The Reserve Bank of Australia (RBA) increased the policy rate by 0.25 points on Tuesday…

Central bank research refutes core mainstream macroeconomic propositions

Australia’s economic performance is not exactly flash at present. GDP growth has slumped and is well below (less than half) the longer-term trend rate. Unemployment and underemployment remain at elevated levels. The federal government has been pursuing an austerity phase in the mistaken belief that achieving a fiscal surplus, no matter, what is a sound and responsible strategy. While the household sector maintained consumption expenditure growth the government’s folly did not manifest. However, that strategy was built on a plunge in the household saving ratio and an ever increasing household debt to income ratio. For years, the central bank (RBA) and the Treasury denied there was a problem – claiming that the rising debt levels were covered by rising wealth. There was never any recognition that the trends in household debt were intrinsically related to the fiscal position of the government. With the external deficit fairly stable at around 3.5 per cent of GDP, the fiscal drag imposed by the government surpluses was only possible because the household sector accumulated debt. Under current institutional arrangements (federal government unnecessarily matching its deficits with debt issuance) the declining public debt ratio was really just an approximate mirror of the rising private debt ratio. But times are changing. The RBA has now released research that refutes core aspects of mainstream macroeconomic theory and finally acknowledges what Modern Monetary Theory (MMT) economists have been pointing out for more than two decades – that the accumulation of household debt ultimately becomes a brake on spending growth.

Declining household saving ratio

It is well documented that during the pre-GFC period, Australian households started dissaving.

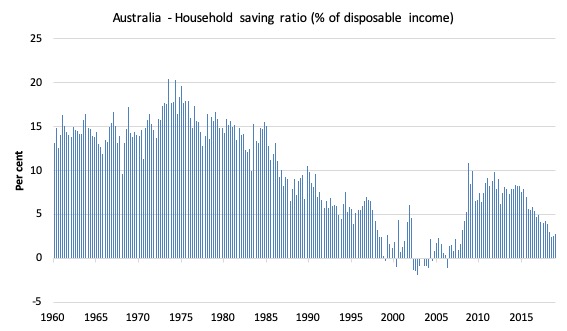

The following graph shows the household saving ratio (% of disposable income) from the March-quarter 1960 to the March-quarter 2019.

The decline in the saving ratio coincided with the squeeze on households from federal government fiscal austerity as the neoliberal ideology became dominant in the 1980s.

It was the Hawke-Keating Labor government who pioneered the neoliberal policy shifts and then handed over power to the conservatives who refined the austerity mantra.

That Labor government of the 1980s deregulated the financial markets and we saw the rise of the financial engineers (the corrupt banks) pushing credit down the throats of anything that they could find (and dupe) that had a heartbeat.

The recent Royal Commission into the Financial Services sector highlighted how corrupt and criminal the big banks and financial companies have been this period in Australia.

By the late 1990s, with the Conservative government recording ever increasing fiscal surpluses, growth was only maintained by the massive private domestic sector credit binge and you can see that the household saving ratio went negative for several quarters.

The GFC brought that period to an end but is didn’t taken long for the banks to regroup and renew the credit push as government support for growth has waned as a result of the austerity obsession.

In the December-quarter 2008, the ratio was 10.9 per cent having risen sharply in the early days of the GFC as households tried to stabilise the record debt situation.

Once the GFC threat was contained by the massive fiscal stimulus, the saving ratio began to fall again, especially as the squeze on wages has intensified and the fiscal contraction resumed.

The following table shows the impact of the neoliberal era on household saving.

| Decade | Average Saving Ratio (%) |

| 1960s | 14.3 |

| 1970s | 16.1 |

| 1980s | 12.0 |

| 1990s | 5.4 |

| 2000s | 1.7 |

| 2010- | 6.6 |

The narrative is very similar to what has been going on in other nations and is characteristic of the neoliberal era – a reliance on unsustainable private debt accumulation as governments withdraw from active fiscal policy use.

These patterns expose our economies to the threat of financial crises much more than in pre-neoliberal decades.

