I have closely followed the progress of India's - Mahatma Gandhi National Rural Employment Guarantee…

The advanced nations should take the lead of Pakistan in job creation

Last Thursday (April 30, 2020), the US Department of Labor’s – Unemployment Insurance Weekly Claims Report – showed a further 3,839,000 workers filed for unemployment benefits in the US, taking the cumulative total since March 14, 2020 to 30,589,000. In a labour force of 164 million odd, that implies the unemployment rate is already around 22 per cent. The highest rate endured during the Great Depression was 24.9 per cent in 1933, which prompted the US President to introduce the major job creation program to stop a social disaster – the New Deal. History tells us that the major job creation programs (starting with FERA then morphing into the WPA) were opposed by the conservative (mostly) Republicans in the Congress. As is now! It wasn’t just the unemployment that mattered. Hours of work were also cut for those who maintained their jobs and some estimates suggest over 50 per cent of America’s labour force were underutilised in one way or another (read David Kennedy’s 2001 book for a vivid account of this period). The problem now is that the US has a Presidency that is unlikely to take the bold steps that Roosevelt took in the 1930s, even though the latter was a fiscal conservative and the former does not appear to be so inclined. However, some nations are leading the way – and they put the more advanced nations to shame in this regard.

In my blog post – The European Commission non-stimulus is a waiting game before new austerity is imposed (April 27, 2020) – I introduced the criteria that I use to appraise the effectiveness of different fiscal options in dealing with a disaster of the scale we are facing in world labour markets.

I followed it up with this blog post – A Job Guarantee would require $A26.5 billion net to reduce the unemployment rate by 6 percentage points (April 30, 2020) – which summarised our latest modelling of the investment needed by the Australian government to deal with the crisis.

It showed how inadequate the current wage subsidy response is in Australia and the wanton disregard for the damage that the flood of unemployment will cause in the short-term and over a much longer term horizon.

The criteria – to repeat – were (with an additional criterion added and highlighted as below):

- Implementation Speed – How quickly can the spending enter the economy? For example, an initiative that seeks to build a fast rail service down the East Coast of Australia to join, say, Brisbane and Melbourne, would take longer to get dollars in to the economy than an announcement that the government will offer a job to anyone who wants one (Job Guarantee). To arrest the severe fall in non-government spending and income generation, speed is essential. It doesn’t preclude medium-term projects, but the government has to be careful not to have large expenditure streams coming on tap after the economy is already recovering and no longer needs the temporary fiscal support. See also Scalability below

- Labour Intensive – Does the intervention target activities that generate lots of employment? With employment growth slumping so dramatically, it is best to target activities that will arrest the employment contraction as substantially as possible.

- Multiplier – How much of the initial spending injection stimulate what economists call ‘multiplier effects’, that is further non-government spending. For example, giving low-wage workers cash payments or sustaining their wages, is likely to result in a high proportion of each dollar being spent on consumption goods and services. Conversely, giving loan guarantees to businesses at the time when the economy is entering a deep recession is unlikely to have strong multiplier effects because the latter rely on spending stimulating output and employment.

- Scalability – fiscal support has to do two broad things: (a) fill the steady-state gap between total spending required to maintain full employment and the non-government spending plans (including, of course, the desire to save overall and withdraw current income from further spending); (b) cyclical shifts in non-government spending that create recessionary or inflationary situations. In this sense, when non-government spending falls cyclically, the government is the only source of recession-preventing expenditure stimulus. But it has to ensure that it withdraws that stimulus proportionally with the recovery in non-government spending so as not to push total expenditure growth beyond the inflation barrier.

- Spatial – Does the option provide benefits to regions or the social settlement or is it biased to certain spatial locations, especially those that already have relatively deeper labour markets (more job opportunities).

- Green – Does the intervention help us move towards a carbon-zero world?

