These notes will serve as part of a briefing document that I will send off…

A summary of my meeting with John McDonnell in London

It is Wednesday and I am reverting to my plan to keep my blog posts short on this day to give me more time for other things. Today, I will briefly outline what happened last Thursday when I met with Shadow British Chancellor John McDonnell in London. As I noted yesterday, I was not going to comment publicly on this meeting. I have a lot of meetings and interactions with people in ‘high’ office which remain private due to the topics discussed etc. But given that John McDonnell told an audience in London later that evening that he had met with me and that I thought the proposed fiscal rule that Labour has adopted was “fine”, I thought it only reasonable that I disclose what happened at that meeting. I did not think the rule was fine and I urged them to scrap it and stop using neoliberal constructs.

As background to my view on the matter, the following blog posts (among others) are relevant:

1. British Labour Party is mad to sign up to the ‘Charter of Budget Responsibility’ (September 28, 2015).

2. The non-austerity British Labour party and reality – Part 2 (September 29, 2015).

3. The full employment fiscal deficit condition (April 13, 2011).

4. Seeking zero fiscal deficits is not a progressive endeavour (June 18, 2015).

5. Jeremy Corbyn’s ‘New Politics’ must not include lying about fiscal deficits (September 15, 2015).

6. British Labour has to break out of the neo-liberal ‘cost’ framing trap (April 12, 2017).

7. British labour lost in a neo-liberal haze (May 4, 2017).

8. When neoliberals masquerade as progressives (November 9, 2017).

9. The lame progressive obsession with meaningless aggregates (November 23, 2017).

10. The New Keynesian fiscal rules that mislead British Labour – Part 1 (February 27, 2018).

11. The New Keynesian fiscal rules that mislead British Labour – Part 2 (February 28, 2018).

12. The New Keynesian fiscal rules that mislead British Labour – Part 3 (March 1, 2018).

13. MMT is just plain good economics – Part 1 (August 9, 2008).

14. MMT is just plain good economics – Part 2 (August 13, 2008).

15. A twitter storm of lies … (August 15, 2018).

I provide links to previous blog posts I have written for two reasons: (a) to avoid detailed repetition; and (b) to help people navigate through related issues on what is now a rather complex body of writing.

JMD made it public that he had met with me when he appeared in a so-called ‘head-to-head’ conversation last Thursday evening (October 11, 2018) with Jenny Manson, who is the co-chair of Jewish Voice for Labour (JVL) and is campaigning to become a future Labour MP.

The event was organised by the Momentum Barnet group in Cricklewood, London as a fundraiser for Manson.

The relevant video is available – HERE.

At the 1 hour mark of the video, a banker from the ‘City’ asked an MMT type question with respect to government spending and ‘financing’. His question was good.

JMD replied (I only cite the relevant section that refers to yours truly):

We have introduced a fiscal rule that’s been developed by Simon Wren … Wren-Lewis, one of our key advisers. In which we have said actually, that yes the deficit does matter, debt does matter. The relationship between debt and GDP, that ratio does matter, because it matters in terms of the confidence of the rest of the world in regard to what we are doing in this country itself.

So our fiscal rule is flexible. Basically it means, we have said that we will not borrow for day to day expenditure, we will balance the deficit over a period of time, be a rolling five-year program, and that yes, if interest rates go to what we call the lower bound there will be knockout rule where we can use fiscal policy to stimulate the economy. Now, that was designed in a way which gives us the flexibility of a progressive Labour government coming to power, to raise the resources we need, to have a long-term vision, where we only borrow to invest, so therefore to grow the economy, but the flexibility if we need it, when monetary policy isn’t working.

I think that’s the best way forward at the moment. There is a big discussion which was an M … MMT debate and funnily enough I met Bill Mitchell this morning for a cup of tea and he had a bit of a wrangle with some of my advisers and it was interesting to spectate but there you are.

But actually his view is our fiscal rule is fine. But, he thinks it’s all right for a sunny day, what happens when the clouds darken. I think there is sufficient flexibility to do it.

What follows is not verbatum but rather my recall.

First, I did meet with JMD last Thursday morning at his Embankment office block in London, near the Houses of Parliament. He was accompanied by two advisers, one being James Meadway. I didn’t catch the name of the other participant.

Second, JMD began the meeting by asking me “What are we getting right?” (or similar).

I indicated that I thought that the Labour Manifesto was a progressive agenda, which represented in broader terms the return of a functional oppositional Left force in British politics, after the years of right-wing Blairism (Third Way) garbage coming out of the British Labour Party.

I said that the social democratic parties had let the progressive side of politics down in recent years and that it was good to see this oppositional left capacity coming back into British politics to give people an effective choice.

I noted that this was also happening in France with the launch of La France Insoumise under Jean-Luc Mélenchon.

As an aside on Jean-Luc Mélenchon (not related to the meeting with JMD), yesterday special French police raided his home and offices searching for evidence of “alleged misuse of funds” in relation to European Parliament elections and the Presidential election campaign.

A report in the Libération news (October 16, 2018) – Perquisition chez Mélenchon : de l’insoumission à l’obstruction – indicated that Jean-Luc Mélenchon and his team resisted the raid by the special anti-corruption police force and indicated that he thought it was a:

… coup de force politique, policier et judiciaire contre Jean-Luc Mélenchon et La France insoumise», et une «attaque sur la base d’éléments fantaisistes …

A political, police and judicial coup against him and his party (La France insoumise) – a fanciful attack.

This police unit has also raided other political opponents of French President Emmanual Macron.

Later in the day, the French Prime Minister Édouard Philippe denied in Parliament that the actions were politically motivated:

Il n’y a aucune instruction individuelle donnée au procureur. Les décisions du procureur, celle-ci en l’occurrence, ont été soumises au contrôle d’un juge de la liberté et de la détention, qui est un magistrat du siège, parfaitement indépendant

This, as Macron’s popularity is in sharp decline.

Third, JMD then asked me “What are we getting wrong?” (or similar).

I replied that the fiscal rule was a poor choice and that such rules that are defined in terms of narrow financial ratios were neoliberal and likely to give them grief.

I noted that the fiscal ambitions to support the Manifesto should be defined in terms of broad goals such as full employment and price stability rather than whether recurrent spending was matched over a rolling five-year period to revenue.

I also noted that the way in which we divide recurrent and capital spending was problematic, given that significant items of recurrent spending, for example, teachers salaries, nurses, etc delivered benefits that were not exhausted within a 12 month period (the normal definition of a recurrent outlay).