It seems that the central banks around the world are finally starting to articulate a narrative that Modern Monetary Theory (MMT) economists have been emphasising for more than two decades now – it is not a sustainable growth strategy to bias fiscal policy towards surplus and rely on ever increasing levels of private debt to sustain expenditure growth.

Eventually, the house of cards collapses.

The GFC demonstrated that.

Yet the dynamic resumed once the system had been bailed out by governments.

Household debt in Australia – precarious and out of control

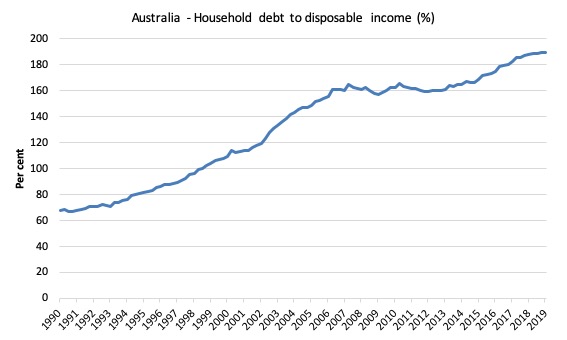

The latest RBA data – Household Finances – Selected Ratios – E2 – shows that the ratio of household debt to annualised household disposable income is now at record levels – each quarter a new record is established.

The following graph shows the ratio from the March-quarter 1990 to the June-quarter 2017.

In June 1988, the ratio was 63.2 per cent. The pre-GFC peak was 165.2 per cent in the June-quarter 2007.

It stabilised for a while as the fear of unemployment and the economic slowdown curbed credit growth for a while. But that didn’t last.

Over the last two years it has accelerated considerably and now stands at 189.7 per cent.

The position of Australian households, carrying record levels of debt, is made more precarious by the record low wages growth and the conduct of the private banks.

Please read my blog – Australia’s household debt problem is not new – it is a neo-liberal product – for more discussion on this point.

The banksters have sought to load as much debt onto households as they can in search of their profits and have ignored the obvious risk in doing that in a flat wages growth environment because they know the neoliberal game is to privatise the gains and socialise the losses.

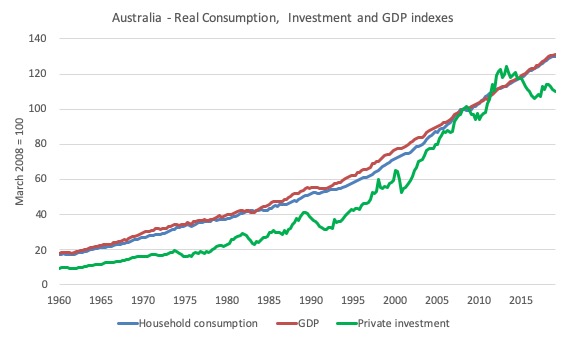

Household consumption expenditure is a dominant component of total GDP expenditure. Most of the variations in GDP are due to variations in private capital formation, while consumption expenditure is typically a stabilising force, being around 57 per cent of total expenditure (while investment ratio is about 18 per cent at present).

The following graph shows volume measures (indexed to 100 at the March-quarter 2008) for household consumption, private capital formation and overall GDP.

It is easy to see the strong proportional relationship between consumption and overall GDP. Small variations in the former have significant effects on the latter.

Private investment expenditure is also influenced by the strength of household consumption expenditure, given that firms do not create productive capacity for the sake of it. They want to produce final goods and services for sale.

So if consumption expenditure starts to falter, things become problematic.

For sustainable consumption expenditure growth, rising wages are essential. It cannot be sustainable if solely driven by credit expansion.

Eventually, the balance sheet implications of the latter scenario become so precarious that households cut back and then the economy moves towards recession rather quickly.