- Supply-chain – Is the intervention likely to run up against supply bottlenecks and introduce demand-pull inflationary pressures. This is particularly relevant in the current crisis, which is a combination of a supply and demand shock. Where factories are closed and/or operating on reduced activity levels, it is essential not to be pumping fiscal support into the economy indiscriminately. All spending initiatives will stimulate broad expenditure growth, including for imports. But a carefully designed package can reduce the supply-side strain. For example, in Australia at present there is likely to be some food supply issues as farmers struggle to get workers to harvest the crops (relying typically on ‘back-packers’) with international borders closed. So a stimulus to create temporary public sector jobs for workers locked out of their usual jobs (because of enforced closures) to help ease the supply chain issues would be desirable.

- Equity – this relates to fairness. Handing out billions to help shareholders withstand the losses to their companies is likely to be less equitable than ensuring low-paid workers are able to sustain their mortgage/rent and other contractual commitments.

- Low Corruptibility – this is what economists call ‘moral hazard’. How easy is the option able to be hijacked by those seeking to corrupt the intent. For example, a wage subsidy is highly susceptible to abuse from unscrupulous businesses (there is an extensive research literature on this) whereas paying the salary of a worker directly or offering then a public sector job is less likely to be corrupted.

I spoke about this approach in my live presentation on Friday evening:

As an aside, in about two weeks – MMTed – will be launching a weekly Q&A program where were take questions from the public and answer them from an Modern Monetary Theory (MMT) perspective. It will be a live program and, in time, we hope to have guests on the program (once we sort out logistics and technology). We will make announcements about this very soon. Likely starting data – Wednesday, May 20, 2020.

But, upon reflection, the first criterion noted above – Implementation speed – should be distinguished from what I refer to as Scalability, which as I note above refers to ensuring that the cyclical stimulus component of the fiscal support is calibrated appropriately with the economic cycle.

Many people – including progressive economists and commentators – get this wrong.

They think it is prudent for currency issuing governments to run a fiscal balance on average over an economic cycle, which means that when the non-government sector is increasing its growth rate, the fiscal position should be moving into surplus to ‘offset’ the times when the non-government sector is contracting or slowing and the government has to run deficits.

But that conception purely constructs variations in the fiscal position in cyclical terms.

It ignores the fact that, if we abstract from these cyclical variations, there is an underlying desire to save overall in the non-government sector which depends on on-going income growth. That process must be supported by fiscal policy or else the overall saving behaviour of the non-government sector will cause recession.

So, if an economy is in a position where there is an external drain on expenditure coming from the external sector, and the private domestic sector exhibits a desire to save overall, then the government has to run a continuous deficit, or, otherwise, the economy enters recession and stagnation.

Thus, Scalability is about managing the fluctuations in the government’s fiscal balance around that steady state to accommodate the cyclical swings in non-government spending.

It makes the conduct of fiscal policy difficult because projects have to be designed to ensure they can be ‘turned off’ as the non-government sector starts to recover.

The cyclical component of fiscal policy should not be ‘pro-cyclical’ – that is, in relation to non-government spending cycles. The steady-state component of fiscal policy has to be pro-cylical, if the non-government sector exhibits an underlying desire to save overall.

That difference is not well understood but is crucial in the design of an effective fiscal intervention.