James Meadway (JM) said the fiscal rule was not neoliberal. I disagreed noting that the idea that we pursue a fiscal aggregate, which the government can’t control anyway, that is independent of the behaviour of other sectors was a neoliberal construct.

While JMD claimed in the video above that I said the fiscal rule was fine, in fact, I said nothing of the sort.

What I indicated that it was probable, based on reasonable costing estimates, that the major parts of the Manifesto could be accommodated within the Rule.

But that would require everything else being unchanged and the most optimistic outlook for current parameters.

I suggested that in a downturn the rule would be blasted out of the water by the cyclical impacts on revenue and spending (the ‘automatic stabilisers’) and at that point the British Labour Party would have to do abandon the rule.

I said that this abandonment would come with significant political costs and open the government to accusations that it was financially incompetent.

I thought that the adherence to such a unnecessary rule in the first place was therefore unwise.

They replied that there was flexibility (as JMD notes in the video) and that at the zero bound, fiscal policy could free itself of the rule.

I noted that this was another neoliberal aspect of the approach. The reason for that conclusion is that the rule as stated requires the Monetary Policy Committee of the Bank of England to indicate to the Treasury that its monetary policy instruments are no longer effective.

So in effect, the elected and accountable Chancellor can only enjoy fiscal freedom when the technocrats in the Bank of England handover the imprimatur to him.

That is a basic Monetarist tenet – that monetary policy has primacy over fiscal policy. That is neoliberal central.

Moreover, the MPC may not indicate monetary policy ineffectiveness, even if the target interest-rate is at zero (the so-called zero bound). As we have seen in the recent years, central banks have been willing to explore all sorts of weird and wonderful policy interventions to remain relevant in the macroeconomic policy sphere.

Further, zero bound outcomes are very rare. Most recessions are not accompanied by zero interest rates at the policy end.

JM responded by claiming that it was likely that the next recession would trigger a zero bound situation.

I replied that that surmise was just a guess and that history suggested such an outcome was rare.

But the very idea that fiscal policy can only enjoy freedom at the behest of an unelected and unaccountable MPC is pure neoliberal thinking.

So while I did concur that under ‘sunny day’ conditions, the British Labour Party could probably introduce key elements of its Manifesto without violating the fiscal rule as stated, it would encounter major difficulties in a recession.

So the obsession with the fiscal rule developed by Simon Wren-Lewis was an unnecessary neoliberal distraction that will come back to haunt them.

They responded by saying that the rolling five-year period gave them flexibility in a downturn.

But as I’ve written many times in the past, if a nation encounters a serious recession that results in a significant deficit, and then within the last years of the rolling window, it may have to introduce major cuts in recurrent outlays in order to move the recurrent balance towards zero.

That is not flexibility.

JMD asked me what I might do differently on the policy front and I said they should announce the intention to introduce a Job Guarantee. We talked about whether the UK was at ‘full capacity’ or not and what that would mean for the fiscal rule.

His advisor (the one I cannot recall his name) said that this would add a lot to total spending. I suggested otherwise.

I said that my assessment was that the UK had idle capacity and so needed a significantly larger deficit anyway. But if it turned out I was wrong, then they would have to increase taxes to squeeze some purchasing power out of the non-government sector to create the space for any extra public spending.

I concluded they were not interested in a Job Guarantee believing their infrastructure spending would be sufficient. That will come back to haunt them I think.

I also noted that JM had declared on social media that MMT was only valid for the US as a result of its reserve currency status. I indicated that that view was incorrect.

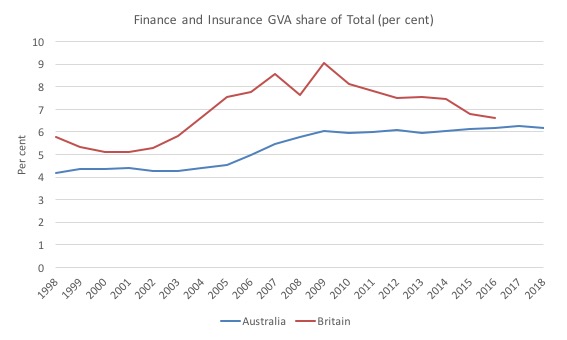

He responded by saying that the UK was a special case because its financial sector was so large relative to the size of the financial sector in other nations.

The inference was that the fiscal rule was necessary to placate any hostility that might arise in this ‘large’ sector.

I said that Australia was a small and very open economy with a significant financial sector as well.

He disagreed about relative sizes.

Well is as it happens, Sydney and Melbourne are significant financial centres in the world markets.

The Global Financial Centres Index (GFCI), which is published by London research Centre and is widely used as an indicator of strength of the financial sector in different nations, ranked London as number one (March 2018 rankings).

Other interesting rankings were Tokyo 5th, Toronto 7th, Sydney 9th, and Melbourne 12th.

The following graph gives you an idea of the relative size of the Finance and Insurance sectors in total Gross Value Added in Australia and the Britain.

In relative terms (to size of economy), the finance and insurance sector in the UK is broadly similar to the sector in Australia.

So I posed the question, given Australia has run current account deficits of around 3 to 4% of GDP since 1975 about, and fiscal deficits for much of that time, why hasn’t the finance sector rendered the Australian currency worthless?

The same goes for Japan. It is run large fiscal deficits, has significant public debt relative to its economic size, and has no problem selling more debt to the bond markets whenever it chooses.

Why hasn’t the yen been dumped and made worthless by these financial markets?

JM said something like the debt is held by Japanese not foreigners and they are running current account surpluses.

So I pointed out the inconsistency.

Japan: current account surplus, debt held locally – no currency dumping.

Australia: current account deficit, debt not held exclusively by locals – no currency dumping.

The claim of relative sizes of the finance sector was at that point reasserted.

Somewhat frustrating given the data.

We broached several other issues, which I won’t comment on here.

The last part of the discussion centred on the use of social media. I indicated that the British MMTers who were strong supporters of JMD and the Labour Party in general were regularly vilified by JMD’s advisers on social media.

JM said that the MMTers were rude to him and that I should control them. I said something like it was not a cult under my control and that I had actually noted at the MMT conference in NYC that a more respectful dialogue on social media should be the aim of both sides.

But in finishing I told JMD that is was counterproductive to abuse his support base for discussing MMT.

I also said something about the dangers of Groupthink and living in an echo chamber where one’s advisers are the only (neoliberal) voice he listens to.