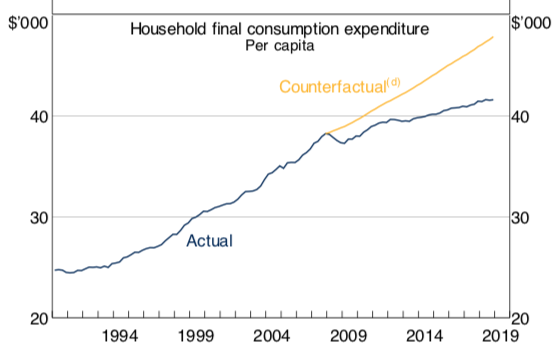

Now consider this graph taken from an RBA Research Discussion Paper 2019-06 (released July 11, 2019) – The Effect of Mortgage Debt on Consumer Spending: Evidence from Household-level Data.

It shows that in per capita terms household final consumption expenditure has been, in the RBA’s words, “relatively weak”.

The “Counterfactual … Assumes household consumption grows at the 1960-2007 average of 0.9 per cent per quarter from March 2008 onwards”.

The penny finally drops!

The combination of the dramatic increase in the household debt ratio and the tapering off in per capita household consumption expenditure is finally starting to resonate among the policy makers.

After years of denying that the rising household debt ratio was anything to worry about, the RBA is now confirming what MMT economists have been saying all along – that too much private debt ultimately becomes a brake on spending growth.

What the RBA haven’t yet been able to bring themselves to acknowledge is that the rising household debt is directly related to the bias towards fiscal austerity. That is one step too far for them at present.

But they are acknowledging that fiscal policy has to be expansionary now rather than for governments to rely exclusively on monetary policy adjustments to sustain economic growth.

So they are nearly there!

In their latest discussion paper, the RBA note that:

A similar pattern of high household debt and weak spending has been observed across a range of other countries … This has led to concerns amongst policymakers that elevated levels of household debt are holding back the economic recovery and pose risks to future growth.

Which has been one of the dominant themes in the development of the MMT literature (not acknowledged by the RBA authors).

This proposition has also been regularly denied by mainstream economists and the RBA itself in the past – they regularly claimed during the period that the federal government was recording increasing fiscal surpluses, only possible, because the private domestic sector was running increasing deficits, that the latter were backed by growing asset values and that there was no problem of solvency.

The neoliberals held out a win-win sort of nirvana – growing financial deregulation freed up credit and allowed for a rapid growth in asset values.

This was part of the period the mainstream economists called the ‘Great Moderation’.

I wrote about that in this blog post (among others) – The Great Moderation myth (January 24, 2010).

I won’t go into the methodology and data deployed by the RBA researchers.

They conclude that:

1. “higher mortgage debt reduces household spending”.

2. “households lower their spending when the gross value of both their debt and their assets increases. In other words, we find that a deepening of household balance sheets is associated with less household spending, even if it is not associated with rising net indebtedness.”

3. “This directly violates conventional consumption theories such as the PIH that assume the composition of a household’s balance sheet does not affect consumption”.

This significant because the data is refuting another core component of the mainstream macroeconomic theory which relies on the Permanent Income Hypothesis, first introduced by Milton Friedman.

The importance of the PIH to mainstream theory was that provided a basis for refuting the idea that fiscal policy can stabilise spending by so-called ‘demand management’ or ‘fine tuning’, a core component of the ideas that Keynes and others introduced to economic thinking.

This idea proposes that governments can always use fiscal policy to inject stimulus if, say, household consumption expenditure lags.

The PIH rejected that idea claiming that any ‘transitory’ boosts to private income will not materially alter household consumption expenditure, which is asserted to be dependent on long-run projections of lifetime income.

The literature is too detailed to summarise in this blog post.

But the fact that the RBA has now rejected the dynamics implied by the PIH is highly significant and is another nail in the mainstream macroeconomic theory’s coffin.

4. “we find little evidence for borrowing and liquidity constraints or precautionary saving motives to be key drivers of the negative debt overhang effect.”

5. “a 10 per cent increase in debt reduces household expenditure by 0.3 per cent”.

What this means is pretty simple.

The neoliberal emphasis on government austerity relies on ever-increasing levels of private domestic debt to keep economies growing and tax revenue rising in the face of declining net public spending.

As MMT has emphasised since we began the project, this strategy is unsustainable over time. Expanding private debt can boost growth for some time, but, sooner or later, the household balance sheets become to precarious and households start to look for ways to increase their saving ratios to manage the elevated levels of risk.