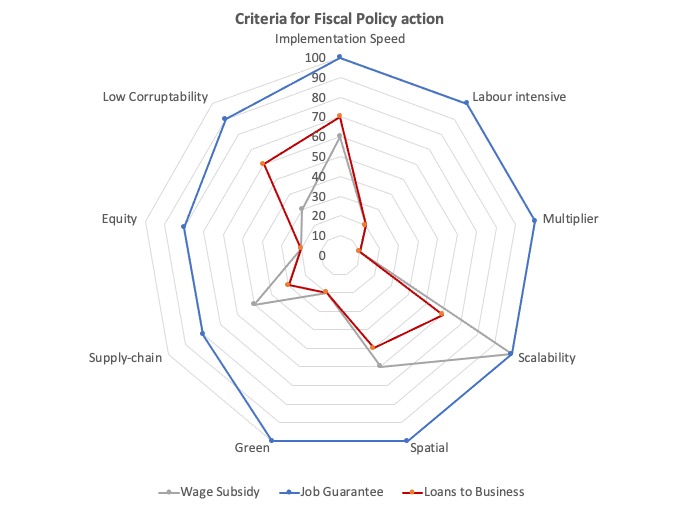

The following graphic shows these options and I have now added the Scalability criterion, which last week I had implicitly embedded in the Implementation Speed criterion.

As before, a position at 0 means the initiative meets none of the requirements or the relevant criterion, whereas 100 means the intervention is strongly meeting that need.

I have compared three options:

1. A wage subsidy.

2. A Job Guarantee.

3. Business loan guarantees.

My weightings are approximate and open to debate.

But the superior option here is the Job Guarantee when assessed against the above criteria.

And making the Scalability criterion more explicit only goes to reinforce this conclusion.

Policy failure amidst the alarm

Which brings me to the point of today’s blog post.

The only way that a government can avoid a major contraction in employment such as we are seeing around the world now is through direct job creation.

The Australian Prime Minister has said today that even if the wage subsidy is not fully taken up – and it won’t be because it is poorly designed and leaves more than a million casual workers behind anyway – they will not be increasing fiscal support elsewhere.

He also said that the JobSeeker payment (unemployment benefit) would have to take care of the rest – that is the workers who the government is now deliberately allowing to become unemployed.

The ILO has just released a report (April 29, 2020)- ILO Monitor: COVID-19 and the world of work. Third edition – which makes for very disturbing reading.

1. “global working hours declined in the first quarter of 2020 by an estimated 4.5 per cent (equivalent to approximately 130 million full-time jobs …”

2. “Global working hours in the second quarter are expected to be 10.5 per cent lower than in the last pre-crisis quarter. This is equivalent to 305 million full-time jobs”.

3. “the Americas (12.4 per cent) and Europe and Central Asia (11.8 per cent) will experience the greatest loss in working hours.”

4. “almost 1.6 billion informal economy workers (representing the most vulnerable in the labour market), out of a worldwide total of two billion and a global workforce of 3.3 billion, have suffered massive damage to their capacity to earn a living.”

5. “The first month of the crisis is estimated to have resulted in a drop of 60 per cent in the income of informal workers globally.”

6. “Without alternative income sources, these workers and their families will have no means to survive.”

The ILO, of course, is calling for “a job-rich approach, backed by stronger employment policies and institutions” within the context of a generalised fiscal stimulus.

I read an interesting article in Dissent over the weekend (published April 30, 2020) – Understanding the Unemployment Crisis – by Colin Gordon, who is a US academic historian.

His focus was on the US disaster and he argued that the scale of the crisis is worse than the reported increase in unemployment insurance claimants (that over the last six weeks are “more than nine times” the “worst six-week stretch of new unemployment claims” any point in US history) understates the severity of the problem.

This is because the:

… the “insured unemployment rate” (the share of the workforce receiving benefits) is but a fraction of the real unemployment rate (the share of the workforce out of work and looking for work) …

the share of the unemployed actually receiving benefits … is under a third in most states, and over half in only two.

The reason is a combination of shoddy policy implementation and deliberate strategies designed to deny people benefits.

He says the state-level capacity is unable “to process the avalanche of claims” and many of the workers who have lost their jobs via the lockdowns will have exited the labour force – into hidden unemployment.

But most importantly, Colin Gordon argues that the:

… the whole logical fabric of the federal stimulus has unraveled … ran out of money so quickly it did little to check the flood of UI claims … slow to roll out everywhere … so narrowly interpreted (by the states) …

Instead of “shoveling federal money … to working families” to help them maintain incomes while in lockdown, the impetus in the US states is now to “re-open as quickly as they can” even though they are “still well on the wrong side of the COVID curve”.

