The Australian Bureau of Statistics (ABS) released the latest CPI data yesterday (June 26, 2025)…

Inflation hysteria as central bankers discuss yield curve control

I am in London today (Monday) and have two events. First, I am doing a ‘Train the Trainers’ workshop for – The Gower Initiative for Modern Monetary Studies – where we will work through some techniques and concepts to help activists educate others about Modern Monetary Theory (MMT). Second, I am meeting with some Labour Party Members of Parliament who are keen to learn more about MMT and incorporate its insights into their political work. Get the drift? People wanting to learn and setting up pathways where that learning can occur. Which means they take advantage of access to one of the founders of MMT to find out what it is about, rather than adopt a superficial version of our work, which they might have heard about when Joe told Aalia, who had picked it up from Eddie, who had been having a conversation with Robyn about something that Abdul had told Amelia, who had read it in some Tweet that was reporting an article written by Kenneth ‘Mr False Spreadsheet’ Rogoff criticising MMT. That is the way to learn.

Many of the outspoken MMT critics on the so-called Left (although their self-selection in that side of the spectrum is debatable) keep hammering away with misnomers and outright lies but none of them attended any of the many events that we have been speaking at in the last week in Britain.

It is also a pity that journalists who have jumped on the ‘we hate the MMT’ train don’t spend at least a few seconds conducting research to see if the MMT experts might have said or have written something about the topic they were inferring MMT was related to.

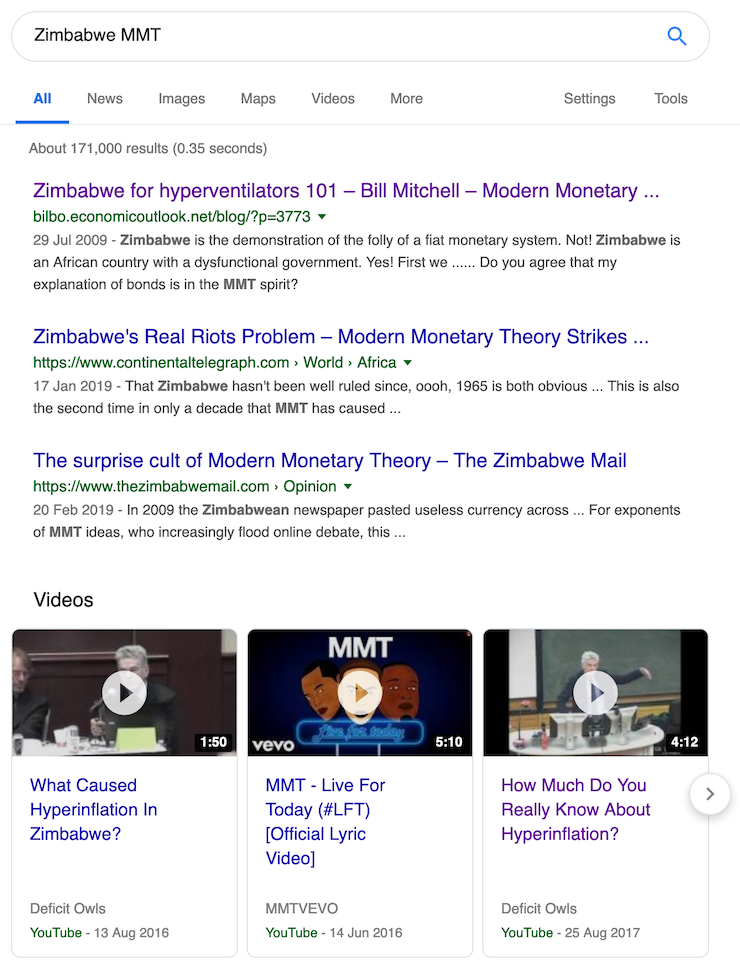

I did this search in Google – https://www.google.com/search?client=firefox-b-d&q=Zimbabwe+MMT

Two words in the search string – Zimbabwe and MMT.

So not very challenging construction which anyone should be able to accomplish with a few seconds typing. That is, zero research skills.

