I have limited time today to write a blog post and last night I was…

Britain’s Leeds Reforms – jumping the shark comes to mind

Last week (July 15, 2025), the British Chancellor delivered the – Rachel Reeves Mansion House 2025 speech – which is an annual event where the Chancellor outlines the state of the economy and what the government is doing. Mansion House, London – is the official residence of London’s Lord Mayor and is located in the heart of the City (financial district). If you want to see an echo chamber in action then this is one place where you will find one. All the self-important characters from the financial markets being duchessed by a sycophantic chancellor all in the one place. Perfection. Reeves was there to tell the ‘markets’ what they had longed for over the last 15 years – that the so-called – Leeds Reforms – would see the regulatory and supervisory framework that was erected after the GFC largely abandoned and that they could get back to relatively unfettered ‘greed is good’ operations again. Perfection. Apparently, the Chancellor has been convinced by the speculators that they hold the interests of the British working class at the centre of their hearts and that they will do everything in their power to advance those interests through their own operations. And, ladies and gentlemen – pigs might fly.

The Speech

The so-called ‘Leeds Reforms’ are a package of policy changes that will reduce the accountability of senior management in the large financial corporations and entice ordinary consumers to become sharemarket speculators.

A win-win for the financial sector.

Apparently, Britain is being held back because of “unnecessary red tape” which is crippling innovation in the financial sector.

The Chancellor said the Government would be “rolling back regulation that has gone too far in seeking to eliminate risk” and reducing “capital requirements to unlock more productive capital”.

They are also planning to reduce the certification requirements for senior financial managers.

The Labour government also wants to water down the so-called ‘ringfencing rules’ which are explained in this article from the 2016 Bank of England Quarterly Bulletin (Fourth Quarter) – Ring-fencing: what is it and how will it affect banks and their customers?.

Those rules were introduced after the GFC to protect small-scale depositors from bank collapse and required banks to “separate core retail banking services from their investment and international banking activities”.

As part of this change, the mechanisms that help consumers deal with complaints against bad financial corporation practices will be reduced and the compensation that badly-behaved banks will have to pay consumers will be significantly reduced.

The warning codes attached to financial market products to signify risk will be watered down.

Home buyers will also be encouraged to borrow huge amounts relatively to their incomes and the deposit gap will be significantly reduced.

So more mortgage holders will default and lose their homes.

Moreover, banks will be encouraged to hassle customers with positive saving balances into buying shares (speculating).

The Chancellor claimed that:

We have been bold in regulating for growth in financial services and I have been clear on the benefits that that will drive: with a ripple effect across all sectors of our economy putting pounds in the pockets of working people; through better deals on their mortgages; better returns on their savings; more jobs paying good wages across our country.

Seen those pigs lately?

Somehow, British Labour has convinced itself that handing back the keys to the financial markets will prompt the banks and speculators to invest in all sorts of productive enterprises rather than wealth-shuffling bets on unproductive financial products, which will lead to a boom in GDP and employment.

Perhaps they should have reflected a bit on recent history.

A little reflection

It is not as if this sort of narrative is new.

Gordon Brown’s record and that of the Blair government of which he was a prominent member, set the scene for the Tories to take over in 2010.

Labour’s approach to financial markets was nothing short of disastrous and culminated in the collapse of the British banking system in 2008-09.

People should never forget Brown’s character-defining – Speech – to the Confederation of British Industry (CBI) on November 28, 2005, where he laid out his approach to the financial markets:

The better, and in my opinion the correct, modern model of regulation – the risk based approach – is based on trust in the responsible company, the engaged employee and the educated consumer, leading government to focus its attention where it should: no inspection without justification, no form filling without justification, and no information requirements without justification, not just a light touch but a limited touch.

The new model of regulation can be applied not just to regulation of environment, health and safety and social standards but is being applied to other areas vital to the success of British business: to the regulation of financial services and indeed to the administration of tax. And more than that, we should not only apply the concept of risk to the enforcement of regulation, but also to the design and indeed to the decision as to whether to regulate at all.

Those words – “not just a light touch but a limited touch” – should be etched on his headstone.