His reasoning is that:

By cutting short the relative generosity of the federal benefits, state unemployment insurance systems can revert to their regular modus operandi-which is aimed less at cushioning the blow of unemployment than it is at compelling participation in the labor market.

Total policy failure – in other words.

But somewhere there is hope …

Amidst all this gloom, I stumbled across an Al Jazeera report (thanks Willem) published April 29, 2020 – Pakistan’s virus-idled workers hired to plant trees – which should put the more advanced nation governments to shame.

The Pakistan government has closed many sectors, including the construction sector – just like most governments. There is nothing unique about the policy measures they have introduced in an attempt to halt the spread of the coronavirus, except one major initiative.

They are generating jobs for:

… tens of thousands of other out-of-work labourers in planting billions of trees across the country to deal with climate change threats.

These workers are being employed on the Government’s – 10 Billion Tree Tsunami programme.

You can follow the program on – Twitter

The program aims to:

… aims to counter the rising temperatures, flooding, droughts and other extreme weather in the country that scientists link to climate change.

So it is targetted at medium- to long-term aspirations – shifting the nation structurally – while also solving the short-run problem.

Refer to the criteria I provided at the outset and also the questions I indicated were important in last week’s analysis and Live presentation.

1. How do we avoid the damage of the crisis now?

2. How do we use the stimulus measures to shift behaviour and achieve longer-term goals – such as fighting climate change?

The Pakistani government is so far ahead of the indolent governments in the West (UK, Europe, US, Australia) on this thinking.

The tree-planting program has increased its normal workforce by a factor of three – to cope with the employment of those displaced by lockdown rules.

There is a variety of work available – “setting up nurseries, planting saplings, and serving as forest protection guards or forest firefighters”.

Social distancing is practised and enforced.

An official said:

Nurturing nature has come to the economic rescue of thousands of people … the green jobs initiative is a way to help Pakistan’s workers recover from the coronavirus crisis with dignity and avoiding handouts …

Another official said:

We can absorb all the unemployed labourers and workers who have fled the cities and returned to their villages in the past few weeks. This is unskilled work

Conclusion

The point is clear.

A Job Guarantee should be a base level policy structure in all nations.

The tree planting program demonstrates, within that nation’s social institutions, all the good things of these sorts of jobs:

1. They are Fast to implement if the institutional structure is already in place – which is why the Job Guarantee should be a permanent policy structure ebbing and flowing in size with the fluctuations in non-government sector spending.

The tree planting program easily scaled up when the need arose.

2. They are Labour intensive – clearly.

3. They have strong Multipliers – because they preserve income of the most disadvantaged who have propensities to consume close to 1.

4. They are Scalable – when the crisis allows other sectors to open, the workers will be quickly reabsorbed back into their old positions again.

5. They are Spatially advantaged – jobs can be created where people live and need work.

6. They are Green – serving longer run objectives as well as the short-term exigencies.

7. They are Equitable – those in need get relief.

So they strongly satisfy most of the essential criteria without doubt.

All governments should be doing this.

That is enough for today!

(c) Copyright 2020 William Mitchell. All Rights Reserved.

Occasionally you mystify me Professor. I understand that Trump is not a fiscal conservative- you do also. But how in the world do you declare FDR to be a fiscal conservative when throughout his presidency he managed to push the US, against all kinds of opposition, into the largest deficits it had ever seen? Even now as a percent of GDP. Pretty much immediately took the US off the gold standard as soon as became President also. Yeah I know about the 1937 recession. And I know the Democratic party in 1932 advocated a balanced budget- FDR didn’t seem to care about that much and abandoned that immediately.

How was he more fiscally conservative in the policies he tried to get enacted than even Donald Trump? I just think you are not looking at the history here correctly.

