’s two, but I also wonder how he thinks workers would rather be in the US than Japan at the moment, and how stable that sentiment is going forward.

Given the constant goal backpeddling from the “responsible” people, I wouldn’t expect much, but it doesn’t hurt to ask.

@Neil Wilson re: ‘Nothing in economics is about science. It’s all rhetorical devices pushing a religious belief’. The irony, and I hope I use that overused word correctly, is that those who have most touted the tools of maths and science for economics have ended up spouting the myths. They are like lab technicians who think they’ve found the answer in a test tube, without paying attention to the results of testing outside a lab. I like your transference of cost idea. I suggest a tax on SUVs and other luxury cars, with a pound for pound subsidy on vegetables, whether imported or home-grown. Who would complain at a green tax? No point worrying about our (UK) own car industry as according to the front page of the New European which I glanced at today, that is already ruined by Brexit. Maybe it would even provide a better opportunity for growing a new transport industry for the future rather than one that is supposedly transitioning while clinging on as long as possible to outdated polluting technology.

The oligarchs and their servants in the financial press are desperate for the public to continue to believe that they (the oligarchs) are the ‘rulers of the universe’, if it was not for the taxes that the oligarchs pay the nation would be broke, this is what most people believe due to being repeatedly told this nonsense for 40 years by mainstream press and mainstream economists. MMT lets people know how money and the financial system really works, the reality is the national govt. has the power of the purse, the national govt. sets the laws, the national govt. are the monopoly issuers of the currency. The things we could be doing in terms of clean energy research, disease research, and poverty (job guarantee). Who ever came up with the saying ‘truth is stranger then fiction’ was not kidding. We just keep going on with silly games of ‘how you going to pay for it’ and ‘there is no alternative’ TINA. A truly bizarre world we live in.

“I suggest a tax on SUVs and other luxury cars”

We already have that – the Vehicle Excise Duty Supplement for cars with a starting price over £40K. Currently it is £310 per year. The cost of the current energy subsidy should be transferred to that supplement.

Which would then drive the market to provide more affordable and greener cars. The current price of Electric Vehicles and their energy efficiency is not acceptable if we are to phase out fossil transport.

@mk, the other lie that the subjugated profession of economics likes to push for their masters is this: In order to fix (climate change / poverty / development / whatever); we “need” to mobilise their accumulated capital so (whatever) can be “financed”, because money-capital is “scarce” and must be competed for with a lax “investment” environment. This “scarcity” of money-capital is a deliberate misrepresentation of what money is, all so that capitalists can use it as a store of the value they extract from workers and the earth, and as a source of power via the capital strike.

So pervasive is this illusion they have painted that, right now, we are witnessing the spectacle of the world’s poorest nations demanding/begging for financial compensation for the damage caused by climate change. The ruling classes of poor nations have the same vested interest in the illusion as those of the rich, so of course this money is delivered as “investment”, taking ownership of their resources and perpetuating the cycle of financial colonisation and debt servitude. It’s a disgusting little scheme, and anyone who challenges it is punished with a capital strike.

Self-sufficiency is also strongly discouraged – the poor must be kept dependant on the rich with a good hard dose of IMF-imposed Ricardian comparative advantage, because self-sufficiency might lead poor countries’ people to contemplate whether they really “need” foreign money-capital at all. That would risk shattering the illusion, maybe even a repudiation of their colonisation and re-taking control of their own resources with their own money – and that is why MMT provokes such invective from the servient economists of the capitalist class. It’s a threat to the illusion they depend on for their own social reproduction.

@Neil Wilson Thanks for update on Vehicle Excise Duty Supplement. I wasn’t aware of that, but then I am not in the mindset or of financial means to be a luxury polluter. That, and it sounds like a tiny figleaf.

@ Neil,

“what we should suggest is that a sovereign nation should think about subsidising ‘needed’ imports (food and fuel) by transferring the cost to ‘discretionary’ imports (luxury import items)”

This could be against WTO rules if the policy is only applied to imports.

If the price mechanism cannot be relied on to prevent us running out of fuel then I can’t see any other workable option to direct rationing.

@Bradley Schott

Great points put in a concise way. It is important to lift the veil to expose the lunacy of our current predicament. If MMT was common knowledge we would finally start to be a civilized planet. Also thanks to all the people who regularly comment here, I learn lots and the discussions are interesting,

“This could be against WTO rules if the policy is only applied to imports.”

Given that WTO ‘sanctions’ are not to sell things, then that would assist the adjustment rather than stall it.

WTO is largely about avoiding treating countries differently. As the USA constantly demonstrates they are not so much rules as guidelines.

I suggest replacing VAT with a tax on the consumption of non-renewables.