That is more or less what transpired.

And after all that … a love song without compromise

Here is one of my favourite artists – Leonard Cohen – on his last album – You Want it Darker that was released in October 2016, just 19 days before he died.

This song – If I Didn’t Have Your Love – is one of my favourite songs.

I go back a long way with Leonard Cohen – I bought his first album – Songs of Leonard Cohen (1967) – as a teenager and then the sequence that unfolded through the 1960s and 1970s and on.

I also read his book – Beautiful Losers (1966) as a teenager. Quite heady days indeed.

That is enough for today!

(c) Copyright 2018 William Mitchell. All Rights Reserved.

Deficit spending is good and should be the norm for a monetary sovereign.

But let’s not forget that our current banking model* was designed/evolved for expensive fiat, i.e. the Gold Standard, not for inexpensive (like it should be) fiat.

What are the consequences of this mismatch? At best, not optimal, one might safely assume.

*Whereby fiat use is largely confined to banks and other depository institutions, with the general public limited to bank deposits or mere physical fiat, aka coins and bills.

Now imagine that – the same time and energy which was essentially spent on individuals whose primary concern is to win office for as long as possible and to secure their own pensions, was instead diverted toward human rights advocates and people similar who do not think about their own pensions and ambitions in life, and who would actually have their eyes opened beyond belief by the knowledge that MMT carries, and who would then take that knowledge and actually do wonderful things with it.

Ah, Leonard Cohen. Absolutely wonderful. However, I find his last album a bit of a downer.

One of the disturbing parts of what McDonnell said to you was that discussing MMT was speculation. He doesn’t seem to take it seriously. This is because the listens to Meadway and Wren-Lewis. Neither, it seems to me will allow their perspective altered by evidence, Meadway because he is an idiot and SWL because his head is so far up his a** that his gaze is seriously restricted. Why is McDonnell sticking to this position? It could be argued that either he is rather insecure dealing with a macro system or he has been somewhat brainwashed by these guys or he is out of his depth. Or all three.

In the Manson discussion, McDonnell seemed to want to talk more about his aims in being an MP than about how he was going to alter economic policy, how his goal was to make things better. About policy, he was rather vague. It sometimes seemed as if he was avoiding talking about detailed policy initiatives or even a detailed account of how things went wrong. I don’t remember him using any of the usual buzzwords either. It is great that he wants to make things better for people, but if he doesn’t know how to do it, then he will end up not achieving the very goals he has set himself.

“… the elected and accountable Chancellor can only enjoy fiscal freedom when the technocrats in the Bank of England handover the imprimatur to him”

I understand the wish, at least in “normal” times, to tie the hands of politicians who might otherwise be tempted to behave irresponsibly, especially in the run-up to an election. Is this thinking inside the neoliberal box? What’s so bad about technocrats as long as they are right-thinking and their intentions are faithful. I personally have not “had enough of experts”.

You are way over his head, with too much conjectural detail for his groupthink mind to take in. You need to send an ambassador to him, who is capable of relating to him on his intellectual and political level.

Hi Bill. I was at the GIMMS launch, got you to sign new copy of Reclaiming the State, am now your devoted fan;o)

I wanted to raise with you the necessity of a JG in UK. I sort of agree with John Mc that we could be at a (labour) resource constraint here, but not for the reason he suggests, which is skills a constraint – and not just in the infrastructure sector. As I see it there is an inexaustible demand for, mostly service, jobs, where high level skills are not necessary, which a socialist government should be prepared to fund – the sorts of jobs which you have suggested for the JG. We’ve already lost huge numbers of useful (I would say essential) jobs already thanks to the tories’ massive cuts to local authority funds.

One thing we do not have is a land constraint – usable land which is unused is a permanent loss to production just like unemployment. Land value tax will sort this, including the housing crisis.

Must have been a pretty frustrating meeting, but one at which I guess you felt you should at least try to see what you could achieve.

Managed to see Leonard Cohen at the Syd Ent Cent. Was rumoured, he’d been fleeced by a manager, hence the tour. Our gain, perversely. He seemed genuinely to enjoy the experience; the lineup of supporting musicians and backing singers, as well as the production, was very good The whole thing was memorable. He skipped on and off stage!

Ry Cooder was another victim of the GFC, and spawned his cutting ‘No Banker Left Behind’ song. Saw him at the State along with Nick Lowe. RC hadn’t been out here since the 70s, AFAIK, when my wife had managed to see him. The GFC was a disaster for so many, but… got to see Cooder live, so…

As an aside, Van Dyke Parks is a wonderful person to follow on Twitter, for light relief from politics.

Thanks for your blog posts, again, Bill.

Deficit spending needs consent before the public and media will accept overt government proposals or policy framed in counter-hegemonic terms.

1. Continue with a fiscal policy but framed in the language of current government finance discourse

2 Keep pushing, pursuading and educating on a more progressive economic model (remember, of course, education is not simply about destroying people’s current world view).

3. Keep the process civil. McDonnell is the closest thing we have to an ally who is close to high office.

REM, we have tried that and it didn’t seem to work. One hypothesis I have is that he is seemingly incapable of moving from microecon, which he relatively successfully engaged in at the GLC, to macroecon.

I agree that he didn’t seem to take in what Bill said. If so, then he may be taking on board, uncritically, whatever Meadway and SWL tell him. Not much different from Hammond, who is taking his ideas from the Treasury. Hammond knows nothing about macroecon, which he has himself admitted, and McDonnell doesn’t seem to know anything either. This doesn’t bode well for the future.

Erratum: I wrongly said that McDonnell was speculating when he said that it was interesting to spectate. Which says to me that he didn’t feel he had any skin in the game, as it were. I think this is shocking.

I wouldn’t worry about it.

We are living through a paradigm shift. That will roll right over the top of them.

This highlights even more the mainstream economists will never take on the city of London. Instead of being masters of the city of London they are there to serve it.

They are scared of it. Instead of taking ownership of it and using banking licences to do it. Nothing will change until the next recession and they start socilaising the losses again.

I’m convinced more than ever Our time will come and we’ll change the financial sandbox that everyone plays in to suit public purpose. The voters will demand it.

It is quite clear the balanced budget approach thought up by Portes and Wren Lewis was all about serving the City Of London and not public purpose.

If you were to ask them what plans they have to reign in both the City of london and the Bank Of England they would look at you like Homer Simpson.

Free Movement of capital is Wren lewis and Meadway’s god. They can’t think of life without it.