Question: how will the Pakistan government fund this initiative?

Not by currency-issuance, surely………..

It is a real battle in Oz to access either the Jobseeker or Jobkeeper benefit.

I am doing the online application for my sister who is elegible for both.

“Jobseeker” was announced first so we started the process with that programme because the employer was not sure if their turnover had retreated more than 20%

The Government interface is MyGov and it seems to be a dragnet requesting a list of asset information for the Aust Tax Office

Admittedly my sister owns assets but the application process is partially prefilled as in the ATO yearly tax return and in our case lists real estate that was sold 15 years ago.

There is no way incorrect ATO data can be corrected or challenged. We have to submit a current Council rate notice for all property other than Principle Place of Residence. Until a box is filled out with a property Certificate of Title number you can’t progress with the application.

The whole process is extremely onerous and has taken 12 hours spread over 2 weeks.

It requires much computer literacy and diligence and I forsee many people going hungry. Which will save money.

A Job Guarantee wage paid out to a Tax File number would get money out into the community much faster.

Hi Jerry Brown. Indeed FDR did fend off conservative opposition to his stimulus measures, but he was also much pursuaded by a much more active left wing and union presence than there is now along with the fear of other conservatives who feared a left wing revolution, such as Joseph P. Kennedy, Sr., (quote from Wiki – New Deal) “in those days I felt and said I would be willing to part with half of what I had if I could be sure of keeping, under law and order, the other half”. If only we had such pressure from alternative sides today. You mention the 1937 recession, caused in part by fiscal contraction, both increased tax rates and reduced spending. However, I’m with you on thinking FDR should be mostly thought of positively. Among other achievements of government workers was the planting of millions of trees (per https://rooseveltinstitute.org/real-lesson-great-depression-fiscal-policy-works/). Well done Pakistan.

Thanks Bill

Found David Kennedy’s paper on jstor and ordered the book.

I’m beginning to wonder if “what do people do” on the Job Guarantee is a bear trap. Ultimately it is an employment system, and the only thing that is traded under an employment system is hours of work. What is done in those hours of work is the problem of the hirer, not the employee.

The political riposte then is “well if you don’t like what they are doing, hire them and get them to do something more productive. And pocket the profit from doing so. You’re a Capitalist aren’t you? Do some Capitalism”

The political requirement for a job, from everybody else’s point of view, is that you are constrained in the use of your own hours the same as everybody else doing a job and that those hours are used for the benefit of others. It appears from the current crisis that “stay at home and don’t infect anybody” is sufficient – at least for the moment.

The Pakistani initiative is fantastic. The only downside to it is that it is a capital project, not a consumption project. You can’t keep planting trees at any intensity for that long before you run out of suitable land – and trees.

Bill hones in here on THE issue–formerly chronic, now acute–which will determine humanity’s near-term and likely long-term future. Will public pressure, protest, and civil disobedience, perhaps on a never-seen-before scale, manage to force governments to take care of all of their citizens, to arrange things (like the JG) so that all can live viable lives, or will governmental catering only to the plutocratic class grow even stronger and manage to crush whatever opposition may arise from “the people?” Let me say again what I’ve said repeatedly on this blog and elsewhere: in the final analysis, this question will be answered only by us, the non-elite 90%, by the breadth and depth and persistence of the opposition we generate when the current health crisis morphs into an even more devastating and enduring economic crisis. Will social distancing and its consequences lead ironically, wondrously, to the firm and emboldening embrace of brothers and sisters standing up for each other, including “the least of these,” or will we show ourselves to be, at our core, fearful, self-obsessed cowards, grasping desperately to preserve only our individual welfare–thus proving that the neoliberals were right about us all along?

Jerry,

The New Deal programmes were more about micro reforms than macro reforms.

The Roosevelt administration might have deficit spended but it wasn’t hard to do comparatively to the sound money policies of previous administrations. The Roosevelt deficits during the 1930s averaged only about 3%.

