The other day I was asked whether I was happy that the US President was…

The Greek colony remains in depression

On June 13, 2019, the European Stability Mechanism (ESM) released its – Terms of Reference for the Evaluation of the Greek Programmes. At the same time, the head of the ESM (Klaus Regling) was lecturing Greece, which is approaching a national election next month, that it “risks missing its budget target” (Source). Apparently, as the failed Syriza government tries to gain electoral support after years of abusing the Greek people who put their faith in them, the bean counters are worried that the permanent state of austerity that the Greek colony is now being held in by the Euro technocrats (and the IMF) might be relaxed a little. Regling claimed there was “great risk” in the Greek government engaging in fiscal slippage. When you look at the data, a fiscal flood is needed not just some ‘slippage’. But such is the oppression of the colony that the technocrats are bearing down on the Government. Meanwhile, the Europhile Left continues to laud the EU as a productive arrangement protecting progressive values. It is beyond laughable.

The revolving door among the top-end-of-town sees officials from the large investment banks, management consultancies, IMF and World Bank regularly shuffle into key policy making positions in the public sector. Klaus Regling is one such character – he is the Managing Director of the European Stability Mechanism (ESM) and CEO of the European Financial Stability Facility (EFSF) those concession

Late last year, Regling was claiming that “even though Greece will achieve a high primary surplus for 2018, this will not be enough to finance the cancellation or postponement of the already-agreed pension cuts.”

Ahead of the January 1, 2019 implementation date for the cuts, agreed by the Greek government in 2017, the parliament votes to abandon them – as an election sweetener.

But still the primary fiscal surplus of 3.5 per cent of GDP into perpetuity remains the operational policy benchmark.

Regling apparently told reporters in Luxembourg last week that:

The need to maintain a stellar fiscal performance in perpetuity was part of the debt relief deal agreed with Greece’s euro-area creditors last year, and failure to meet its targets could lead to suspension of some relief measures.

He also told the reporters that Syriza’s:

… decision to boost spending and cut taxes without consulting with creditors first.

If one ever needed reminding of the colony status of the once magnificent Greek nation you just have to consider that statement.

The EU institutions consider it appropriate that democratically-elected governments in the EMU should ‘consult’ creditors first before they introduce any fiscal shifts.

That is such a perverted conception of democracy that it is hard to imagine any progressive person supporting this institutional structure and not demanding that it be abandoned – dissolved.

And consider what it means for a nation to be forced to run a 3.5 per cent primary fiscal surplus into perpetuity.

All the ‘internal devaluation’ measures (cutting wages, pensions, etc) have fundamentally failed to turn Greece into a current account surplus nation.

The following graph shows the Current Account position as a per cent of GDP.

It is clear that the external sector continues to drain net spending from the economy.

In that context, a primary surplus of 3.5 per cent is madness. It is national sabotage writ large.

The Greek economic reality – updated

The first graph shows the real GDP Index (quarterly seasonally adjusted data from Hellenic Statistical Authority) from the peak in the March-quarter 2008 to the March-quarter 2019 (latest available).

This is what the European Commission has referred to as a recovery and a vindication of their policy position on Greece.

Real GDP has shrunk by 23.9 per cent since the crisis began and has been stuck around that mark since 2012. There has been virtually no growth at all since the trough was reached in the December-quarter 2013.

This is despite all the IMF blabber about growth-friendly austerity.

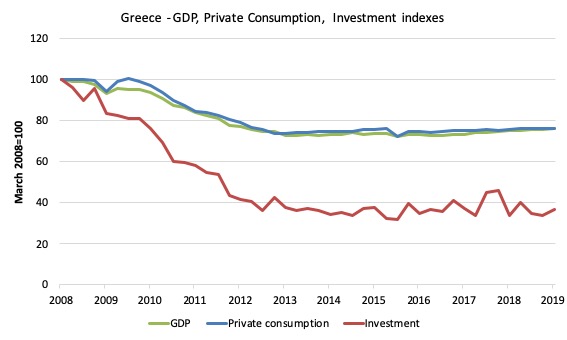

The next graph shows the evolution of real GDP, private consumption and gross fixed capital formation (investment) from the peak in the March-quarter 2008 to the March-quarter 2019 – 11 years of travail for the Greek nation.

Private consumption spending is now by 24 per cent lower than it was when Greece entered the crisis. It remains below the level of the June-quarter 2012 and has been static for the best part of two years.

Moreover, investment spending (capital formation) has fallen by a staggering 63 per cent and is also static.

The decimation of Greece’s productive capacity is thus on-going.