History shows that the risk-based approach badly failed and it was always going to fail.

I wrote more about Brown’s attempt to reinvent himself after the disaster leading to the GFC in this blog post – A former UK Chancellor attempts to save face and just becomes confused (October 3, 2017).

This UK Guardian article (December 12, 2011) – Labour’s lax regulation of the City contributed to RBS collapse – watchdog – is a good reminder of the consequences of Brown’s failure as Chancellor.

The article was based on the Report by Adair Turner (boss of the FSA) – The failure of the Royal Bank of Scotland: Financial Services Authority Board Report – released in December 2011.

The Report was scathing about the performance of the RBS management and how they took advantage of the lax regulatory and supervisory environment created by the Government to take on too much risk.

The Report concluded that:

The key prudential regulations being applied by the FSA, and by other regulatory authorities across the world, were dangerously inadequate; this increased the likelihood that a global financial crisis would occur at some time …

The supervisory approach entailed inadequate focus on the core prudential issues of capital, liquidity and asset quality, and insufficient willingness to challenge management judgements and risk assessments.

In asking the question: “Why were regulation and the supervisory approach deficient?”, the Report concluded that:

Key elements of the answer are that the FSA’s approach reflected widely held but mistaken assumptions about the stability of financial systems and responded to political pressures for a ‘light touch’ regulatory regime …

the FSA’s decision to place low priority on the supervision of liquidity, were based on assumptions about the beneficial impact of financial sophistication and innovation, and about the inherently self-correcting of financial markets, which were simply wrong …

The “light touch” approach rested on flawed assumptions such as:

The erroneous belief that financial markets were inherently stable, and that the Basel II capital adequacy regime would itself ensure a sound

banking system …And the FSA operated within the context of frequent political demands for it to avoid imposing ‘unnecessary’ burdens which could undermine

the competitiveness of UK financial firms.

The analysis of the deficiencies of the supervisory and regulatory practice at the time points to the Labour government attempting to achieve “desired regulatory outcomes more through principles than through detailed rules”.

The Government claimed that the financial market firms “would improve” their behaviour if the regulations and enforcement was relaxed.

So the regulators placed trust in the senior management of the financial firms, a trust which was obviously not justified by what happened.

There were no “detailed review and direct testing” done.

The regulators were instructed by government to accept “assurances from firms’ senior management and boards” that all was well.

There were many other “deficiencies” in the way the Government treated the financial markets, which led to the GFC collapse.

The Report itemises the aspects of government that were responsible for this failure, but saves special attention for Gordon Brown:

A sustained political emphasis on the need for the FSA to be ‘light touch’ in its approach and mindful of London’s competitive position. The then

Chancellor, Gordon Brown, on several occasions in 2005 and 2006, made it clear that there was a strong public policy focus on fostering

the ‘competitiveness’ of the UK financial services sector, and a belief that unnecessarily restrictive and intrusive regulation could impair that

competitiveness.

The Report referred to a “Treasury press release dated 24 May 2005, at the launch of the Better Regulation Action Plan”, where Brown was quoted:

… the new model we propose is quite different. In a risk based approach there is no inspection without justification, no form filling without justification, and no information requirements without justification.

Not just a light touch but a limited touch.

Tony Blair made a big thing about eliminating “heavy-handed” supervision of the financial markets and its alleged damaging impact on “innovation and business expansion”.

The FSA responded claiming that it had dramatically reduced the staff overseeing the financial markets.

The Report published a letter from the FSA Chair in June 2005 to PM Blair, which assured Blair that the “FSA applied to the supervision of its largest banks only a fraction of the resource applied by US regulators to banks of equivalent size and importance.”

You could almost cut and paste the statements from the then Chancellor Brown into the Mansion House speech by Rachel Reeves some 20 years later and the message would be the same.

Brown was Chancellor between 1997 and 2007.