Having said that, it is clear Roosevelt radically changed the nature of public enterprise in the US.

Thank you Patrick B and Henry. Maybe it is not fair to describe the government deficit spending during WWII as characterizing FDR’s preferences and that any President would have had to do the same thing. But before the US entered that war, there were policies FDR took that in effect were US deficit spending- ‘Lend- Lease’ loans to the UK is one of them.

I would also point out that fiscal conservatives do not take their countries off of an existing gold standard. And they do not start massive jobs programs. And they do not devise and implement social safety nets and economic stabilizers like social security and unemployment insurance. And they do not try to implement new rights for the citizens like a right to a job and a right to decent health care- even though he couldn’t get that through. And they do not organize things like FDIC for bank deposit insurance provided by the government. And they do not do Many other things that FDR tried to do but was blocked by actual fiscal conservatives and the Supreme Court of the US.

So, sometimes Bill mystifies me. Maybe his definition of fiscally conservative is different than mine. I would like to know what that definition is and then I could maybe understand what he means. I could call Bill Mitchell a ‘fiscal conservative’ because he says that at times it may be the right policy for a government to run a fiscal surplus. If I wanted to make my own definition of what fiscally conservative means then I might be correct.

May

One incident does not prove anything. Please do your research on how their State treat their minorities and how there is no civil society to counter it. As a Hindu I would rather live and work here in the USA than in Pakistan, where Hindu girls are abducted, converted, and married.

Thanks Bill, brilliant and enlightening as usual. Only thing I disagree with: you seem to be suggesting that only the Republicans are opposing job programs today. That is simply wrong. BOTH parties equally oppose any help to workers. You seem to also say Trump is not keen to take bold steps in fiscal expansion. Again wrong: he has expanded fiscally by the trillions during his presidency (tax cuts, stimulus bills) but for the 1%. And the Democrats, far from even trying to oppose him voted along with him nearly unanimously every time. Actually the Republicans first floated the idea of a UBI at the beginning of the pandemic and… Nancy Pelosi brutally stopped it. There is complete corporate capture of the US government & both parties serve the same donors against the working class. I expect better from you bill than to repeat the conventional talking points “Trump& Republicans bad, Dems good”…

Planting trees ultimately welcome birds, fruits and helpful for some animal grazing and help to reduce the temperature in summer. I will suggest forestry ministry allocate forest lands zone and planting trees on specific sites. After this pandemic I will work for myself and create jobs rather finding a job.

I think it is good that people will have a means to livelihood and restoring nature. However so many ppl will not produce that can be consumed or used by the people. To procure consumables, the govt will still have to layout more resources. Interesting and people centric challenge.

Newton Finn writes:

“or will we show ourselves to be, at our core, fearful, self-obsessed cowards, grasping desperately to preserve only our individual welfare-thus proving that the neoliberals were right about us all along?’

Perhaps not cowardly, but certainly instinctively self-interested and not entirely rational.

Eg, in 1946 with the image of that mushroom-shaped cloud over Hiroshima etched in everyone’s brains, a genuine attempt to introduce an international rules based system, to which all nations belonged, was made. It failed partially because of “who we are”….but the attempt remains as an ongoing vision among people of goodwill.

Covid19 has turned out to be a fizzer; the economic shutdown will be relatively short-lived, so governments will be able to return to business as usual, financed by debt owed to private interests…..albeit with increased public austerity.

And Peter Switzer is already spruiking the housing market in OZ. There is no problem. Steve Keen will remain wrong forever.

Jerry Brown writes:

” Maybe his definition of fiscally conservative is different than mine”.

Well, anyone who thinks governments have to tax in order to spend is a ‘fiscal conservative’?

Bernie Sanders is a fiscal conservative – that’s why he lost to the other fiscal conservative Biden.

ie, we are all fiscal conservatives (except those of us who profess to be MMT’ers) and we all prefer to pay the minimum amount of tax….which is why ‘progressive’ parties (like Sanders) can’t win elections.