Look at the USA with a highly valued and strong currency and record deficits. They have a large financial sector too etc

Larry,

All of Hammonds ideas are from City economists.

They wrote his speech for him regarding Brexit.

Word for word I’ll try and find the link.

Derek- I thought McD was considering credit controls and has voiced a leaning towards LVT (which Labour dropped in the 1950’s), Corbyn certainly voices the desire to de-financilaise:

‘But when private debt is twice the size of the real economy, when traders no longer understand the products they are trading and banks are funding speculation, rather than productive investment, something has gone grossly wrong. Banks should be helping the real economy not suffocating it. Let me remind you of the words of John Maynard Keynes when he said: “There cannot be a real recovery . . . until the ideas of lenders and the ideas of productive borrowers are brought together again . . . . Seldom in modern history has the gap between the two been so wide and so difficult to bridge’.” Keynes was writing about the Great Depression of the 1930s but the gulf between finance and the real economy may be even wider today.

Read more at: https://inews.co.uk/news/politics/jeremy-corbyn-vs-city-labour-leaders-eef-speech-full/‘

Empty rhetoric?

I believe it is a pity that Chris Williamson MP is not a contender for Shadow Chancellor. https://twitter.com/DerbyChrisW/status/1020654693507379203 He is a big supporter of MMT. I get the impression that John McDonnell is impressed by very big names, which is superficial, but there it is. He has said that he will be talking to Joseph Stiglitz recently. A name with a nobel prize drop. I wonder if it would work if we told JM that MMT has grown out of the work of Keynes, Wynne Godley and Abba Lerner, and is not just a theory, but how money works?

It just beggars belief to say that someone, who ever they are should control other peoples behaviour. I am surprised that he even suggested it, after Chuka Ummuna told Jeremy Corbyn “to call off his dogs.” Can you see any difference? I can’t. You would have thought that he would have seen parallels here before he said it. Very strange.

Anthony Molloy:

“What’s so bad about technocrats as long as they are right-thinking and their intentions are faithful.”

Know of any that fit that criteria? I’ve never seen evidence of a technocrat having competence. although they certainly are experts at something.

Thanks for the Leonard Cohen, Bill. last album I bought was in the 80’s (I’m Your Man?). very moving to hear his voice even if he could barely sustain a clear pitch and more gravelly than ever! The bleakness still maintains a vision of love and listening to it followed my reading one of Larkin’s last poems which is a very bleak vision but doesn’t have the background glow of love there, just the bleakness:

I work all day, and get half-drunk at night.

Waking at four to soundless dark, I stare.

In time the curtain-edges will grow light.

Till then I see what’s really always there:

Unresting death, a whole day nearer now,

Making all thought impossible but how

And where and when I shall myself die.

Arid interrogation: yet the dread

Of dying, and being dead,

Flashes afresh to hold and horrify.

The mind blanks at the glare. Not in remorse

-The good not done, the love not given, time

Torn off unused-nor wretchedly because

An only life can take so long to climb

Clear of its wrong beginnings, and may never;

But at the total emptiness for ever,

The sure extinction that we travel to

And shall be lost in always. Not to be here,

Not to be anywhere,

And soon; nothing more terrible, nothing more true.

I prefer Leonard Cohen’s redemptive love! But if ‘You want it darker’ Larkin’s your man.

Still, a great poem with a beautiful metre to it -but dark or what! Anyway-thought I’d cheer you all up with that , sort of echoes the bleakness in the UK with Brexit diverting us from the real issues and Universal Credit sending people to food banks and resorting to the sex industry and Meadway and McD still talking about fiscal rules!

Weird that Meadway seems to think that because japan’s bonds are largely domestically owned it makes a difference. Every time one mentions Japan people seem to say ‘oh, but Japan is different.’ Often my knowledge base is not secure enough to challenge them but they all come out with that.

Bill. After reading I couldn’t help but laugh a little bit. They were flummoxed with you. It’s sad too. They’re not really trying to understand what you’r saying. They’r trying to understand you within the neoliberal frame.

A while ago I commented with some algebra that I thought showed that a 5-year rolling balance policy meant a total constraint on spending. That it dictated that year 6 spending had to equal year 1 spending; otherwise the balance achieved in years 1 to 5 would be broken in years 2 to 6.

Nobody complained, was this because I had it right, or because I wasn’t even wrong? Is there something I haven’t got about a rolling balance policy?

Corbyn and McDonnell had Richard Murphy as an advisor. I’m sure his advice would be much the same as yours. They didn’t listen to him either. In fact Murphy ended their association calling them both ‘gutless & clueless’. A description many of us in Scotland would agree with.

Anthony Molloy says:

“I understand the wish, at least in “normal” times, to tie the hands of politicians who might otherwise be tempted to behave irresponsibly, especially in the run-up to an election … What’s so bad about technocrats as long as they are right-thinking and their intentions are faithful. I personally have not “had enough of experts”.

I heartily agree. I recall how (at what seems like an impossibly long time ago) it was standard practice for any Chancellor, of either party, to manoeuvre himself (it was always a him; why was that I wonder?) into such a position as in the lead-up to the (anticipated) timing of the next dissolution to be able to have begun to reduce bank-rate – thus reducing mortgage-repayment costs for owner-occupiers – with the sole purpose of increasing his party’s vote-count. Quite often, I seem to remember (though I could be jaundiced!), only for bank-rate to be put up again after the election.

It’s an almost irresistible temptation, which only someone of Gladstonian willpower seems ever to have been proof against, for most politicians finding themselves in that position to utilise it for party-political advantage. I suspect Gordon Brown “prudently” (to use his favourite word) deprived himself of that power for precisely that reason.

I’ve never been persuaded by the MMT line that handing control over monetary policy to the central bank “de-politicizes” it. (Tell that to Donald Trump!).

It’s great that you met them face to face. It sounds as though the discussion you had may have moved towards greater understanding. I agree that it is entirely counterproductive having social media slanging matches. You report that JMD wasn’t enthused by the Job Guarantee concept. I’ve wondered whether Labour’s proposals for a “National Education Service” with generous bursaries and a focus on non-academic vocational skills could have the macroeconomic and social benefits hoped for a Job Guarentee -basically to in effect be a Job Guarantee. If at any time anyone could take up a course learning a skill suitable for them and be paid to do so -then in what way is that inferior to any other Job Guarantee proposal? To my mind at least it would be a potentially useful thing for people to be doing whilst by contrast most other Job Guarantee suggestions are either things that ought to be done all the time irrespective of the macroeconomic cycle or are a waste of time.