The other thing to note is that despite all the on-going ‘internal devaluation’ cutting wages, pensions and labour costs in general, allegedly to increase the international competitiveness of the nation, the external sector is still contributing negatively to growth. Even though the export index has risen in the last two years, imports are also rising – at a faster rate.

Now, consider the labour market.

Here is how the commentators present misleading information. There have been claims that the Employment-to-working age population ratio (over 15 years) has risen since 2014, which is a true statement as the following graph shows.

In the September-quarter 2008 (the peak employment quarter before the crisis), the ratio was 49.2 per cent. In the March-quarter 2019, the ratio was at 41.8 per cent.

That is around the value it was in the September-quarter 2017 – so only marginal improvement.

Had the ratio remained at 49.2 per cent, total employment would be 669 thousand larger than it currently is – that is, 17.5 per cent higher.

That is one measure of the scale of damage that has been inflicted on the labour market.

But you should also note that the EPOP ratio is somewhat misleading in this case. Why?

Because it is comprised of a numerator (Employment) and a denominator (Working Age Population). Normally, the denominator will be growing steadily at some positive rate.

But the scale of the crisis has been so great that Greece’s working age population has declined over the period from the September-quarter 2008 to the March-quarter 2019 by some 314.4 thousand (or 3.4 per cent).

Consider the absolute fall in total employment. It has fallen by 825.6 thousand (17.8 per cent) since the September-quarter 2008 peak.

The recent gains in the EPOP ratio have thus been biased upwards by a continued fall over the last year in the working age population even though only the most modest employment gains have been made.

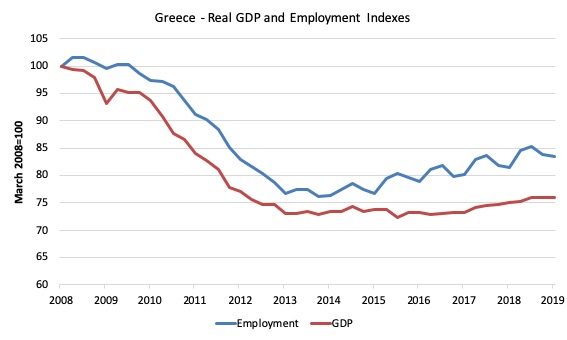

The next graph shows the evolution in employment and real GDP (both indexed to 100 at the March-quarter 2008) up to the March-quarter 2019.

I added real GDP to the graph because it allows us to infer that productivity growth has also slumped over this period, which is no surprise, given the dramatic loss in investment spending.

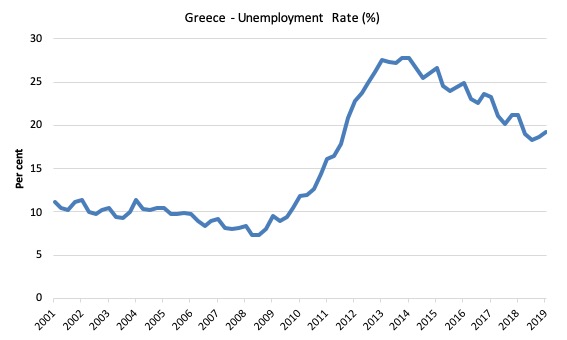

From another perspective, the next graph shows the actual unemployment rate since the March-quarter 2001 to the March-quarter 2019.

While the European Commission talks about progress under the bailout plans, the reality is that the unemployment rate is still at 19.2 per cent – more than 10 years after the crisis. An appalling waste of human capacity.

The available statistical indicators all point to the same conclusion – after engineering a Depression, the managers of Greece (the colonial masters) have put it into a holding pattern of stagnation allowing some growth to percolate through on the back of generalised global growth.

They cannot claim that prosperity is just around the corner with current policy structures in place.

The other point to note by way of comparison with the various graphs is that it is impossible to run the structural rigidity line when trying to explain the evolution of the Greek economy.

The correspondence between the collapse in output and employment – linked via the derived demand for the latter as a consequence of the former – and the correspondence between the demand-side of the labour market (employment) and the unemployment rate quells any suggestion that the collapse was driven by supply-side shifts in preferences by workers or rigidities emerging from employment protection, minimum wages or any of the other suspects that are wheeled out by the likes of the IMF, OECD and the European Commission when trying to deflect blame.

This is a massive demand-side induced Depression that Greece has been dealing with – deliberately inflicted and persisted with by the Troika using the so-called socialist party, Syriza as its puppet.

There is no way that a unilateral exit would have been as costly as this catastrophe.

Evidence that the EU technocrats do not even understand the monetary system

There was an interesting Bloomberg story – The EU’s Secret Plan for a Catastrophic Grexit (June 14, 2019) – about a book that will be available for sale next month. The authors Viktoria Dendrinou and Eleni Varvitsioti. The former is a Bloomberg writer and the latter a Greek journalist.