Neil Halliday, I would argue that hardly anyone thinks the government needs to tax in order to spend- most of people are fine with the idea that government’s can also borrow in order to spend. MMTers know better for sure. But we make up a tiny percentage of the populace. When you describe someone as a fiscal conservative then you should be prepared to say compared to who or what standard is that person a fiscal conservative. FDR was not fiscally conservative judged by the actions of his administration even compared to Donald Trump. Like Dean Baker says- you got to look at what they do and not what they say when describing politicians. Has Donald Trump impressed you as far as showing any coherent political philosophy whatsoever? Besides maybe that If it is good for Trump- it must be good for the country?

Jerry, I agree.

But did Bill say FDR was more fiscally conservative than Trump?

The actual sentence was: “even though the latter (FDR) was a fiscal conservative and the former (Trump) does not appear to be so inclined……the deficit spend is still inadequate for what is required”.

Some nuance there…given we all agree Trump’s policy is – Trump first, America second, and everyone else third.

But another poster says FDR’s av. deficits during the 30’s amounted to only 3% of GDP; I think the current US economic rescue package under Trump (though poorly targeted) is larger than that in percentage terms…and is STILL inadequate.

@ Jerry Brown

“I would argue that hardly anyone thinks the government needs to tax in order to spend- most of people are fine with the idea that government’s can also borrow in order to spend”.

And I would argue that “hardly anyone” (apart from what you rightly describe as “a tiny percentage of the populace” – ie MMT’ers) thinks that governments are not exactly the same as households or businesses, only bigger. In other words that govts *do* need to tax in order to spend. The “borrowing” bit is just incidental.

Thatcher thought that, so does Merkel – and both were elected and re-elected largely on the strength of proclaiming it to be true and running their economies in accordance with that doctrine. As have all other governments (except Japan’s, inadvertently) ever since the world went off the gold-standard causing continuing to do so to immediately become obsolete.

But you do go on to say “MMTers know better for sure”. So obviously there’s no fundamental disagreement here. I just think your opening statement needs heavily qualifying. eg Most people may as you say “be fine with the idea that government’s can also borrow in order to spend”*but* only in the context of taking it as read that such govt borrowing must be repaid dollar for dollar (usually at our childrens’ and grandchildrens’ expense!).

Dear Dekin O’Sullivan (at 2020/05/05 at 8:19 am)

Thanks for your comment.

But the last part doesn’t resonate at all with what I wrote nor what my consistent message has been.

1. I am no fan of the GOP.

2. I am less of a fan of the Democratic Party, given they claim to represent progressive side but sell it out.

3. I explicitly said that Donald Trump has blown the GOP’s austerity mindset and while crazy is not loath to increase the deficit.

No repetition of “conventional talking points” here!

best wishes

bill

Newton,

“will we show ourselves to be, at our core, fearful, self-obsessed cowards, grasping desperately to preserve only our individual welfare-thus proving that the neoliberals were right about us all along?”

Even if the former is true, they cannot prove the later. In times of crisis, they expose the virtues, because they must to keep some hope, of various forms of private charity (however horrible of a fix it is in practice). There is no escaping altruism.

Sobering outlook suggesting activity levels are likely to remain at 10% of those before the outbreak. Somehow, I suspect even Bill’s estimate of the size of fiscal stimulus is way too low.

https://www.medrxiv.org/content/10.1101/2020.04.26.20080994v1.full.pdf

Absolutely staggering judgment from the German constitutional court today: (https://www.bundesverfassungsgericht.de/SharedDocs/Pressemitteilungen/EN/2020/bvg20-032.html).

Says the European Court of Justice got it wrong upholding the validity of the ECB’s QE programme in the Weiss case 18 months ago (http://curia.europa.eu/juris/liste.jsf?language=en&num=C-493/17).