This is what came up.

So my blog post – Zimbabwe for hyperventilators 101 (July 29, 2009) – appears first.

It has my name in the search result which means that there is no doubt it was written by one of the MMT founders and therefore authorities on the topic.

And two out of the three videos featured are from public lectures I have given on the topic over the last decade.

Surrounding those entries are the hysterical criticisms of MMT, none of which (if you read them) goes anywhere near to understanding what actually happpening as historical fact in Zimbabwe that set up the conditions for the hyperinflationary episode.

They all just repeat the lie that the hyperinflation was caused by out-of-control fiscal deficits and wrongly associate MMT with the policies that Robert Mugable followed.

Gutter journalism at its best.

Here is a classic example published today by Australia’s national broadcaster (the ABC) – Federal election 2019: RBA and Morrison Government clash on economy, unite to stop housing slide – and written by its “business editor”.

While I hate unemployment, the ABC should immediately sack the journalist for lying and refusing to at least type in two words to a search engine – Zimbabwe and MMT.

His article is about the split in perception between the Australian Treasury and the central bank (RBA) about the economic outlook, which matters at present because next Saturday we have our Federal election. I will return to that split presently.

But the journalist, trying to be pithy and appear to be on top of everything chic (attacking MMT, in this case) wrote in relation to a recent report from the Bank of International Settlements:

The BIS … now fears rates are forever locked into a narrow band just around zero …

With central banks now all but out of ammo, there are growing calls for governments, particularly in developed nations, to abandon fiscal restraint; to borrow up big now rates are set to remain around zero permanently, and even print money.

Known as Modern Monetary Theory, it’s never worked in practice. Just ask Zimbabweans or anyone who survived Germany in the 1930s. And it throws aside all the logic that’s prevailed for the past 60 years.

Two words Ian – Zimbabwe and MMT.

And if you had read the first-listed article resulting from the search you would not have, in all honesty, written that attack on MMT.

And if you read about MMT more widely – like a few more of the works of the core group – you also would not have written that MMT is about ‘printing money’ or abandoning ‘fiscal restraint’ or borrowing ‘up big now rates’ are low.

None of those characterisations have anything at all to do with our work.

And you should admit to your readers you haven’t read any of it and then tender your resignation from the privileged position you hold at the national broadcaster where you get access to the whole population and are poisoning their minds with lies.

Return to yield curve control being discussed

On matters central banking though, there was an interesting speech given in the US city of Richmond by Federal Reserve Bank Governor Lael Brainard (May 8, 2019) – “Fed Listens” in Richmond: How Does Monetary Policy Affect Your Community?.

In that Speech, the government said that in order “to use monetary policy to achieve maximum employment and price stability”, the Federal Reserve would ensure that “equilibrium interest rates will remain low in the future”.

She calls this the “new normal” and claimed that this “present a challenge for the traditional ways of conducting monetary policy”.

The reason is there is “less room to cut interest rates and thus less room to buffer the economy using our conventional tool”. All this, of course, assumes that variations in interest rates are effective at all anyway.

She also acknowledged, importantly, “that inflation doesn’t move as much with economic activity and employment as it has in the past”.

Which, in practical terms, means that governments can push higher employment levels with the same risk of accelerating inflation.

Then her argument became perverse:

But there is an important risk with today’s low sensitivity of inflation to slack: It makes it more difficult to boost inflation to our objective of 2 percent on a sustainable basis. And, as we know from other countries, if inflation consistently falls short of the central bank’s objective, lower inflation tends to get embedded in people’s expectations. Expectations that inflation will remain low in turn can create a self-fulfilling dynamic with actual inflation, making it even more difficult for the central bank to boost inflation. And because inflation is reflected in nominal interest rates, that, in turn, can also reduce the amount of policy space the central bank has available to prevent the economy from slipping into recession.

First, this admission is tantamount to a rejection of the prevailing orthodoxy that monetary policy is an effective tool and that low interest rates will, sooner or later, lead to accelerating inflation.