At that point, household consumption spending growth – the most dominant source of aggregate spending in the economy – falters, and economic growth falters.

That is what the RBA is now finally admitting after years of denial about the impacts of rising household debt ratios

We saw associated evidence of this dynamic last week (July 11, 2019), when the ABS data – Lending to households and businesses, Australia, May 2019 – showed that:

1. “lending commitments to households fell 1.3% in May 2019”.

2. “The fall in lending to households was driven by owner occupier dwellings excluding refinancing (down 2.7%) and investment dwellings excluding refinancing (down 1.7%).”

3. Over the 12 months to May 2019, total lending to households was down 16.3 per cent. Owner-occupied lending to Households was down by 18 per cent; Lending for Investment dwellings was down by 27.8 per cent; and lending for Personal finance was down by 16.2 per cent.

The annual falls in mortgage lending are the worst since 2010.

The wheels are falling off.

Conclusion

As MMT type analysis is slowly seeping into the public discussion – whether it is acknowledged in that way or not – there is a growing realisation that the neoliberal framework is incapable of sustaining stable prosperity.

The contradictions that MMT economists have been pointing out for more than two decades and are at the core of our approach are now being acknowledged by some of the mainstream policy arms, particularly central bankers.

The mainstream academic economists are still in denial and trying to refute the core MMT propositions, choosing to simplify them to the point of inanity.

But we understand what their game is about – reputation defense.

However, the more pragmatic economists in central banks, for example, are finding that the data cannot support the mainstream theories.

This is just another little step towards abandoning the mainstream macroeconomic framework.

That is enough for today!

(c) Copyright 2019 William Mitchell. All Rights Reserved.

The RBA governor has been advocating fiscal stimulus a number of times recently but it seems he has been told to pull his head in by the Treasurer following a meeting in which he meekly uttered that “the economy’s fundamental are strong”. It does to my mind confirm (as if we needed conformation) that the RBA is not independent but can be leaned on. The RBA governor may even have been threatened with the early termination of his appointment.

Its quite clear that the Treasurer is desperate to protect his surplus and will not countenance any direct fiscal stimulus.

“Its quite clear that the Treasurer is desperate to protect his surplus and will not countenance any direct fiscal stimulus.”

And unfortunately, Nondestructive Testing is not an analytical technique applicable to national economies.

It is noteworthy that long before MMT arrived, Keynes explained how debt accumulation was a major threat to consumption spending and employment.

Unfortunately he dealt with this in an almost inpenetrably tangled section of the General Theory – Chapter 8, Part IV.

Greatly simplified, Keynes wrote:

“Larger financial provision which it is thought necessary to make before reckoning net income” will be “less favourable to consumption”.

“In the case of advances by building societies to help an individual to build his own house, the desire to be clear of debt more rapidly … may stimulate the houseowner to save more than he otherwise would.”

“Such factors may be serious in a non-static economy, especially during a period which immediately succeeds a lively burst of investment”.

He considered that these effects could be analysed either as a reduction in NET household incomes (due to higher financial provisions for debt servicing) or as a reduction (“heavy drag”) in the propensity to consume.

“This is just another little step towards abandoning the mainstream macroeconomic framework.”

But what about their microeconomic framework? If that is the core of mainstream macro theory, then either the micro changes (unlikely), or they keep fudging it (more likely).

This brief anecdote made for an enjoyable read:

https://www.zerohedge.com/news/2019-07-14/how-aoc-set-death-trap-worlds-most-powerful-central-bank-setting-stage-mmt

Good news for the Australian people. I hope not that many will be under water when asset prices start falling.

I wonder if the rise of computing technology (eg data science) is part of the reason why you are starting to see the analysis being done. We have enough computing power and analytical tools to be able to properly look at the data and check if underlying theories actually work in real life.

My own experience of micro and macro teaching was all about understanding “the model” and never involved much connection to actual data. Checking assumptions, questioning theories was not part of the syllabus! This is in contrast to learning about say chemistry, where it was often a history lesson of now false theories, and how they were overtaken by better theories.