It makes no difference whether a government bond is owned by a domestic investor or a foreign investor. In either case, the asset is held in a reserve account at the currency issuer’s central bank. In either case, the bond is serviced in precisely the same way (the central bank writes up the relevant reserve account).

Any nation that issues its own currency, allows the currency to float in foreign exchange markets, and enforces tax obligations in its currency can employ any unused resources that are for sale in the cireency. This is the case regardless of whether the nation’s currency is the world’s “reserve currency” or among the world’s most demanded currencies or a currency that is not in high demand in foreign exchange markets. Full employment is achievable for any monetarily sovereign nation.

Nations that are net importers of essential commodities (energy and food) and that don’t produce output that the rest of the world wants to buy might have to depend on foreign aid to provision their populations. But even those nations can achieve full employment.

Hi Bill, Always enjoy your analysis of different economic discussions. I am just learning about the subject. I had hoped the Labour Party would tell the truth about money creation and that they had been more in touch with your knowledge, as I am a (real) Labour Party supporter. I try to spread the word as politely as I can but am amazed when I am occasionally told not to talk about such things. Thanks for your hard work. Ron

Simon,

Empty rhetoric?

He must know the rules by now.

“The inference was that the fiscal rule was necessary to placate any hostility that might arise in this ‘large’ sector.”

That sounds like obeying the banks to me and that the Labour party must play in the sandbox provided by the FIRE sector.

Instead of creating a MMT sandbox and saying this is what you play in or you lose your banking licence. You will be bowler hat boring again or else.

Labour has a fantastic oppertunity to put the FIRE sector back in their box. McDonnell won’t take it because he is being advised by people who don’t know how to reform it.

My own theory is that in the event (which I regard as no better than 50/50) that Labour win a GE, Corbyn will not last twelve months before his own party’s Blairite neolibs depose him.

These notes confirm most of my worst fears. Corbyn has good intent, but lacks the knowledge, confidence or clout within his party to implement a seriously progressive agenda.

JMcD, has decided he prefers the wallpaper in No.10. !! Twelve months beyond an election is quite likely his idea of longterm thinking. In the meantime he will not disturb the stratus quo, and will certainly not do anything which will challenge The City.

No confidence from this quarter. To say I’d prefer JMcD and Labour than Hammond and the Tories is to damn with the faintest praise imaginable.

Roll on the big crash! It’s the only way we’ll see any meaningful change in policy direction at all. I don’t think we’ll have to wait long.

Agreed Derek. I assume that when McD refers to international ‘confidence’ he’s summoning up the spirits of the ‘bond vigilantes’ and fears of the market?

Bill has made it clear time and time again that the bond market are ‘supplicants’ in reality and need not be invested with power.

I think Corbyn would want to really restrain the City but maybe he just doesn’t have the macroeconomic knowledge.

The most positive spin I can put on what McD says is that he’s worried about the Overton Window and secretly saying ‘bollocks’ (UK slang alert) to the deficit but externally parroting the mainstream line- but maybe I’m extending too much charity there?

Far from being a democrat John McDonnell and his advisors Simon Wren-Lewis and James Meadway consistently refuse to debate their fiscal strategy. Now McDonnell has resorted to lying claiming Bill Mitchell supports their fiscal strategy. The current British Labour Party is a turd that will do little to seriously address Britain’s many problems if elected to office.

Simon, I think you may be giving McDonnell more credit than he deserves. I am doubtful that he knows anything about the Overton window. I am left wondering how bright these two guys are. They don’t seem to be be very adept cognitively. But I may be doing them an injustice.

I am inclined to agree.

I always credited Gordon Brown with having something up his sleeve before he got into No 10. Turned out the only thing up there was his arm.

I don’t believe JMcD is going to suddenly turn out to be a closet red if he gets into office. Labour is back peddling furiously when they ought to be offering a radical progressive left programme which Corbyn’s election as leader cried out for. If he doesn’t accept the logic of MMT he won’t be able to deliver anything. How the hell does he think Brown/Darling bailed the banks FFS ?

Stop paying your credit card bills and let’s bring the whole stinking finance industry down. Again.

Yes. I think you are.

Too much charity. I think the crucial insight of Bill’s commentary is that JMcD does Micro, which was fine at the GLC with its strictures, but he doesn’t ‘get’ macro. Thinks the same rules apply.

Hi Carol,

pleased to see that you are embracing MMT and are a fan of Bill.

I went, via link, to your web site but found that this campaign is worded in the usual ‘mainstream’ narrative.

Quotes:-

“will provide a direct financial benefit to every taxpayer in the UK whose taxes pay for the infrastructure and public services that generate land wealth.”

“government investment in infrastructure can continue as the government will be able to borrow against this future income stream” (refers to deferred LVT)

“LVT will return part of that benefit to the public purse” (is it a huge purse? do they keep it in a vault)

I am in favour of adding land value into the mix but there seems to be confusion with it being both a Gov tax and a local authority tax. It may help with re-distribution but tax being a fiscal tool it shouldn’t be the reason to displace (abolish) other taxes.

Now you are on board you should get your head around the true purpose of Job Guarantee and maybe start with a new or parallel website called ‘Labour Job Guarantee Campaign’.

Recently here I asked Bill — what is the role of a fiscal conservative in an MMT system?

I think a related question is — in an MMT system what is the proper level of taxation compared to spending? Instead of looking at the deficit this looks at the ratio of tax-revenue* to total US Gov. spending.

.

I seems to me (IStM) that there is a range of allowable ratio of tax-revenue to total spending. If it goes too low inflation will be a problem and if it goes too high there will be a surplus followed by a recession. But, what is the ideal ratio?

There will be a push provided by the will of the people to reduce their personal taxes to set it at the minimum. But, then there is no fiscal space left for the Gov. to spend more in an emergency.

Fiscal conservatives will want to push the ratio up. Currently they want to push it above 1.0 into surplus territory.

.

* . Note: I think the absolute value of the balance of trade deficit needs to be added to the tax revenue.

BTW — does this ratio currently have a name? It needs one.

The role of a fiscal conservative is to develop time travel so that they can go back to a fixed exchange rate world in which their views were relevant.

Or they can just move the the euro-zone. It is a whole lot easier than the time machine thing. ;-D

I’m on board with all of this. But can someone please point me to an instance where MMT has been implemented and perhaps even shown itself to be workable? I hope so. That is the only way these kinds of ideological/political conflicts can be settled.