Central banks around the world have been trying to push inflation up to some arbitrary targetting level with little success.

The ECB, for example, has categorically failed to meet its ‘price stability’ charter.

But that should give them pause for thought – it demonstrates the mainstream understanding is a fiction.

It also confirms what Modern Monetary Theory (MMT) economists have been saying ever since.

Second, somehow if holding low inflation long enough leads to the expectations of inflation coming down and converging with the actual rate at low levels, that will lock the economy into recession.

She wants us to believe that this is because the central bank has a lower “amount of policy space”.

The two things are that the pretence of have effective ‘space’ anyway at non-zero rates is contradicated by the evidence. And, the sleeper in the whole discussion is fiscal policy.

The main game has always been fiscal policy and the space to conduct fiscal policy has nothing to do with the interest rates that the central bank sets.

It has nothing to do with fiscal ratios or the like.

It has everything to do with the availablility of real resources that are for sale in that currency,

So in a recession or slowing economy where the central bank already has dropped rates to zero – with commensurate declines in rates all along the yield curve, fiscal policy has the capacity to take up spending slack in the economy and avoid a recession with rising unemployment.

It simply doesn’t matter if monetary policy is stuck at the (preferred) zero interest rate.

Her speech went on to articulate alternative monetary policy strategies to cope with this situation (zero rates ineffectiveness).

She claimed that the central bank might pursue “average inflation targetting” where:

… the Fed would aim to achieve its inflation objective on average over a longer period of time-perhaps over the business cycle. So if inflation fell short during a recession, the Federal Reserve would aim at inflation above target during the recovery and expansion. This approach would also have aspects of a make-up policy, as policy would likely be kept easier – that is, more accommodative – than otherwise during the period where inflation is above target.

But in trying to dream up new ways to make the (unmakable) monetary policy effective in these situations, the central banker becomes somewhat incoherent.

Think about the above plan.

It relies on a symmetry around some cycle and the capacity of the central bank to drive up inflation above some norm to offset the times inflation is subdued (or negative).

But think about her previous acknowledgement that try as they might, central banks have been unable to push up the inflation rate even though overall GDP growth has been positive and unemployment has been falling.

What will change to make it possible for central banks to suddenly be able to manipulate the rate at its will? Answer: it isn’t going to happen.

But the interesting suggestion was about yield curve control.

She said:

… once the short-term interest rates we traditionally target have hit zero, we might turn to targeting slightly longer-term interest rates-initially one-year interest rates, for example, and if more stimulus is needed, perhaps moving out the curve to two-year rates. Under this policy, the Federal Reserve would stand ready to use its balance sheet to hit the targeted interest rate, but unlike the asset purchases that were undertaken in the recent recession, there would be no specific commitments with regard to purchases of Treasury securities.

So what does that mean?

First, she refers to existing uantitative easing policies that many central banks have instigated during the GFC.

QE involves the central bank buying assets from the private sector – government bonds and high quality corporate debt. This essentially amounts to a financial assets swap with the banks – they sell their financial assets and receive back in return extra reserves.

So the central bank is buying one type of financial asset (private holdings of bonds, company paper) and exchanging it for another (reserve balances at the central bank). The net financial assets in the private sector are in fact unchanged although the portfolio composition of those assets is altered (maturity substitution) which changes yields and returns.

In terms of changing portfolio compositions, quantitative easing increases central bank demand for ‘long maturity’ assets held in the private sector which reduces interest rates at the longer end of the yield curve. These are traditionally thought of as the investment rates.

This might increase aggregate demand given the cost of investment funds is likely to drop. But on the other hand, the lower rates reduce the interest-income of savers who will reduce consumption (demand) accordingly.

How these opposing effects balance out is unclear but the evidence suggests there is not very much impact at all.

For the monetary aggregates (outside of base money) to increase, the banks would then have to increase their lending and create deposits.

This is at the heart of the mainstream belief is that quantitative easing will stimulate the economy sufficiently to put a brake on the downward spiral of lost production and the increasing unemployment. The recent experience (and that of Japan in 2001) showed that quantitative easing does not succeed in doing this.