‘PIH’

Oh dear! another dodgy acronym to digest just when I thought I’d reached my personal dodgy acronym potential limit (DAPL) meaning there were non left for me to learn!

It never stops.

“…finally acknowledges what Modern Monetary Theory (MMT) economists have been pointing out for more than two decades.”

Two.

Decades.

Neoliberlism is a paradigm and nothing more they come when their predecessors accumulate too many anomalies (stagflation did for Keynesianism) and go when they accumulate too many anomalies of their own. Neoliberalism is stickie because it serves powerful vested interests but we’re only one recession away from a paradigm shift.

Willem – The house prices are already falling, and have been for years in many parts of the country. There was an article recently saying almost 30% of house sales in the last quarter were at a loss to the seller.

Thanks Bill

Does this situation also expose the limits/failure/trap of the Monetary Policy stimulation fetish that the Neo Liberal proponents have got us all into again?

The capacity of most households to pay back their current Debt is relying maintaining historically low interest rates.

If there is by some miracle, some fiscal stimulus and the economy does pick up, the Monetary Fetishists would raise interest rates then what happens then?

“Monetary policy can only “work” if lower interest rates persuade the private sector to dis-save and/or go into debt to fund current consumer spending and investment. OK low interest rates might induce a devalued currency, which could result in more exports and some import substitution eventually, but the majority of the stimulus was reliant on reducing the the returns to private-sector wealth (assets – debt) in the hope that the private sector would respond by liquidating some of its wealth to fund current expenditure. So Bill’s point that neoliberalism resolved the “paradox of thrift” by reducing the incentives to save and (more importantly) eliminating impediments to borrowing is well-made. This reliance on reductions in private sector net worth to fund growth was really stupid because unlike a fiat currency issuing sovereign nation state; individuals, families and firms really go bust and did so in such large numbers that they nearly crashed the system in 2007/08.

In a low interest environment, this kind of trickery simply does not work any more. A point the governor of the RBA tried to make before he was silenced.”

The time has come for the government sector to do some heavy lifting.

So what if the RBA puts out one paper that tends to support MMT.

Back in 2014 the BoE put out a paper that admitted that banks don’t loan their depositor’s money, that banks create new money with every loan.

I’m told that soon after that, the BoE made a statement or put out a paper that took that back. Or maybe 2 of them.

IIRC, the IMF put out a paper in about 2012 that admitted that austerity in Europe had not stimulated the European nation’s GDPs. Then put out another paper saying the 1st paper was wrong. And the IMF has not changed its behavior.

.

This is a pattern. Therefore I predict that, very soon the RBA will put out another paper saying the 1st paper (mentioned above) was wrong. And, maybe add a statement to go with the paper.

This is how the ‘powers that be’ are winning [so far]. There is 1 step forward and then 2 steps back.

Since neoclassical economics ‘assumes’ that all unemployment is voluntary {output is supply determined}, neither fiscal or monetary policy is effective.

Steve, I think your arithmetic may be a tad faulty. Under your scheme, the powers that be would always be going backward. I doubt that this was what you meant.

The RBA and the neoliberal business and political elites that control them, only have concerns for the massive leech (the FIRE sector) and now that they see the host (the general populace) is weakening they are now recommending some sustenance (fiscal stimulus) for the host.

The FIRE (Finance, Insurance and Real Estate speculation sectors) went from 7% of Australia’s GDP to 12% over the last few decades of the neoliberal era. This and all other manifestations of the neoliberal scam such as price gouging privatised utilities and services, tax evading corporations, resource plundering mineral/energy corporations, unrestrained gambling, the propagandistic mass media, the corrupting and exploitative defence equipment corporations and the antidemocratic state security industry all need to be cut down to size or eliminated.

We know who the real ‘leaners’ are and still remember the ‘lifters’ in the productive economy that were destroyed along the way.

Bernie Sanders and his supporter base built their Our Revolution movement to step by step to take on the neoliberal oligarchy and to assist likeminded representatives to gain elected office at all levels in US society from local to federal. Each Western and in fact all nations must do something similar.