It makes no sense to target a particular fiscal balance in the MMT world in which we live. The fiscal balances are largely out of the government’s control. The fiscal balance depends on the aggregated spending and saving decisions of the domestic non-government sector and the external sector. The government influences but cannot control those decisions.

There will always be a valid and legitimate place for philosophical conservatives who want a small public sector. The appropriate size and scope of the public sector will aways be subject to contestation, negotiation, and review. That is a healthy thing in a free society.

Fiscal conservatism, by contrast, is irrelevant and silly in an MMT world.

The only way to deal with fiscal conservatives is to defeat them. They have nothing constructive to offer.

I don’t think anyone can. It is pretty new and neoliberalism has blocked an experimentation with it.

However, parts of it have sort of been implemented in the past few decades.

For example, Repubs and Repuds have spent like drunken sailor when they have the Presidency since Reagan and there has been no inflation. Why?

And, Bush II & Obama spent many Trillions to shore up the big banks and to stimulate the economy and there has been no inflation. Why?

. . Neoliberals keep saying that the sh*t will hit the fan any time now for 40 years and it never has. At least not the kind of sh*t they were saying would happen.

MMT describes nearly all of the world’s economies today. The major exceptions are the Eurozone nations.

A universal buffer stock Job Guarantee has not been implemented anywhere, but partial Job Guarantees have been implemented in Argentina and India (India’s National Rural Employment Guarantee Scheme is still effect). Between 1945 and 1975 Australia had a de facto Job Guarantee in the sense that the federal government always ensured an ample supply of entry level jobs in utilities and railway enterprises. The New Deal programs in the United States constituted a de facto and incomplete Job Guarantee.

“…..given Australia has run current account deficits of around 3 to 4% of GDP since 1975 about, and fiscal deficits for much of that time, why hasn’t the finance sector rendered the Australian currency worthless?”

Bill,

While the currency may not have been reduced to zero it has had some wild gyrations and is very much lower than it was in the 1970s.

I can remember the Australian dollar being around US$1.10 – 1.20 in the late 1970s. Now it’s hanging around US$0.70. It’s been as low as US$0.48 (2001) and has spent considerable time in the US$0.60s.

@ F. Thomas Burke

“I’m on board with all of this. But can someone please point me to an instance where MMT has been implemented and perhaps even shown itself to be workable?”

Certainly, that’s an easy one: it’s already implemented, and works every single day in the UK, Japan, the US, Canada, Aus, NZ, China…etc. i.e. in any country with its own, sovereign, fiat, non-convertible currency, and whose currency is not pegged to another.

Govt spends currency into the economy by crediting the reserve accounts of the banks of the initial recipients of public spending *without* recourse to previously paid tax revenue, bond sales, or receipts from prior privatisations, and it does this every single day, as a matter of course. It’s no big deal.

(If you’re in any doubt, ask yourself whether you received a gigantic extraordinary tax demand in advance of the humungous US or UK bank bailouts? Or QE? Or various Iraqi misadventures? No, of course not, because that’s not how it works – taxes just hoover up the excess later, to prevent the massive inflation that would otherwise result from all that govt-created currency floating around.)

MMT is a description of how our post-Gold Standard/BrettonWoods monetary system *already* functions today – it’s certainly not a prescription for how it could work in some idyllic future, or faraway country.

The only exception to this descriptive function – in the sense that it has yet to be implemented – is the Job Guarantee, which is intended to act as the anchor for inflation, and is a more moral and productive measure than using unemployment (NAIRU), as is done today.

MMT is quietly going on every day right as we speak – much like the Earth was happily rotating around the Sun in Galileo’s time – even though everyone around him insisted it wasn’t.

Ucumist comments on the Labour Land Campaign (which advocates a switch of taxation off economically productive activities like work, trade and investment and onto wealth by means of a land value tax): “this campaign is worded in the usual ‘mainstream’ narrative”.

The lens of MMT is a very sharp one with wide-ranging implications for policy in many disparate areas but the question of taxation has so far been pretty much left out of the discourse. While MMT imposes the need for taxation to drain money out of the system when required, it does not address the fact that there are different forms of taxation that can be ranked on the basis of various criteria. Some taxes are fairer than others (Income Tax or Inheritance Tax versus Council Tax or VAT); some taxes are easier to collect than others (any of them versus VAT); and, most importantly, some taxes carry heavy deadweight losses (VAT, Income Tax and Corporation Tax), i.e. every pound of revenue to the Treasury shrinks the economy. In all these respects, a land value tax is superior to any of our current taxes. The MMT lens does not change the picture that it is less fair that a nurse pays out 20% of his disposable income in VAT while the Duke of Westminster pays out 0.0001%: this will be so whether taxes are levied to drain excess money out of the economy or “fund” government expenditure. And there is synergy: while MMT sets out to maximise the capacity of the factor of production that is labour, LVT will maximise the factor of production that is land (and there is actually a great deal more idle land right now than there is idle labour).

“… But can someone please point me to an instance where MMT has been implemented and perhaps even shown itself to be workable? .. ”

Yes, during WWI and WWII, where Gov ‘money’ was not considered an issue, and the focus was instead on maximising use of real resources, incl. full employment.

Hi Anthony,

I am still, with Bill’s help, researching and understanding MMT. An amateur. How I perceive it MMT is a true description of how a Sovereign State Fiat Currency works, whether you are a Left, Middle or Right wing Government. Taxes ( & rule of law) are a necessity to validate the currency, re-distribute wealth, influence what is purchased and un-create (volume control) the originally currency that was issued to represent labour, materials & profit (valuations) for Government commissioned production.

What taxes are used, where they are applied and how they are enforced is a political decision. MMT does describe how the aggregate tax affects the system but it is my understanding that we the people by voting determine (wishful thinking) the tax mix. In reality the politicians are influenced more by the lobbyists than by the voters.

I for instance am in favour of adding LVT to the mix and reducing VAT but that is my political preference. Bill may have his preferred tax mix according to his views. To believe that there is a best ranking for taxes can only be a personal / political preference and so cannot be a described part of MMT.

Taxes have to be wide ranging in order for them to be an effective currency tool. Alcohol, tobacco, unearned income, excessive profits and many other things depending on the type of society you want to live in. To elevate LVT to some sort of panacea is to miss the point. If desired then lobby & get it added by all means but as just another part of the wealth distribution tax tool kit.