The point here is that QE was made operational by the central banks accouncing the quantity of government bonds that it would buy each period (monthly in the US case).

Second, Leal Brainard is, however, saying that the central bank is going to specify the rates at the longer maturities on the yield curve, which would set borrowing costs for those who operate in those segments of the maturity curve.

It is more or less what the Bank of Japan has refined to an art.

Its ‘yield-curve control (YCC) program is part of its Quantitative and Qualitative Monetary Easing (QQE) program and involves the Bank of Japan buying huge amounts of Japanese government bonds at targetted maturities (the 10-year bonds) in the secondary bond market.

In effect, the Bank bond purchases have matched the Government’s deficit spending since 2012. And prior to that, at specific times, the Bank’s currency-issuance capacity has been used to manipulate yields.

What this proves beyond doubt that the central bank always calls the shots on yields and the bond markets only set yields if the government allows them to.

This should tell you that all the claims made by mainstream economists and the sycophantic commentators that just copy their words that bond markets will drive yields up when they lose trust in a government’s ability to pay and this sparks a crisis which can only be resolved by fiscal austerity are hollow.

The bond markets can never drive a currency-issuing government into insolvency.

The bond markets can never drive yields up to elevated levels unless the government (via its central banks) allows that.

The bond markets are mendicants in this context.

I analysed that policy in this blog post – Bank of Japan once again shows who calls the shots (September 3, 2018).

The difference she is suggesting, though minor, is that the central bank would just announce that it was going to by x number of bonds at a price they consider would stabilise the yield at some low rate.

The last time the US central bank intervened in this way was during the Second World War when it wanted to ensure that War Bonds did not require high yields – as a strategy to keep government interest payments down.

This was the so-called Treasury-Fed Accord, which I analysed in this series of blog posts

1. When intra-governmental relations became absurd – the US-Fed Accord – Part 3 (September 25, 2017).

2. When intra-governmental relations became absurd – the US-Fed Accord – Part 2 (September 21, 2017).

3. When intra-governmental relations became absurd – the US-Fed Accord – Part 1 (September 19, 2017).

The point of departure from QE is that the central bank may not actually swap any reserves for bonds.

At present, central banks target the very short-term rates. This revived yield curve control plan would simply target longer maturities – say the 1 year or 2 year borrowing rates.

How would they do that?

1. With the short-term rate at zero and the 1-year bond rate at say 2 per cent, the central bank would just announce to the market that it desires to peg the 1-year rate at 1 per cent and stands ready to buy whatever amount of bonds maturing in that range it takes to ensure the purchase price delivers that yield.

Remember, in fixed-income markets, bond prices vary inversely with yields.

Imagine a $1000 bond had a coupon of 5 per cent, meaning that you would get $50 dollar per annum until the bond matured at which time you would get $1000 back.

After issuance, the bond will trade in the secondary market. So if investors pushed the demand for the bond up, so that its price rose to say $1100, then the $50 dollar per annum that is fixed (that is what we mean by a ‘fixed-income’ asset) will be approximately 4.5 per cent.

The general rule for fixed-income bonds is that when the prices rise, the yield falls and vice versa. Thus, the price of a bond can change in the market place according to interest rate fluctuations.

When interest rates rise, the price of previously issued bonds fall because they are less attractive in comparison to the newly issued bonds, which are offering a higher coupon rates (reflecting current interest rates).

When interest rates fall, the price of older bonds increase, becoming more attractive as newly issued bonds offer a lower coupon rate than the older higher coupon rated bonds.

2. With that knowledge, the central bank’s announcement amounts to it telling the market that it will push the price of the specific maturity asset up beyond the initial issue price.

In a 2004 paper published by the US Federal Reserve – Monetary Policy Alternatives at the Zero Bound: An Empirical Assessment – the authors concluded that:

If the Federal Reserve were willing to purchase an unlimited amount of a particular asset, say a Treasury security, at a fixed price, there is little doubt that it could establish that asset’s price. Presumably, this would be true even if the Federal Reserve’s commitment to purchase the long-lived asset was promised for a future date. Conceptually, it is useful to think of the Federal Reserve as providing investors in that security with a put option allowing them to sell back their holdings to the central bank at an established price. We can use our term-structure model to price that option.