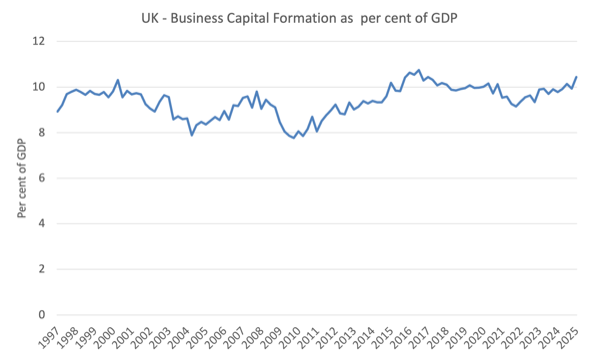

The following graph shows the Capital Formation Expenditure by Private Business as a per cent of GDP, starting in the March-quarter 1997.

There was no appreciable upsurge in Business Capex during his period of tenure.

Conclusion

British Labour has really jumped the shark.

Reeves’ Leeds Reforms are just a replay of Brown’s light touch and we all know (as above) how that panned out

Brown’s approach did not lead to a massive Capex boom but rather spawned the ‘greed is good’ boom which crashed so badly in 2008 – as it always was going to.

Pretending that the goals and interests of the senior managers in the financial corporations are somehow closely aligned with the aspirations of the British working class is delusional.

The former will always push their corporations towards and beyond the risk frontier because their own prosperity depends on it.

But at that frontier the risk of collapse is high and the sort of products that these firms dabble in do nothing much to advance the interests of the working class.

The senior managers also know – from what happened during the GFC – that nary one of them will be prosecuted when their businesses collapse and they put out their hands for government assistance.

Thinking they will self-regulate in the interests of all is a fantasy.

That is enough for today!

(c) Copyright 2025 William Mitchell. All Rights Reserved.

This situation is far worse than Brown’s light touch period. The UK has already had 16 years of decline after 2008 and Brexit.

Reeves is entirely beholden to the City and banksters, has evidently never read Minsky , and her approach is rinse and repeat of Gideon’s neoliberal austerity from 2010.

That a Labour Chancellor demonstrates her continuing slavish adherence to right wing conservatism and gives a willing endorsement of that deregulatory ⁵narrative is a good reason to hope for, if not expect, Starmer’s annihilation at the next election.

Only a child can believe that a minority of the upper class that owns the business world would have identical interests with the working class and the national economy.

Consensus around the incorrect worldview that a privileged minority wants us to have—that is, the image of a democratic failure.

And the only visible opposition to the present order is right-wing lunatics who think that the misfortunes they are experiencing are some socialist conspiracy.

Labor and social democratic parties are beyond salvage.

Was 20th-century democratization only a historical exception? Is the experiment over?

/lasse: Democracy has always been an illusion. Political institutions worked to some extent to society’s benefit in the third quarter of the 20th century, but only after two world wars and a Great Depression in between to trim some of the wealth and power off the ruling psychopaths, and to give humankind a dose of moral shock treatment (now, seemingly, a distant memory and with no lasting effect). Political power was also more evenly balanced by the strong unionisation of the workforce. However, unions never entirely represented the interest of its members, as exemplified, in Australia, by the union movement’s complicity in the introduction of neoliberalism in the early-1980s (by a Labor Government!).

The growth in the post-WW2 period was aimless and should have been directed with the purpose of creating a sustainable and equitable (full employment) post-industrial society with a low-throughput, steady-state economy reliant on renewable energy. Fossil fuels should have been the temporary energy source for the transition process. Sadly, that opportunity has been lost. People (and Mother Nature) are paying the price for this failure. Future generations are in for a very difficult time.

I have now lived long enough it seems to see mistakes repeated over and over again.

We need credit going to the real business sector, ( which has suffered in the UK because of lack of small and medium banks, concentration of large banks,hardly any non bank financing) limits on mortage debt for preexisting assets.

Compared to US & Germany ,which both have below regulatory threshold abundance of small & medium banks lending to SME’s ; and US in particular has more nonbank credit going to firms.

Britain urgently needs a more distributed banking market,less concentration, more relational lending to SME’s ,less bubble-bust inducing mortage lending.

Excellent comment. But unfortunately few have a memory like yours on these matters, and most have forgotten the GFC. Dev in UK really sad. But see now that quarterly growth in EU of 0,1 % is hailed as good compared to with how much worse it could have been. Pathetic