As for LVT being easier to collect, that is just wishful thinking. All taxes are easy to collect if the law is willingly applied without favour. The same miscreants who distort the tax rules now will turn LVT into Swiss cheese given the chance & the political help.

The ability of the US, EU and UK to rescue the financial system after the collapse in 2008. ?

Does that help at all ?

Dear Henry Rech (at 2018/10/18 at 5:19 pm)

You correctly noted:

And Australia is much better off than we were in the 1970s – in material terms (absolute, per capita and relative).

We are one of the wealthiest nations overall in the world even with the “wild gyrations” in our exchange rate. Doesn’t that tell you something?

This was one of the slides I used for my talk in Germany last weekend at a panel on Balance of Payments fluctuations and MMT:

It shows that massive exchange rate fluctuations barely dent our material progress and any negative impacts of the depreciating currency (of which there are few) are more than offset by the subsequent appreciation.

best wishes

bill

Applause to Bill for not being one of those economists who, when they get a whiff of being in favour with a potentially powerful politician, tone down their analysis and neoliberalise their position.

I suspect JMD and his advisers know Bill is right. But they are too gutless to say so. They sense power might come their way by playing it safe and they’ve done the calculation that sounding a bit “fiscally responsible” is less risky in the media and with the “confidence fairy” than making a principled stand for something progressive. Alas, the very rise of Corbyn and populist movements elsewhere has taught us that the time is ripe for a genuine progressive politics. Why don’t they use the swell of support to win hearts and minds for a genuinely progressive economics? They could if they wanted to. But they lack the courage. And inevitably they will be hoist by their own petard when they find they can’t stick to their silly rule.

The irony is that a right populist force will just ignore the confidence fairy stuff, deficit spend and stare down the so-called markets. Like is happening in Italy. With all the other baggage that comes with it. It makes me think of Zizek who said that the thing socialist progressives fear most is an actual revolution cause then they have to actually govern.

Spot-on, cs.

I agree with all those points you make. People demand change and our current crop of politicians are feart. We may need to find some new ones.

Re Bill being uncompromising (and a comment on currency):

I too appreciate Bill’s steadfast approach. In his role as educator and advisor it is important he be uncompromising.

I have a bit more sympathy with the wishy-washiness of progressive politicians with broad public support, depending on the reasons for it. If they understand MMT but won’t embrace full-on functional finance in public it may be because it would distract from their main discourse of fairness, rebuilding the economy, environmental progress, etc. for which MMT may not be necessary. I personally faced such a situation at a much more modest level when I made a presentation to the Parliamentary Finance Committee of Canada a few weeks ago regarding the inclusion of prescription drugs in public healthcare. It would be the biggest increase in a social program in 50 years in my country. The change doesn’t require an appeal to functional finance since the reasoning for it is ironclad anyway. Cost savings under a national public plan would be very large if the overcharging by the pharmaceutical and insurance industries were eliminated. Appealing to functional finance would distract from the main points regarding fairness, best use of resources, etc. Knowledge of MMT did give me additional confidence that what I said re financing the program was correct. Regrettably ironclad arguments only go so far due to the power of moneyed interests. They must be wedded to political action on the ground. Fortunately that is happening for the first time in 50 years so there is hope a worthwhile program will emerge. We’ll see…

Further and more generally, retrograde politicians don’t cite functional finance when they argue for deficit spend for regressive purposes. They just argue for their spending. Certainly the U.S. is an excellent example of this. Functional finance is clearly understood by the economic elites and is being very actively used by them to enrich themselves. Progressive politicians in the U.S. could just argue directly for the programs they support without answering the ‘how will we pay for it?” question except by brushing it off with ”we’ll pay for it like other programs”. A grasp of of MMT does allow them to argue for socially beneficial programs without ”taxing the rich”: the programs don’t need the money of the wealthy, they can just be implemented.

I totally agree that progressive politicians should never feed into deficit scare discourse by making ”sound finance”-type arguments. If that is what Labour politicians are doing it is wrong. Of course an understanding of MMT is critical during periods when the government needs to engage in substantial counter-cyclical fiscal spending and mustn’t be distracted by spurious deficit scare tactics. But I am unsure that a public explanation of functional finance is helpful.

Re currency fluctuations: the situation is the same in Canada: huge fluctuations, little overall effect, although some commodity exporting industries and the regions dependent on them, have been badly affected.

Look, I just don’t think it’s too hard to educate the wider populace about the functional role of deficits. I am no mathematical genius or star logician, but I can understand it.

If you can grapple with such complex economic ideas as mortgage interest rates, what PAYE means on your payslip and the proportion money going into your pension scheme you can understand a government deficit offsetting demand leakages to imports and savings.

Just like Friedman convinced the world with his narrative about Monetarism, or Thatcher with her Hayekian vision of a market society, we can do the same with a progressive policy programme based on MMT . Hence why I deem the stance of JMD etc as gutless and condescending. The mainstream Left always underestimate the intellectual ability of the populace despite saying they respect them so much and are their champions.

If you don’t tackle the “government is a household” trope (which the fiscal rule buys into), no matter how wonderful your initiative is, the Right will always come back with “how are you going to pay for it?”.

One final point…

The cynic in me suspects that the mainstream left parties like nothing more than being attacked for being “too fiscally conservative” – far from wanting the criticism to go away, the political strategists love it and relish the outcry and enjoy tweeting out how they’ve been attacked for being too responsible! They think that makes them more electable by being attacked from the “far Left”.

Problem is that Third Way strategy no longer works. Note the demise of the PD in Italy. The people go to the right populists who say “it’s time to take back control of the state”.

Somebody needs to tie John McDonnell to a chair in a room without his loony and unaccountable “soft deficit” advisers and have him spend twenty minutes of his life listening to Stephanie Kelton’s clear explanation how modern fiat monetary systems like the UK’s actually work:-

https://www.youtube.com/watch?time_continue=16&v=WS9nP-BKa3M

Oh dear, you’re going soft, Schofield. What’s wrong with a baseball bat ? (OK cricket bat if you insist)

I’d give a great deal for exclusive attention from Stephanie Kelton. Don’t see what JMcD has done that merits such privilege.

I’m prepared to accept that Labour has to play by the accepted rules and look responsible if it wants to win government but to misrepresent an expressed view like this is just downright dishonest!