There is no doubt about that.

Conclusion

All this is consistent with my claim that the bond markets cannot dictate terms to a government that is intent on using its central bank to regulate yields.

With capital controls and yield curve control, the private investors cannot also do much damage to the exchange rate either.

That is an important consideration for the British Labour Party which has been crippled by the poor advice it has been getting along the lines that the City of London (financial sector) can destroy the sterling if the government refuses to play ball.

The reality is that it is the Government that calls the shots.

That is enough for today!

(c) Copyright 2019 William Mitchell. All Rights Reserved.

Bill, unfortunately Google decided a little while ago to customize searches for the person searching, so the reason why your article comes up first is because Google decided your article is more relevant

to you because you are you. (Stupid Google)

For me, your article was second (still great!) but the first was that idiotic article by Continental Telegraph (second in your list) that states that MMT leads to runaway inflation.

The danger with Google customizing search results to the person searching is that they are contributing to the same “thought bubbles” where people are presented with results that go along with the way they think already!

Charles – I can independently verify, that “Zimbabwe” + “MMT”, returns the same result on Google.

It’s funny reading this article (the start of it anyway), as I have at least twice had to reference the hyperinflation myths myself, this week – sometimes it feels almost as if my posts elsewhere on the Internet (centered around Ireland), are being watched…

Here is an article to cheer people up, regarding the UK, today – The Guardian newspaper appear to take an editorial line, backing MMT!

https://www.theguardian.com/commentisfree/2019/may/12/the-guardian-view-on-a-green-new-deal-we-need-it-now

Congratulations Bill – I don’t post here often, but it appears that MMT is hitting mainstream not just in the US, but on the European side of the Atlantic now, as well.

I first learned about MMT, indirectly through Yves Smyth/Susan Webber’s Naked Capitalism blog, around 2011-2013 (tbh, Susan deserves as much credit for popularizing MMT, as many of its founders) – and have been blue in the face trying to discuss it online (with varying degrees of failure) since – and it’s extremely gratifying, seeing it enter the mainstream now – particularly running upon the wave, of an issue as critically important as climate change.

Many thanks for the hard work, and please do not let up as it’s genuinely the centre of the most economically/politically significant issues around – I wish I had more ability to directly contribute myself, beyond constantly trying to discuss and find the best narratives for it. It’s finally at a watershed now, though – fair play.

Bill. I’m glad for you. It looks like the Brits are more open-minded than the people here. You guys should try to be invited to a program on Free Speech TV. Maybe a web site of you guys. (I think I suggested that already) You need a forum for presenting your ideas, where you aren’t forced to continually fend off lies.

There must be something in the water at the ABC, Bill.

This was Peter Martin’s response to a comment I made in The Conversation recently:

John, I think you comment is unclear.

I would say, “If we eliminate the national debt, we eliminate some or most of the savings of the non-gov. sector. That is we take their savings away from them (for no pressing reason) and use it to pay them (or different people) as their bonds come due.”

Also, since in the US case much of this savings is held by the foreign sector, there is no way for the US gov. to tax it directly from the holders of those bonds. So, how much damage to the US economy would be done by taxing the US private sector and *hoping* that the foreign sector would give or sell them the bonds so the US people or corps could pay their taxes with money from the foreign sector.

This last point is another reason that the US national debt can and will never be paid off (in the intended way, i.e. with tax revenues). The only way to pay it off is with newly created dollars and this defeats (or undoes) the reason given to want to pay it off.

Steve_American,

At March 2018, the 3 largest foreign holders of Federal Securities were China 5.8%, Japan 5.2% and Ireland 5.1%. 39.6% of ‘debt’ was held by the US Government sector. I think those figures came from a trusted source – Bill’s blog.