The book – The Last Bluff – documents the “top-secret plan” hatched by EU technocrats in 2012 to handle the likelihood of a Grexit at the time that Greece was facing insolvency.

They note that the plan was “ode-named “Croatia’s Accession to the European Union” to disguise that it was a doomsday scenario for the country farther south.”

The technocrats dragged out the plan again in 2015, this time code-named “Albania Contingency Analysis & Plan, Sovereign Default 2015” – to prepare for a situation:

… to minimize the economic and humanitarian catastrophe should Greece be forced out of the EU and the euro zone …

I will have more to say in the months to come once I had read the whole book (the article provides excerpts) but these points are interesting:

1. The EU recognised that the ECB’s Emergency Liquidity Assistance (ELA) that helped maintain solvency Greek banking system would not continue because the ECB would no longer accept Greek government debt as collateral.

This would immediately bankrupt the banking system in Greece.

The only solution would be for that the:

Bank of Greece would have to provide liquidity in a new currency-essentially exiting the euro zone.

That is obvious and should have happened.

But to all those Europhile progressives (and others) who claimed that this shift would be difficult to accomplish and would take months if not years to render operationalise, the EU knew otherwise.

We read that:

This wouldn’t require printing new money right away. The practical part could be dealt with within hours, only requiring the central bank to change its information technology systems so it could convert the euros in bank accounts to its new currency. In a matter of hours, the Bank of Greece could convert everything. Contracts under Greek law would become redenominated, and civil servants and pensioners would have to be paid in the new currency, while taxes would have to be paid in it as well.

Which is what I have been saying all along and amplified in my 2015 book – Eurozone Dystopia: Groupthink and Denial on a Grand Scale.

There were no technological constraints at all.

The new currency and the payments system in that currency would be operational virtually immmediately.

2. It is clear that the EU officials did not understand currencies very well.

They claimed – in the secret documents that:

Greece will need to introduce new legislation … swapping euros under Greek law to the new drachma … If Greece left the euro zone, clearly the first thing that would happen would be that the new currency would have no credibility … No one would want to hold that currency, so you would soon enter into a spiral of devaluation … This would have major implications for Greek debt, as it still would be denominated in euros …

As I have indicated before it is likely that the new drachma would actually appreciate because it would be in short-supply.

The first thing the Greek government could do is demand all taxes be paid in that new currency thereby immediately creating a strong demand for it.

Many commentators confuse the introduction of a new currency with breaking a peg of an existing currency. They are not comparable.

The existing currency is already in volume in the foreign exchange markets. There is no volume for a new currency until the government spends it into existence.

So initially, there would be excess demand, not excess supply.

For anyone who knows anything that would push the value up not down.

Further, people would be converting euros into the new currency further creating relative upward pressure on its value.

Further, the Greek public debt would be redenominated in the new currency under the Lex Monetae principle, which is an accepted convention in international law.

So all the talk of the Government having to default on its public debt ignored that reality.

3. Remember the former finance minister now failed German European Parliament candidate claimed on Australian radio, in relation to a question whether the Greek government could print a new currency that:

… we don’t have a capacity … because …Maybe you don’t know that. But when Greece entered the euro in the year 2000 … one of the things we had to do was to get rid of all our printing presses … in order to impress on the world that this is not a temporary phenomenon … that we mean this to be forever … we smashed the printing presses, so we have no printing presses

I wrote about it in this blog post – A Greek exit is not rocket science (July 8, 2015).

That was an outright lie.

In that blog post cited I disclosed the location of the Bank of Greece, Banknote Printing Works (IETA) at 341 Messogeion Avenue, 15231 Chalandri (Athens).

The EU secret plan report also recognised this.

The The Last Bluff recounts that:

The physical production of the emergency notes probably wouldn’t be a major issue. Euro-printing operations were spread across member states; in 2015 Greece printed 10-euro notes in its national mint in the Chalandri suburb in northeastern Athens. Ironically, Greece’s capacity to print euros could facilitate its switch to a new currency, as the euro plates could be easily adjusted and the spare supplies of paper, paint, and security materials at the mint could be used to print emergency banknotes until the new setup was up and running.

We will wait for the release of the book for further commentary and analysis.

Conclusion

As the GFC fades into the past, the daily attention that Greece received in the press during the height of the crisis has receded.

But the most cursory examination of the data shows that Greece remains mired in depression and has no means available under its current EU membership to escape that malaise.

The future would be much better if the new government that is elected exits the EMU as a matter of priority.

There can be no doubt that the costs of such an action would be less than what the nation is facing as an EU colony.

That is enough for today!