I know one doesn’t implement MMT any more than one implements gravity but it’s interesting to note that between 1796 and 1821 the. Bank of England issued a fiat currency that floated on the currency exchanges and supplied its banknotes at an artificially constrained interest rate of 5% maximum to any one (an individual or a bank seeking reserves) who could offer good security (google the Real Bills Doctrine). All the while the ratio government spending to GDP rose to some of the highest levels in British history due to war with France and the government relied on taxation to stop the economy overheating and to ensure the resources needed to sustain the war effort were available.

By 1820, the British economy was the most productive in the world!

The Industrial Revolution got an MMT boost!

@ PhilipR,

Actually the JG [jobs guarantee] is a key part of MMT. It is what keeps inflation under control. IIRC.

And, (like you said) they have to not worry “how can we pay for this needed program?”.

.

@ PhilipR

“I’m prepared to accept that Labour has to play by the accepted rules and look responsible if it wants to win government”

The problem with that approach is that if the Labour leadership mean what they say about “fiscal responsibility”, and stick to it, then they will never be able to implement a political program that differs significantly from their opponents, but if they say they’ll be “fiscally responsible” and *don’t* really mean it, then no sooner do they break their ‘pretend’ rules, but the opposition and press will be all over them, as usual, claiming, with apparent evidence, that Labour don’t know how to run the economy.

Honesty is always the best policy: Frustratingly, Corbyn and McDonnell have had three years in which they could have promoted MMT, had they only been more aware of it. Subject to preposterous amounts of abuse anyway, they may as well have been hung for a sheep as a lamb, but the lying, Thatcherite, “govt is just like a household” narrative could have been challenged vociferously at every interview during this period, to the point where ‘taxes don’t fund spending” could, by now, have become just as familiar a catchphrase. After all, what mainstream journalist could have resisted challenging Labour on that premise at every opportunity! Yet an informed and capable Shadow Chancellor would have been able to explain it, repeatedly, until the message sunk in.

That’s how the Overton window gets shifted: by politicians announcing what appear to be ever more unacceptable policies, until gradually they become accepted as the mainstream. The Right has been getting away with it for decades – it’s really about time the Left had a go.

But even if it were possible to “turn” JMcD, would there still be time to get the MMT message across before another GE? I’d say it’s highly unlikely. Perhaps we will have to wait for the next generation of economic advisors and politicians, but, sadly, I’m not sure how many of us will still be around to see the day.

Mr S, they had the opportunity to be aware of it. I and others gave them articles to read. They don’t appear to have read them. Which means they are deliberately remaining ignorant. I am unable to think of a good excuse for this.

If John McDonnell was a genuine socialist he’d explore all thinking about how the UK monetary system actually works and avoid lying to cover up the fact he doesn’t do this. The only conclusion one can draw is he’s a fake socialist!

Recently on another site I suggested that we all stop using “Socialism” as in social democracy.

Instead we use “Welfare-ism” as in Welfare democracy.

I say this because when I learned things in the late 60s and early 70s Socialism meant the Gov. owns the major means off production and maybe distribution.

This is not at all the same as having free college educ., a strong safety net, and Gov. guaranteed healthcare.

OTOH, it may be too late to undo this change in the meaning.

But then, we need a new word or phrase for the old Definition of socialism. How about “Real Socialism”?

.

Steve, welfareism is a terrible neologism. It will never work. Real Socialism is a bit better. It is true that a change in the generally understood meaning of the term socialism, is needed. And the term, social democracy, is not understood to be identical to the term, socialsim. I would advocate using “social democracy” on its own without tying it to socialism of any stripe, as it brings together the sense of the social and the notion of democracy.

Steve_American, larry,

Regarding the US anyway, I’ve lately thought that the term “federalism” would be better than “socialism” in the old 60s/70s sense that Steve mentions. I also have no problem with larry’s “social democracy” phrase, though I would explain it as follows.

Democracy is government of the people, by the people, and for the people. This characterization leaves room for different kinds of government that are in each case democratic.

Collective Democracy is government of, by, and for people working together in formal and informal federations, synergistically coordinating complementary skills to achieve shared goals.

Distributive Democracy is government of, by, and for people working individually and equitably to achieve personal or common goals.

Social (or Federate?) Democracy is government of, by, and for the people utilizing both collective and distributive democratic methods.

Democratic Collectivism is the categorical view that government (or as much of it as possible) should be collectively democratic.

Democratic Distributivism is the categorical view that government (or as much of it as possible) should be distributively democratic.

Democratic Federalism is the categorical view that government (or as much of it as possible) insofar as it extends over a hierarchy of federations that bottoms out in various teams of individual citizens should be socially democratic in various ways appropriate to respective locations in the hierarchy.

The latter might be called democratic socialism except that socialism is a categorical view espousing collective ownership and management of the “means of production.” This may take many shapes (one especially extreme form being Marxist communism, based on questionable views of history and class warfare). This has no bearing on what is meant by “social democracy” as characterized above (or in any sense that MMT might propose so far as I have seen).

“It shows that massive exchange rate fluctuations barely dent our material progress …..”

Bill,

As you say, over the course of the cycle, the damage done is redressed to an extent.

But currency weakness always puts pressures on government policy and limit what can be done. For a wealthy and financially well balanced country like Australia these circumstances are tolerable. For economies not so well disposed (those with high foreign debt levels or those that rely on foreign investment) the situation can be more problematic even devastating.

Currency weakness is there to remind governments that policy prescriptions can have deleterious impacts. If foreign gets out of hand, if inflation is not controlled within reasonable limits, punishment follows in the markets.

I know you disagree with this, it’s just that I have seen too much of this over my 40 plus years of adult life, and a lot of it in professional circumstances, that I cannot agree with you.

FTB, I don’t think Federalism will do either, as it has connotations that some find objectionable. I would suggest, as an abbreviation of Democratic Socialism, DemSoc, but that brings up images of 1984, a totalitarian regime if ever there was one. Hence, my suggestion of Social Democracy. I hesitate to use a standard abbreviation, SocDem, though DemSoc is worse. The UK party, the Liberal Democrats, get away with using LibDem. 1984 does not seem to intrude.

Exchange rates are at least an two sided issue, how volatile a currency are against the USD probably have to be adjusted for general USD index, the general global trend.

https://imgur.com/a/xZ8ffso – Chart USD index and USD-AUD exchange rate.

https://www.macrotrends.net/1329/us-dollar-index-historical-chart – Source

The Lib Dems in the UK get away with nothing. They are pathetic.

Only one thing worse for a country that currency weakness and that’s….currency strength.

The rising ‘value’ of the Dollar will cripple the US. Count the days.