The ECB has not shown the Public Sector Purchase Programme is a ‘proportionate’ policy, it says, and the ECJ’s decision in favour in Weiss was incomprehensible and ultra vires (ie unlawful).

This never happens – it is like the NSW Court of Appeal deciding that the Australian High Court is wrong.

The upshot (if the programme is disproportionate) is that it is not monetary policy and it is outside the ECB’s powers.

The ECJ’s decision in Weiss on proportionality was I thought the strongest part of its judgment.

It cited evidence from the ECB pointing to:

“… the practices of other central banks and to various studies, which show that large-scale purchases of government bonds can contribute to achieving that objective [reversing deflation] by means of facilitating access to financing that is conducive to boosting economic activity by giving a clear signal of the ESCB’s commitment to achieving the inflation target set, by promoting a reduction in real interest rates and, at the same time, by encouraging commercial banks to provide more credit in order to rebalance their portfolios.”

The German court decided that the ECB had to be given a last chance to justify QE before the Bundesbank had to cease involvement in the programme:

“German … authorities and courts may participate neither in the development nor in the implementation, execution or operationalisation of ultra vires acts. Following a transitional period of no more than three months allowing for the necessary coordination with the Eurosystem, the Bundesbank may thus no longer participate in the implementation and execution of the ECB decisions at issue, unless the ECB Governing Council adopts a new decision that demonstrates in a comprehensible and substantiated manner that the monetary policy objectives pursued by the PSPP are not disproportionate to the economic and fiscal policy effects resulting from the programme.

If the German authorities can’t get their heads around QE there must be slim chance that Italy etc will remain solvent even in the short term. Patently zero chance of anything like a coronabond. Which leaves Italian default or (better) German exit from the Euro as real live possibilities.

Bill,

Many thanks for clarifying! You are indeed at the forefront of critiquing the so called “left” parties from… the left and exposing them. Glad to hear you reiterate that position.

No, no conventional talking points here indeed! 🙂

@Newton

“Will public pressure, protest, and civil disobedience, perhaps on a never-seen-before scale, manage to force governments to take care of all of their citizens”

As the last UK general election showed, class consciousness is dead. The public will never revolt because they have been brainwashed for too long by a stenographic media that exists to prop up right-wing neoliberalism. The same will happen in the US in November.

The Pakistan programme is really interesting. I was able to use it in a letter to FT yesterday in response to the leading one from Guy Standing pushing UBI for developing countries. They didn’t publish it today – but I live in hope. I know Guy and bcc’d him. He wasn’t happy with me and said I should have the decency to read his book!

“He wasn’t happy with me and said I should have the decency to read his book!”

I wouldn’t waste your time. You’re arguing with people who genuinely believe they should be supported by those doing the actual work because they are such awesome dudes.

In every UBI scheme you will find somewhere a group of people, a slave class, locked into the UBI area who have to do the work to stay alive and who don’t get the UBI. With Finland because of the Euro exchange rate lock it is the rest of the Eurozone, same with the Canadian towns and of course Alaska.

Or you’ll find a “qualification period” – a rolling set of immigrants who have to slave for X years before they become “freemen”. We know that works – the Roman Empire used it for centuries.

Or it will be a stipend, not enough to live on – which is just a way of paying tax credits that requires higher taxation levels, and we know what tax credits do (encourage substitution of labour for capital and reduce productivity).

Robert H @ 19:19, You are correct as usual. My comment was poorly worded- although I would argue the meaning of it was able to be understood. Once someone understands MMT, they understand that the government that issues the currency it taxes in does not ‘need’ tax revenue to spend. It needs to tax in order to make people desire to earn the currency. And sometimes to free up resources that the government wishes to use or redirect.

But you know I know all that at this point I should hope 🙂

@Jerry

There are other reasons to tax, notably to correct dysfunctional markets.

You are right Carol- there are other reasons to tax.