(c) Copyright 2019 William Mitchell. All Rights Reserved.

Greece needs another currency, its own currency. However, it shouldn’t be paper based – that also hasn’t worked out well in the past, with drachma tax evasion, and corruption rife.

People should have smart cards to carry virtual electronic cash. I don’t wan’t to say crypto, since this has negative connotations, and it will be fiat and only createable by the state.

Reality is stranger than fiction. You simply cannot make this up. How can so few ravage so many?

Dear Bill

The graph that shows the EPOP must refer to total population. It was 49% in 2008. Surely, it isn’t possible that in good times only 49% of the Greek working-age population was employed. That’s shockingly low.

Best wishes. James Schipper

Dear James Schipper (at 2019/06/25 at 8:46 pm)

Sorry, James, the graph is total employment to working age population (> 15 years).

best wishes

bill

Tony may be on to something with his suggestion that a new Greek currency be in electronic form, not paper based. Being an American and taking for granted the national (and world) ubiquity and acceptance of the dollar, I had never fully appreciated the axiom of MMT that taxes valorize a currency. I had leaned to something more amorphous like broad social agreement. Bill’s current take on Greece, and what might be done to improve its sorry situation, finally brought this axiom home to me. “The first thing the Greek government could do is demand all taxes be paid in that new currency thereby immediately creating a strong demand for it.” Bingo, taxes do indeed underpin the value of a currency. Another flash of clarity and insight c/o Bill.

There is another article in the Guardian from a few weeks ago by Prof. Costas Lapavitsas in which he urges Britain to leave the EU in order to be able to implement Corbyn’s plans.

Unluckily, he remained rather vague merely claiming that : “Brussels would not tolerate socialist policies in the UK (or anywhere else).”

Furhtermore, as Bill has repeatedly stated, he declared the EU practically impossible to reform from the inside since: “EU institutions are designed to be impervious to expressions of popular democratic will. Any treaty reform would require unanimity among member states, while any reform via secondary legislation would need the consent of the commission, the majority of governments and the majority of MEPs, before jumping the hurdle of the European court of justice. There is just no chance.”

This didn’t stop most commenters, who one should think are mostly progressives, from either disqualifying the argument on the basis of the nationality of Prof. Lapavitsas or claiming that the EU is in fact “checking” the UK’s worst neoliberal instincts. Ok, nothing new. What really brought to the verge of tears is the zeal with which the nefarious austerity the troika inflicted upon Greece was defended even after ten years of needless and senseless suffering. With progressives that hold the repayment of odious debts in higher regard than democracy or human rights, who the hell needs conservatives?

It would seem the only way to achieve fiscal autonomy, or at least a debt forgiveness, in Europe is to wage all out war and try to conquer the world. Twice.

@ Newton Finn… yes, it’s a flash.. The nuances and ramifications of policy and flow interactions is obviously as complex as you want to delve into, but.. wandering Twitter regularly on this stuff, it’s amazing how it remains unseen by otherwise learnèd sages. I sometimes feel like tweeting ‘it’s the monopoly currency, stupid’.. paraphrasing Clinton. Of course, I don’t. ((-:

Yves Smith of Naked Capitalism always insists that there are insuperable obstacles to Grexit related to both software and hardware. Her claim is that it cannot be accomplished quickly enough to avoid a cataclysmic capital flight. While the hardware for printing bank notes might take months to prepare I don’t see why software for managing electronic currency would take months.

@Nicholas

I also don’t see why capital controls couldn’t be imposed if a potential “cataclysmic capital flight” is actually the objection; my suspicion would be that other objections are hidden behind those communicated upon the surface.

Yves Smith and her site has many merits. But her position on Greece is wrong in many ways. Governments all over the world have issued new currencies in the middle of shooting wars in a matter of a week or two from the idea to the execution. The idea that it would be difficult for a wealthy country in peacetime is laughable, but there are a couple of other people who share this delusion. Bill in this post (and Mosler elsewhere) have dealt with the capital flight problem.

Smith also asserts that the EU would be within its rights to send tanks over the border of Greece if it declared a hard Grexit. And that such subduing of a rebellious province of Europe is supported by the EU treaties and international law. This remarkable position is ahh – unique to her.

@eg

Do you even need capital controls if you have a fiat currency? A much-missed MMT contributor, Neil Wilson, once explained to me that you can’t have capital flight with a fiat currency because there is nowhere else you can spend it. Shifting your money from an onshore bank account to an offshore one effectively makes no difference as the money remains unspent in both locations.,If you want to spend in the offshore location, you first have to exchange your money for the local currency, so the original currency ends up being exchanged again and again on the FOREX markets until someone decides to spend it in the country that issued it in the first place.