Government Sector I take to mean the money issuing central government sector, not state authorities. So that’s 39.6% of debt that could be wiped from government sector records with zero impact on the financial assets of the private sector. The government could buy up more debt to put on its books. This would mean the private sector swapping an interest paying asset for a non-interest paying one, but no change in total assets.

If the government starts to run annual surpluses, taxing more than it spends, then the net savings of the private sector are reduced.

Patrick,

It seems you are implying that the US Gov. and the Fed. just cancel the debt owed to those nations.

That will never fly. It would crash the world’s economy. It would make taking dollars when you sell oil [for example] be very risky. The US could only buy foreign stuff and resources with foreign money or gold.

But, the question was “paying off the debt”. This is far more than running a surplus for a few years.

But, I think the question was about paying off Aust. debt or maybe some other nation’s debt.

I went off on a tangent when I spoke about the US case.

The google search completion is absolutely mad. When I type in „Adolf Hitler ist” google comletes this sentence as follows: „Adolf Hitler ist unser Retter unser Held” (our saviour our hero). When I type in „MMT is” the first thing that comes is „MMT is wrong”. If this is what artificial intelligence and „smart algorithm” have to offer, OMG.

Thank you for your wonderful work.

Michael, Germany

Hi Steve_American

Where did I anywhere imply or overtly write anything regarding cancelling US bonds held by the private sector, whether domestic or foreign holders? (It’s a rhetorical question).

MMT shows us that the issuance of public debt, by a currency issuing government, the US, Australia or another, is an administrative/legal arrangement and not an economic imperative. Taking another country as an example, the Bank of Japan now holds over 50% of Japanese Government Bonds. It keeps on buying up bonds, without the government running a surplus. The ‘debt’ left in the private sector is being reduced, but this doesn’t impact on the net quantity of financial assets of the private sector.

I received the similar links for a “zimbabwe mmt” search, but I read Bill’s blog all the time. For a test I tried going “incognito” and using duckduckgo instead of google. This time the search yielded different results:

1. Zimbabwe for Hyperventilators 101

2. Zimbabwe: MMT drops debut album

3. MMT: fear of hyperinflation|naked capitalism

4. wikipedia on hyperinflation

Bill’s important piece is still very much first in line.

A hip hop group in Zimbabwe is called MMT!

Gee, those fake news guys are everywhere!

Patrick,

Your 1st comment is another example of the truism that on line you need to be more exact to avoid being misinterpreted.

So, now I think you were thinking about having the Fed. buy all US bonds held foreign nations as they come due. This would be a sort of paying down the debt with newly created dollars. Yes, the Fed. could do this. It would be sort of like a form of QE. What would be the way the Fed. would not let foreign gov. buy more US Bonds? If there isn’t one, then what is the point of this?

As I said, paying off/down the debt with newly created dollars is not really paying it off in the sense of the meaning of the phrase “Pay the debt off”.

Here in the US, you would be surprised to learn the percentage of the people who do not know that all the profits (that is, all the interest earned on US Bonds) of the Fed. are paid to its real owner, which is the US Gov.. So, the right hand pays the left hand and it all comes out of and goes into the same wallet.

The Few have successfully fought real full employment and wellbeing for the Many for 4 decades to line their own pockets, of course they will not give that up and acknowledge that the fake economic model for that was bogus and just to fool the Many so they shouldn’t see the grand embezzlement they were victims of.

You don’t convince organized mafia or organized money that they are wrong with reasonable arguments, they will always have their cadre of journalists, academia and so on as their henchman’s.

The Few have successfully fought real full employment and wellbeing for the Many for 4 decades to line their own pockets, of course they will not give that up and acknowledge that the fake economic model for that was bogus and just to fool the Many so they shouldn’t see the grand embezzlement they were victims of.

You don’t convince organized mafia or organized money that they are wrong with reasonable arguments, they will always have their cadre of journalists, academia and so on as their henchman’s.

“Falsehood flies, and the truth comes limping after it.”

Jonathan Swift in The Examiner, Nov. 9, 1710